Global Enterprise Monitoring Market

Market Size in USD Billion

CAGR :

%

USD

35.01 Billion

USD

119.86 Billion

2024

2032

USD

35.01 Billion

USD

119.86 Billion

2024

2032

| 2025 –2032 | |

| USD 35.01 Billion | |

| USD 119.86 Billion | |

|

|

|

|

Enterprise Monitoring Market Size

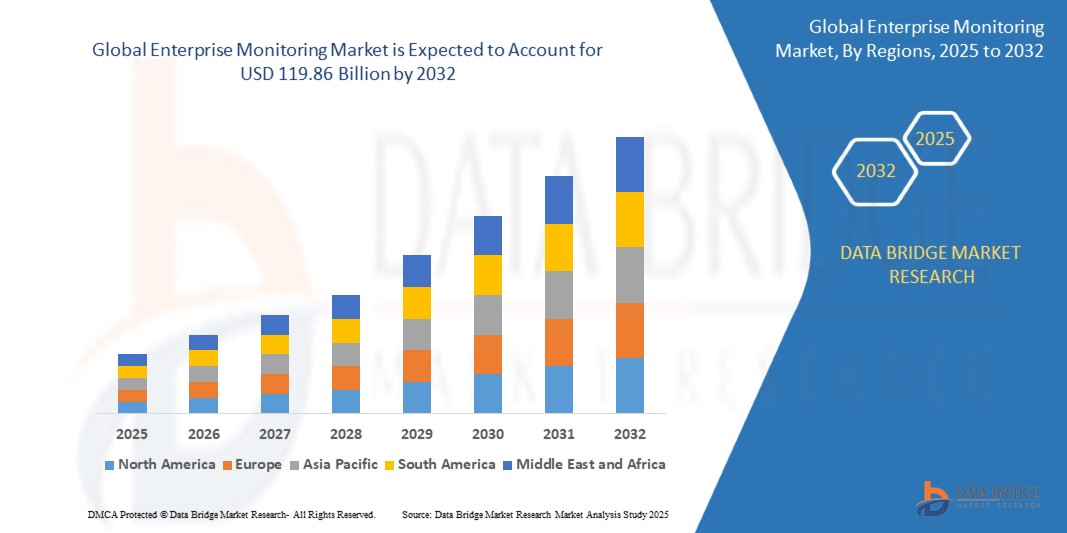

- The global enterprise monitoring market size was valued at USD 35.01 billion in 2024 and is expected to reach USD 119.86 billion by 2032, at a CAGR of 16.63% during the forecast period

- The market growth is largely fueled by the increasing adoption of cloud computing, hybrid IT infrastructures, and digital transformation initiatives across enterprises, driving the need for comprehensive monitoring solutions that ensure seamless performance, security, and reliability of IT systems

- Furthermore, rising enterprise reliance on real-time data analytics, AI-driven insights, and proactive issue detection is establishing advanced monitoring platforms as critical tools for optimizing operations, reducing downtime, and enhancing overall IT efficiency. These converging factors are accelerating the uptake of enterprise monitoring solutions, thereby significantly boosting the market’s growth

Enterprise Monitoring Market Analysis

- Enterprise monitoring solutions include software and platforms that track, analyze, and manage the performance, availability, and security of IT infrastructure, applications, and networks. They provide real-time alerts, dashboards, and predictive analytics to help organizations maintain system health, improve operational efficiency, and ensure business continuity

- The escalating demand for enterprise monitoring is primarily driven by growing complexity in IT environments, increasing digital operations, stringent regulatory compliance requirements, and the necessity for uninterrupted service delivery across industries

- North America dominated the enterprise monitoring market with a share of 39.7% in 2024, due to the high adoption of cloud computing, IT infrastructure investments, and the growing need for real-time performance insights

- Asia-Pacific is expected to be the fastest growing region in the enterprise monitoring market during the forecast period due to rapid digital transformation, increasing cloud adoption, and investments in IT infrastructure across countries such as China, Japan, and India

- Infrastructure segment dominated the market with a market share of 43% in 2024, due to the critical need for monitoring IT infrastructure components such as servers, storage systems, and networks. Organizations are increasingly prioritizing infrastructure monitoring to ensure high availability, prevent downtime, and optimize resource utilization. Advanced analytics and real-time monitoring capabilities provide IT teams with actionable insights, helping them maintain operational efficiency and minimize service disruptions. The segment’s dominance is further reinforced by the growing adoption of hybrid and cloud-based infrastructures, which require continuous visibility and management for seamless business operations

Report Scope and Enterprise Monitoring Market Segmentation

|

Attributes |

Enterprise Monitoring Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Enterprise Monitoring Market Trends

Rising Adoption of AI-Driven and Cloud-Based Monitoring Solutions

- The enterprise monitoring market is undergoing rapid transformation with the growing adoption of AI-driven and cloud-based monitoring platforms. Organizations are shifting from static monitoring methods toward intelligent solutions that leverage AI, machine learning, and predictive analytics to enhance IT performance and business continuity

- For instance, companies such as Dynatrace and Datadog provide AI-powered monitoring solutions that deliver automated root cause analysis and anomaly detection across applications, infrastructure, and user experience metrics. Similarly, New Relic and Splunk are expanding their monitoring suites with AI-driven dashboards to provide enterprises with proactive insights in complex IT environments

- Cloud-based enterprise monitoring solutions are gaining momentum as organizations modernize IT infrastructures and migrate workloads from on-premises systems

- These platforms enable centralized visibility, scalability, and flexibility across distributed IT ecosystems, ensuring seamless monitoring of both legacy and cloud-native applications

- The integration of AI with monitoring tools allows enterprises to predict potential system failures, optimize application performance, and enhance security posture through real-time detection of anomalies. This shift toward predictive and automated monitoring is minimizing downtime and improving overall service quality

- In summary, the rising use of AI-driven and cloud-based enterprise monitoring solutions is redefining the market. This trend reflects the ongoing evolution of monitoring technologies from reactive to proactive systems, enabling enterprises to meet the growing demands of digital business operations

Enterprise Monitoring Market Dynamics

Driver

Demand for Real-Time IT Performance Visibility

- The increasing demand for real-time visibility into IT system performance is a critical driver of the enterprise monitoring market. Organizations are relying on advanced monitoring solutions to ensure uninterrupted digital services, reduce downtime, and safeguard customer experience in a highly competitive environment

- For instance, Cisco and SolarWinds provide real-time IT infrastructure monitoring tools that allow enterprises to track network traffic, application latency, and cloud workloads with instant alerts. These capabilities enable IT teams to identify and address system anomalies before they escalate into major disruptions

- Real-time monitoring has become essential in sectors such as e-commerce, banking, and telecommunications, where even small outages lead to substantial financial losses and reputational risks

- Enterprises are investing in monitoring platforms to improve service reliability, optimize resource usage, and ensure compliance with service level agreements (SLAs)

- The growing digitalization of business operations, combined with the increasing complexity of IT ecosystems, further reinforces the relevance of real-time monitoring. By providing continuous visibility, enterprises can maintain operational efficiency and improve customer satisfaction in fast-growing digital markets

Restraint/Challenge

Integration Across Hybrid and Multi-Cloud Environments

- A key challenge in the enterprise monitoring market is the complexity of integrating monitoring solutions across hybrid and multi-cloud environments. As enterprises diversify their IT infrastructures across public cloud, private cloud, and on-premises systems, ensuring seamless visibility becomes increasingly difficult

- For instance, organizations that utilize AWS, Microsoft Azure, and Google Cloud simultaneously often face fragmented monitoring silos, making it challenging to achieve unified dashboards and comprehensive performance analytics. This lack of integration can delay issue detection and compromise overall system reliability

- In addition, traditional monitoring tools often struggle with scalability and compatibility in hybrid environments. Enterprises require interoperable solutions that can handle diverse APIs, multiple data formats, and dynamic workloads without creating gaps in visibility or increasing operational overhead

- The challenge is further compounded by security and compliance concerns in multi-cloud deployments. Enterprises must align monitoring solutions with strict regulatory frameworks while managing the complexity of data across different geographies and platforms

- As a result, integration challenges remain a major restraint in enterprise monitoring adoption, particularly for large organizations with complex IT ecosystems. Addressing these issues will require advanced platform interoperability, API-driven integration tools, and end-to-end monitoring solutions designed specifically for hybrid and multi-cloud architectures

Enterprise Monitoring Market Scope

The market is segmented on the basis of platform and vertical.

• By Platform

On the basis of platform, the enterprise monitoring market is segmented into infrastructure, application performance, security, digital experience, and workforce operation. The infrastructure segment dominated the largest market revenue share of 43% in 2024, driven by the critical need for monitoring IT infrastructure components such as servers, storage systems, and networks. Organizations are increasingly prioritizing infrastructure monitoring to ensure high availability, prevent downtime, and optimize resource utilization. Advanced analytics and real-time monitoring capabilities provide IT teams with actionable insights, helping them maintain operational efficiency and minimize service disruptions. The segment’s dominance is further reinforced by the growing adoption of hybrid and cloud-based infrastructures, which require continuous visibility and management for seamless business operations.

The digital experience segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for end-to-end monitoring of user interactions and customer journeys. Organizations are leveraging digital experience monitoring to enhance service quality, improve application responsiveness, and boost overall user satisfaction. Integration with AI-driven analytics and performance optimization tools enables enterprises to proactively detect issues, optimize workflows, and maintain a competitive edge in the digital-first environment. The rapid digital transformation across industries and the increasing focus on personalized user experiences are key factors driving this segment’s robust growth.

• By Vertical

On the basis of vertical, the enterprise monitoring market is segmented into BFSI, IT & ITES, telecom, retail & e-commerce, media & entertainment, healthcare & life sciences, manufacturing, government, transportation & logistics, and others. The IT & ITES vertical dominated the largest market revenue share in 2024, owing to the sector’s heavy reliance on complex IT systems and cloud-based services. Continuous monitoring is essential for IT organizations to ensure service uptime, optimize application performance, and maintain security compliance. Growing adoption of managed services, AI-driven analytics, and automation tools further reinforces monitoring investments in this vertical. The presence of large-scale data centers and mission-critical applications also makes IT & ITES a major contributor to market revenue.

The healthcare & life sciences vertical is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increasing digitization of patient care, telemedicine, and clinical operations. Real-time monitoring of IT infrastructure, applications, and digital experiences is critical for ensuring patient safety, regulatory compliance, and seamless delivery of healthcare services. The rapid adoption of electronic health records (EHRs), connected medical devices, and AI-driven healthcare solutions is creating heightened demand for comprehensive enterprise monitoring solutions. Growing investments in smart hospitals and healthcare IT modernization are key factors accelerating growth in this vertical.

Enterprise Monitoring Market Regional Analysis

- North America dominated the enterprise monitoring market with the largest revenue share of 39.7% in 2024, driven by the high adoption of cloud computing, IT infrastructure investments, and the growing need for real-time performance insights

- Enterprises in the region increasingly rely on monitoring solutions to ensure operational efficiency, maintain service uptime, and enhance security across IT and business processes

- This adoption is further supported by a technologically advanced workforce, high digital maturity, and substantial IT budgets, establishing enterprise monitoring solutions as critical tools for organizations across sectors

U.S. Enterprise Monitoring Market Insight

The U.S. enterprise monitoring market captured the largest revenue share in 2024 within North America, fueled by the widespread deployment of IT infrastructure and cloud-based applications. Businesses are increasingly prioritizing proactive monitoring to detect anomalies, optimize performance, and prevent downtime. The rising adoption of AI-driven analytics, automation tools, and integrated monitoring platforms, combined with the need for compliance with data security standards, is significantly propelling market growth. Moreover, the growing trend of hybrid IT environments and managed services further strengthens the demand for comprehensive monitoring solutions.

Europe Enterprise Monitoring Market Insight

The Europe enterprise monitoring market is projected to expand at a substantial CAGR during the forecast period, driven by stringent data security regulations and increasing digitalization across enterprises. Growing investments in IT modernization, coupled with the demand for enhanced operational efficiency, are fostering adoption. Enterprises across the region are leveraging monitoring tools to manage complex IT systems, improve application performance, and ensure cybersecurity compliance. The market is witnessing significant growth across BFSI, IT & ITES, and government sectors, with solutions being adopted in both legacy and modern IT environments.

U.K. Enterprise Monitoring Market Insight

The U.K. enterprise monitoring market is expected to grow at a noteworthy CAGR during the forecast period, driven by increasing digital transformation initiatives and the need for robust IT governance. Organizations are adopting monitoring solutions to manage application performance, infrastructure, and digital experiences. The growing focus on cloud-based services, cybersecurity, and remote workforce management further supports market expansion. In addition, the country’s strong IT services ecosystem and high awareness of enterprise monitoring benefits are stimulating demand across multiple verticals.

Germany Enterprise Monitoring Market Insight

The Germany enterprise monitoring market is anticipated to expand at a considerable CAGR during the forecast period, fueled by the adoption of advanced IT infrastructure and the emphasis on operational efficiency and regulatory compliance. Enterprises are increasingly deploying monitoring solutions to optimize IT performance, secure sensitive data, and manage complex digital workflows. Germany’s focus on technological innovation, smart manufacturing, and digital services accelerates market growth. The integration of monitoring platforms with automation and AI-driven analytics is gaining traction in both enterprise and public sector applications.

Asia-Pacific Enterprise Monitoring Market Insight

The Asia-Pacific enterprise monitoring market is poised to grow at the fastest CAGR during 2025 to 2032, driven by rapid digital transformation, increasing cloud adoption, and investments in IT infrastructure across countries such as China, Japan, and India. The region’s growing focus on smart enterprise initiatives and the need for real-time monitoring solutions are accelerating market penetration. Furthermore, rising demand from BFSI, manufacturing, and IT & ITES sectors, along with government initiatives promoting digitalization, is boosting adoption.

Japan Enterprise Monitoring Market Insight

The Japan enterprise monitoring market is gaining momentum due to the country’s advanced IT landscape, high enterprise digital maturity, and emphasis on operational efficiency. Organizations are adopting monitoring solutions to ensure system reliability, enhance application performance, and support digital transformation initiatives. The integration of AI and analytics-driven monitoring, along with strong government support for digital innovation, is fueling growth. In addition, the adoption of IoT and smart enterprise technologies is creating demand for comprehensive monitoring platforms across commercial and industrial sectors.

China Enterprise Monitoring Market Insight

The China enterprise monitoring market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid digitalization, extensive IT infrastructure investments, and strong adoption of cloud and hybrid systems. Enterprises are increasingly relying on monitoring solutions to optimize performance, ensure cybersecurity, and improve business continuity. The country’s growing IT & ITES sector, coupled with government-led digital initiatives and the rise of smart enterprises, is significantly contributing to market growth. Affordable, scalable monitoring solutions and domestic technology providers further support widespread adoption across verticals.

Enterprise Monitoring Market Share

The enterprise monitoring industry is primarily led by well-established companies, including:

- Microsoft (U.S.)

- IBM (U.S.)

- Cisco (U.S.)

- Dynatrace (U.S.)

- Datadog (U.S.)

- New Relic (U.S.)

- Elastic N.V. (U.S.)

- BMC Software (U.S.)

- Zoho Corporation (India)

- SolarWinds (U.S.)

- Paessler (Germany)

- Trianz (U.S.)

- ScienceLogic (U.S.)

- Grafana Labs (U.S.)

- VirtualMetric (Netherlands)

- Coralogix (U.S.)

- Nagios (U.S.)

- Pandora FMS (Spain)

- Sumo Logic (U.S.)

- Atatus (India)

- Zabbix (Latvia)

- Checkmk (Germany)

Latest Developments in Global Enterprise Monitoring Market

- In May 2024, IBM launched a new hybrid IT monitoring solution that combines AI-driven analytics with edge and cloud monitoring. The solution is designed to optimize IT performance by offering real-time insights, predictive issue detection, and automated remediation workflows. Enterprises can manage increasingly complex digital infrastructures more efficiently, reduce unplanned downtime, and ensure seamless performance across both on-premises and cloud environments. The platform also supports advanced anomaly detection, enabling IT teams to proactively resolve performance bottlenecks and improve service reliability

- In March 2024, Cisco acquired Splunk to expand its enterprise monitoring portfolio, strengthening security, observability, and application performance monitoring capabilities. This acquisition allows organizations to gain deeper insights into IT operations, detect anomalies faster, and enhance threat management through advanced analytics. By combining Splunk’s robust data analytics with Cisco’s infrastructure and networking expertise, enterprises can achieve comprehensive operational visibility, accelerate incident response, ensure business continuity, and improve overall IT resilience

- In January 2024, Dynatrace acquired Runecast, integrating AI-powered security and compliance solutions into its monitoring platform. This strategic acquisition enhances proactive IT risk management by enabling automated detection of vulnerabilities, continuous compliance reporting, and real-time security monitoring. Enterprises benefit from strengthened security posture, early identification of potential threats, and reduced operational risks, while IT teams can focus on strategic initiatives rather than reactive maintenance

- In September 2023, BMC partnered with ServiceNow to enhance IT service management and integrate enterprise monitoring for cloud environments. The partnership improves operational efficiency by automating workflows, providing end-to-end visibility across IT assets, and enabling proactive incident detection and resolution. Organizations can streamline processes, reduce service disruptions, and gain unified oversight of IT operations, ensuring better service delivery, faster problem resolution, and enhanced user experience

- In July 2023, Microsoft and New Relic formed a strategic partnership to enable seamless integration of New Relic’s monitoring tools with Microsoft Azure. This collaboration strengthens cloud monitoring capabilities, improves real-time performance management, and provides predictive insights that help enterprises detect and resolve IT issues proactively. The integration allows organizations to consolidate monitoring data, gain actionable intelligence across complex Azure environments, and enhance operational efficiency and system reliability

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.