Global Electric Guitar Market

Market Size in USD Billion

CAGR :

%

USD

1.89 Billion

USD

2.49 Billion

2025

2033

USD

1.89 Billion

USD

2.49 Billion

2025

2033

| 2026 –2033 | |

| USD 1.89 Billion | |

| USD 2.49 Billion | |

|

|

|

|

Electric Guitar Market Size

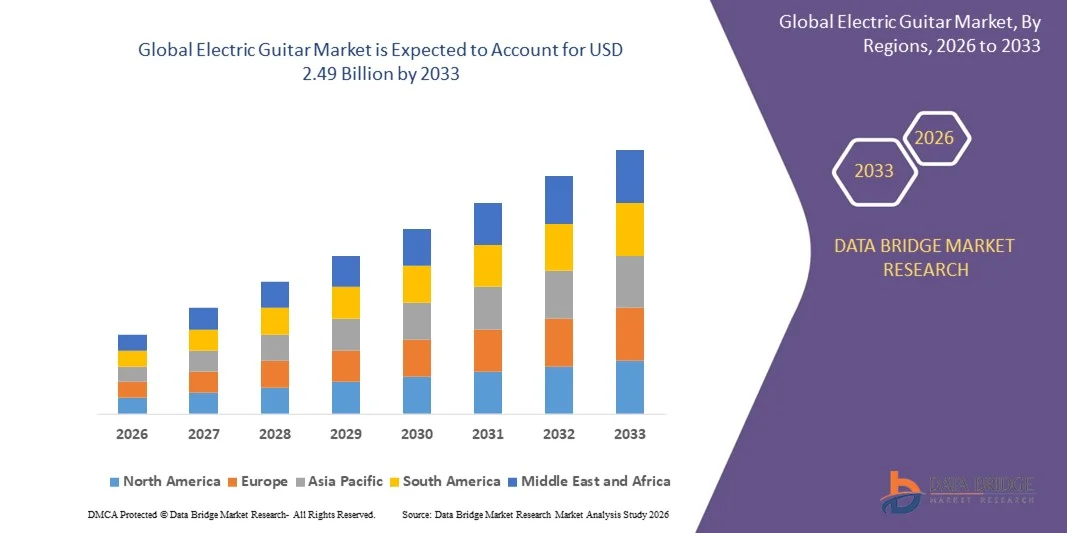

- The global electric guitar market size was valued at USD 1.89 billion in 2025 and is expected to reach USD 2.49 billion by 2033, at a CAGR of 3.50% during the forecast period

- The market growth is largely fueled by the increasing popularity of music education programs, live performances, and home recording setups, driving higher adoption of electric guitars across professional musicians, hobbyists, and students

- Furthermore, rising consumer demand for premium quality, versatile, and artist-endorsed instruments is encouraging manufacturers to innovate with new models, finishes, and features. These factors are accelerating the uptake of electric guitars, thereby significantly boosting the industry's growth

Electric Guitar Market Analysis

- Electric guitars, providing amplified sound and diverse tonal possibilities, are increasingly vital for contemporary music production, live performances, and music education due to their versatility, playability, and integration with digital effects and recording setups

- The escalating demand for electric guitars is primarily fueled by the growth of music schools, increasing live and virtual music events, expanding online retail channels, and a rising preference among musicians for custom and signature models that cater to both aesthetic and performance needs

- Asia-Pacific dominated electric guitar market with a share of 35.5% in 2025, due to growing music education programs, increasing popularity of live performances, and rising adoption of Western music styles across developing countries

- North America is expected to be the fastest growing region in the electric guitar market during the forecast period due to high consumer spending on musical instruments, thriving music schools, and extensive live music culture

- Solid body segment dominated the market with a market share of 65.5% in 2025, due to its versatility across musical genres and its established reputation among professional and amateur guitarists. Solid body electric guitars are highly favored for their sustain, reduced feedback, and adaptability to various pickups and effects, making them suitable for studio recording and live performances. Musicians often prioritize solid body guitars for rock, metal, and pop applications due to their reliable tone and durability. The availability of numerous models and customizable options further enhances their appeal, supporting strong market demand

Report Scope and Electric Guitar Market Segmentation

|

Attributes |

Electric Guitar Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Electric Guitar Market Trends

Rising Adoption of Artist-Endorsed and Signature Guitar Models

- A key trend in the electric guitar market is the growing adoption of artist-endorsed and signature models, driven by rising consumer desire for professional-quality instruments associated with renowned musicians. This trend is enhancing brand recognition and influencing purchasing decisions among both beginner and experienced guitarists

- For instance, Fender’s collaboration with artists such as Eric Clapton and Billie Eilish has produced signature Stratocaster and Telecaster models that attract enthusiasts seeking professional-grade playability and distinctive sound. These collaborations create strong marketing appeal and elevate sales across global music retail channels

- The increasing popularity of limited-edition and custom artist models is encouraging guitar manufacturers to innovate in design, tone, and aesthetic elements, thereby expanding the diversity of available instruments. This is fostering greater consumer engagement and loyalty in the premium guitar segment

- Consumers are showing preference for models that replicate the tonal characteristics and specifications of iconic guitars used in live performances and recordings. This is strengthening the market presence of brands that maintain close artist partnerships

- The trend is also influencing the second-hand and collector guitar markets, where signature editions maintain higher resale value and attract enthusiasts seeking rare models. This reinforces the long-term impact of artist endorsements on market dynamics

- Rising social media influence and online demonstrations by professional guitarists further fuel awareness and demand for signature guitars. This trend is driving consistent growth in both physical retail and e-commerce channels

Electric Guitar Market Dynamics

Driver

Growing Popularity of Music Education and Home Recording

- The electric guitar market is benefiting from the expanding popularity of music education programs and the increasing adoption of home recording setups, which encourage learners and hobbyists to purchase personal instruments. These trends support growth in beginner and intermediate guitar segments

- For instance, Gibson and Fender provide educational packages and online tutorials that enable students to learn guitar skills effectively from home. These initiatives increase accessibility and drive adoption among younger demographics and casual musicians

- Rising interest in DIY music production and independent recording is creating demand for versatile electric guitars suitable for home studios. This is encouraging manufacturers to develop models optimized for both practice and recording environments

- Music schools and academies globally are incorporating modern electric guitars into curricula to support contemporary music genres, which fuels instrument sales and brand exposure. This is expanding the base of potential long-term customers

- Growing participation in live streaming, social media performances, and digital content creation is prompting hobbyists and aspiring professionals to invest in electric guitars that offer reliable tone and performance. This dynamic is shaping the broader growth trajectory of the market

Restraint/Challenge

High Cost of Premium and Custom Electric Guitars

- The electric guitar market faces challenges due to the high cost of premium and custom instruments, which limits accessibility for beginners and casual players. Manufacturing quality materials and ensuring superior craftsmanship contributes to elevated retail prices

- For instance, PRS Guitars offers custom shop models that can cost several times more than standard production guitars, restricting their affordability and market penetration. These pricing factors make cost-sensitive consumers hesitant to upgrade to high-end instruments

- Production of boutique and limited-edition guitars involves skilled labor and meticulous assembly, increasing operational costs for manufacturers. This constrains the ability to scale and meet demand without compromising quality

- Fluctuations in raw material prices, including premium tonewoods and hardware components, add to cost pressures and affect pricing stability. This creates challenges for maintaining competitive pricing in a growing market

- The combination of high manufacturing costs and niche market targeting limits overall accessibility, which can slow growth in segments driven by new or casual guitarists. This challenge underscores the need for manufacturers to balance affordability with quality

Electric Guitar Market Scope

The market is segmented on the basis of product and distribution channel.

- By Product

On the basis of product, the electric guitar market is segmented into solid body, semi-hollow body, and hollow body. The solid body segment dominated the market with the largest market revenue share of 65.5% in 2025, driven by its versatility across musical genres and its established reputation among professional and amateur guitarists. Solid body electric guitars are highly favored for their sustain, reduced feedback, and adaptability to various pickups and effects, making them suitable for studio recording and live performances. Musicians often prioritize solid body guitars for rock, metal, and pop applications due to their reliable tone and durability. The availability of numerous models and customizable options further enhances their appeal, supporting strong market demand.

The semi-hollow body segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing adoption among jazz, blues, and indie musicians seeking a balance between resonance and reduced feedback. For instance, Gibson’s ES series offers semi-hollow body guitars that combine warm tones with playability, attracting both professional artists and enthusiasts. The aesthetic appeal and versatile tonal characteristics of semi-hollow guitars contribute to their growing popularity in modern music production and live performances. Musicians value their ability to produce clean, rich sounds without excessive noise, which is particularly advantageous for studio recording. The rising interest in vintage-inspired designs also supports the segment’s accelerated growth trajectory.

- By Distribution Channel

On the basis of distribution channel, the electric guitar market is segmented into offline and online. The offline segment held the largest market revenue share in 2025, driven by the importance of in-person product experience, instrument testing, and professional consultation before purchase. Offline stores allow customers to try guitars for playability, tone, and ergonomics, which is crucial for musicians making significant investments. Retailers often provide additional services such as repairs, customization, and expert guidance, enhancing the customer experience and reinforcing market dominance. Music schools, studios, and professional musicians frequently prefer offline channels for high-end or specialized instruments due to the assurance of quality and service availability.

The online segment is expected to witness the fastest CAGR from 2026 to 2033, driven by the convenience of home delivery, wide product selection, and competitive pricing. For instance, Guitar Center and Sweetwater have expanded their e-commerce platforms, offering virtual demos, detailed specifications, and customer reviews that simplify purchasing decisions. Online sales are particularly popular among younger consumers and hobbyists who prioritize accessibility and variety. The integration of augmented reality and virtual try-on features enhances customer confidence in online purchases. In addition, rising digital marketing and global shipping options are contributing to accelerated growth in the online distribution segment.

Electric Guitar Market Regional Analysis

- Asia-Pacific dominated the electric guitar market with the largest revenue share of 35.5% in 2025, driven by growing music education programs, increasing popularity of live performances, and rising adoption of Western music styles across developing countries

- The region’s cost-effective manufacturing landscape, strong presence of guitar brands, and expanding consumer base for musical instruments are accelerating market expansion

- The availability of skilled luthiers, favorable government initiatives promoting music education, and increasing disposable income across developing economies are contributing to higher adoption of electric guitars in both professional and amateur segments

China Electric Guitar Market Insight

China held the largest share in the Asia-Pacific electric guitar market in 2025, owing to its robust manufacturing infrastructure, strong presence of domestic guitar brands, and growing export of musical instruments globally. The country’s competitive production costs, extensive supply chain networks, and increasing investments in music education and cultural programs are major growth drivers. Demand is also supported by rising interest among youth and hobbyist musicians seeking quality instruments at affordable prices.

India Electric Guitar Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by expanding music schools, growing live music scenes, and rising adoption of Western and contemporary music genres. Government initiatives promoting cultural activities and rising disposable income are strengthening the demand for electric guitars. In addition, the increasing availability of international brands through online and offline channels and rising influencer-led music trends are contributing to rapid market expansion.

Europe Electric Guitar Market Insight

The Europe electric guitar market is expanding steadily, supported by a mature music culture, high demand for premium instruments, and strong presence of iconic guitar brands. The region emphasizes quality craftsmanship, innovation in design, and collaboration between music academies and manufacturers. Growing interest in music festivals, studio recording, and niche genres is further enhancing the adoption of electric guitars in both professional and consumer segments.

Germany Electric Guitar Market Insight

Germany’s electric guitar market is driven by its strong music education system, heritage of instrument craftsmanship, and presence of high-end manufacturers. The country benefits from collaborations between music schools, professional musicians, and guitar makers to innovate in design and tone quality. Demand is particularly strong for studio-quality and performance-oriented guitars, catering to both recording artists and live performers.

U.K. Electric Guitar Market Insight

The U.K. market is supported by a vibrant music industry, growing popularity of live concerts, and increasing adoption of electric guitars by emerging musicians. With rising interest in music education, cultural programs, and niche genres, local demand for both standard and custom guitars continues to grow. Investments in boutique guitar manufacturing and endorsements by prominent artists are further driving market expansion.

North America Electric Guitar Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by high consumer spending on musical instruments, thriving music schools, and extensive live music culture. Strong demand from professional musicians, hobbyists, and educational institutions is boosting sales. In addition, growth in online retail platforms, influencer-led marketing, and collaborations between artists and guitar brands are supporting market expansion.

U.S. Electric Guitar Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its established music industry, high penetration of music education, and significant presence of leading guitar brands. The country’s focus on innovation, artist endorsements, and premium instrument offerings is encouraging the adoption of electric guitars across age groups. Presence of a mature distribution network and strong cultural affinity for Western music further solidify the U.S.'s leading position in the region.

Electric Guitar Market Share

The electric guitar industry is primarily led by well-established companies, including:

- Fender Musical Instruments Corporation (U.S.)

- Gibson Brands, Inc. (U.S.)

- Karl Höfner GmbH & Co. KG (Germany)

- PRS Guitars (U.S.)

- Yamaha Corporation (Japan)

- B.C. Rich Guitars (U.S.)

- C.F. Martin & Co., Inc. (U.S.)

- Cort Guitars (South Korea)

- The ESP Guitar Company (Japan)

- G&L Musical Instruments (U.S.)

- Godin Guitars (Canada)

- Ibanez Guitars (Japan)

- SAMICK Musical Instrument Co., Ltd (South Korea)

- Schecter Guitar Research (U.S.)

- Taylor-Listug, Inc. (U.S.)

Latest Developments in Global Electric Guitar Market

- In December 2025, acclaimed guitarist Nuno Bettencourt launched his own guitar brand, Nuno Guitars, after departing a long-term relationship with Washburn, introducing new models including updated takes on the iconic N4 series. This move signifies a shift toward artist‑driven instrument design, reinforcing the trend of musicians entering manufacturing to create signature instruments that resonate strongly with fans and collectors, potentially expanding the boutique segment of the electric guitar market while intensifying competition among established brands

- In July 2023, Fender Musical Instruments Corporation (FMIC) unveiled a range of new releases across its wholly‑owned and licensed brands such as Jackson, Gretsch, EVH, and Charvel, reinforcing these brands’ historic reputations for quality tone and performance. This strategic refresh served to strengthen Fender’s portfolio breadth, addressing evolving musician demands and sustaining its leadership position across multiple subsegments of the global electric guitar market

- In June 2023, PRS Guitars, in collaboration with artist John Mayer, introduced two updated models — featuring a maple fretboard option and a new color for the rosewood version, marking the first refresh of the rosewood model since its January 2022 launch. These targeted updates enhanced product appeal and underscored PRS’s responsiveness to consumer preferences, helping to maintain brand momentum and stimulate renewed sales interest

- In July 2021, Kirk Hammett, guitarist from Metallica, partnered with Gibson Brands, Inc. to launch a signature guitar line, aiming to blend artist expertise with high-quality production. This collaboration strengthens Gibson’s presence in the high-end signature guitar segment and appeals to fans and collectors, enhancing brand prestige and driving interest in premium instruments

- In July 2021, Kyser Musical Products partnered with Fender Musical Instruments Company to launch electric guitar capos, now available on both Kysermusical.com and Fender.com. This development expands accessory offerings, complements core guitar sales, and supports Fender’s strategy to create a holistic ecosystem for guitar players

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.