Global Electronic Shelf Label Market

Market Size in USD Million

CAGR :

%

USD

920.24 Million

USD

3,721.16 Million

2022

2030

USD

920.24 Million

USD

3,721.16 Million

2022

2030

| 2023 –2030 | |

| USD 920.24 Million | |

| USD 3,721.16 Million | |

|

|

|

|

Electronic Shelf Label Market Analysis and Size

The global electronic shelf label market is segmented on the basis of component, product type, technology, display size, store type, communication technology. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

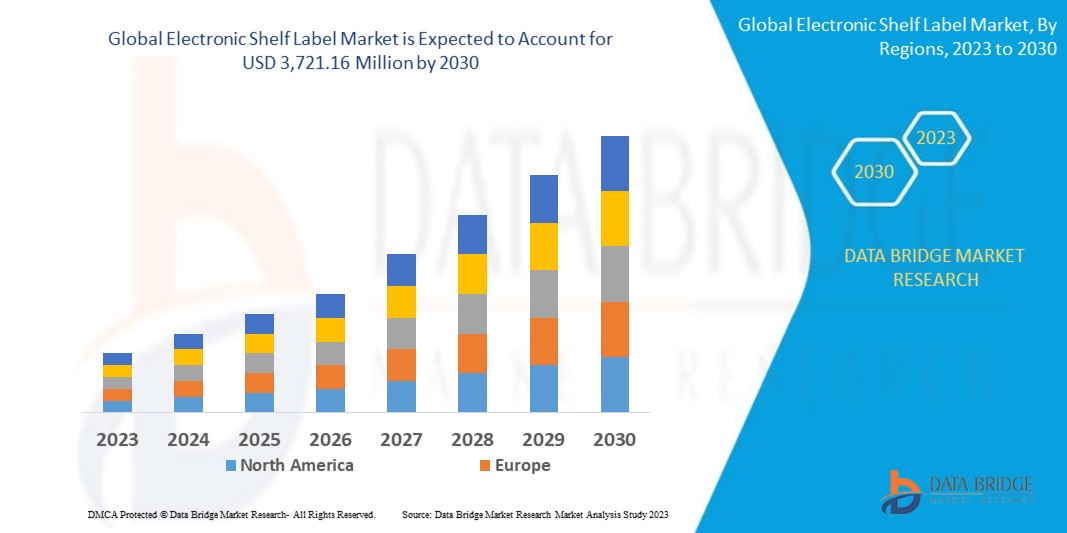

Data Bridge Market Research analyses that the global electronic shelf label market which was USD 920.24 million in 2022, would rocket up to USD 3,721.16 million by 2030, and is expected to undergo a CAGR of 20.12% during the forecast period. This indicates the market value. The “hypermarkets” accounts for the largest store type segment in the electronic shelf label market within the forecasted period owing to the growing adoption of digital technologies in the retail sector. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Electronic Shelf Label Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Component (Displays, Batteries, Transceivers, Microprocessors, Others), Product Type (LCD ESL, Segmented E-Paper ESL, Full-Graphic E-Paper ESL), Technology (ZigBee, BLE, Wi-Fi), Display Size (Less than 3 inches, 3 to 7 inches, 7 to 10 inches, More than 10 inches), Store Type (Hypermarkets, Supermarkets, Non-Food Retail Stores, Specialty Stores, Other Store Types), Communication Technology (Radio Frequency, Infrared, Near Field Communication, Other Communication Technologies) |

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of the Middle East and Africa |

|

Market Players Covered |

SES-imagotag (France), Pricer AB (Sweden), E Ink Holdings Inc., (Taiwan), Displaydata Limited (U.K.), M2COMM (Taiwan), SAMSUNG (South Korea), Diebold Nixdorf, Incorporated (U.S.), Opticon Sensors Europe B.V. (Netherlands), Teraoka Seiko Co., Ltd., (Japan), and NZ Electronic Shelf Labelling (New Zealand), Advantech Co., Ltd (Taiwan), FORBIX SEMICON (India), LANCOM Systems GmbH (Germany), SOLUM Group HQ (Germany), Cicor Management AG (Switzerland) and CSY Retail Systems Ltd (U.K.) |

|

Market Opportunities |

|

Market Definition

Electronic shelf label is basically utilized by the retailers for displaying product pricing on shelves. When a price is altered under the management of a central server, the product pricing is automatically updated. On the front edge of retail shelves, electronic display modules are typically connected. They are widely used across various stores such as hypermarkets, supermarkets, non-food retail stores, specialty stores and other store types.

Global Electronic Shelf Label Market Dynamics

Drivers

- Surge in Digitalization and Automation in Stores

Factors such as the introduction of new channels for the supply of goods, rising wages and higher investments in the e-commerce sector all significantly impact the adoption of automation in the retail sector. Technologies such as automated backroom unloading, self-checkout terminals, self-checking robots, and electronic shelf labels have proven effective at a large scale in the retail business and given retailers huge returns. Given that businesses are investing more and more in technologies to improve the shopping experience for customers, store digitalization is here to stay for a very long time. Retailers worldwide are giving customers many options throughout the entire purchasing process, and a seamless transition between online and offline shopping platforms is becoming more and more crucial

- Growing Efficiency and Accuracy in Pricing

ESLs allow retailers to update prices and product information in real-time electronically. This enhances pricing accuracy, reduces pricing errors, and ensures consistency across all shelves, leading to improved operational efficiency

- Enhanced Customer Experience

ESLs enable dynamic pricing strategies, such as personalized pricing, promotions, and flash sales, which can enhance the shopping experience and attract more customers. Shoppers can also access real-time product information and reviews through ESLs

Opportunity

- Rising Expansion of E-commerce

As the e-commerce sector grows, ESLs can help traditional brick-and-mortar retailers compete by offering online-like shopping experiences. ESLs enable online price matching, which can attract customers back to physical stores

Restraints/Challenges

- High Initial Implementation Costs

The upfront costs associated with implementing ESL systems can be significant for retailers, particularly smaller businesses. These costs include the purchase of hardware (ESL tags and infrastructure) and software, such as installation and training expenses

- Infrastructure and Compatibility Challenges

Retailers need to invest in the necessary infrastructure, including Wi-Fi networks and back-end systems, to support ESLs. Ensuring compatibility with existing systems and integrating ESLs can be complex and costly

This global electronic shelf label market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the variable frequency drive market contact the Data Bridge Market Research for an Analyst Brief, our team will help you make an informed market decision to achieve market growth

Recent Developments

- In July 2020, In accordance with a Master Framework Agreement signed by Pricer AB and the Canadian Tire Dealer Association (CTDA), Pricer will serve as the CTDA's sole provider of electronic shelf label systems. ESL equipment will be installed in 38 locations across the nation as part of Pricer's first delivery under the deal

- In February 2020, A distribution contract was struck by Bison Schweiz AG, based in Switzerland, and Hanshow Technology to work together on developing the German and Swiss markets. As part of their agreement, the businesses will combine top-tier ESL systems from Bison with world-class ESL solutions from Hanshow to drive digitization trends in the European retail sector

The Global Electronic Shelf Label Market Scope

The global electronic shelf label market is segmented on the basis of component, product type, technology, display size, store type, communication technology. the growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications

Component

- Displays

- Batteries

- Transceivers

- Microprocessors

- Others

Product Type

- LCD ESL

- Segmented E-Paper ESL

- Full-Graphic E-Paper ESL

Technology

- ZigBee

- BLE

- Wi-Fi

Display Size

- Less than 3 inches

- 3 to 7 inches

- 7 to 10 inches

- More than 10 inches

Store Type

- Hypermarkets

- Supermarkets

- Non-Food Retail Stores

- Specialty Stores

- Other Store Types

Communication Technology

- Radio Frequency

- Infrared

- Near Field Communication

- Other Communication Technologies

The Global Electronic Shelf Label Market Region Analysis/Insights

The global electronic shelf label market is analyzed and market size insights and trends are provided by component, product type, technology, display size, store type, communication technology, as referenced above.

The regions covered in the global electronic shelf label market are North America, South America, Europe, Asia-Pacific, and the Middle East and Africa. The countries covered in the global Electronic Shelf Label market report are U.S., Canada, Mexico, Brazil, Argentina, the Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of the Middle East and Africa

Europe dominates the global electronic shelf label market. The market is estimated to grow within the region because of the high growth of full graphic e-paper display along with the prevalence of majority of electronics manufacturers within the region. Asia-Pacific is expected to witness significant growth during the forecast period of 2023 to 2030 due to the prevalence of labor at low cost along with increased presence of retail giants with higher customers’ interest within the region.

The region section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as down-stream and up-stream value chain analysis, technical trends, and Porter’s five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and the challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the region data.

Semiconductor Infrastructure Growth Installed Base and New Technology Penetration

The global electronic shelf label market also provides you with a detailed market analysis for every region’s growth in healthcare expenditure for capital equipment, installed base of different kinds of products for the global electronic shelf label market, the impact of technology using lifeline curves, and changes in battery regulatory scenarios and their impact on the variable frequency drive market. The data is available for the historic period 2010 to 2020.

Competitive Landscape and Global Electronic Shelf Label Market Share Analysis

The global electronic shelf label market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the global electronic shelf label market.

Some of the major players operating in the global electronic shelf label market are:

- SES-imagotag (France)

- Pricer AB (Sweden)

- E Ink Holdings Inc., (Taiwan)

- Displaydata Limited (U.K.)

- M2COMM (Taiwan)

- SAMSUNG (South Korea)

- Diebold Nixdorf, Incorporated (U.S.)

- Opticon Sensors Europe B.V. (Netherlands)

- Teraoka Seiko Co., Ltd., (Japan)

- NZ Electronic Shelf Labelling (New Zealand)

- Advantech Co., Ltd (Taiwan)

- FORBIX SEMICON (India)

- LANCOM Systems GmbH (Germany)

- SOLUM Group HQ (Germany)

- Cicor Management AG (Switzerland)

- CSY Retail Systems Ltd (U.K.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Electronic Shelf Label Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Electronic Shelf Label Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Electronic Shelf Label Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.