Global Corneal Topography And Tomography Systems Market

Market Size in USD Million

CAGR :

%

USD

784.08 Million

USD

1,149.64 Million

2024

2032

USD

784.08 Million

USD

1,149.64 Million

2024

2032

| 2025 –2032 | |

| USD 784.08 Million | |

| USD 1,149.64 Million | |

|

|

|

|

Corneal Topography and Tomography Systems Market Size

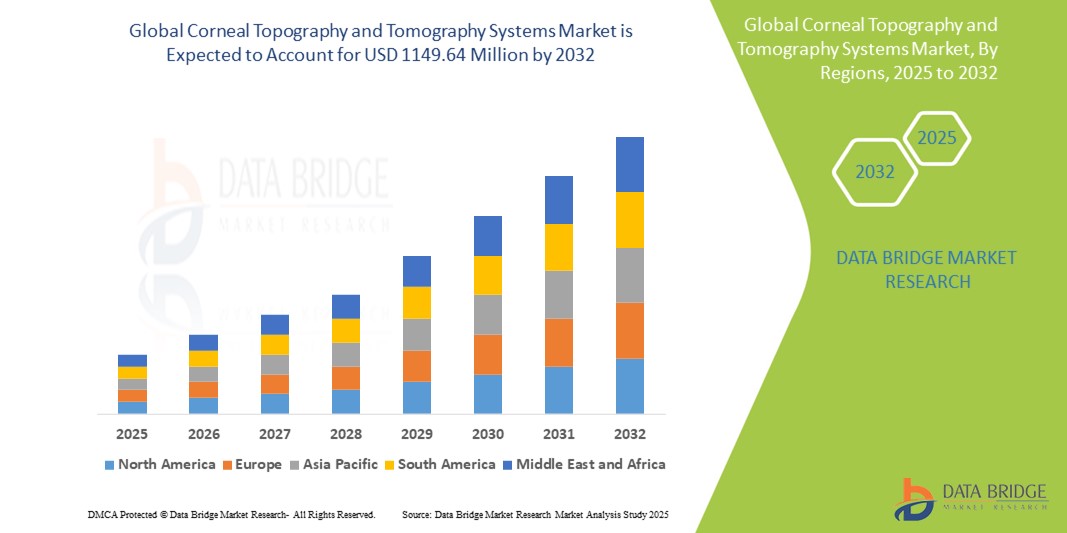

- The global corneal topography and tomography systems market size was valued at USD 784.08 million in 2024 and is expected to reach USD 1,149.64 million by 2032, at a CAGR of 4.90% during the forecast period

- The market growth is largely fueled by the increasing prevalence of ophthalmic disorders such as keratoconus, astigmatism, and cataracts, along with the growing geriatric population worldwide, which is more prone to such conditions

- Furthermore, rising demand for advanced diagnostic technologies, expanding applications in cataract and refractive surgery planning, and growing investments in healthcare infrastructure are establishing corneal topography and tomography systems as essential tools in modern eye care. These converging factors are accelerating the adoption of these systems, thereby significantly boosting the industry's growth.

Corneal Topography and Tomography Systems Market Analysis

- Corneal topography and tomography systems, which provide detailed 3D imaging and surface mapping of the cornea, are increasingly vital components of modern ophthalmic diagnostics and surgical planning in both clinical and surgical settings due to their precision, non-invasive nature, and ability to detect and monitor a wide range of corneal disorders

- The escalating demand for these systems is primarily fueled by the rising prevalence of corneal diseases such as keratoconus and astigmatism, growing awareness of eye health, and the surge in cataract and refractive surgeries globally

- North America dominates the corneal topography and tomography systems market with the largest revenue share of 40.9% in 2024, characterized by early adoption of advanced diagnostic technologies, strong healthcare infrastructure, and a robust presence of leading ophthalmic device manufacturers

- Asia-Pacific is expected to be the fastest growing region in the corneal topography and tomography systems market during the forecast period due to expanding access to eye care services, increased healthcare investments, and a large patient pool affected by refractive and corneal disorders

- Placido disc systems segment dominates the corneal topography and tomography systems market with a market share of 43% in 2024, driven by its widespread use in cataract and refractive surgery evaluation, high accuracy, and affordability, making them a preferred choice in both developed and emerging healthcare markets

Report Scope and Corneal Topography and Tomography Systems Market Segmentation

|

Attributes |

Corneal Topography and Tomography Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Corneal Topography and Tomography Systems Market Trends

“Technological Advancements Driving Precision Diagnostics and Surgical Planning”

- A significant and accelerating trend in the global corneal topography and tomography systems market is the ongoing technological innovation aimed at enhancing diagnostic accuracy, imaging resolution, and surgical planning capabilities. The integration of high-definition imaging, real-time data processing, and multimodal platforms is transforming ophthalmic diagnostics and pre-surgical assessments

- For instance, the Pentacam AXL Wave combines Scheimpflug imaging with wavefront aberrometry and optical biometry in one device, enabling ophthalmologists to perform comprehensive eye assessments with greater efficiency. Similarly, devices such as the Galilei G6 integrate dual Scheimpflug cameras and Placido rings, providing layered corneal analysis with exceptional accuracy for cataract and refractive procedures

- The incorporation of artificial intelligence (AI) and machine learning into corneal imaging platforms is also gaining traction. AI can detect subtle corneal abnormalities, assist in early diagnosis of conditions such as keratoconus, and enhance decision-making in refractive surgery. For instance, some systems now utilize AI-based screening tools to flag atypical topographic patterns automatically, increasing diagnostic confidence

- Furthermore, the fusion of corneal topography/tomography with other ophthalmic diagnostic tools, such as anterior segment OCT and aberrometry, enables comprehensive and streamlined patient evaluations. This multimodal approach enhances surgical planning and outcomes by offering ophthalmologists an integrated view of corneal health and structure

- The growing demand for precision in eye care and improved patient outcomes is driving manufacturers to develop more compact, user-friendly, and AI-capable systems. Companies such as NIDEK, Topcon, and OCULUS are continuously innovating to meet the evolving needs of ophthalmologists and eye care centers, with systems offering cloud integration, tele-ophthalmology compatibility, and real-time image sharing

- This trend toward smarter, more connected, and multifunctional diagnostic devices is redefining the standard of care in ophthalmology, leading to higher adoption rates in both advanced and emerging healthcare settings globally

Corneal Topography and Tomography Systems Market Dynamics

Driver

“Rising Prevalence of Eye Disorders and Demand for Advanced Diagnostic Tools”

- The increasing global prevalence of corneal and refractive disorders such as keratoconus, astigmatism, dry eye disease, and post-surgical complications is a significant driver for the heightened demand for corneal topography and tomography systems. These conditions require precise diagnostics, and the rising patient awareness is amplifying the adoption of advanced imaging technologies in ophthalmology

- For instance, the rising number of cataract and LASIK procedures globally has pushed the demand for high-precision preoperative planning tools. Devices such as the OCULUS Pentacam and Topcon CA-800 are gaining traction due to their reliability in measuring corneal curvature, thickness, and elevation, which are critical for safe and successful surgical outcomes

- As the global population ages, the incidence of age-related ocular conditions continues to climb, particularly in developed regions. This demographic shift is fueling the demand for accurate, non-invasive diagnostic systems in both hospital-based and private practice settings

- Furthermore, the evolution of ophthalmic care toward personalized medicine is making topography and tomography systems essential. These devices offer comprehensive patient data that supports tailored treatment planning and early intervention, especially for progressive conditions such as keratoconus

- The integration of these systems into broader ophthalmic imaging and surgical workflows—combined with increasing healthcare investment, especially in emerging markets—is accelerating their adoption. Training programs and continuous technology upgrades by manufacturers are also supporting widespread use in routine diagnostics and advanced clinical applications

- The convenience of rapid, automated diagnostics, reduced operator dependency, and cloud-based data sharing are key features driving adoption in modern eye care practices. The trend toward digitalized, patient-centric ophthalmology is positioning corneal topography and tomography systems as indispensable diagnostic solutions in the global market

Restraint/Challenge

“High Equipment Costs and Limited Accessibility in Low-Income Region”

- The relatively high initial cost of corneal topography and tomography systems poses a significant challenge to broader market penetration, particularly in resource-constrained settings. These advanced diagnostic devices require substantial capital investment, making them less accessible to small clinics and eye care centers in developing regions

- For instance, premium systems integrating multiple imaging modalities such as Scheimpflug tomography, Placido disc topography, and wavefront aberrometry can carry high acquisition and maintenance costs, placing them out of reach for many ophthalmic practices, especially in rural and underserved areas

- In addition, the need for trained personnel to operate and interpret these systems further limits adoption. In many emerging markets, there is a shortage of specialized ophthalmologists and optometrists, which constrains the utility of these high-end diagnostic tools

- These economic and infrastructural limitations hinder the ability of health systems to scale up early diagnosis and surgical planning capabilities for eye disorders, especially as demand for refractive and cataract procedures rises

- Moreover, slower reimbursement processes and inconsistent insurance coverage for advanced eye diagnostics can also deter healthcare providers from investing in topography and tomography systems

Corneal Topography and Tomography Systems Market Scope

The market is segmented on the basis of product type, application, and end user

- By Product Type

On the basis of product type, the corneal topography and tomography systems market is segmented into placido disc systems, scheimpflug systems, scanning slit systems, optical coherence tomography (OCT), ray tracing systems, LED triangulation systems, and others. The placido disc systems segment dominated the market with the largest revenue share of 43% in 2024. This dominance is driven by their proven accuracy in mapping corneal curvature, widespread clinical adoption, and relatively lower cost compared to other advanced imaging modalities. These systems are extensively used in cataract surgery planning and refractive procedures due to their ability to provide detailed anterior corneal surface information.

The optical coherence tomography (OCT) segment is projected to experience the fastest growth rate from 2025 to 2032. OCT devices offer high-resolution cross-sectional images of the cornea and anterior segment, enabling more precise diagnosis and monitoring of corneal pathologies. Recent technological advancements, including swept-source OCT and integration with artificial intelligence for enhanced image interpretation, are contributing to its rapid adoption.

- By Application

On the basis of application, the market is segmented into Cataract surgery evaluation, corneal disorder diagnosis, refractive surgery evaluation, contact lens fitting, post-refractive surgery evaluation, post-penetrating keratoplasty, and others. The cataract surgery evaluation segment commands the largest market share in 2024, driven by the growing volume of cataract surgeries worldwide, especially among aging populations. Corneal topography and tomography systems are crucial for preoperative assessments, helping to detect irregular astigmatism and other corneal abnormalities that can impact surgical outcomes.

The refractive surgery evaluation segment is anticipated to register the fastest growth over the forecast period. Increasing demand for LASIK, PRK, and other vision correction surgeries worldwide is driving this trend. Precise corneal imaging is essential in these procedures to identify candidates, customize surgical plans, and monitor postoperative healing to minimize complications such as ectasia.

- By End User

On the basis of end user, the market is segmented into hospitals, ophthalmic clinics, ambulatory surgical centers, academic and research institutes, and others. Hospitals segment held the highest revenue share in 2024, owing to their comprehensive ophthalmic care capabilities and high patient throughput. Hospitals typically invest in advanced diagnostic systems to support a wide range of services, including cataract and refractive surgeries, corneal disease management, and emergency ophthalmic care.

Ophthalmic clinics are expected to witness the fastest growth from 2025 to 2032. The surge in specialized eye care centers and outpatient clinics, driven by increasing patient awareness and accessibility, is accelerating the adoption of topography and tomography systems in these settings. These clinics benefit from quicker patient turnaround times and the ability to provide focused eye care services, which support early diagnosis and ongoing management of corneal conditions.

Corneal Topography and Tomography Systems Market Regional Analysis

- North America dominates the corneal topography and tomography systems market with the largest revenue share of 40.9% in 2024, driven by early adoption of advanced diagnostic technologies, strong healthcare infrastructure, and a robust presence of leading ophthalmic device manufacturers

- Healthcare providers and patients in the region highly value the accuracy, non-invasive nature, and detailed imaging capabilities offered by corneal topography and tomography systems for cataract surgery planning, refractive surgery evaluation, and corneal disorder diagnosis

- This widespread adoption is further supported by advanced healthcare infrastructure, high healthcare expenditure, a technologically inclined medical community, and the growing preference for early and precise diagnosis, establishing these systems as essential tools in both clinical and surgical ophthalmic settings

U.S. Corneal Topography and Tomography Systems Market Insight

The U.S. corneal topography and tomography systems market captured the largest revenue share in North America in 2024, fueled by the swift adoption of advanced ophthalmic diagnostic technologies and growing awareness of eye health. Healthcare providers prioritize precise corneal imaging for cataract surgery evaluation, refractive surgery, and corneal disorder diagnosis. The growing preference for non-invasive and accurate diagnostic tools, combined with robust demand for integrated imaging systems in hospitals and clinics, further propels market growth. Moreover, increasing research and development efforts and reimbursement support significantly contribute to the market’s expansion.

Europe Corneal Topography and Tomography Systems Market Insight

The Europe market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing incidences of ocular diseases and stringent regulatory standards for eye care diagnostics. Rising healthcare expenditure and growing awareness about early diagnosis are fostering the adoption of corneal topography and tomography systems. European healthcare facilities increasingly integrate these systems into routine ophthalmic examinations, with significant growth seen in both new hospital setups and ophthalmic clinics.

U.K. Corneal Topography and Tomography Systems Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, propelled by rising government initiatives aimed at improving eye care services and increased prevalence of vision-related disorders. The growing trend toward early diagnosis and technologically advanced ophthalmic instruments is encouraging healthcare providers and clinics to adopt corneal imaging systems. The U.K.’s well-established healthcare infrastructure and awareness campaigns continue to stimulate demand.

Germany Corneal Topography and Tomography Systems Market Insight

The Germany’s market is expected to expand at a considerable CAGR during the forecast period, supported by high investment in healthcare infrastructure and technology innovation. Increasing demand for precise diagnostic tools in ophthalmology and a growing geriatric population contribute to market growth. The integration of advanced imaging technologies with hospital and clinical workflows, along with a strong emphasis on data accuracy and patient outcomes, aligns well with local healthcare priorities.

Asia-Pacific Corneal Topography and Tomography Systems Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR from 2025 to 2032, driven by rising urbanization, expanding healthcare infrastructure, and increasing government support for eye care. Countries such as China, Japan, and India are witnessing rapid adoption of ophthalmic diagnostic technologies due to increasing awareness, prevalence of eye disorders, and affordability of advanced imaging systems. The region’s expanding medical tourism sector and growing number of eye care specialists further boost market demand.

Japan Corneal Topography and Tomography Systems Market Insight

The Japan’s market is gaining momentum due to the country’s advanced healthcare system, aging population, and high demand for precision diagnostics. The adoption of corneal topography and tomography systems is increasing in hospitals and specialized eye clinics, with integration into broader ophthalmic care pathways. The growing focus on early diagnosis and post-surgical evaluation is further accelerating market growth.

India Corneal Topography and Tomography Systems Market Insight

The India accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rising healthcare expenditure, rapid urbanization, and growing awareness of eye diseases. The increasing number of ophthalmic clinics, government initiatives on eye health, and availability of cost-effective imaging solutions are key factors driving market expansion. In addition, the growing demand for refractive surgeries and corneal disorder diagnosis supports the uptake of corneal topography and tomography systems across the country.

Corneal Topography and Tomography Systems Market Share

The corneal topography and tomography systems industry is primarily led by well-established companies, including:

- Topcon Corporation (Japan)

- NIDEK CO., LTD. (Japan)

- Carl Zeiss SE(Germany)

- Heidelberg Engineering GmbH (Germany)

- Eye-Tech (U.S.)

- Alcon Inc. (Switzerland)

- OCULUS (Germany)

- Tomey Corporation (Japan)

- Haag-Streit AG (Switzerland)

- Essilor Instruments USA (U.S.)

- Tracey Technologies (U.S.)

- Visionix Ltd. (Israel)

- EyeSys Vision (U.S.)

- WaveFront Dynamics (U.S.)

- MEDA Co., Ltd. (China)

- Bon Optic Vertriebsgesellschaft mbH (Germany)

- CSO Italia S.r.l. (Italy)

- Ziemer Ophthalmic Systems AG (Switzerland)

- iVIS Technologies (Italy)

- SCHWIND eye-tech-solutions GmbH (Germany)

Latest Developments in Global Corneal Topography and Tomography Systems Market

- In May 2025, Topcon Healthcare and Pangaea Data announced a strategic investment aimed at accelerating Pangaea's efforts to address critical care gaps in eye health and systemic disease, potentially leveraging advanced ophthalmic imaging technologies, including corneal topography and tomography, through AI-driven solutions

- In April 2023, a high-resolution aberrometer prototype, the T-eyede, demonstrated its ability to detect micro alterations specific to keratoconus compared to healthy eyes. This highlights the ongoing advancements in diagnostic precision for corneal conditions

- In March 2023, WaveFront Dynamics Inc. commercially released the WaveDyn Vision Analyzer. This device is designed to enhance eye care diagnostics by precisely measuring optical distortions affecting vision, providing comprehensive data on corneal health to improve outcomes for refractive surgery and contact lens fitting

- In February 2023, Tracey Technologies launched iTrace Prime, an upgraded software for its iTrace Aberrometer and Corneal Topographer. This new version enhances vision analysis with faster processing and improved reporting features, integrating with advanced diagnostic tools to enable more effective identification of vision issues and optimized surgical planning for cataract and refractive procedures

- In January 2023, UC Health launched a USD 2 million initiative to enhance eye care for diabetic patients through teleophthalmology, leveraging advanced ophthalmic diagnostic equipment, which includes corneal topography and tomography systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.