Global Cytokinin Market

Market Size in USD Billion

CAGR :

%

USD

2.36 Billion

USD

3.35 Billion

2025

2033

USD

2.36 Billion

USD

3.35 Billion

2025

2033

| 2026 –2033 | |

| USD 2.36 Billion | |

| USD 3.35 Billion | |

|

|

|

|

Cytokinin Market Size

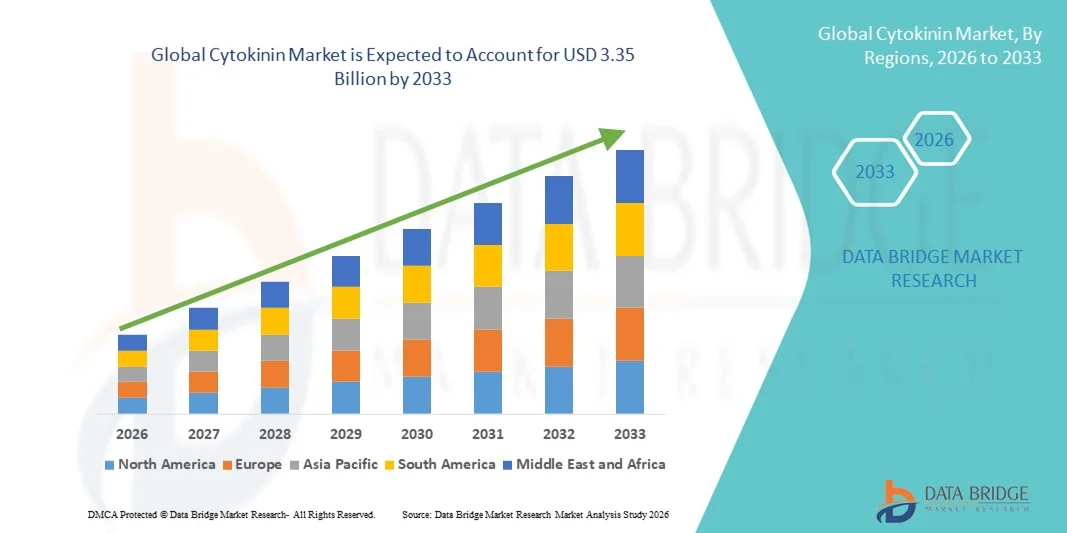

- The global cytokinin market size was valued at USD 2.36 billion in 2025 and is expected to reach USD 3.35 billion by 2033, at a CAGR of 4.5% during the forecast period

- The market growth is largely driven by the increasing use of cytokinins in modern agriculture to enhance crop yield, improve stress tolerance, and regulate plant growth, supported by advances in plant biotechnology and precision farming practices

- Furthermore, rising demand for sustainable and high-efficiency agrochemical solutions is positioning cytokinins as essential plant growth regulators for cereals, fruits, vegetables, and horticultural crops. These combined factors are accelerating the adoption of cytokinin-based products, thereby strengthening overall market expansion

Cytokinin Market Analysis

- Cytokinins, functioning as key plant hormones that promote cell division, delay senescence, and support nutrient mobilization, are becoming integral to crop management strategies across commercial agriculture and horticulture due to their ability to improve plant vigor and productivity

- The increasing demand for cytokinins is primarily supported by the shift toward high-value crop cultivation, growing awareness of yield optimization techniques, and the need to improve crop resilience under changing climatic conditions

- North America dominated the cytokinin market with a share of 42% in 2025, due to advanced agricultural practices, strong investment in plant biotechnology, and widespread adoption of crop yield–enhancing inputs

- Asia-Pacific is expected to be the fastest growing region in the cytokinin market during the forecast period due to rapid agricultural modernization, rising food demand, and increasing adoption of advanced farming techniques

- Adenine-type segment dominated the market with a market share of 62.5% in 2025, due to its widespread occurrence in plants and proven effectiveness in regulating cell division and shoot formation. These cytokinins are extensively used in agriculture and plant tissue culture due to their high biological activity and compatibility with existing crop management practices. Strong research backing and ease of formulation further support the dominance of adenine-type cytokinins across commercial applications

Report Scope and Cytokinin Market Segmentation

|

Attributes |

Cytokinin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cytokinin Market Trends

Increasing Adoption of Cytokinin-Based Biostimulants in Sustainable Agriculture

- A major trend shaping the cytokinin market is the rising adoption of cytokinin-based biostimulants to support sustainable agricultural practices, driven by the need to enhance crop productivity while reducing dependence on conventional chemical inputs. Cytokinins are increasingly recognized for their role in promoting cell division, delaying leaf senescence, and improving nutrient mobilization, which aligns well with sustainable farming objectives

- For instance, companies such as Valagro and UPL Limited actively commercialize cytokinin-enriched biostimulant formulations that are widely used in horticulture and field crops to improve yield quality and plant vigor. These products are integrated into crop nutrition programs to support balanced growth and stress management under varying environmental conditions

- The application of cytokinins is expanding in high-value crops where uniform growth, improved flowering, and enhanced fruit set are critical for commercial success. This trend is strengthening the role of cytokinins as functional inputs in precision crop management strategies

- Agricultural producers are increasingly adopting cytokinin-based solutions to mitigate the effects of abiotic stresses such as drought and temperature fluctuations. This adoption is contributing to improved crop resilience and more stable production outcomes

- The growing emphasis on sustainable yield enhancement is encouraging research institutions and agribusiness firms to invest in advanced cytokinin formulations with improved efficacy. This is reinforcing the long-term integration of cytokinins into modern plant growth management systems

- Overall, the increasing preference for environmentally responsible and performance-oriented agricultural inputs is driving sustained interest in cytokinin-based biostimulants, positioning them as key components within the evolving sustainable agriculture landscape

Cytokinin Market Dynamics

Driver

Rising Demand for Crop Yield Enhancement and Stress Resistance

- The rising demand for improved crop yield and enhanced stress resistance is a primary driver for the cytokinin market, as farmers seek effective plant growth regulators to optimize productivity under challenging growing conditions. Cytokinins support physiological processes that directly influence yield formation and plant longevity

- For instance, Bayer AG offers cytokinin-containing plant growth regulator solutions that are applied across cereals and specialty crops to improve growth consistency and stress tolerance. These solutions assist growers in maintaining productivity despite environmental variability

- The increasing global focus on food security is encouraging the adoption of crop inputs that maximize output per unit of cultivated land. Cytokinins contribute to efficient resource utilization by supporting balanced plant development and delayed aging

- Changing climatic patterns are intensifying stress conditions for crops, which is increasing reliance on growth regulators that enhance plant defense mechanisms. This is strengthening demand for cytokinin-based products across diverse agricultural regions

- The continued emphasis on productivity enhancement and crop resilience is sustaining strong momentum for cytokinin adoption, directly supporting overall market growth

Restraint/Challenge

High Production Costs and Limited Farmer Awareness

- The cytokinin market faces challenges related to high production costs, as the synthesis and formulation of plant hormones require controlled processes, specialized inputs, and stringent quality standards. These factors increase manufacturing expenses and influence product pricing

- For instance, BASF SE invests in advanced biochemical production technologies to ensure consistency and effectiveness of plant growth regulators, which contributes to higher operational and development costs. Such investments, while essential for quality assurance, raise barriers to cost reduction

- Limited awareness among small and medium-scale farmers regarding the benefits and correct application of cytokinins restricts broader market penetration. Many growers remain reliant on traditional inputs due to limited access to technical guidance

- The requirement for precise dosage and application timing further complicates adoption, as improper use may not deliver expected results. This creates hesitation among farmers unfamiliar with hormone-based crop management

- Overall, the combined impact of elevated production costs and insufficient farmer awareness continues to challenge widespread cytokinin adoption, requiring focused education efforts and cost-optimization strategies to unlock the market’s full potential

Cytokinin Market Scope

The market is segmented on the basis of type, application, and end use industry.

- By Type

On the basis of type, the cytokinin market is segmented into adenine-type and phenyl-type cytokinins. The adenine-type segment dominated the market with the largest revenue share of 62.5% in 2025, driven by its widespread occurrence in plants and proven effectiveness in regulating cell division and shoot formation. These cytokinins are extensively used in agriculture and plant tissue culture due to their high biological activity and compatibility with existing crop management practices. Strong research backing and ease of formulation further support the dominance of adenine-type cytokinins across commercial applications.

The phenyl-type segment is expected to witness the fastest growth from 2026 to 2033, supported by increasing research interest in their higher stability and prolonged physiological effects. Phenyl-type cytokinins are gaining attention for specialized agricultural and experimental applications where sustained plant response is required. Their potential in advanced plant biotechnology and controlled-environment farming is accelerating adoption across emerging markets.

- By Application

On the basis of application, the cytokinin market is segmented into cell division, seed dormancy, senescence, and others. The cell division segment dominated the market in 2025 owing to the fundamental role of cytokinins in promoting cell proliferation and shoot development. This application is central to crop yield enhancement, micropropagation, and tissue culture processes, making it a primary focus for agricultural producers and research institutions. Continuous demand for higher productivity crops reinforces the strong position of this segment.

The senescence segment is projected to grow at the fastest rate during the forecast period, driven by rising demand for delaying leaf aging and extending shelf life of horticultural produce. Cytokinins are increasingly used to maintain chlorophyll content and improve post-harvest quality in fruits, vegetables, and ornamental plants. Growing emphasis on reducing post-harvest losses is further supporting rapid growth in this application area.

- By End Use Industry

On the basis of end use industry, the cytokinin market is segmented into agriculture, healthcare, cosmetics, and others. The agriculture segment dominated the market in 2025, driven by extensive use of cytokinins to enhance crop growth, improve stress tolerance, and increase yield quality. Farmers and agribusinesses rely on cytokinin-based products to optimize plant development and support sustainable farming practices. Government support for advanced agrochemicals also contributes to sustained demand from this sector.

The cosmetics segment is anticipated to register the fastest growth from 2026 to 2033, fueled by rising use of plant hormones in anti-aging and skin rejuvenation formulations. Cytokinins are valued for their ability to promote cell renewal and reduce visible signs of aging, aligning with growing consumer preference for bio-based cosmetic ingredients. Increasing investment in premium and natural skincare products is accelerating adoption within the cosmetics industry.

Cytokinin Market Regional Analysis

- North America dominated the cytokinin market with the largest revenue share of 42% in 2025, driven by advanced agricultural practices, strong investment in plant biotechnology, and widespread adoption of crop yield–enhancing inputs

- Producers and research institutions in the region highly value cytokinins for their role in promoting cell division, delaying senescence, and improving overall plant vigor across high-value crops

- This strong adoption is further supported by extensive R&D activities, presence of major agrochemical and biotechnology companies, and increasing focus on sustainable and precision agriculture, positioning North America as a leading market for cytokinin-based solutions

U.S. Cytokinin Market Insight

The U.S. cytokinin market captured the largest revenue share within North America in 2025, supported by the country’s highly developed agricultural sector and strong emphasis on crop productivity and innovation. Widespread use of plant growth regulators in cereals, fruits, vegetables, and greenhouse cultivation continues to drive demand. The presence of advanced research infrastructure and increasing adoption of tissue culture and controlled-environment farming further strengthen market growth.

Europe Cytokinin Market Insight

The Europe cytokinin market is projected to expand at a steady CAGR during the forecast period, driven by growing adoption of sustainable farming practices and strict regulations promoting efficient use of agrochemicals. Rising demand for high-quality horticultural produce and increased use of plant hormones in tissue culture are supporting market expansion. The region is witnessing consistent uptake across agriculture and research applications, supported by strong academic and institutional involvement.

U.K. Cytokinin Market Insight

The U.K. cytokinin market is anticipated to grow at a notable CAGR over the forecast period, supported by increasing focus on advanced crop science and sustainable agricultural inputs. Growing interest in improving crop resilience and yield efficiency is encouraging the use of cytokinins in both open-field and controlled farming systems. Strong collaboration between research institutions and agricultural producers continues to support market development.

Germany Cytokinin Market Insight

The Germany cytokinin market is expected to expand at a considerable CAGR, driven by the country’s emphasis on innovation, biotechnology, and environmentally responsible agriculture. High adoption of plant growth regulators in precision farming and horticulture is contributing to market growth. Germany’s strong research ecosystem and focus on high-efficiency crop inputs further reinforce demand for cytokinin-based products.

Asia-Pacific Cytokinin Market Insight

The Asia-Pacific cytokinin market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid agricultural modernization, rising food demand, and increasing adoption of advanced farming techniques. Growing awareness of plant growth regulators and expanding cultivation of fruits, vegetables, and cash crops are accelerating market growth. Government initiatives supporting agricultural productivity and biotechnology adoption further strengthen regional expansion.

Japan Cytokinin Market Insight

The Japan cytokinin market is gaining steady momentum due to strong focus on high-value crop production and advanced agricultural technologies. Cytokinins are increasingly used in tissue culture, greenhouse farming, and precision agriculture to enhance plant growth and quality. The country’s emphasis on innovation and efficiency in limited arable land conditions continues to drive demand.

China Cytokinin Market Insight

The China cytokinin market accounted for the largest revenue share in Asia Pacific in 2025, supported by large-scale agricultural activities, rapid adoption of modern farming inputs, and strong government support for agricultural biotechnology. Rising demand for higher crop yields and quality is driving extensive use of plant growth regulators. The presence of a large farming base and expanding domestic production capabilities further propel market growth in China.

Cytokinin Market Share

The cytokinin industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Bayer AG (Germany)

- Redox Industries Limited (Australia)

- Xinyi (H.K.) Industrial Co., Ltd (China)

- Sichuan Guoguang Agrochemical Co., Ltd (China)

- Nufarm Limited (Australia)

- Crop Care Australasia (Australia)

- Valagro USA Inc. (U.S.)

- Zhengzhou Farm-Reaching Biochemical Co., Ltd (China)

- Agri-Growth International, Inc. (Canada)

- Du Pont (U.S.)

- Syngenta Group (Switzerland)

- UPL Limited (India)

Latest Developments in Global Cytokinin Market

- In November 2025, UPL expanded its biologicals portfolio by launching a new cytokinin-enriched biostimulant under its Natural Plant Protection platform, targeting yield improvement and stress resistance in high-value crops. This development strengthened competition in the cytokinin market by increasing availability of bio-based growth regulators and supporting the shift toward sustainable and environmentally responsible farming practices

- In June 2025, Syngenta strengthened the cytokinin market by commissioning a 22,000 m² biologicals production facility in Orangeburg, South Carolina, with an annual capacity of 16,000 metric tons of biostimulants. This expansion significantly enhances Syngenta’s ability to supply cytokinin-based products that improve crop growth and stress tolerance, reinforcing its leadership in sustainable agriculture while supporting rising global demand for biological plant growth regulators

- In April 2025, BASF India accelerated cytokinin market growth by acquiring full ownership of BASF Agricultural Solutions India, integrating its crop protection and biologicals businesses. This strategic move expanded BASF’s plant growth regulator portfolio, including cytokinins, enabling stronger market penetration in India and supporting the development of resilient, productivity-focused agricultural solutions

- In February 2024, Corteva Agriscience advanced the cytokinin market by establishing Corteva Biologicals following the integration of Symborg and Stoller. This initiative consolidated cytokinin-based solutions such as X-Cyte under a dedicated biologicals platform, strengthening Corteva’s position in sustainable crop inputs and driving adoption of cytokinins for improved cell division, shoot growth, and stress tolerance

- In January 2023, Sumitomo Chemical reinforced its global cytokinin market presence through the acquisition of a U.S.-based biostimulant company, expanding its Biorationals business. The acquisition enhanced Valent BioSciences’ cytokinin-based offerings, including Promalin and ProTone, supporting increased use of cytokinins in fruit development and shoot growth across key agricultural regions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.