Global Electronics Access Control Systems Market

Market Size in USD Billion

CAGR :

%

USD

15.56 Billion

USD

29.24 Billion

2025

2033

USD

15.56 Billion

USD

29.24 Billion

2025

2033

| 2026 –2033 | |

| USD 15.56 Billion | |

| USD 29.24 Billion | |

|

|

|

|

What is the Global Electronics Access Control Systems Market Size and Growth Rate?

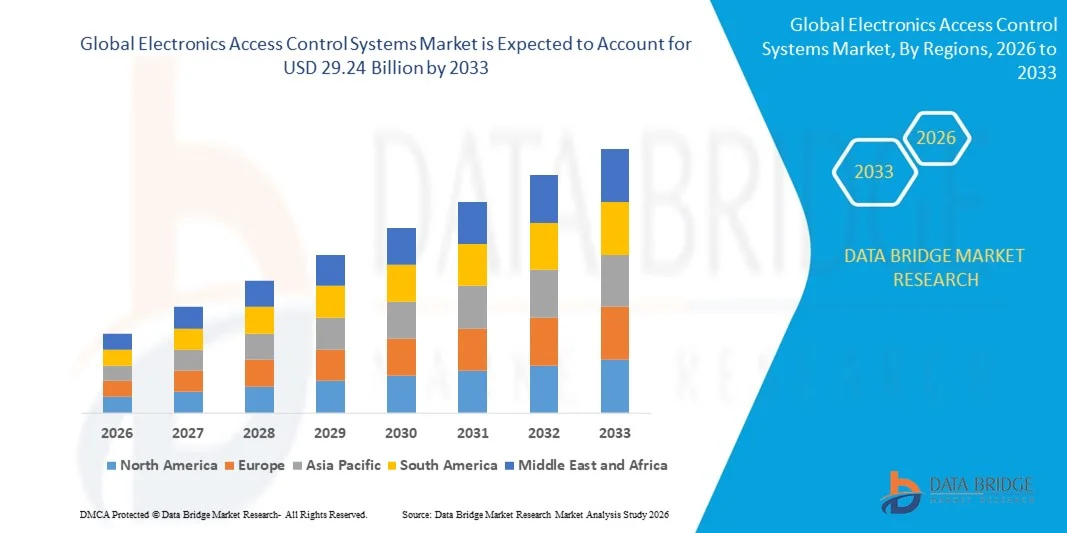

- The global electronics access control systems market size was valued at USD 15.56 billion in 2025 and is expected to reach USD 29.24 billion by 2033, at a CAGR of8.20% during the forecast period

- The growing need for better security systems due to rising criminal activities, illegal immigration and tackle fraudulence has been directly influencing the growth of electronics access control systems market

What are the Major Takeaways of Electronics Access Control Systems Market?

- Rising demand for high-security measures as well as the proliferating threats of terrorism is also flourishing the growth of the electronics access control systems market. In addition, the rising circumstances of vandalism and public place violence are also positively impacting the growth of the market

- Furthermore, the increasing centers of healthcare, road constructions, educational buildings and residential buildings are also largely lifting the growth of the electronics access control systems market

- North America dominated the electronics access control systems market with a 39.47% revenue share in 2025, driven by robust growth in semiconductor design, embedded system development, electronics manufacturing, and extensive R&D activities across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 9.47% from 2026 to 2033, propelled by rapid expansion of commercial infrastructure, industrial automation, and smart city deployments across China, Japan, India, South Korea, and Southeast Asia

- The Authentication Systems segment dominated the market with a 41.2% share in 2025, supported by growing demand for secure access management, biometric verification, RFID-based authentication, and cloud-enabled control solutions across commercial, government, and industrial sectors

Report Scope and Electronics Access Control Systems Market Segmentation

|

Attributes |

Electronics Access Control Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Electronics Access Control Systems Market?

Increasing Shift Toward High-Speed, Compact, and PC-Based Electronics Access Control Systems

- The electronics access control systems market is witnessing strong adoption of compact, USB-powered, and high-sampling-rate analyzers designed to support embedded systems, IoT devices, FPGA debugging, and complex digital protocols

- Manufacturers are introducing multi-channel, high-bandwidth, and software-defined analyzers that offer advanced triggering, deep memory buffering, and compatibility with modern development tools

- Growing demand for cost-efficient, lightweight, and field-deployable testing equipment is driving usage across electronics design labs, R&D centers, repair facilities, and academic environments

- For instance, companies such as Saleae, Tektronix, Keysight, and RIGOL have upgraded their portable analyzers with enhanced channel counts, protocol decoding (SPI, I2C, UART, CAN), and cloud-enabled data visualization

- Increasing need for rapid debugging, high-speed digital signal validation, and multi-device testing is accelerating the shift toward portable, PC-integrated analyzers

- As electronics become more compact and digitally complex, Electronics Access Control Systems will remain vital for fast prototyping, real-time testing, and advanced embedded system analysis

What are the Key Drivers of Electronics Access Control Systems Market?

- Rising demand for affordable, accurate, and easy-to-use logic analyzers to support rapid debugging and validation in microcontroller, FPGA, and digital circuit development

- For instance, in 2025, leading companies such as Saleae, Yokogawa, and Good Will Instrument upgraded their analyzer portfolios to support higher sampling rates, enhanced protocol decoding, and flexible software interfaces

- Growing adoption of IoT devices, consumer electronics, robotics, EV systems, and smart automation is boosting demand for digital signal testing tools across the U.S., Europe, and Asia-Pacific

- Advancements in signal acquisition, memory depth, waveform compression, and USB-powered architectures have strengthened performance, portability, and efficiency

- Rising use of AI chips, high-speed serial interfaces, and complex communication buses is creating demand for high-density, multi-channel portable analyzers

- Supported by steady investments in electronics R&D, semiconductor innovation, and testing infrastructure, the Electronics Access Control Systems market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Electronics Access Control Systems Market?

- High costs associated with premium, high-bandwidth, and multi-channel logic analyzers restrict adoption among small engineering teams and academic institutions

- For instance, during 2024–2025, fluctuations in semiconductor component prices, specialized chip shortages, and longer lead times increased device manufacturing costs for several global vendors

- Complexity in analyzing high-speed digital protocols, mixed-signal systems, and advanced timing sequences increases the need for skilled engineers and training

- Limited awareness in emerging markets regarding logic analyzer capabilities, protocol support, and debugging best practices slows adoption

- Competition from digital oscilloscopes with built-in logic analyzer features (MSO), software debuggers, and protocol analyzers creates pricing pressure and reduces product differentiation

- To address these issues, companies are focusing on cost-optimized designs, training resources, cloud-based analytics, and higher software integration to increase global adoption of electronics access control systems

How is the Electronics Access Control Systems Market Segmented?

The market is segmented on the basis of product type and end user.

- By Product Type

On the basis of product type, the electronics access control systems market is segmented into Authentication Systems, Intruder Alarm Systems, and Perimeter Security Systems. The Authentication Systems segment dominated the market with a 41.2% share in 2025, supported by growing demand for secure access management, biometric verification, RFID-based authentication, and cloud-enabled control solutions across commercial, government, and industrial sectors. Authentication Systems are widely adopted due to their ability to provide real-time access monitoring, audit trails, and integration with enterprise security platforms. These systems are increasingly used in offices, manufacturing units, healthcare facilities, and smart buildings to prevent unauthorized access and streamline operational security.

The Perimeter Security Systems segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising adoption of integrated sensor networks, IoT-enabled surveillance, and AI-powered threat detection in both outdoor and critical infrastructure applications. Increasing security concerns and regulatory compliance requirements further accelerate demand for advanced perimeter solutions globally.

- By End User

On the basis of end user, the electronics access control systems market is segmented into Commercial Spaces, Military and Defense, Government, Residential, Education, Healthcare, Industrial, and Others. The Commercial Spaces segment dominated the market with a 38.7% share in 2025, fueled by the expansion of office complexes, retail centers, and smart building infrastructure requiring robust access control and surveillance integration. Adoption of authentication systems, IoT-enabled locks, and cloud-based monitoring solutions in commercial establishments ensures operational efficiency and regulatory compliance.

The Military and Defense segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by the need for secure installations, restricted facility access, and advanced perimeter protection technologies. Rising investment in defense infrastructure, critical facility security, and technology modernization programs is boosting the adoption of high-performance, multi-layered electronics access control systems for personnel, vehicles, and equipment globally.

Which Region Holds the Largest Share of the Electronics Access Control Systems Market?

- North America dominated the electronics access control systems market with a 39.47% revenue share in 2025, driven by robust growth in semiconductor design, embedded system development, electronics manufacturing, and extensive R&D activities across the U.S. and Canada. High adoption of IoT-enabled access solutions, cloud-based security platforms, and smart building integration continues to fuel demand for Electronics Access Control Systems across commercial, industrial, government, and educational facilities

- Leading North American companies are introducing advanced authentication systems, integrated alarm solutions, and perimeter monitoring technologies with enhanced connectivity, AI-powered analytics, and cloud-enabled control interfaces, strengthening the region’s technological advantage. Ongoing investments in IoT, AI-enabled infrastructure, and smart building projects further drive long-term market growth

- Strong innovation ecosystems, high concentration of engineering talent, and sustained investments in advanced electronics and security infrastructure reinforce North America’s market leadership

U.S. Electronics Access Control Systems Market Insight

The U.S. is the largest contributor in North America, supported by widespread adoption of smart security solutions, rapid deployment of cloud-based access control platforms, and extensive integration of AI-enabled monitoring systems across commercial, government, industrial, and healthcare sectors. Rising investments in IoT devices, connected buildings, and smart city initiatives intensify demand for Electronics Access Control Systems capable of real-time access monitoring, threat detection, and data analytics. Presence of major technology providers, R&D hubs, and high cybersecurity awareness further fuels market expansion.

Canada Electronics Access Control Systems Market Insight

Canada contributes significantly to regional growth, driven by the adoption of integrated access control solutions, advanced alarm systems, and perimeter monitoring in commercial, healthcare, and educational sectors. Government-backed initiatives, skilled workforce availability, and strong focus on smart building projects further boost market penetration.

Asia-Pacific Electronics Access Control Systems Market

Asia-Pacific is projected to register the fastest CAGR of 9.47% from 2026 to 2033, propelled by rapid expansion of commercial infrastructure, industrial automation, and smart city deployments across China, Japan, India, South Korea, and Southeast Asia. High-volume adoption of IoT-enabled access solutions, cloud-connected monitoring systems, and AI-based security platforms accelerates demand. Growth in manufacturing facilities, critical infrastructure, and urban development increases the need for scalable and efficient Electronics Access Control Systems.

China Electronics Access Control Systems Market Insight

China is the largest contributor in Asia-Pacific due to significant investments in smart building infrastructure, industrial automation, and government security programs. Rising deployment of biometric authentication, AI-enabled monitoring, and cloud-based access control systems drives regional adoption. Competitive pricing and domestic manufacturing capabilities further expand both domestic and export markets.

Japan Electronics Access Control Systems Market Insight

Japan exhibits steady growth supported by advanced smart building initiatives, industrial automation projects, and modernization of commercial and residential access control systems. Emphasis on reliability, low-latency connectivity, and integrated security platforms drives adoption of high-quality solutions.

India Electronics Access Control Systems Market Insight

India is emerging as a key growth hub, fueled by rapid urbanization, expansion of commercial complexes, and government-supported smart city projects. Rising demand for secure access, IoT-enabled monitoring, and AI-powered security solutions accelerates market penetration across commercial, industrial, and residential sectors.

South Korea Electronics Access Control Systems Market Insight

South Korea contributes significantly due to high adoption of smart building technologies, advanced industrial facilities, and robust IT infrastructure. Increasing deployment of AI-driven surveillance, cloud-connected authentication systems, and integrated perimeter security solutions supports sustained market growth across commercial, defense, and industrial applications.

Which are the Top Companies in Electronics Access Control Systems Market?

The electronics access control systems industry is primarily led by well-established companies, including:

- Johnson Controls (U.S.)

- Cisco (U.S.)

- Honeywell International Inc. (U.S.)

- Siemens (Germany)

- ASSA ABLOY Group (Sweden)

- Nortek Security & Control LLC (U.S.)

- Cognitec Systems GMBH (Germany)

- FUJITSU (Japan)

- Godrej & Boyce Manufacturing Company Limited (India)

- Hitachi, Ltd. (Japan)

- KISI Inc. (U.S.)

- Allegion plc (Ireland)

- Bosch Sicherheitssysteme GmbH (Germany)

- Safran (France)

- Wirepath Home Systems, LLC (U.S.)

- Everspring Industry Co., Ltd. (Taiwan)

- Magal Security Systems Ltd. (Israel)

- GEZE South Africa (Pty) Ltd. (South Africa)

- 3M (U.S.)

- Panasonic India (India)

What are the Recent Developments in Global Electronics Access Control Systems Market?

- In August 2025, ASSA ABLOY acquired SiteOwl, a U.S.-based cloud platform for physical security lifecycle management, strengthening its access control solutions by improving how integrators, service providers, and end users manage infrastructure. Combining SiteOwl's digital capabilities with ASSA ABLOY's expertise enables streamlined lifecycle management and positions the company as a leader in digital security transformation, paving the way for new growth opportunities

- In August 2025, Allegion acquired Brisant Secure Limited, a U.K.-based provider of residential security hardware known for its Ultion high-security locks and key systems, enhancing its European portfolio. This acquisition complements Allegion UK's existing non-residential offerings and previous UAP acquisition, reinforcing its market presence and expanding its range of secure access solutions

- In June 2025, Suprema expanded its Access Control Unit (ACU) portfolio with the CoreStation 20 (CS-20) and Door Interface (DI-24) module, offering a compact RFID controller for up to 500,000 users with PoE+ and encrypted communication, while the DI-24 manages two doors and four readers. These additions enhance scalability, deployment flexibility, and overall security for diverse facilities, supporting broader adoption of advanced access control systems

- In April 2025, Honeywell signed a 10-year global distribution agreement with Milestone Systems, extending a partnership initiated in 2017, and becoming Milestone’s exclusive access control alliance partner. The agreement strengthens collaboration on on-premises, hybrid, and cloud integrations, ensuring cohesive, future-proof security ecosystems worldwide and enhancing Honeywell's integrated access control offerings

- In January 2025, Nedap launched AEOS Certificate Management and Device Certificate Management, making AEOS the first access control system to implement end-to-end certificate management from server to reader. This capability enhances security by assigning unique digital certificates for encrypted communication across servers, controllers, and access readers, significantly reducing cyber risks and preventing unauthorized access within the AEOS ecosystem

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Electronics Access Control Systems Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Electronics Access Control Systems Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Electronics Access Control Systems Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.