Global Dental Elevator And Luxator Market

Market Size in USD Billion

CAGR :

%

USD

307.60 Billion

USD

447.92 Billion

2025

2033

USD

307.60 Billion

USD

447.92 Billion

2025

2033

| 2026 –2033 | |

| USD 307.60 Billion | |

| USD 447.92 Billion | |

|

|

|

|

Dental Elevator and Luxator Market Size

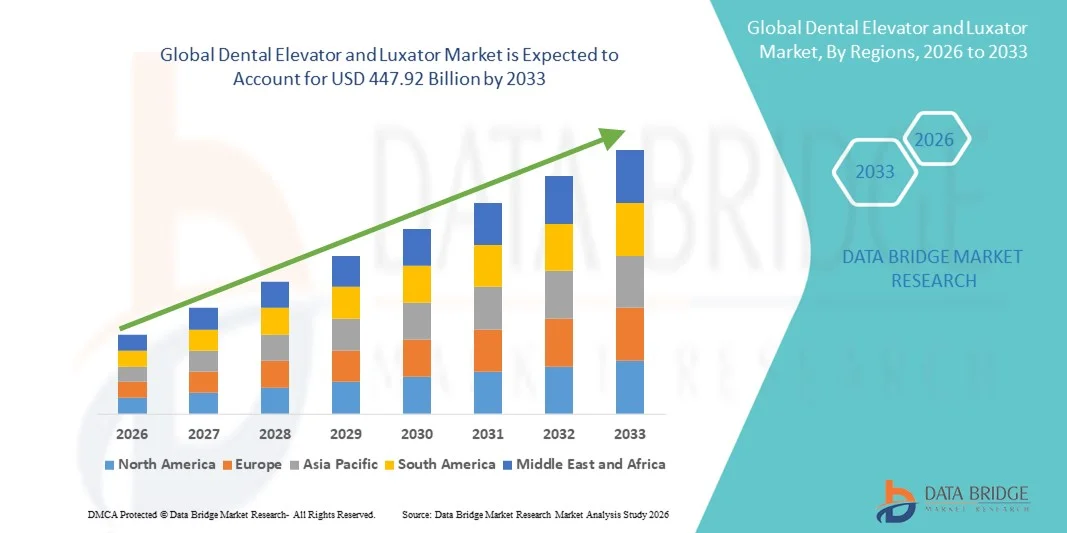

- The global dental elevator and luxator market size was valued at USD 307.6 billion in 2025 and is expected to reach USD 447.92 billion by 2033, at a CAGR of 4.81% during the forecast period

- The market growth is largely fueled by the increasing volume of dental extraction procedures and continuous technological advancements in dental surgical instruments, leading to improved efficiency, precision, and patient outcomes in both hospital and clinic settings

- Furthermore, rising demand for minimally invasive dental procedures, growing awareness of oral health, and increasing preference for ergonomically designed and atraumatic instruments are establishing dental elevators and luxators as essential tools in modern dental practice, thereby significantly boosting the industry’s growth

Dental Elevator and Luxator Market Analysis

- Dental elevators and luxators, used for atraumatic tooth extraction and periodontal procedures, are essential instruments in modern dental practice across hospitals, dental clinics, and specialty oral surgery centers due to their ability to preserve surrounding bone and soft tissue while improving procedural efficiency

- The increasing demand for minimally invasive dental procedures, rising prevalence of dental caries and periodontal diseases, growing geriatric population, and expanding access to professional dental care are the primary factors driving the adoption of dental elevators and luxators globally

- North America dominated the dental elevator and luxator market with the largest revenue share of 37.4% in 2025, supported by a high volume of dental procedures, advanced dental care infrastructure, strong presence of leading dental instrument manufacturers, and widespread adoption of modern extraction techniques across the U.S. and Canada

- Asia-Pacific is expected to be the fastest-growing region in the dental elevator and luxator market during the forecast period, registering a strong CAGR of 7.6%, driven by increasing dental healthcare expenditure, growing awareness of oral hygiene, expanding dental clinic networks, and rising demand for cost-effective dental surgical instruments in countries such as China, India, and Southeast Asia

- The Dental Elevator segment dominated the largest market revenue share of 58.9% in 2025, driven by its extensive and long-established use in routine tooth extraction procedures across hospitals and dental clinics worldwide

Report Scope and Dental Elevator and Luxator Market Segmentation

|

Attributes |

Dental Elevator and Luxator Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Dental Elevator and Luxator Market Trends

Increasing Preference for Minimally Invasive and Ergonomically Designed Extraction Instruments

- A key trend in the global dental elevator and Luxator market is the growing preference for minimally invasive tooth extraction techniques, which has significantly increased demand for precision-engineered elevators and luxators. Dental professionals are increasingly adopting these instruments to reduce trauma to surrounding bone and soft tissue, thereby improving patient recovery outcomes

- For instance, modern luxators with thinner, sharper blades and improved tip designs are being widely adopted in atraumatic extractions, particularly in orthodontic, periodontal, and implant-related procedures. Manufacturers are focusing on enhanced blade geometry and material strength to improve cutting efficiency while minimizing force application

- Another notable trend is the rising emphasis on ergonomic instrument design to reduce hand fatigue and musculoskeletal strain among dental practitioners. Dental elevators and luxators with lightweight handles, anti-slip grips, and balanced weight distribution are gaining strong traction across clinics and hospitals

- The increasing integration of high-quality stainless steel and advanced alloy materials is further enhancing instrument durability, corrosion resistance, and sterilization compatibility, supporting repeated clinical use

- In addition, growing awareness regarding infection control and hygiene standards is driving demand for autoclavable and reusable dental elevators and luxators that comply with global sterilization protocols. This trend is reshaping product innovation and procurement decisions across dental care settings worldwide

Dental Elevator and Luxator Market Dynamics

Driver

Rising Volume of Dental Extractions and Oral Surgical Procedures

- The increasing prevalence of dental disorders such as tooth decay, periodontal disease, impacted teeth, and malocclusion is a major driver for the Dental Elevator and Luxator market. These conditions frequently require tooth extraction procedures, directly boosting demand for elevators and luxators

- For instance, the growing number of orthodontic treatments and dental implant procedures globally has led to higher utilization of atraumatic extraction instruments, as preserving alveolar bone is critical for successful implant placement

- The expansion of dental clinics, oral surgery centers, and hospital-based dental departments—particularly in emerging economies—is further accelerating instrument adoption. Improved access to dental care and rising awareness of oral health are contributing to increased procedural volumes

- In addition, the aging global population is more susceptible to tooth loss and complex dental conditions, driving consistent demand for reliable and high-performance dental extraction tools

- The growing focus on patient comfort, reduced procedure time, and improved clinical outcomes is encouraging dental professionals to invest in advanced dental elevators and luxators, supporting sustained market growth

Restraint/Challenge

High Instrument Costs and Limited Skilled Handling in Developing Regions

- One of the primary challenges in the dental elevator and luxator market is the relatively high cost of premium-quality instruments, particularly those made from advanced materials or designed for specialized atraumatic procedures. This can limit adoption among small dental practices and clinics with budget constraints

- For instance, In developing regions, limited access to trained dental professionals capable of properly handling luxators poses another challenge. Improper use can increase the risk of instrument damage or patient injury, discouraging widespread adoption

- In addition, frequent sterilization requirements and wear over time can increase replacement and maintenance costs for dental practices, especially those with high patient volumes

- The presence of low-cost, substandard products in certain markets may also impact overall market perception and create pricing pressure for established manufacturers

- Overcoming these challenges will require improved practitioner training, greater emphasis on clinical education, and the introduction of cost-effective yet durable dental elevator and luxator solutions to ensure broader global adoption

Dental Elevator and Luxator Market Scope

The market is segmented on the basis of type, size, and end use.

- By Type

On the basis of type, the Global Dental Elevator & Luxator market is segmented into Dental Elevators and Dental Luxators. The Dental Elevator segment dominated the largest market revenue share of 58.9% in 2025, driven by its extensive and long-established use in routine tooth extraction procedures across hospitals and dental clinics worldwide. Dental elevators are widely preferred due to their strong mechanical leverage, durability, and effectiveness in loosening teeth prior to extraction. Their suitability for a wide range of clinical scenarios, including impacted and multi-rooted teeth, further strengthens demand. Dentists’ familiarity with elevators, supported by decades of clinical training and standardized protocols, also contributes to dominance. In addition, dental elevators are cost-effective and reusable, making them a practical choice for high-volume practices. Continuous demand from general dentistry and oral surgery sustains consistent revenue growth for this segment.

The Dental Luxators segment is expected to witness the fastest CAGR of 8.2% from 2026 to 2033, driven by the growing preference for minimally invasive and atraumatic extraction techniques. Luxators are increasingly adopted for preserving alveolar bone and surrounding tissues, which is critical for dental implant placement and cosmetic procedures. Rising demand for implant-supported restorations and advanced oral surgery is accelerating luxator usage. Improved blade designs, enhanced sharpness, and ergonomic handles are improving clinical efficiency and outcomes. Increasing patient awareness regarding faster healing and reduced postoperative pain further supports growth. The expanding focus on precision dentistry is expected to sustain rapid adoption.

- By Size

On the basis of size, the Global Dental Elevator & Luxator market is segmented into 2.5mm, 3mm, 3.2mm, 4mm, 5mm, and 10mm. The 3mm size segment accounted for the largest market revenue share of 32.4% in 2025, owing to its widespread applicability across routine dental extraction procedures. This size offers an optimal balance between control and force, making it suitable for both anterior and posterior teeth. Dental professionals commonly rely on 3mm instruments due to their versatility and ease of handling in diverse clinical settings. High usage frequency in daily dental practice significantly contributes to revenue dominance. Furthermore, manufacturers widely offer 3mm elevators and luxators as standard instruments, ensuring easy availability. Its inclusion in most dental surgical kits further reinforces its leading market position.

The 2.5mm size segment is projected to register the fastest CAGR of 8.6% from 2026 to 2033, driven by rising adoption in minimally invasive, pediatric, and precision-focused dental procedures. Smaller instrument sizes allow improved access to narrow periodontal spaces and reduce trauma during extraction. Increasing emphasis on aesthetic outcomes and tissue preservation is boosting demand for finer tools. Growth in pediatric dentistry and microsurgical techniques further supports segment expansion. Technological advancements enhancing strength and durability of smaller instruments are improving clinical confidence. These factors collectively contribute to accelerated growth.

- By End Use

On the basis of end use, the Global Dental Elevator & Luxator market is segmented into Hospitals & Clinics, Dental Clinics, Research and Academic Institutes, and Others. The Dental Clinics segment dominated the market with a revenue share of 47.6% in 2025, driven by the high volume of outpatient dental procedures performed globally. Dental clinics serve as the primary setting for routine extractions, oral surgeries, and implant preparations. The increasing number of private dental clinics, especially in emerging economies, significantly contributes to demand. Rising awareness of oral health and cosmetic dentistry further fuels procedural volumes. Clinics frequently purchase and replace dental elevators and luxators due to regular usage, supporting recurring revenue. Accessibility and affordability of clinic-based dental care reinforce this segment’s dominance.

The Hospitals & Clinics segment is expected to witness the fastest CAGR of 7.8% from 2026 to 2033, driven by the growing number of complex oral and maxillofacial surgeries performed in hospital settings. Hospitals increasingly handle trauma cases, impacted tooth extractions, and medically complex patients requiring advanced dental interventions. Expansion of dental departments within multispecialty hospitals supports instrument demand. Rising healthcare infrastructure investments, particularly in developing regions, further accelerate growth. In addition, hospitals’ focus on adopting advanced and atraumatic surgical tools strengthens demand for elevators and luxators. This trend is expected to sustain strong growth over the forecast period.

Dental Elevator and Luxator Market Regional Analysis

- North America dominated the dental elevator and luxator market with the largest revenue share of 37.4% in 2025, supported by a high volume of dental extraction procedures, advanced dental care infrastructure, and widespread adoption of modern oral surgery techniques

- The region benefits from strong penetration of dental clinics, specialty oral surgery centers, and well-established reimbursement systems

- High patient awareness regarding oral health and routine dental procedures further contributes to sustained demand. The strong presence of leading dental instrument manufacturers and continuous product innovations also reinforce North America’s market leadership

U.S. Dental Elevator and Luxator Market Insight

The U.S. dental elevator and luxator market captured the largest revenue share within North America in 2025, driven by a high number of tooth extractions, periodontal surgeries, and implant procedures. The widespread adoption of minimally invasive extraction techniques and ergonomic dental instruments has increased demand for advanced elevators and luxators. Strong investments in dental education, a large base of practicing dentists, and rapid uptake of premium-quality surgical tools continue to support market growth. In addition, the replacement demand for reusable instruments contributes significantly to recurring revenue.

Europe Dental Elevator and Luxator Market Insight

The Europe dental elevator and luxator market is projected to expand at a steady CAGR during the forecast period, driven by growing emphasis on preventive and surgical dental care. Increasing dental tourism, particularly in Eastern and Southern Europe, is supporting higher procedural volumes. The region also benefits from strong regulatory standards and rising adoption of high-quality, precision dental instruments across clinics and hospitals. Expanding geriatric populations further increase the need for tooth extraction and oral surgical procedures.

U.K. Dental Elevator and Luxator Market Insight

The U.K. dental elevator and luxator market is anticipated to grow at a noteworthy CAGR, supported by increasing demand for restorative and surgical dental procedures. Rising awareness of oral hygiene, expanding private dental clinics, and improving access to specialized oral care services are key growth drivers. The adoption of advanced dental instruments to improve procedural efficiency and patient comfort is further accelerating market expansion across the country.

Germany Dental Elevator and Luxator Market Insight

The Germany dental elevator and luxator market is expected to expand at a considerable CAGR, fueled by the country’s strong dental care infrastructure and focus on precision medical devices. Germany’s emphasis on high-quality surgical instruments, combined with technological advancements in dental tool design, supports sustained demand. A growing aging population and increasing prevalence of periodontal diseases further contribute to market growth.

Asia-Pacific Dental Elevator and Luxator Market Insight

The Asia-Pacific dental elevator and luxator market is expected to be the fastest-growing region, registering a strong CAGR of 7.6% during the forecast period, driven by rising dental healthcare expenditure and expanding access to oral care services. Rapid growth in dental clinic networks, increasing awareness of oral hygiene, and improving affordability of dental procedures are key contributors. Governments across the region are investing in healthcare infrastructure, further supporting demand for dental surgical instruments.

China Dental Elevator and Luxator Market Insight

China dental elevator and luxator market accounted for the largest market revenue share in Asia-Pacific in 2025, supported by a rapidly expanding dental care market and increasing adoption of modern dental procedures. Rising urbanization, growing middle-class population, and higher disposable incomes are driving demand for advanced dental treatments. The expansion of private dental clinics and domestic manufacturing of cost-effective dental instruments further strengthens market growth.

Japan Dental Elevator and Luxator Market Insight

The Japan dental elevator and luxator market is gaining steady momentum due to the country’s aging population and high prevalence of dental disorders. Strong emphasis on precision, ergonomics, and high-quality dental tools supports consistent adoption of advanced elevators and luxators. Well-established dental care systems and increasing focus on minimally invasive procedures continue to drive market demand.

Dental Elevator and Luxator Market Share

The Dental Elevator and Luxator industry is primarily led by well-established companies, including:

• Hu-Friedy (U.S.)

• Dentsply Sirona (U.S.)

• Karl Schumacher Dental (U.S.)

• Medesy (Italy)

• American Eagle Instruments (U.S.)

• Integra LifeSciences (U.S.)

• Aesculap (B. Braun) (Germany)

• Zepf Medical Instruments (Germany)

• G. Hartzell & Son (U.S.)

• Helmut Zepf Medizintechnik (Germany)

• Otto Leibinger GmbH (Germany)

• ASA Dental (Italy)

• J&J Instruments (Pakistan)

• Carl Martin Solingen (Germany)

• Den-Mat Holdings (U.S.)

Latest Developments in Global Dental Elevator and Luxator Market

- In May 2023, Coltene Whaledent, a major dental products manufacturer, announced the launch of its new Ossia Max Elevators line, designed for atraumatic tooth extraction with an ergonomic design and a variety of blade shapes to suit different clinical needs. This launch underscores Coltene’s focus on improving extraction precision and clinician comfort in surgical procedures

- In June 2023, EMS Electro Medical Systems introduced the Physiodis LUX 550 luxator, a piezoelectric instrument that uses ultrasonic vibrations to gently sever periodontal ligaments and facilitate minimally invasive tooth extraction, reflecting ongoing technological advancements in dental extraction tools

- In July 2023, Meisinger USA completed the acquisition of Hager & Werken, a German manufacturer of dental instruments including elevators and luxators, strengthening its portfolio and global production capabilities in specialized dental extraction instruments. This strategic move highlights industry consolidation and expansion of product lines for broader clinical offerings

- In June 2021, a comprehensive industry report highlighted that the global Dental Elevator and Luxator market was projected to deliver greater revenues during 2021–2026, driven by increasing oral disease prevalence, technological improvements in instrument design, and expanding surgical care worldwide. This analysis set the stage for subsequent innovation and market development

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.