Global Contract Research Organization Cros Services Market

Market Size in USD Billion

CAGR :

%

USD

61.70 Billion

USD

133.22 Billion

2024

2032

USD

61.70 Billion

USD

133.22 Billion

2024

2032

| 2025 –2032 | |

| USD 61.70 Billion | |

| USD 133.22 Billion | |

|

|

|

|

Contract Research Organization (CROs) Services Market Size

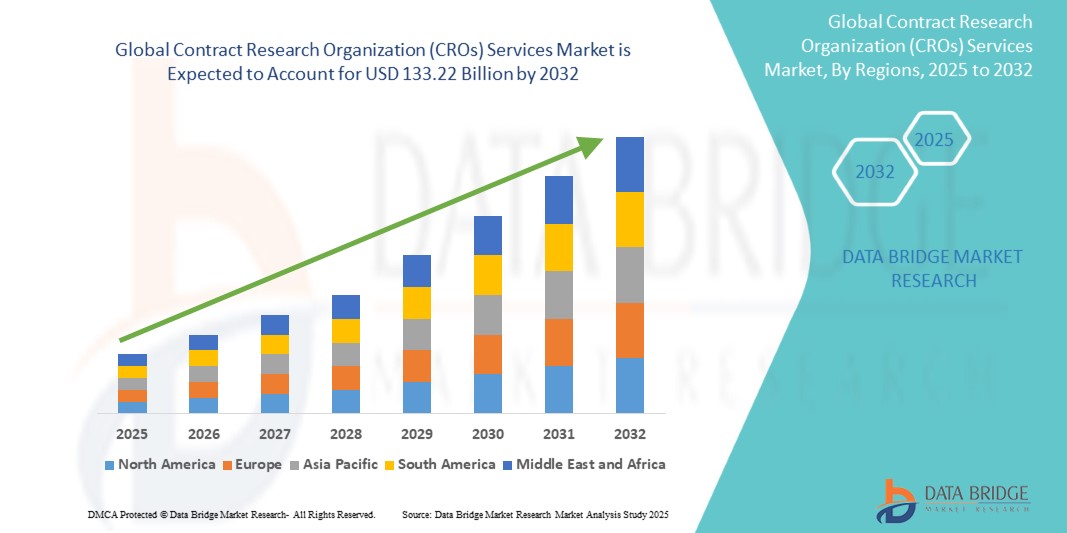

- The global contract research organization (CROs) services market size was valued at USD 61.70 billion in 2024 and is expected to reach USD 133.22 billion by 2032, at a CAGR of 10.10% during the forecast period

- The market growth is largely fueled by the increasing outsourcing of clinical trials, preclinical studies, and drug development activities by pharmaceutical, biotechnology, and medical device companies to reduce costs and improve efficiency

- Furthermore, rising demand for faster drug approvals, expanding R&D pipelines, and the growing prevalence of chronic diseases are positioning CROs as indispensable partners in the global healthcare ecosystem. These converging factors are accelerating CRO adoption, thereby significantly boosting the industry’s growth

Contract Research Organization (CROs) Services Market Analysis

- Contract research organizations (CROs), offering outsourced clinical trial management, preclinical research, regulatory services, and laboratory testing, are becoming indispensable partners for pharmaceutical, biotechnology, and medical device companies due to their ability to reduce R&D costs, accelerate timelines, and provide specialized expertise

- The escalating demand for CRO services is primarily fueled by the rising complexity of drug development, increasing prevalence of chronic diseases, and the growing trend of outsourcing clinical research to streamline operations and enhance global reach

- North America dominated the global contract research organization (CROs) services market with the largest revenue share of 49.1% in 2024, characterized by a strong pharmaceutical base, early adoption of advanced clinical trial technologies, and the presence of leading CROs, with the U.S. experiencing substantial growth in large-scale late-phase trials and oncology research

- Asia-Pacific is expected to be the fastest growing region in the global contract research organization (CROs) services market during the forecast period due to expanding patient recruitment opportunities, cost-efficient trial setups, and increasing investments in healthcare infrastructure

- Clinical research services segment dominated the global contract research organization (CROs) services market with a market share of 61.9% in 2024, driven by the surge in demand for Phase II–IV clinical trials and the rising emphasis on personalized medicine and biologics development

Report Scope and Contract Research Organization (CROs) Services Market Segmentation

|

Attributes |

Contract Research Organization (CROs) Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Contract Research Organization (CROs) Services Market Trends

Accelerating Adoption of Decentralized and Virtual Clinical Trials

- A significant and accelerating trend in the global CROs services market is the rapid adoption of decentralized clinical trials (DCTs) and virtual study models, enabled by digital health tools, telemedicine, and remote patient monitoring technologies. This shift is redefining how clinical research is conducted globally

- For instance, ICON plc has expanded its decentralized trial offerings through its partnership with digital health firms, while Parexel has increasingly adopted remote monitoring and hybrid trial models to enhance patient participation

- AI and machine learning are being integrated into CRO services to improve patient recruitment, optimize site selection, and analyze real-world evidence more efficiently. For instance, Labcorp Drug Development applies predictive analytics to reduce trial delays and improve protocol design

- DCT adoption also enables inclusion of more diverse patient populations across geographies, reducing barriers such as travel and improving retention. Companies such as Syneos Health are leveraging wearable devices and mobile apps to streamline patient data collection

- This trend towards digitally enabled, patient-centric trials is reshaping the CRO ecosystem, as sponsors increasingly prefer CROs capable of executing hybrid and fully decentralized studies. Consequently, firms such as IQVIA are investing heavily in digital platforms, AI tools, and advanced data analytics to strengthen their leadership in this space

- The demand for CROs offering robust decentralized and technology-driven solutions is rapidly expanding across both large pharmaceutical companies and emerging biotechs, as efficiency, speed, and patient accessibility become critical success factors in drug development

Contract Research Organization (CROs) Services Market Dynamics

Driver

Growing Outsourcing of R&D by Pharma and Biotech Companies

- The rising R&D expenditures by pharmaceutical and biotechnology firms, combined with the increasing complexity of clinical development, is driving the outsourcing of services to CROs. This allows sponsors to focus on innovation while leveraging CRO expertise, global infrastructure, and cost efficiencies

- For instance, in March 2024, ICON plc announced a strategic agreement with a leading biotech firm to manage multiple late-stage oncology trials, showcasing the rising reliance on CROs for critical therapeutic areas

- As drug pipelines expand and regulatory requirements become more stringent, CROs provide specialized support in regulatory submissions, clinical monitoring, pharmacovigilance, and data management, accelerating time-to-market

- In addition, the increasing prevalence of chronic diseases and demand for biologics and personalized medicine are fueling growth in clinical trial volumes, further boosting CRO service adoption

- The globalization of clinical trials, particularly in emerging markets, has also strengthened demand for CROs with strong international networks and local regulatory expertise

- As a result, CRO partnerships have become indispensable for both large pharmaceutical leaders and small-to-mid-sized biotech firms, ensuring sustained market expansion

Restraint/Challenge

Regulatory Complexity and Data Security Concerns

- CROs services market faces significant challenges from complex, evolving regulatory frameworks across regions, making trial approval and execution highly resource-intensive. Sponsors often encounter delays due to varying compliance standards in the U.S., Europe, and Asia

- For instance, delays in adapting to the EU Clinical Trials Regulation (CTR) have impacted several multinational trials, highlighting regulatory hurdles for CROs managing global studies

- Moreover, the increasing use of digital technologies in decentralized and hybrid trials has amplified concerns regarding data privacy, cybersecurity, and compliance with standards such as GDPR and HIPAA. Breaches or non-compliance can severely damage reputations and delay approvals

- Smaller CROs may struggle to maintain the infrastructure and expertise required to meet these stringent regulations, placing them at a disadvantage compared to larger global players

- Rising costs associated with regulatory audits, compliance monitoring, and maintaining secure IT systems also add to operational challenges

- Overcoming these barriers through continuous investment in compliance infrastructure, robust cybersecurity measures, and transparent collaboration with regulators will be critical for long-term market growth

Contract Research Organization (CROs) Services Market Scope

The market is segmented on the basis of molecule type, type, therapeutic area and end user.

- By Molecule Type

On the basis of molecule type, the contract research organization (CROs) services market is segmented into vaccines, cell & gene therapy, and others. The vaccines segment dominated the market in 2024, underpinned by sustained global immunization programs and the normalization of larger, multi-country registrational trials post-pandemic. Sponsors lean on CROs for rapid site start-up, cold-chain logistics coordination, and pharmacovigilance at scale, which are hard to replicate in-house. High trial volumes in pediatric, influenza, RSV, and combination vaccines maintain steady outsourcing pipelines. Public–private funding streams and advance purchase agreements also stabilize trial demand, reducing sponsor risk and encouraging CRO engagement. Growing focus on real-world evidence (RWE) and post-authorization safety studies further extends CRO involvement across the vaccine lifecycle. Collectively, these dynamics keep vaccines the most revenue-intensive molecule type for CROs.

The cell & gene therapy segment is expected to witness the fastest growth during the forecast period, propelled by expanding pipelines in oncology, hematology, and rare diseases. These programs require specialized protocol design, complex chain-of-identity/chain-of-custody controls, and bespoke biomarker strategies—all areas where experienced CROs command premium demand. Regulatory pathways for ATMPs demand rigorous CMC packages and long-term follow-up, increasing the breadth of outsourced services. Limited patient pools drive global, adaptive, and decentralized trial designs that favor CROs with advanced data platforms. Manufacturing constraints and vein-to-vein logistics push sponsors to partners who can integrate clinical operations with supply orchestration. As approvals and expedited designations rise, CROs with ATMP centers of excellence are best positioned to capture outsized growth.

- By Type

On the basis of type, the contract research organization (CROs) services market is segmented into early phase development services, pharmacokinetics/pharmacodynamics (PK/PD), clinical research services, laboratory services, physical characterization, stability testing, batch release testing, raw material testing, other analytical testing, and consulting services. The clinical research services segment dominated the market in 2024 with a market share of 61.9%, reflecting the cost and complexity of Phase II–IV programs where most R&D spend occurs. CROs provide global site networks, centralized monitoring, and data management at scale, compressing timelines and reducing fixed costs for sponsors. Oncology, immunology, and metabolic trials rely on intricate endpoints and companion diagnostics, deepening dependence on full-service CRO capabilities. Increasing use of hybrid/decentralized models, eCOA, and remote monitoring has favored CROs with integrated tech stacks.

The early phase development services segment is anticipated to grow at the fastest pace, driven by the increasing number of biotech startups focusing on novel molecules and the growing demand for proof-of-concept studies. CROs offering integrated Phase I/II trial capabilities help reduce time-to-market while ensuring regulatory compliance. This segment benefits from the surge in precision medicine and biologics research, where early safety and dosage studies are critical to success. High demand for adaptive, Bayesian designs and micro-sampling pushes uptake of tech-enabled early phase platforms. Integration of PK/PD modeling, bioanalytics, and early safety pharmacology strengthens the value proposition.

- By Therapeutic Area

On the basis of therapeutic area, the contract research organization (CROs) services market is segmented into oncology, CNS disorders, infectious diseases, cardiovascular diseases, immunological disorders, respiratory disorders, diabetes, and other therapeutic areas. The oncology segment dominated the market in 2024, given the sheer volume of active studies and high per-trial budgets. Complex endpoints (PFS, ORR, MRD), biomarker-driven stratification, and companion diagnostics necessitate specialized operational and statistical expertise. Immuno-oncology combinations and tumor-agnostic designs expand trial counts and operational complexity. The need for global recruitment, rare mutation enrichment, and sophisticated imaging/central labs further entrenches CRO partnerships. Post-marketing commitments and outcomes research sustain service demand beyond approval. Overall, oncology’s breadth and depth make it the cornerstone of CRO revenue.

The CNS disorders segment is projected to be the fastest growing, driven by increasing R&D in neurodegenerative diseases such as Alzheimer’s, Parkinson’s, and multiple sclerosis. These trials are highly complex, require long-term monitoring, and involve challenges in patient recruitment, making CRO partnerships essential. The growing burden of mental health disorders also drives investments in CNS pipelines, where CROs provide critical support in trial design, patient stratification, and advanced imaging/biomarker analysis. Wearables and remote cognitive assessments enable richer data capture, increasing reliance on tech-enabled CROs. Regulators’ openness to novel endpoints and surrogate measures supports innovative designs. As unmet need and payer interest surge, sponsors outsource to de-risk execution and accelerate development.

- By End User

On the basis of end user, the contract research organization (CROs) services market is segmented into pharmaceuticals & biopharmaceutical companies, medical device companies, and academic institutes. The pharmaceuticals & biopharmaceutical companies segment dominated the CROs services market in 2024, as these companies increasingly outsource preclinical, clinical, and regulatory services to cut costs and improve operational efficiency. The rising complexity of biologics, biosimilars, and large-scale vaccine trials further accelerates CRO engagement. Large pharma players rely on CROs for global patient recruitment, trial execution, and regulatory navigation, making them the key revenue contributors. Strategic partnerships and functional service provider (FSP) models deepen multi-year engagements, while global regulatory heterogeneity further encourages reliance on CROs’ in-region expertise. Consequently, this end-user group remains the primary revenue engine for CROs.

The medical device companies segment is expected to witness the fastest growth, driven by increasing regulatory scrutiny and the need for robust clinical evidence to support product approvals. Rising adoption of digital health, SaMD, diagnostics, and wearables increases the volume of clinical investigations and post-market studies. CROs with device-specific biostatistics, human factors engineering, and usability testing capabilities gain share. Real-world performance data, registries, and surveillance requirements extend service demand beyond premarket trials. Global pathway navigation—especially for combination products and companion diagnostics—favors experienced CRO partners. As devices converge with therapeutics and software, outsourcing intensity and growth rates accelerate in this segment.

Contract Research Organization (CROs) Services Market Regional Analysis

- North America dominated the contract research organization (CROs) services market with the largest revenue share of 49.1% in 2024, characterized by a strong pharmaceutical base, early adoption of advanced clinical trial technologies, and the presence of leading CROs, with the U.S. experiencing substantial growth in large-scale late-phase trials and oncology research

- Sponsors in the region value CRO partnerships for their ability to accelerate complex late-phase trials, ensure regulatory compliance with the FDA, and provide access to cutting-edge data analytics and decentralized trial technologies

- This widespread adoption is further reinforced by the concentration of leading CRO players, availability of skilled professionals, and a favorable environment for innovative trial models, making North America the hub for outsourced clinical research activities globally

U.S. Contract Research Organization (CROs) Services Market Insight

The U.S. contract research organization (CROs) services market captured the largest revenue share of 79% in 2024 within North America, fueled by the country’s strong pharmaceutical and biotech pipeline and its heavy investment in R&D. The rising demand for outsourcing early-phase and clinical trial services is driven by high operational costs faced by sponsors and the need for regulatory expertise. Increasing adoption of decentralized clinical trials, digital platforms, and AI-based data analytics further enhances efficiency in the U.S. market. Moreover, strategic collaborations between CROs and life sciences companies continue to accelerate drug development timelines and expand the service scope.

Europe CROs Services Market Insight

The Europe contract research organization (CROs) services market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent regulatory standards, increasing demand for cost-effective drug development, and robust government support for clinical research. The region is witnessing growth in outsourcing preclinical and clinical development across oncology, CNS, and rare diseases. Rising partnerships between pharma companies and CROs in countries such as Germany, U.K., and France are fostering demand. Moreover, Europe’s highly skilled research workforce and advanced trial infrastructure continue to make it an attractive hub for CRO service adoption.

U.K. CROs Services Market Insight

The U.K. contract research organization (CROs) services market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the presence of a strong biopharmaceutical sector and a government focus on life sciences innovation. Rising clinical research activity in rare diseases and cell & gene therapy is creating opportunities for CROs. In addition, the U.K.’s post-Brexit regulatory framework is encouraging global pharma companies to rely on local CROs for compliance and trial management. The integration of digital technologies into clinical trials is also enhancing efficiency and fueling market expansion.

Germany CROs Services Market Insight

The Germany contract research organization (CROs) services market is expected to expand at a considerable CAGR during the forecast period, driven by a high concentration of pharmaceutical and medical device companies seeking outsourcing support. The country’s focus on innovation in biologics, biosimilars, and personalized medicine strengthens demand for CRO services. Furthermore, Germany’s strong emphasis on data privacy and regulatory adherence makes it a trusted destination for clinical trials. Increasing adoption of digital health technologies and collaborations between CROs and academic research centers further support market growth.

Asia-Pacific CROs Services Market Insight

The Asia-Pacific contract research organization (CROs) services market is poised to grow at the fastest CAGR of 22% during 2025 to 2032, driven by rapid expansion of the pharmaceutical sector in China, India, and South Korea. Low-cost clinical trial services, increasing patient pool availability, and supportive government policies are attracting global pharma companies to outsource trials in the region. Growing investment in advanced laboratory services and rising adoption of AI and big data analytics in clinical research are boosting efficiency. The affordability and scalability of CRO services in APAC continue to strengthen its position as a global outsourcing hub.

Japan CROs Services Market Insight

The Japan contract research organization (CROs) services market is gaining momentum due to the country’s strong pharmaceutical innovation pipeline and demand for high-quality clinical trials. Japanese CROs are increasingly focusing on oncology, immunology, and rare disease research, aligning with local therapeutic priorities. The integration of AI-driven data management, e-clinical platforms, and personalized medicine research is fueling adoption. Japan’s regulatory framework, combined with its advanced healthcare infrastructure, positions it as a preferred market for both local and multinational CRO collaborations.

India CROs Services Market Insight

The India CROs services market accounted for the largest revenue share in Asia-Pacific in 2024, driven by its expanding pharmaceutical manufacturing base, cost-effective clinical trials, and availability of a diverse patient population. India has emerged as a preferred outsourcing destination for global pharma companies due to its skilled workforce and favorable government policies supporting R&D and clinical research. The growth of domestic CROs, coupled with investment in advanced laboratory services and digital trial solutions, is strengthening India’s position as a leading CRO market in the region.

Contract Research Organization (CROs) Services Market Share

The contract research organization (CROs) Services industry is primarily led by well-established companies, including:

- IQVIA Holdings Inc. (U.S.)

- Laboratory Corporation of America Holdings (U.S.)

- Syneos Health, Inc. (U.S.)

- ICON plc (Ireland)

- Parexel International (MA) Corporation (U.S.)

- Charles River Laboratories International, Inc. (U.S.)

- Medpace Holdings, Inc. (U.S.)

- PRA Health Sciences, Inc. (U.S.)

- WuXi AppTec Co., Ltd. (China)

- PPD, Inc. (U.S.)

- Covance Inc. (U.S.)

- SGS SA (Switzerland)

- PSI CRO AG (Switzerland)

- Pharmaron Beijing Co., Ltd. (China)

- Clinipace, Inc. (U.S.)

- CMIC Holdings Co., Ltd. (Japan)

- ICON Clinical Research Limited (Ireland)

- Worldwide Clinical Trials, LLC (U.S.)

- Fortrea Holdings Inc. (U.S.)

- Axcelead, Inc. (Japan)

What are the Recent Developments in Global Contract Research Organization (CROs) Services Market?

- In July 2025, biotechnology-focused CRO Novotech received Frost & Sullivan’s 2025 Global Company of the Year Award in the biotech CRO category. The accolade highlights Novotech's excellence in clinical trial innovation, strategic execution, and client-centric services, particularly supporting biotech and small-to-mid-sized pharma development through advanced, flexible trial delivery

- In June 2025, Precision for Medicine was awarded the Fierce CRO Award for its innovative methodologies in drug development. The recognition centered on their cutting-edge centralized monitoring and agile data management, particularly in oncology and rare disease trials, enabling clean, compliant trial data for regulatory scrutiny and accelerated outcomes

- In June 2025, Lindus Health received recognition at the Fierce CRO Awards, earning the Outstanding Patient Recruitment and Retention award for its innovative Patient Identification Center (PIC) technique. This AI-enabled method leverages real-world medical record data to improve screening precision. In one pre-diabetes trial, they achieved a 54% screen conversion rate five times the industry benchmark and completed enrollment in just four months

- In January 2025, Lindus Health a technology-driven CRO known as the “anti-CRO” raised USD 55 million in Series B funding, led by Balderton Capital, to enhance its AI-driven eClinical platform, Citrus, and accelerate innovation in clinical trial operations. The investment will enable them to optimize study design, automate central monitoring, implement real-time biostatistics, and expand their clinical operations and product development teams

- In November 2024, Novotech established a strategic partnership with Beijing Biostar Pharmaceuticals, following Biostar’s HKEX listing. This alliance is aimed at accelerating clinical research and development programs and underscores Novotech’s expanding role in enabling biotech innovators across Asia-Pacific through global CRO support

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.