Global Dental Cam Milling Machine Market

Market Size in USD Billion

CAGR :

%

USD

1.58 Billion

USD

2.71 Billion

2025

2033

USD

1.58 Billion

USD

2.71 Billion

2025

2033

| 2026 –2033 | |

| USD 1.58 Billion | |

| USD 2.71 Billion | |

|

|

|

|

Dental CAM Milling Machine Market Size

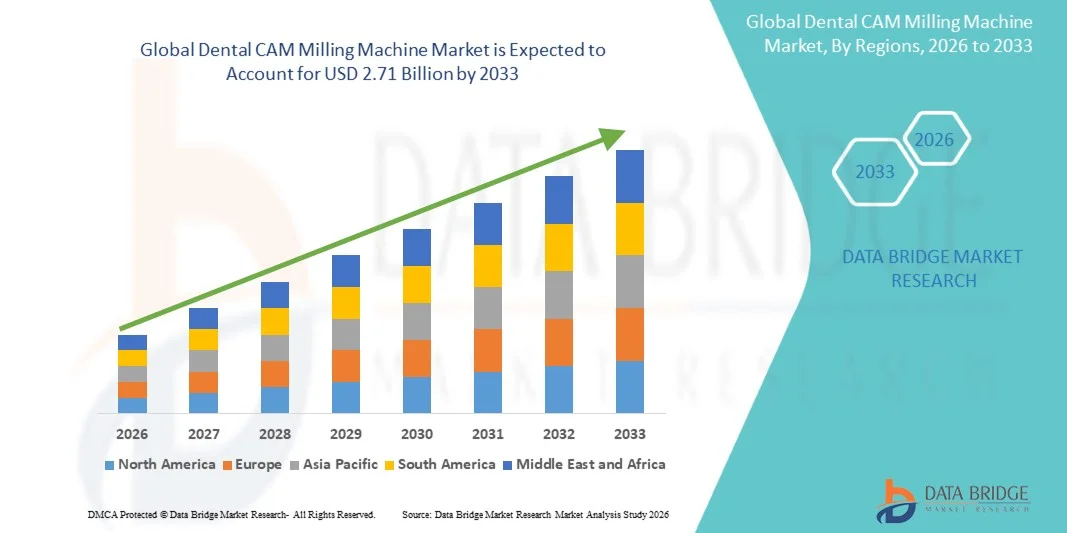

- The global dental CAM milling machine market size was valued at USD 1.58 billion in 2025 and is expected to reach USD 2.71 billion by 2033, at a CAGR of 7.00% during the forecast period

- The market growth is largely fueled by the increasing adoption of digital dentistry and continuous technological advancements in CAD/CAM systems, which are accelerating the shift toward automated, high-precision dental manufacturing across dental laboratories and clinics. These developments are driving greater efficiency, accuracy, and consistency in restorative workflows

- Furthermore, rising demand for high-quality dental prosthetics such as crowns, bridges, implants, and dentures—along with the growing preference for chairside and same-day dentistry—is establishing dental CAM milling machines as a core solution in modern dental practices. These converging factors are accelerating the uptake of Dental CAM Milling Machine solutions, thereby significantly boosting the industry’s growth

Dental CAM Milling Machine Market Analysis

- Dental CAM Milling Machines, offering automated and high-precision fabrication of dental restorations such as crowns, bridges, dentures, and implants, are increasingly vital components in modern dental laboratories and clinics due to their efficiency, accuracy, and ability to integrate with digital workflows

- The escalating demand for dental CAM milling machines is primarily fueled by the widespread adoption of digital dentistry, rising patient preference for same-day restorations, and increasing investments by dental clinics and laboratories in advanced CAD/CAM technologies

- North America dominated the dental CAM milling machine market with the largest revenue share of approximately 38.6% in 2025, supported by a well-established dental infrastructure, high adoption of digital dentistry solutions, and strong presence of leading domestic and multinational manufacturers. The U.S. is witnessing significant growth in installations, driven by innovations in high-speed milling machines, AI-assisted design software, and integration with intraoral scanners

- Asia-Pacific is expected to be the fastest growing region in the dental CAM milling machine market during the forecast period, registering a robust CAGR of around 10.4%, due to increasing dental awareness, rising disposable incomes, rapid expansion of dental clinics, and growing adoption of digital dental solutions in countries such as China, India, and Japan

- The Lab Scale Milling Machine segment dominated the largest market revenue share of approximately 62% in 2025, driven by its compact design, cost-effectiveness, and suitability for smaller dental labs and clinics

Report Scope and Dental CAM Milling Machine Market Segmentation

|

Attributes |

Dental CAM Milling Machine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Dental CAM Milling Machine Market Trends

“Advancements in Precision Milling and CAD/CAM Integration”

- A significant and accelerating trend in the global dental CAM milling machine market is the increasing adoption of high-precision milling systems integrated with advanced CAD/CAM software for dental prosthetics, crowns, bridges, and orthodontic appliances

- For instance, in 2023, Roland DG Corporation launched its next-generation dental milling machines with enhanced 5-axis precision, enabling faster production and highly accurate restorations

- The development of hybrid milling units capable of handling multiple materials, including zirconia, PMMA, and composite resins, is improving workflow flexibility for dental laboratories.

- Integration with digital scanning technologies is allowing direct transfer of patient data to milling machines, reducing manual intervention and errors

- High-speed milling capabilities are reducing production times and increasing throughput for clinics and laboratories

- Automated tool management and intelligent software calibration are enhancing machine efficiency and longevity

- Compact desktop milling machines are gaining popularity among small dental clinics due to space efficiency

- Multi-material and multi-color milling options are expanding prosthetic aesthetic capabilities. User-friendly software interfaces are simplifying operation and reducing operator training time

- Continuous improvements in cooling systems and dust extraction are increasing safety and device lifespan. Cloud-enabled monitoring and remote diagnostics are beginning to streamline maintenance and service

- Overall, this trend reflects the global shift toward fully digitalized, precise, and time-efficient dental manufacturing workflows

Dental CAM Milling Machine Market Dynamics

Driver

“Rising Demand for Customized Dental Prosthetics and Digital Dentistry”

- The growing need for personalized dental restorations and cosmetic dentistry is a key driver for the Dental CAM Milling Machine market

- For instance, in 2022, Sirona Dental Systems introduced expanded CAD/CAM milling solutions to support same-day crown production in dental clinics worldwide

- Increasing prevalence of dental disorders and rising patient awareness of aesthetics are boosting demand for custom prosthetics

- The expansion of private dental clinics and dental laboratories is driving equipment acquisition

- Government initiatives supporting oral health and dental care infrastructure are encouraging investments in digital dentistry

- The rising adoption of chairside CAD/CAM systems enables dentists to produce restorations in a single visit, enhancing patient satisfaction

- Emerging markets in Asia-Pacific and Latin America are witnessing accelerated adoption due to urbanization and increasing disposable income

- Integration with intraoral scanning technology is improving diagnostic accuracy and reducing turnaround time

- Rapid advancements in software for design, simulation, and production planning are improving efficiency

- The trend toward minimally invasive procedures is driving the demand for precise and reliable milling machines

- Availability of multi-material milling and color matching solutions is enhancing patient-centered treatment. Overall, these factors are significantly contributing to the sustained growth of the market

Restraint/Challenge

“High Capital Investment and Maintenance Costs”

- The relatively high cost of advanced Dental CAM Milling Machines remains a major barrier to adoption, especially for smaller clinics and laboratories

- For instance, in 2021, several dental practices in developing regions delayed upgrades to CAD/CAM systems due to budget constraints

- Regular maintenance, tool replacement, and calibration further add to the total cost of ownership. Complexity of operation requires skilled technicians, which can limit adoption in regions with limited trained personnel

- Integration with existing software and intraoral scanning devices can require additional investment and training

- High power consumption and cooling requirements increase operational expenses. Inconsistent supply of compatible milling blocks or materials may disrupt workflows

- Technological obsolescence is a concern due to rapid innovation in dental milling solutions. Smaller dental labs may face difficulties in justifying investment without guaranteed ROI

- Insurance and reimbursement limitations for digitally fabricated prosthetics in some regions can constrain adoption

- Addressing these challenges through modular, cost-effective solutions and training initiatives will be essential for sustained market growth

- Expanding support infrastructure and service networks will further facilitate broader adoption across diverse markets

Dental CAM Milling Machine Market Scope

The market is segmented on the basis of type, application, and end user.

- By Type

On the basis of type, the Dental CAM Milling Machine market is segmented into Lab Scale Milling Machine and Office Scale Milling Machine. The Lab Scale Milling Machine segment dominated the largest market revenue share of approximately 62% in 2025, driven by its compact design, cost-effectiveness, and suitability for smaller dental labs and clinics. These machines are preferred for precision milling of dental restorations such as crowns, bridges, and veneers. The widespread adoption is supported by ease of integration with CAD/CAM software, low maintenance requirements, and enhanced milling accuracy. Increasing demand from emerging markets and growing dental lab setups contribute to the segment’s strong performance. The segment benefits from technological advancements, such as multi-axis milling capabilities and material versatility. In addition, the ability to produce complex dental prosthetics efficiently has positioned lab-scale machines as the backbone of modern dental labs. Rising awareness of digital dentistry and streamlined workflow adoption further strengthen market dominance. Dental technicians value their adaptability for various materials, including zirconia, wax, and PMMA. Educational institutions and training centers also prefer lab-scale machines due to affordability and hands-on learning opportunities. Overall, these factors drive sustained growth and high market share for lab-scale milling machines.

The Office Scale Milling Machine segment is expected to witness the fastest CAGR of 11.8% from 2026 to 2033, driven by increasing adoption in dental clinics seeking on-site milling solutions. Office-scale machines allow dentists to provide same-day restorations, improving patient experience and operational efficiency. Integration with digital scanning technologies and chairside CAD/CAM systems enhances their appeal. Rising investments in private dental practices and cosmetic dentistry further fuel demand. The segment benefits from advancements in automation, speed, and material handling. Expanding applications in crowns, inlays, and veneers, alongside growing patient preference for quick treatments, also contribute to rapid growth. Dental professionals increasingly adopt office-scale machines to reduce lab dependency and turnaround time. Supportive financing options and software improvements further accelerate adoption. The segment’s convenience and compact footprint make it ideal for space-limited clinics. Continuous innovation in milling tools and software enhances precision and efficiency. Office-scale machines are expected to gain more traction in developed regions like North America and Europe.

- By Application

On the basis of application, the Dental CAM Milling Machine market is segmented into Crowns, Dentures, Bridges, Veneers, and Inlays and Onlays. The Crowns segment dominated the market with a revenue share of around 37% in 2025, driven by high clinical demand and the routine use of crowns for restorative procedures. Crowns benefit from precise digital design and milling processes that improve fit, durability, and aesthetics. Dental labs and clinics prioritize crown production due to consistent demand across all patient age groups. Integration with CAD/CAM workflows enhances efficiency and reduces human error. The adoption of high-strength materials such as zirconia and lithium disilicate contributes to segment growth. Crowns are a critical component of dental prosthetics, increasing market reliance on accurate milling systems. The segment also benefits from expanding dental insurance coverage and cosmetic dentistry trends. Rising dental awareness and preventive care measures boost elective crown procedures. Clinics leverage milling machines to shorten production time and improve patient satisfaction. Innovations in multi-unit crowns and hybrid materials also support market dominance. Overall, crowns remain the most significant application segment in dental milling.

The Dentures segment is projected to witness the fastest CAGR of 12.2% from 2026 to 2033, due to rising geriatric populations and growing incidence of tooth loss globally. Office and lab-scale milling machines facilitate customized denture production with enhanced comfort and precision. Increasing preference for digital denture workflows reduces manual labor and production errors. Adoption is driven by higher disposable incomes and aesthetic expectations among patients. Integration with 3D scanning and printing technologies further accelerates production. Emerging markets witness rapid growth due to expanding dental care infrastructure. Technological advancements in flexible denture materials and multi-material milling enhance segment adoption. Clinics and labs aim to improve turnaround times and patient convenience. Government healthcare initiatives and insurance coverage for prosthetics support growth. Dental labs are increasingly shifting from traditional casting to CAD/CAM milled dentures. The growing cosmetic dentistry market further strengthens denture adoption.

- By End User

On the basis of end user, the Dental CAM Milling Machine market is segmented into Dental Laboratories, Dental Clinics, and Research and Academic Institutes. The Dental Laboratories segment dominated the market with a revenue share of 55% in 2025, owing to high-volume production of crowns, bridges, dentures, and other restorations. Labs benefit from multi-unit milling capabilities, material versatility, and integration with advanced CAD/CAM systems. Rising demand for aesthetic and durable dental prosthetics reinforces segment dominance. Dental laboratories have established workflows and expertise that favor investment in reliable milling machines. Growing collaboration between labs and dental clinics enhances efficiency and output. Technological advancements in milling tools and software support consistent production quality. The segment’s reliance on high-precision systems sustains revenue dominance. Labs also invest in training and workforce upskilling to maintain competitiveness. Demand from private and commercial labs continues to drive sales. Geographic expansion and adoption in emerging markets further strengthen market position. Overall, dental laboratories remain the largest end-user segment.

The Dental Clinics segment is expected to witness the fastest CAGR of 11.5% from 2026 to 2033, driven by the need for chairside milling and same-day restorations. Clinics increasingly adopt compact, office-scale machines to provide efficient patient care and improve operational efficiency. Integration with intraoral scanners and digital workflows enhances convenience. Rising cosmetic dentistry trends and patient demand for rapid treatment are key drivers. Clinics benefit from reduced dependency on external labs and faster turnaround times. Growing adoption in urban and semi-urban regions supports CAGR growth. Technological improvements in speed, accuracy, and software ease-of-use further accelerate adoption. Clinics are investing in multi-material milling for diverse restorative applications. Awareness campaigns and dental insurance coverage for cosmetic procedures aid growth. Overall, office-scale adoption by clinics is set to expand rapidly through 2033

Dental CAM Milling Machine Market Regional Analysis

- North America dominated the dental CAM milling machine market with the largest revenue share of approximately 38.6% in 2025

- Supported by a well-established dental infrastructure

- High adoption of digital dentistry solutions, and strong presence of leading domestic and multinational manufacturers

U.S. Dental CAM Milling Machine Market Insight

The U.S. dental CAM milling machine market is witnessing significant growth in Dental CAM Milling Machine installations, driven by innovations in high-speed milling machines, AI-assisted design software, and integration with intraoral scanners. The country’s strong dental healthcare framework and early adoption of advanced digital solutions are key factors propelling market expansion.

Europe Dental CAM Milling Machine Market Insight

The Europe dental CAM milling machine market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing adoption of digital dentistry, growing number of dental laboratories, and rising demand for high-precision prosthetics and orthodontic solutions. Countries such as Germany, France, and the U.K. are investing in advanced milling technologies to enhance dental workflows and patient outcomes.

U.K. Dental CAM Milling Machine Market Insight

The U.K. dental CAM milling machine market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by rising awareness of cosmetic dentistry, increasing number of dental clinics adopting CAD/CAM solutions, and government initiatives promoting dental healthcare innovation.

Germany Dental CAM Milling Machine Market Insight

The Germany dental CAM milling machine market is expected to expand at a considerable CAGR during the forecast period, driven by strong R&D in dental technology, a large network of dental clinics and labs, and increasing integration of CAD/CAM systems with 3D printing and imaging solutions.

Asia-Pacific Dental CAM Milling Machine Market Insight

Asia-Pacific dental CAM milling machine market is expected to be the fastest growing region in the Dental CAM Milling Machine market during the forecast period, registering a robust CAGR of around 10.4%, due to increasing dental awareness, rising disposable incomes, rapid expansion of dental clinics, and growing adoption of digital dental solutions in countries such as China, India, and Japan.

Japan Dental CAM Milling Machine Market Insight

The Japan dental CAM milling machine market is gaining momentum owing to advanced dental technology adoption, high patient focus on cosmetic dentistry, and integration of digital workflows in dental laboratories and clinics. Increasing investments in AI-assisted CAD/CAM systems are further supporting market growth.

China Dental CAM Milling Machine Market Insight

The China dental CAM milling machine market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by rapid expansion of dental clinics, rising dental awareness, adoption of digital dentistry solutions, and strong domestic manufacturing capabilities. The market is expected to continue its growth trajectory with increasing penetration of intraoral scanners and high-speed milling machines.

Dental CAM Milling Machine Market Share

The Dental CAM Milling Machine industry is primarily led by well-established companies, including:

- Roland DGA Corporation (U.S.)

- VHF Dental Maschinen GmbH (Germany)

- Amann Girrbach AG (Austria)

- Straumann Group (Switzerland)

- Dentsply Sirona (U.S.)

- Young Innovations (U.S.)

- Planmeca Oy (Finland)

- DMG Mori (Germany)

- Aidite (China)

- Dental Wings (Canada)

- Kavo Kerr (U.S.)

- Shining 3D (China)

- Imes-icore (Germany)

- Arfona Inc. (U.S.)

- JENNY Dental (Switzerland)

- BEGO (Germany)

- Zirkonzahn GmbH (Italy)

- StarDental (U.S.)

- PreciDent (France)

Latest Developments in Global Dental CAM Milling Machine Market

- In May 2023, Roland DGA’s DGSHAPE Americas business group introduced the DWX‑52D Plus and DWX‑42W Plus dental milling machines, representing the next generation of 5‑axis milling solutions designed to enhance productivity in dental laboratories. The DWX‑52D Plus featured a redesigned and optimized spindle assembly with nearly twice the gripping power of its predecessor, allowing faster milling of hybrid resins, PMMA, and zirconia. The DWX‑42W Plus wet mill also offered improved material handling and reliability, collectively helping labs produce high‑quality restorations more

- In October 2024, DGSHAPE Corporation launched the DWX‑53D dry dental mill, a next‑generation desktop milling solution focused on delivering a cleaner and more precise production experience. With a more rigid design and advanced IoT‑enabled DGSHAPE CLOUD support, the DWX‑53D provided enhanced flexibility in milling PMMA, zirconia, and other CAD/CAM materials while also offering live production monitoring and automated cleaning processes that boosted maintenance efficiency

- In November 2024, Roland DGA’s DGSHAPE DWX‑53DC milling solution received the 2024 WOW! Award from Journal of Dental Technology magazine, recognizing its advanced features such as a 50% faster automatic disc changer, built‑in webcam for remote monitoring, and automatic pressure control. This award underscored the machine’s industry impact in saving time, reducing manual intervention, and improving overall productivity for dental labs

- In March 2025, DGSHAPE Corporation introduced the DWX‑43W wet dental milling machine, expanding its product portfolio with an advanced wet milling option that combined automated workflow features with consistent, high‑precision output. The DWX‑43W supported batch milling of up to six units and included automated draining and correction systems, minimizing maintenance while ensuring efficient production of titanium abutments and other restorations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.