Global Epoxy Resin Market

Market Size in USD Billion

CAGR :

%

USD

14.84 Billion

USD

24.78 Billion

2024

2032

USD

14.84 Billion

USD

24.78 Billion

2024

2032

| 2025 –2032 | |

| USD 14.84 Billion | |

| USD 24.78 Billion | |

|

|

|

|

Epoxy Resin Market Size

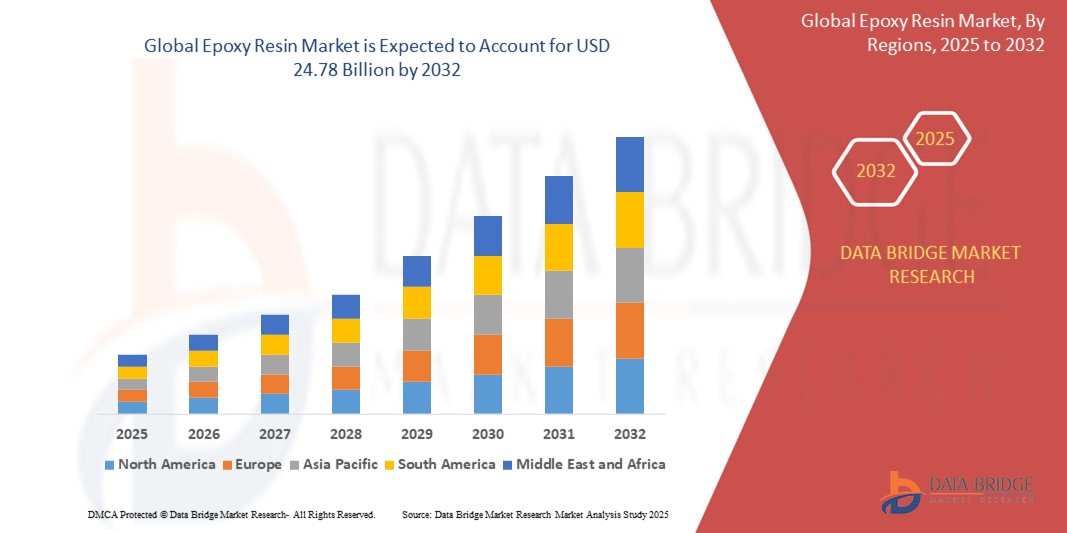

- The global epoxy resin market size was valued at USD 14.84 billion in 2024 and is expected to reach USD 24.78 billion by 2032, at a CAGR of 6.62% during the forecast period

- The market growth is largely fueled by rising demand across construction, automotive, and electronics sectors, driven by the superior mechanical strength, chemical resistance, and adhesion properties of epoxy resins

- Furthermore, growing emphasis on lightweight materials in wind energy and aerospace applications, along with increasing adoption of sustainable and low-VOC formulations, is propelling the expansion of epoxy resin usage across diverse industrial domains, thereby significantly boosting the market’s grow

Epoxy Resin Market Analysis

- Epoxy resins, known for their exceptional mechanical strength, chemical resistance, and strong adhesion, are critical materials in coatings, adhesives, composites, and electronic components across construction, automotive, and electrical industries

- The escalating demand for epoxy resins is primarily driven by infrastructure development, increasing use of lightweight composites in wind and aerospace sectors, and growing environmental regulations encouraging low-VOC and sustainable resin formulations

- Asia-Pacific dominated the epoxy resin market with a share of 59.61% in 2024, due to rapid industrialization, increasing construction activity, and strong demand for lightweight composite materials across automotive, wind energy, and electronics sectors

- North America is expected to be the fastest growing region in the epoxy resin market during the forecast period due to increasing usage of epoxy resin in energy-efficient buildings, EV battery systems, and protective industrial coatings

- Paints and coatings segment dominated the market with a market share of 37.91% in 2024, due to large-scale demand in protective coatings for industrial equipment, marine infrastructure, pipelines, and bridges. Epoxy coatings are preferred for their excellent adhesion, abrasion resistance, and chemical protection, especially in corrosive or high-humidity environments. The construction boom across emerging economies and the increased focus on long-lasting, low-maintenance protective layers has also strengthened the segment’s growth

Report Scope and Epoxy Resin Market Segmentation

|

Attributes |

Epoxy Resin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Epoxy Resin Market Trends

“Rising Advancements in Nanotechnology”

- A significant and accelerating trend in the global epoxy resin market is the rising incorporation of nanotechnology to enhance performance characteristics such as mechanical strength, thermal stability, and corrosion resistance across end-use applications

- For instance, 3M has developed nano-modified epoxy adhesives that provide superior bonding and durability in structural applications, while Huntsman offers epoxy systems enhanced with nanomaterials to meet high-performance requirements in aerospace and electronics

- Nanotechnology enables epoxy resins to deliver improved conductivity, flame retardancy, and reduced shrinkage, making them ideal for advanced electronics and automotive components. For instance, BASF integrates nano-silica into epoxy coatings to increase scratch resistance and longevity in industrial coatings

- These nano-enhanced formulations are gaining popularity in sectors such as automotive, wind energy, and consumer electronics where weight reduction, durability, and advanced material performance are critical

- This trend toward nanotechnology integration is transforming traditional epoxy resin systems into next-generation materials, with leading companies investing in R&D to develop products that meet the evolving performance demands of modern industries

- The demand for nanotechnology-enabled epoxy resins is expanding rapidly as manufacturers seek high-strength, lightweight, and functionally superior materials to support innovation and efficiency across a wide range of applications

Epoxy Resin Market Dynamics

Driver

“Growing Demand from Construction Industry”

- The increasing demand for durable, high-performance materials in infrastructure and residential development is a significant driver for the heightened use of epoxy resins in the construction industry

- For instance, in July 2022, DIC Corporation acquired Guangdong TOD New Materials Co., Ltd., strengthening its production capacity in China to meet growing regional demand for construction-grade coating resins. Such strategies by key companies are expected to drive epoxy resin market growth in the forecast period

- As construction activities surge globally, epoxy resins are widely used in flooring, coatings, grouts, and sealants due to their superior mechanical strength, chemical resistance, and longevity under heavy loads and harsh environments

- Furthermore, the shift toward green buildings and sustainable infrastructure is increasing the use of low-VOC, eco-friendly epoxy formulations that meet regulatory and environmental standards without compromising performance

- The demand for epoxy resins is also propelled by their versatility in concrete protection, corrosion resistance in steel structures, and ability to bond various materials, making them essential in modern construction practices

- The adoption of advanced construction technologies and the need for durable, long-lasting materials across both residential and commercial sectors continue to position epoxy resins as a key component in meeting evolving industry requirements

Restraint/Challenge

“Fluctuating Raw Material Prices”

- The volatility in raw material prices, particularly those derived from petroleum such as bisphenol-A (BPA) and epichlorohydrin, poses a significant challenge to the stable growth of the epoxy resin market

- For instance, Olin Corporation, a key global supplier of epoxy resins, has reported margin pressures due to fluctuating feedstock costs, which directly impact production expenses and pricing strategies

- These raw materials are highly sensitive to global crude oil price shifts, geopolitical disruptions, and supply chain bottlenecks, making it difficult for manufacturers to maintain consistent product pricing and profit margins

- Addressing this challenge requires long-term supply agreements, strategic sourcing, and process optimization to mitigate risks. Companies such as Huntsman International LLC and BASF have been investing in more localized production and sustainable feedstock alternatives to reduce dependency on volatile global markets

- Unpredictable price swings can also hinder investment planning, especially for small and mid-sized players, and impact end-user industries such as construction, automotive, and electronics, which rely on epoxy resins for performance-critical applications

- Overcoming this challenge will depend on raw material innovation, diversification of supply chains, and adoption of bio-based or recycled alternatives to enhance cost stability and market resilience

Epoxy Resin Market Scope

The market is segmented on the basis of physical forms, formulation type, application, and end-user.

• By Physical Forms

On the basis of physical form, the epoxy resin market is segmented into solid, liquid, solution, and solvent cut epoxy. The liquid segment dominated the largest market revenue share in 2024, driven by its superior adaptability in formulation and broad compatibility with curing agents, fillers, and additives. Liquid epoxy resins are preferred in a wide range of industrial applications due to their excellent wetting ability, ease of mixing, and capacity to form strong cross-linked networks, especially in coatings, adhesives, and composite laminates. Industries such as construction and automotive heavily rely on liquid epoxy for both protective and structural applications due to its uniform consistency and effective curing behavior at room or elevated temperatures.

The solid segment is anticipated to witness the fastest growth rate from 2025 to 2032, primarily due to its increasing use in powder coatings and electronic encapsulation. Solid epoxy resins are solvent-free, enabling eco-friendly and low-VOC applications in line with tightening environmental regulations. Their high glass transition temperature and superior chemical resistance make them highly desirable in electrical insulation materials, automotive primers, and appliances requiring long-term durability and thermal stability.

• By Formulation Type

On the basis of formulation type, the epoxy resin market is segmented into DGBEA, DGBEF, Novolac, Aliphatic, Glycidylamine, and others. The DGBEA segment held the largest market revenue share in 2024, owing to its widespread usage in conventional epoxy systems across coatings, adhesives, and construction materials. DGBEA-based epoxy resins are known for their balanced mechanical strength, ease of processing, and cost-effectiveness, making them the default choice for applications that do not require specialized chemical or thermal resistance. Their low viscosity and compatibility with a variety of curing agents further enhance their applicability in diverse manufacturing sectors.

The Novolac segment is projected to witness the fastest CAGR from 2025 to 2032, propelled by the rising demand for high-performance epoxy systems in chemically aggressive and high-temperature environments. Novolac epoxy resins offer higher functionality and cross-link density compared to bisphenol-based variants, resulting in improved chemical, thermal, and dimensional stability. These properties are particularly valued in coatings for chemical tanks, industrial flooring, corrosion protection systems, and aerospace components where structural integrity and longevity under stress are critical.

• By Application

On the basis of application, the epoxy resin market is segmented into paints and coatings, construction, electrical and electronics, wind turbine and composites, civil engineering, adhesives and sealants, composites, electrical encapsulations, and others. The paints and coatings segment held the largest market revenue share of 37.91% in 2024, supported by large-scale demand in protective coatings for industrial equipment, marine infrastructure, pipelines, and bridges. Epoxy coatings are preferred for their excellent adhesion, abrasion resistance, and chemical protection, especially in corrosive or high-humidity environments. The construction boom across emerging economies and the increased focus on long-lasting, low-maintenance protective layers has also strengthened the segment’s growth.

The wind turbine and composites segment is anticipated to record the fastest growth from 2025 to 2032, driven by the growing emphasis on sustainable energy and the increasing deployment of wind power systems. Epoxy resin is widely used in manufacturing lightweight, high-strength composite materials for wind turbine blades and housings, offering the necessary fatigue resistance and structural performance under extreme weather conditions. The global shift toward net-zero targets and advancements in epoxy-based composite technology further drive demand in this application area.

• By End-User

On the basis of end-user, the epoxy resin market is segmented into building and construction, transportation, general industrial, consumer goods, wind power, aerospace, marine, and others. The building and construction segment accounted for the largest market revenue share in 2024, underpinned by the versatile use of epoxy resin in concrete bonding agents, protective floor coatings, waterproofing systems, and structural adhesives. Epoxy’s outstanding durability, resistance to moisture and chemicals, and ability to reinforce structural integrity make it indispensable in both commercial and residential infrastructure. Rapid urbanization, increasing investment in civil engineering projects, and the focus on high-performance building materials continue to fuel its dominance.

The wind power segment is forecasted to grow at the highest CAGR from 2025 to 2032, fueled by the accelerating global transition to renewable energy. Epoxy resin is integral to wind turbine manufacturing due to its high strength-to-weight ratio and superior mechanical performance, which are essential for ensuring the longevity and efficiency of large turbine blades. As governments and private sectors invest in expanding wind energy capacity, particularly offshore wind farms, the use of advanced epoxy systems in rotor blade fabrication and nacelle housing is expected to rise significantly.

Epoxy Resin Market Regional Analysis

- Asia-Pacific dominated the epoxy resin market with the largest revenue share of 59.61% in 2024, driven by rapid industrialization, increasing construction activity, and strong demand for lightweight composite materials across automotive, wind energy, and electronics sectors

- The region’s expanding middle-class population, rising urban infrastructure investments, and supportive government initiatives for renewable energy are contributing to accelerated adoption

- In addition, the presence of cost-effective raw material suppliers, growing exports of epoxy-based composites, and expansion of manufacturing facilities are further strengthening regional market growth

Japan Epoxy Resin Market Insight

The Japan epoxy resin market is growing steadily due to the high demand for precision electronics, automotive applications, and corrosion-resistant coatings. Japanese manufacturers are focused on innovation in flame-retardant and thermally stable formulations to support electric vehicles and electronics miniaturization. The country’s emphasis on high-performance materials and its mature construction sector continue to drive epoxy resin consumption in adhesives, flooring, and protective coatings.

China Epoxy Resin Market Insight

The China market held the largest share in Asia-Pacific in 2024, supported by large-scale infrastructure development, a booming electronics industry, and the country’s dominant position in wind turbine manufacturing. With China being a global leader in epoxy resin production, domestic suppliers benefit from economies of scale, enabling competitive pricing. Government support for green building initiatives and the rapid growth of EV and 5G infrastructure are also driving demand for epoxy-based composites and encapsulants.

Europe Epoxy Resin Market Insight

The Europe epoxy resin market is projected to grow at a substantial CAGR over the forecast period, driven by stringent environmental regulations, strong demand for recyclable and low-VOC materials, and expansion in the aerospace and renewable energy sectors. European manufacturers are investing in bio-based epoxy resins and advanced composite technologies to meet sustainability goals. The demand for long-lasting coatings, corrosion protection, and high-strength adhesives across infrastructure and marine industries further supports market growth.

U.K. Epoxy Resin Market Insight

The U.K. market is expected to grow steadily, backed by rising demand for durable coatings in infrastructure refurbishment and expansion of offshore wind energy projects. Initiatives to reduce VOC emissions and reliance on petroleum-based products are encouraging the adoption of eco-friendly epoxy formulations. Growth in electronics manufacturing and the transition to electric mobility also contribute to increasing epoxy resin usage in encapsulation and lightweight component manufacturing.

Germany Epoxy Resin Market Insight

Germany’s epoxy resin market is expanding significantly, driven by strong industrial manufacturing, automotive innovation, and leadership in wind power technology. The country’s commitment to sustainable construction and high-performance composites is boosting demand for epoxy systems with superior mechanical, thermal, and chemical resistance. Advanced R&D infrastructure and growing demand for epoxy adhesives in aerospace and electronics sectors support continued market development.

North America Epoxy Resin Market Insight

North America is projected to register the fastest CAGR from 2025 to 2032, fueled by increasing usage of epoxy resin in energy-efficient buildings, EV battery systems, and protective industrial coatings. Rising demand for advanced composites in aerospace and defense, coupled with government support for clean energy and infrastructure upgrades, is accelerating growth. The region also benefits from high consumer preference for performance coatings and growing investment in renewable energy projects such as wind farms.

U.S. Epoxy Resin Market Insight

The U.S. epoxy resin market captured the largest revenue share in 2024 within North America, driven by robust construction spending, a thriving automotive sector, and leadership in aerospace innovation. Epoxy resin is extensively used in high-strength adhesives, protective coatings, and structural composites in both civil and military applications. Increasing demand for energy-efficient insulation materials and durable flooring systems in commercial construction further boosts market growth.

Epoxy Resin Market Share

The epoxy resin industry is primarily led by well-established companies, including:

- SPOLCHEMIE (Czech Republic)

- BASF (Germany)

- Huntsman International LLC (U.S.)

- 3M (U.S.)

- NAN YA PLASTICS CORPORATION (Taiwan)

- Hexion (U.S.)

- Olin Corporation (U.S.)

- Solvay (Belgium)

- Chang Chun Group (Taiwan)

- NAMA Chemicals (Saudi Arabia)

- Sika AG, ASTRAL ADHESIVES (India)

- Eagle Chemicals (Egypt)

- LEUNA-Harze GmbH (Germany)

- Elite Crete Systems (U.S.)

- RBC Industries Inc. (U.S.)

Latest Developments in Global Epoxy Resin Market

- In February 2025, Westlake Corporation announced that Westlake Epoxy will introduce EpoVIVE, a sustainable epoxy product portfolio, at JEC World 2025 in Paris. The EpoVIVE line includes epoxy phenolic resins and curing agents designed to support sustainability goals across various applications. Developed with a focus on environmental responsibility, the portfolio reflects Westlake’s dedication to sustainable innovation and collaborative value-chain advancement

- In March 2024, Grasim Industries Limited, the flagship company of the Aditya Birla Group, officially launched its expansion project at Vilayat, Gujarat, in the Chemical business. This project aims to increase the epoxy resins and formulation capacity by 123,000 tonnes, doubling the overall capacity of Advanced Materials to 246,000 tonnes per annum. This expansion signifies a pivotal moment for the Advanced Material business, positioning it as a key player in the global epoxy materials market, supported by ambitious growth plans

- In February 2024, the Board of Directors at DCM Shriram Ltd granted in-principle approval for the Chemicals business to expand into the domain of "Advanced Materials" through strategic investments in epoxy and value-added products. This proactive step involves a significant investment of Rs. 1000 crores over the next few years to establish a state-of-the-art greenfield epoxy manufacturing plant

- In July 2022, DIC Corporation acquired Guangdong TOD New Materials Co., Ltd., a China-based manufacturer of coating resins, as part of its strategy to expand coating resin production capacity across Asia, particularly in China. This acquisition aligns with DIC’s medium- to long-term plan to solidify its leadership in the Asian coatings resin market by offering environmentally friendly and functional resin products. The company also plans to leverage expanded production capabilities at Ideal Chemi Plast in India to support this regional growth

- In November 2021, Solvay launched Reactsurf 0092, a reactive waterborne emulsifier designed for solid epoxy resins used in industrial coatings and paints. The innovation supports the company’s commitment to sustainable development by addressing regulatory and environmental demands for cleaner, safer coating solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL EPOXY RESIN MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL EPOXY RESIN MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 SECONDARY SOURCES

2.15 GLOBAL EPOXY RESIN MARKET: RESEARCH SNAPSHOT

2.16 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 PRICE INDEX OVERVIEW

5 EXECUTIVE SUMMARY

6 PREMIUM INSIGHTS

6.1 RAW MATERIAL COVERAGE

6.2 PRODUCTION CONSUMPTION ANALYSIS

6.3 IMPORT EXPORT SCENARIO

6.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

6.5 PORTER’S FIVE FORCES

6.6 VENDOR SELECTION CRITERIA

6.7 PESTEL ANALYSIS

6.8 REGULATION COVERAGE

6.8.1 PRODUCT CODES

6.8.2 CERTIFIED STANDARDS

6.8.3 SAFETY STANDARDS

6.8.3.1. MATERIAL HANDLING & STORAGE

6.8.3.2. TRANSPORT & PRECAUTIONS

6.8.3.3. HARAD IDENTIFICATION

7 PRICE INDEX

8 PRODUCTION CAPACITY OVERVIEW

9 SUPPLY CHAIN ANALYSIS

9.1 OVERVIEW

9.2 LOGISTIC COST SCENARIO

9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

10 CLIMATE CHANGE SCENARIO

10.1 ENVIRONMENTAL CONCERNS

10.2 INDUSTRY RESPONSE

10.3 GOVERNMENT’S ROLE

10.4 ANALYST RECOMMENDATIONS

11 GLOBAL EPOXY RESIN MARKET, BY PRODUCT, 2018-2032(USD MILLION) (KILO TONS)

11.1 OVERVIEW

11.2 GLYCIDYL

11.3 NON-GLYCIDYL.

12 GLOBAL EPOXY RESIN MARKET, BY CHEMICAL CHAIN, 2018-2032 (USD MILLION)

12.1 OVERVIEW

12.2 BISPHENOL EPOXY RESINS

12.3 ALIPHATIC EPOXY RESINS

12.4 NOVOLAC EPOXY RESINS

12.5 HALOGENATED EPOXY RESINS

12.6 EPOXY RESIN DILUENTS

12.7 GLYCIDYLAMINE EPOXY RESINS

13 GLOBAL EPOXY RESIN MARKET, BY FORM, 2018-2032 (USD MILLION)

13.1 OVERVIEW

13.2 LIQUID

13.3 POWDER

14 GLOBAL EPOXY RESIN MARKET, BY APPLICATION, 2018-2032(USD MILLION)

14.1 OVERVIEW

14.2 COATINGS AND PAINTS

14.2.1 COATINGS AND PAINTS, BY APPLICATION

14.2.1.1. INDUSTRIAL COATINGS

14.2.1.2. MARINE COATINGS

14.2.1.3. DECORATIVE PAINTS

14.3 ADHESIVES

14.3.1 ADHESIVES, BY APPLICATION

14.3.1.1. CONSTRUCTION AND CIVIL ENGINEERING

14.3.1.2. ELECTRONICS

14.3.1.3. AUTOMOTIVE INDUSTRY

14.4 COMPOSITE MATERIALS

14.4.1 COMPOSITE MATERIALS, BY APPLICATION

14.4.1.1. AEROSPACE

14.4.1.1.1. AEROSPACE, BY APPLICATION

14.4.1.1.1.1 AIRCRAFT STRUCTURES

14.4.1.1.1.2 INTERIOR COMPONENTS

14.4.1.1.1.3 OTHERS

14.4.1.2. AUTOMOTIVE

14.4.1.3. SPORTS EQUIPMENT

14.5 ELECTRICAL AND ELECTRONIC ENCAPSULATION

14.5.1 ELECTRICAL AND ELECTRONIC ENCAPSULATION, BY APPLICATION

14.5.1.1. ENCAPSULATION OF COMPONENTS

14.5.1.2. CIRCUIT BOARD MANUFACTURING

14.6 CASTING AND MOLDING

14.6.1 CASTING AND MOLDING, BY APPLICATION

14.6.1.1. ART AND SCULPTURE

14.6.1.2. INDUSTRIAL MOLDING

14.7 FLOORING

14.7.1 FLOORING, BY APPLICATION

14.7.1.1. COMMERCIAL FLOORING

14.7.1.2. INDUSTRIAL FLOORING

14.7.1.3. DECORATIVE FLOORING

14.8 OTHERS

15 GLOBAL EPOXY RESIN MARKET, BY VERTICAL, 2018-2032(USD MILLION)

15.1 OVERVIEW

15.2 AUTOMOTIVE

15.2.1 AUTOMOTIVE, BY PRODUCT

15.2.1.1. GLYCIDYL

15.2.1.2. NON-GLYCIDYL

15.3 CONSTRUCTION

15.3.1 CONSTRUCTION, BY PRODUCT

15.3.1.1. GLYCIDYL

15.3.1.2. NON-GLYCIDYL

15.4 AEROSPACE AND DEFENCE

15.4.1 AEROSPACE AND DEFENCE, BY PRODUCT

15.4.1.1. GLYCIDYL

15.4.1.2. NON-GLYCIDYL

15.5 CONSUMER GOODS

15.5.1 CONSUMER GOODS, BY PRODUCT

15.5.1.1. GLYCIDYL

15.5.1.2. NON-GLYCIDYL

15.6 WIND POWER

15.6.1 WIND POWER, BY PRODUCT

15.6.1.1. GLYCIDYL

15.6.1.2. NON-GLYCIDYL

15.7 ELECTRICAL AND ELECTRONICS

15.7.1 ELECTRICAL AND ELECTRONICS, BY PRODUCT

15.7.1.1. GLYCIDYL

15.7.1.2. NON-GLYCIDYL

15.8 MECHANICAL ENGINEERING

15.8.1 MECHANICAL ENGINEERING, BY PRODUCT

15.8.1.1. GLYCIDYL

15.8.1.2. NON-GLYCIDYL

15.9 AGRICULTURE

15.9.1 AGRICULTURE, BY PRODUCT

15.9.1.1. GLYCIDYL

15.9.1.2. NON-GLYCIDYL

15.1 SOLAR ENERGY

15.10.1 SOLAR ENERGY, BY PRODUCT

15.10.1.1. GLYCIDYL

15.10.1.2. NON-GLYCIDYL

15.11 HYDROPOWER

15.11.1 HYDROPOWER, BY PRODUCT

15.11.1.1. GLYCIDYL

15.11.1.2. NON-GLYCIDYL

15.12 PACKAGING

15.12.1 PACKAGING, BY PRODUCT

15.12.1.1. GLYCIDYL

15.12.1.2. NON-GLYCIDYL

15.13 HEALTHCARE

15.13.1 HEALTHCARE, BY PRODUCT

15.13.1.1. GLYCIDYL

15.13.1.2. NON-GLYCIDYL

15.14 OIL AND GAS

15.14.1 OIL AND GAS, BY PRODUCT

15.14.1.1. GLYCIDYL

15.14.1.2. NON-GLYCIDYL

15.15 MINING

15.15.1 MINING, BY PRODUCT

15.15.1.1. GLYCIDYL

15.15.1.2. NON-GLYCIDYL

15.16 OTHERS

15.16.1 OTHERS, BY PRODUCT

15.16.1.1. GLYCIDYL

15.16.1.2. NON-GLYCIDYL

16 GLOBAL EPOXY RESIN MARKET, BY GEOGRAPHY, 2018-2032(USD MILLION) (KILO TONS)

GLOBAL EPOXY RESIN MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

16.2 EUROPE

16.2.1 GERMANY

16.2.2 U.K.

16.2.3 ITALY

16.2.4 FRANCE

16.2.5 SPAIN

16.2.6 RUSSIA

16.2.7 SWITZERLAND

16.2.8 TURKEY

16.2.9 BELGIUM

16.2.10 NETHERLANDS

16.2.11 REST OF EUROPE

16.3 ASIA-PACIFIC

16.3.1 JAPAN

16.3.2 CHINA

16.3.3 SOUTH KOREA

16.3.4 INDIA

16.3.5 SINGAPORE

16.3.6 THAILAND

16.3.7 INDONESIA

16.3.8 MALAYSIA

16.3.9 PHILIPPINES

16.3.10 AUSTRALIA & NEW ZEALAND

16.3.11 REST OF ASIA-PACIFIC

16.4 SOUTH AMERICA

16.4.1 BRAZIL

16.4.2 ARGENTINA

16.4.3 REST OF SOUTH AMERICA

16.5 MIDDLE EAST AND AFRICA

16.5.1 SOUTH AFRICA

16.5.2 EGYPT

16.5.3 SAUDI ARABIA

16.5.4 UNITED ARAB EMIRATES

16.5.5 ISRAEL

16.5.6 REST OF MIDDLE EAST AND AFRICA

17 GLOBAL EPOXY RESIN MARKET, COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: GLOBAL

17.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

17.3 COMPANY SHARE ANALYSIS: EUROPE

17.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

17.5 MERGERS AND ACQUISITIONS

17.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

17.7 EXPANSIONS

17.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

18 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

19 GLOBAL EPOXY RESIN MARKET - COMPANY PROFILES

19.1 OLIN CORPORATION

19.1.1 COMPANY SNAPSHOT

19.1.2 PRODUCT PORTFOLIO

19.1.3 REVENUE ANALYSIS

19.1.4 RECENT UPDATES

19.1.5 PRODUCTION CAPACITY OVERVIEW

19.2 KUKDO CHEMICAL CO.

19.2.1 COMPANY SNAPSHOT

19.2.2 PRODUCT PORTFOLIO

19.2.3 REVENUE ANALYSIS

19.2.4 RECENT UPDATES

19.2.5 PRODUCTION CAPACITY OVERVIEW

19.3 HEXION INC

19.3.1 COMPANY SNAPSHOT

19.3.2 PRODUCT PORTFOLIO

19.3.3 REVENUE ANALYSIS

19.3.4 RECENT UPDATES

19.3.5 PRODUCTION CAPACITY OVERVIEW

19.4 NAN YA PLASTICS CORPORATION

19.4.1 COMPANY SNAPSHOT

19.4.2 PRODUCT PORTFOLIO

19.4.3 REVENUE ANALYSIS

19.4.4 RECENT UPDATES

19.4.5 PRODUCTION CAPACITY OVERVIEW

19.5 GRASIM INDUSTRIES LIMITED

19.5.1 COMPANY SNAPSHOT

19.5.2 PRODUCT PORTFOLIO

19.5.3 REVENUE ANALYSIS

19.5.4 RECENT UPDATES

19.5.5 PRODUCTION CAPACITY OVERVIEW

19.6 CHANG CHUN GROUP

19.6.1 COMPANY SNAPSHOT

19.6.2 PRODUCT PORTFOLIO

19.6.3 REVENUE ANALYSIS

19.6.4 RECENT UPDATES

19.6.5 PRODUCTION CAPACITY OVERVIEW

19.7 WESTLAKE CORPORATION

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 REVENUE ANALYSIS

19.7.4 RECENT UPDATES

19.7.5 PRODUCTION CAPACITY OVERVIEW

19.8 DIC CORPORATION

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 REVENUE ANALYSIS

19.8.4 RECENT UPDATES

19.8.5 PRODUCTION CAPACITY OVERVIEW

19.9 HUNTSMAN INTERNATIONAL LLC

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 REVENUE ANALYSIS

19.9.4 RECENT UPDATES

19.9.5 PRODUCTION CAPACITY OVERVIEW

19.1 CHINA PETROCHEMICAL CORPORATION

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 REVENUE ANALYSIS

19.10.4 RECENT UPDATES

19.10.5 PRODUCTION CAPACITY OVERVIEW

19.11 MITSUBISHI CHEMICAL GROUP CORPORATION.

19.11.1 COMPANY SNAPSHOT

19.11.2 PRODUCT PORTFOLIO

19.11.3 REVENUE ANALYSIS

19.11.4 RECENT UPDATES

19.11.5 PRODUCTION CAPACITY OVERVIEW

19.12 ATUL LTD

19.12.1 COMPANY SNAPSHOT

19.12.2 PRODUCT PORTFOLIO

19.12.3 REVENUE ANALYSIS

19.12.4 RECENT UPDATES

19.12.5 PRODUCTION CAPACITY OVERVIEW

19.13 DAICEL CHEMTECH INC. A

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 REVENUE ANALYSIS

19.13.4 RECENT UPDATES

19.13.5 PRODUCTION CAPACITY OVERVIEW

19.14 VIZAGCHEMICAL

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 REVENUE ANALYSIS

19.14.4 RECENT UPDATES

19.14.5 PRODUCTION CAPACITY OVERVIEW

19.15 LEUNA-HARZE GMBH

19.15.1 COMPANY SNAPSHOT

19.15.2 PRODUCT PORTFOLIO

19.15.3 REVENUE ANALYSIS

19.15.4 RECENT UPDATES

19.15.5 PRODUCTION CAPACITY OVERVIEW

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

20 RELATED REPORTS

21 QUESTIONNAIRE

22 CONCLUSION

23 ABOUT DATA BRIDGE MARKET RESEARCH

Global Epoxy Resin Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Epoxy Resin Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Epoxy Resin Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.