Global Crypto Hardware Wallets Market

Market Size in USD Million

CAGR :

%

USD

450.70 Million

USD

1,896.96 Million

2024

2032

USD

450.70 Million

USD

1,896.96 Million

2024

2032

| 2025 –2032 | |

| USD 450.70 Million | |

| USD 1,896.96 Million | |

|

|

|

|

Crypto Hardware Wallets Market Size

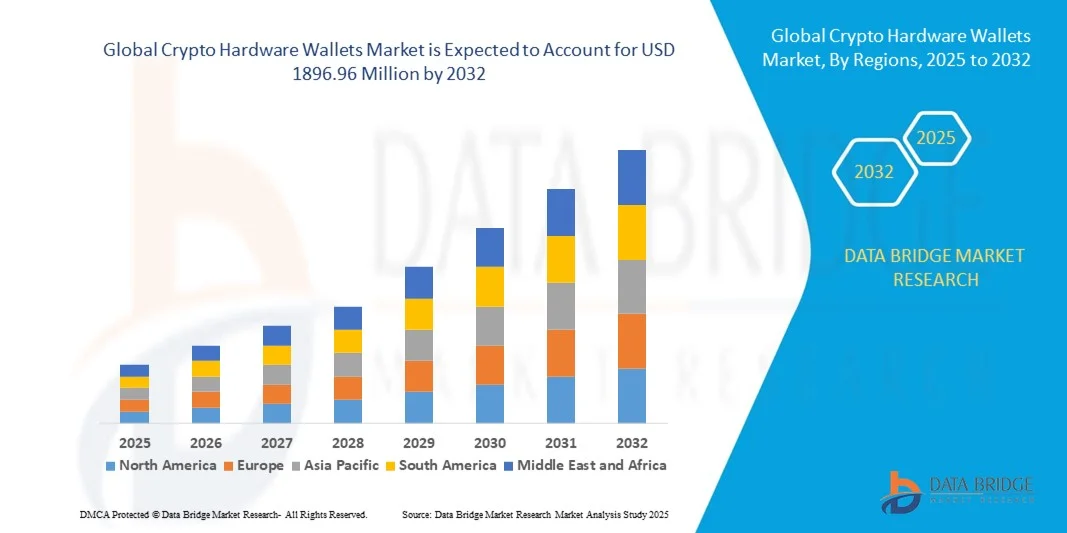

- The global crypto hardware wallets market size was valued at USD 450.7 million in 2024 and is expected to reach USD 1896.96 million by 2032, at a CAGR of 19.68% during the forecast period

- The market growth is largely fueled by the increasing adoption of cryptocurrencies and the rising need for secure, offline storage solutions to protect digital assets

- Furthermore, growing concerns over cybersecurity, hacking, and loss of private keys are driving users toward hardware wallets that offer enhanced security and control. These converging factors are accelerating the adoption of crypto hardware wallets, thereby significantly boosting the market’s expansion

Crypto Hardware Wallets Market Analysis

- Crypto hardware wallets are physical devices that allow users to store and manage private keys securely offline, protecting cryptocurrencies, NFTs, and other digital assets from online threats. These devices often integrate with wallets, exchanges, and DeFi platforms, enhancing both security and usability for individual and professional users

- The escalating demand for hardware wallets is primarily fueled by the surge in retail and institutional cryptocurrency adoption, rising awareness of self-custody solutions, and a growing preference for secure, user-friendly, and versatile crypto storage options

- North America dominated the crypto hardware wallets market with a share of 40.13% in 2024, due to a growing awareness of cryptocurrency investments, high adoption of digital assets, and the presence of well-established fintech infrastructure

- Asia-Pacific is expected to be the fastest growing region in the crypto hardware wallets market during the forecast period due to rising cryptocurrency adoption, government initiatives supporting blockchain innovation, and increasing smartphone penetration in countries such as China, Japan, and India

- Installed segment dominated the market with a market share of 52.6% in 2024, due to its strong offline security, tamper-resistant features, and capability to store private keys securely without continuous internet connectivity. Investors and crypto enthusiasts often prioritize installed wallets to minimize exposure to cyber threats and ensure safe long-term storage of digital assets. The segment’s dominance is further reinforced by the growing awareness of cybersecurity risks in crypto trading and investment

Report Scope and Crypto Hardware Wallets Market Segmentation

|

Attributes |

Crypto Hardware Wallets Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Crypto Hardware Wallets Market Trends

Integration of Hardware Wallets with DeFi and NFTs

- The global crypto hardware wallets market is experiencing a surge in adoption as integration with decentralized finance (DeFi) and non-fungible tokens (NFTs) becomes a critical functionality. This trend is expanding the usefulness of hardware wallets beyond simple storage, enabling users to securely access diverse services in the blockchain ecosystem

- For instance, Ledger has launched updates allowing users to directly interact with DeFi applications and manage NFTs through its Ledger Live platform. Similarly, Trezor hardware wallets are incorporating integrations with third-party services that streamline DeFi interactions and token management

- The growing popularity of NFTs is driving demand for secure long-term storage solutions that safeguard digital assets against online threats. Hardware wallets provide offline security while also facilitating seamless connection with NFT marketplaces and platforms where buying, selling, and showcasing assets take place

- DeFi adoption reflects the rising need for secure participation in lending, staking, and yield farming activities. Through direct integration, hardware wallets ensure stronger protection for private keys without compromising the user’s ability to interact with decentralized platforms in real time

- Interoperability is becoming central to adoption, as newer wallets are enabling cross-chain support. Multiple blockchain compatibility increases convenience for users managing assets across Ethereum, Binance Smart Chain, Solana, and other networks, aligning hardware wallets with the multi-chain expansion of DeFi and NFTs

- The integration of crypto hardware wallets with DeFi and NFT ecosystems marks a significant advancement, positioning them as indispensable tools for the evolving digital asset economy. Their dual advantage of strong offline security and seamless ecosystem interaction is setting a long-term trajectory for expanded adoption among retail and institutional crypto investors

Crypto Hardware Wallets Market Dynamics

Driver

Rising Demand for Secure Offline Crypto Storage

- The growing frequency of cyberattacks, exchange hacks, and phishing scams is propelling strong demand for secure offline storage solutions such as hardware wallets. Investors are increasingly aware of the vulnerabilities associated with storing assets on online wallets or centralized exchanges and are turning toward hardware wallets for protection

- For instance, Ledger and Trezor hardware wallets have gained significant popularity, with both companies reporting record sales during periods of heightened crypto market volatility. Such demand spikes demonstrate how security concerns directly drive adoption within the retail and institutional investor community

- Hardware wallets offer distinct advantages such as private key isolation, offline transaction signing, and protection against malware attacks. This ensures a significantly lower risk profile as compared to hot wallets, establishing hardware wallets as the gold standard for crypto security

- The increasing complexity and diversification of crypto portfolios is further emphasizing the need for reliable, long-term storage solutions. Institutional investors managing large-scale crypto holdings are prioritizing cold wallets as part of robust digital asset custody frameworks

- The demand for secure offline storage underscores the long-term sustainability of hardware wallets in the digital asset market. By offering unmatched levels of safety, these wallets are becoming integral to customer trust, investor protection, and the continued mainstream adoption of cryptocurrencies

Restraint/Challenge

High Cost and Technical Complexity

- The relatively high cost of crypto hardware wallets remains a barrier for retail adoption, particularly in emerging markets or for casual investors holding smaller amounts of cryptocurrency. The investment can appear disproportionate when compared to free or low-cost software wallet alternatives

- For instance, the Ledger Nano X and Trezor Model T are premium devices priced higher than basic software wallets, often discouraging price-sensitive customers. While these wallets offer superior security, their upfront costs reduce accessibility for small-scale asset holders

- Technical complexity also presents an obstacle, as setting up hardware wallets and executing secure transactions requires a learning curve. Users unfamiliar with seed phrases, firmware updates, or backup practices often face challenges that may result in adoption hesitancy or improper use

- Retail investors sometimes perceive hardware wallets as cumbersome due to their physical requirements, such as connecting devices via USB or Bluetooth, which may appear less convenient compared to instant access through mobile-based wallets or exchange accounts

- To overcome these barriers, manufacturers must focus on creating affordable entry-level models, streamlining user interfaces, and offering clear educational resources on safe usage. Reducing complexity and cost will be vital to driving mass adoption and ensuring profitability in the growing crypto hardware wallet market

Crypto Hardware Wallets Market Scope

The market is segmented on the basis of type, product type, and application.

- By Type

On the basis of type, the crypto hardware wallets market is segmented into USB connectivity type, Bluetooth connectivity type, NFC connectivity, and others. The USB connectivity type dominated the largest market revenue share in 2024, owing to its reliable wired connection, enhanced security, and ease of compatibility with most computers and devices. Users often prefer USB wallets for storing significant crypto assets due to the reduced risk of wireless hacking and their ability to integrate seamlessly with popular cryptocurrency management software. The established trust and widespread adoption of USB wallets in both individual and professional settings reinforce their leading position.

The Bluetooth connectivity type is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increasing mobile usage, convenience of wireless transfers, and compatibility with smartphones and tablets. Bluetooth wallets offer users the flexibility to manage crypto assets on-the-go while maintaining robust security protocols. Their growing adoption is also supported by the rise of mobile-based crypto applications and the need for easy peer-to-peer transactions without relying on physical connections.

- By Product Type

On the basis of product type, the market is segmented into web-based and installed hardware wallets. The installed hardware wallet segment held the largest market revenue share of 52.6% in 2024 due to its strong offline security, tamper-resistant features, and capability to store private keys securely without continuous internet connectivity. Investors and crypto enthusiasts often prioritize installed wallets to minimize exposure to cyber threats and ensure safe long-term storage of digital assets. The segment’s dominance is further reinforced by the growing awareness of cybersecurity risks in crypto trading and investment.

The web-based hardware wallet segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the demand for convenient access, cloud-based management, and multi-device compatibility. Web-based wallets allow users to quickly access funds, monitor portfolios, and perform transactions remotely. Their growth is fueled by the increasing number of retail crypto users seeking flexible yet secure storage solutions with seamless integration into trading platforms.

- By Application

On the basis of application, the crypto hardware wallets market is segmented into individual and professional users. The individual user segment dominated the largest market revenue share in 2024, owing to the growing retail adoption of cryptocurrencies, increasing awareness about secure asset storage, and the rising number of small-scale investors seeking safe and user-friendly storage options. Individuals prioritize wallets that provide convenience, robust security, and compatibility with multiple digital assets.

The professional user segment is projected to witness the fastest growth rate from 2025 to 2032, driven by the rising adoption of cryptocurrencies by businesses, institutional investors, and crypto exchanges. Professional users demand advanced security features, multi-signature approvals, and enterprise-level wallet management solutions to safeguard large volumes of digital assets. The growth is also supported by regulatory compliance requirements and the increasing need for secure treasury and transaction management in professional settings.

Crypto Hardware Wallets Market Regional Analysis

- North America dominated the crypto hardware wallets market with the largest revenue share of 40.13% in 2024, driven by a growing awareness of cryptocurrency investments, high adoption of digital assets, and the presence of well-established fintech infrastructure

- Consumers in the region highly value secure, offline storage solutions, ease of use, and compatibility with multiple cryptocurrency platforms and wallets

- This widespread adoption is further supported by high disposable incomes, a technologically inclined population, and the increasing trend of self-custody for digital assets, establishing crypto hardware wallets as a preferred solution for both individual and professional users

U.S. Crypto Hardware Wallets Market Insight

The U.S. crypto hardware wallets market captured the largest revenue share in 2024 within North America, fueled by rapid adoption of cryptocurrencies, rising retail investor participation, and a robust fintech ecosystem. Consumers are increasingly prioritizing the security of private keys and digital assets through reliable offline hardware wallets. The growing demand for mobile-compatible devices, multi-asset support, and integration with popular crypto platforms, exchanges, and DeFi applications is significantly contributing to market expansion.

Europe Crypto Hardware Wallets Market Insight

The Europe crypto hardware wallets market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing digital asset adoption, stringent data security regulations, and rising awareness of cyber threats. The growth is supported by countries such as Germany, France, and the Netherlands, where cryptocurrency trading and investment are increasing. European consumers are attracted to hardware wallets for strong security features, offline storage capabilities, and support for multiple cryptocurrencies across both individual and professional users.

U.K. Crypto Hardware Wallets Market Insight

The U.K. crypto hardware wallets market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising retail and institutional participation in digital assets and growing concerns over online security. Both consumers and businesses are opting for hardware wallets to protect private keys and mitigate hacking risks. The region’s robust fintech ecosystem, high cryptocurrency awareness, and regulatory clarity are expected to continue stimulating market growth.

Germany Crypto Hardware Wallets Market Insight

The Germany crypto hardware wallets market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing cryptocurrency adoption, strong cybersecurity awareness, and a focus on data protection. Germany’s tech-savvy population and early blockchain adopters are promoting wallet adoption across both individual and professional users. The integration of wallets with multi-platform and enterprise-level solutions is also driving demand among investors and fintech companies.

Asia-Pacific Crypto Hardware Wallets Market Insight

The Asia-Pacific crypto hardware wallets market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rising cryptocurrency adoption, government initiatives supporting blockchain innovation, and increasing smartphone penetration in countries such as China, Japan, and India. The region’s growing interest in self-custody of digital assets, combined with manufacturing hubs producing affordable hardware wallets, is expanding accessibility to a wider consumer base.

Japan Crypto Hardware Wallets Market Insight

The Japan crypto hardware wallets market is gaining momentum due to high technological adoption, strong interest in cryptocurrencies, and increasing individual and institutional investment. Japanese consumers highly value secure, user-friendly wallets that integrate with mobile and desktop platforms. The adoption of wallets is further driven by trends combining hardware wallets with blockchain applications, including NFTs and DeFi platforms, in both residential and commercial sectors.

China Crypto Hardware Wallets Market Insight

The China crypto hardware wallets market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, a tech-savvy population, and growing interest in digital assets. China’s strong domestic manufacturing, availability of affordable hardware wallets, and integration with local crypto platforms and digital asset management applications are key factors propelling widespread adoption in both individual and professional segments.

Crypto Hardware Wallets Market Share

The crypto hardware wallets industry is primarily led by well-established companies, including:

- Ledger SAS (France)

- Shift Cryptosecurity AG (Switzerland)

- Coinkite (Canada)

- BitLox (Denmark)

- CoolWallet (Taiwan)

- Cryobit LLC. (U.S.)

- SatoshiLabs s.r.o. (Czech Republic)

- KeepKey (U.S.)

- GEMNET Pte Ltd (Singapore)

- BitMain Technologies Holding Company (China)

- Intel (U.S.)

- OPENDIME (Canada)

- Cryobit LLC. (U.S.)

Latest Developments in Global Crypto Hardware Wallets Market

- In August 2025, Bullet Blockchain announced a strategic partnership with Tangem to enhance cryptocurrency access and security. This collaboration integrates Tangem's military-grade hardware wallets, supporting over 16,000 cryptocurrencies, with Bullet Blockchain's network of over 200 Bitcoin ATMs across the U.S. The partnership aims to provide users with secure and convenient options for managing and accessing their digital assets, strengthening both companies’ positions in the growing hardware wallet market

- In July 2025, Blockstream, a leading Bitcoin infrastructure firm, acquired Elysium Lab, a Swiss startup specializing in keyless Bitcoin wallets and Lightning infrastructure. This acquisition led to the formation of Blockstream Europe, signaling a deeper commitment to European fintech and Bitcoin-native R&D. The move enhances Blockstream's presence in Europe and strengthens its capabilities in developing advanced crypto wallet solutions, expanding its market influence

- In June 2025, Stripe acquired Privy, a crypto wallet provider offering white-label onboarding and wallet services for developers. This acquisition enables Stripe to expand its blockchain infrastructure and provide developers with tools to integrate crypto solutions more seamlessly. Privy's existing user base of 75 million wallets across 1,000 applications will benefit from Stripe's resources, potentially accelerating the adoption of crypto solutions and driving growth in the hardware wallet ecosystem

- In May 2024, Ledger launched the Ledger Stax, a premium hardware wallet featuring a curved E Ink touchscreen and support for over 5,500 coins and tokens. Priced at $399, it emphasizes user-friendliness and robust security. The Ledger Stax provides users with a secure and intuitive way to manage digital assets, catering to both crypto enthusiasts and newcomers, and strengthening Ledger’s position as a leading hardware wallet provider

- In 2022, Cypherock introduced the X1 hardware wallet, supporting over 9,000 digital assets including major cryptocurrencies, NFTs, and access to DeFi applications via WalletConnect. Its ultra-compact design, user-friendly interface, and robust security features offered a comprehensive solution for secure crypto storage. The Cypherock X1 significantly contributed to expanding consumer trust and adoption in the crypto hardware wallet market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Crypto Hardware Wallets Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Crypto Hardware Wallets Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Crypto Hardware Wallets Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.