Global Drive Systems Market

Market Size in USD Billion

CAGR :

%

USD

46.76 Billion

USD

78.86 Billion

2025

2033

USD

46.76 Billion

USD

78.86 Billion

2025

2033

| 2026 –2033 | |

| USD 46.76 Billion | |

| USD 78.86 Billion | |

|

|

|

|

Drive Systems Market Size

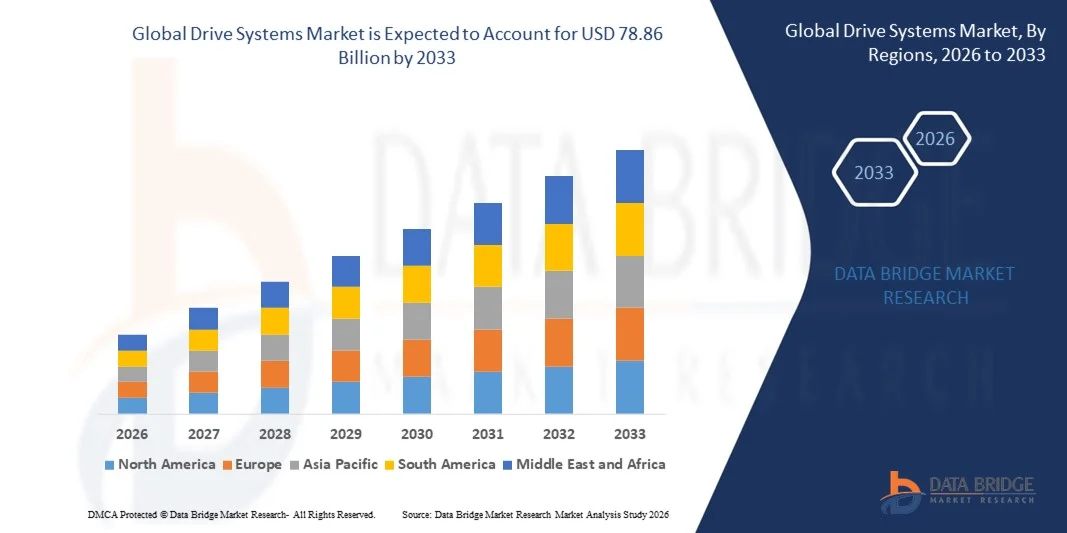

- The global drive systems market size was valued at USD 46.76 billion in 2025 and is expected to reach USD 78.86 billion by 2033, at a CAGR of 6.75% during the forecast period

- The market growth is largely fueled by increasing adoption of advanced automotive technologies and innovations in drive systems, leading to enhanced vehicle performance, fuel efficiency, and safety across both passenger and commercial vehicles

- Furthermore, rising consumer preference for vehicles offering improved handling, traction, and driving comfort is establishing advanced drive systems, including automatic and AWD solutions, as the preferred choice for modern mobility. These converging factors are accelerating the adoption of sophisticated drive systems, thereby significantly boosting the industry's growth

Drive Systems Market Analysis

- Drive systems, which manage the transmission of power from the engine to the wheels, are increasingly vital components in both passenger and commercial vehicles due to their impact on performance, fuel economy, and driving experience

- The escalating demand for drive systems is primarily fueled by growing vehicle sales, technological advancements such as CVT, dual-clutch, and integrated electric drive modules, and a rising preference for vehicles offering enhanced safety, control, and operational efficiency

- North America dominated the drive systems market with a share of over 40% in 2025, due to the presence of leading automotive manufacturers, strong adoption of advanced vehicle technologies, and increasing consumer preference for high-performance vehicles

- Asia-Pacific is expected to be the fastest growing region in the drive systems market during the forecast period due to rising urbanization, growing vehicle ownership, and increasing adoption of advanced drive technologies in countries such as China, Japan, and India

- Passenger vehicle segment dominated the market with a market share of 68.5% in 2025, due to the high adoption of modern vehicles equipped with advanced drive technologies. Consumers increasingly prioritize comfort, safety, and performance, which drives the integration of sophisticated drive systems in passenger cars

Report Scope and Drive Systems Market Segmentation

|

Attributes |

Drive Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Drive Systems Market Trends

Growing Integration of Energy-Efficient and Smart Drive Technologies

- A key trend in the drive systems market is the increasing integration of energy-efficient motors, variable frequency drives (VFDs), and smart drive technologies across industrial, automotive, and robotics applications. This integration enhances operational efficiency, reduces energy consumption, and enables precise control of machinery across diverse sectors

- For instance, Siemens and ABB offer advanced VFDs and smart drive solutions that are widely adopted in manufacturing plants and automation systems to optimize motor performance and reduce energy usage. These technologies provide adaptive control, predictive maintenance capabilities, and seamless integration with industrial IoT platforms

- The automotive industry is increasingly adopting electric drive systems in hybrid and electric vehicles where applications such as traction motors and regenerative braking require highly efficient and compact drive solutions. This is accelerating the transition toward sustainable mobility and low-emission transport solutions

- Industrial automation is leveraging smart drives for precise motion control in robotic arms, conveyor systems, and packaging machinery. Drive systems equipped with real-time monitoring and adaptive control functions improve productivity, reduce downtime, and support scalable automation solutions

- The energy sector is deploying advanced drive technologies in renewable energy systems, including wind turbines and solar trackers, where efficient torque management and speed control are critical for maximizing power output. This trend strengthens the adoption of intelligent drive solutions that enhance reliability and energy yield

- The market is witnessing growing demand for integration of drives with cloud-based analytics, AI-driven predictive maintenance, and digital twin technologies. This is positioning drive systems as essential enablers of Industry 4.0 transformation and smart manufacturing initiatives

Drive Systems Market Dynamics

Driver

Rising Demand for Industrial Automation and Robotics

- The growing need for automated production processes and robotic systems in manufacturing, logistics, and material handling is driving demand for sophisticated drive systems capable of precise and reliable performance. These systems enable faster production cycles, reduced labor costs, and enhanced operational efficiency

- For instance, Rockwell Automation provides integrated drive solutions for robotics and conveyor systems that help manufacturers achieve higher throughput and improved accuracy. Their smart drives facilitate predictive maintenance, reduce energy consumption, and support scalable automation deployments

- The expansion of e-commerce and warehousing operations is accelerating adoption of automated guided vehicles (AGVs) and robotic material handling systems, which rely on high-performance drives for smooth operation and precise motion control

- Industrial sectors are increasingly implementing collaborative robots (cobots) that require compact, energy-efficient drive systems to work safely alongside humans. This growing automation trend is reinforcing the demand for versatile drive technologies

- Continuous modernization of manufacturing facilities to enhance productivity, maintain competitiveness, and reduce operational costs is further contributing to the market growth. Advanced drive systems are becoming indispensable components in these industrial upgrades

Restraint/Challenge

High Initial Investment and Maintenance Costs

- The drive systems market faces challenges due to the high capital expenditure required for acquiring and installing advanced motors, VFDs, and smart drive solutions. These costs can be prohibitive for small and medium-sized enterprises and can slow adoption in price-sensitive industries

- For instance, Mitsubishi Electric’s high-performance drive systems involve substantial upfront investment, which can limit adoption among smaller manufacturers seeking cost-effective automation solutions. Maintenance, calibration, and specialized training requirements further add to operational expenses

- The complexity of integrating drives with existing industrial equipment and IT systems requires skilled personnel and specialized services, which increases ongoing costs and resource dependency

- High-performance drives often demand periodic software updates, component replacements, and preventative maintenance to ensure optimal efficiency and reliability. These recurring costs present a significant barrier for widespread deployment

- The market continues to encounter challenges in balancing technological sophistication with affordability, as companies must optimize investments while achieving performance and energy efficiency goals. These constraints collectively influence the pace of adoption and market growth

Drive Systems Market Scope

The market is segmented on the basis of operation, vehicle type, and type.

- By Operation

On the basis of operation, the drive systems market is segmented into automatic and manual. The automatic segment dominated the market with the largest market revenue share in 2025, driven by increasing consumer preference for convenience, comfort, and reduced driving fatigue. Automatic drive systems are widely adopted in passenger vehicles due to their ease of use in congested urban traffic conditions. In addition, technological advancements in automatic transmissions, such as continuously variable transmissions (CVT) and dual-clutch systems, have improved fuel efficiency and driving performance, further strengthening their market position.

The manual segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by demand in emerging economies where cost-effectiveness and lower maintenance requirements remain key considerations. Manual drive systems are often preferred in commercial vehicles for their robustness and reliability under heavy-duty operating conditions. Automotive manufacturers continue to innovate in manual transmission designs to enhance efficiency and durability, making them increasingly attractive for price-sensitive markets.

- By Vehicle Type

On the basis of vehicle type, the drive systems market is segmented into passenger vehicles and commercial vehicles. The passenger vehicle segment dominated the market with the largest share of 68.5% in 2025, owing to the high adoption of modern vehicles equipped with advanced drive technologies. Consumers increasingly prioritize comfort, safety, and performance, which drives the integration of sophisticated drive systems in passenger cars. The expansion of urban mobility solutions and growing middle-class vehicle ownership in regions such as North America and Europe further reinforce the dominance of passenger vehicles.

The commercial vehicle segment is expected to witness the fastest growth from 2026 to 2033, driven by rising investments in logistics, goods transportation, and fleet modernization. For instance, Volvo Trucks is integrating advanced drive systems to improve fuel efficiency and payload handling. Growing demand for durable and efficient drive systems in commercial vehicles ensures enhanced operational efficiency and reduced total cost of ownership, particularly in emerging markets with expanding infrastructure networks.

- By Type

On the basis of type, the drive systems market is segmented into rear-wheel drive (RWD), all-wheel drive (AWD), and others. The RWD segment dominated the market in 2025, supported by its established performance advantage in high-torque applications and widespread use in premium and performance vehicles. Automotive enthusiasts and commercial vehicle operators often prefer RWD systems for their balance, handling, and stability during heavy load operations. The compatibility of RWD with various powertrains and its robust mechanical design contribute to sustained market preference.

The AWD segment is projected to witness the fastest growth from 2026 to 2033, fueled by increasing consumer demand for enhanced traction, stability, and safety in adverse driving conditions. For instance, Subaru has seen significant sales growth in AWD vehicles due to their superior performance in snow and off-road conditions. AWD systems are increasingly integrated into passenger SUVs and crossovers, reflecting a global shift toward all-terrain mobility and improved vehicle control, particularly in regions experiencing challenging weather and road conditions.

Drive Systems Market Regional Analysis

- North America dominated the drive systems market with the largest revenue share of over 40% in 2025, driven by the presence of leading automotive manufacturers, strong adoption of advanced vehicle technologies, and increasing consumer preference for high-performance vehicles

- Consumers in the region highly value enhanced fuel efficiency, driving comfort, and superior traction offered by modern drive systems such as AWD and automatic transmissions

- This widespread adoption is further supported by high disposable incomes, technological awareness, and the demand for vehicles optimized for safety and convenience, establishing advanced drive systems as a preferred choice across passenger and commercial vehicles

U.S. Drive Systems Market Insight

The U.S. drive systems market captured the largest revenue share in 2025 within North America, fueled by strong demand for automatic and AWD systems in passenger and commercial vehicles. Consumers are increasingly prioritizing enhanced handling, fuel efficiency, and safety features in vehicles. The rising trend of connected and autonomous vehicles, along with investments in performance-enhancing drive technologies, further propels market growth. Moreover, the integration of smart transmission systems and traction control technologies is significantly contributing to the adoption of advanced drive systems across the country.

Europe Drive Systems Market Insight

The Europe drive systems market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent emission regulations and a rising focus on vehicle performance and safety. The increasing adoption of automatic and AWD systems in passenger vehicles and light commercial vehicles is fostering market growth. European consumers are also drawn to the comfort, efficiency, and technological sophistication these drive systems offer. The region is witnessing significant adoption across Germany, France, and Italy, with advanced drive technologies incorporated into both new vehicles and retrofit solutions.

U.K. Drive Systems Market Insight

The U.K. drive systems market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising trend of performance-oriented vehicles and a growing preference for safer, fuel-efficient drive systems. In addition, urbanization and traffic congestion are encouraging the adoption of automatic and AWD solutions for ease of driving and better vehicle control. The U.K.’s strong automotive R&D infrastructure and consumer inclination toward technologically advanced vehicles are expected to sustain market growth.

Germany Drive Systems Market Insight

The Germany drive systems market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of fuel efficiency, vehicle safety, and technological innovation. Germany’s well-established automotive industry, coupled with high consumer standards for vehicle performance, promotes the adoption of automatic and AWD systems in passenger and commercial vehicles. The integration of advanced drive systems with electric and hybrid powertrains is also becoming increasingly prevalent, reflecting local preferences for sustainable and high-performance mobility solutions.

Asia-Pacific Drive Systems Market Insight

The Asia-Pacific drive systems market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rising urbanization, growing vehicle ownership, and increasing adoption of advanced drive technologies in countries such as China, Japan, and India. The region's emerging middle class, government incentives for fuel-efficient and safer vehicles, and rapid growth of automotive manufacturing are driving demand. Furthermore, as APAC becomes a hub for automotive innovation and component manufacturing, the affordability and accessibility of vehicles equipped with advanced drive systems are expanding to a wider consumer base.

Japan Drive Systems Market Insight

The Japan drive systems market is gaining momentum due to the country’s high technological adoption, urbanization, and emphasis on vehicle safety and efficiency. Japanese consumers value vehicles with advanced automatic and AWD systems for convenience, reliability, and superior traction in diverse driving conditions. The integration of drive systems with hybrid and electric vehicles, along with a focus on reducing driver fatigue, is fueling growth. Moreover, Japan’s aging population is expected to increase demand for user-friendly and safe drive technologies in both passenger and commercial vehicles.

China Drive Systems Market Insight

The China drive systems market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, expanding middle-class vehicle ownership, and strong adoption of automatic and AWD systems. China is one of the largest automotive markets globally, with growing consumer preference for enhanced vehicle performance, safety, and comfort. Government initiatives supporting electric vehicles and smart mobility, coupled with local manufacturing capabilities, are key factors propelling the adoption of advanced drive systems across passenger and commercial segments.

Drive Systems Market Share

The drive systems industry is primarily led by well-established companies, including:

- Aker Solutions (Norway)

- Schlumberger Limited (U.S.)

- NOV Inc. (U.S.)

- AXON Pressure Products, Inc. (U.S.)

- Triten Corporation (U.S.)

- ESTec Oilfield Inc. (U.S.)

- Nabors Industries Ltd (U.S.)

- Jereh Group (China)

- Bournedrill Pty Ltd (Australia)

- Command Drilling Technologies Ltd (Canada)

- Petro Rigs, Inc. (U.S.)

- SKF (Sweden)

Latest Developments in Global Drive Systems Market

- In November 2025, Magna International Inc. opened a new electric drive systems production facility in Wuhu, China, marking a major step in localizing EV powertrain manufacturing to meet surging demand in the world’s largest new‑energy vehicle market. This expansion enhances Magna’s ability to supply scalable high‑performance eDrive modules for battery electric vehicles, shortening logistics lead times and reducing cost pressures for OEMs, while reinforcing its competitive foothold in Asia’s electrified mobility landscape

- In October 2025, BorgWarner Inc. secured multiple contracts to supply advanced AWD technologies, including its torque‑on‑demand transfer case and Generation VI Cross Wheel Drive system, to Chery for upcoming pickup and SUV models. This agreement positions BorgWarner to play a central role in enhancing vehicle traction, efficiency, and off‑road performance, supporting Chery’s domestic and global growth while driving broader adoption of sophisticated drive systems in mainstream models

- In January 2025, Stellantis took full control of its joint venture with Punch Powertrain that produces eDCT (electrified dual‑clutch transmission) units, strengthening its in‑house hybrid powertrain capabilities. By internalizing design and production of these transmissions, Stellantis aims to accelerate deployment of hybrid and plug‑in hybrid drive systems across its vehicle portfolio, improving efficiency and emissions performance while reducing dependency on external partners

- In February 2025, Magna International Inc. expanded its long‑term innovation partnership with Mercedes‑Benz by equipping the automaker’s new electric off‑road model with the eDS Duo electric drive system. This collaboration underscores how advanced electric drive technologies are now central to premium vehicle performance and off‑road capability, signaling a shift in market expectations toward more versatile and efficient propulsion systems

- In July 2025, ZF Friedrichshafen AG showcased its latest chassis and by‑wire technologies, including steer‑by‑wire and brake‑by‑wire systems slated for production from 2026, alongside contracts from major automakers for these digital drive‑control systems. These developments reflect a broader industry trend toward replacing mechanical linkages with electronic control architectures, which improve vehicle dynamics, reduce weight, and enable new levels of automation and customization in drive systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.