Global Crew Boats Market

Market Size in USD Billion

CAGR :

%

USD

14.51 Billion

USD

22.95 Billion

2025

2033

USD

14.51 Billion

USD

22.95 Billion

2025

2033

| 2026 –2033 | |

| USD 14.51 Billion | |

| USD 22.95 Billion | |

|

|

|

|

What is the Global Crew Boats Market Size and Growth Rate?

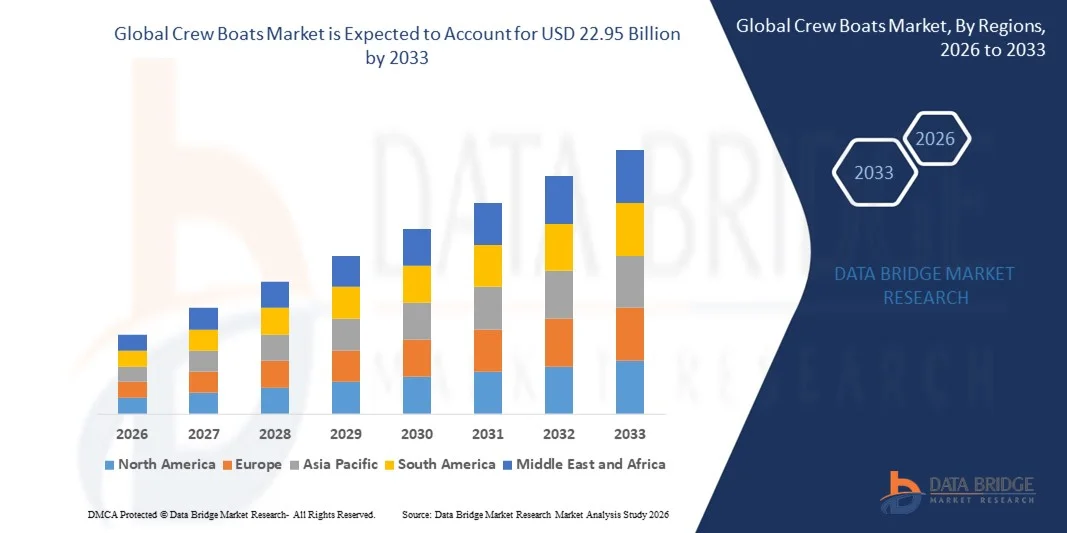

- The global crew boats market size was valued at USD 14.51 billion in 2025 and is expected to reach USD 22.95 billion by 2033, at a CAGR of5.9% during the forecast period

- The growth of shipping sector across the globe and the increasing maritime transport or seaborne trade transporting massive volume of goods across the sea acts as the major factors driving the crew boats market

- The expansion of oil and gas industry and the extensive use of the crew boats in the respective industry for transportation of rig staff from rig to their stay locations and provide emergency vigilance to offshore rigs influence the crew boats market

What are the Major Takeaways of Crew Boats Market?

- The rise in demand for crew boats from the marine sector for various purposes such as fishing and other commercial and the growing trend of marine tourism accelerate the crew boats market growth. The high adoption of these boats for the safety purposes and the increasing technological advancement in order to improve lifespan, passenger holding capacity and reliability of the boats by the manufacturers also propels the crew boats market

- In addition, rise in transportation, increasing need of safety and security, surge in investment and expansion of end use industries positively affect the crew boats market.

- Asia-Pacific dominated the crew boats market with a 44.12% revenue share in 2025, driven by expanding offshore projects, strong shipbuilding capabilities, and increasing deployment of crew transfer vessels across China, Japan, South Korea, India, and Southeast Asia

- North America is projected to register the fastest CAGR of 10.02% from 2026 to 2033, supported by rising offshore wind development, increasing oil & gas activity in the Gulf of Mexico, and growing demand for fast crew transfer vessels

- The Medium (Less than 24 m) segment dominated the market with a 52.6% share in 2025, primarily due to its high suitability for short-range crew transfer, coastal operations, port activities, offshore support, and rapid personnel mobility

Report Scope and Crew Boats Market Segmentation

|

Attributes |

Crew Boats Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Crew Boats Market?

Increasing Shift Toward High-Speed, Compact, and Fuel-Efficient Crew Boats

- The crew boats market is experiencing a strong transition toward lightweight, high-speed, and fuel-efficient vessels designed to support offshore oil & gas operations, wind farm logistics, and coastal security missions

- Manufacturers are increasingly developing aluminum-hull, hybrid-propulsion, and low-emission crew boats that offer higher maneuverability, reduced operational costs, and improved passenger safety

- Growing demand for compact, multi-role, and technologically advanced vessels equipped with motion-stabilized seating, digital navigation, and remote monitoring systems is shaping next-generation designs

- For instance, companies such as Damen Shipyards Group, Incat Crowther, and Grandweld Shipyards have introduced upgraded fast-crew boats featuring optimized hull forms, higher fuel efficiency, and hybrid/dual-fuel capabilities to meet tightening marine emission standards

- Increasing focus on rapid crew transfer, offshore asset connectivity, and fuel savings is accelerating the industry’s shift toward modern, performance-driven crew boat architectures.

- As offshore activities expand and marine environmental regulations strengthen, high-speed and energy-efficient crew boats will remain essential for safe personnel transport and operational continuity

What are the Key Drivers of Crew Boats Market?

- Rising demand for reliable, fast, and cost-efficient personnel transport vessels to support offshore oil & gas exploration, subsea operations, and coastal patrol missions

- For instance, in 2025, leading players such as Damen, Gulf Craft, and Austal expanded their crew boat portfolios with higher-capacity seating, advanced safety systems, and improved fuel-efficient engines to meet global fleet modernization needs

- Growing offshore wind farm development across the U.S., Europe, and Asia-Pacific is boosting demand for crew transfer vessels (CTVs) with enhanced stability and operational efficiency

- Advancements in hull engineering, propulsion systems, onboard digital monitoring, and hybrid marine technology are improving vessel performance and lowering lifecycle operating costs

- Rising offshore investments, coastal security modernization, and maritime infrastructure expansion are creating demand for high-speed, multi-role crew boats with superior endurance and safety

- Supported by increasing marine logistics needs and offshore workforce mobility requirements, the global Crew Boats market is poised for sustained long-term growth

Which Factor is Challenging the Growth of the Crew Boats Market?

- High upfront costs associated with advanced propulsion systems, hybrid engines, and lightweight hull materials limit adoption for smaller operators and coastal service providers

- For instance, during 2024–2025, fluctuations in marine-grade aluminum prices, engine component shortages, and extended shipyard lead times increased construction costs for several global shipbuilders

- Operational complexity in managing high-speed navigation, offshore weather risks, and crew safety compliance increases training and certification requirements

- Limited technical awareness in emerging maritime economies regarding fuel-efficient propulsion, digital vessel monitoring, and hybrid marine technologies slows modernization

- Competition from helicopter crew transfers, chartered multi-purpose offshore vessels, and autonomous surface craft creates pricing pressure and impacts fleet expansion decisions

- To address these challenges, manufacturers are focusing on cost-optimized designs, modular construction, hybrid propulsion options, and enhanced digital analytics to improve global adoption and reduce operating costs

How is the Crew Boats Market Segmented?

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the crew boats market is segmented into Medium (Less than 24 m) and Large (Greater than 24 m) vessels. The Medium (Less than 24 m) segment dominated the market with a 52.6% share in 2025, primarily due to its high suitability for short-range crew transfer, coastal operations, port activities, offshore support, and rapid personnel mobility. These vessels are favored for their agility, lower fuel consumption, lower chartering cost, and easy maneuverability, making them widely preferred by offshore service providers, marine agencies, and coastal security units. Their compact size, faster deployment capability, and lower operational complexity further boost adoption across emerging maritime regions.

The Large (Greater than 24 m) segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by the expansion of offshore wind farms, deep-water exploration projects, longer-distance transfer needs, and increasing demand for higher passenger capacity and endurance. Rising global offshore investments continue to support growth in this segment.

- By Application

On the basis of application, the crew boats market is segmented into Offshore, Marine, Defense, Oil and Gas, Fishing, and Others. The Oil and Gas segment dominated the market with a 41.3% share in 2025, supported by extensive use of crew boats for personnel transport, equipment movement, offshore platform access, and emergency response. High dependency of offshore rigs, subsea operations, and drilling activities on fast and reliable crew transfer fuels this segment’s strong demand. Crew boats remain essential for daily logistics, operational continuity, and safety compliance in global offshore oilfields.

The Offshore segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rapid expansion of offshore wind farms, subsea cabling projects, marine construction, and increasing renewable energy investments. Growing environmental regulations, rising demand for low-emission hybrid vessels, and increased focus on operational efficiency are further contributing to the strong growth of offshore crew transfer applications.

Which Region Holds the Largest Share of the Crew Boats Market?

- Asia-Pacific dominated the crew boats market with a 44.12% revenue share in 2025, driven by expanding offshore projects, strong shipbuilding capabilities, and increasing deployment of crew transfer vessels across China, Japan, South Korea, India, and Southeast Asia. Growing investment in offshore wind farms, marine transportation, coastal security, and oil & gas operations continues to elevate demand for both medium- and large-sized crew boats across regional waters

- Leading shipbuilders in Asia-Pacific are introducing next-generation crew boats featuring enhanced fuel efficiency, hybrid propulsion, stronger hull designs, and improved safety systems, strengthening the region’s technological leadership. Rising maritime trade activity, rapid port modernization, and increasing inter-island transportation further support long-term market growth

- A vast coastal workforce, expanding marine infrastructure, and high adoption of advanced navigation systems and vessel monitoring technologies further reinforce Asia-Pacific’s dominant position in the global Crew Boats market

China Crew Boats Market Insight

China is the largest contributor in Asia-Pacific, supported by extensive shipbuilding capacity, large offshore energy operations, and rapid expansion of marine transportation networks. High-volume production capability, competitive pricing, and strong government-backed maritime development programs accelerate adoption of modern crew boats across domestic and international markets.

Japan Crew Boats Market Insight

Japan shows steady growth driven by advanced marine engineering, strong demand for precision-designed vessels, and expansion of offshore renewable energy facilities. Increasing focus on safety, reliability, and hybrid propulsion technologies is propelling the adoption of premium crew transfer vessels.

India Crew Boats Market Insight

India is emerging as a major growth hub with rising investment in port modernization, offshore exploration, coastal security, and inter-island connectivity. Demand for medium-sized, fuel-efficient crew boats is increasing across oil & gas, maritime logistics, and defence operations. Government-backed shipbuilding initiatives further enhance adoption.

North America Crew Boats Market Insight

North America is projected to register the fastest CAGR of 10.02% from 2026 to 2033, supported by rising offshore wind development, increasing oil & gas activity in the Gulf of Mexico, and growing demand for fast crew transfer vessels. The U.S. and Canada are rapidly adopting next-generation crew boats equipped with advanced propulsion systems, high-speed hulls, and enhanced onboard safety standards. Expansion of maritime logistics, modernization of coastal defence fleets, and increased investment in marine transportation technology further accelerate market growth across the region.

U.S. Crew Boats Market Insight

The U.S. remains the largest contributor in North America, driven by large-scale offshore wind projects, expanding coastal security operations, and modernization of offshore service fleets. Demand is rising for high-speed, fuel-efficient crew boats capable of long-range operation, advanced navigation, and multi-mission support. Strong presence of maritime service companies, large offshore oil operations, and government-backed coastal infrastructure programs strengthens national market expansion.

Canada Crew Boats Market Insight

Canada contributes significantly through growing offshore exploration, Arctic maritime operations, and coastal transportation services. Increasing investments in marine safety, shipbuilding capability, and modernization of government-operated vessels drive adoption of medium-sized and hybrid-propulsion crew boats. Expanding port infrastructure and rising activity in fisheries, marine logistics, and coastal energy projects further support sustained growth.

Which are the Top Companies in Crew Boats Market?

The crew boats industry is primarily led by well-established companies, including:

- SEACOR Marine (U.S.)

- HamiltonJet (New Zealand)

- Stanford Marine Group (U.A.E.)

- Chantiers ALLAIS (France)

- Scruton Marine (Canada)

- SEATRAN MARINE, LLC (U.S.)

- Southern Marine Services Ltd. (U.K.)

- Blount Boats & Shipyard (U.S.)

- Damen Shipyards Group (Netherlands)

- Maersk (Denmark)

- Tidewater Inc. (U.S.)

- Siem Offshore Inc. (Norway)

- BOURBON (France)

- Kawasaki Kisen Kaisha, Ltd. (“K” Line) (Japan)

- MMA Offshore Limited. (Australia)

- Havila Shipping ASA (Norway)

- Galliano Marine Service (U.S.)

- Nam Cheong Limited (Malaysia)

- Hornbeck Offshore (U.S.)

- Vroon (Netherlands)

What are the Recent Developments in Global Crew Boats Market?

- In June 2025, Avikus, a leading autonomous navigation subsidiary of HD Hyundai, entered into a strategic partnership with maritime tech company ZeroNorth to jointly integrate autonomous navigation with real-time voyage optimisation solutions, marking a major step toward next-generation smart vessel operations. This collaboration is expected to accelerate global adoption of AI-driven autonomous maritime technologies

- In May 2025, Norway announced a new multinational agreement with the U.K., Belgium, Denmark, and the Netherlands to strengthen cooperation on the international operation of autonomous vessels, aiming to harmonise North Sea shipping standards and ensure safe deployment under each nation’s regulatory framework. This initiative is set to boost cross-border alignment and accelerate autonomous shipping across Europe

- In April 2025, U.S.-based defence company Eureka Naval Craft partnered with Australia’s Greenroom Robotics to jointly develop highly advanced autonomous systems for naval platforms, with plans to extend these technologies into commercial marine workboats as well, according to CEO Bo Jardine. This partnership is anticipated to drive innovation in next-generation autonomous vessel capabilities

- In April 2024, the U.K.-based unmanned systems specialist Kraken Technology Group collaborated with Auterion to build modular and cost-effective autonomy software and unmanned systems tailored for coastal maritime security applications. This cooperation is expected to enhance the deployment of scalable autonomous solutions for maritime defence operations

- In January 2023, IDEX-DIO confirmed its 50th SPRINT contract focused on Armed Autonomous Boat Swarms, with the Indian Navy partnering with Sagar Defence Engineering Pvt. Ltd to advance indigenous autonomous swarm systems under the SPRINT innovation programme. This milestone is projected to strengthen domestic defence technology development and operational readiness

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.