Global Electronics Shutter Market

Market Size in USD Billion

CAGR :

%

USD

46.21 Billion

USD

59.00 Billion

2025

2033

USD

46.21 Billion

USD

59.00 Billion

2025

2033

| 2026 –2033 | |

| USD 46.21 Billion | |

| USD 59.00 Billion | |

|

|

|

|

Electronics Shutter Market Size

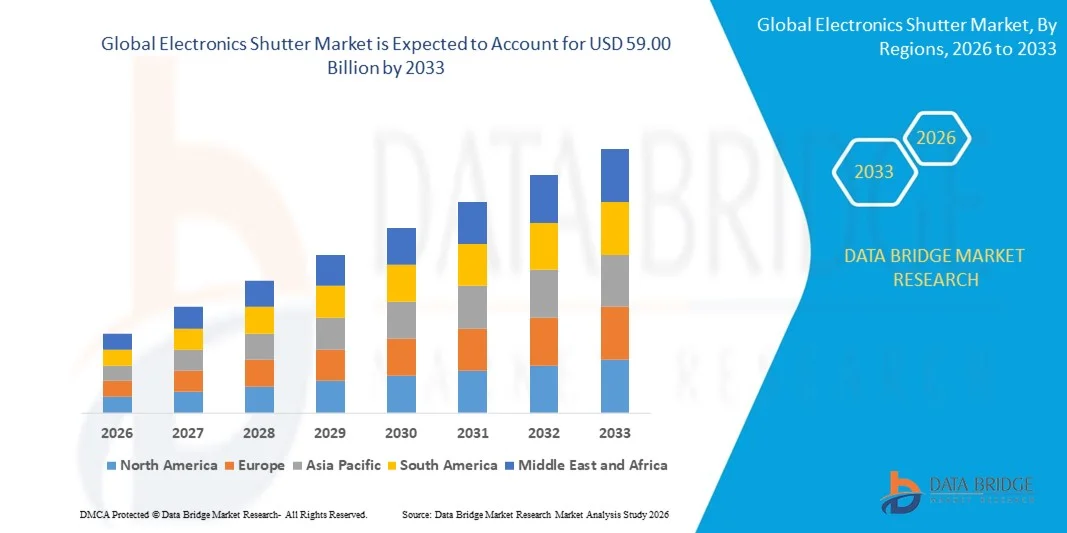

- The global electronics shutter market size was valued at USD 46.21 billion in 2025 and is expected to reach USD 59.00 billion by 2033, at a CAGR of 3.10% during the forecast period

- The market growth is largely fuelled by the increasing adoption of electronic devices in consumer electronics, automotive, and industrial applications, which require precise and durable shutter mechanisms

- Rising demand for compact and high-performance imaging systems in smartphones, cameras, and security equipment is further driving market expansion

Electronics Shutter Market Analysis

- The market is witnessing strong growth due to increasing usage in smartphones, digital cameras, automotive ADAS (Advanced Driver Assistance Systems), and surveillance equipment, where high-speed and precise shutter operation is critical

- Expansion of the consumer electronics sector, coupled with rising investments in smart imaging and automated devices, is fueling demand for advanced electronic shutters

- North America dominated the electronics shutter market with the largest revenue share of 36.84% in 2025, driven by increasing adoption of consumer electronics, automotive imaging systems, and industrial automation solutions

- Asia-Pacific region is expected to witness the highest growth rate in the global electronics shutter market, driven by rapid urbanization, rising disposable incomes, growing electronics manufacturing capabilities, and increasing demand for high-performance imaging systems in consumer, automotive, and industrial applications

- The CMOS Sensors segment held the largest market revenue share in 2025, driven by its low power consumption, faster readout speeds, and cost-effectiveness, making it widely preferred in consumer electronics and automotive imaging applications. CMOS-enabled shutters often provide seamless integration with compact devices and support advanced features such as high-speed imaging and low-light performance, enhancing their adoption across multiple industries

Report Scope and Electronics Shutter Market Segmentation

|

Attributes |

Electronics Shutter Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Electronics Shutter Market Trends

Rising Demand For High-Precision Imaging And Automation

- The growing adoption of electronic devices in consumer electronics, automotive, and industrial sectors is significantly shaping the electronics shutter market. Manufacturers increasingly prefer electronic shutters for applications requiring fast, precise, and reliable image capture or light control. The demand is further fueled by smartphones, digital cameras, security systems, and industrial imaging equipment, driving innovation in shutter design and performance

- Increasing emphasis on miniaturization, energy efficiency, and integration with AI-enabled imaging systems is accelerating the uptake of electronic shutters. Consumer electronics and professional imaging markets are driving manufacturers to develop compact, high-speed shutters suitable for both mass-market and specialized applications

- Automation and smart device trends are influencing purchasing decisions, with companies focusing on advanced electronic shutters that provide higher response speeds, lower power consumption, and enhanced durability. These factors are helping brands differentiate products in a competitive market and build technological leadership

- For instance, in 2024, Sony in Japan and Canon in Japan expanded their imaging device portfolios by incorporating high-speed electronic shutters in cameras and smartphones. These launches addressed rising consumer demand for precision imaging, faster frame rates, and improved low-light performance across retail and professional channels

- While demand for electronic shutters is growing, sustained market expansion depends on continuous R&D, cost-effective production, and maintaining reliability and performance under varying environmental conditions. Companies are also focusing on developing scalable manufacturing processes, supply chain efficiency, and innovative shutter mechanisms for broader adoption

Electronics Shutter Market Dynamics

Driver

Growing Demand For High-Speed And Precise Imaging Systems

- Rising adoption of electronic shutters in cameras, smartphones, automotive ADAS, and industrial imaging is a major driver for the market. Companies are increasingly replacing mechanical shutters with electronic alternatives to achieve faster response, reduced wear, and improved precision

- Expanding applications across consumer electronics, security equipment, automotive safety systems, and medical imaging devices are influencing market growth. Electronic shutters enhance image quality, enable advanced functionalities, and support automation in these devices

- Device manufacturers are promoting electronic shutter-based innovations through product launches, marketing campaigns, and industry collaborations. These efforts are supported by growing demand for miniaturized, energy-efficient, and high-performance imaging solutions

- For instance, in 2023, Canon in Japan and Nikon in Japan reported increased incorporation of electronic shutters in cameras and mirrorless devices. This expansion responded to higher demand for precise, high-speed imaging and low-noise capture capabilities, boosting product differentiation

- Although rising demand supports growth, wider adoption depends on cost optimization, supply of semiconductor components, and scalable manufacturing processes. Investment in R&D, advanced fabrication technology, and supply chain efficiency will be critical for meeting global demand and maintaining a competitive edge

Restraint/Challenge

High Cost And Technical Complexity Compared To Mechanical Shutters

- The relatively higher cost and technical complexity of electronic shutters compared to conventional mechanical shutters remain a key challenge, limiting adoption in price-sensitive consumer devices. Advanced materials, precise fabrication, and integration with electronics contribute to elevated costs

- Consumer and manufacturer awareness regarding the benefits of electronic shutters remains uneven, particularly in emerging markets where mechanical shutters dominate. Limited understanding of functional advantages restricts adoption in cameras, smartphones, and industrial equipment

- Supply chain and component availability challenges also impact market growth. Electronic shutters require precise semiconductor components and adherence to strict quality standards, which increase operational costs and manufacturing complexity

- For instance, in 2024, imaging device manufacturers in Southeast Asia reported slower uptake of electronic shutters due to higher prices and limited knowledge of advantages compared to mechanical alternatives. Component shortages and quality compliance requirements further constrained production

- Overcoming these challenges will require cost-efficient design, component sourcing strategies, and educational initiatives for manufacturers and end users. Collaboration with suppliers, device manufacturers, and technical institutions can help unlock long-term growth potential. In addition, developing robust, high-performance, and affordable electronic shutters will be essential for widespread adoption

Electronics Shutter Market Scope

The market is segmented on the basis of technology, shuttering type, and application

- By Technology

On the basis of technology, the electronics shutter market is segmented into CMOS Sensors and CCD Sensors. The CMOS Sensors segment held the largest market revenue share in 2025, driven by its low power consumption, faster readout speeds, and cost-effectiveness, making it widely preferred in consumer electronics and automotive imaging applications. CMOS-enabled shutters often provide seamless integration with compact devices and support advanced features such as high-speed imaging and low-light performance, enhancing their adoption across multiple industries.

The CCD Sensors segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its superior image quality, high sensitivity, and low noise characteristics, making it ideal for broadcast, professional photography, and high-end surveillance applications. CCD-based shutters are particularly valued for precision imaging and consistent performance in demanding conditions, often serving as a critical component in specialized imaging systems.

- By Shuttering Type

On the basis of shuttering type, the market is segmented into Rolling and Global. The Rolling Shutter segment held the largest revenue share in 2025, owing to its suitability for high-speed and cost-efficient imaging systems commonly used in smartphones, digital cameras, and industrial applications. Rolling shutters offer efficient data capture and simplified integration with CMOS sensors, making them a preferred choice for mass-market devices.

The Global Shutter segment is expected to grow at the fastest rate from 2026 to 2033 due to increasing demand for distortion-free imaging in automotive ADAS, professional cameras, and scientific equipment. Global shutters are favored for precise and simultaneous exposure of all pixels, enabling high-quality capture in dynamic and fast-moving environments.

- By Application

On the basis of application, the market is segmented into Consumer Electronics, Broadcast, Automotive, Retail, Government, Surveillance, and Others. The Consumer Electronics segment accounted for the largest market share in 2025, driven by widespread use in smartphones, tablets, and digital cameras, where fast, compact, and reliable shutters are essential for high-quality imaging. Consumer preference for high-resolution photography and video recording further fuels adoption.

The Automotive segment is expected to witness the fastest growth rate from 2026 to 2033, propelled by rising integration of electronic shutters in advanced driver assistance systems (ADAS), in-vehicle cameras, and autonomous vehicles. Increasing demand for precise imaging and real-time data capture in automotive safety and navigation systems is driving growth across the segment.

Electronics Shutter Market Regional Analysis

- North America dominated the electronics shutter market with the largest revenue share of 36.84% in 2025, driven by increasing adoption of consumer electronics, automotive imaging systems, and industrial automation solutions

- Consumers and manufacturers in the region highly value the precision, speed, and reliability offered by electronic shutters, which enhance imaging performance in smartphones, cameras, automotive ADAS, and surveillance systems

- This widespread adoption is further supported by advanced manufacturing capabilities, high disposable incomes, and strong R&D infrastructure, establishing electronic shutters as a preferred choice for both consumer and professional imaging applications

U.S. Electronics Shutter Market Insight

The U.S. electronics shutter market captured the largest revenue share in 2025 within North America, fueled by the rapid integration of imaging systems in consumer electronics and automotive safety applications. Manufacturers are increasingly prioritizing high-speed, high-precision shutters for cameras, smartphones, and advanced driver assistance systems (ADAS). The growing trend of smart devices, along with rising demand for high-resolution imaging and low-light performance, is further propelling market growth. Moreover, advancements in CMOS sensor-based shutters and miniaturized imaging systems are significantly contributing to the market’s expansion.

Europe Electronics Shutter Market Insight

The Europe electronics shutter market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by increasing demand for high-quality imaging in consumer electronics, broadcast, and surveillance sectors. Stringent regulations for automotive safety and rising adoption of automated industrial imaging systems are also fostering market growth. European consumers and manufacturers are attracted to the precision, durability, and energy efficiency offered by electronic shutters. The region is witnessing significant expansion across professional cameras, automotive ADAS, and government surveillance project.

U.K. Electronics Shutter Market Insight

The U.K. electronics shutter market is expected to witness strong growth from 2026 to 2033, driven by rising adoption of advanced imaging solutions and increasing integration of smart devices in consumer and industrial applications. Concerns regarding safety, security, and high-quality imaging are encouraging businesses and consumers to adopt electronic shutters. The U.K.’s robust electronics manufacturing and research infrastructure, along with growing e-commerce and technology retail channels, is expected to continue supporting market expansion.

Germany Electronics Shutter Market Insight

The Germany electronics shutter market is expected to witness notable growth from 2026 to 2033, fueled by increasing awareness of precision imaging, automotive safety applications, and industrial automation. Germany’s well-developed technology ecosystem, focus on innovation, and emphasis on sustainable and energy-efficient solutions promote the adoption of electronic shutters in consumer electronics, automotive, and professional imaging systems. Integration with advanced imaging sensors and smart automation solutions is becoming increasingly prevalent.

Asia-Pacific Electronics Shutter Market Insight

The Asia-Pacific electronics shutter market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising production and consumption of smartphones, cameras, automotive electronics, and surveillance equipment in countries such as China, Japan, and India. Increasing urbanization, technological advancements, and expanding middle-class populations are boosting adoption. Furthermore, APAC’s role as a manufacturing hub for imaging components ensures greater affordability and availability, widening access to electronic shutter technologies across consumer and industrial applications.

Japan Electronics Shutter Market Insight

The Japan electronics shutter market is expected to witness strong growth from 2026 to 2033 due to the country’s advanced technological ecosystem, high smartphone penetration, and growing demand for high-precision imaging solutions. Adoption is driven by an increasing number of connected devices, smart cameras, and automotive imaging systems. Integration with IoT-enabled security, industrial automation, and professional imaging equipment is further fueling growth. In addition, Japan’s aging population is likely to spur demand for user-friendly, high-performance imaging solutions in both consumer and commercial sectors.

China Electronics Shutter Market Insight

The China electronics shutter market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, rising disposable incomes, and strong adoption of consumer electronics and automotive imaging systems. China is one of the largest markets for smartphones, cameras, and surveillance solutions, where electronic shutters are increasingly preferred for high-speed, high-resolution imaging. The push toward smart cities, availability of affordable electronic shutter solutions, and strong domestic manufacturers are key factors driving market growth in China.

Electronics Shutter Market Share

The Electronics Shutter industry is primarily led by well-established companies, including:

• Sony Corporation (Japan)

• Himax Technologies, Inc. (U.S.)

• GalaxyCore Shanghai Limited Corporation (China)

• SK HYNIX INC. (South Korea)

• OmniVision Technologies, Inc. (U.S.)

• SAMSUNG (South Korea)

• TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION (Japan)

• Canon Inc. (Japan)

• Panasonic Corporation (Japan)

• Apple Inc. (U.S.)

• Quanzhou Heyi Electronics Co., Ltd (China)

• Semiconductor Components Industries, LLC (U.S.)

• RAMA ROLLING SHUTTER WORKS (Taiwan)

• SKP Automation Systems (South Korea)

• NIEN MADE ENTERPRISE CO., LTD. (Taiwan)

• Glidemaster (U.K.)

• DUNES INDUSTRIES (U.S.)

• Thorlabs, Inc. (U.S.)

• Cambo (Netherlands)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Electronics Shutter Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Electronics Shutter Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Electronics Shutter Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.