Global Enterprise High Productivity Application Platform As A Service Market

Market Size in USD Billion

CAGR :

%

USD

18.71 Billion

USD

277.81 Billion

2025

2033

USD

18.71 Billion

USD

277.81 Billion

2025

2033

| 2026 –2033 | |

| USD 18.71 Billion | |

| USD 277.81 Billion | |

|

|

|

|

Enterprise High-Productivity Application Platform as a Service Market Size

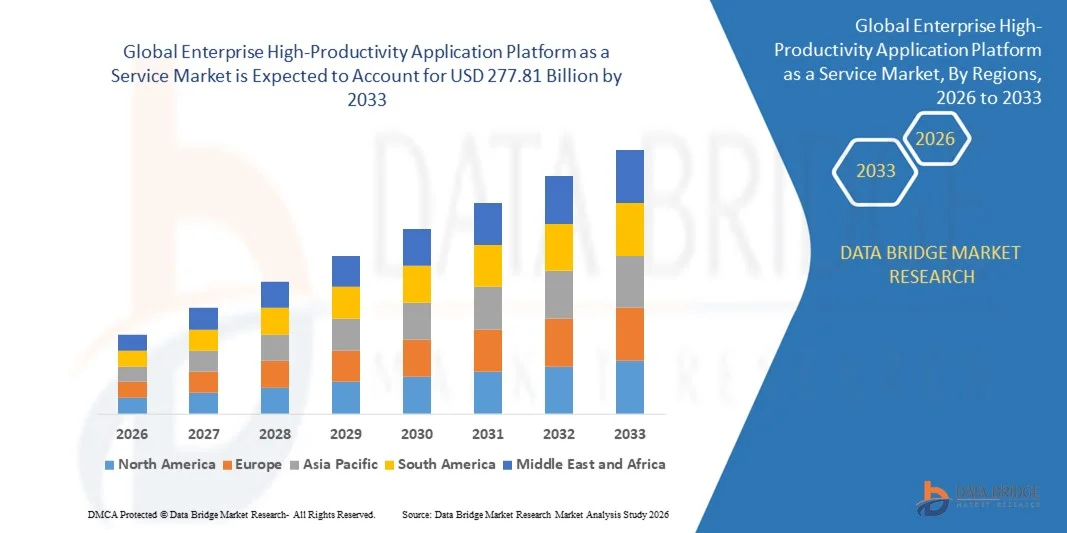

- The global enterprise high-productivity application platform as a service market size was valued at USD 18.71 billion in 2025 and is expected to reach USD 277.81 billion by 2033, at a CAGR of 40.10% during the forecast period

- The market growth is largely fueled by the increasing adoption of low-code and high-productivity platforms across enterprises, driven by the need to accelerate application development, automate workflows, and support digital transformation initiatives in both large and small organizations

- Furthermore, rising enterprise demand for scalable, secure, and integrated platforms that enable rapid deployment of business applications is establishing high-productivity application platforms as a preferred solution for modern IT environments. These factors are collectively driving strong market expansion

Enterprise High-Productivity Application Platform as a Service Market Analysis

- High-productivity application platforms, offering low-code/no-code development environments, automation capabilities, and seamless integration with enterprise systems, are becoming critical tools for enhancing operational efficiency and reducing time-to-market for applications across industries

- The escalating adoption of these platforms is primarily fueled by growing enterprise digitalization, increasing demand for agile application development, and the need for efficient workflow management, making them essential for enterprises aiming to modernize IT operations and accelerate innovation

- North America dominated the enterprise high-productivity application platform as a service market with a share of 49.15% in 2025, due to early adoption of low-code and no-code platforms and strong enterprise digital transformation initiatives

- Asia-Pacific is expected to be the fastest growing region in the enterprise high-productivity application platform as a service market during the forecast period due to rapid digitalization, expanding enterprise IT investments, and growing adoption of cloud-based platforms

- Software segment dominated the market with a market share of 6.5% in 2025, due to strong demand for low-code and no-code platforms that enable rapid application development and workflow automation. Enterprises increasingly rely on core platform software to streamline business processes, improve developer productivity, and reduce time-to-market for digital solutions. These platforms offer prebuilt modules, integration tools, and analytics capabilities that support enterprise-wide scalability and customization. Widespread adoption across IT, operations, and business teams further strengthens software dominance

Report Scope and Enterprise High-Productivity Application Platform as a Service Market Segmentation

|

Attributes |

Enterprise High-Productivity Application Platform as a Service Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Enterprise High-Productivity Application Platform as a Service Market Trends

Growing Adoption of Low-Code and No-Code Platforms

- A notable trend in the enterprise high-productivity application platform as a service market is the increasing adoption of low-code and no-code development platforms, driven by the rising need for rapid application development, process automation, and digital transformation across enterprises. These platforms are empowering organizations to accelerate application delivery, reduce dependency on traditional IT resources, and enable citizen developers to participate in software creation

- For instance, Microsoft Power Platform and Salesforce Lightning are widely adopted by global enterprises to streamline business processes, integrate with existing systems, and provide scalable solutions for both IT teams and business units. Such adoption strengthens enterprise agility and enhances productivity across operational functions

- The growing preference for cloud-based deployment models is further fueling the trend, as organizations seek platforms that offer scalability, flexibility, and seamless integration with existing enterprise ecosystems. This shift allows enterprises to reduce infrastructure management burdens and focus on innovation

- Industries such as BFSI, healthcare, and IT services are leveraging low-code/no-code platforms to accelerate application rollout for customer service, compliance tracking, and internal workflow automation. This is positioning high-productivity platforms as critical tools for operational efficiency

- The adoption of these platforms is also being accelerated by the increasing demand for mobile and web-accessible applications that support remote workforce management and real-time data access. Organizations are prioritizing platforms that enable cross-functional collaboration and rapid iteration

- Enterprises are increasingly investing in platforms that offer analytics, AI integration, and prebuilt modules, which enhance decision-making and accelerate digital initiatives. This trend is expected to continue as organizations focus on maximizing ROI from their high-productivity application platforms

Enterprise High-Productivity Application Platform as a Service Market Dynamics

Driver

Increasing Enterprise Digital Transformation Initiatives

- The growing emphasis on enterprise digital transformation is driving the adoption of high-productivity application platforms, as organizations aim to modernize legacy systems, improve operational efficiency, and accelerate the delivery of business applications. These platforms enable enterprises to automate workflows, integrate disparate systems, and deploy applications faster with lower development costs

- For instance, OutSystems has been widely implemented by global enterprises to deliver mission-critical applications rapidly while maintaining enterprise-grade security and compliance. Such platforms support scalability and facilitate the modernization of IT infrastructure in alignment with digital transformation goals

- The rise of remote and hybrid work models is reinforcing the need for platforms that support mobile and web-enabled applications, enabling employees to access and manage workflows seamlessly from any location. This shift is fostering platform adoption across multiple industries

- Enterprises are also focusing on customer-centric digital solutions that require agile development cycles and faster deployment of applications. High-productivity platforms help meet these requirements by providing reusable components, prebuilt connectors, and integration capabilities

- Rising awareness of low-code/no-code and high-productivity platforms among IT and business leaders further drives adoption, as organizations recognize the benefits of empowering business users to participate in application development

Restraint/Challenge

Data Security and Compliance Concerns

- The enterprise high-productivity application platform as a service market faces challenges related to data security, privacy, and regulatory compliance. Organizations handling sensitive information must ensure that applications developed on low-code/no-code platforms meet stringent security standards and adhere to regulations such as GDPR, HIPAA, and SOC 2

- For instance, Appian and Mendix provide enterprise-grade security features to address these concerns, but the need for comprehensive monitoring, access control, and encryption increases complexity and operational overhead. Ensuring secure integration with legacy systems further compounds these challenges

- The rapid development cycles enabled by these platforms can increase the risk of security gaps if proper governance frameworks are not in place. This raises concerns among enterprises about potential data breaches, intellectual property exposure, and compliance violations

- Enterprises are also cautious about multi-tenant cloud deployments, which may pose additional security and privacy risks when sensitive data is shared across environments. Mitigating these risks requires robust platform design, continuous monitoring, and adherence to best practices

- The challenge of balancing agility with security and compliance continues to constrain the widespread adoption of high-productivity platforms, making it critical for vendors to provide built-in security, audit trails, and regulatory compliance features to support enterprise requirements

Enterprise High-Productivity Application Platform as a Service Market Scope

The market is segmented on the basis of component, deployment, organization size, vertical, and type.

- By Component

On the basis of component, the Enterprise High-Productivity Application Platform as a Service market is segmented into software and services. The software segment dominated the market with the largest revenue share of 62.5% in 2025, driven by strong demand for low-code and no-code platforms that enable rapid application development and workflow automation. Enterprises increasingly rely on core platform software to streamline business processes, improve developer productivity, and reduce time-to-market for digital solutions. These platforms offer prebuilt modules, integration tools, and analytics capabilities that support enterprise-wide scalability and customization. Widespread adoption across IT, operations, and business teams further strengthens software dominance.

The services segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by rising demand for consulting, integration, and managed services. Organizations seek expert support to align platform capabilities with complex enterprise requirements and legacy systems. Growing emphasis on customization, training, and ongoing optimization drives higher service adoption.

- By Deployment

On the basis of deployment, the market is segmented into Platform as a Service and on-premises. The Platform as a Service segment held the largest market share in 2025, supported by its scalability, cost efficiency, and faster deployment cycles. Enterprises prefer PaaS models to reduce infrastructure management burdens and enable continuous updates and innovation. Cloud-based deployment also supports remote collaboration and integration with other enterprise cloud solutions.

The on-premises segment is expected to register the fastest growth rate over the forecast period, driven by data security concerns and regulatory compliance requirements. Industries with strict data governance policies increasingly adopt on-premises deployments to maintain greater control over sensitive information. This trend is particularly strong in regulated environments requiring customized security architectures.

- By Organization Size

On the basis of organization size, the market is segmented into small and medium enterprises and large enterprises. Large enterprises dominated the market revenue share in 2025 due to their complex operational structures and higher IT budgets. These organizations leverage high-productivity platforms to standardize processes, enhance cross-department collaboration, and accelerate enterprise-wide digital transformation initiatives. Integration with existing enterprise systems further supports adoption at scale.

Small and medium enterprises are projected to witness the fastest growth from 2026 to 2033, driven by the need to improve operational efficiency with limited resources. SMEs increasingly adopt these platforms to build applications without extensive development teams. Affordable subscription models and ease of use significantly support rapid SME adoption.

- By Vertical

On the basis of vertical, the market is segmented into BFSI, government and public sector, healthcare and life sciences, IT and telecommunication, consumer goods and retail, education, and others. The IT and telecommunication segment accounted for the largest revenue share in 2025, driven by continuous demand for rapid application development and service innovation. These organizations rely on high-productivity platforms to manage large-scale digital services, automate workflows, and enhance customer engagement.

The healthcare and life sciences segment is expected to grow at the fastest pace during the forecast period, supported by increasing digitalization of patient management and operational processes. Demand for secure, compliant, and agile application development tools accelerates adoption. Platforms enable faster deployment of healthcare applications while maintaining regulatory standards.

- By Type

On the basis of type, the Enterprise High-Productivity Application Platform as a Service market is segmented into monthly subscription and annual subscription. The annual subscription segment dominated the market in 2025, driven by cost advantages and long-term platform adoption strategies among enterprises. Organizations prefer annual plans to ensure pricing stability, continuous platform access, and enterprise-wide deployment consistency. Long-term contracts also support better vendor support and customization options.

The monthly subscription segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by demand for flexibility and lower upfront commitment. Startups and smaller organizations increasingly favor monthly models to scale usage based on evolving needs. This model supports experimentation and gradual expansion without long-term financial constraints.

Enterprise High-Productivity Application Platform as a Service Market Regional Analysis

- North America dominated the enterprise high-productivity application platform as a service market with the largest revenue share of 49.15% in 2025, driven by early adoption of low-code and no-code platforms and strong enterprise digital transformation initiatives

- Organizations in the region place high importance on rapid application development, workflow automation, and seamless integration with existing enterprise IT ecosystems

- This strong adoption is supported by advanced cloud infrastructure, high IT spending, and a mature enterprise software landscape, positioning high-productivity platforms as a core enabler across large enterprises and technology-driven industries

U.S. Enterprise High-Productivity Application Platform as a Service Market Insight

The U.S. market accounted for the largest revenue share in 2025 within North America, supported by widespread adoption of cloud-native platforms and automation tools across enterprises. Companies increasingly focus on improving operational efficiency and accelerating digital innovation through low-code development environments. Strong presence of leading platform providers, coupled with high demand for scalable and secure enterprise solutions, continues to drive market growth. The increasing use of AI-enabled application platforms further strengthens adoption across industries.

Europe Enterprise High-Productivity Application Platform as a Service Market Insight

The Europe market is expected to grow at a steady CAGR during the forecast period, driven by increasing digital transformation initiatives across public and private sectors. Enterprises are adopting high-productivity platforms to modernize legacy systems and comply with evolving regulatory and data protection requirements. Growing demand for efficient application lifecycle management and automation across industries supports market expansion. Adoption is further encouraged by rising cloud acceptance and investments in enterprise software modernization.

U.K. Enterprise High-Productivity Application Platform as a Service Market Insight

The U.K. market is projected to register notable growth over the forecast period, fueled by rising cloud adoption and emphasis on business process automation. Organizations are increasingly leveraging low-code platforms to enhance agility and reduce development costs. The country’s strong financial services and technology sectors continue to drive demand for scalable and secure application development platforms. Government-led digital transformation initiatives also contribute to sustained market growth.

Germany Enterprise High-Productivity Application Platform as a Service Market Insight

The Germany market is anticipated to expand at a considerable CAGR, supported by increasing focus on Industry 4.0 and enterprise process optimization. German enterprises are adopting high-productivity platforms to streamline operations and integrate digital solutions across manufacturing and industrial applications. Strong emphasis on data security, compliance, and system reliability further accelerates adoption. The integration of automation platforms with enterprise resource planning systems is gaining traction across large organizations.

Asia-Pacific Enterprise High-Productivity Application Platform as a Service Market Insight

The Asia-Pacific market is expected to witness the fastest CAGR from 2026 to 2033, driven by rapid digitalization, expanding enterprise IT investments, and growing adoption of cloud-based platforms. Countries such as China, India, and Japan are experiencing strong demand for agile application development tools to support business scalability. Rising adoption among SMEs and increasing government focus on digital infrastructure development are key growth drivers. The region’s expanding technology ecosystem further supports widespread platform adoption.

Japan Enterprise High-Productivity Application Platform as a Service Market Insight

The Japan market is gaining traction due to increasing adoption of automation and digital workplace solutions across enterprises. Organizations are leveraging high-productivity platforms to address workforce efficiency challenges and accelerate application deployment. Strong demand for reliable, secure, and compliant enterprise software supports market growth. Integration of these platforms with AI and IoT-driven business processes further enhances adoption across industries.

China Enterprise High-Productivity Application Platform as a Service Market Insight

The China market held the largest revenue share in Asia-Pacific in 2025, driven by rapid enterprise digital transformation and strong government support for cloud adoption. Chinese organizations increasingly adopt low-code platforms to accelerate application development and reduce reliance on traditional coding resources. The presence of a large enterprise base, coupled with expanding cloud infrastructure and domestic platform providers, continues to propel market growth. Increasing focus on smart enterprises and digital process automation further strengthens adoption across sectors.

Enterprise High-Productivity Application Platform as a Service Market Share

The enterprise high-productivity application platform as a service industry is primarily led by well-established companies, including:

- Kony, Inc. (U.S.)

- Pegasystems Inc. (U.S.)

- Salesforce (U.S.)

- Oracle (U.S.)

- Microsoft (U.S.)

- ProntoForms Corporation (Canada)

- K2 (U.S.)

- Creatio (U.S.)

- AgilePoint, Inc. (U.S.)

- Betty Blocks (Netherlands)

- Kintone Corporation (Japan)

- Appian Corporation (U.S.)

- Mendix Tech BV (Netherlands)

- OutSystems (Portugal)

- Quickbase, Inc. (U.S.)

- ServiceNow, Inc. (U.S.)

- Google (U.S.)

- Zoho Corporation Pvt. Ltd. (India)

- WaveMaker, Inc. (U.S.)

- Workday, Inc. (U.S.)

Latest Developments in Global Enterprise High-Productivity Application Platform as a Service Market

- In March 2025, OutSystems launched the Agent Workbench, a low-code environment purpose-built for developing enterprise AI agents, which significantly strengthened its position in the high-productivity application platform market. This launch expanded platform capabilities beyond traditional application development into AI-driven automation, enabling enterprises to accelerate intelligent workflow creation while maintaining governance and scalability. The development reflects rising market demand for AI-embedded low-code platforms that enhance productivity and reduce development complexity

- In February 2025, Microsoft Power Platform was recognized as a Leader in the Gartner Magic Quadrant for Enterprise Low-Code Application Platforms, reinforcing its strong market presence and enterprise credibility. This recognition boosted customer confidence and further accelerated adoption among large organizations seeking scalable, integrated productivity platforms. The acknowledgment highlights Microsoft’s continued innovation and deep integration across enterprise ecosystems

- In January 2025, OutSystems was named a Leader in the Gartner Magic Quadrant for Enterprise Low-Code Application Platforms for the ninth consecutive year, underscoring its sustained influence in the market. This recognition strengthened its competitive advantage and validated its platform maturity, driving increased enterprise adoption for mission-critical applications. The achievement reflects growing enterprise reliance on proven high-productivity platforms for long-term digital transformation

- In November 2024, Appian released a major platform update introducing enterprise-ready AI features, including AI-powered semantic search and expanded AI availability across regulated environments. This enhancement improved application intelligence and operational efficiency, supporting enterprises seeking automation with compliance and scalability. The update aligned with market demand for secure, AI-enabled productivity platforms that deliver faster insights and improved decision-making

- In March 2024, OutSystems formed a strategic partnership with Temus, appointing it as Singapore’s first Premier Partner to expand regional delivery and implementation capabilities. This partnership strengthened OutSystems’ presence in Asia-Pacific and supported faster enterprise adoption through localized expertise. The collaboration reflects the market’s growing emphasis on ecosystem partnerships to scale platform adoption across emerging digital economies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.