Global Drone Sensor Market

Market Size in USD Billion

CAGR :

%

USD

1.46 Billion

USD

8.77 Billion

2025

2033

USD

1.46 Billion

USD

8.77 Billion

2025

2033

| 2026 –2033 | |

| USD 1.46 Billion | |

| USD 8.77 Billion | |

|

|

|

|

What is the Global Drone Sensor Market Size and Growth Rate?

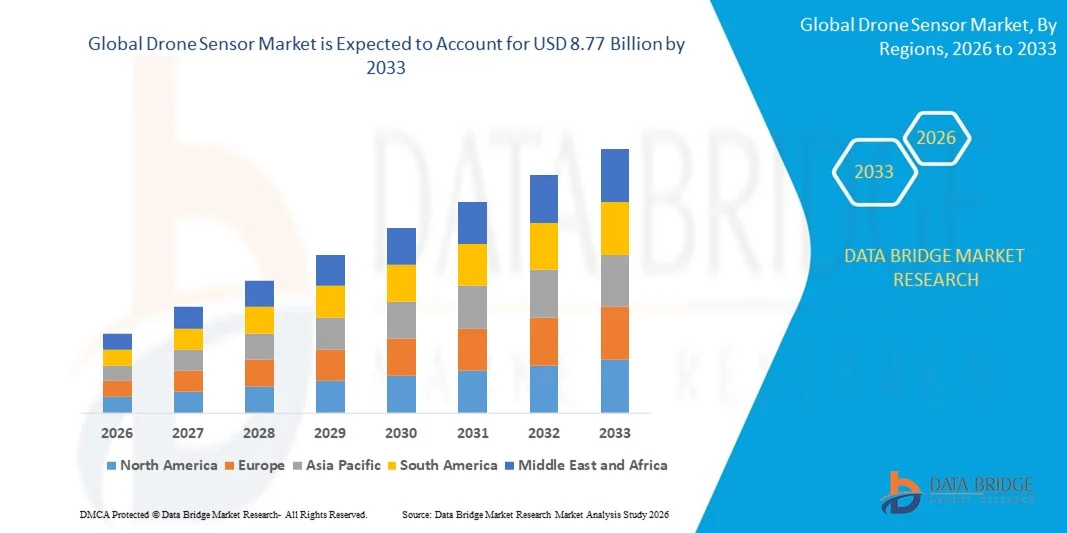

- The global drone sensor market size was valued at USD 1.46 billion in 2025 and is expected to reach USD 8.77 billion by 2033, at a CAGR of25.10% during the forecast period

- The increasing demand for drones for mapping, precise positing and high resolution imaging has been directly influencing the growth of drone sensor market

- Also high adoption of drones in agriculture sector for crop growth analysis is also flourishing the growth of the drone sensor market

What are the Major Takeaways of Drone Sensor Market?

- The drones are also largely used in defense sector for intelligence gathering, monitoring, surveillance, search and rescue operations along with and various other purposes, associated with rising military budget particularly in developing countries are also positively impacting the growth of the market

- Furthermore, the growing adoption of drone for media, integration of redundancies as failsafe and growing demand for drones for payload delivery are also largely lifting the growth of the drone sensor market

- North America dominated the Drone Sensor market with a 37.19% revenue share in 2025, driven by strong investments in UAV technology, autonomous systems, aerospace electronics, and defense R&D across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 8.24% from 2026 to 2033, fueled by rapid growth in drone manufacturing, UAV deployments, 5G connectivity, and autonomous applications across China, Japan, India, South Korea, and Southeast Asia

- The Inertial Sensor segment dominated the market with a 38.7% share in 2025, owing to its critical role in flight stabilization, navigation, orientation, and motion tracking

Report Scope and Drone Sensor Market Segmentation

|

Attributes |

Drone Sensor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Drone Sensor Market?

Increasing Shift Toward High-Precision, Lightweight, and AI-Integrated Drone Sensors

- The drone sensor market is witnessing strong adoption of miniaturized, lightweight, and high-accuracy sensors designed to support real-time navigation, obstacle detection, imaging, and environmental monitoring

- Manufacturers are introducing multi-sensor fusion solutions, integrating IMUs, LiDAR, cameras, GPS, and environmental sensors to enhance flight stability, autonomy, and situational awareness

- Growing demand for compact, low-power, and high-resolution sensors is driving deployment across commercial, defense, agriculture, surveying, and industrial inspection drones

- For instance, companies such as Bosch Sensortec, Sony Semiconductor Solutions, TE Connectivity, Infineon Technologies, and Velodyne LiDAR are advancing sensor performance through improved accuracy, faster response times, and AI-ready architectures

- Increasing need for autonomous flight, precision mapping, and real-time data processing is accelerating the shift toward smart, AI-enabled drone sensors

- As drones become more autonomous and mission-critical, advanced sensor technologies will remain essential for safety, reliability, and performance optimization

What are the Key Drivers of Drone Sensor Market?

- Rising demand for high-performance sensors to enable navigation, collision avoidance, imaging, and payload stabilization in drones

- For instance, in 2025, leading sensor manufacturers expanded their drone-specific portfolios with higher-resolution cameras, improved IMUs, and long-range LiDAR solutions

- Growing adoption of drones in defense, agriculture, infrastructure inspection, logistics, and surveillance is boosting demand across North America, Europe, and Asia-Pacific

- Advancements in MEMS technology, AI processing, edge computing, and sensor miniaturization have strengthened accuracy, power efficiency, and real-time performance

- Rising integration of AI algorithms, computer vision, and autonomous navigation systems is creating demand for multi-modal, high-density sensor architectures

- Supported by increasing investments in drone R&D, smart sensing technologies, and autonomous systems, the Drone Sensor market is expected to witness robust long-term growth

Which Factor is Challenging the Growth of the Drone Sensor Market?

- High costs associated with advanced sensors, including LiDAR, thermal imaging, and high-resolution vision systems, restrict adoption among small drone manufacturers and hobbyists

- For instance, during 2024–2025, semiconductor shortages, rising raw material prices, and supply chain disruptions increased sensor production costs for several global vendors

- Complexity in sensor calibration, integration, and data fusion increases development time and requires skilled engineering expertise

- Regulatory restrictions and varying compliance standards across regions limit rapid deployment of advanced drone sensor systems

- Competition from low-cost, lower-accuracy sensors creates pricing pressure and impacts differentiation for premium sensor providers

- To address these challenges, companies are focusing on cost-efficient sensor designs, AI-driven calibration, modular architectures, and scalable manufacturing to expand global adoption of Drone Sensors

How is the Drone Sensor Market Segmented?

The market is segmented on the basis of channel count, application, and vertical.

- By Sensor Type

On the basis of sensor type, the drone sensor market is segmented into Inertial Sensors, Image Sensors, Speed and Distance Sensors, Position Sensors, Pressure Sensors, Light Sensors, Ultrasonic Sensors, Current Sensors, Altimeter Sensors, and Others. The Inertial Sensor segment dominated the market with a 38.7% share in 2025, owing to its critical role in flight stabilization, navigation, orientation, and motion tracking. Inertial sensors, including IMUs, gyroscopes, and accelerometers, are essential components in all drone platforms, ensuring precise control and reliable performance. Their compact size, low power consumption, and continuous accuracy drive widespread adoption.

The Image Sensor segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for high-resolution imaging in aerial photography, mapping, surveillance, and inspection. Increasing integration of AI-based vision systems further accelerates growth.

- By Platform Type

Based on platform type, the drone sensor market is segmented into Vertical Take-Off and Landing (VTOL) Platforms, Fixed-Wing Platforms, and Hybrid Platforms. The VTOL Platform segment dominated the market with a 46.2% share in 2025, supported by extensive use of multi-rotor drones across commercial, consumer, and defense applications. VTOL drones offer superior maneuverability, hovering capability, and ease of deployment in confined environments, increasing sensor integration density.

The Hybrid Platform segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by growing adoption in long-range surveillance, logistics, and mapping applications. Hybrid platforms combine VTOL flexibility with fixed-wing endurance, requiring advanced sensor suites for navigation, stability, and mission execution.

- By Application

On the basis of application, the drone sensor market is segmented into Collision Detection and Avoidance, Data Acquisition, Motion Detection, Air Pressure Measurement, Power Monitoring, and Others. The Collision Detection and Avoidance segment dominated the market with a 33.9% share in 2025, as safe navigation and obstacle avoidance are critical for both autonomous and semi-autonomous drone operations. Integration of LiDAR, ultrasonic, vision, and radar sensors supports real-time threat detection and flight safety.

The Data Acquisition segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing use of drones for surveying, mapping, environmental monitoring, and infrastructure inspection. High-precision sensors enable accurate data capture, supporting commercial and industrial growth.

- By End User

Based on end user, the drone sensor market is segmented into Construction, Media and Entertainment, Agriculture, Personal, Security and Surveillance, Defense, Law Enforcement, Transportation, and Others. The Defense segment dominated the market with a 29.8% share in 2025, driven by extensive use of drones for reconnaissance, intelligence, surveillance, and tactical operations. Advanced sensor systems are essential for mission accuracy, reliability, and situational awareness.

The Agriculture segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by rising adoption of precision agriculture, crop monitoring, and yield optimization solutions. Increasing use of imaging, environmental, and positioning sensors supports strong growth in agricultural drone deployments.

Which Region Holds the Largest Share of the Drone Sensor Market?

- North America dominated the Drone Sensor market with a 37.19% revenue share in 2025, driven by strong investments in UAV technology, autonomous systems, aerospace electronics, and defense R&D across the U.S. and Canada. High adoption of MEMS sensors, LiDAR, vision systems, and embedded navigation solutions continues to fuel demand for Drone Sensors in industrial, defense, commercial, and academic applications

- Leading companies in North America are introducing high-resolution, multi-modal sensors, AI-enabled navigation modules, and smart sensor fusion systems, strengthening the region’s technological edge. Continuous investment in autonomous drones, precision agriculture, and aerial surveying drives long-term market expansion

- Strong engineering talent concentration, advanced manufacturing infrastructure, and robust innovation ecosystems further reinforce regional market leadership

U.S. Drone Sensor Market Insight

The U.S. is the largest contributor in North America, supported by defense programs, commercial drone adoption, and rapid development of high-performance sensor technologies. Rising integration of LiDAR, IMU, and imaging sensors in autonomous platforms intensifies demand for drones capable of precise navigation, collision avoidance, and environmental sensing. Presence of major sensor manufacturers, strong startup ecosystems, and advanced UAV testing infrastructure further boosts growth.

Canada Drone Sensor Market Insight

Canada contributes significantly to regional growth, driven by expanding UAV testing facilities, aerospace R&D clusters, and smart agriculture initiatives. Universities and engineering labs increasingly utilize drones equipped with altimeters, position, and environmental sensors for research, mapping, and precision applications. Government-backed innovation programs and skilled workforce availability strengthen regional adoption.

Asia-Pacific Drone Sensor Market

Asia-Pacific is projected to register the fastest CAGR of 8.24% from 2026 to 2033, fueled by rapid growth in drone manufacturing, UAV deployments, 5G connectivity, and autonomous applications across China, Japan, India, South Korea, and Southeast Asia. Rising adoption in commercial, defense, agriculture, and industrial sectors increases demand for high-accuracy IMU, LiDAR, and vision sensors.

China Drone Sensor Market Insight

China is the largest contributor to Asia-Pacific due to massive drone production capacity, government-supported UAV programs, and semiconductor investments. Development of autonomous systems, AI-enabled navigation, and high-resolution imaging drives demand for advanced Drone Sensors. Local manufacturing and competitive pricing expand adoption domestically and for export.

Japan Drone Sensor Market Insight

Japan shows steady growth, supported by precision electronics manufacturing, advanced telecom infrastructure, and UAV innovation programs. Strong focus on quality and reliability drives adoption of premium sensors for industrial inspection, autonomous drones, and robotics applications.

India Drone Sensor Market Insight

India is emerging as a major growth hub, driven by UAV startups, defense drone programs, and government-backed electronics manufacturing initiatives. Increasing demand for embedded sensors, imaging systems, and navigation modules fuels adoption in commercial, agricultural, and research applications.

South Korea Drone Sensor Market Insight

South Korea contributes significantly due to high demand for AI-enabled drones, smart city monitoring, and autonomous UAVs. Strong sensor R&D, display technologies, and high-performance electronics development support sustained market growth for advanced Drone Sensors with high accuracy and multi-modal capabilities.

Which are the Top Companies in Drone Sensor Market?

The drone sensor industry is primarily led by well-established companies, including:

- TE Connectivity (Switzerland)

- Raytheon Company (U.S.)

- Bosch Sensortec GmbH (Germany)

- Sony Semiconductor Solutions Corporation (Japan)

- Infineon Technologies AG (Germany)

- Trimble Inc. (U.S.)

- Parker Hannifin Corp (U.S.)

- InvenSense (U.S.)

- Sparton (U.S.)

- FLIR Systems, Inc. (U.S.)

- Velodyne Lidar, Inc. (U.S.)

- KVH Industries, Inc. (U.S.)

- SBG Systems (France)

- Ainstein (U.S.)

- SlantRange, Inc. (U.S.)

- Sensirion AG (Switzerland)

- Sentera, Inc. (U.S.)

- YOST LABS (U.S.)

- LeddarTech Inc. (Canada)

- ams AG (Austria)

What are the Recent Developments in Global Drone Sensor Market?

- In June 2025, Ouster received approval from the U.S. Department of Defense for its OS1 digital LiDAR sensor under the Blue UAS framework, enabling its integration into military drone programs, and this approval is expected to accelerate adoption of high-performance LiDAR sensors in defense UAVs

- In April 2024, InvenSense, a TDK subsidiary, announced the availability of its SmartSonic ICU-10201 ultrasonic time-of-flight sensor with integrated on-chip processing, enhancing energy-efficient IoT and robotics applications through precise obstacle avoidance and proximity sensing, applicable to drones, robotics, and vacuum cleaners, and this launch highlights growing market demand for versatile and compact sensors

- In January 2024, Bosch Sensortec GmbH launched the BMA580 and BMA530, recognized as the world’s smallest accelerometers, enabling advanced features in ultra-compact IoT and robotics devices, and this development underscores Bosch’s commitment to miniaturized high-performance sensor solutions that drive innovation

- In June 2023, RTX Corporation was awarded a USD 118 million contract by the U.S. Army to upgrade the sensor payload of MQ-1C Gray Eagle unmanned aircraft systems, improving surveillance and reconnaissance capabilities, and this contract demonstrates the strategic importance of advanced drone sensors in military applications

- In February 2023, Teledyne FLIR Defense received a USD 13 million contract from the U.S. Department of Defense to upgrade its R80D SkyRaider unmanned aerial system, developing prototype chemical and radiological detection sensor payloads and integrating existing Army detectors, and this project highlights the increasing reliance on sophisticated drone sensors in defense operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Drone Sensor Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Drone Sensor Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Drone Sensor Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.