Global Edge Banding Materials Market

Market Size in USD Million

CAGR :

%

USD

95.86 Million

USD

208.51 Million

2025

2033

USD

95.86 Million

USD

208.51 Million

2025

2033

| 2026 –2033 | |

| USD 95.86 Million | |

| USD 208.51 Million | |

|

|

|

|

What is the Global Edge Banding Materials Market Size and Growth Rate?

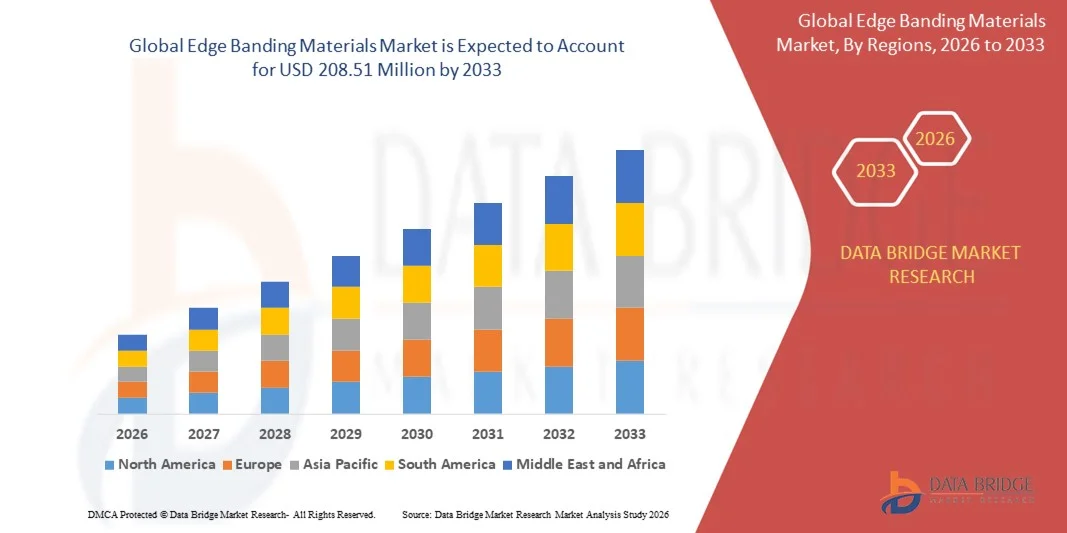

- The global edge banding materials market size was valued at USD 95.86 million in 2025 and is expected to reach USD 208.51 million by 2033, at a CAGR of10.20% during the forecast period

- The rise in the adoption of edge banding materials because of advent of cutting-edge industry-grade hot-melt adhesive with the heat applicators acts as one of the major factors driving the growth of edge banding materials market

- The growth of housing industry across the globe especially in developing countries consisting of contractors, builders and other entities affiliated to the government and rise in demand for sustainable and user-friendly edge banding materials accelerate the edge banding materials market growth

What are the Major Takeaways of Edge Banding Materials Market?

- The rise in the popularity of PVC owning to the choice of different color schemes, customization, impermeability and ease of use on curved surfaces and the higher durability of PVC edge bands in comparison with wood edge bands further influence the edge banding materials market

- In addition, increase in demand for variants of plastic edge band materials such as acrylic and ABS, increasing disposable income of middle class population, expansion of construction and housing sectors, rise in the number of construction projects and advancements in the interior design sphere positively affect the edge banding materials market

- Furthermore, product diversification and innovative product diversification and extend profitable opportunities to the edge banding materials market players

- Asia-Pacific dominated the edge banding materials market with a 42.05% revenue share in 2025, driven by rapid urbanization, large-scale furniture manufacturing, growing modular interior demand, and increasing adoption of automated production technologies across China, Japan, India, South Korea, and Southeast Asia

- North America is projected to register the fastest CAGR of 9.47% from 2026 to 2033, driven by increased residential and commercial construction, demand for modular furniture, and expansion of sustainable and recycled edge banding materials

- The Plastic Wood segment dominated the market with a 52.3% share in 2025, driven by its cost-effectiveness, ease of application, and aesthetic appeal in furniture, cabinetry, and interior paneling

Report Scope and Edge Banding Materials Market Segmentation

|

Attributes |

Edge Banding Materials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Edge Banding Materials Market?

Increasing Adoption of Eco-Friendly, High-Performance, and Automated Edge Banding Materials

- The edge banding materials market is witnessing strong adoption of eco-friendly, recyclable, and low-emission materials, driven by sustainability regulations and consumer demand for green furniture and interior solutions

- Manufacturers are introducing pre-coated, heat-resistant, and high-gloss edge banding films suitable for automated application lines, providing faster processing, improved adhesion, and consistent surface quality

- Growing demand for customizable, high-performance materials is encouraging manufacturers to provide solutions compatible with CNC machines, automatic edgebanders, and high-speed production systems

- For instance, companies such as REHAU, Edging Master, and Doellken have launched PVC, ABS, and melamine edge banding variants with improved scratch resistance, UV stability, and chemical resistance

- Increasing integration of digital design and automated application systems is accelerating the shift toward high-speed, precision, and consistent edge banding solutions

- As furniture and interior production becomes more automated and quality-conscious, Edge Banding Materials remain vital for achieving efficient production, aesthetic consistency, and material durability

What are the Key Drivers of Edge Banding Materials Market?

- Rising demand for sustainable, durable, and visually appealing edge banding materials across residential, commercial, and institutional furniture segments

- For instance, in 2024, companies such as REHAU, Doellken, and Altendorf expanded their product lines to include recycled PVC, ABS, and melamine-based edge banding with enhanced adhesive properties

- Growing adoption of automated edge banding machines in high-volume furniture manufacturing and interior paneling is boosting demand for pre-coated and high-speed application materials

- Advancements in UV-coated, heat-resistant, and chemical-resistant edge banding have strengthened performance, lifespan, and aesthetic appeal in finished furniture products

- Rising consumer preference for eco-friendly and low-VOC materials is creating a shift toward biodegradable or recyclable edge banding options

- Supported by steady investment in R&D for high-quality finishes, adhesive technology, and machine compatibility, the Edge Banding Materials market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Edge Banding Materials Market?

- High costs associated with premium, eco-friendly, and high-performance edge banding materials restrict adoption among small manufacturers and regional furniture workshops

- For instance, during 2023–2025, fluctuations in raw material prices, such as PVC, ABS, and melamine, increased production costs for global suppliers

- Complexity in matching edge banding material properties with diverse substrate types requires skilled technicians and machine calibration

- Limited awareness in emerging markets regarding eco-friendly edge banding benefits and installation best practices slows adoption

- Competition from low-cost, uncoated, or imported edge banding films creates pricing pressure and reduces product differentiation

- To address these issues, companies are focusing on cost-optimized formulations, training programs, machine-compatible materials, and sustainable product lines to increase global adoption of edge banding materials

How is the Edge Banding Materials Market Segmented?

The market is segmented on the basis of material and end use.

- By Material

On the basis of material, the edge banding materials market is segmented into Plastic Wood, Metal, and Others. The Plastic Wood segment dominated the market with a 52.3% share in 2025, driven by its cost-effectiveness, ease of application, and aesthetic appeal in furniture, cabinetry, and interior paneling. Plastic wood edge banding provides high durability, resistance to moisture, and compatibility with automated edgebanding machines, making it the preferred choice for large-scale furniture manufacturers, modular kitchens, and office interiors.

The Metal segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising demand for premium and modern furniture designs, industrial-grade interiors, and architectural applications requiring sleek, metallic finishes. Increasing use of aluminum, stainless steel, and composite metals in high-end furniture and commercial projects is driving accelerated adoption globally.

- By End Use

On the basis of end use, the market is segmented into Residential, Commercial, and Others. The Residential segment dominated the market with a 48.7% share in 2025, fueled by growing urbanization, modular home designs, and rising consumer preference for aesthetically pleasing, durable, and easy-to-install furniture. Edge banding materials are extensively used in residential cabinetry, kitchen furniture, wardrobes, and decorative panels, providing protection and enhancing visual appeal.

The Commercial segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increased construction of office spaces, hotels, retail outlets, and institutional facilities requiring premium, durable, and maintenance-friendly edge finishes. Expanding infrastructure development, high demand for modular interiors, and adoption of automated production lines in commercial furniture manufacturing are driving the rapid uptake of edge banding solutions in this segment.

Which Region Holds the Largest Share of the Edge Banding Materials Market?

- Asia-Pacific dominated the edge banding materials market with a 42.05% revenue share in 2025, driven by rapid urbanization, large-scale furniture manufacturing, growing modular interior demand, and increasing adoption of automated production technologies across China, Japan, India, South Korea, and Southeast Asia. High demand for cost-effective, durable, and aesthetically pleasing edge banding materials continues to fuel usage across residential, commercial, and industrial furniture applications

- Leading companies in Asia-Pacific are investing in advanced production facilities, sustainable material innovations, and automation technologies, strengthening the region’s supply chain and technological edge. Expanding export markets, government incentives for manufacturing, and rising consumer spending support long-term market growth

- Strong manufacturing ecosystems, skilled workforce availability, and ongoing innovation in material composition and finishing further reinforce regional market leadership

China Edge Banding Materials Market Insight

China is the largest contributor in Asia-Pacific due to extensive furniture production capacity, advanced plastics and polymer industries, and strong government support for industrial modernization. Rising demand for plastic wood, metal, and eco-friendly materials drives market adoption across both domestic and export channels. Local manufacturing efficiency and competitive pricing further enhance market penetration.

Japan Edge Banding Materials Market Insight

Japan demonstrates steady growth supported by precision manufacturing, advanced furniture design, and a focus on high-quality and durable materials. Increasing adoption of premium commercial and residential furniture, combined with eco-conscious regulations, boosts demand for high-end edge banding solutions.

India Edge Banding Materials Market Insight

India is emerging as a key growth hub, fueled by expanding modular furniture production, increasing urban housing projects, and government initiatives supporting domestic manufacturing. Growing consumer preference for stylish, durable, and maintenance-friendly interiors accelerates adoption of edge banding materials.

South Korea Edge Banding Materials Market Insight

South Korea contributes significantly with strong demand from residential, commercial, and office furniture segments. Rapid industrial modernization, rising exports, and the use of automated finishing processes support the adoption of high-quality, multi-material edge banding solutions.

North America Edge Banding Materials Market

North America is projected to register the fastest CAGR of 9.47% from 2026 to 2033, driven by increased residential and commercial construction, demand for modular furniture, and expansion of sustainable and recycled edge banding materials. Adoption of advanced manufacturing techniques, innovation in materials, and growing awareness of design aesthetics and durability further accelerate market growth across the U.S. and Canada.

U.S. Edge Banding Materials Market Insight

The U.S. is the largest contributor in North America, supported by rising investments in residential and commercial interiors, furniture manufacturing, and modular systems. Increasing interest in sustainable and eco-friendly edge banding materials drives higher adoption rates across domestic and export markets.

Canada Edge Banding Materials Market Insight

Canada contributes significantly due to growing residential and office space development, demand for high-quality furniture, and adoption of automated production technologies. Government incentives and skilled manufacturing capabilities strengthen regional growth potential.

Which are the Top Companies in Edge Banding Materials Market?

The edge banding materials industry is primarily led by well-established companies, including:

- Vaibhav Industries (India)

- VEENA POLYMERS (India)

- Squareone Decor (India)

- Paramount Composites India (India)

- E3 Panels (India)

- GDECOR INDUSTRIES PVT LTD (India)

- Altendorf Group (Germany)

- Kamco Limited (U.K.)

- David Clouting (U.K.)

- Doellken (Germany)

- EdgeCo Incorporated (U.S.)

- REHAU (Germany)

- UltraTech Cement Ltd (India)

- The Collins Companies (U.S.)

- ASIS International (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- Edging Master Manufacturing Sdn. Bhd. (Malaysia)

- Pegasus (U.K.)

- FIBRO (Germany)

- Teknaform (Canada)

- PDRC Digital Solutions Inc. (U.S.)

- PROADEC (France)

What are the Recent Developments in Global Edge Banding Materials Market?

- In May 2025, E3 Edge Band, an Indian edge banding tape manufacturer, expanded its production capacity by inaugurating a new plant in Andhra Pradesh and announced another facility in Gujarat. The company also entered the export market through a warehouse in Dubai, aiming to achieve INR 200 crore revenue by launching new materials, reflecting its strategic growth and international expansion plans

- In March 2025, Powerspeed Electrical Ltd inaugurated its Electrosales Timber Factory in Mutare, Zimbabwe, spanning over 15,000 sqm and featuring advanced machinery, including an edge banding machine. The facility increased production capacity, created 35 jobs, and adopted zero-waste practices by supporting livestock farming with wood shavings from timber processing, demonstrating commitment to sustainable manufacturing

- In April 2024, EXCITECH launched its Laser Edge Banding Machine, revolutionizing woodworking with precision laser technology. The machine supports multiple materials, includes user-friendly software, reduces labor costs with automatic feeding, and highlights EXCITECH’s focus on innovation and industry advancement

- In April 2024, GDecor Industries India introduced a new PVC edge banding catalogue, offering wood textures, solid colors, fabric matt, and metallic sparkle finishes. Designed to enhance furniture aesthetics and durability across cabinets, doors, and panels, the launch also aims to expand GDecor’s distributor network across India, improving product accessibility nationwide

- In January 2024, Akij Board launched ProEDGE, a premium PVC edge banding material featuring built-in adhesive, antibacterial and antifungal properties, and resistance to dust and humidity. The product ensures a seamless and durable finish for furniture edges, reflecting Akij Board’s commitment to quality and long-lasting solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Edge Banding Materials Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Edge Banding Materials Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Edge Banding Materials Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.