Global Digital Hearing Aids Market

Market Size in USD Billion

CAGR :

%

USD

8.52 Billion

USD

14.97 Billion

2025

2033

USD

8.52 Billion

USD

14.97 Billion

2025

2033

| 2026 –2033 | |

| USD 8.52 Billion | |

| USD 14.97 Billion | |

|

|

|

|

Digital Hearing Aids Market Size

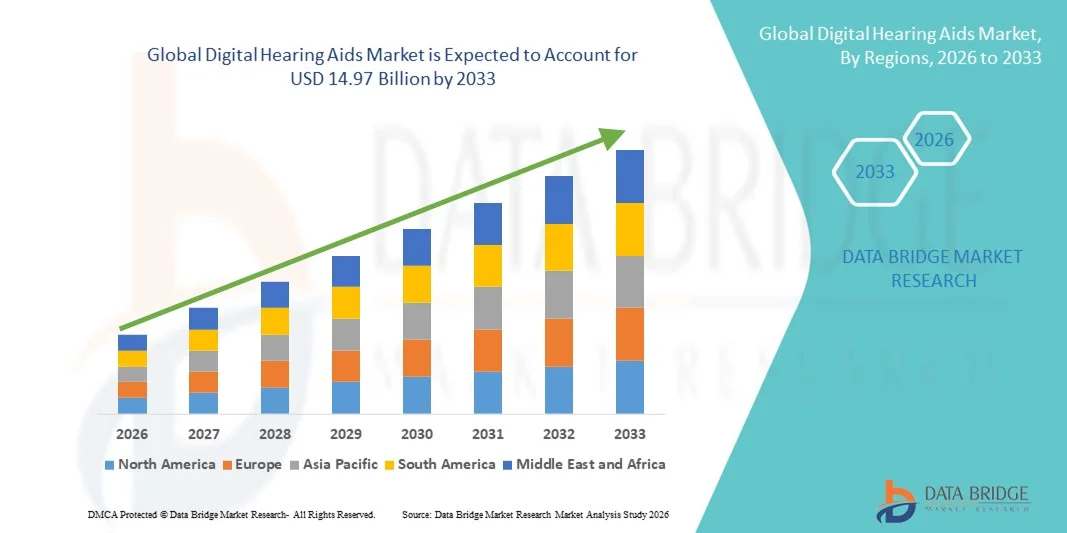

- The global digital hearing aids market size was valued at USD 8.52 billion in 2025 and is expected to reach USD 14.97 billion by 2033, at a CAGR of 7.30% during the forecast period

- The market growth is largely fueled by the increasing prevalence of hearing loss, aging populations, and the growing adoption of advanced digital hearing technologies that provide enhanced sound quality and connectivity

- Furthermore, rising consumer preference for discreet, comfortable, and customizable hearing solutions, along with integration with smartphones and other smart devices, is positioning digital hearing aids as the preferred choice for both medical and lifestyle needs. These converging factors are accelerating the adoption of digital hearing aids, thereby significantly driving the industry's growth

Digital Hearing Aids Market Analysis

- Digital hearing aids, providing advanced amplification and sound processing for individuals with hearing loss, are becoming essential solutions in both medical and lifestyle contexts due to their improved sound clarity, customizable settings, and seamless integration with smartphones and other smart devices

- The rising demand for digital hearing aids is primarily driven by increasing prevalence of hearing impairment, growing awareness about early diagnosis and treatment, and consumer preference for discreet, comfortable, and technologically advanced devices

- North America dominated the digital hearing aids market with the largest revenue share of 39.8% in 2025, supported by high adoption rates, established healthcare infrastructure, and a strong presence of leading industry players, with the U.S. witnessing significant growth in digital hearing aid adoption due to innovations in AI-driven sound enhancement and rechargeable models

- Asia-Pacific is expected to be the fastest growing region in the digital hearing aids market during the forecast period due to increasing geriatric population, rising awareness about hearing health, and improving healthcare accessibility

- Behind the Ear Hearing Aids segment dominated the digital hearing aids market with a market share of 41.7% in 2025, owing to its versatility, high amplification capacity, and suitability for a wide range of hearing loss severities

Report Scope and Digital Hearing Aids Market Segmentation

|

Attributes |

Digital Hearing Aids Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Digital Hearing Aids Market Trends

Enhanced User Experience Through AI and Smartphone Integration

- A significant and accelerating trend in the global digital hearing aids market is the growing integration with artificial intelligence (AI) and smartphone applications, enhancing sound customization, noise reduction, and connectivity with other smart devices

- For instance, ReSound ONE hearing aids offer AI-driven sound adjustments and real-time streaming through its smartphone app, allowing users to fine-tune hearing settings for different environments. Similarly, Oticon More provides seamless integration with iOS and Android devices for personalized control

- AI integration in digital hearing aids enables features such as automatic environment detection, predictive sound enhancement, and adaptive feedback cancellation, improving overall hearing experience. For instance, some Widex MOMENT models learn user preferences over time and adjust amplification for optimal clarity in various settings

- The integration of hearing aids with smartphones and other connected devices allows centralized management of hearing programs, remote adjustments by audiologists, and real-time notifications for device performance, creating a more intuitive hearing solution

- This trend toward AI-powered, connected, and adaptive hearing aids is reshaping consumer expectations for hearing care. Consequently, companies such as Signia are developing devices with AI-based sound personalization and app-controlled adjustments

- The demand for digital hearing aids with intelligent AI features and smartphone connectivity is rapidly increasing across both medical and lifestyle segments, as consumers prioritize convenience, personalized sound, and comprehensive hearing health management

- Integration of digital hearing aids with fitness and wellness tracking features, such as heart rate monitoring and activity alerts, is emerging as a value-added trend enhancing device functionality and lifestyle appeal

Digital Hearing Aids Market Dynamics

Driver

Increasing Prevalence of Hearing Loss and Awareness of Hearing Health

- The rising incidence of hearing impairment, coupled with growing awareness about early diagnosis and treatment, is a significant driver for the heightened demand for digital hearing aids

- For instance, in March 2025, GN Hearing launched an awareness campaign highlighting early intervention benefits and promoting AI-enabled hearing devices, aiming to improve accessibility and adoption

- As consumers recognize the impact of untreated hearing loss on quality of life, digital hearing aids offer advanced features such as adaptive noise reduction, speech enhancement, and connectivity to smartphones and streaming services, providing superior performance compared to analog devices

- Furthermore, the increasing focus on preventive healthcare and routine audiological checkups is driving adoption, making digital hearing aids an essential component of comprehensive hearing care

- The convenience of app-controlled hearing adjustments, remote audiologist support, and discreet device designs are key factors propelling adoption across age groups and lifestyles. The availability of user-friendly devices and government initiatives for hearing health further support market growth

- Growing consumer preference for wireless and rechargeable hearing aids with extended battery life is driving demand, especially among active and tech-savvy users

- Expansion of insurance coverage and reimbursement programs for hearing aids in key markets is reducing out-of-pocket expenses, making advanced digital hearing solutions more accessible

Restraint/Challenge

High Costs and Technology Adoption Barriers

- The relatively high cost of advanced digital hearing aids, especially those with AI-driven features, can limit adoption among price-sensitive consumers, posing a challenge to broader market penetration

- For instance, high-priced models from brands such as Phonak and Oticon may deter first-time buyers, particularly in developing regions or among middle-income populations

- In addition, older adults or individuals unfamiliar with digital technology may face challenges in operating app-integrated or AI-enabled hearing aids, affecting user experience and satisfaction

- Addressing these challenges through more affordable device options, consumer education, and simplified interfaces is crucial to expand adoption. Companies such as Starkey emphasize user-friendly designs and flexible financing options to make advanced hearing aids accessible

- While the market is gradually becoming more cost-competitive, perceived premium pricing and technology learning curves can still hinder widespread acceptance, especially among older or less tech-savvy users

- Overcoming these barriers through innovative, accessible, and affordable hearing solutions, coupled with patient education and support, will be vital for sustained market growth

- Limited awareness and social stigma associated with hearing aid usage continue to restrict market penetration in certain regions, particularly in developing countries

- Regulatory approvals and compliance with international medical device standards can slow product launches and market entry for new hearing aid innovations

Digital Hearing Aids Market Scope

The market is segmented on the basis of technology, product type, product, type of hearing loss, technology type, and distribution channel.

- By Technology

On the basis of technology, the market is segmented into conventional hearing aids and digital hearing aids. The digital hearing aids segment dominated the market with the largest market revenue share in 2025, driven by advanced sound processing capabilities, adaptive noise reduction, and seamless connectivity with smartphones and other smart devices. Users prefer digital hearing aids for their ability to provide personalized amplification, real-time adjustments, and integration with AI-powered features that enhance speech clarity in various environments. The widespread availability of rechargeable and wireless models further strengthens the segment’s dominance. In addition, digital hearing aids are increasingly favored by audiologists and healthcare providers for their versatility and compatibility with tele-audiology services. The adoption is also supported by growing awareness of hearing health and the rising prevalence of hearing loss across all age groups. Digital hearing aids also benefit from continuous innovation, such as integration with fitness and wellness tracking apps, further driving consumer adoption.

Conventional hearing aids are expected to witness the fastest growth from 2026 to 2033, particularly in developing regions, due to their lower cost, ease of use, and simpler technology. These devices appeal to price-sensitive consumers who require basic amplification without advanced connectivity features. The growth is further supported by increasing outreach programs and government initiatives promoting hearing care accessibility in emerging markets. In addition, conventional devices require minimal training for users and are compatible with basic batteries, making them an attractive solution for first-time users and older adults.

- By Product Type

On the basis of product type, the market is segmented into behind the ear (BTE) hearing aids, receiver in the ear (RITE) hearing aids, in the ear (ITE) hearing aids, completely in the ear (CIC) hearing aids, and in the canal (ITC) hearing aids. The BTE segment dominated the market with a market share of 41.7% in 2025, due to its versatility, high amplification capacity, and suitability for a wide range of hearing loss severities. BTE devices are favored by audiologists for their ease of fitting, comfort, and ability to accommodate larger batteries and additional features such as wireless connectivity and directional microphones. The segment also benefits from continuous technological advancements improving aesthetics, noise reduction, and integration with apps for personalized sound adjustments. Moreover, BTE aids support connectivity with smartphones, enabling remote adjustments and tele-audiology support. Consumers also appreciate the durability and reliability of BTE devices, particularly for severe hearing loss cases. Their adaptability across age groups and compatibility with multiple sound processing features further reinforce the dominance of this segment.

The RITE segment is expected to witness the fastest growth during the forecast period, driven by consumer preference for discreet and lightweight designs without compromising performance. RITE devices combine the benefits of BTE and ITE aids, offering connectivity options, advanced features, and improved comfort, particularly appealing to tech-savvy users seeking unobtrusive hearing solutions. The adoption is further accelerated by rising awareness of digital hearing solutions and the growing availability of wireless and rechargeable options. In addition, RITE aids are ideal for active users due to their small form factor and compatibility with streaming devices. Their increasing aesthetic appeal and ability to accommodate advanced features such as AI-based sound optimization also contribute to segment growth.

- By Product

On the basis of product, the market is segmented into devices, implants, and accessories. The devices segment dominated the market in 2025, accounting for the largest revenue share, as it includes a broad range of hearing aids with advanced digital features suitable for most hearing loss types. Devices are widely adopted due to their versatility, easy fitting, and integration with digital platforms for personalized hearing experiences. The segment also benefits from ongoing technological innovations, such as AI-assisted sound optimization, remote audiologist adjustments, and smartphone-controlled functionality, which drive consumer preference and satisfaction. Devices also have high compatibility with tele-audiology and app-based management, improving accessibility for users in urban and rural areas. Furthermore, continuous improvements in battery life and miniaturization enhance user convenience and adoption rates. The broad availability of accessories such as chargers, wireless microphones, and protective cases supports ecosystem adoption, strengthening the device segment further.

The implants segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing adoption of cochlear implants for severe to profound hearing loss. Advances in implant technology, improved surgical techniques, and rising awareness about implant solutions are accelerating market penetration. Growth is also supported by expanding insurance coverage and government initiatives facilitating access to cochlear implants in emerging markets. In addition, increasing pediatric implantation programs and adult rehabilitation solutions are further boosting demand. The segment benefits from continuous R&D in implant design, sound coding strategies, and wireless connectivity. Consumer trust and improved outcomes in speech perception reinforce the rapid adoption of implantable hearing solutions.

- By Type of Hearing Loss

On the basis of type of hearing loss, the market is segmented into sensorineural, conductive, and others. The sensorineural segment dominated the market in 2025, driven by its high prevalence among adults and the aging population. Digital hearing aids designed for sensorineural loss provide advanced amplification, noise reduction, and clarity in speech perception, which are critical for effective hearing rehabilitation. Audiologists recommend these devices widely due to their adaptability across varying levels of hearing impairment and their compatibility with modern connectivity features. Sensorineural hearing loss devices also support tele-audiology and app-based customization, increasing convenience for users. Moreover, rising awareness about early intervention and preventive hearing care boosts adoption. Continuous innovations in AI-driven sound processing specifically tailored for sensorineural conditions further solidify this segment’s dominance.

The conductive hearing loss segment is expected to witness the fastest growth during the forecast period, particularly due to increased adoption of implantable solutions and bone-anchored hearing aids. Rising awareness of treatment options and early diagnosis programs are boosting adoption in children and adults with conductive hearing impairments. Technological advancements in lightweight, comfortable devices are also supporting segment growth. In addition, government healthcare programs and insurance reimbursement are improving accessibility. The convenience of wireless connectivity and smartphone integration further enhances consumer interest. Pediatric-focused devices with adjustable amplification levels are driving adoption in this growing segment.

- By Technology Type

On the basis of technology type, the market is segmented into digital hearing aids and analog hearing aids. The digital segment dominated the market with the largest revenue share in 2025 due to superior sound processing, programmable settings, and integration with AI and mobile apps. Digital hearing aids allow precise amplification, environmental adaptation, and wireless connectivity, offering a customized hearing experience that analog devices cannot match. The dominance is further reinforced by consumer demand for discreet, rechargeable, and feature-rich devices. Digital hearing aids also benefit from tele-audiology, remote programming, and real-time audiologist support, which improve user satisfaction. In addition, innovations such as directional microphones and adaptive noise filtering strengthen the appeal of digital solutions. Integration with lifestyle and wellness apps further differentiates digital hearing aids from traditional analog devices.

Analog hearing aids are expected to witness the fastest growth from 2026 to 2033, particularly in cost-sensitive markets where basic amplification needs are prioritized. These devices are simpler, require minimal maintenance, and are an accessible entry point for users new to hearing aids, especially in rural and underserved regions. Their low price point and easy operation make them attractive for first-time users or older adults who prefer straightforward technology. Analog hearing aids are also less dependent on battery replacements and software updates, which increases reliability. In addition, outreach and government programs in developing regions are promoting basic hearing aid adoption. Consumer trust in simple analog devices and local availability supports the expected growth of this segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into retail stores, e-commerce, and others. The retail stores segment dominated the market in 2025, accounting for the largest revenue share, due to the personalized service, professional fitting, and on-site audiologist support offered in physical stores. Consumers prefer retail outlets for initial consultations, hearing tests, and demonstrations, which enhance trust and ensure proper device selection and adjustment. In addition, retail channels remain critical for first-time users requiring hands-on guidance and support. Physical stores also offer after-sales services, repairs, and warranty support, which improve customer satisfaction. The opportunity for audiologists to educate users about device features in person further strengthens retail dominance. Moreover, retail networks ensure wide accessibility across urban and semi-urban regions, boosting adoption.

The e-commerce segment is expected to witness the fastest growth during the forecast period, driven by increasing online availability of digital hearing aids, tele-audiology services, and consumer comfort with remote purchasing. The growth is further supported by smartphone-enabled product guidance, home trials, and flexible delivery options, making it convenient for tech-savvy and younger consumers seeking hassle-free access to advanced hearing solutions. E-commerce platforms also enable direct-to-consumer sales, reducing costs and offering promotional discounts. Integration with online audiologist consultations supports proper device fitting and personalization. The segment benefits from increasing internet penetration and growing consumer trust in online healthcare purchases. In addition, the ability to purchase accessories, batteries, and complementary devices online enhances the attractiveness of this distribution channel.

Digital Hearing Aids Market Regional Analysis

- North America dominated the digital hearing aids market with the largest revenue share of 39.8% in 2025, supported by high adoption rates, established healthcare infrastructure, and a strong presence of leading industry players, with the U.S. witnessing significant growth in digital hearing aid adoption due to innovations in AI-driven sound enhancement and rechargeable models

- Consumers in the region highly value the advanced sound processing, AI-enabled features, and seamless smartphone integration offered by digital hearing aids, which enhance personalization, comfort, and connectivity

- This widespread adoption is further supported by well-established healthcare infrastructure, high disposable incomes, and strong presence of key industry players, establishing digital hearing aids as the preferred solution for both medical and lifestyle needs

U.S. Digital Hearing Aids Market Insight

The U.S. digital hearing aids market captured the largest revenue share of 79% in 2025 within North America, driven by the growing prevalence of hearing loss and rising awareness about early intervention. Consumers are increasingly prioritizing advanced hearing solutions with AI-enabled sound processing, smartphone integration, and personalized amplification. The growing preference for tele-audiology services, rechargeable devices, and app-controlled adjustments further propels the market. Moreover, the presence of key industry players offering innovative, high-tech hearing aids enhances accessibility and consumer trust. The market is also supported by high disposable incomes and well-established healthcare infrastructure, making the U.S. a major hub for adoption of digital hearing aids.

Europe Digital Hearing Aids Market Insight

The Europe digital hearing aids market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the increasing geriatric population and government initiatives promoting hearing health. The rising awareness of hearing loss and adoption of advanced digital devices are fostering market growth. European consumers are drawn to the convenience, discreet design, and connectivity features offered by modern hearing aids. The region is experiencing significant growth across residential, clinical, and assisted living applications, with digital hearing aids being incorporated into healthcare programs and rehabilitation plans. The emphasis on quality healthcare services and technological innovation further supports market expansion.

U.K. Digital Hearing Aids Market Insight

The U.K. digital hearing aids market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing hearing impairment prevalence and the adoption of AI-enabled, smartphone-compatible devices. In addition, consumer awareness of the benefits of early diagnosis and intervention is encouraging both individuals and healthcare providers to adopt digital solutions. The U.K.’s robust retail and e-commerce infrastructure, alongside government programs supporting hearing care, is expected to continue stimulating market growth. The trend toward tele-audiology services and home-based fittings is further boosting adoption, particularly among tech-savvy and elderly users.

Germany Digital Hearing Aids Market Insight

The Germany digital hearing aids market is expected to expand at a considerable CAGR during the forecast period, fueled by a strong focus on healthcare innovation and rising awareness of hearing health. Germany’s advanced medical infrastructure and emphasis on high-quality healthcare solutions promote the adoption of technologically sophisticated hearing aids. Consumers increasingly prefer devices with AI-driven sound optimization, connectivity, and rechargeable batteries. Integration with smartphones, tele-audiology, and other assistive devices is also becoming more prevalent. The demand for privacy-focused, user-friendly solutions aligns with local expectations, supporting continued growth in residential, clinical, and commercial settings.

Asia-Pacific Digital Hearing Aids Market Insight

The Asia-Pacific digital hearing aids market is poised to grow at the fastest CAGR of 22% during the forecast period of 2026 to 2033, driven by rising aging populations, increasing awareness of hearing health, and expanding healthcare infrastructure in countries such as China, Japan, and India. The region’s growing adoption of telemedicine and digital healthcare solutions is driving the uptake of advanced hearing aids. Moreover, improving affordability of digital hearing aids due to local manufacturing and cost-effective distribution channels is expanding the consumer base. Government initiatives promoting geriatric health and early hearing intervention are further boosting adoption across residential, clinical, and assisted living sectors.

Japan Digital Hearing Aids Market Insight

The Japan digital hearing aids market is gaining momentum due to the country’s rapidly aging population, high technology adoption, and demand for convenient, connected hearing solutions. Japanese consumers prioritize advanced features such as AI-enabled sound processing, smartphone connectivity, and rechargeable devices. The market is supported by the integration of hearing aids with tele-audiology services and healthcare monitoring systems. Growth is also fueled by increasing awareness of hearing loss management and proactive hearing care. In addition, rising adoption in residential, clinical, and eldercare applications ensures steady expansion of the market.

India Digital Hearing Aids Market Insight

The India digital hearing aids market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s growing geriatric population, increasing urbanization, and rising disposable incomes. India is becoming a key market for digital hearing aids, with adoption expanding across residential, clinical, and institutional applications. Government programs promoting healthcare access, along with local manufacturing and affordable device options, are key factors propelling market growth. The increasing awareness about hearing health and availability of tele-audiology services further support widespread adoption. Rapid technological adoption among middle-class and tech-savvy consumers is enhancing the demand for advanced, connected hearing solutions.

Digital Hearing Aids Market Share

The Digital Hearing Aids industry is primarily led by well-established companies, including:

- GN Hearing A/S (Denmark)

- Sonova AG (Switzerland)

- Cochlear Ltd. (Australia)

- MED EL Medical Electronics (Austria)

- WS Audiology (Denmark)

- Starkey Hearing Technologies (U.S.)

- Bernafon AG (Switzerland)

- Unitron (Canada)

- Advanced Bionics LLC (U.S.)

- AudioNova International B.V. (Netherlands)

- Beltone Hearing Care, Inc. (U.S.)

- Interton A/S (Denmark)

- Danavox Hearing A/S (Denmark)

- Jabra Enhance (Denmark)

- Audio Service GmbH (Germany)

- Rexton Hearing Technologies, Inc. (U.S.)

- Audibene GmbH (Germany)

- A&M Hearing (Brazil)

- HearUSA, Inc. (U.S.)

- ShootBox, LLC (U.S.)

What are the Recent Developments in Global Digital Hearing Aids Market?

- In October 2025, Oticon unveiled the Oticon Zeal™, a revolutionary new completely‑in‑the‑ear hearing aid category powered by advanced BrainHearing™ AI technology, offering same‑day fitting, connectivity to digital ecosystems, and discreet, powerful sound processing. This launch expanded Oticon’s portfolio with a new form factor combining discretion with full functionality

- In June 2025, Cochlear launched the Nucleus® Nexa™ Smart Cochlear Implant System — the world’s first smart implant platform with enhanced wireless connectivity and streamlined clinical programming, marking a major milestone in implantable hearing technology. The approval and rollout of Nexa represent a significant expansion of next‑generation clinical hearing solutions

- In March 2025, Cochlear and GN expanded their Smart Hearing Alliance R&D partnership to accelerate development of integrated hearing solutions, focusing on artificial intelligence, deep neural networks, and improved connectivity between cochlear implants and hearing aids. The extended collaboration aims to enhance bimodal user experiences and connectivity with consumer devices via a unified app

- In February 2025, GN introduced its most intelligent hearing portfolio to date, including the launch of the ReSound Vivia the world’s smallest AI‑powered hearing aid featuring deep neural network sound processing for enhanced speech clarity and Bluetooth LE Audio connectivity. This breakthrough device combines advanced artificial intelligence with superior noise reduction and all‑day comfort while supporting Auracast broadcast audio for public venue streaming

- In August 2024, Sonova announced two new hearing aid platforms including the Phonak Audéo Sphere Infinio with real‑time AI that significantly improves speech understanding in noisy environments highlighting a major technological leap in hearing aid processing power and connectivity. This launch was described as the company’s biggest to date and set new benchmarks in AI‑driven sound performance

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.