Global Digestible Sensors Market

Market Size in USD Billion

CAGR :

%

USD

4.60 Billion

USD

16.52 Billion

2025

2033

USD

4.60 Billion

USD

16.52 Billion

2025

2033

| 2026 –2033 | |

| USD 4.60 Billion | |

| USD 16.52 Billion | |

|

|

|

|

Digestible Sensors Market Size

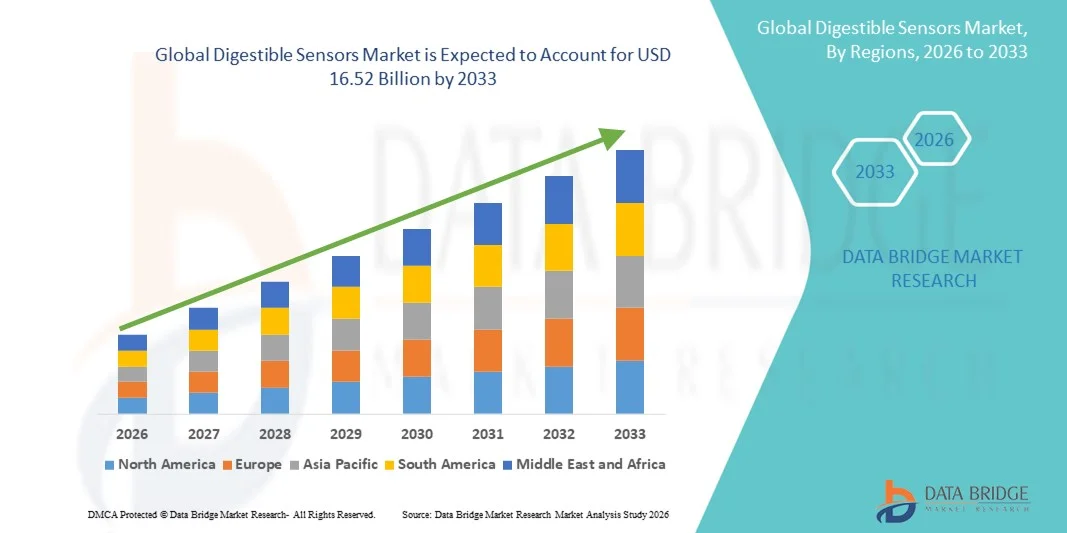

- The global digestible sensors market size was valued at USD 4.60 billion in 2025 and is expected to reach USD 16.52 billion by 2033, at a CAGR of 17.33% during the forecast period

- The market growth is largely fueled by the expanding demand for remote health monitoring, personalized medicine, and continuous internal physiological tracking, driven by rising chronic disease prevalence, aging populations, and the shift toward non‑invasive diagnostic technologies

- Furthermore, increasing consumer and healthcare provider interest in real‑time data‑driven healthcare solutions, advancements in miniaturized sensor technologies, and integration with digital health platforms are establishing digestible sensors as essential tools in modern medical diagnostics and wellness monitoring. These converging factors are accelerating the adoption of digestible sensor solutions, thereby significantly boosting the industry’s growth

Digestible Sensors Market Analysis

- Digestible sensors, offering ingestible electronic devices capable of monitoring physiological conditions within the gastrointestinal tract, are increasingly vital components of modern healthcare and remote patient monitoring systems due to their non-invasive design, real-time data collection, and seamless integration with digital health platforms

- The escalating demand for digestible sensors is primarily fueled by the growing prevalence of chronic diseases, increasing emphasis on personalized medicine, and a rising preference for continuous internal health monitoring over conventional diagnostic methods

- North America dominated the digestible sensors market with the largest revenue share of 42.7% in 2025, characterized by advanced healthcare infrastructure, high adoption of digital health technologies, and a strong presence of key industry players, with the U.S. leading in clinical trials and commercial deployments, driven by innovations in biosensor and imaging technologies

- Asia-Pacific is expected to be the fastest growing region in the digestible sensors market during the forecast period due to expanding healthcare access, rising investment in medical technology, and increasing awareness of non-invasive diagnostic solutions

- Ingestible sensors segment dominated the market with a market share of 47.2% in 2025, driven by their ability to provide accurate internal physiological monitoring, ease of integration with patient monitoring systems, and compatibility with therapeutic and diagnostic applications

Report Scope and Digestible Sensors Market Segmentation

|

Attributes |

Digestible Sensors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Digestible Sensors Market Trends

Integration with AI and Cloud-Based Health Platforms

- A significant and accelerating trend in the global digestible sensors market is the growing integration with artificial intelligence (AI) and cloud-based health monitoring platforms, enabling real-time analysis and predictive insights for patient care

- For instance, ingestible sensors integrated with AI algorithms can analyze gastrointestinal data and provide actionable health recommendations directly to healthcare providers through secure cloud systems

- AI integration in digestible sensors enables features such as pattern recognition for early detection of anomalies, predictive alerts for potential health risks, and automated reporting of patient vitals. For instance, some capsules can alert physicians if irregular gastric pH or temperature is detected

- The seamless integration of digestible sensors with digital health platforms facilitates centralized monitoring of multiple patient parameters, allowing healthcare providers to manage diagnostics, therapeutics, and monitoring data from a single interface

- This trend towards more intelligent, connected, and data-driven healthcare monitoring is fundamentally reshaping patient management practices. Consequently, companies such as Proteus Digital Health are developing AI-enabled ingestible sensors that provide real-time data analytics and predictive health alert

- The demand for digestible sensors with AI and cloud integration is growing rapidly across hospitals and remote patient monitoring services, as healthcare providers increasingly prioritize continuous monitoring and personalized healthcare delivery

- Integration with mobile health applications is also becoming a key trend, allowing patients to track real-time digestive health metrics and share data directly with physicians. For instance, some ingestible sensors sync with smartphone apps to provide notifications and trend reports

Digestible Sensors Market Dynamics

Driver

Rising Demand for Non-Invasive and Continuous Monitoring

- The increasing prevalence of chronic gastrointestinal and metabolic diseases, coupled with the growing emphasis on non-invasive patient monitoring, is a significant driver for the heightened demand for digestible sensors

- For instance, in May 2025, Medtronic launched an ingestible sensor capable of continuous monitoring of gastrointestinal pH and temperature for hospital patients, demonstrating the rising adoption of advanced monitoring solutions

- As healthcare providers seek more accurate and continuous internal monitoring, digestible sensors offer advantages such as real-time data collection, improved patient compliance, and reduced need for invasive procedures

- Furthermore, the growing interest in personalized medicine and remote healthcare monitoring is making digestible sensors an integral component of modern clinical practice, offering seamless integration with patient health management systems

- The convenience of continuous internal monitoring, early anomaly detection, and automated reporting through ingestible sensors are key factors propelling adoption in hospitals, clinics, and remote patient monitoring programs

- Rising investments in digital healthcare infrastructure and telemedicine initiatives are further driving market growth. For instance, governments and private healthcare providers are funding programs that integrate ingestible sensors into patient care workflows

- Increasing patient awareness and willingness to adopt advanced non-invasive diagnostics is expanding the market potential. For instance, patients with chronic digestive disorders are actively seeking ingestible sensors for self-monitoring and early intervention

Restraint/Challenge

High Cost and Regulatory Approval Hurdles

- The relatively high cost of advanced ingestible sensors and the complex regulatory approval process for medical devices pose significant challenges to broader market penetration

- For instance, clinical trials and FDA approvals for ingestible biosensors can take several years, making it difficult for new entrants to quickly commercialize innovative devices

- Addressing these challenges requires substantial investment in R&D, compliance with stringent safety and efficacy standards, and obtaining necessary approvals to ensure market entry

- In addition, concerns about patient data privacy, sensor safety, and long-term biocompatibility can affect adoption rates, particularly in regions with strict healthcare regulations

- Overcoming these challenges through cost reduction strategies, regulatory support, and robust safety assurances will be vital for sustained market growth and wider acceptance of digestible sensor technologies

- Limited awareness among healthcare professionals about new ingestible sensor technologies can slow adoption in certain regions. For instance, some clinics prefer traditional diagnostic tools until sensors are fully validated

- Potential technological limitations, such as battery life, signal transmission reliability, and capsule retention, also pose challenges. For instance, sensor malfunction or delayed data transmission may affect clinical trust and uptake

Digestible Sensors Market Scope

The market is segmented on the basis of technology, product type, application, and end user.

- By Technology

On the basis of technology, the digestible sensors market is segmented into image, temperature, pressure, biosensors, and accelerometer. The biosensors segment dominated the market with the largest revenue share of 38% in 2025, driven by its capability to accurately detect biochemical and physiological changes within the gastrointestinal tract. Biosensors are widely preferred for their high sensitivity, precision, and ability to continuously monitor patient health metrics. Hospitals and clinics often utilize biosensor-based ingestible devices for real-time diagnostics and patient monitoring. The integration of biosensors with cloud-based analytics platforms enables physicians to receive automated alerts for anomalies, enhancing clinical decision-making. Furthermore, biosensors are compatible with remote patient monitoring programs, supporting telemedicine initiatives. Their established clinical efficacy and broad adoption across healthcare institutions reinforce their dominant position in the market.

The image sensors segment is expected to witness the fastest growth rate of 21.5% from 2026 to 2033, fueled by increasing adoption of capsule endoscopy and non-invasive imaging procedures. Image sensors provide visual insights into the gastrointestinal tract, enabling early detection of abnormalities such as ulcers, polyps, or tumors. Hospitals and diagnostic centers are adopting image-based ingestible capsules for patient-friendly procedures, reducing the need for traditional endoscopy. Technological advancements in high-resolution, low-power imaging sensors are driving their popularity. In addition, integration with AI-based image analysis software is enhancing diagnostic accuracy. The growing preference for minimally invasive and patient-comfort-focused solutions is further propelling the uptake of image sensor technology.

- By Product Type

On the basis of product type, the digestible sensors market is segmented into strip sensors, ingestible sensors, invasive sensors, wearable sensors, and implantable sensors. The ingestible sensors segment dominated the market with a market share of 47.2% in 2025, driven by their non-invasive design, ease of swallowing, and ability to provide continuous internal monitoring. Ingestible sensors are extensively used for gastrointestinal diagnostics, therapeutic monitoring, and patient tracking in hospitals. Physicians prefer ingestible capsules for their patient compliance benefits and ability to reduce the need for invasive procedures. Integration with mobile health apps and cloud platforms enables real-time reporting and remote monitoring. Their proven accuracy in measuring pH, temperature, and other physiological parameters contributes to widespread adoption. The segment’s compatibility with multiple applications and technologies strengthens its market dominance.

The wearable sensors segment is expected to witness the fastest growth rate of 23% from 2026 to 2033, fueled by the rising adoption of integrated health monitoring systems combining ingestible and wearable devices. Wearable sensors provide complementary external monitoring for vital signs such as heart rate, hydration, and activity levels. The integration of wearable and ingestible sensors enables holistic patient monitoring and data analytics. Rising consumer interest in preventive health and fitness tracking is driving demand for wearable solutions. The development of lightweight, flexible, and user-friendly wearable sensors further accelerates adoption. Increasing investment in remote patient monitoring and home healthcare programs supports the rapid growth of this segment.

- By Application

On the basis of application, the digestible sensors market is segmented into patient monitoring, diagnostics, and therapeutics. The patient monitoring segment dominated the market with a share of 44% in 2025, driven by the growing need for continuous health monitoring for chronic disease management. Digestible sensors enable healthcare providers to monitor gastrointestinal conditions, drug absorption, and internal vitals in real-time. Integration with telemedicine platforms allows remote tracking and proactive interventions. Hospitals and home healthcare services increasingly rely on these devices to reduce hospital visits and enhance patient compliance. The convenience of non-invasive, continuous monitoring makes it a preferred solution for physicians and patients alike. Strong adoption in hospitals, clinics, and remote monitoring programs reinforces its dominant position.

The diagnostics segment is expected to witness the fastest growth rate of 22% from 2026 to 2033, fueled by the increasing demand for non-invasive, accurate diagnostic solutions. Digestible sensors equipped with imaging, temperature, or biosensor technologies provide precise insights into gastrointestinal and metabolic health. Integration with AI and cloud platforms enables automated analysis and anomaly detection. The adoption of capsule endoscopy and diagnostic ingestible devices is increasing in hospitals and diagnostic centers. Rising awareness of early disease detection and preventive care drives market expansion. Continuous technological advancements, such as higher resolution imaging and miniaturized sensors, further accelerate the growth of the diagnostics segment.

- By End User

On the basis of end user, the digestible sensors market is segmented into consumers, pharmaceutical companies, healthcare providers, sports and fitness institutes, and others. The healthcare providers segment dominated the market with a share of 50% in 2025, driven by hospitals, clinics, and telemedicine services integrating digestible sensors into patient care. Providers rely on these devices for continuous monitoring, diagnostics, and therapeutic tracking, improving patient outcomes. Integration with cloud-based platforms allows physicians to access real-time patient data remotely. Digestible sensors reduce hospital stays and invasive procedures, enhancing efficiency in clinical workflows. Healthcare providers also benefit from automated reporting, early anomaly detection, and predictive health analytics. Their established adoption and direct influence over patient care decisions reinforce their market dominance.

The pharmaceutical companies segment is expected to witness the fastest growth rate of 24% from 2026 to 2033, fueled by the increasing use of ingestible sensors for drug adherence monitoring and clinical trials. Pharmaceutical companies utilize ingestible devices to track medication ingestion, bioavailability, and patient compliance in real-time. The integration of sensor data with analytics platforms improves drug development and monitoring accuracy. Rising investment in clinical research and digital therapeutics supports rapid adoption. Collaborations with healthcare providers and technology companies further accelerate growth. Growing emphasis on personalized medicine and regulatory support for innovative drug monitoring technologies is also driving this segment’s expansion.

Digestible Sensors Market Regional Analysis

- North America dominated the digestible sensors market with the largest revenue share of 42.7% in 2025, characterized by advanced healthcare infrastructure, high adoption of digital health technologies, and a strong presence of key industry players, with the U.S. leading in clinical trials and commercial deployments, driven by innovations in biosensor and imaging technologies

- Healthcare providers and hospitals in the region highly value the real-time monitoring, predictive analytics, and seamless integration offered by digestible sensors with digital health platforms and telemedicine solutions

- This widespread adoption is further supported by advanced healthcare infrastructure, high healthcare expenditure, a technology-savvy medical workforce, and strong investment in remote patient monitoring programs, establishing digestible sensors as a preferred solution for hospitals, clinics, and home healthcare services.

U.S. Digestible Sensors Market Insight

The U.S. digestible sensors market captured the largest revenue share of 79% in 2025 within North America, fueled by the rapid adoption of advanced healthcare technologies and increasing focus on non-invasive patient monitoring. Hospitals and clinics are prioritizing continuous internal monitoring for chronic disease management and gastrointestinal diagnostics. The growing integration of ingestible sensors with AI and cloud-based health platforms further propels the market. Moreover, the expanding trend of telemedicine and remote patient monitoring, along with high healthcare expenditure and strong regulatory support for innovative medical devices, significantly contributes to market expansion.

Europe Digestible Sensors Market Insight

The Europe digestible sensors market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing awareness of non-invasive diagnostics and stringent healthcare regulations. The rising demand for continuous patient monitoring in hospitals and home care settings is fostering adoption. European healthcare providers value precision, patient compliance, and integration with digital health platforms. The region is witnessing strong growth across hospitals, clinics, and remote patient monitoring applications. Digestible sensors are being increasingly incorporated into new healthcare protocols and telemedicine programs, supporting proactive healthcare management.

U.K. Digestible Sensors Market Insight

The U.K. digestible sensors market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing focus on preventive healthcare and personalized medicine. Growing concerns over gastrointestinal diseases and patient monitoring requirements are encouraging hospitals and clinics to adopt ingestible sensors. The country’s advanced healthcare infrastructure, coupled with strong digital health adoption and supportive government initiatives, is expected to stimulate market growth. The integration of sensors with mobile health applications and cloud-based reporting platforms further enhances usability and adoption.

Germany Digestible Sensors Market Insight

The Germany digestible sensors market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of advanced diagnostics and non-invasive monitoring solutions. Germany’s emphasis on innovation, high-quality healthcare infrastructure, and adoption of digital health technologies promotes the use of ingestible sensors. Hospitals and clinics are increasingly deploying sensors for patient monitoring, diagnostics, and therapeutic tracking. The integration of sensors with electronic health records and telemedicine systems is becoming prevalent, supporting proactive patient care and real-time monitoring. Local consumer preference for technologically advanced and reliable medical solutions aligns with the market’s growth trajectory.

Asia-Pacific Digestible Sensors Market Insight

The Asia-Pacific digestible sensors market is poised to grow at the fastest CAGR of 25% from 2026 to 2033, driven by rising healthcare infrastructure investments, increasing prevalence of chronic diseases, and growing adoption of digital health solutions in countries such as China, Japan, and India. The expanding number of hospitals, telemedicine initiatives, and remote patient monitoring programs is fueling demand. Furthermore, government support for smart healthcare initiatives and increasing awareness of non-invasive diagnostic tools are boosting adoption. APAC is also emerging as a hub for manufacturing sensor components, improving affordability and accessibility across the region.

Japan Digestible Sensors Market Insight

The Japan digestible sensors market is gaining momentum due to the country’s advanced healthcare system, high adoption of digital health technologies, and focus on patient convenience. Hospitals and clinics are increasingly implementing ingestible sensors for gastrointestinal diagnostics and therapeutic monitoring. The integration of sensors with cloud platforms and AI analytics enhances real-time monitoring and predictive care. Moreover, Japan’s aging population and rising prevalence of chronic diseases are likely to spur demand for non-invasive, patient-friendly monitoring solutions in both residential and hospital settings.

India Digestible Sensors Market Insight

The India digestible sensors market accounted for the largest revenue share in Asia Pacific in 2025, attributed to the country’s rapidly expanding healthcare infrastructure, increasing awareness of non-invasive monitoring, and growing adoption of digital health solutions. Hospitals, clinics, and remote patient monitoring services are adopting ingestible sensors for diagnostics, patient tracking, and therapeutic applications. Government initiatives promoting smart healthcare and affordable medical technology, combined with strong domestic manufacturing capabilities, are key factors propelling market growth. Increasing prevalence of chronic gastrointestinal and metabolic diseases further drives the demand for ingestible sensors.

Digestible Sensors Market Share

The Digestible Sensors industry is primarily led by well-established companies, including:

- MC10, Inc. (U.S.)

- CapsoVision, Inc. (U.S.)

- Proteus Digital Health, Inc. (U.S.)

- HQ, Inc. (U.S.)

- Olympus Corporation (Japan)

- IntroMedic Co., Ltd. (South Korea)

- Medtronic plc (Ireland)

- JINSHAN Science & Technology (China)

- Medimetrics Personalized Drug Delivery B.V. (Netherlands)

- Microchips Biotech, Inc. (U.S.)

- etectRx, Inc. (U.S.)

- Atmo Biosciences (Australia)

- Koninklijke Philips N.V. (Netherlands)

- Otsuka Holdings Co., Ltd. (Japan)

- RF Co., Ltd. (China)

- BodyCAP S.A.S. (France)

- Capsule Technologies, Inc. (U.S.)

- Motus GI, Inc. (U.S.)

- SmartPill Corporation (U.S.)

- Sensirion AG (Switzerland)

What are the Recent Developments in Global Digestible Sensors Market?

- In October 2025, Mass General Brigham researchers validated an ingestible biosensor pill for at‑home monitoring of intestinal inflammation, showing strong diagnostic potential for acute mesenteric ischemia in preclinical models, which could lead to earlier, non‑invasive diagnosis of serious GI conditions

- In June 2025, Caltech engineers announced the development of “PillTrek,” a smart ingestible capsule, capable of measuring pH, temperature, glucose, neurotransmitters, and other biomarkers inside the GI tract, offering expanded real‑time biochemical insights in a compact, wireless, electrochemical sensor platform for gut health research and diagnostics

- In June 2025, University of Maryland researchers reported a milestone advancement in ingestible capsule technology, introducing a 3D‑printed capsule with integrated microneedles and a tunable drug reservoir that allows controlled drug release within the gastrointestinal tract, improving precision therapeutic delivery for conditions such as Crohn’s disease and ulcerative colitis

- In May 2025, Imec presented a highly miniaturized ingestible sensor prototype that is three times smaller than current capsule endoscopies and the first to provide redox balance, pH, and temperature measurements for gut health monitoring, offering valuable real‑time insights into intestinal inflammation and microbiome conditions

- In March 2025, researchers unveiled a wireless ingestible capsule capable of detecting “leaky gut” in real time, using a bioimpedance sensing device that continuously and non‑invasively monitors gastrointestinal mucosal barrier integrity, potentially revolutionizing early detection and management of conditions such as inflammatory bowel disease (IBD) with real‑time wireless data transmission

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.