Global Dietary Fibers In Food Industry Market

Market Size in USD Billion

CAGR :

%

USD

6.62 Billion

USD

16.16 Billion

2021

2029

USD

6.62 Billion

USD

16.16 Billion

2021

2029

| 2022 –2029 | |

| USD 6.62 Billion | |

| USD 16.16 Billion | |

|

|

|

|

Dietary Fibres in Food Industry Market Analysis and Size

The global dietary fibres market is growing in tandem with advancements in the food and nutrition sectors. The growing inclination of the general public to live healthier lifestyles has played an important role in market growth. The efforts of nutritionists and doctors to raise awareness about the importance of eating a well-balanced diet have resulted in an increase in demand for health foods.

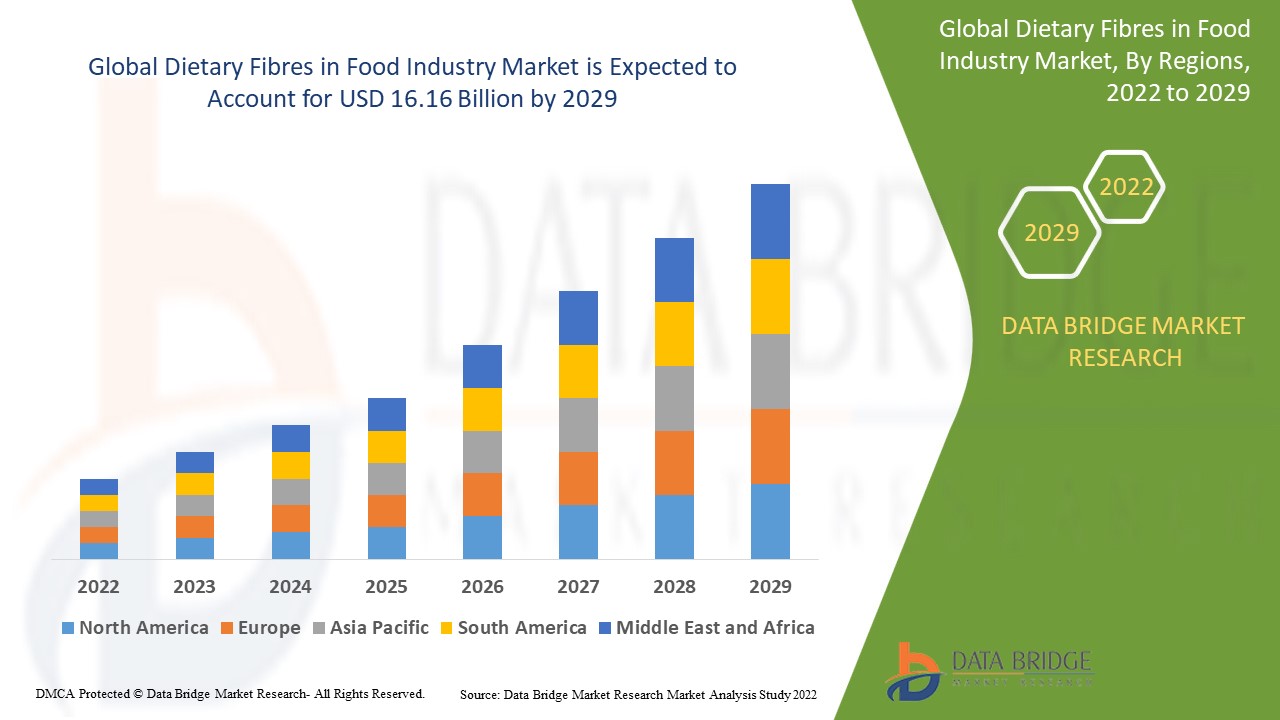

Data Bridge Market Research analyses that the dietary fibres in food industry market which was growing at a value of 6.62 billion in 2021 and is expected to reach the value of USD 16.16 billion by 2029, at a CAGR of 11.80% during the forecast period of 2022-2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, patent analysis and consumer behaviour.

Dietary Fibres in Food Industry Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Soluble and Insoluble), Application (Feed, Functional food and Beverages, other), Source (Fruits & Vegetables, Legumes, Cereals and Grains, Nuts, Seeds), Processing Treatment (Extrusion Cooking, Canning, Grinding. Boiling and Frying) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, Sweden, Poland, Denmark, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Hain Celestial (U.S.), Dole Food Company, Inc. (U.S.), Dairy Farmers of America, Inc. (U.S.), General Mills Inc. (U.S.), Danone S.A. (France), United Natural Foods, Inc. (U.S.), GCMMF (India), THE HERSHEY COMPANY (U.S.), Amy’s Kitchen, Inc. (U.S.), Organic Valley (U.S.), Conagra Brands, Inc. (U.S.), Nestlé S.A. (Switzerland), Eden Foods (U.S.), SunOpta (Canada) |

|

Opportunities |

|

Market Definition

Dietary fibres, also known as roughage, are indigestible complex carbohydrates found in a variety of foods such as fruits, vegetables, nuts, lentils, and grains. Dietary fibres are classified into two types: soluble and non-soluble. Both types aid in the proper functioning of the digestive system. Soluble fibres promote satiety, aid in weight loss, and regulate the body's cholesterol and blood sugar levels. Insoluble fibres, on the other hand, absorb water to normalise bowel movements and ensure proper stomach and intestine function.

Dietary Fibres in Food Industry Market Dynamics

Drivers

- Rapid product innovation and development according to the customers dynamics

Whole grains and high-fibre food manufacturers are constantly developing and introducing on-the-go items to address this issue. In addition, several whole grains and high fibre food producers have set production goals for the coming years in order to increase their market share in the stronger products category in response to customer demand for food with high nutritional attributes. Furthermore, extensive research and development (R&D) is being carried out to use waste products, such as peanut skins and hulls, as raw materials to improve the overall efficiency of dietary fibres. Other factors, such as the availability of a diverse range of fortified food products and rising consumer spending on food and nutrition, are expected to fuel the market even further.

- Change in food consumption patterns and growing trend of healthy eating

The global dietary fibre market is expected to grow due to significant changes in people's food consumption habits. Over the last decade, there has been a paradigm shift from traditional food consumption patterns to health-driven choices made by the general public. This trend has been mirrored in the global dietary fibres in food industry market, which is experiencing high demand from a variety of population demographics. The high nutritional value of dietary fibres in food industry has played an important role in gaining consumer trust, and the sapid taste of these foods has increased their popularity.

Opportunity

The growing intensity of promotional activities, as well as the availability of products with improved tastes and flavours, all have an impact on the dietary fibres in food industry market. Furthermore, rapid urbanisation, population growth, the availability of a wide range of products with multiple options such as authenticity, awareness of chronic diseases, an increase in health consciousness, and an increase in disposable income all benefit the dietary fibres in food industry market.

Restraints

Whereas growth is constrained by the FDA's strict regulations, by the announcement of a future change in the use of dietary fibres, which results in the recall of products already on the market for further examination and reassessment

This dietary fibres in food industry market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the dietary fibres in food industry market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Dietary Fibres in Food Industry Market

The outbreak of the COVID 19 pandemic in 2020 and the subsequent imposition of lockdowns to contain disease spread temporarily impacted the trade scenario of fruits and vegetables from which fibre is derived. Furthermore, due to increased awareness of the link between a healthy gut microbiome and immune function, metabolic wellness, digestive health, and mental well-being, health-conscious consumers took proactive and preventive measures to protect their health during the pandemic.

Recent development

- Tate & Lyle paid USD 237 million for Quantum Hi-Tech (Guangdong) Bilogical, a prebiotic manufacturer based in China, in April 2022. Tate & Lyle's goal of becoming a growth-focused food and beverage solutions company while strengthening its position as a player in the rapidly expanding global dietary fibre market was aligned with the acquisition.

- Cargill, Incorporated will invest USD 45 million in July 2021 to add soluble fibres to its European portfolio of starches, sweeteners, and texturizers. With this investment, the company has been developing soluble fibre, allowing food manufacturers to improve the nutritional profiles of their products by using fewer calories and sugars.

- Ingredion will launch Novelose 3490 dietary fibre with Low FODMAP certification in June 2020. The new product allows food manufacturers to create high-fiber bakery and snack products and food processors to create low FODMAP diets.

Global Dietary Fibres in Food Industry Market Scope

The dietary fibres in food industry market is segmented on the basis of type, application, source and processing treatment. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Soluble

- Insoluble

Application

- Feed

- Functional food

- Beverages

- Other

Source

- Fruits & Vegetables

- Legumes

- Cereals and Grains

- Nuts

- Seeds

Processing treatment

- Extrusion Cooking

- Canning

- Grinding

- Boiling

- Frying

Dietary Fibres in Food Industry Market Regional Analysis/Insights

The dietary fibres in food industry market is analysed and market size insights and trends are provided by country, type, application, source and processing treatment as referenced above.

The countries covered in the dietary fibres in food industry market report are U.S., Canada and Mexico in North America, Germany, Sweden, Poland, Denmark, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the global dietary fibres in food industry market due to technological advancements in this region making dietary fibres available for a wide range of applications. This region is expected to be the largest market for dietary fibres, as it is for novel and superior performing products and global industrialization.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Dietary Fibres in Food Industry Market Share Analysis

The dietary fibres in food industry market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to dietary fibres in food industry market.

Some of the major players operating in the industry dietary fibres in food market are:

- Hain Celestial (U.S.)

- Dole Food Company, Inc. (U.S.)

- Dairy Farmers of America, Inc. (U.S.)

- General Mills Inc. (U.S.)

- Danone S.A (France)

- United Natural Foods, Inc. (U.S.)

- GCMMF (India)

- THE HERSHEY COMPANY (U.S.)

- Amy’s Kitchen, Inc. (U.S.)

- Organic Valley (U.S.)

- Conagra Brands, Inc. (U.S.)

- Nestlé SA (Switzerland)

- Eden Foods (U.S.)

- SunOpta (Canada)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL DIETARY FIBRES IN FOOD INDUSTRY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL DIETARY FIBRES IN FOOD INDUSTRY MARKETSIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 TOP TO BOTTOM ANALYSIS

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL DIETARY FIBRES IN FOOD INDUSTRY MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 SUPPLY CHAIN ANALYSIS

5.3 RAW MATERIAL IMPORT-EXPORT ANALYSIS

5.4 PORTER’S FIVE FORCES ANALYSIS

5.4.1 BARGAINING POWER OF SUPPLIERS

5.4.2 BARGAINING POWER OF BUYERS/CONSUMERS

5.4.3 THREAT OF NEW ENTRANTS

5.4.4 THREAT OF SUBSTITUTE PRODUCTS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

5.6 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

5.7 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.8 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING ANALYSIS

9 PRODUCTION CAPACITY OF KEY MANUFACTURERES

10 GLOBAL DIETARY FIBRES IN FOOD INDUSTRY MARKET, BY TYPE (VALUE AND VOLUME)

10.1 OVERVIEW

10.2 SOLUBLE

10.2.1 GUMS

10.2.2 PECTIN

10.2.3 PSYLLIUM

10.2.4 BETA-GLUCANS

10.2.5 OTHERS

10.3 INSOLUBLE

10.3.1 LIGNIN

10.3.2 CELLULOSE

11 GLOBAL DIETARY FIBRES IN FOOD INDUSTRY MARKET, BY PRODUCT TYPE (VALUE AND VOLUME)

11.1 OVERVIEW

11.2 PEA FIBER

11.3 WHEAT FIBER

11.4 BAMBOO FIBER

11.5 SOY FIBER

11.6 POTATO FIBER

11.7 CITRUS FIBER

11.8 CELLULOSE

11.9 OAT FIBER

11.1 APPLE FIBER

11.11 COCOA FIBER

11.12 ACACIA FIBER

11.13 SUGAR CANE FIBER

11.14 CORN FIBER

11.15 CARROT FIBER

11.16 SUGAR BEET FIBER

11.17 OTHERS

12 GLOBAL DIETARY FIBRES IN FOOD INDUSTRY MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FOOD & BEVERAGES

12.2.1 FOOD & BEVERAGES, BY TYPE

12.2.1.1. BAKERY

12.2.1.1.1. BAKERY, BY TYPE

12.2.1.1.1.1 BREAD & ROLLS

12.2.1.1.1.2 CAKES & PASTRIES

12.2.1.1.1.3 WAFERS

12.2.1.1.1.4 BISCUIT

12.2.1.1.1.5 COOKIES& CRACKERS

12.2.1.1.1.6 OTHERS

12.2.1.1.2. BAKERY, BY FIBER TYPE

12.2.1.1.2.1 PEA FIBER

12.2.1.1.2.2 WHEAT

12.2.1.1.2.3 BAMBOO FIBER

12.2.1.1.2.4 SOY FIBER

12.2.1.1.2.5 POTATO FIBER

12.2.1.1.2.6 CITRUS FIBER

12.2.1.1.2.7 CELLULOSE

12.2.1.1.2.8 OAT FIBER

12.2.1.1.2.9 APPLE FIBER

12.2.1.1.2.10 COCOA FIBER

12.2.1.1.2.11 ACACIA FIBER

12.2.1.1.2.12 SUGAR CANE FIBER

12.2.1.1.2.13 CORN FIBER

12.2.1.1.2.14 CARROT FIBER

12.2.1.1.2.15 SUGAR BEET FIBER

12.2.1.1.2.16 OTHERS

12.2.1.2. PRECOOKED CEREALS

12.2.1.2.1. PRECOOKED CERELAS, BY FIBER TYPE

12.2.1.2.1.1 PEA FIBER

12.2.1.2.1.2 WHEAT

12.2.1.2.1.3 BAMBOO FIBER

12.2.1.2.1.4 SOY FIBER

12.2.1.2.1.5 POTATO FIBER

12.2.1.2.1.6 CITRUS FIBER

12.2.1.2.1.7 CELLULOSE

12.2.1.2.1.8 OAT FIBER

12.2.1.2.1.9 APPLE FIBER

12.2.1.2.1.10 COCOA FIBER

12.2.1.2.1.11 ACACIA FIBER

12.2.1.2.1.12 SUGAR CANE FIBER

12.2.1.2.1.13 CORN FIBER

12.2.1.2.1.14 CARROT FIBER

12.2.1.2.1.15 SUGAR BEET FIBER

12.2.1.2.1.16 OTHERS

12.2.1.3. MEAT& POULTRY PRODUCTS

12.2.1.3.1. MEAT & POULTRY PRODUCTS, BY TYPE

12.2.1.3.1.1 MEATBALL

12.2.1.3.1.2 BURGERS

12.2.1.3.1.3 SAUSAGES

12.2.1.3.1.4 OTHERS

12.2.1.3.2. MEAT & POULTRY PTODUCTS, BY FIBER TYPE

12.2.1.3.2.1 PEA FIBER

12.2.1.3.2.2 WHEAT

12.2.1.3.2.3 BAMBOO FIBER

12.2.1.3.2.4 SOY FIBER

12.2.1.3.2.5 POTATO FIBER

12.2.1.3.2.6 CITRUS FIBER

12.2.1.3.2.7 CELLULOSE

12.2.1.3.2.8 OAT FIBER

12.2.1.3.2.9 APPLE FIBER

12.2.1.3.2.10 COCOA FIBER

12.2.1.3.2.11 ACACIA FIBER

12.2.1.3.2.12 SUGAR CANE FIBER

12.2.1.3.2.13 CORN FIBER

12.2.1.3.2.14 CARROT FIBER

12.2.1.3.2.15 SUGAR BEET FIBER

12.2.1.3.2.16 OTHERS

12.2.1.3.2.17 OTHERS

12.2.1.4. FISH & SURIMI PRODUCTS

12.2.1.4.1. MEAT & POULTRY PRODUCTS, BY TYPE

12.2.1.4.1.1 FISH STICKS

12.2.1.4.1.2 BURGERS

12.2.1.4.1.3 FISHBALLS

12.2.1.4.1.4 SURIMI PRODUCTS

12.2.1.4.1.5 OTHERS

12.2.1.4.2. MEAT & POULTRY PTODUCTS, BY FIBER TYPE

12.2.1.4.2.1 PEA FIBER

12.2.1.4.2.2 WHEAT

12.2.1.4.2.3 BAMBOO FIBER

12.2.1.4.2.4 SOY FIBER

12.2.1.4.2.5 POTATO FIBER

12.2.1.4.2.6 CITRUS FIBER

12.2.1.4.2.7 CELLULOSE

12.2.1.4.2.8 OAT FIBER

12.2.1.4.2.9 APPLE FIBER

12.2.1.4.2.10 COCOA FIBER

12.2.1.4.2.11 ACACIA FIBER

12.2.1.4.2.12 SUGAR CANE FIBER

12.2.1.4.2.13 CORN FIBER

12.2.1.4.2.14 CARROT FIBER

12.2.1.4.2.15 SUGAR BEET FIBER

12.2.1.4.2.16 OTHERS

12.2.1.5. CONFECTIONERY

12.2.1.5.1. CONFECTIONERY, BY FIBER TYPE

12.2.1.5.1.1 HARD CANDIES

12.2.1.5.1.2 CHEWING GUMS

12.2.1.5.1.3 JELLY

12.2.1.5.1.4 CHCOLATE SYRUPS

12.2.1.5.1.5 OTHERS

12.2.1.5.2. CONFECTIONERY, BY FIBER TYPE

12.2.1.5.2.1 PEA FIBER

12.2.1.5.2.2 WHEAT

12.2.1.5.2.3 BAMBOO FIBER

12.2.1.5.2.4 SOY FIBER

12.2.1.5.2.5 POTATO FIBER

12.2.1.5.2.6 CITRUS FIBER

12.2.1.5.2.7 CELLULOSE

12.2.1.5.2.8 OAT FIBER

12.2.1.5.2.9 APPLE FIBER

12.2.1.5.2.10 COCOA FIBER

12.2.1.5.2.11 ACACIA FIBER

12.2.1.5.2.12 SUGAR CANE FIBER

12.2.1.5.2.13 CORN FIBER

12.2.1.5.2.14 CARROT FIBER

12.2.1.5.2.15 SUGAR BEET FIBER

12.2.1.5.2.16 OTHERS

12.2.1.6. NUTRITION PRODUCTS

12.2.1.6.1. NUTRITION PRODUCTS, BY FIBER TYPE

12.2.1.6.1.1 NUTRION SUPPLEMENTS

12.2.1.6.1.2 NUTRION BARS

12.2.1.6.1.3 OTHERS

12.2.1.6.2. CONFECTIONERY, BY FIBER TYPE

12.2.1.6.2.1 PEA FIBER

12.2.1.6.2.2 WHEAT

12.2.1.6.2.3 BAMBOO FIBER

12.2.1.6.2.4 SOY FIBER

12.2.1.6.2.5 POTATO FIBER

12.2.1.6.2.6 CITRUS FIBER

12.2.1.6.2.7 CELLULOSE

12.2.1.6.2.8 OAT FIBER

12.2.1.6.2.9 APPLE FIBER

12.2.1.6.2.10 COCOA FIBER

12.2.1.6.2.11 ACACIA FIBER

12.2.1.6.2.12 SUGAR CANE FIBER

12.2.1.6.2.13 CORN FIBER

12.2.1.6.2.14 CARROT FIBER

12.2.1.6.2.15 SUGAR BEET FIBER

12.2.1.6.2.16 OTHERS

12.2.1.7. DAIRY PRODUCTS

12.2.1.7.1. DAIRY PRODUCTS, BY FIBER TYPE

12.2.1.7.1.1 QUARK

12.2.1.7.1.2 CHEESE

12.2.1.7.1.3 CHEESE SPREADS

12.2.1.7.1.4 READY TO EAT MILK DESSERTS

12.2.1.7.1.5 YOGURTS

12.2.1.7.1.5.1. REGULAR

12.2.1.7.1.5.2. FROZEN

12.2.1.7.1.6 OTHERS

12.2.1.7.1.6.1. DAIRY PRODUCTS, BY FIBER TYPE

12.2.1.7.1.7 PEA FIBER

12.2.1.7.1.8 WHEAT

12.2.1.7.1.9 BAMBOO FIBER

12.2.1.7.1.10 SOY FIBER

12.2.1.7.1.11 POTATO FIBER

12.2.1.7.1.12 CITRUS FIBER

12.2.1.7.1.13 CELLULOSE

12.2.1.7.1.14 OAT FIBER

12.2.1.7.1.15 APPLE FIBER

12.2.1.7.1.16 COCOA FIBER

12.2.1.7.1.17 ACACIA FIBER

12.2.1.7.1.18 SUGAR CANE FIBER

12.2.1.7.1.19 CORN FIBER

12.2.1.7.1.20 CARROT FIBER

12.2.1.7.1.21 SUGAR BEET FIBER

12.2.1.7.1.22 OTHERS

12.2.1.8. SANCKS& EXTRUDED SNACKS

12.2.1.8.1. SANCKS& EXTRUDED SNACKS, BY FIBER TYPE

12.2.1.8.1.1 PEA FIBER

12.2.1.8.1.2 WHEAT

12.2.1.8.1.3 BAMBOO FIBER

12.2.1.8.1.4 SOY FIBER

12.2.1.8.1.5 POTATO FIBER

12.2.1.8.1.6 CITRUS FIBER

12.2.1.8.1.7 CELLULOSE

12.2.1.8.1.8 OAT FIBER

12.2.1.8.1.9 APPLE FIBER

12.2.1.8.1.10 COCOA FIBER

12.2.1.8.1.11 ACACIA FIBER

12.2.1.8.1.12 SUGAR CANE FIBER

12.2.1.8.1.13 CORN FIBER

12.2.1.8.1.14 CARROT FIBER

12.2.1.8.1.15 SUGAR BEET FIBER

12.2.1.8.1.16 OTHERS

12.2.1.9. PASTA & NOODLES

12.2.1.9.1. PASTA & NOODLES, BY FIBER TYPE

12.2.1.9.1.1 PEA FIBER

12.2.1.9.1.2 WHEAT

12.2.1.9.1.3 BAMBOO FIBER

12.2.1.9.1.4 SOY FIBER

12.2.1.9.1.5 POTATO FIBER

12.2.1.9.1.6 CITRUS FIBER

12.2.1.9.1.7 CELLULOSE

12.2.1.9.1.8 OAT FIBER

12.2.1.9.1.9 APPLE FIBER

12.2.1.9.1.10 COCOA FIBER

12.2.1.9.1.11 ACACIA FIBER

12.2.1.9.1.12 SUGAR CANE FIBER

12.2.1.9.1.13 CORN FIBER

12.2.1.9.1.14 CARROT FIBER

12.2.1.9.1.15 SUGAR BEET FIBER

12.2.1.9.1.16 OTHERS

12.2.1.10. SOUP & SAUCES

12.2.1.10.1. SOUP & SAUCES, BY FIBER TYPE

12.2.1.10.1.1 PEA FIBER

12.2.1.10.1.2 WHEAT

12.2.1.10.1.3 BAMBOO FIBER

12.2.1.10.1.4 SOY FIBER

12.2.1.10.1.5 POTATO FIBER

12.2.1.10.1.6 CITRUS FIBER

12.2.1.10.1.7 CELLULOSE

12.2.1.10.1.8 OAT FIBER

12.2.1.10.1.9 APPLE FIBER

12.2.1.10.1.10 COCOA FIBER

12.2.1.10.1.11 ACACIA FIBER

12.2.1.10.1.12 SUGAR CANE FIBER

12.2.1.10.1.13 CORN FIBER

12.2.1.10.1.14 CARROT FIBER

12.2.1.10.1.15 SUGAR BEET FIBER

12.2.1.10.1.16 OTHERS

12.2.1.11. SPORTS NUTRITION

12.2.1.11.1. SPORTS NUTRITION, BY FIBER TYPE

12.2.1.11.1.1 PEA FIBER

12.2.1.11.1.2 WHEAT

12.2.1.11.1.3 BAMBOO FIBER

12.2.1.11.1.4 SOY FIBER

12.2.1.11.1.5 POTATO FIBER

12.2.1.11.1.6 CITRUS FIBER

12.2.1.11.1.7 CELLULOSE

12.2.1.11.1.8 OAT FIBER

12.2.1.11.1.9 APPLE FIBER

12.2.1.11.1.10 COCOA FIBER

12.2.1.11.1.11 ACACIA FIBER

12.2.1.11.1.12 SUGAR CANE FIBER

12.2.1.11.1.13 CORN FIBER

12.2.1.11.1.14 CARROT FIBER

12.2.1.11.1.15 SUGAR BEET FIBER

12.2.1.11.1.16 OTHERS

12.2.1.12. FROZEN & CONVENIENCE FOOD

12.2.1.12.1. FROZEN & CONVENIENCE FOOD, BY FIBER TYPE

12.2.1.12.1.1 PEA FIBER

12.2.1.12.1.2 WHEAT

12.2.1.12.1.3 BAMBOO FIBER

12.2.1.12.1.4 SOY FIBER

12.2.1.12.1.5 POTATO FIBER

12.2.1.12.1.6 CITRUS FIBER

12.2.1.12.1.7 CELLULOSE

12.2.1.12.1.8 OAT FIBER

12.2.1.12.1.9 APPLE FIBER

12.2.1.12.1.10 COCOA FIBER

12.2.1.12.1.11 ACACIA FIBER

12.2.1.12.1.12 SUGAR CANE FIBER

12.2.1.12.1.13 CORN FIBER

12.2.1.12.1.14 CARROT FIBER

12.2.1.12.1.15 SUGAR BEET FIBER

12.2.1.12.1.16 OTHERS

12.3 BEVERAGES

12.3.1 BEVERAGES, BY FEED TYPE

12.3.1.1. SOFT DRINKS

12.3.1.2. FRUIT JUICES

12.3.1.3. INSTANT TEA & COFFEE

12.3.1.4. OTHERS

12.3.2 BEVERAGES, BY FIBER TYPE

12.3.2.1. PEA FIBER

12.3.2.2. WHEAT

12.3.2.3. BAMBOO FIBER

12.3.2.4. SOY FIBER

12.3.2.5. POTATO FIBER

12.3.2.6. CITRUS FIBER

12.3.2.7. CELLULOSE

12.3.2.8. OAT FIBER

12.3.2.9. APPLE FIBER

12.3.2.10. COCOA FIBER

12.3.2.11. ACACIA FIBER

12.3.2.12. SUGAR CANE FIBER

12.3.2.13. CORN FIBER

12.3.2.14. CARROT FIBER

12.3.2.15. SUGAR BEET FIBER

12.3.2.16. OTHERS

13 GLOBAL DIETARY FIBRES IN FOOD INDUSTRY MARKET, BY GRADE

13.1 OVERVIEW

13.2 30 MICRON

13.3 75 MICRON

13.4 90 MICRON

13.5 200 MICRON

13.6 500 MICRON

13.7 OTHERS

14 GLOBAL DIETARY FIBRES IN FOOD INDUSTRY MARKET, BY COLOR

14.1 OVERVIEW

14.2 WHITE

14.3 BEIGE

14.4 LIGHT YELLOW

14.5 CREAM

14.6 BROWN

14.7 OTHERS

15 GLOBAL DIETARY FIBRES IN FOOD INDUSTRY MARKET, BY ODOR

15.1 OVERVIEW

15.2 NATURAL FLAVOR/ODOR

15.3 FLAVORLESS

16 GLOBAL DIETARY FIBRES IN FOOD INDUSTRY MARKET, BY CATEGORY

16.1 OVERVIEW

16.2 GMO

16.3 NON-GMO

17 GLOBAL DIETARY FIBRES IN FOOD INDUSTRY MARKET, COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: GLOBAL

17.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

17.3 COMPANY SHARE ANALYSIS: EUROPE

17.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

17.5 MERGERS & ACQUISITIONS

17.6 NEW PRODUCT DEVELOPMENT & APPROVALS

17.7 EXPANSIONS & PARTNERSHIP

17.8 REGULATORY CHANGES

18 GLOBAL DIETARY FIBRES IN FOOD INDUSTRY MARKET, BY GEOGRAPHY

OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

18.1 NORTH AMERICA

18.1.1 U.S.

18.1.2 CANADA

18.1.3 MEXICO

18.2 EUROPE

18.2.1 GERMANY

18.2.2 U.K.

18.2.3 ITALY

18.2.4 FRANCE

18.2.5 SPAIN

18.2.6 SWITZERLAND

18.2.7 NETHERLANDS

18.2.8 BELGIUM

18.2.9 RUSSIA

18.2.10 TURKEY

18.2.11 REST OF EUROPE

18.3 ASIA-PACIFIC

18.3.1 JAPAN

18.3.2 CHINA

18.3.3 SOUTH KOREA

18.3.4 INDIA

18.3.5 AUSTRALIA

18.3.6 SINGAPORE

18.3.7 THAILAND

18.3.8 INDONESIA

18.3.9 MALAYSIA

18.3.10 PHILIPPINES

18.3.11 REST OF ASIA-PACIFIC

18.4 SOUTH AMERICA

18.4.1 BRAZIL

18.4.2 ARGENTINA

18.4.3 REST OF SOUTH AMERICA

18.5 MIDDLE EAST AND AFRICA

18.5.1 SOUTH AFRICA

18.5.2 UAE

18.5.3 SAUDI ARABIA

18.5.4 KUWAIT

18.5.5 REST OF MIDDLE EAST AND AFRICA

19 GLOBAL DIETARY FIBRES IN FOOD INDUSTRY MARKET, SWOT & DBMR ANALYSIS

20 GLOBAL DIETARY FIBRES IN FOOD INDUSTRY MARKET, COMPANY PROFILE

20.1 DUPONT

20.1.1 COMPANY OVERVIEW

20.1.2 REVENUE ANALYSIS

20.1.3 GEOGRAPHICAL PRESENCE

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPMENTS

20.2 INTERFIBER

20.2.1 COMPANY OVERVIEW

20.2.2 REVENUE ANALYSIS

20.2.3 GEOGRAPHICAL PRESENCE

20.2.4 PRODUCT PORTFOLIO

20.2.5 RECENT DEVELOPMENTS

20.3 CREAFILL FIBERS CORPORATION

20.3.1 COMPANY OVERVIEW

20.3.2 REVENUE ANALYSIS

20.3.3 GEOGRAPHICAL PRESENCE

20.3.4 PRODUCT PORTFOLIO

20.3.5 RECENT DEVELOPMENTS

20.4 HL AGRO PRODUCTS PVT. LTD.

20.4.1 COMPANY OVERVIEW

20.4.2 REVENUE ANALYSIS

20.4.3 GEOGRAPHICAL PRESENCE

20.4.4 PRODUCT PORTFOLIO

20.4.5 RECENT DEVELOPMENTS

20.5 ROQUETTE FRÈRES

20.5.1 COMPANY OVERVIEW

20.5.2 REVENUE ANALYSIS

20.5.3 GEOGRAPHICAL PRESENCE

20.5.4 PRODUCT PORTFOLIO

20.5.5 RECENT DEVELOPMENTS

20.6 CARGILL, INCORPORATED

20.6.1 COMPANY OVERVIEW

20.6.2 REVENUE ANALYSIS

20.6.3 GEOGRAPHICAL PRESENCE

20.6.4 PRODUCT PORTFOLIO

20.6.5 RECENT DEVELOPMENTS

20.7 J. RETTENMAIER & SÖHNE GMBH + CO KG

20.7.1 COMPANY OVERVIEW

20.7.2 REVENUE ANALYSIS

20.7.3 GEOGRAPHICAL PRESENCE

20.7.4 PRODUCT PORTFOLIO

20.7.5 RECENT DEVELOPMENTS

20.8 INGREDION INCORPORATED

20.8.1 COMPANY OVERVIEW

20.8.2 REVENUE ANALYSIS

20.8.3 GEOGRAPHICAL PRESENCE

20.8.4 PRODUCT PORTFOLIO

20.8.5 RECENT DEVELOPMENTS

20.9 GRAIN PROCESSING CORPORATION

20.9.1 COMPANY OVERVIEW

20.9.2 REVENUE ANALYSIS

20.9.3 GEOGRAPHICAL PRESENCE

20.9.4 PRODUCT PORTFOLIO

20.9.5 RECENT DEVELOPMENTS

20.1 UNIPEKTIN INGREDIENTS AG

20.10.1 COMPANY OVERVIEW

20.10.2 REVENUE ANALYSIS

20.10.3 GEOGRAPHICAL PRESENCE

20.10.4 PRODUCT PORTFOLIO

20.10.5 RECENT DEVELOPMENTS

20.11 BRENNTAG

20.11.1 COMPANY OVERVIEW

20.11.2 REVENUE ANALYSIS

20.11.3 GEOGRAPHICAL PRESENCE

20.11.4 PRODUCT PORTFOLIO

20.11.5 RECENT DEVELOPMENTS

20.12 QINGDAO CPI (ENTERPRISE)INTERNATIONAL CO., LTD.

20.12.1 COMPANY OVERVIEW

20.12.2 REVENUE ANALYSIS

20.12.3 GEOGRAPHICAL PRESENCE

20.12.4 PRODUCT PORTFOLIO

20.12.5 RECENT DEVELOPMENTS

20.13 UNIQUE SOY PRODUCTS INTERNATIONAL, LLC

20.13.1 COMPANY OVERVIEW

20.13.2 REVENUE ANALYSIS

20.13.3 GEOGRAPHICAL PRESENCE

20.13.4 PRODUCT PORTFOLIO

20.13.5 RECENT DEVELOPMENTS

20.14 EMSLAND GROUP

20.14.1 COMPANY OVERVIEW

20.14.2 REVENUE ANALYSIS

20.14.3 GEOGRAPHICAL PRESENCE

20.14.4 PRODUCT PORTFOLIO

20.14.5 RECENT DEVELOPMENTS

20.15 AGT FOOD AND INGREDIENTS

20.15.1 COMPANY OVERVIEW

20.15.2 REVENUE ANALYSIS

20.15.3 GEOGRAPHICAL PRESENCE

20.15.4 PRODUCT PORTFOLIO

20.15.5 RECENT DEVELOPMENTS

20.16 AVEBE

20.16.1 COMPANY OVERVIEW

20.16.2 REVENUE ANALYSIS

20.16.3 GEOGRAPHICAL PRESENCE

20.16.4 PRODUCT PORTFOLIO

20.16.5 RECENT DEVELOPMENTS

20.17 JELU-WERK J. EHRLER GMBH & CO. KG

20.17.1 COMPANY OVERVIEW

20.17.2 REVENUE ANALYSIS

20.17.3 GEOGRAPHICAL PRESENCE

20.17.4 PRODUCT PORTFOLIO

20.17.5 RECENT DEVELOPMENTS

20.18 INTERFIBER

20.18.1 COMPANY OVERVIEW

20.18.2 REVENUE ANALYSIS

20.18.3 GEOGRAPHICAL PRESENCE

20.18.4 PRODUCT PORTFOLIO

20.18.5 RECENT DEVELOPMENTS

20.19 ROLLIT PRODIMPEX

20.19.1 COMPANY OVERVIEW

20.19.2 REVENUE ANALYSIS

20.19.3 GEOGRAPHICAL PRESENCE

20.19.4 PRODUCT PORTFOLIO

20.19.5 RECENT DEVELOPMENTS

20.2 PRORICH AGRO FOODS

20.20.1 COMPANY OVERVIEW

20.20.2 REVENUE ANALYSIS

20.20.3 GEOGRAPHICAL PRESENCE

20.20.4 PRODUCT PORTFOLIO

20.20.5 RECENT DEVELOPMENTS

20.21 PRORICH AGRO FOODS

20.21.1 COMPANY OVERVIEW

20.21.2 REVENUE ANALYSIS

20.21.3 GEOGRAPHICAL PRESENCE

20.21.4 PRODUCT PORTFOLIO

20.21.5 RECENT DEVELOPMENTS

20.22 CFF GMBH & CO. KG

20.22.1 COMPANY OVERVIEW

20.22.2 REVENUE ANALYSIS

20.22.3 GEOGRAPHICAL PRESENCE

20.22.4 PRODUCT PORTFOLIO

20.22.5 RECENT DEVELOPMENTS

20.23 THE SCOULAR COMPANY

20.23.1 COMPANY OVERVIEW

20.23.2 REVENUE ANALYSIS

20.23.3 GEOGRAPHICAL PRESENCE

20.23.4 PRODUCT PORTFOLIO

20.23.5 RECENT DEVELOPMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

21 RELATED REPORTS

22 CONCLUSION

23 QUESTIONNAIRE

24 ABOUT DATA BRIDGE MARKET RESEARCH

Global Dietary Fibers In Food Industry Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Dietary Fibers In Food Industry Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Dietary Fibers In Food Industry Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.