Global Dental Sutures Market

Market Size in USD Billion

CAGR :

%

USD

632.09 Billion

USD

970.06 Billion

2025

2033

USD

632.09 Billion

USD

970.06 Billion

2025

2033

| 2026 –2033 | |

| USD 632.09 Billion | |

| USD 970.06 Billion | |

|

|

|

|

Dental Sutures Market Size

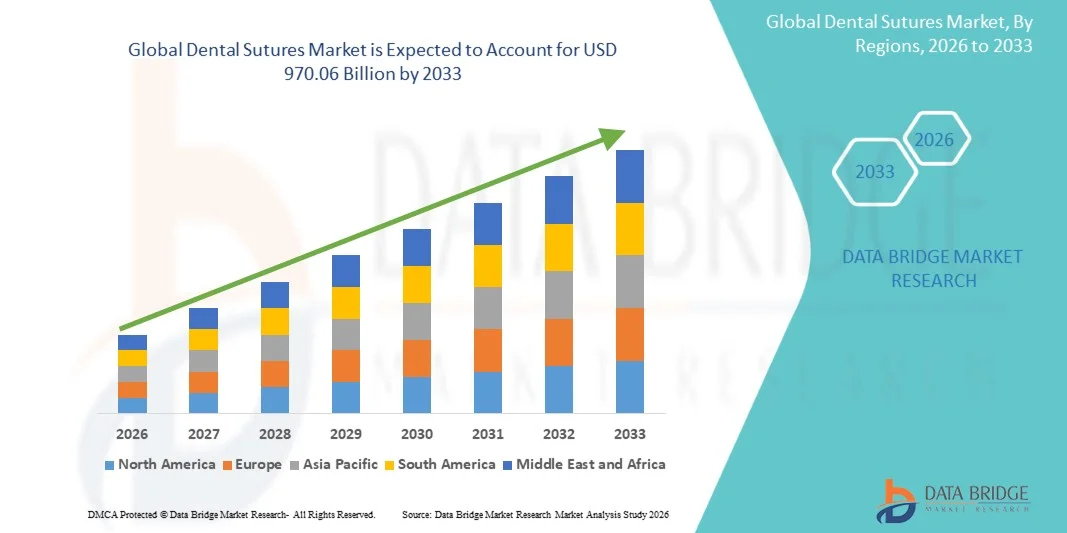

- The global dental sutures market size was valued at USD 632.09 billion in 2025 and is expected to reach USD 970.06 billion by 2033, at a CAGR of 5.50% during the forecast period

- The market growth is largely fueled by increasing adoption of advanced dental procedures, rising patient awareness about oral health, and the growing preference for minimally invasive surgeries that require effective suture solutions

- Furthermore, rising demand for biocompatible, absorbable, and high-strength suture materials, along with technological innovations in dental sutures, is driving market expansion and enhancing procedural efficiency in both hospitals and dental clinics

Dental Sutures Market Analysis

- Dental sutures, used for wound closure in oral and maxillofacial procedures, are increasingly vital components of modern dental surgeries in both hospitals and specialty clinics due to their high biocompatibility, ease of handling, and ability to promote faster healing

- The escalating demand for dental sutures is primarily fueled by the rising adoption of minimally invasive dental procedures, increasing patient awareness about oral health, and growing preference for absorbable and high-strength suture materials that reduce post-operative complications

- North America dominated the dental sutures market with the largest revenue share of 38.5% in 2025, supported by advanced dental care infrastructure, high adoption of modern dental procedures, and a strong presence of key suture manufacturers. The U.S. experienced significant growth due to increasing dental surgeries, rising patient awareness, and adoption of absorbable and synthetic suture materials

- Asia-Pacific is expected to be the fastest-growing region in the dental sutures market during the forecast period, registering a CAGR of 7.6%, driven by expanding dental care infrastructure, increasing urbanization, rising disposable incomes, and growing preference for modern dental treatments in countries such as India, China, and Japan

- The absorbable segment dominated the largest market revenue share of 54.3% in 2025, driven by its extensive use in oral surgeries, periodontal procedures, and implant dentistry due to its self-dissolving properties, reducing the need for suture removal and enhancing patient compliance

Report Scope and Dental Sutures Market Segmentation

|

Attributes |

Dental Sutures Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Dental Sutures Market Trends

“Growing Adoption of Advanced Suturing Materials and Techniques”

- A significant trend in the global dental sutures market is the increasing adoption of advanced suturing materials, including absorbable and non-absorbable sutures, as well as the development of specialized coated sutures that reduce infection risk and improve healing outcomes

- Surgeons and dental practitioners are increasingly preferring these advanced materials due to their superior tensile strength, biocompatibility, and ease of handling

- For instance, in 2023, companies like SutureTech and Hu-Friedy launched polyglycolic acid-based absorbable sutures specifically designed for pediatric and periodontal applications, enhancing healing efficiency while reducing patient discomfort. Similarly, barbed and antibacterial-coated sutures are being increasingly utilized in complex oral surgeries

- This trend is further fueled by rising awareness among dental professionals regarding post-operative complications, infection control, and patient comfort, driving the adoption of innovative suturing solutions across hospitals, dental clinics, and specialized surgical centers globally

- In addition, the growing prevalence of dental implants and cosmetic dentistry procedures, particularly in North America and Europe, is creating demand for high-performance sutures that ensure precision and minimize tissue trauma, supporting faster recovery and better aesthetic outcomes

- Furthermore, increasing research and development initiatives by leading manufacturers to improve suture performance, including enhanced knot security, flexibility, and antimicrobial properties, are accelerating the shift toward next-generation suturing solutions in both routine and complex dental procedures

Dental Sutures Market Dynamics

Driver

“Rising Dental Surgeries and Oral Health Awareness”

- The global demand for dental sutures is being driven by the increasing number of dental procedures and oral surgeries worldwide, including periodontal surgeries, implant procedures, and oral maxillofacial surgeries. An aging population with higher incidences of oral diseases, coupled with increased elective cosmetic procedures, is propelling market growth

- For instance, in 2022, the World Health Organization (WHO) reported a steady rise in dental care procedures across Asia-Pacific and Europe, creating higher demand for suturing solutions that ensure faster healing and minimize post-surgical complications

- Furthermore, growing awareness of oral hygiene and preventive dental care is encouraging early intervention, resulting in higher procedural volumes where high-quality sutures are required. The adoption of minimally invasive dental techniques, which rely on precise suturing, is also boosting demand in developed markets such as the U.S., Germany, and Japan

- In addition, increasing investments by hospitals and dental clinics in advanced surgical equipment, along with expanding dental insurance coverage in emerging economies, is providing a strong push for the adoption of premium suture products

Restraint/Challenge

“High Costs and Limited Awareness in Emerging Regions”

- Despite growing demand, the global dental sutures market faces challenges due to the relatively high cost of advanced sutures compared to traditional options, which can limit adoption in price-sensitive regions such as parts of Africa, Latin America, and South Asia

- For instance, while absorbable and coated sutures provide significant clinical advantages, their prices are 20–30% higher than standard silk or nylon sutures, leading smaller clinics or rural hospitals to continue using conventional products

- Furthermore, limited awareness and training among dental professionals in emerging markets regarding the benefits of advanced sutures can slow adoption rates. Some practitioners continue to rely on older techniques due to familiarity and lower cost

- Other challenges include stringent regulatory requirements and the need for comprehensive clinical validation before launching new suture types, which can delay product availability and affect market growth

- Addressing these challenges through awareness campaigns, training programs, and cost-effective product development will be crucial for sustained growth in the global Dental Sutures market over the forecast period

Dental Sutures Market Scope

The market is segmented on the basis of type, technique, material, and end user.

• By Type

On the basis of type, the Global Dental Sutures market is segmented into absorbable and non-absorbable. The absorbable segment dominated the largest market revenue share of 54.3% in 2025, driven by its extensive use in oral surgeries, periodontal procedures, and implant dentistry due to its self-dissolving properties, reducing the need for suture removal and enhancing patient compliance. Hospitals and dental clinics prefer absorbable sutures for pediatric and geriatric patients to minimize follow-up visits. Technological advancements in synthetic absorbable materials such as polyglycolic acid and polylactic acid provide consistent tensile strength and controlled absorption rates. The availability of various needle designs and suture sizes improves procedural flexibility. Absorbable sutures are widely used in minimally invasive and microsurgical applications. Integration with hemostatic and antibacterial coatings enhances wound healing outcomes. Increased adoption in dental implantology drives consistent demand. Surgeons benefit from predictable absorption and reduced tissue reaction. Global awareness about patient comfort and infection prevention supports market dominance. Adoption in cosmetic dental procedures further strengthens market share. Strong reimbursement coverage in developed markets boosts utilization. Continuous R&D ensures superior material quality and clinical outcomes.

The non-absorbable segment is expected to witness the fastest CAGR of 15.7% from 2026 to 2033, fueled by its preference in complex oral surgeries, periodontal flap procedures, and long-term tissue approximation where prolonged tensile strength is required. Materials such as silk, nylon, and polyester are widely used due to their durability and minimal tissue reaction. Non-absorbable sutures are preferred in procedures requiring extended wound support. The segment benefits from increasing dental implant procedures globally. High demand in teaching hospitals and specialty clinics supports growth. Technological advancements in coating and needle design improve handling and reduce trauma. Rising adoption in cosmetic and reconstructive dentistry drives market expansion. Surgeons appreciate the precision and knot security offered by non-absorbable sutures. Increasing number of dental surgeries in emerging markets enhances growth opportunities. Training programs for advanced suture techniques expand adoption. Strong preference among experienced surgeons fuels market expansion. These factors collectively contribute to the rapid growth of non-absorbable sutures in the global market.

• By Technique

On the basis of technique, the Global Dental Sutures market is segmented into interrupted simple sutures, continuous simple sutures, mattress sutures, and crisscross sutures. The interrupted simple sutures segment dominated the largest market revenue share of 47.6% in 2025, driven by their versatility, ease of placement, and ability to maintain wound edge approximation even if one suture fails. This technique is widely taught in dental schools and used in routine periodontal, implant, and oral surgery procedures. Surgeons prefer it for predictable wound healing and precise tension control. Interrupted sutures allow better drainage of exudates and minimize tissue strangulation. They are ideal for high-tension areas and irregular wound edges. Availability in multiple suture materials enhances adoption. The segment benefits from both absorbable and non-absorbable suture use. Increased usage in microsurgical dental procedures strengthens market dominance. Consistent outcomes and reduced complications support hospital and clinic adoption. Integration with hemostatic and antibacterial coatings further improves results. Adoption in pediatric and geriatric patients contributes to market share. These factors collectively sustain the dominance of interrupted simple sutures.

The continuous simple sutures segment is expected to witness the fastest CAGR of 16.2% from 2026 to 2033, driven by the efficiency and speed of placement in long incisions and periodontal surgeries. Continuous sutures reduce operative time and improve workflow in high-volume dental clinics. They are preferred in procedures requiring uniform tension along the wound. Adoption is growing in dental implant and flap surgeries. Improved suture materials reduce tissue trauma and enhance patient comfort. Increasing demand for minimally invasive techniques supports growth. Continuous sutures integrate well with absorbable synthetic materials. Rising cosmetic and orthodontic procedures fuel adoption. Technological improvements in needle and suture design ease placement. Surgeons appreciate reduced suture consumption per procedure. Growth in emerging markets enhances segment adoption. Availability of training programs increases surgeon confidence. These factors collectively drive rapid growth of continuous simple sutures.

• By Material

On the basis of material, the Global Dental Sutures market is segmented into synthetic material and natural material. The synthetic material segment dominated the largest market revenue share of 59.4% in 2025, due to its consistent quality, predictable absorption, and minimal tissue reactivity. Synthetic sutures such as polyglycolic acid, polylactic acid, and polyester are widely used in hospitals, dental clinics, and specialty practices. These materials are preferred for both absorbable and non-absorbable sutures. The segment benefits from technological advancements in coating for smooth passage and reduced friction. Synthetic sutures support a wide range of oral surgical procedures, including implantology, periodontal therapy, and endodontic surgery. High tensile strength and customizable absorption rates make them ideal for complex procedures. Increasing demand for infection control and predictable healing drives adoption. Availability of multiple sizes and needle configurations enhances versatility. Synthetic sutures are widely accepted in developed markets. Integration with hemostatic and antibacterial properties further strengthens market presence. Continuous R&D ensures innovation and enhanced clinical outcomes. Global preference for advanced materials sustains dominance.

The natural material segment is expected to witness the fastest CAGR of 14.8% from 2026 to 2033, driven by rising adoption of silk, catgut, and other naturally derived sutures in periodontal and oral surgical procedures. These materials are appreciated for their handling, knot security, and familiarity among experienced surgeons. Natural sutures are widely used in teaching hospitals and clinics with traditional surgical techniques. Growing preference for biodegradable and eco-friendly materials supports growth. Adoption is increasing in emerging markets with expanding dental infrastructure. Natural sutures are commonly used in pediatric and geriatric dentistry. Technological improvements in sterilization and coating improve performance. Surgeons value minimal tissue reaction and reliable knot security. Growth in cosmetic and reconstructive dental surgeries fuels adoption. Accessibility and cost-effectiveness enhance market penetration. Integration with absorbable techniques increases usage. These factors collectively drive strong growth of natural material sutures.

• By End User

On the basis of end user, the Global Dental Sutures market is segmented into hospitals, clinics, research laboratories, and others. The hospitals segment dominated the largest market revenue share of 51.7% in 2025, driven by high patient volumes, advanced surgical infrastructure, and the need for reliable suturing solutions in routine and complex oral procedures. Hospitals offer multi-specialty dental care including oral surgery, implantology, and pediatric dentistry, which generates consistent demand for dental sutures. Hospitals benefit from bulk procurement and consistent supply chains. Preference for high-quality absorbable and synthetic sutures is strong. Staff training programs enhance adoption of advanced techniques. Integration with surgical workflows ensures efficiency. Hospitals play a key role in clinical trials and device validation. Availability of specialized dental surgeons supports procedural adoption. Regulatory compliance and safety standards favor hospital usage. Reimbursement policies and insurance coverage facilitate high utilization. Hospitals are often centers for teaching and innovation in suturing techniques. These factors collectively sustain dominance in the end-user segment.

The clinics segment is expected to witness the fastest CAGR of 15.6% from 2026 to 2033, fueled by the increasing number of private dental clinics offering specialized oral care services. Clinics are adopting sutures for efficiency, aesthetic outcomes, and patient satisfaction in procedures such as implant placement, periodontal therapy, and cosmetic dentistry. Rising awareness of oral health and preventive care supports adoption. Portable, cost-effective sutures are preferred in outpatient settings. Integration with minimally invasive techniques enhances workflow. Clinics benefit from shorter procedure times using continuous and synthetic sutures. Growing demand for pediatric and geriatric dental care drives expansion. Clinics increasingly participate in continuing education and training programs to enhance surgical outcomes. Rising disposable income in emerging markets supports market penetration. Adoption of modern suturing techniques improves procedural efficiency. Availability of advanced synthetic and absorbable materials strengthens usage. These factors collectively contribute to the rapid growth of the clinics segment.

Dental Sutures Market Regional Analysis

- North America dominated the dental sutures market with the largest revenue share of 38.7% in 2025, characterized by advanced healthcare infrastructure, high patient awareness, and strong adoption of minimally invasive dental procedures

- The region benefits from increasing prevalence of dental implants, periodontal surgeries, and oral surgeries requiring advanced suture solutions. Innovations in absorbable and non-absorbable suture materials, as well as enhanced sterilization and biocompatibility, are driving market growth

- High disposable incomes, well-established dental clinics, and the growing preference for efficient surgical outcomes further strengthen adoption across hospitals, specialty clinics, and dental chains

U.S. Dental Sutures Market Insight

The U.S. dental sutures market captured the largest revenue share in 2025 within North America, fueled by extensive use of periodontal, implant, and oral surgical procedures. The growing adoption of absorbable sutures, advanced suture materials, and minimally invasive techniques is driving demand. Dental professionals increasingly prefer high-performance sutures that reduce healing time and improve surgical outcomes. Expanding dental clinics and hospitals, coupled with increasing awareness about post-surgical care and cosmetic dentistry, further contribute to market growth. Innovations in suture packaging and sterilization technologies are also supporting rapid adoption.

Europe Dental Sutures Market Insight

The Europe dental sutures market is projected to expand at a substantial CAGR throughout the forecast period, driven by high patient awareness, rising dental care expenditure, and stringent healthcare standards. Growth is supported by increasing adoption of advanced periodontal and implant procedures. The market is witnessing significant expansion across private dental clinics, hospitals, and multi-specialty practices. European dental professionals value biocompatible, sterile, and easy-to-handle sutures that improve clinical outcomes and reduce post-operative complications.

U.K. Dental Sutures Market Insight

The U.K. dental sutures market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by rising awareness of oral health, increased number of dental clinics, and demand for minimally invasive procedures. The adoption of both absorbable and non-absorbable sutures for periodontal, implant, and oral surgical procedures is increasing. Growing investments in dental infrastructure and integration of modern surgical techniques contribute to market expansion.

Germany Dental Sutures Market Insight

The Germany dental sutures market is expected to expand at a considerable CAGR during the forecast period, driven by well-established healthcare infrastructure, increasing patient awareness, and focus on advanced oral surgical techniques. Demand is rising for high-quality, sterilized, and easy-to-use sutures in both hospital and private clinic settings. Germany’s emphasis on healthcare innovation and sustainability promotes adoption of newer suture materials and packaging technologies.

Asia-Pacific Dental Sutures Market Insight

The Asia-Pacific dental sutures market is expected to be the fastest-growing region, registering a CAGR of 8.2% during the forecast period, driven by rising urbanization, increasing dental care expenditure, expanding dental clinics and hospitals, and growing patient awareness in countries such as China, India, and Japan. Government initiatives to improve oral healthcare infrastructure, increasing dental insurance coverage, and the adoption of advanced surgical techniques are further accelerating market growth. Enhanced accessibility to high-quality sutures at competitive prices is also supporting rapid adoption.

Japan Dental Sutures Market Insight

The Japan dental sutures market is growing steadily due to high patient awareness, technological advancements in dental surgery, and increasing adoption of minimally invasive procedures. The demand for absorbable and non-absorbable sutures in implantology, periodontal surgeries, and oral surgeries is rising. Aging population and emphasis on cosmetic dentistry further support market growth.

China Dental Sutures Market Insight

China dental sutures market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid urbanization, increasing dental care expenditure, rising prevalence of oral health issues, and high patient awareness. Adoption of advanced surgical techniques, including implants and periodontics, is increasing demand for high-quality sutures. Strong domestic manufacturing and government initiatives to improve oral healthcare accessibility are key growth factors.

India Dental Sutures Market Insight

India dental sutures market is projected to witness rapid growth in the Dental Sutures market, supported by rising dental care awareness, expansion of dental clinics and hospitals, increasing disposable incomes, and government initiatives promoting oral health. Adoption of modern surgical techniques, advanced sutures, and minimally invasive procedures is driving market growth, particularly in urban and semi-urban regions.

Dental Sutures Market Share

The Dental Sutures industry is primarily led by well-established companies, including:

• B. Braun S.E. (Germany)

• Medtronic plc (Ireland)

• Peters Surgical (France)

• DemeTECH Corporation (U.S.)

• Teleflex Incorporated (U.S.)

• Hu-Friedy (U.S.)

• 3M (U.S.)

• Internacional Farmacéutica S.A. (Spain)

• Aesculap (B. Braun Group) (Germany)

• Kono Seisakusho Co., Ltd. (Japan)

• Sutures India Pvt. Ltd. (India)

• Assut Medical Sàrl (Switzerland)

• Unisur Lifecare (India)

• SMI AG (Belgium)

Latest Developments in Global Dental Sutures Market

- In April 2021, Dolphin Sutures, an Indian medical device manufacturer, introduced its non-absorbable Polytetrafluoroethylene (PTFE) dental suture product line called TEFLENE in India, expanding its dental offerings with a high tensile strength suture designed for improved biocompatibility and handling in oral surgeries

- In August 2021, the SVS Institute of Dental Sciences in India initiated a research study on the efficacy of barbed sutures for mucogingival surgeries, aiming to generate clinical evidence on improved handling and healing outcomes compared to conventional sutures

- In May 2022, Medical Microinstruments (MMI) SpA launched the Symani Surgical System Simulator in collaboration with VirtaMed, designed to enhance microsurgical training and precision, including applications relevant to suture handling and dental microsurgery techniques

- In March 2023, Sutures India expanded its dental product portfolio by launching a range of biodegradable dental sutures, developed to support environmentally conscious surgical procedures while maintaining performance in dental wound closure

- In June 2023, Medtronic entered into a collaborative partnership with a dental research institute to co-develop next-generation surgical sutures featuring antimicrobial properties, aimed at enhancing dental surgical efficiency and reducing infection risks

- In August 2023, C. R. Bard, a subsidiary of Becton, Dickinson and Company (BD), launched a new polyester-based dental suture featuring enhanced knot security and a specialized coating to improve ease of use and performance during dental procedures

- In October 2023, Dentsply Sirona announced a merger with a dental implant company, enabling a combined product line that includes dental suturing solutions designed to complement implant placement and other oral surgical procedures

- In November 2023, Johnson & Johnson launched a new line of biodegradable dental sutures intended to improve post-operative recovery in dental surgeries by offering predictable absorption profiles and reduced need for suture removal

- In June 2025, Applied Medical Technology, Inc. introduced two innovative suture-passing solutions — RHAPSO and GEMINI, engineered to deliver precision, procedural efficiency, and versatility for minimally invasive surgical and dental applications

- In May 2025, Septodont, a French dental consumables company, announced expansion of its global R&D activities and market reach — notably including growth initiatives in the Chinese market, furthering development and distribution of dental sutures and consumables worldwide

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.