Global Electronic Warfare Market

Market Size in USD Billion

CAGR :

%

USD

22.66 Billion

USD

31.28 Billion

2025

2033

USD

22.66 Billion

USD

31.28 Billion

2025

2033

| 2026 –2033 | |

| USD 22.66 Billion | |

| USD 31.28 Billion | |

|

|

|

|

Electronic Warfare Market Size

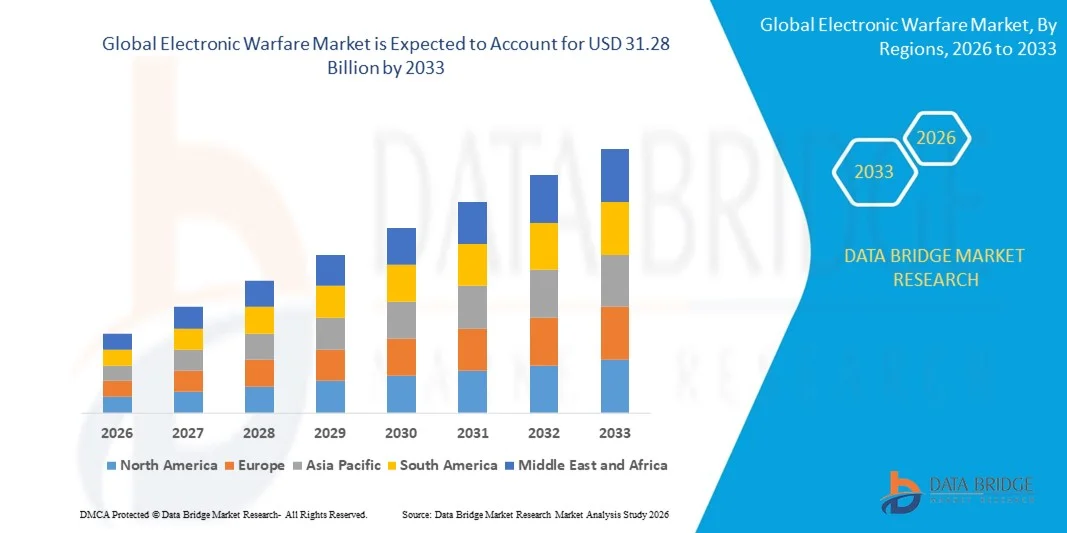

- The global electronic warfare market size was valued at USD 22.66 billion in 2025 and is expected to reach USD 31.28 billion by 2033, at a CAGR of 4.11% during the forecast period

- The market growth is largely fuelled by the rising demand for advanced defense systems, increasing military modernization programs, and the growing adoption of electronic countermeasure and electronic attack technologies

- In addition, geopolitical tensions and the need for enhanced battlefield situational awareness are driving investments in electronic warfare solutions

Electronic Warfare Market Analysis

- The market is witnessing significant technological advancements, including AI-driven electronic warfare systems, miniaturized components, and integrated defense platforms

- Increasing collaborations between defense contractors and governments are fostering innovation and the development of next-generation electronic warfare capabilities

- North America dominated the electronic warfare market with the largest revenue share of 36.75% in 2025, driven by increasing defense modernization programs, strategic military investments, and high adoption of advanced EW systems

- Asia-Pacific region is expected to witness the highest growth rate in the global electronic warfare market, driven by rising defense budgets, modernization of military platforms, and increasing adoption of advanced EW technologies across key countries such as China, Japan, and India

- The airborne segment held the largest market revenue share in 2025, driven by the extensive integration of EW systems in fighter jets, transport aircraft, and drones for threat detection, electronic attack, and signal intelligence. Airborne EW solutions offer high mobility, real-time situational awareness, and multi-domain operational support, making them a preferred choice for military forces globally

Report Scope and Electronic Warfare Market Segmentation

|

Attributes |

Electronic Warfare Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Electronic Warfare Market Trends

Rising Demand for Advanced Defense and Countermeasure Systems

- The growing focus on modernizing military capabilities is significantly shaping the electronic warfare market, as defense organizations increasingly prioritize systems that provide enhanced threat detection, situational awareness, and electronic attack capabilities. Advanced EW systems are gaining traction due to their ability to protect assets, disrupt adversary communications, and improve battlefield effectiveness, strengthening adoption across air, land, and naval defense platforms

- Increasing awareness around national security, cyber threats, and regional conflicts has accelerated the demand for electronic warfare solutions in defense and aerospace sectors. Governments and military agencies are actively investing in advanced radar, jamming, and electronic surveillance systems, prompting collaborations between defense contractors and technology providers to develop next-generation solutions

- Technological modernization trends are influencing procurement decisions, with militaries emphasizing AI-enabled EW systems, network-centric operations, and integrated electronic attack and protection platforms. These factors are helping countries enhance defense readiness, while also driving the adoption of interoperable, multi-domain electronic warfare capabilities

- For instance, in 2024, Lockheed Martin in the U.S. and Rheinmetall in Germany expanded their electronic warfare portfolios by introducing AI-driven radar jamming and electronic countermeasure solutions for air and naval platforms. These launches were in response to rising global defense modernization needs, with deployment across military fleets, training exercises, and international collaborations

- While demand for electronic warfare systems is growing, sustained market expansion depends on continuous R&D, advanced integration capabilities, and maintaining operational reliability under complex combat scenarios. Manufacturers are also focusing on enhancing scalability, interoperability, and developing innovative solutions that balance cost, efficiency, and technological superiority for broader adoption

Electronic Warfare Market Dynamics

Driver

Growing Demand for Advanced Defense and Electronic Countermeasure Capabilities

- Rising investments in defense modernization and national security programs are a major driver for the electronic warfare market. Governments are increasingly procuring systems that provide electronic attack, protection, and support capabilities to enhance operational effectiveness and strategic advantage

- Expanding applications in air defense, naval operations, and battlefield surveillance are influencing market growth. EW systems help detect, disrupt, and neutralize threats while maintaining communication and situational awareness, enabling militaries to respond to evolving combat scenarios

- Defense contractors are actively promoting EW solutions through technology demonstrations, international defense expos, and strategic partnerships. These efforts are supported by growing defense budgets, regional conflicts, and the increasing need for integrated, AI-enabled solutions to protect assets and personnel

- For instance, in 2023, Northrop Grumman in the U.S. and Thales in France reported increased incorporation of AI-enabled electronic warfare capabilities in aircraft and naval systems. This expansion followed heightened global security concerns and modernization programs, driving repeat procurements and long-term strategic contracts

- Although rising defense modernization and electronic threat mitigation trends support growth, wider adoption depends on cost optimization, regulatory approvals, and advanced integration with existing military platforms. Investment in AI, signal processing, and interoperable system design will be critical for meeting global demand and maintaining competitive advantage

Restraint/Challenge

High Costs and Complex Integration Requirements

- The relatively high cost of electronic warfare systems compared to conventional defense technologies remains a key challenge, limiting adoption among budget-constrained militaries. Expensive R&D, advanced components, and specialized training contribute to elevated program costs

- Operational complexity and integration challenges also restrict market growth, as EW systems must be compatible with multiple platforms, communications networks, and legacy equipment. This requires specialized expertise and extensive testing to ensure reliability and effectiveness in real-world scenarios

- Supply chain and technological dependency issues impact market expansion, as components often require sourcing from certified defense suppliers with strict compliance standards. Logistical and maintenance complexities increase operational costs and deployment timelines

- For instance, in 2024, defense agencies in Southeast Asia and Latin America reported slower adoption of advanced electronic warfare platforms due to budget constraints, complex system integration requirements, and lack of trained personnel. These factors prompted phased procurement plans and selective deployment across key units

- Overcoming these challenges will require cost-efficient production, robust integration frameworks, and focused training programs for military operators. Collaboration with governments, defense integrators, and technology providers can help unlock long-term growth potential. In addition, developing modular, scalable, and interoperable EW solutions will be essential for widespread adoption

Electronic Warfare Market Scope

The market is segmented on the basis of platform, capability, product, and end use.

- By Platform

On the basis of platform, the electronic warfare market is segmented into airborne, land, naval, and space. The airborne segment held the largest market revenue share in 2025, driven by the extensive integration of EW systems in fighter jets, transport aircraft, and drones for threat detection, electronic attack, and signal intelligence. Airborne EW solutions offer high mobility, real-time situational awareness, and multi-domain operational support, making them a preferred choice for military forces globally.

The naval segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing deployment of electronic warfare systems on warships, submarines, and patrol vessels. Naval EW platforms are gaining traction due to the rising need for maritime threat protection, secure communication, and electronic countermeasure capabilities, enhancing operational safety and strategic defense across global naval fleets.

- By Capability

On the basis of capability, the market is segmented into electronic support, electronic attack, and electronic protection. The electronic support segment held the largest share in 2025, owing to the growing demand for threat detection, radar warning, and signal intelligence systems that enhance situational awareness and decision-making during military operations.

The electronic attack segment is expected to register the fastest growth from 2026 to 2033, driven by rising investments in jamming, deception, and offensive EW technologies that can disrupt enemy communications and radar systems, providing tactical advantage in modern warfare.

- By Product

On the basis of product, the market is segmented into equipment and operational support. The equipment segment held the largest market share in 2025, supported by increasing demand for EW hardware such as jammers, receivers, and integrated signal intelligence systems for air, land, and naval platforms.

The operational support segment is projected to witness the fastest growth rate during 2026–2033, fueled by the adoption of software, training, and simulation services that enhance system performance, optimize deployment strategies, and provide mission readiness across defense forces.

- By End Use

On the basis of end use, the market is segmented into OEM and upgradation. The OEM segment held the largest share in 2025, driven by the production of EW systems integrated into new military platforms and advanced defense equipment.

The upgradation segment is expected to witness the fastest growth from 2026 to 2033, owing to modernization initiatives in existing military assets and the need to equip legacy systems with advanced electronic warfare capabilities to meet evolving operational requirements.

Electronic Warfare Market Regional Analysis

- North America dominated the electronic warfare market with the largest revenue share of 36.75% in 2025, driven by increasing defense modernization programs, strategic military investments, and high adoption of advanced EW systems

- Defense organizations in the region highly value the enhanced situational awareness, threat detection, and electronic countermeasure capabilities offered by EW systems across air, land, and naval platforms

- This widespread adoption is further supported by high defense budgets, advanced infrastructure, and the growing need for multi-domain operational readiness, establishing EW solutions as a preferred choice for military forces

U.S. Electronic Warfare Market Insight

The U.S. electronic warfare market captured the largest revenue share in 2025 within North America, fueled by rapid adoption of airborne and naval EW platforms and increasing investments in AI-enabled threat detection and jamming systems. Military organizations are prioritizing advanced EW solutions to enhance operational efficiency, secure communications, and electronic attack capabilities. Growing integration of EW systems with next-generation aircraft, ships, and ground vehicles is significantly contributing to market expansion.

Europe Electronic Warfare Market Insight

The Europe electronic warfare market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by defense modernization initiatives, rising geopolitical tensions, and strict military regulations. Increasing urbanization, demand for interoperable defense platforms, and investments in AI and electronic countermeasure technologies are fostering EW adoption. The region is experiencing significant growth across air, land, and naval applications, with EW systems being integrated into both new military platforms and modernization programs.

U.K. Electronic Warfare Market Insight

The U.K. electronic warfare market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising defense expenditure, modernization of legacy systems, and demand for advanced electronic attack and protection capabilities. Concerns regarding cybersecurity and battlefield readiness are encouraging military agencies to adopt next-generation EW solutions. The UK’s strong defense technology base, combined with extensive R&D initiatives, is expected to continue stimulating market growth.

Germany Electronic Warfare Market Insight

The Germany electronic warfare market is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing awareness of cyber threats and the demand for technologically advanced, interoperable EW systems. Germany’s robust defense infrastructure, focus on innovation, and emphasis on multi-domain operations promote the adoption of EW solutions, particularly in air and naval defense platforms. Integration with AI-enabled threat detection and electronic countermeasure technologies is becoming increasingly prevalent

Asia-Pacific Electronic Warfare Market Insight

The Asia-Pacific electronic warfare market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing defense budgets, military modernization programs, and technological advancements in countries such as China, Japan, and India. The region's growing focus on national security, coupled with government initiatives promoting advanced defense systems, is driving EW adoption. Furthermore, as APAC emerges as a hub for defense technology manufacturing, the accessibility and deployment of EW solutions are expanding across the region.

Japan Electronic Warfare Market Insight

The Japan electronic warfare market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s high-tech military infrastructure, increasing defense investments, and demand for advanced threat detection capabilities. Adoption is driven by modernization of air, naval, and land defense platforms, with integration of EW systems into connected and autonomous military assets. Furthermore, Japan’s focus on cybersecurity and operational readiness is expected to spur demand for next-generation EW solutions.

China Electronic Warfare Market Insight

The China electronic warfare market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid military modernization, increased defense spending, and high adoption of advanced airborne, naval, and land EW systems. China is one of the largest markets for EW solutions, with increasing integration of AI-enabled threat detection and electronic countermeasure platforms. Government initiatives for smart defense systems and the presence of strong domestic manufacturers are key factors propelling market growth in China.

Electronic Warfare Market Share

The Electronic Warfare industry is primarily led by well-established companies, including:

- L3Harris Technologies, Inc. (U.S.)

- Raytheon Company (U.S.)

- Lockheed Martin Corporation (U.S.)

- Saab AB (Sweden)

- BAE Systems (U.K.)

- Boeing (U.S.)

- Northrop Grumman (U.S.)

- Cobham (U.K.)

- Leonardo S.p.A. (Italy)

- Textron Systems (U.S.)

- Elbit Systems Ltd. (Israel)

- General Dynamics Mission Systems, Inc. (U.S.)

- IAI (Israel)

- THALES GROUP (France)

- ASELSAN A.S. (Turkey)

- Teledyne Defense Electronics (U.S.)

- HENSOLDT AG (Germany)

- HR Smith Group Of Companies (U.K.)

- Tata Advanced Systems Limited (India)

- Hindustan Aeronautics Limited (India)

Latest Developments in Global Electronic Warfare Market

- In August 2025, L3Harris Technologies launched a hybrid-VTOL demonstrator in collaboration with Joby Aviation to host electronic warfare (EW) payloads. Flight tests are planned for the last quarter of 2025. The platform aims to enhance airborne EW capabilities, improve rapid deployment of adaptive jamming systems, and strengthen innovation and technological leadership in the global EW market

- In July 2025, L3Harris signed the first EA-37A export agreement with Italy for advanced stand-off jamming suites. The deal highlights growing European demand for sophisticated EW solutions. It expands L3Harris’s presence in international defense markets and reinforces Europe’s adoption of next-generation electronic attack systems

- In April 2025, UAE-based EDGE Group expanded its operations in Brazil through counter-drone and missile-defense agreements. This strategic move broadens EW reach in South America. It enhances regional defense capabilities, promotes adoption of advanced electronic protection and attack technologies, and strengthens EDGE’s position in the Latin American EW market

- In February 2025, L3Harris partnered with Shield AI to co-develop AI-powered EW systems for adaptive jamming. The collaboration focuses on integrating artificial intelligence into EW platforms. It improves threat detection, operational efficiency, and positions both companies at the forefront of next-generation EW technology development

- In January 2025, Elbit Systems secured a USD 80 million order to upgrade F-16I Sufa EW suites with advanced jamming and support functions. The contract enhances aircraft survivability, mission readiness, and effectiveness in complex operational scenarios. It also strengthens Elbit’s leadership in airborne tactical EW solutions globally

- In June 2023, Elbit Systems won a contract from Airbus Helicopters to supply airborne EW self-defense systems for the Luftwaffe CH-53 GS/GE transport helicopters. The contract included radar warning receivers, EW controllers, and countermeasure delivery systems. These upgrades improved operational efficiency, mission success, and the company’s presence in European defense markets

- In March 2023, the Indian Ministry of Defense signed a contract with Bharat Electronics Limited (BEL) to procure two Integrated EW Systems under Project Himshakti for USD 362.2 million. This initiative enhances India’s electronic warfare capabilities, supports modernization of military assets, and strengthens domestic EW manufacturing capacity

- In April 2023, L3Harris Technologies was awarded a five-year, USD 584 million contract by the U.S. Air Force. The deal covers the design, manufacture, and repair of tools and software to protect aircraft from electronic threats. It enhances operational readiness, system reliability, and maintains L3Harris’s leadership in integrated defensive EW solutions

- In April 2023, Lockheed Martin’s Rotary and Mission Systems business signed a USD 63.3 million revised contract for the Electronic Surface Warfare Improvement Program (SEWIP) with the U.S. Naval Sea Systems Command. The project includes production of SEWIP AN/SLQ-32(V)6 systems, improving electronic attack and protection capabilities across naval fleets

- In April 2023, BAE Systems received a USD 491 million contract from Lockheed Martin to produce AN/ASQ-239 EW kits for the F-35 Block 4 fighter jet. The contract enhances aircraft survivability, supports advanced EW integration, and reinforces BAE’s position as a key provider of next-generation airborne electronic warfare solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Electronic Warfare Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Electronic Warfare Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Electronic Warfare Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.