Global Electrical Tapes Market

Market Size in USD Billion

CAGR :

%

USD

12.66 Billion

USD

19.42 Billion

2024

2032

USD

12.66 Billion

USD

19.42 Billion

2024

2032

| 2025 –2032 | |

| USD 12.66 Billion | |

| USD 19.42 Billion | |

|

|

|

|

What is the Global Electrical Tapes Market Size and Growth Rate?

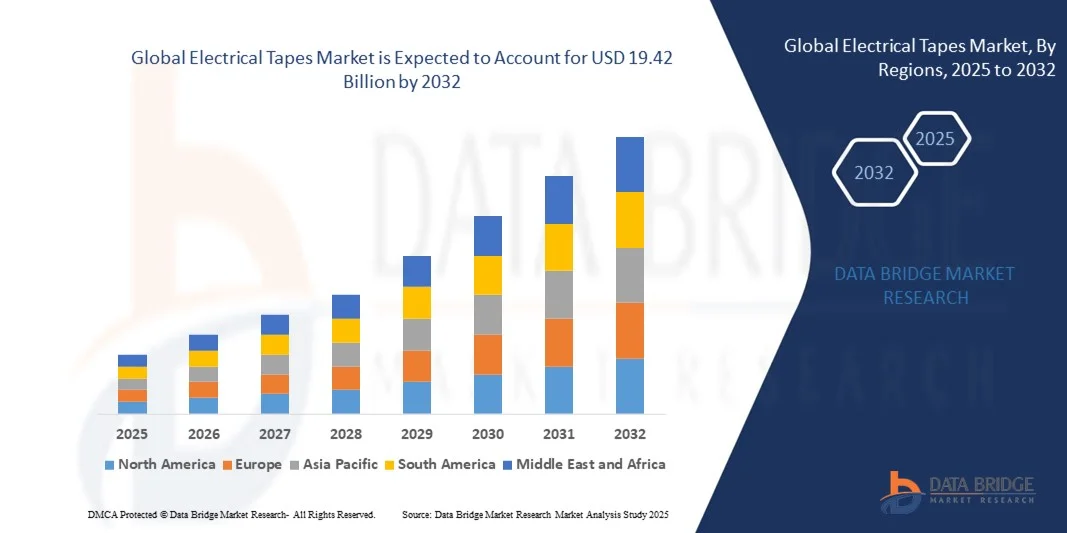

- The global electrical tapes market size was valued at USD 12.66 billion in 2024 and is expected to reach USD 19.42 billion by 2032, at a CAGR of 5.5% during the forecast period

- The expansion of manufacturing sector in developing and developed nations and the rise in awareness regarding the advantages and benefits of electrical tapes act as major key drivers for the electrical tapes market. The increase in demand for electrical tapes by several industries owning to its properties such as dielectric strength and heat resistance and rising inclination towards these tapes from adhesive due to their characteristics including ease of use and safe operation accelerate the market growth

- In addition, significant growth of construction industry across the globe and increase in demand for these tapes in different colors to ensure safety influences the electrical tapes market

What are the Major Takeaways of Electrical Tapes Market?

- Technological advancements, high utilization in the automotive industry and rising demand for environment-friendly and sustainable pressure-sensitive tapes extend profitable opportunities to the market players

- Fluctuation in the prices of raw material is expected to obstruct the market growth. Concerns associated with the durability and suitability of electrical tapes is projected to challenge the electrical tapes market

- The Asia-Pacific region dominated the electrical tapes market with the largest revenue share of 42.3% in 2024, driven by rapid industrialization, infrastructure development, and the expansion of the electrical and electronics sector

- The North America electrical tapes market is poised to grow at the fastest CAGR of 12.4% during 2025–2032, propelled by technological advancements, increasing industrial safety awareness, and modernization of electrical infrastructure

- The PVC Electrical Tape segment dominated the market with the largest revenue share of 46.8% in 2024, owing to its cost-effectiveness, strong insulation properties, and resistance to moisture and abrasion

Report Scope and Electrical Tapes Market Segmentation

|

Attributes |

Electrical Tapes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Electrical Tapes Market?

Growing Shift Toward Eco-Friendly and Flame-Retardant Materials

- A significant trend in the global electrical tapes market is the transition toward sustainable, halogen-free, and flame-retardant materials driven by stringent environmental regulations and rising safety awareness. Manufacturers are increasingly adopting non-toxic, recyclable materials to reduce environmental impact and meet compliance standards such as RoHS and REACH

- For instance, 3M introduced its Temflex and Scotch Electrical Tapes with enhanced flame retardancy and eco-compliant materials, designed for use in both residential and industrial electrical insulation applications

- The demand for PVC-free and low-VOC electrical tapes is also gaining momentum, particularly across Europe and North America, where regulatory bodies are enforcing sustainability standards in manufacturing and construction sectors

- In addition, industries such as automotive, electronics, and renewable energy are increasingly favoring high-durability, low-emission electrical tapes that support green manufacturing practices. These tapes offer superior insulation and enhance operational safety by minimizing fire risks

- Companies are innovating bio-based adhesives and recyclable backing materials to strengthen their eco-friendly portfolios. For instance, tesa SE and Nitto Denko Corporation are investing in developing environmentally sustainable electrical insulation solutions that combine performance efficiency with reduced carbon footprint

- This shift toward sustainable production and usage of electrical tapes is reshaping market dynamics, aligning the industry with global sustainability goals while offering manufacturers opportunities to differentiate through eco-conscious innovation

What are the Key Drivers of Electrical Tapes Market?

- The rising demand for electrical insulation, protection, and maintenance applications across power generation, automotive, and construction industries is a major driver of the Electrical Tapes market. These tapes ensure safety, durability, and resistance in complex wiring systems

- For instance, in June 2024, Nitto Denko Corporation launched a new range of high-temperature electrical tapes designed for electric vehicles (EVs) and renewable energy applications, enhancing efficiency and fire protection in high-voltage systems

- The expansion of the electronics manufacturing sector and increasing penetration of EVs and hybrid vehicles are creating strong demand for high-performance insulation tapes that withstand heat, abrasion, and electrical stress

- Moreover, infrastructure development projects in emerging economies such as India and China are boosting the consumption of electrical tapes in construction wiring and industrial maintenance

- Technological advancements such as pressure-sensitive adhesives, double-sided insulation tapes, and flame-retardant formulations are improving reliability and application convenience, further propelling adoption across industries

- The increasing focus on energy efficiency and equipment longevity is leading manufacturers to use advanced electrical tapes to ensure long-term electrical stability and cost savings. This consistent demand across sectors ensures sustained market growth

Which Factor is Challenging the Growth of the Electrical Tapes Market?

- The fluctuating prices of raw materials, especially PVC, rubber, and adhesives, pose a significant challenge to the growth of the electrical tapes market. Volatility in petrochemical supply chains impacts production costs and profit margins for manufacturers

- For instance, in 2024, disruptions in global PVC supply due to energy shortages and geopolitical tensions led to increased production costs, creating challenges for tape manufacturers in maintaining price competitiveness

- Environmental concerns associated with PVC-based electrical tapes—including their limited recyclability and emission of harmful substances during production—are prompting regulatory restrictions in several regions

- Furthermore, the availability of low-cost counterfeit and substandard products, particularly in developing markets, threatens established brands by eroding customer trust and undermining quality standards

- To overcome these challenges, companies are investing in alternative raw materials, circular economy models, and localized production facilities to ensure stability and sustainability in supply chains

- Addressing material cost volatility, quality assurance, and environmental compliance will be crucial for manufacturers to maintain competitiveness and ensure long-term growth in the evolving Electrical Tapes market

How is the Electrical Tapes Market Segmented?

Electrical tapes market is segmented on the basis of product type and application.

- By Product Type

On the basis of product type, the electrical tapes market is segmented into PVC Electrical Tape, Cloth Electrical Tapes, Rubber Tapes, Polyimide Tapes, Polyester Film Tapes, and Others. The PVC Electrical Tape segment dominated the market with the largest revenue share of 46.8% in 2024, owing to its cost-effectiveness, strong insulation properties, and resistance to moisture and abrasion. PVC tapes are widely used in residential and industrial electrical applications due to their flexibility, ease of application, and compatibility with a wide range of voltage ratings.

The Polyimide Tapes segment is projected to witness the fastest CAGR from 2025 to 2032, driven by their superior thermal stability, chemical resistance, and electrical insulation properties. These tapes are increasingly utilized in electronics manufacturing and aerospace sectors, where high-temperature endurance is essential. As industries move toward advanced electronic devices, demand for high-performance polyimide tapes is expected to accelerate significantly.

- By Application

Based on application, the electrical tapes market is segmented into Construction, Electrical/Electronic, Aerospace, Automotive, and Others. The Electrical/Electronic segment held the largest market share of 41.3% in 2024, primarily due to the extensive use of electrical tapes for wire harnessing, insulation, and circuit board protection in consumer electronics and industrial electrical systems. The increasing adoption of renewable energy and the expansion of power distribution infrastructure are further boosting segment growth.

The Automotive segment is anticipated to record the fastest CAGR from 2025 to 2032, supported by the rising adoption of EVs, advanced wiring systems, and thermal management solutions. Electrical tapes play a crucial role in insulating, bundling, and protecting automotive wiring harnesses against heat and vibration. With increasing emphasis on lightweight, high-performance materials, the demand for heat-resistant and flame-retardant electrical tapes in the automotive sector is expected to grow rapidly.

Which Region Holds the Largest Share of the Electrical Tapes Market?

- The Asia-Pacific region dominated the electrical tapes market with the largest revenue share of 42.3% in 2024, driven by rapid industrialization, infrastructure development, and the expansion of the electrical and electronics sector

- The region’s strong manufacturing base in countries such as China, Japan, South Korea, and India, along with government initiatives supporting industrial safety and renewable energy expansion, significantly boosts demand

- Furthermore, the rising production of electric vehicles, increasing construction activities, and growing adoption of sustainable insulation materials continue to strengthen Asia-Pacific’s leading position in the global market

China Electrical Tapes Market Insight

The China electrical tapes market captured the largest revenue share of 49.6% in 2024 within the Asia-Pacific region, fueled by extensive industrial manufacturing, infrastructure expansion, and the growing electronics sector. The country's strong focus on modernization and high-volume production of electrical components drives consistent demand for insulation and protective tapes. In addition, China’s large-scale investments in 5G networks, renewable energy, and EV infrastructure have accelerated tape usage in electrical and electronic applications. Local manufacturers are also expanding their product lines with eco-friendly and flame-retardant PVC tapes, further supporting market growth.

Japan Electrical Tapes Market Insight

The Japan electrical tapes market is expected to witness steady growth during the forecast period, driven by advancements in electronics, automotive innovation, and energy-efficient technologies. The country’s emphasis on precision engineering and high-quality manufacturing fosters the adoption of premium insulation and heat-resistant tapes such as polyimide and polyester film types. In addition, Japan’s growing shift toward smart factories and automated assembly systems has increased the need for reliable electrical insulation solutions. The integration of eco-friendly production standards and a focus on product miniaturization are further shaping market trends in the country.

India Electrical Tapes Market Insight

The India electrical tapes market is projected to expand at a notable CAGR throughout the forecast period, supported by rapid urbanization, infrastructure development, and the expansion of power transmission networks. The government’s focus on rural electrification and renewable energy projects under initiatives such as “Power for All” and “Make in India” has increased demand for durable, cost-effective electrical insulation materials. Furthermore, the growing domestic automotive and construction industries are boosting the use of PVC and rubber-based electrical tapes. The rise of local manufacturers and increased awareness of safety standards continue to drive growth in the Indian market.

Which Region is the Fastest Growing Region in the Electrical Tapes Market?

The North America electrical tapes market is poised to grow at the fastest CAGR of 12.4% during 2025–2032, propelled by technological advancements, increasing industrial safety awareness, and modernization of electrical infrastructure. The expansion of EV manufacturing, renewable energy projects, and power grid upgrades is fueling strong regional demand. The growing preference for high-performance, flame-retardant, and eco-friendly insulation tapes also supports market expansion.

U.S. Electrical Tapes Market Insight

The U.S. electrical tapes market accounted for the largest share of 79% in 2024 within North America, driven by increased electrical maintenance activities, modernization of energy systems, and strong growth in electronics manufacturing. Rising investments in EV charging infrastructure, smart grid development, and data centers are contributing to the market’s rapid expansion. In addition, the adoption of UL-certified and RoHS-compliant products is rising as companies prioritize safety and sustainability. The presence of leading players such as 3M and Avery Dennison continue to strengthen innovation and product diversity across the U.S. market.

Which are the Top Companies in Electrical Tapes Market?

The electrical tapes industry is primarily led by well-established companies, including:

- Nitto Denko Corporation (Japan)

- AVERY DENNISON CORPORATION (U.S.)

- HellermannTyton (U.K.)

- Plymouth Rubber Europa, S.A. (Spain)

- Electro Tape Specialties, Inc. (U.S.)

- PPM INDUSTRIES UK LTD. (U.K.)

- Godson Tapes Pvt. Limited (India)

- Intertape Polymer Group (Canada)

- 3M (U.S.)

- Teraoka Seisakusho Co., Ltd. (Japan)

- Euro Tapes Private Limited (India)

- Parafix Tapes & Conversions Ltd. (U.K.)

- Saint-Gobain Performance Plastics h-old S.p.A. (France)

- Four Pillars Enterprise Co., Ltd. (Taiwan)

- Shanghai Yongguan Adhesive Products Corp., Ltd. (China)

- Furukawa Electric Co., Ltd. (Japan)

- Denka Company Limited (Japan)

- ACHEM (China)

- tesa Tapes India Private Limited (India)

- Wuerth India Pvt. Ltd. (India)

- Scapa Group plc (U.K.)

What are the Recent Developments in Global Electrical Tapes Market?

- In July 2025, Rexel, a major electrical distributor, expanded its market presence through the acquisition of Warshauer Electric Supply, reinforcing its position in the electrical distribution landscape. This move reflects the growing consolidation trend in the sector, directly influencing the supply chain for electrical tapes and related materials. This acquisition is expected to enhance Rexel’s distribution efficiency and strengthen its product availability across key markets

- In July 2025, Swift Electric was acquired by USESI/Monarch, marking another significant step in the wave of consolidation within the electrical distribution industry. This acquisition enables USESI/Monarch to fill geographical gaps and broaden its portfolio of electrical and insulation products. The deal is anticipated to bolster the company’s market coverage and optimize its customer service capabilities

- In June 2023, Arkema expanded its portfolio of high-performance polymers through the acquisition of a controlling interest in PI Advanced Materials, a move aimed at strengthening its specialty materials business. This acquisition enhances Arkema’s technological expertise and positions it as a stronger global leader in advanced material solutions

- In January 2023, Zone Enterprises, a provider of engineered sealing, insulating, and sound solutions, completed the acquisition of Can-Do National Tape from High Street Capital, a private equity firm. This acquisition expands Zone Enterprises’ capabilities in custom die-cut and rotary-cut adhesive products. The move strengthens the company’s position in the industrial adhesives and tape manufacturing market

- In December 2022, Shurtape Technologies, LLC announced the acquisition of Pro Tapes & Specialties, Inc., a manufacturer serving industries such as graphic arts, die-cutting, and general industrial applications. This strategic acquisition enhances Shurtape’s product range and service capabilities. The deal positions Shurtape to better meet evolving customer needs and expand its presence across diverse end-use sectors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.