Global Diagnostics Telematics Market

Market Size in USD Billion

CAGR :

%

USD

13.80 Billion

USD

93.99 Billion

2025

2033

USD

13.80 Billion

USD

93.99 Billion

2025

2033

| 2026 –2033 | |

| USD 13.80 Billion | |

| USD 93.99 Billion | |

|

|

|

|

Diagnostics Telematics Market Size

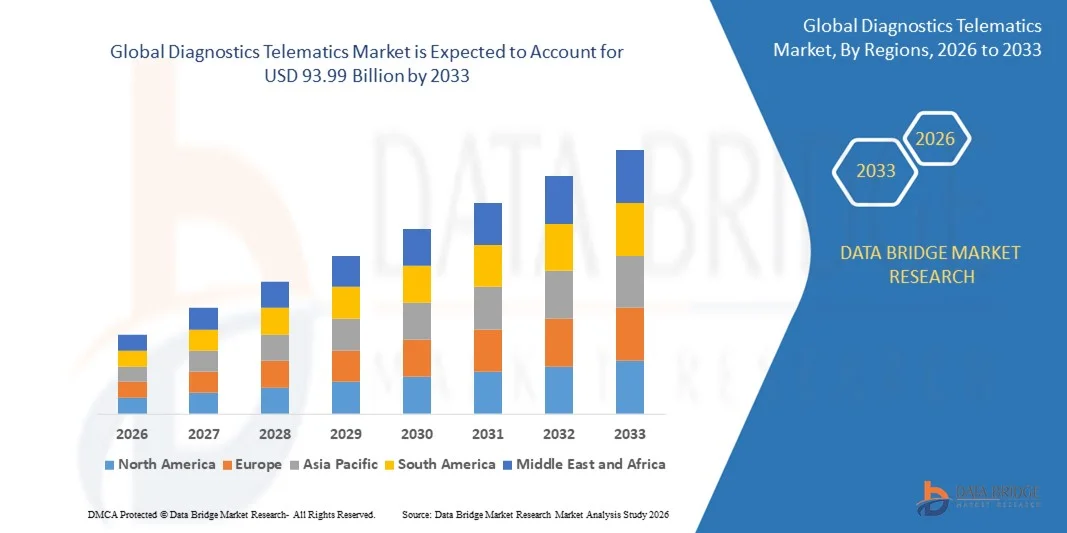

- The global diagnostics telematics market size was valued at USD 13.80 billion in 2025 and is expected to reach USD 93.99 billion by 2033, at a CAGR of 27.10% during the forecast period

- The market growth is largely fuelled by the rising adoption of connected vehicles, increasing demand for real-time vehicle health monitoring, and growing focus on predictive maintenance and fleet efficiency

- Rapid advancements in IoT, cloud computing, and data analytics are enabling more accurate diagnostics, fault detection, and performance optimization, supporting widespread adoption across passenger and commercial vehicles

Diagnostics Telematics Market Analysis

- The diagnostics telematics market is experiencing robust growth driven by the automotive industry’s shift toward connected, software-driven, and data-centric vehicle ecosystems

- Increasing integration of advanced sensors and onboard diagnostics systems is enabling continuous monitoring of vehicle components, improving reliability, safety, and lifecycle management

- North America dominated the diagnostics telematics market with the largest revenue share of 38.45% in 2025, driven by the rising adoption of connected vehicles, advanced fleet management solutions, and increasing demand for real-time vehicle diagnostics

- Asia-Pacific region is expected to witness the highest growth rate in the global diagnostics telematics market, driven by rising vehicle production, expanding fleet industries, government initiatives for connected mobility, and increasing demand for advanced telematics solutions

- The Telematic Control Unit segment held the largest market revenue share in 2025 driven by its central role in collecting, processing, and transmitting vehicle data. These units enable real-time diagnostics, vehicle tracking, and integration with connected vehicle services, making them a critical component for fleet operators and passenger vehicles

Report Scope and Diagnostics Telematics Market Segmentation

|

Attributes |

Diagnostics Telematics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Diagnostics Telematics Market Trends

Rising Adoption of Connected Vehicles and Real-Time Vehicle Monitoring

- The growing penetration of connected vehicles is significantly shaping the diagnostics telematics market, as automotive OEMs, fleet operators, and consumers increasingly rely on real-time data for vehicle health monitoring and performance optimization. Diagnostics telematics solutions are gaining traction due to their ability to provide continuous insights into engine performance, component health, and fault detection, supporting proactive maintenance and reduced downtime. This trend is strengthening adoption across passenger vehicles, commercial fleets, and logistics operations, encouraging service providers to enhance platform capabilities

- Increasing focus on operational efficiency, safety, and cost reduction has accelerated the demand for diagnostics telematics in fleet management and mobility services. Fleet operators are actively adopting telematics-based diagnostics to optimize maintenance schedules, reduce unexpected breakdowns, and improve asset utilization. This has also driven collaborations between automotive OEMs, telematics providers, and cloud service companies to deliver integrated and scalable diagnostic solutions

- Data-driven decision-making and digital transformation trends are influencing purchasing behavior, with stakeholders emphasizing advanced analytics, cloud connectivity, and remote monitoring capabilities. These factors are helping telematics providers differentiate offerings in a competitive market while building long-term customer value. Companies are increasingly highlighting predictive maintenance, uptime improvement, and cost savings in marketing strategies to strengthen adoption

- For instance, in 2024, automotive OEMs and fleet service providers in the U.S. and Germany expanded the deployment of diagnostics telematics platforms across commercial vehicle fleets to enable real-time fault detection and predictive maintenance. These deployments were introduced to reduce maintenance costs and improve fleet reliability, with solutions integrated across cloud-based dashboards and mobile applications

- While demand for diagnostics telematics is rising, sustained market expansion depends on data accuracy, cybersecurity, and seamless integration with existing vehicle systems. Market participants are focusing on improving platform scalability, data security, and interoperability to support broader adoption across diverse vehicle types and use cases

Diagnostics Telematics Market Dynamics

Driver

Growing Demand for Real-Time Vehicle Diagnostics and Predictive Maintenance

- Rising demand for real-time vehicle diagnostics is a major driver for the diagnostics telematics market, as fleet operators and OEMs seek to minimize downtime and improve vehicle reliability. Telematics-enabled diagnostics allow continuous monitoring of vehicle systems, enabling early fault detection and timely maintenance interventions, which improves overall operational efficiency

- Expanding use of telematics solutions across commercial fleets, logistics, ride-hailing, and shared mobility services is supporting market growth. Diagnostics telematics helps optimize maintenance planning, enhance safety, and reduce total cost of ownership, making it an essential tool for large-scale vehicle operations. Increasing vehicle electrification and software-driven architectures further reinforce this trend

- Automotive OEMs and telematics service providers are actively promoting diagnostics-enabled platforms through product innovation, strategic partnerships, and subscription-based service models. These efforts are supported by increasing regulatory focus on vehicle safety and emissions monitoring, encouraging broader adoption of connected diagnostic solutions

- For instance, in 2023, automotive manufacturers and fleet operators in the U.S. and Japan reported expanded use of diagnostics telematics across commercial and passenger vehicle platforms. This expansion was driven by growing demand for predictive maintenance, improved safety compliance, and enhanced vehicle lifecycle management, strengthening customer retention and service revenues

- Although rising demand supports strong growth, long-term adoption depends on data standardization, integration complexity, and cost-effective deployment. Continued investment in analytics, connectivity infrastructure, and platform interoperability will be critical for sustaining market momentum

Restraint/Challenge

Data Security Concerns and High Implementation Complexity

- Data security and privacy concerns remain a key challenge for the diagnostics telematics market, as solutions rely heavily on continuous data transmission and cloud-based analytics. Risks related to data breaches, unauthorized access, and regulatory compliance can limit adoption, particularly among large fleets and enterprise users

- High implementation complexity and integration costs also restrict adoption, especially for small and medium-sized fleet operators. Diagnostics telematics systems require compatibility with vehicle hardware, onboard diagnostics systems, and IT infrastructure, increasing upfront investment and deployment time

- Connectivity limitations and data reliability issues can further impact system performance, particularly in regions with inconsistent network coverage. Ensuring accurate and real-time diagnostics across diverse operating environments adds to operational challenges for service providers

- For instance, in 2024, fleet operators in parts of Southeast Asia and Latin America reported slower adoption of diagnostics telematics due to concerns over data security, integration challenges, and inconsistent connectivity. These factors limited full-scale deployment despite growing awareness of long-term efficiency benefits

- Addressing these challenges will require enhanced cybersecurity frameworks, standardized data protocols, and simplified deployment models. Strengthening data protection measures, improving system interoperability, and offering flexible pricing structures will be essential to unlock the long-term growth potential of the global diagnostics telematics market

Diagnostics Telematics Market Scope

The market is segmented on the basis of hardware, form, connectivity, service, vehicle, and aftermarket.

- By Hardware

On the basis of hardware, the diagnostics telematics market is segmented into Telematic Control Unit, Navigation Systems, Communication Devices, Audio/Video Interface, and CAN Bus. The Telematic Control Unit segment held the largest market revenue share in 2025 driven by its central role in collecting, processing, and transmitting vehicle data. These units enable real-time diagnostics, vehicle tracking, and integration with connected vehicle services, making them a critical component for fleet operators and passenger vehicles.

The Navigation Systems segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand for advanced route optimization, real-time traffic updates, and integration with connected mobility platforms. Navigation systems enhance driver convenience and fleet efficiency, making them an essential feature in modern telematics solutions.

- By Form

On the basis of form, the market is segmented into Embedded, Tethered, and Integrated. The Embedded segment held the largest market revenue share in 2025 due to the rising adoption of factory-fitted telematics solutions in passenger cars and commercial vehicles, offering seamless connectivity and reliable performance

The Integrated segment is projected to grow at the highest CAGR during 2026–2033, driven by demand for unified telematics solutions that combine multiple hardware and software functionalities into a single platform, simplifying vehicle monitoring and data management.

- By Connectivity

On the basis of connectivity, the market is segmented into Satellite and Cellular. The Cellular segment held the largest market share in 2025 owing to widespread mobile network coverage, lower installation costs, and ease of real-time data transmission for diagnostics and fleet management.

The Satellite segment is expected to witness the fastest growth rate from 2026 to 2033 due to its reliability in remote areas and growing use in long-haul transportation and logistics operations, ensuring uninterrupted vehicle tracking and communication.

- By Service

On the basis of service, the market is segmented into Consulting, Implementation, and Maintenance. The Implementation segment held the largest market share in 2025, driven by increasing deployment of telematics solutions across passenger and commercial vehicles to enhance operational efficiency and ensure regulatory compliance.

The Consulting segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by rising demand for expert guidance on selecting, integrating, and optimizing telematics solutions to achieve business objectives and reduce operational costs.

- By Vehicle

On the basis of vehicle, the market is segmented into Passenger Car, LCV, Truck, and Bus. The Passenger Car segment held the largest market revenue share in 2025 due to the rising integration of telematics features in new vehicles for safety, navigation, and connected services.

The Truck segment is expected to register the fastest growth rate during 2026–2033, driven by the growing adoption of telematics in fleet management, route optimization, fuel efficiency monitoring, and compliance with transport regulations.

- By Aftermarket

On the basis of aftermarket, the market is segmented into Passenger Car Aftermarket, LCV Aftermarket, and HCV Aftermarket. The Passenger Car Aftermarket segment held the largest market revenue share in 2025, owing to the high demand for retrofitting older vehicles with telematics solutions to enable connectivity, diagnostics, and vehicle tracking.

The HCV Aftermarket segment is projected to witness the fastest growth from 2026 to 2033, driven by increased focus on fleet optimization, regulatory compliance, and preventive maintenance in heavy commercial vehicles.

Diagnostics Telematics Market Regional Analysis

- North America dominated the diagnostics telematics market with the largest revenue share of 38.45% in 2025, driven by the rising adoption of connected vehicles, advanced fleet management solutions, and increasing demand for real-time vehicle diagnostics

- Consumers and fleet operators in the region highly value the operational efficiency, predictive maintenance, and seamless integration offered by telematics systems with other vehicle management platforms

- This widespread adoption is further supported by robust automotive infrastructure, high disposable incomes, and government initiatives promoting connected mobility, establishing diagnostics telematics as a preferred solution for both passenger and commercial vehicles

U.S. Diagnostics Telematics Market Insight

The U.S. diagnostics telematics market captured the largest revenue share in 2025 within North America, fueled by rapid adoption of connected vehicles and the increasing trend of smart fleet management. Vehicle owners and fleet operators are increasingly prioritizing real-time monitoring, predictive maintenance, and enhanced safety features. The rising integration of telematics solutions with mobile applications, cloud-based platforms, and advanced analytics further propels market growth. Moreover, government incentives for connected mobility and increasing investment in intelligent transportation systems are significantly contributing to market expansion.

Europe Diagnostics Telematics Market Insight

The Europe diagnostics telematics market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent vehicle safety regulations and the growing demand for efficient fleet operations. The increase in urbanization, rising vehicle connectivity, and focus on reducing emissions are fostering the adoption of telematics systems. European fleet operators and individual vehicle owners are drawn to the operational efficiency, fuel optimization, and data-driven insights offered by these solutions.

U.K. Diagnostics Telematics Market Insight

The U.K. diagnostics telematics market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising demand for connected vehicles, intelligent fleet management, and real-time vehicle monitoring. Increasing awareness about regulatory compliance, road safety, and cost-efficient fleet operations is encouraging adoption among commercial and passenger vehicles. The U.K.’s strong automotive sector, advanced digital infrastructure, and growth in e-mobility are expected to further stimulate market growth.

Germany Diagnostics Telematics Market Insight

The Germany diagnostics telematics market is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing adoption of electric vehicles, government regulations on emissions, and demand for smart transportation solutions. Germany’s well-developed automotive industry, focus on innovation, and emphasis on sustainability support the adoption of telematics systems in both passenger and commercial vehicles. The integration of telematics with autonomous vehicle technologies and connected mobility platforms is also gaining traction.

Asia-Pacific Diagnostics Telematics Market Insight

The Asia-Pacific diagnostics telematics market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India. The region’s growing fleet industry, supported by government initiatives promoting intelligent transportation systems, is driving telematics adoption. In addition, APAC’s emergence as a hub for vehicle electronics and telematics components is increasing the affordability and accessibility of telematics solutions across the region.

Japan Diagnostics Telematics Market Insight

The Japan diagnostics telematics market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s high-tech automotive culture, increasing adoption of connected vehicles, and demand for real-time vehicle monitoring. Japanese consumers and fleet operators are increasingly prioritizing predictive maintenance, safety, and operational efficiency. The integration of telematics with IoT-enabled vehicles, smart infrastructure, and advanced analytics is fueling market growth. Moreover, Japan’s aging population is likely to boost demand for user-friendly, reliable vehicle monitoring solutions in both passenger and commercial sectors.

China Diagnostics Telematics Market Insight

The China diagnostics telematics market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, growing vehicle fleet size, and high rates of technological adoption. China is one of the largest markets for connected vehicles, with telematics systems becoming increasingly popular in passenger, commercial, and logistics vehicles. Government initiatives for smart cities, supportive regulatory frameworks, and the presence of domestic telematics solution providers are key factors propelling market growth in China.

Diagnostics Telematics Market Share

The Diagnostics Telematics industry is primarily led by well-established companies, including:

- Verizon (U.S.)

- Magneti Marelli S.p.A. (Italy)

- Intel Corporation (U.S.)

- MiX Telematics (South Africa)

- Robert Bosch GmbH (Germany)

- HARMAN International (U.S.)

- TomTom International BV (Netherlands)

- Masternaut Limited (U.K.)

- I.D. Systems (U.S.)

- Teletrac Navman US Ltd (U.S.)

- Trimble Inc. (U.S.)

- Omnitracs (U.S.)

- Continental AG (Germany)

- Bridgestone Corporation (Japan)

- Delphi Technologies (U.K.)

- Qualcomm Technologies, Inc. (U.S.)

- LG Electronics (South Korea)

- Visteon Corporation (U.S.)

Latest Developments in Global Diagnostics Telematics Market

- In March 2025, Samsara Inc. entered a strategic partnership with Hyundai Translead to integrate its Safety Solution with Hyundai Translead’s HT LinkVue system. This collaboration aims to enhance vehicle safety, improve fleet monitoring, and provide real-time data insights. The integration is expected to strengthen both companies’ position in the global diagnostics telematics market

- In January 2025, Samsara Inc. expanded its strategic collaboration with Stellantis to enable access to millions of connected vehicles across Europe. This move allows fleet operators to leverage telematics data for better operational efficiency, predictive maintenance, and improved vehicle performance. The expansion is set to boost telematics adoption in the European market

- In August 2024, Motive launched new Driver Safety and Fleet Management solutions across the U.S. FedEx Freight fleet. These solutions focus on improving driver behavior, ensuring compliance, and enhancing overall fleet efficiency. The initiative is expected to reduce accidents and operational costs while promoting advanced telematics usage

- In May 2024, Motive expanded its operations into Mexico by introducing AI-powered safety, security, and fleet management solutions. The deployment enables real-time monitoring, predictive maintenance, and optimized fleet operations for local businesses. This expansion is likely to drive telematics adoption and strengthen market presence in Latin America

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.