Global Digital Isolator Market

Market Size in USD Million

CAGR :

%

USD

4.01 Million

USD

6.06 Million

2024

2032

USD

4.01 Million

USD

6.06 Million

2024

2032

| 2025 –2032 | |

| USD 4.01 Million | |

| USD 6.06 Million | |

|

|

|

|

Digital Isolator Market Size

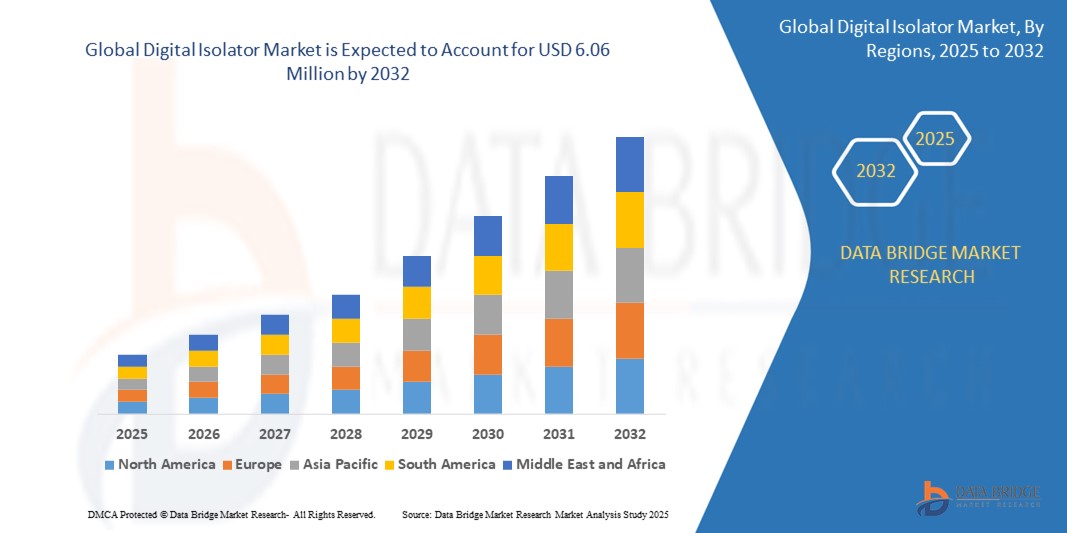

- The global digital isolator market size was valued at USD 4.01 million in 2024 and is expected to reach USD 6.06 million by 2032, at a CAGR of 5.30% during the forecast period

- This growth is driven by rising demand for noise-free electronics and increased signal precision

Digital Isolator Market Analysis

- Digital isolators are revolutionizing high-speed data transmission by offering superior electrical isolation, higher reliability, and better performance compared to traditional optocouplers, ensuring safe and efficient operation in critical applications

- The growing demand for digital isolators is fueled by the rapid expansion of electric vehicles (EVs), advancements in industrial automation, rising need for galvanic isolation in medical devices, and increasing focus on power efficiency and miniaturization

- Asia-Pacific is expected to dominate the digital isolator market with the largest market share of 31.41%, driven by the rapid growth of industrial automation, expansion of automotive electronics, and the increasing adoption of high-speed communication technologies

- North America is expected to witness the fastest growth in the digital isolator market, driven by the rising demand for high-speed data communication, advancements in automotive electronics, and the widespread adoption of Industry 4.0 technologies across the U.S. and Canada

- The above 75 Mbps segment is expected to dominate the market with the market share of 34.25% as it enables fast data transfer and greater electromagnetic interference (EMI) immunity in applications such as electric vehicle (EV) powertrains, high-speed serial buses, and high-frequency switching power supplies, supporting high-speed data communication, automotive electronics, and advanced industrial equipment

Report Scope and Digital Isolator Market Segmentation

|

Attributes |

Digital Isolator Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis |

Digital Isolator Market Trends

“Emergence of High-Voltage Isolation Solutions for EV and Industrial Applications”

- A rising trend in the digital isolator market is the growing demand for high-voltage isolation solutions, particularly for electric vehicles (EVs), renewable energy systems, and industrial automation equipment

- Manufacturers are focusing on developing digital isolators with higher working voltages, enhanced creepage and clearance distances, and reinforced isolation ratings to meet strict industry safety standards

- This trend is accelerating as industries require reliable isolation for high-voltage power converters, motor drives, and battery management systems

- For instance, in June 2024, Analog Devices introduced a new portfolio of high-voltage digital isolators specifically designed for EV battery management and industrial automation applications

- The adoption of high-voltage isolation is expected to drive innovation and performance improvements in next-generation EVs, renewable energy systems, and critical industrial applications

Digital Isolator Market Dynamics

Driver

“Growth of Industrial Automation and Industry 4.0 Initiatives”

- The global shift toward smart factories, IoT-enabled production lines, and real-time data-driven operations is increasing the demand for robust and reliable isolation solutions

- Digital isolators provide critical protection for sensitive communication interfaces across noisy industrial environments, enabling safe and high-speed data transmission

- The rise of Industry 4.0 is pushing manufacturers to adopt more advanced isolators that ensure operational continuity and safeguard critical systems

- For instance, in 2023, Siemens expanded its digital factory offerings by integrating high-speed digital isolators into its new industrial automation systems for enhanced signal integrity

- This driver is expected to fuel consistent demand for digital isolators across the manufacturing and industrial sectors worldwide

Opportunity

“Increasing Demand for Compact and Energy-Efficient Isolation Solutions”

- As devices become smaller and more energy-conscious, there is a rising opportunity for manufacturers to develop compact, low-power digital isolators that deliver high performance without compromising safety

- Miniaturization trends in medical devices, automotive electronics, and consumer gadgets are creating strong market pull for space-saving and energy-efficient isolation components

- Companies are innovating with silicon carbide (SiC) and gallium nitride (GaN) technologies to meet these demands, offering isolators with higher efficiency and lower thermal loads

- For instance, in 2024, Skyworks Solutions launched a new range of ultra-compact digital isolators tailored for wearables and automotive systems, reducing device footprint by 30%

- The drive toward compact, energy-efficient systems presents a significant growth avenue for isolator manufacturers aiming to differentiate themselves in competitive markets

Restraint/Challenge

“Cost Constraints and Price Sensitivity in Emerging Markets”

- A key challenge for the digital isolator market is the price sensitivity in emerging economies, where cost constraints often lead OEMs to opt for cheaper, legacy alternatives such as opt couplers

- Advanced digital isolators offer superior performance but come at a premium, which can deter adoption in highly cost-competitive segments such as basic consumer electronics and low-end automotive systems

- Balancing high performance with affordability remains a critical hurdle for manufacturers trying to penetrate mass-market applications in price-sensitive regions

- For instance, a 2023 market survey by Frost & Sullivan highlighted that over 45% of electronics manufacturers in Southeast Asia preferred lower-cost opt couplers over digital isolators due to budget limitations

- Addressing cost concerns through scaled manufacturing, localized production, and value-based marketing will be essential for expanding digital isolator adoption in emerging markets

Digital Isolator Market Scope

The market is segmented on the basis of technology, insulating material, data rate, channel type, and industry vertical.

|

Segmentation |

Sub-Segmentation |

|

By Technology |

|

|

By Insulating Material |

|

|

By Data Rate |

|

|

By Channel Type |

|

|

By Industry Vertical |

|

In 2025, the 75 Mbps is projected to dominate the market with a largest share in data rate segment

The above 75 Mbps segment is expected to dominate the digital isolator market with the largest market share of 34.25% in 2025 as it enables fast data transfer and greater electromagnetic interference (EMI) immunity in applications such as electric vehicle (EV) powertrains, high-speed serial buses, and high-frequency switching power supplies, supporting high-speed data communication, automotive electronics, and advanced industrial equipment.

The channel 6 is expected to account for the largest share during the forecast period in channel type segment

In 2025, the Channel 6 segment is expected to dominate the market with the largest market share of 28.11% due to its extensive use in industrial automation, power electronics, and automotive applications, where isolation of multiple signal paths is required.

Digital Isolator Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Digital Isolator Market”

- Asia-Pacific is expected to dominate the digital isolator market with the largest market share of 31.41%, driven by the rapid growth of industrial automation, expansion of automotive electronics, and the increasing adoption of high-speed communication technologies

- China dominates the region’s growth, supported by strong manufacturing capabilities, rising investments in electric vehicles (EVs), and government initiatives promoting industrial modernization

- The region benefits from a surge in demand for robust and EMI-resistant components across industries such as automotive, power electronics, telecommunications, and consumer electronics

“North America is projected to register the Highest CAGR in the Digital Isolator Market”

- North America is expected to witness the fastest growth in the digital isolator market, driven by the rising demand for high-speed data communication, advancements in automotive electronics, and the widespread adoption of Industry 4.0 technologies across the U.S. and Canada

- Supportive initiatives such as government incentives for electric vehicles, increased investments in smart manufacturing, and strong R&D activities in semiconductor technologies are propelling market expansion

- The growing focus on enhancing electromagnetic interference (EMI) immunity in critical applications, along with the presence of major technology players and startups, is accelerating innovation and adoption of digital isolators in the region

- This strong momentum positions North America as a major growth engine for the global digital isolator market, offering significant opportunities for manufacturers, technology developers, and investors focused on advanced electronic solutions

Digital Isolator Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Texas Instruments Incorporated (U.S.)

- Infineon Technologies AG (Germany)

- Broadcom (U.S.)

- Renesas Electronics Corporation (Japan)

- TT Electronics (U.K.)

- Amphenol Corporation (U.S.)

- Littelfuse, Inc. (U.S.)

- MORNSUN Guangzhou Science & Technology Co. Ltd.

- Analog Devices, Inc. (U.S.)

- NVE Corporation (U.S.)

- Vicor Corporation (U.S.)

- Murata Manufacturing Co., Ltd. (Japan)

- TE Connectivity (Switzerland)

- NXP Semiconductors (Netherlands)

- Monolithic Power Systems, Inc. (U.S.)

- Skyworks Solutions, Inc. (U.S.)

- ROHM CO., LTD. (Japan)

- STMicroelectronics (Switzerland)

- Semiconductor Components Industries, LLC (Onsemi)

- Advantech Co., Ltd. (Taiwan)

- Microchip Technology Inc. (U.S.)

- Kinetic Technologies (U.S.)

Latest Developments in Global Digital Isolator Market

- In May 2022, Texas Instruments Incorporated launched a new portfolio of solid-state relays to enhance the safety of electric vehicles (EVs), strengthening its focus on automotive electronics innovation

- In February 2022, Texas Instruments Inc. introduced the AMC23C1x digital isolator series, including AMC23C12, AMC23C11, and AMC23C14, featuring isolated comparators with fast response times, further expanding its industrial and automotive offerings

- In January 2022, Analog Devices Inc. unveiled the ADUM4165 isolated USB transceiver using iCoupler technology, supporting USB 2.0 ports with data rates from 1.5 to 480 Mbps, reinforcing its leadership in high-speed connectivity solutions

- In November 2021, Infineon Technologies AG, a Germany-based electronic component manufacturer, acquired Syntronixs Asia, a key semiconductor component service provider, broadening its global production capabilities

- In August 2021, Analog Devices Inc. completed the acquisition of Maxim Integrated Products Inc., a major U.S. analog and mixed-signal IC manufacturer, strengthening its position as a leading supplier in the semiconductor isolator market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.