Global Cumin Seed Oil Market

Market Size in USD Million

CAGR :

%

USD

483.74 Million

USD

714.71 Million

2025

2033

USD

483.74 Million

USD

714.71 Million

2025

2033

| 2026 –2033 | |

| USD 483.74 Million | |

| USD 714.71 Million | |

|

|

|

|

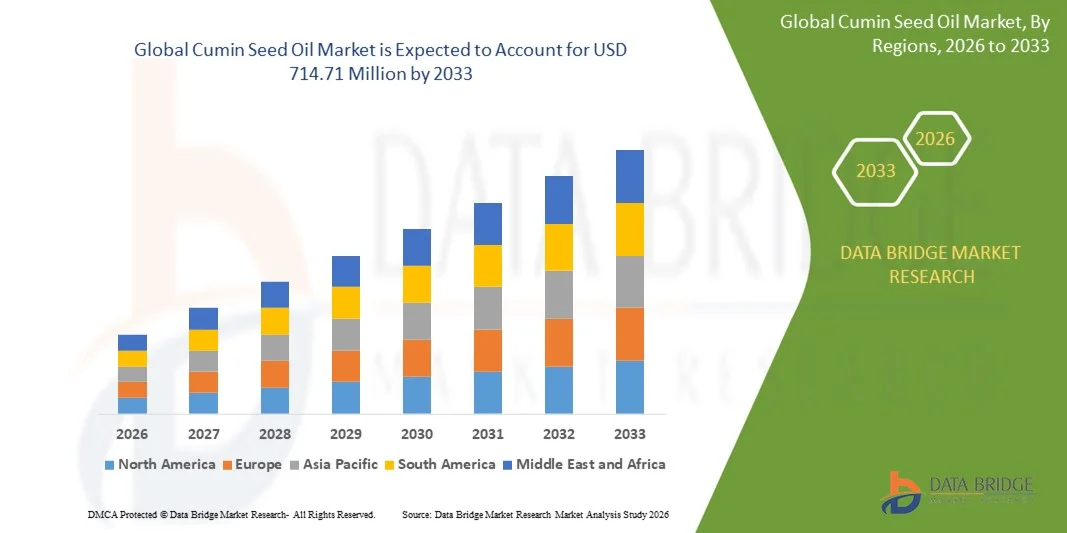

What is the Global Cumin Seed Oil Market Size and Growth Rate?

- The global cumin seed oil market size was valued at USD 483.74 million in 2025 and is expected to reach USD 714.71 million by 2033, at a CAGR of5.00% during the forecast period

- The major growing factor towards cumin seed oil market is the rise in product demand in functional foods. Furthermore, the rise in the product demand in functional foods and is also expected to heighten the overall demand for cumin seed oil market

What are the Major Takeaways of Cumin Seed Oil Market?

- The rise in cosmetics and personal care exports and increase in organic ingredients demand due to strict EU regulations regarding limiting synthetic chemical usage are also expected to serve as foremost drivers for the cumin seed oil market at a global level

- In addition, the rise in the product demand in cosmetics along with rise in the consumption of natural ingredients in skin care applications are also lifting the growth of the cumin seed oil market

- Asia-Pacific dominated the cumin seed oil market with an estimated 45.2% revenue share in 2025, driven by large-scale cumin seed cultivation, strong presence of traditional medicine systems, and high consumption of natural oils across India, China, Southeast Asia, and the Middle East-linked Asian markets

- North America is expected to register the fastest CAGR of 8.45% from 2026 to 2033, driven by rising consumer preference for natural digestive aids, plant-based supplements, and clean-label ingredients

- The Oil segment dominated the market with a 61.3% share in 2025, driven by its extensive use across culinary, cosmetic, aromatherapy, and traditional medicine applications

Report Scope and Cumin Seed Oil Market Segmentation

|

Attributes |

Cumin Seed Oil Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Cumin Seed Oil Market?

Increasing Shift Toward Natural, Cold-Pressed, and Therapeutic-Grade Cumin Seed Oils

- The cumin seed oil market is witnessing growing adoption of cold-pressed and steam-distilled oils with high purity and preserved bioactive compounds, driven by rising demand from food, nutraceutical, and personal care industries

- Manufacturers are focusing on clean-label processing, solvent-free extraction, and improved yield optimization to enhance oil quality, aroma, and therapeutic efficacy

- Growing consumer preference for natural digestive aids, immunity-boosting ingredients, and plant-based remedies is accelerating use of cumin seed oil in dietary supplements and traditional medicine

- For instance, companies such as Sabinsa, Kerfoot Group, OPW Ingredients, Dwarkesh Pharmaceuticals, and MANISH AGRO are expanding cumin seed oil offerings for pharmaceutical, food flavoring, and cosmetic applications

- Increasing emphasis on traceability, origin certification, and compliance with global food and cosmetic regulations is strengthening product acceptance

- As demand for herbal oils continues to rise, cumin seed oil will remain vital for digestive health, immunity support, and functional formulations

What are the Key Drivers of Cumin Seed Oil Market?

- Rising demand for natural digestive, anti-inflammatory, and antioxidant ingredients in nutraceutical and functional food products

- For instance, during 2024–2025, manufacturers increased investment in standardized cumin seed oil production to meet growing export demand from the U.S. and Europe

- Growing adoption of cumin seed oil in Ayurvedic, Unani, and traditional herbal formulations is boosting consumption across Asia-Pacific and the Middle East

- Advancements in extraction technology, quality testing, and shelf-life stabilization have improved oil consistency and global acceptance

- Expanding use in flavoring agents, aromatherapy products, and natural cosmetics is widening application scope

- Supported by rising health awareness and preference for plant-based wellness solutions, the Cumin Seed Oil market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Cumin Seed Oil Market?

- Fluctuations in raw cumin seed prices, crop yield variability, and climatic dependency impact production stability and cost structure

- For instance, during 2024–2025, inconsistent harvests and rising agricultural input costs affected cumin seed availability in major producing regions

- Stringent regulatory requirements related to food safety, purity standards, and labeling increase compliance costs for manufacturers

- Limited consumer awareness in certain regions regarding the therapeutic benefits and correct usage of cumin seed oil restricts adoption

- Competition from alternative essential oils and synthetic flavoring agents creates pricing pressure

- To address these challenges, companies are focusing on contract farming, supply-chain integration, quality certification, and consumer education to strengthen global adoption of Cumin Seed Oil

How is the Cumin Seed Oil Market Segmented?

The market is segmented on the basis of form, application, and end use.

- By Form

On the basis of form, the cumin seed oil market is segmented into Oil and Capsule. The Oil segment dominated the market with a 61.3% share in 2025, driven by its extensive use across culinary, cosmetic, aromatherapy, and traditional medicine applications. Liquid cumin seed oil is preferred due to its high versatility, ease of blending, and suitability for both direct consumption and formulation-based uses. The oil form is widely utilized in Ayurveda and Unani medicine for digestive and therapeutic benefits, while food manufacturers favor it for flavoring and seasoning applications. Additionally, higher consumer familiarity and wider availability support segment dominance.

The Capsule segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for standardized, dosage-controlled dietary supplements. Growing preference for convenient, odor-free, and easy-to-consume formats among health-conscious consumers is accelerating adoption.

- By Application

On the basis of application, the cumin seed oil market is segmented into Cosmetics and Personal Care, Dietary Supplements, and Culinary. The Dietary Supplements segment dominated the market with a 43.8% share in 2025, supported by increasing use of cumin seed oil for digestive health, immunity support, and anti-inflammatory benefits. Rising consumer inclination toward natural and plant-based supplements has boosted demand across capsules, softgels, and herbal blends. Strong presence of nutraceutical brands and growing awareness of gut health further reinforce segment leadership.

The Cosmetics and Personal Care segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising use of cumin seed oil in skincare, haircare, and aromatherapy products. Its antioxidant, antimicrobial, and skin-soothing properties are increasing adoption in natural and organic cosmetic formulations.

- By End Use

On the basis of end use, the cumin seed oil market is segmented into Retail and Industrial. The Industrial segment dominated the market with a 56.5% share in 2025, driven by bulk consumption from food processors, nutraceutical manufacturers, pharmaceutical companies, and cosmetic formulators. Industrial buyers prefer large-volume procurement for standardized production, cost efficiency, and consistent quality. Expanding use of cumin seed oil as an ingredient in functional foods, supplements, and personal care products supports sustained industrial demand.

The Retail segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing direct-to-consumer sales through online platforms, health stores, and specialty wellness retailers. Rising consumer awareness, premium packaging, and growth of e-commerce are accelerating retail market expansion.

Which Region Holds the Largest Share of the Cumin Seed Oil Market?

- Asia-Pacific dominated the cumin seed oil market with an estimated 45.2% revenue share in 2025, driven by large-scale cumin seed cultivation, strong presence of traditional medicine systems, and high consumption of natural oils across India, China, Southeast Asia, and the Middle East-linked Asian markets

- Extensive use of cumin seed oil in Ayurvedic, Unani, traditional Chinese medicine, culinary applications, and dietary supplements continues to fuel regional demand

- Availability of raw materials, cost-effective extraction, strong export activity, and growing domestic consumption reinforce Asia-Pacific’s leadership in the global cumin seed oil market

India Cumin Seed Oil Market Insight

India is the largest contributor within Asia-Pacific, supported by its position as one of the world’s leading producers of cumin seeds. Strong demand from the pharmaceutical, nutraceutical, and food industries drives large-scale consumption. Expanding exports of herbal oils, government support for spice and botanical exports, and rising domestic health awareness further strengthen market growth.

China Cumin Seed Oil Market Insight

China contributes significantly due to growing use of herbal oils in traditional medicine, functional foods, and cosmetics. Rising consumer interest in digestive health and natural remedies supports steady market expansion.

North America Cumin Seed Oil Market

North America is expected to register the fastest CAGR of 8.45% from 2026 to 2033, driven by rising consumer preference for natural digestive aids, plant-based supplements, and clean-label ingredients. Growing incorporation of cumin seed oil into dietary supplements, functional foods, and natural personal care products supports rapid regional growth. Strong presence of nutraceutical brands, advanced retail distribution, and e-commerce penetration accelerates market expansion

U.S. Cumin Seed Oil Market Insight

The U.S. leads North America due to high consumer spending on wellness products and strong demand for herbal oils in supplements and natural foods. Increasing awareness of digestive and immunity benefits drives sustained market growth.

Canada Cumin Seed Oil Market Insight

Canada contributes steadily, supported by growing adoption of natural health products, expanding ethnic food consumption, and rising regulatory acceptance of herbal ingredients. Expanding health retail channels further boost market penetration.

Which are the Top Companies in Cumin Seed Oil Market?

The cumin seed oil industry is primarily led by well-established companies, including:

- Sabinsa (U.S.)

- AOS Products Pvt. Ltd. (India)

- Safa Honey Co. (Pakistan)

- Kerfoot Group (U.K.)

- MANISH AGRO (India)

- Z-COMPANY (India)

- HAB SHIFA (Pakistan)

- OPW Ingredients GmbH (Germany)

- Dwarkesh Pharmaceuticals Private Limited (India)

What are the Recent Developments in Global Cumin Seed Oil Market?

- In August 2025, TriNutra partnered with Nutritunes to supply ThymoQuin, a USP-grade black seed oil, for Nutritunes’ premium dietary supplement portfolio. The product is formulated to support cortisol balance, immune function, heart health, and gut microbiome wellness, featuring 3% thymoquinone and less than 1.25% free fatty acids, reinforcing its high purity and efficacy. This partnership strengthens the positioning of clinically standardized black seed oil in the premium nutraceutical segment

- In November 2024, Sahara Glow, a leading Egyptian producer of high-quality black seed oil, announced its official expansion into the U.S. market. Along with its flagship cold-pressed black seed oil rich in thymoquinone, the company launched a range of natural healing creams through its TikTok shop, targeting inflammation relief and overall wellness. This expansion marks Sahara Glow’s strategic entry into the fast-growing U.S. natural remedies and social-commerce channel

- In May 2024, WOW Skin Science, an award-winning natural hair, skin, and lifestyle brand, announced that its popular Red Onion Black Seed Oil product line became available across 400 Walmart stores nationwide as well as online platforms. This retail expansion significantly enhanced product accessibility and brand visibility. The move underscores growing mass-market demand for black seed oil–based personal care solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cumin Seed Oil Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cumin Seed Oil Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cumin Seed Oil Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.