Global Dental Chairs Market

Market Size in USD Million

CAGR :

%

USD

599.60 Million

USD

869.14 Million

2025

2033

USD

599.60 Million

USD

869.14 Million

2025

2033

| 2026 –2033 | |

| USD 599.60 Million | |

| USD 869.14 Million | |

|

|

|

|

Dental Chairs Market Size

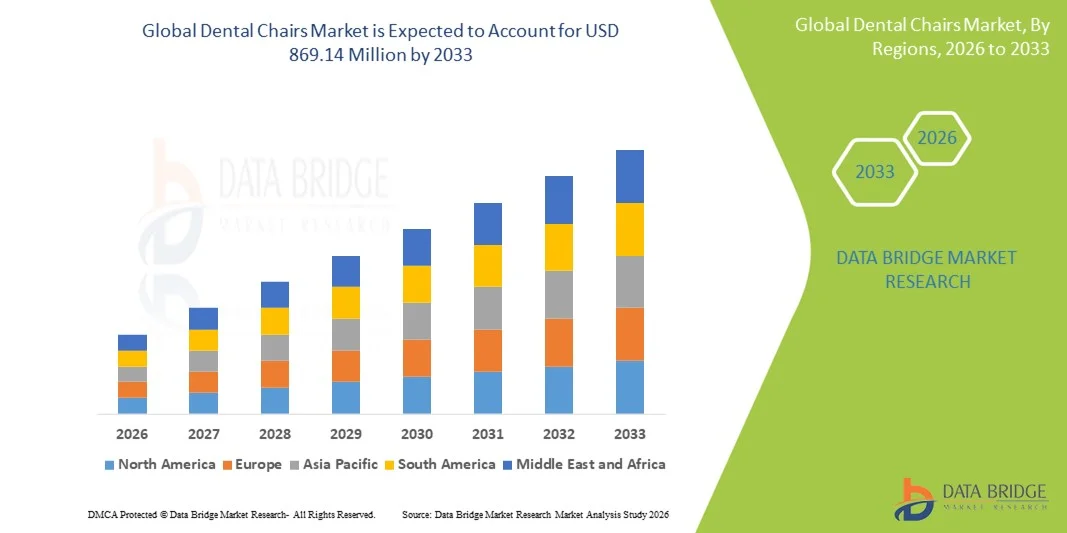

- The global dental chairs market size was valued at USD 599.60 Million in 2025 and is expected to reach USD 869.14 Million by 2033, at a CAGR of 4.75% during the forecast period

- The market growth is largely fueled by increasing investments in dental healthcare infrastructure, rising patient awareness about oral health, and technological advancements in dental equipment, leading to enhanced operational efficiency and patient comfort

- Furthermore, the growing adoption of ergonomically designed, technologically advanced, and multifunctional dental chairs is driving demand across dental clinics, hospitals, and specialty care centers. These converging factors are accelerating the uptake of Dental Chairs solutions, thereby significantly boosting the industry's growth

Dental Chairs Market Analysis

- Dental chairs, providing ergonomic seating and integrated functionalities for dental procedures, are increasingly vital components in modern dental clinics and hospitals due to enhanced patient comfort, operational efficiency, and technological integration

- The escalating demand for dental chairs is primarily fueled by rising oral healthcare awareness, increasing number of dental clinics, and adoption of advanced features such as motorized adjustments, integrated imaging systems, and patient monitoring solutions

- North America dominated the dental chairs market with the largest revenue share of approximately 41.22% in 2025, supported by high healthcare spending, a large patient base, and strong presence of key dental equipment manufacturers. The U.S. witnessed substantial growth in dental chair installations, driven by innovations in ergonomics, automation, and digital integration

- Asia-Pacific is expected to be the fastest-growing region in the dental chairs market during the forecast period, projected to expand at a CAGR of 7.8% from 2026 to 2033, driven by increasing urbanization, rising disposable incomes, growing number of dental clinics, and adoption of technologically advanced dental chairs in both public and private healthcare facilities

- The standalone dental chairs segment dominated the largest market revenue share of 53.1% in 2025, owing to stability, durability, and suitability for high-volume hospitals, academic institutes, and multi-procedural operations

Report Scope and Dental Chairs Market Segmentation

|

Attributes |

Dental Chairs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Dental Chairs Market Trends

Growing Demand for Ergonomic and Multi-Functional Dental Chairs

- A major trend in the global dental chairs market is the increasing adoption of ergonomic and multi-functional designs that enhance patient comfort and improve clinician efficiency

- For instance, in 2024, A-dec launched an upgraded ergonomic dental chair with advanced mobility and integrated instrumentation for improved procedural workflow. This trend reflects the emphasis on patient-centric design, with chairs featuring adjustable headrests, reclining positions, and modular add-ons

- Clinics and hospitals are increasingly seeking chairs with compact designs and ease of maintenance, allowing better space utilization

- Integration with advanced instrumentation and modular components allows simultaneous access to dental tools, improving procedural efficiency

- Technological improvements, such as vibration-dampening and pressure-distributing seat designs, are enhancing patient experience. Portable and standalone chairs are gaining traction, particularly in rural and mobile dental units

- The trend is also supported by the rising number of dental procedures, growing awareness of oral health, and adoption of advanced dental care practices

- Ergonomically designed chairs reduce clinician fatigue during long procedures, boosting clinical performance. Multi-functional designs now incorporate LED lighting, instrument trays, and foot control systems

- The increasing demand for pediatric and geriatric-friendly chairs with specialized seating also contributes to growth. Customizable features for surgery, orthodontics, and routine examination are emerging as key differentiators

- Overall, this trend is driving innovation and adoption across hospitals, clinics, and academic institutes globally

Dental Chairs Market Dynamics

Driver

Rising Dental Procedures and Oral Health Awareness

- The rising prevalence of oral diseases, increasing dental procedures, and growing awareness about oral health are key drivers of the dental chairs market

- For instance, in March 2023, Planmeca introduced a fully integrated dental chair with advanced imaging compatibility, targeting high-volume dental clinics to enhance procedural efficiency

- Hospitals and dental clinics are investing in modern powered and non-powered chairs to meet the growing patient inflow. Increased cosmetic dentistry, orthodontic treatments, and implant procedures are boosting demand for specialized chairs

- Rising per capita income in emerging markets is enabling patients to access advanced dental care facilities

- Dental chairs with modular components, including cuspidors, handpieces, and auxiliary instruments, are preferred for their versatility

- Research and academic institutes are adopting modern chairs for training and procedural simulations. Powered dental chairs are in demand for their smooth operation, precision control, and integration with surgical instrument

- Portable dental chairs are becoming popular for mobile clinics and field-based dental services. Technological innovation in chair ergonomics and materials is increasing longevity and reducing maintenance costs

- Growth in dental tourism in countries like India and Thailand also contributes to increased chair adoption. Overall, increasing procedural volume, patient awareness, and demand for quality dental care are major market growth drivers

Restraint/Challenge

High Initial Costs and Maintenance Requirements

- The high initial cost of advanced dental chairs and the ongoing maintenance requirements pose a challenge for widespread adoption, especially in smaller clinics and developing regions

- For instance, in July 2022, a report highlighted that dental startups in Africa faced financial barriers due to the premium price of powered dental chairs with modular components

- Non-powered chairs are more affordable but may not offer the same level of operational efficiency as powered or multi-functional designs

- Dental clinics must allocate additional budget for regular servicing, sterilization, and replacement of components like cuspidors, handpieces, and control panels. The cost of training staff to operate advanced dental chairs may add to the financial burden

- High maintenance costs and dependence on specialized service personnel can limit adoption in low-resource regions. Poor infrastructure and unstable electricity supply in certain regions can hinder the use of powered chairs

- Some dental chairs require frequent calibration and software updates to maintain performance standards. The premium price for ergonomically advanced chairs may discourage smaller clinics from upgrading

- Clinics may prefer to extend the lifecycle of existing chairs rather than invest in new models, slowing market growth

- Efforts to produce more cost-effective modular and portable chairs are ongoing but have yet to fully alleviate cost constraints

- Overcoming these financial and operational challenges is vital for sustained growth in the dental chairs market

Dental Chairs Market Scope

The market is segmented on the basis of type, product, component, application, end-user, and technology.

- By Type

On the basis of type, the Dental Chairs market is segmented into ceiling mounted design, mobile independent design, and dental chair mounted design. The ceiling mounted design segment dominated the largest market revenue share of 44.5% in 2025, driven by its ergonomic design, space-saving capabilities, and integration with dental units. Hospitals, high-volume clinics, and specialty centers prefer this type because it allows seamless integration with instruments, lighting, and suction devices. The chair’s ability to support multiple functions such as examination, surgery, and orthodontics enhances procedural efficiency. Features like memory positions, smooth reclining, and enhanced patient comfort increase adoption. The durable and hygienic design reduces maintenance efforts. Multi-functional modularity supports training in academic institutes. Compatibility with advanced imaging devices, vibration-free operation, and adjustable height for operator ergonomics further drive the segment.

The mobile independent design segment is expected to witness the fastest CAGR of 22.7% from 2026 to 2033, fueled by growing use in ambulatory surgical centers, mobile dental units, and outreach programs. Its portability allows treatment across multiple locations without extensive infrastructure. Lightweight and foldable designs, battery-powered operation, and rapid setup increase usability. Rising dental awareness in rural areas and developing economies drives adoption. Small clinics benefit from cost-effectiveness and flexibility. Integration with portable auxiliary devices supports multi-procedural use. Mobile chairs are increasingly preferred for cosmetic dentistry, orthodontics, and temporary dental camps. Ergonomic design and patient comfort features also contribute to growth. Rising demand from specialty centers and budget clinics accelerates market expansion.

- By Product

On the basis of product, the market is segmented into non-powered dental chairs and powered dental chairs. The powered dental chairs segment dominated the largest market revenue share of 52.3% in 2025, due to automation in reclining, height adjustment, and integration with dental instruments. Hospitals and advanced clinics prefer powered chairs for precision, patient comfort, and efficiency. Advanced features include programmable memory positions, vibration-free operation, and multi-functional instrument compatibility. Adoption in oral surgeries, implantology, and orthodontics drives dominance. Powered chairs reduce clinician fatigue and improve workflow accuracy. High durability, safety features, and ergonomic design enhance usability. Integration with surgical and imaging instruments supports multi-purpose use. Long-term reliability and enhanced patient experience contribute to market leadership. Academic and research institutes adopt these chairs for procedural training.

The non-powered dental chairs segment is expected to witness the fastest CAGR of 21.9% from 2026 to 2033, driven by small clinics, specialty centers, and cost-sensitive markets. Non-powered chairs are portable, low-maintenance, and flexible in use. Technological improvements in cushioning, ergonomic support, and durable material enhance patient comfort. Popular in rural regions, mobile units, and temporary setups, these chairs allow budget-conscious clinics to deliver efficient care. Easy sterilization and simple operation reduce maintenance efforts. Non-powered chairs support outreach programs and fieldwork. Growing awareness about ergonomics in low-cost chairs supports adoption. Integration with modular accessories expands functionality. Rising dental tourism in cost-sensitive markets also drives demand.

- By Component

On the basis of component, the market is segmented into chair, dental cuspidor, dental chair handpiece, and others. The chair segment dominated the largest market revenue share of 47.8% in 2025, driven by its critical role in patient positioning, comfort, and procedural efficiency. Hospitals and high-volume clinics prefer chairs with memory positions, adjustable headrests, and reclining mechanisms. Multi-functional chairs improve workflow and patient handling. Ergonomic designs reduce clinician fatigue and allow integration with auxiliary devices such as handpieces, lighting, and suction. Durable construction and hygienic surfaces increase adoption. Enhanced adjustability for surgical, orthodontic, and examination procedures supports market dominance. Integration with powered systems adds precision. Chairs with vibration-free operation improve patient experience. Adoption in research and training institutes enhances revenue.

The dental cuspidor segment is expected to witness the fastest CAGR of 23.4% from 2026 to 2033, fueled by hygiene requirements, anti-splash features, and ease of sterilization. Hospitals and clinics are increasingly adopting advanced cuspidors with ergonomic placement, water efficiency, and multi-functional integration. Rising awareness of cross-contamination prevention drives adoption. Modular designs compatible with powered and non-powered chairs increase usability. Mobile units and specialty centers also contribute to growth. Cuspidor innovations improve operator convenience. Compliance with health regulations supports market expansion. Integration with dental handpieces and chair units enhances functionality.

- By Application

On the basis of application, the market is segmented into examination, surgery, orthodontic applications, and others. The examination segment dominated the largest market revenue share of 49.2% in 2025, driven by routine dental check-ups, diagnostic evaluations, and preventive care. Hospitals and clinics prefer examination chairs with ergonomic designs, adjustable reclining, and auxiliary integration. Multi-functional chairs improve patient comfort and workflow. Academic institutes adopt chairs for procedural training. Memory positioning, headrest adjustability, and multi-angle access enhance usability. Integration with diagnostic imaging improves efficiency. Durable and hygienic materials further strengthen dominance. Growing dental patient population and preventive care campaigns fuel adoption.

The surgery segment is expected to witness the fastest CAGR of 24.1% from 2026 to 2033, due to increasing oral surgeries, implantology, and complex dental procedures. Powered, ergonomic, and multi-functional chairs enhance surgical precision and reduce clinician fatigue. Adoption in specialty dental centers and hospitals is rising. Integration with advanced instruments, imaging, and suction devices improves workflow. Growing investment in surgical dental infrastructure supports growth. Training and research institutes adopt chairs for surgical procedures. Technological innovations improve patient safety and efficiency. Multi-angle adjustability and memory positions support complex treatments. Expansion of dental tourism and elective surgeries accelerates demand.

- By End User

On the basis of end-user, the market is segmented into hospitals, dental clinics, and research & academic institutes. The hospitals segment dominated the largest market revenue share of 45.6% in 2025, due to the high patient volumes, advanced infrastructure, and multi-disciplinary dental procedures. Hospitals prefer powered, multi-functional, and ergonomic chairs for routine check-ups, surgical procedures, orthodontics, and implantology. The chairs’ features, such as memory positioning, smooth reclining, integrated cuspidors, and modular instrument connectivity, enhance procedural efficiency. Durable construction and hygienic surfaces reduce maintenance costs and ensure long-term reliability. Hospitals also adopt chairs with adjustable headrests and vibration-free operation to improve patient comfort. Integration with imaging devices and suction systems further strengthens their preference. Academic hospitals use these chairs for both clinical and teaching purposes. The robust after-sales support from manufacturers, warranty services, and compliance with health regulations drive adoption. Multi-procedural adaptability and patient safety remain critical for maintaining the market dominance of hospital-based dental chairs.

The dental clinics segment is expected to witness the fastest CAGR of 23.7% from 2026 to 2033, fueled by the growth of private practices, cosmetic dentistry, outpatient procedures, and specialty clinics. Small to medium-sized dental clinics increasingly prefer portable, flexible, and semi-powered chairs to optimize space and reduce operational costs. Non-powered or lightweight powered chairs are popular due to their affordability and ease of maintenance. The chairs’ ergonomic design, patient comfort, and modular accessory compatibility support faster workflow. Rising awareness about ergonomic designs among dentists further encourages adoption. Specialty dental centers, including orthodontic and pediatric clinics, are leveraging these chairs for patient-specific treatments. Increasing dental tourism in urban areas and developing countries also drives the segment. Integration with imaging, suction, and instrument units enhances multi-procedural usability. The convenience of easy sterilization and portability for multi-room clinics contributes to growth. Rising investments in private dental healthcare infrastructure further support the segment’s rapid expansion.

- By Technology

On the basis of technology, the market is segmented into portable dental chairs and standalone dental chairs. The standalone dental chairs segment dominated the largest market revenue share of 53.1% in 2025, owing to stability, durability, and suitability for high-volume hospitals, academic institutes, and multi-procedural operations. These chairs provide enhanced patient comfort, ergonomic positioning, and modular adaptability for surgical, examination, and orthodontic procedures. Integration with powered handpieces, cuspidors, and lighting systems improves workflow efficiency. Hospitals and specialty centers favor standalone chairs for multi-chair setups, ensuring consistency in patient handling. Memory positioning, adjustable headrests, and vibration-free operations reduce clinician fatigue. Compliance with medical standards, long-term reliability, and ease of maintenance support dominance. Standalone chairs are widely adopted in research and academic institutes for teaching and procedural training. Durable materials, infection control features, and robust support structures contribute to long-term usage. Their compatibility with both powered and non-powered auxiliary devices enhances procedural versatility. Advanced manufacturing techniques, hygienic designs, and modularity further reinforce market leadership.

The portable dental chairs segment is expected to witness the fastest CAGR of 25.0% from 2026 to 2033, driven by growing demand in mobile dental services, outreach programs, and temporary clinics. Lightweight, foldable, and battery-powered chairs improve portability while maintaining patient comfort and ergonomic support. Small clinics, rural dental setups, and mobile specialty units prefer portable chairs due to space efficiency and operational flexibility. Integration with modular dental units allows multi-procedural use, supporting examination, minor surgery, and orthodontic care. Rising dental awareness in developing regions further accelerates adoption. Technological enhancements, including durable cushioning, hygienic surfaces, and foldable instrument support, improve usability. Portable chairs facilitate outreach programs, temporary dental camps, and home care visits. Their adoption in mobile cosmetic dentistry and pediatric care is increasing. Manufacturers focus on lightweight construction without compromising stability. Rising investment in mobile healthcare infrastructure and dental tourism contributes to segment growth. Ergonomic designs, ease of setup, and reduced maintenance further accelerate adoption globally.

Dental Chairs Market Regional Analysis

- North America dominated the dental chairs market with the largest revenue share of approximately 41.22% in 2025

- Supported by high healthcare spending, a large patient base, and the strong presence of key dental equipment manufacturers

- The market led the region, witnessing substantial growth in dental chair installations driven by innovations in ergonomics, automation, and digital integration

U.S. Dental Chairs Market Insight

The U.S. dental chairs market captured the majority revenue share within North America in 2025, fueled by widespread adoption in hospitals, private dental clinics, and specialty care centers. Technological advancements in digital control, imaging integration, and ergonomic designs further propelled the market’s expansion, alongside continuous investment by leading manufacturers in research and development.

Europe Dental Chairs Market Insight

The Europe dental chairs market is projected to grow at a significant CAGR during the forecast period, driven by increasing healthcare expenditure, rising demand for advanced dental treatments, and growing investments in modern dental equipment. Countries such as Germany, France, and the U.K. are witnessing steady adoption of technologically advanced dental chairs across private clinics and public healthcare facilities.

U.K. Dental Chairs Market Insight

The U.K. dental chairs market is anticipated to expand moderately, supported by the adoption of ergonomically designed chairs and increasing awareness of modern dental treatment facilities. The presence of a strong dental services infrastructure and growing patient preference for comfortable and technologically advanced dental treatments are expected to stimulate growth.

Germany Dental Chairs Market Insight

The Germany dental chairs market is expected to register steady growth, driven by the country’s well-established healthcare infrastructure, emphasis on high-quality dental care, and increasing modernization of dental clinics with automated and digital dental chairs.

Asia-Pacific Dental Chairs Market Insight

The Asia-Pacific dental chairs market is expected to be the fastest-growing region during the forecast period, driven by increasing urbanization, rising disposable incomes, and a growing number of dental clinics. Technologically advanced dental chairs that integrate automation, imaging, and ergonomic designs are seeing rapid adoption in countries such as China, Japan, and India, supported by expanding public and private healthcare facilities.

Japan Dental Chairs Market Insight

The Japan dental chairs market is witnessing moderate growth due to an aging population, increasing focus on patient comfort, and adoption of digital and automated dental chair solutions in both private and public clinics.

China Dental Chairs Market Insight

The China dental chairs market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid urbanization, rising middle-class population, and increasing awareness of oral healthcare. The expansion of dental services, coupled with adoption of advanced and cost-effective dental chairs, is boosting overall market growth.

Dental Chairs Market Share

The Dental Chairs industry is primarily led by well-established companies, including:

• Dentsply Sirona (U.S.)

• Sirona Dental Systems GmbH (Germany)

• Planmeca Oy (Finland)

• KaVo Kerr (U.S.)

• Cefla Dental Group (Italy)

• Foshan Nanhai JMT Medical Equipment Co., Ltd. (China)

• Osstem Implant Co., Ltd. (South Korea)

• Mectron S.p.A (Italy)

• A-Equipments (India)

• Belmont Dental (Japan)

• Stern Weber (Italy)

• Foshan First Dental Laboratory Co., Ltd. (China)

• MDT Dental (U.S.)

Latest Developments in Global Dental Chairs Market

- In June 2023, A‑dec launched the first digitally connected dental chair and delivery system — the A‑dec 500 Pro and A‑dec 300 Pro — featuring a new user interface with touchscreen controls and compatibility with the A‑dec+ software platform, enabling connected workflows and smarter dental operatory management. This introduction reflects a strategic shift toward connected and ergonomic chair systems in modern dental clinics

- In December 2023, Midmark patented a voice‑activated dental chair that allows hands‑free adjustments during clinical procedures, improving hygiene by reducing physical contact and lowering the risk of cross‑contamination in dental environments. This innovation highlights the market focus on hygiene, practitioner convenience, and ergonomic workflow advancements

- In November 2023, Planmeca began integrating high‑definition 3D imaging technology directly into its dental chair systems, enabling chairside diagnostic imaging and enhancing real‑time procedural accuracy and efficiency. Such integration reflects the broader trend of multi‑functional dental chairs serving as hybrid diagnostic and treatment platforms

- In January 2024, A‑dec introduced an AI‑integrated workstation dental chair capable of real‑time patient monitoring, predictive maintenance, and automated positioning, reducing manual adjustments and enhancing workflow efficiency for clinicians. This AI‑enhanced functionality represents a significant technological advancement in dental chair design

- In March 2025, Planmeca announced a strategic partnership with MediDental to jointly develop an integrated electromechanical dental chair platform optimized for advanced imaging workflows, aiming to enhance diagnostic integration and clinical efficiency. This collaboration underscores the increasing industry emphasis on interoperability and advanced chair mechanics in high‑performance dental environments

- In August 2025, at the International Dental Show (IDS 2025) in Cologne, Planmeca launched its “Pro Series” of dental chair platforms (Pro40, Pro50, Pro50S) focused on enhanced ergonomics and digital integration, representing the latest advances in smart dental chair technology tailored for modern practices. This launch signals the continued innovation momentum in ergonomic design and digital connectivity for dental chairs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.