Global Depyrogenated Sterile Empty Vials Market

Market Size in USD Billion

CAGR :

%

USD

1.39 Billion

USD

2.83 Billion

2025

2033

USD

1.39 Billion

USD

2.83 Billion

2025

2033

| 2026 –2033 | |

| USD 1.39 Billion | |

| USD 2.83 Billion | |

|

|

|

|

Depyrogenated Sterile Empty Vials Market Size

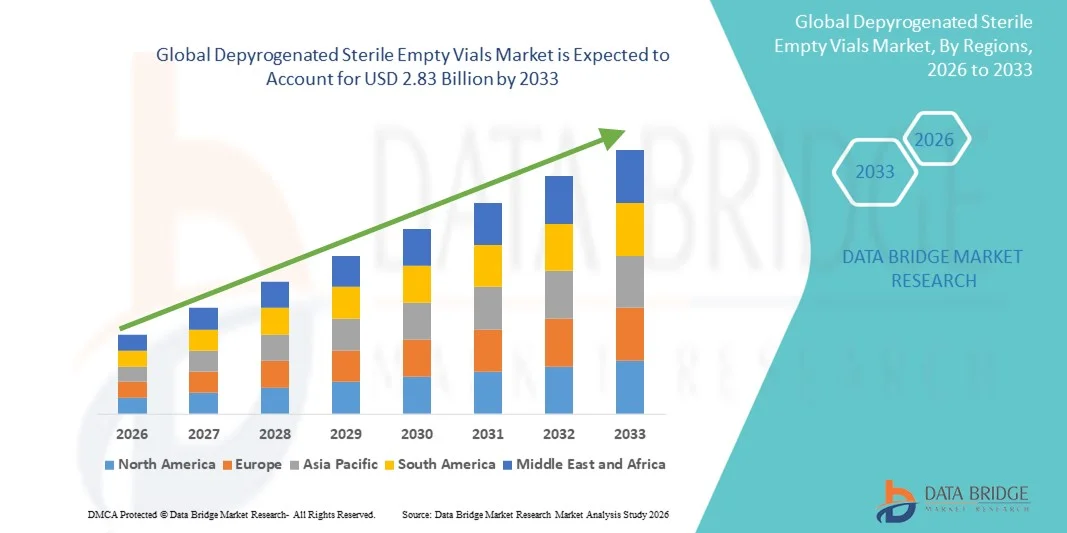

- The global Depyrogenated Sterile Empty Vials market size was valued at USD 1.39 billion in 2025 and is expected to reach USD 2.83 billion by 2033, at a CAGR of 9.32% during the forecast period

- The market growth is largely fueled by the expanding pharmaceutical and biotechnology industries, along with continuous technological advancements in sterile manufacturing and filling processes, leading to increased adoption of high-quality depyrogenated sterile empty vials across both clinical and commercial applications

- Furthermore, rising demand for safe, contamination-free, and regulatory-compliant primary packaging solutions for injectable drugs, vaccines, and biologics is establishing depyrogenated sterile empty vials as a critical component of modern pharmaceutical packaging. These converging factors are accelerating the uptake of depyrogenated sterile empty vials solutions, thereby significantly boosting the overall market growth

Depyrogenated Sterile Empty Vials Market Analysis

- Depyrogenated sterile empty vials, designed to ensure endotoxin-free and contamination-free packaging for injectable drugs and biologics, are essential components of modern pharmaceutical and biotechnology manufacturing due to their role in maintaining drug safety, stability, and regulatory compliance

- The escalating demand for depyrogenated sterile empty vials is primarily driven by the rapid growth in injectable drug production, increasing vaccine manufacturing, rising biologics and biosimilars development, and stringent regulatory requirements for parenteral packaging across global pharmaceutical markets

- North America dominated the depyrogenated sterile empty vials market with the largest revenue share of approximately 38.4% in 2025, supported by a well-established pharmaceutical and biotechnology ecosystem, high adoption of advanced aseptic filling technologies, strong presence of leading vial manufacturers, and robust production of injectable drugs and biologics, with the U.S. accounting for a major portion of regional demand

- Asia-Pacific is expected to be the fastest-growing region in the depyrogenated sterile empty vials market during the forecast period, driven by rapid expansion of pharmaceutical manufacturing capacity, increasing vaccine production, growing investments in biologics, and rising demand for compliant primary packaging solutions in countries such as China and India

- The glass segment accounted for the largest market revenue share of 71.8% in 2025, owing to its superior chemical resistance, high thermal stability, and long-standing acceptance in pharmaceutical packaging

Report Scope and Depyrogenated Sterile Empty Vials Market Segmentation

|

Attributes |

Depyrogenated Sterile Empty Vials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Schott AG (Germany) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Depyrogenated Sterile Empty Vials Market Trends

Increasing Demand for High-Quality, Contamination-Free Primary Packaging

- A significant and accelerating trend in the global depyrogenated sterile empty vials market is the growing emphasis on high-quality, contamination-free primary packaging solutions for injectable pharmaceuticals, biologics, and vaccines

- As drug formulations become more complex and sensitive, manufacturers are prioritizing vial integrity, sterility assurance, and pyrogen-free standards to ensure patient safety and regulatory compliance

- For instance, in 2024, several global pharmaceutical manufacturers expanded their procurement of depyrogenated sterile empty vials to support large-scale production of injectable biologics and vaccines, particularly for oncology, immunology, and infectious disease applications

- Advancements in vial washing, depyrogenation tunnel technology, and automated filling lines are further supporting this trend by enabling consistent quality, reduced human intervention, and improved production efficiency. These improvements help minimize the risk of endotoxin contamination during manufacturing and packaging processes

- In addition, the growing adoption of ready-to-use (RTU) depyrogenated sterile vials is gaining momentum, as these products reduce preparation time, lower contamination risks, and support faster time-to-market for pharmaceutical companies

- This trend is reshaping industry expectations, encouraging vial manufacturers to invest in advanced production capabilities and stringent quality control systems to meet global pharmacopeia standards, including USP, EP, and JP requirements

- As a result, demand for depyrogenated sterile empty vials is steadily increasing across developed and emerging markets, driven by the expansion of injectable drug pipelines worldwide

Depyrogenated Sterile Empty Vials Market Dynamics

Driver

Expansion of Pharmaceutical and Biologics Manufacturing Worldwide

- The global Depyrogenated Sterile Empty Vials market is strongly driven by the rapid expansion of pharmaceutical, biotechnology, and vaccine manufacturing activities across North America, Europe, Asia-Pacific, and other regions. The rising production of injectables, biosimilars, and specialty drugs has significantly increased the need for high-quality sterile packaging solutions

- For instance, in 2025, multiple biologics manufacturing facilities in Asia-Pacific and Europe announced capacity expansions to support increased production of injectable therapies, directly boosting demand for depyrogenated sterile empty vials

- Stringent regulatory requirements related to sterility, endotoxin control, and patient safety mandate the routine use of depyrogenated vials throughout drug development, clinical trials, and commercial manufacturing

- Furthermore, the growing prevalence of chronic diseases, rising vaccination programs, and increasing focus on personalized medicine are accelerating the production of injectable treatments, reinforcing long-term demand for sterile vial solutions

- The increasing export of pharmaceutical products across international markets also necessitates adherence to global quality standards, further driving the adoption of depyrogenated sterile empty vials by manufacturers seeking regulatory approval worldwide

Restraint/Challenge

High Manufacturing Costs and Complex Regulatory Compliance

- Despite strong demand, the market faces challenges associated with high manufacturing costs and complex regulatory requirements. The production of depyrogenated sterile empty vials requires advanced equipment, controlled environments, and rigorous quality testing, which can significantly increase operational expenses

- For instance, small- and mid-sized vial manufacturers in emerging markets have reported difficulties in upgrading to fully automated depyrogenation and inspection systems due to high capital investment requirements

- Compliance with varying global regulatory standards, including differences in validation, documentation, and inspection protocols across regions, can further complicate market entry and expansion for manufacturers

- Supply chain disruptions, fluctuations in raw material prices, and energy-intensive production processes can also impact cost structures and profit margins, particularly during periods of global uncertainty

- Addressing these challenges through process optimization, technological advancements, and harmonization of regulatory standards will be essential to ensure sustained growth in the global Depyrogenated Sterile Empty Vials market

Depyrogenated Sterile Empty Vials Market Scope

The market is segmented on the basis of product, package technology, and end use.

- By Product

On the basis of product, the Global Depyrogenated Sterile Empty Vials market is segmented into 2 ml, 5 ml, 10 ml, 20 ml, and >20 ml. The 10 ml segment dominated the largest market revenue share of 34.6% in 2025, driven by its extensive use in injectable drug formulations, vaccines, and biologics across pharmaceutical and biotechnology companies. These vials are widely preferred due to their optimal volume capacity, compatibility with automated filling lines, and suitability for multi-dose and single-dose applications. The rising production of parenteral drugs, especially oncology injectables and biosimilars, further strengthens demand. Additionally, regulatory emphasis on sterility and endotoxin control favors depyrogenated vials in this size range. The segment benefits from standardized packaging practices and cost efficiency in large-scale manufacturing. Growth is also supported by increasing vaccine stockpiling and global immunization programs.

The 2 ml segment is expected to witness the fastest CAGR of 8.9% from 2026 to 2033, fueled by rising demand for high-potency drugs, lyophilized formulations, and precision dosing applications. These vials are increasingly used for specialty injectables, gene therapies, and clinical trial samples where small volumes are critical. The expansion of personalized medicine and biologics development accelerates adoption. Additionally, growing R&D activities and clinical trials globally are driving demand for small-volume sterile packaging. The segment also benefits from reduced drug wastage and improved storage efficiency.

- By Package Technology

On the basis of package technology, the Global Depyrogenated Sterile Empty Vials market is segmented into glass and plastic. The glass segment accounted for the largest market revenue share of 71.8% in 2025, owing to its superior chemical resistance, high thermal stability, and long-standing acceptance in pharmaceutical packaging. Borosilicate glass vials are widely used for injectable drugs due to their low extractables and leachables profile. Regulatory agencies strongly favor glass for critical parenteral applications, further supporting dominance. Glass vials also withstand depyrogenation processes at high temperatures, ensuring compliance with sterility standards. Their transparency aids visual inspection, enhancing quality assurance. Widespread use across vaccines, biologics, and injectables sustains strong demand.

The plastic segment is projected to grow at the fastest CAGR of 9.6% from 2026 to 2033, driven by increasing adoption of cyclic olefin polymers (COP) and cyclic olefin copolymers (COC). These materials offer lightweight properties, break resistance, and design flexibility compared to traditional glass. Plastic vials are gaining traction in clinical trials, diagnostics, and emergency use medications. Their compatibility with advanced drug delivery systems and reduced risk of delamination supports growth. Rising focus on transportation safety and cost efficiency further accelerates adoption.

- By End Use

On the basis of end use, the Global Depyrogenated Sterile Empty Vials market is segmented into clinical labs, compounding labs, pharmaceutical companies, contract manufacturing organizations (CMOs), and distributors. The pharmaceutical companies segment dominated the market with a revenue share of 42.3% in 2025, driven by large-scale production of injectable drugs, vaccines, and biologics. Pharmaceutical manufacturers rely heavily on depyrogenated sterile vials to meet stringent regulatory and quality requirements. Continuous expansion of injectable drug pipelines and biosimilar development supports sustained demand. In-house filling operations and long-term supply contracts further strengthen this segment’s position. Increased global drug approvals and vaccination programs contribute significantly to volume consumption.

The contract manufacturing organization (CMO) segment is anticipated to register the fastest CAGR of 10.4% from 2026 to 2033, supported by the rapid outsourcing of sterile drug manufacturing. Pharmaceutical and biotech companies increasingly partner with CMOs to reduce capital expenditure and accelerate time-to-market. CMOs require large volumes of depyrogenated sterile empty vials for aseptic filling operations. Growth in biologics, cell and gene therapies, and small-batch production fuels this trend. Expansion of CMOs in emerging markets further enhances demand momentum.

Depyrogenated Sterile Empty Vials Market Regional Analysis

- North America dominated the depyrogenated sterile empty vials market with the largest revenue share of approximately 38.4% in 2025, supported by a well-established pharmaceutical and biotechnology ecosystem and strong demand for high-quality primary packaging solutions

- The region benefits from the high adoption of advanced aseptic filling and depyrogenation technologies, along with a strong presence of leading vial manufacturers and contract manufacturing organizations

- Robust production of injectable drugs, vaccines, and biologics, coupled with stringent regulatory standards for sterility and endotoxin control, continues to reinforce the dominance of depyrogenated sterile empty vials across both pharmaceutical and biotechnology applications

U.S. Depyrogenated Sterile Empty Vials Market Insight

The U.S. depyrogenated sterile empty vials market accounted for the major share of North American revenue in 2025, driven by large-scale manufacturing of injectable pharmaceuticals, biologics, and vaccines. The presence of major pharmaceutical companies, high R&D activity, and increasing approvals of injectable therapies are sustaining consistent demand for depyrogenated sterile empty vials. Additionally, strong regulatory oversight by the FDA is accelerating the adoption of high-quality, compliant vial packaging solutions.

Europe Depyrogenated Sterile Empty Vials Market Insight

The Europe depyrogenated sterile empty vials market is expected to expand at a steady CAGR during the forecast period, supported by a strong pharmaceutical manufacturing base and increasing production of sterile injectables. The region places significant emphasis on regulatory compliance, quality assurance, and patient safety, which is driving demand for depyrogenated and contamination-free primary packaging solutions across pharmaceutical and biotechnology industries.

U.K. Depyrogenated Sterile Empty Vials Market Insight

The U.K. depyrogenated sterile empty vials market is projected to grow at a notable rate, driven by increasing biologics manufacturing, expanding vaccine development activities, and growing investments in pharmaceutical R&D. The country’s well-developed healthcare and regulatory framework is encouraging pharmaceutical manufacturers to adopt high-standard sterile packaging solutions.

Germany Depyrogenated Sterile Empty Vials Market Insight

The Germany depyrogenated sterile empty vials market is anticipated to register solid growth over the forecast period, supported by Germany’s strong pharmaceutical and biotechnology manufacturing capabilities. The country’s focus on precision manufacturing, quality control, and compliance with stringent European regulatory standards is driving steady demand for depyrogenated sterile empty vials, particularly for injectable drugs and advanced biologics.

Asia-Pacific Depyrogenated Sterile Empty Vials Market Insight

The Asia-Pacific depyrogenated sterile empty vials market is expected to be the fastest-growing regional market during the forecast period, driven by rapid expansion of pharmaceutical manufacturing capacity and increasing vaccine and biologics production. Rising healthcare investments, growing export-oriented drug manufacturing, and increasing compliance with global packaging standards are accelerating demand for depyrogenated sterile empty vials across the region.

China Depyrogenated Sterile Empty Vials Market Insight

China depyrogenated sterile empty vials market represents the largest market for depyrogenated sterile empty vials in the Asia-Pacific region, supported by its expanding pharmaceutical manufacturing base and growing production of vaccines and injectable medicines. Strong government support for domestic drug manufacturing, coupled with rising investments in biologics and biosimilars, is driving sustained demand for compliant sterile vial packaging solutions.

India Depyrogenated Sterile Empty Vials Market Insight

The India depyrogenated sterile empty vials market is witnessing rapid growth due to increasing pharmaceutical exports, expanding injectable drug manufacturing, and growing vaccine production capacity. Rising investments in sterile manufacturing infrastructure and adherence to international regulatory standards are further supporting the adoption of depyrogenated sterile empty vials across pharmaceutical and biotechnology companies.

Depyrogenated Sterile Empty Vials Market Share

The Depyrogenated Sterile Empty Vials industry is primarily led by well-established companies, including:

• Schott AG (Germany)

• Gerresheimer AG (Germany)

• Stevanato Group (Italy)

• Nipro Corporation (Japan)

• West Pharmaceutical Services, Inc. (U.S.)

• Corning Incorporated (U.S.)

• SGD Pharma (France)

• DWK Life Sciences (Germany)

• Bormioli Pharma (Italy)

• Ardagh Group (Luxembourg)

• AptarGroup, Inc. (U.S.)

• Pacific Vial Manufacturing Inc. (U.S.)

• Shandong Medicinal Glass Co., Ltd. (China)

• Arab Pharmaceutical Glass Company (Saudi Arabia)

• Becton, Dickinson and Company (U.S.)

• Amcor plc (Switzerland)

• Acme Vial & Glass Co. (India)

• Origin Pharma Packaging (U.K.)

• OMPI (Italy)

• Nexus Packaging (U.S.)

Latest Developments in Global Depyrogenated Sterile Empty Vials Market

- In March 2025, Gerresheimer AG announced an expansion of its sterile vial production facility in Peachtree City, Georgia, aimed at significantly increasing capacity for depyrogenated glass vials to meet growing U.S. demand for ready-to-use injectable packaging components. The expansion reflects rising demand from pharmaceutical and biotech manufacturers for high-quality depyrogenated empty vials used in drug delivery and biologics production, amid robust overall market growth

- In February 2025, Stevanato Group introduced a new line of depyrogenated nested sterile vials compatible with robotic aseptic filling systems, targeting contract development and manufacturing organizations (CDMOs) and compounding labs to improve automation efficiencies in vial handling. This development underscores the industry’s shift toward automated and highly controlled sterile fill-finish operations to reduce contamination risk and improve throughput

- In January 2025, DWK Life Sciences unveiled its next-generation low-endotoxin Type I borosilicate vials specifically designed for biologics and freeze-dried drug applications, enhancing container closure integrity and supporting sensitive drug formulations. This product launch highlights innovation in vial materials and manufacturing tailored to meet the stringent requirements of advanced therapeutics

- In December 2024, West Pharmaceutical Services entered a partnership with a U.S.-based biotechnology startup to co-develop smart vial stoppers embedded with real-time sterility sensors, aiming to enhance quality assurance during storage and distribution of depyrogenated empty vials. This collaboration reflects the emerging trend of integrating digital monitoring technologies into primary pharmaceutical packaging solutions

- In November 2024, SGD Pharma launched a 5 ml depyrogenated ready-to-use (RTU) vial format in the United States featuring a Type I molded glass body and validated pyrogen removal protocols to streamline fill-finish operations for parenteral drugs. The introduction of this format addresses customer demand for standardized, high-quality vial sizes in injectable drug production

- In June 2024, PCI Pharma Services inaugurated an 82,000-square-foot facility in Ireland to increase production capacity for sterile injectable packaging solutions, including depyrogenated empty vials, strengthening regional supply chain resilience amid growing pharmaceutical production. This strategic expansion supports increased demand for sterile packaging in Europe and demonstrates industry commitment to scaling upstream manufacturing infrastructure

- In February 2024, the EZ-fill Smart ready-to-fill vial platform — originally launched in November 2022 by Stevanato Group in collaboration with Gerresheimer AG — became commercially available for high-volume automated vial production, signaling broader industry adoption of advanced vial solutions for injectable therapies. This shift toward innovative ready-to-fill technologies helps reduce operational costs and improve production efficiency for vial users

- In October 2024, SGD S.A. introduced a new siliconization service at its Saint-Quentin Lamotte plant in northern France to enhance internal services for depyrogenated vial production, particularly focusing on vial sizes for high-demand injectable formulations. This service expansion demonstrates an emphasis on comprehensive vial manufacturing capabilities to meet evolving pharmaceutical needs

- In May 2023, ResearchAndMarkets.com published a global market report highlighting growth trends in the depyrogenated sterile empty vials industry as it expanded from USD3.32 billion in 2022 to an estimated USD3.51 billion in 2023, with infectious disease treatment and vaccine distribution identified as key demand drivers. The report cited product launches such as Gerresheimer’s Gx RTF injection vials introduced at Pharmapack 2021, which underpin the technology progress within the sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.