Global Diameter Signaling Market

Market Size in USD Billion

CAGR :

%

USD

1.52 Billion

USD

2.60 Billion

2025

2033

USD

1.52 Billion

USD

2.60 Billion

2025

2033

| 2026 –2033 | |

| USD 1.52 Billion | |

| USD 2.60 Billion | |

|

|

|

|

Diameter Signaling Market Size

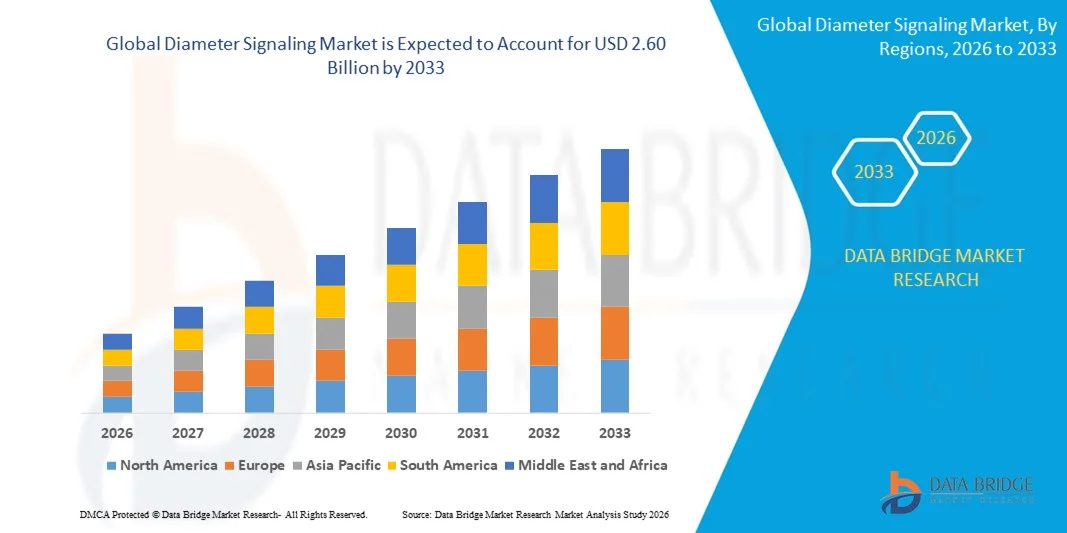

- The global diameter signaling market size was valued at USD 1.52 billion in 2025 and is expected to reach USD 2.60 billion by 2033, at a CAGR of 6.90% during the forecast period

- The market growth is largely fueled by the rapid expansion and technological advancement of LTE and 5G networks, driving the need for efficient signaling management to handle increasing mobile data traffic and subscriber mobility

- Furthermore, growing demand from telecom operators for scalable, high-performance, and reliable signaling solutions is establishing Diameter signaling as a critical component in modern mobile network infrastructure. These converging factors are accelerating the deployment of Diameter solutions, thereby significantly boosting the industry's growth

Diameter Signaling Market Analysis

- Diameter signaling, facilitating efficient routing, policy management, and authentication in LTE and 5G networks, is increasingly vital for telecom operators to maintain seamless mobility, VoLTE services, and high-quality network performance

- The escalating demand for Diameter signaling solutions is primarily fueled by the proliferation of 4G/5G networks, increasing mobile internet and IoT traffic, and rising operator focus on network optimization, session management, and secure signaling communications

- Asia-Pacific dominated the diameter signaling market in 2025, due to rapid expansion of LTE and 5G networks, increasing mobile data traffic, and a strong presence of telecom infrastructure providers

- North America is expected to be the fastest growing region in the diameter signaling market during the forecast period due to rapid adoption of 5G networks, rising data traffic, and strong demand for efficient signaling solutions

- Diameter Routing Agent (DRA) segment dominated the market with a market share of 42.5% in 2025, due to its critical role in routing signaling messages efficiently across LTE and 5G networks. Service providers prefer DRA solutions for their ability to reduce signaling load on core networks and improve network reliability. The segment also benefits from strong demand due to its compatibility with multiple Diameter interfaces and support for high-volume signaling transactions, ensuring seamless mobility management. In addition, DRA solutions enhance security and policy enforcement, which further drives adoption across telecom operators

Report Scope and Diameter Signaling Market Segmentation

|

Attributes |

Diameter Signaling Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Diameter Signaling Market Trends

Growing Adoption of 5G and LTE Network Deployments

- A significant trend in the Diameter Signaling market is the increasing deployment of 4G LTE and 5G networks globally, driven by the rapid rise in mobile data traffic, IoT connectivity, and the need for seamless mobility management. This expansion is elevating the importance of Diameter signaling solutions as essential components for authentication, policy control, and session management across modern mobile networks

- For instance, Ericsson and Huawei have deployed advanced Diameter Signaling Controllers to optimize LTE and 5G network performance, enhance VoLTE services, and improve signaling efficiency in high-traffic environments. These deployments help operators manage growing signaling volumes while reducing latency and improving network reliability

- Telecom operators are increasingly leveraging Diameter signaling for seamless roaming, mobility, and policy management across complex network architectures. This trend is positioning Diameter signaling as a backbone technology for next-generation networks, ensuring uninterrupted service delivery for both enterprise and consumer users

- Mobile network densification and increasing adoption of small cells, particularly in urban and high-density areas, are driving the need for robust signaling management. Diameter signaling facilitates efficient routing of authentication and policy messages, which is critical for handling high volumes of simultaneous connections in 5G networks

- The market is also witnessing adoption of Diameter signaling solutions in VoLTE, VoWiFi, and other IP-based communication services. These solutions are enabling operators to maintain service quality, reduce dropped calls, and ensure accurate session tracking across diverse devices and platforms

- Operators are increasingly integrating Diameter signaling with analytics and automation tools to improve network performance monitoring and traffic optimization. This convergence is accelerating the deployment of intelligent signaling solutions and reinforcing Diameter signaling’s role in supporting scalable and high-performing mobile networks

Diameter Signaling Market Dynamics

Driver

Rising Demand for Efficient Signaling Management and Network Optimization

- The growing demand for efficient network signaling management is a key driver of the Diameter Signaling market, as telecom operators aim to optimize core network performance and reduce congestion in LTE and 5G environments. Diameter signaling solutions enable seamless routing of authentication, policy, and subscriber session messages, which are critical for maintaining service quality and reliability

- For instance, Oracle and Nokia provide Diameter Edge Agents and Routing Agents that allow operators to manage high signaling loads, improve network scalability, and reduce operational complexity. These solutions are particularly valuable for operators handling large-scale deployments with extensive roaming and mobility requirements

- The rise of data-intensive applications, IoT devices, and real-time communication services is intensifying the need for robust signaling solutions. Diameter signaling facilitates session continuity, policy enforcement, and low-latency message routing, supporting smooth operation of modern mobile networks

- Operators are increasingly prioritizing Diameter signaling to enable interoperability between legacy 4G systems and next-generation 5G networks. This is essential for maintaining consistent subscriber experiences while transitioning to higher-capacity network architectures

- The growing complexity of mobile networks, coupled with increasing subscriber expectations for uninterrupted connectivity and high-quality services, continues to reinforce the demand for advanced Diameter signaling solutions. These solutions are becoming critical enablers for network optimization, traffic management, and overall operational efficiency

Restraint/Challenge

High Complexity and Integration Costs of Diameter Signaling Solutions

- The Diameter Signaling market faces challenges due to the technical complexity of deploying, configuring, and integrating signaling solutions across LTE, VoLTE, and 5G networks. Operators require advanced expertise, specialized infrastructure, and extensive testing to ensure seamless operation, which increases implementation costs and time-to-market

- For instance, integrating Ericsson Diameter Signaling Controllers or Huawei signaling solutions into multi-vendor networks requires careful orchestration, rigorous testing, and specialized knowledge to maintain interoperability, reliability, and service continuity

- The market also encounters difficulties in scaling signaling solutions to handle high-volume traffic without impacting latency or network performance. Complex routing rules, policy enforcement, and interworking with legacy protocols contribute to operational challenges

- Moreover, the requirement for high-performance hardware, software, and continuous monitoring adds to total cost of ownership. Telecom operators must balance investment in robust Diameter signaling solutions with budgetary constraints while ensuring network efficiency and reliability

- High integration complexity, coupled with the need for ongoing maintenance and upgrades, continues to be a barrier for operators, limiting rapid adoption of Diameter signaling solutions in some regions or smaller-scale networks

Diameter Signaling Market Scope

The market is segmented on the basis of type, application, offering, and connectivity technology.

- By Type

On the basis of type, the Diameter Signaling market is segmented into Diameter Routing Agent (DRA), Diameter Edge Agent (DEA), Diameter Interworking Function (IWF), and others. The DRA segment dominated the market with the largest revenue share of 42.5% in 2025, driven by its critical role in routing signaling messages efficiently across LTE and 5G networks. Service providers prefer DRA solutions for their ability to reduce signaling load on core networks and improve network reliability. The segment also benefits from strong demand due to its compatibility with multiple Diameter interfaces and support for high-volume signaling transactions, ensuring seamless mobility management. In addition, DRA solutions enhance security and policy enforcement, which further drives adoption across telecom operators.

The DEA segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by increasing deployment at network edges to handle signaling traffic efficiently. For instance, companies such as Huawei and Ericsson are integrating DEA solutions to optimize traffic between mobile networks and external IP networks. DEA adoption is growing due to its capability to localize signaling processing, reduce latency, and improve subscriber experience. Its deployment in 5G and LTE networks for roaming and interconnection purposes further accelerates growth. The demand is also driven by operators seeking cost-effective solutions to offload signaling from central cores while maintaining high performance.

- By Application

On the basis of application, the Diameter Signaling market is segmented into LTE Broadcast, Policy Management, Mobility, Voice over LTE (VoLTE), and others. The Policy Management segment dominated the market in 2025, driven by the need to control subscriber services, enforce QoS policies, and optimize network resources. Telecom operators rely on policy management to dynamically manage bandwidth, prioritize traffic, and ensure efficient network utilization. The segment benefits from the growing adoption of data-intensive services and the requirement for seamless enforcement of policies across LTE and 5G networks. Advanced policy control platforms also enable analytics-based decision-making, which boosts demand.

The Mobility segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising user mobility and increasing global adoption of LTE and 5G services. For instance, Nokia’s mobility solutions are deployed by operators to manage subscriber handovers efficiently and ensure uninterrupted connectivity. Mobility applications require high-performance Diameter signaling to support roaming, session continuity, and real-time authentication. The growing number of mobile subscribers and expansion of IoT devices further drives demand. The need for scalable mobility solutions that handle high signaling volumes efficiently is expected to sustain the segment’s growth.

- By Offering

On the basis of offering, the Diameter Signaling market is segmented into hardware, software, and solutions. The Solutions segment dominated the market in 2025, driven by the increasing need for end-to-end signaling management platforms that integrate routing, interworking, and policy enforcement. Solutions offer telecom operators complete packages that reduce deployment complexity and enhance operational efficiency. They also enable integration with existing network infrastructure, ensuring seamless performance across multiple interfaces. The segment benefits from service providers’ preference for turnkey deployments that optimize network performance and reduce the risk of signaling congestion.

The Software segment is expected to witness the fastest growth from 2026 to 2033, fueled by the trend toward virtualization and cloud-native telecom networks. For instance, Affirmed Networks provides software-based Diameter signaling solutions that allow operators to deploy functions flexibly on virtualized cores. Software offerings support rapid scalability, automation, and integration with NFV/SDN frameworks, enabling cost-efficient network expansion. The segment’s growth is further driven by telecom operators transitioning from traditional hardware to software-centric architectures for agility and reduced maintenance costs.

- By Connectivity Technology

On the basis of connectivity technology, the Diameter Signaling market is segmented into 3G, 4G, 5G, and others. The 4G segment dominated the market in 2025, driven by the widespread adoption of LTE networks and the critical role of Diameter signaling in managing mobility, policy, and subscriber sessions. Telecom operators rely on 4G infrastructure to support high-speed data services and seamless roaming, creating strong demand for signaling solutions. The segment also benefits from the maturity of 4G networks and the availability of robust Diameter interfaces for policy enforcement and QoS management.

The 5G segment is expected to witness the fastest growth from 2026 to 2033, fueled by global 5G rollouts and increasing demand for ultra-low latency and high-capacity mobile services. For instance, Ericsson and Nokia are deploying 5G Diameter signaling solutions to handle complex service-based architectures and enhanced mobility scenarios. The growth is driven by operators seeking signaling solutions that support massive IoT connectivity, network slicing, and real-time analytics. The requirement for scalable, high-performance signaling in 5G networks ensures rapid adoption of this segment over the forecast period.

Diameter Signaling Market Regional Analysis

- Asia-Pacific dominated the diameter signaling market with the largest revenue share in 2025, driven by rapid expansion of LTE and 5G networks, increasing mobile data traffic, and a strong presence of telecom infrastructure providers

- The region’s cost-effective network deployment landscape, rising investments in telecom modernization, and growing adoption of advanced signaling solutions are accelerating market growth

- The availability of skilled telecom professionals, favorable government policies promoting digital connectivity, and rapid industrialization across developing economies are contributing to increased adoption of Diameter signaling solutions in both urban and rural networks

China Diameter Signaling Market Insight

China held the largest share in the Asia-Pacific Diameter Signaling market in 2025, owing to its status as a global leader in mobile network infrastructure deployment and 5G expansion. The country’s strong telecom ecosystem, government support for next-generation networks, and extensive rollout of LTE and 5G services are major growth drivers. Demand is further bolstered by rising mobile subscribers, high smartphone penetration, and increasing data traffic requiring efficient signaling management.

India Diameter Signaling Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by expanding 4G and 5G networks, rising smartphone adoption, and increasing investments in telecom infrastructure. Initiatives such as Digital India and support for telecom modernization are strengthening the demand for Diameter signaling solutions. In addition, rapid urbanization, growth in mobile internet usage, and increasing focus on efficient network management are contributing to robust market expansion.

Europe Diameter Signaling Market Insight

The Europe Diameter Signaling market is expanding steadily, supported by increasing deployment of LTE and 5G networks, strong focus on network optimization, and growing demand for advanced telecom services. The region emphasizes high-quality network performance, regulatory compliance, and innovation in signaling management solutions. Increasing adoption of VoLTE, policy management, and mobility services is further enhancing market growth.

Germany Diameter Signaling Market Insight

Germany’s Diameter Signaling market is driven by its leadership in high-performance telecom networks, strong R&D capabilities, and advanced network infrastructure. The country has well-established telecom standards, partnerships between operators and technology providers, and continuous innovation in signaling solutions. Demand is particularly strong for LTE and 5G network deployments, roaming solutions, and policy enforcement platforms.

U.K. Diameter Signaling Market Insight

The U.K. market is supported by mature telecom networks, increasing investments in 5G rollout, and focus on advanced signaling management for enhanced service delivery. Growing emphasis on mobility solutions, policy control, and VoLTE services is boosting adoption. With ongoing support for digital infrastructure, network upgrades, and collaboration between operators and solution providers, the U.K. remains a significant contributor to the European market.

North America Diameter Signaling Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by rapid adoption of 5G networks, rising data traffic, and strong demand for efficient signaling solutions. Investments in network densification, policy management, and mobility solutions are boosting growth. In addition, increased collaboration between telecom operators and signaling solution vendors, along with focus on network modernization and IoT integration, is supporting market expansion.

U.S. Diameter Signaling Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by expansive LTE and 5G network infrastructure, strong R&D capabilities, and early adoption of advanced signaling technologies. The country’s focus on network reliability, low-latency communication, and high-volume signaling management is driving demand. Presence of key telecom players, advanced infrastructure, and robust service provider ecosystem further solidify the U.S.'s leading position in the region.

Diameter Signaling Market Share

The diameter signaling industry is primarily led by well-established companies, including:

- Huawei Technologies Co., Ltd. (China)

- Telefonaktiebolaget LM Ericsson (Sweden)

- F5, Inc. (U.S.)

- Nokia (Finland)

- Oracle (U.S.)

- Cisco (U.S.)

- Enghouse Networks (Canada)

- TNS Inc. (U.S.)

- BroadForward BV (Netherlands)

- Ribbon Communications Operating Company, Inc. (U.S.)

- Squire Technologies Ltd (U.K.)

- Packet Force Pvt. Ltd. (India)

- Sinch (Sweden)

- Syniverse Technologies LLC (U.S.)

- EXFO Inc. (Canada)

- TietoEVRY (Finland/Norway)

- Marben Products (U.K.)

- Diametriq (U.S.)

- Computaris (U.K.)

- Cellusys (Ireland)

Latest Developments in Global Diameter Signaling Market

- In October 2025, Oracle announced a strategic partnership with a leading telecommunications provider to enhance its diameter signaling solutions through advanced analytics and network performance optimization. This collaboration focuses on integrating AI‑driven insights into Diameter signaling management, enabling operators to more efficiently monitor traffic flows, improve service quality, and reduce operational costs. The move reflects Oracle’s commitment to meeting evolving demands for smarter, data‑centric signaling networks as operators scale 5G deployments, positioning the company as a competitive innovator in telecom signaling infrastructure

- In September 2025, Huawei Technologies introduced a new diameter signaling controller designed to address the demands of 5G networks and enable operators to manage signaling traffic more effectively. The launch underscores Huawei’s focus on innovation within the signaling solutions segment and its intent to capture opportunities arising from accelerating 5G rollouts. By offering controllers tailored for higher network throughput and enhanced interoperability, Huawei strengthens its position among telecom vendors supporting next‑generation network management requirements

- In September 2025, Cisco Systems launched a new suite of diameter signaling products designed to support the increased demands of 5G networks. This product introduction is significant because it strengthens Cisco’s ability to offer robust signaling solutions capable of handling higher traffic volumes, improved session management, and enhanced reliability essential for seamless 5G service delivery. Operators adopting these new products can better manage signaling complexity across next‑generation networks, expanding Cisco’s market presence amid rising 5G deployments

- In August 2025, Ericsson announced a partnership with a major telecommunications provider in Southeast Asia to enhance diameter signaling capabilities and optimize network performance. This collaboration enables Ericsson to extend its reach in the rapidly growing Asia‑Pacific telecom market, helping operators improve signaling efficiency as mobile data and VoLTE usage continue to surge. The deal highlights the importance of strategic alliances in reinforcing service delivery, reducing latency, and ensuring scalable signaling infrastructures in competitive markets

- In July 2025, Avine Technologies acquired a 53% stake in Logate, a move that reflects broader ecosystem expansion within the diameter signaling market. This acquisition enhances Avine’s ability to provide more comprehensive signaling solutions, combining Logate’s specialized expertise with Avine’s existing product portfolio. The transaction accelerates capabilities in network automation, traffic routing, and signaling orchestration, reinforcing competitive differentiation as telecom operators increasingly seek integrated and intelligent signaling platforms

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Diameter Signaling Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Diameter Signaling Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Diameter Signaling Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.