Global Expandable Microspheres Market

Market Size in USD Billion

CAGR :

%

USD

5.94 Billion

USD

14.20 Billion

2025

2033

USD

5.94 Billion

USD

14.20 Billion

2025

2033

| 2026 –2033 | |

| USD 5.94 Billion | |

| USD 14.20 Billion | |

|

|

|

|

What is the Global Expandable Microspheres Market Size and Growth Rate?

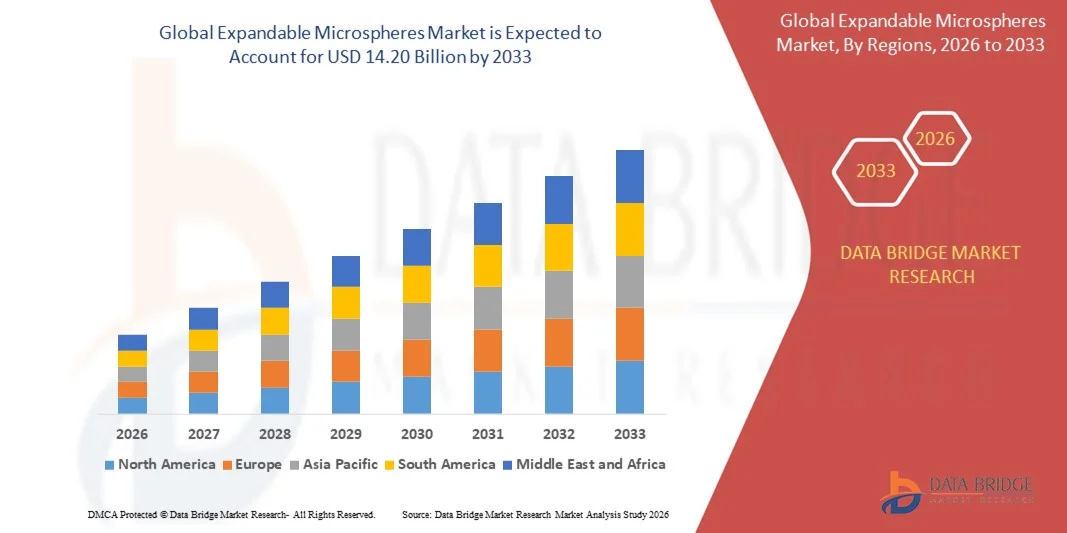

- The global expandable microspheres market size was valued at USD 5.94 billion in 2025 and is expected to reach USD 14.20 billion by 2033, at a CAGR of11.50% during the forecast period

- Major factors that are expected to boost the growth of the expandable microspheres market in the forecast period are the rise in the utilization in the end-use industries such as automotive, construction, sports and leisure, and consumer goods

- Furthermore, the widespread utilization of the product in the light-weighting of automobiles is further anticipated to propel the growth of the expandable microspheres market

What are the Major Takeaways of Expandable Microspheres Market?

- The growing acceptance of lightweight materials in automobile production to improve fuel efficiency is further estimated to cushion the growth of the expandable microspheres market. On the other hand, the rise in the costs of raw materials is further projected to impede the growth of the expandable microspheres market in the timeline period

- In addition, the usage in the construction industry for thermal insulation applications will further provide potential opportunities for the growth of the expandable microspheres market in the coming years. However, the dearth of quality control in the advancing countries might further challenge the growth of the expandable microspheres market in the near future

- Asia-Pacific dominated the expandable microspheres market with an estimated 41.6% revenue share in 2025, driven by strong growth in automotive manufacturing, construction activities, consumer goods production, and rapid industrial expansion across China, Japan, India, South Korea, and Southeast Asia

- North America is projected to register the fastest CAGR of 11.36% from 2026 to 2033, driven by increasing focus on lightweight automotive components, sustainable construction materials, and high-performance consumer products across the U.S. and Canada

- The Polyacrylic Ester (PAE) segment dominated the market with an estimated 41.6% share in 2025, due to its superior thermal expansion properties, high elasticity, and strong compatibility with polymers, coatings, and elastomers

Report Scope and Expandable Microspheres Market Segmentation

|

Attributes |

Expandable Microspheres Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Expandable Microspheres Market?

Increasing Shift Toward Lightweight, High-Expansion, and Application-Specific Expandable Microspheres

- The expandable microspheres market is witnessing a growing shift toward lightweight, high-expansion, and thermally stable microspheres designed to enhance volume, reduce density, and improve material performance across polymers, coatings, and composites

- Manufacturers are introducing advanced polymer-based microspheres with controlled expansion temperatures, uniform particle size distribution, and improved compatibility with thermoplastics, elastomers, and resins

- Rising demand for material weight reduction, improved insulation, and enhanced surface finish is driving adoption across automotive, construction, footwear, packaging, and consumer goods industries

- For instance, leading players such as Nouryon, SEKISUI Chemical, 3M, and Akzo Nobel are expanding their portfolios of expandable microspheres for use in lightweight automotive parts, sealants, paints, and synthetic leather

- Increasing focus on sustainability, energy efficiency, and material cost optimization is accelerating the use of expandable microspheres as fillers and blowing agents

- As industries prioritize lightweighting and performance enhancement, expandable microspheres will remain critical in advanced material engineering and product innovation

What are the Key Drivers of Expandable Microspheres Market?

- Rising demand for lightweight and high-performance materials in automotive, construction, and consumer goods manufacturing is a primary growth driver

- For instance, during 2024–2025, manufacturers increased adoption of expandable microspheres in interior automotive components, synthetic leather, and insulation materials to meet emission and fuel-efficiency regulations

- Growing use of expandable microspheres in paints, coatings, and adhesives to improve texture, thermal insulation, and surface smoothness is boosting market demand

- Advancements in polymer chemistry, encapsulation technology, and thermal expansion control have enhanced product reliability and application versatility

- Increasing adoption in packaging and footwear industries to reduce material consumption while maintaining durability and comfort further supports growth

- Backed by rising industrial production and material innovation, the Expandable Microspheres market is expected to experience steady long-term expansion

Which Factor is Challenging the Growth of the Expandable Microspheres Market?

- High production costs associated with advanced polymer encapsulation and controlled expansion technologies limit adoption among cost-sensitive manufacturers

- For instance, fluctuations in raw material prices and polymer feedstock availability during 2024–2025 impacted manufacturing margins for several suppliers

- Technical challenges related to expansion consistency, processing temperature sensitivity, and compatibility with different base materials increase formulation complexity

- Limited awareness among small manufacturers regarding performance benefits and processing advantages slows penetration in emerging markets

- Competition from alternative fillers, chemical blowing agents, and lightweight additives creates pricing pressure and substitution risk

- To overcome these challenges, companies are focusing on cost-efficient formulations, expanded application testing, sustainability-driven innovation, and customer education to increase global adoption of expandable microspheres

How is the Expandable Microspheres Market Segmented?

The market is segmented on the basis of product type, type, application, and end-users.

- By Product Type

On the basis of product type, the expandable microspheres market is segmented into Polyacrylic Ester (PAE), Polyvinyl Acetate (PVA), Vinyl Acetate Ethylene (VAE), Synthetic Rubber, and others. The Polyacrylic Ester (PAE) segment dominated the market with an estimated 41.6% share in 2025, due to its superior thermal expansion properties, high elasticity, and strong compatibility with polymers, coatings, and elastomers. PAE-based microspheres are widely used in automotive parts, sealants, paints, and synthetic leather applications where lightweighting and surface smoothness are critical.

The VAE segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing adoption in construction adhesives, flexible coatings, and consumer goods. Rising demand for flexible, cost-efficient, and eco-friendly polymer solutions is accelerating the use of VAE-based expandable microspheres across multiple industries.

- By Type

On the basis of type, the expandable microspheres market is segmented into Wet and Dry microspheres. The Dry segment dominated the market with a 58.3% share in 2025, owing to its ease of handling, longer shelf life, uniform expansion behavior, and compatibility with dry blending and extrusion processes. Dry expandable microspheres are extensively used in plastics, rubber, coatings, and lightweight composite manufacturing.

The Wet segment is projected to register the fastest growth rate from 2026 to 2033, supported by increasing demand in water-based coatings, paints, and environmentally friendly formulations. Growing regulatory focus on low-VOC and waterborne systems, particularly in Europe and Asia-Pacific, is driving adoption of wet expandable microspheres in sustainable manufacturing applications.

- By Application

On the basis of application, the expandable microspheres market is segmented into Lightweight Fillers and Blowing Agents. The Lightweight Filler segment dominated the market with a 52.7% share in 2025, driven by its extensive use in automotive components, construction materials, consumer goods, and packaging to reduce weight while maintaining mechanical strength. Expandable microspheres as fillers help improve thermal insulation, surface texture, and material efficiency.

The Blowing Agents segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by rising demand in foamed plastics, synthetic leather, footwear, and sealants. Increasing focus on material cost reduction, density control, and improved processing efficiency continues to boost adoption of expandable microspheres as advanced blowing agents.

- By End Users

On the basis of end users, the expandable microspheres market is segmented into Automotive, Construction, Sports & Leisure, Consumer Goods, and Others. The Automotive segment held the largest market share of 34.9% in 2025, supported by strong demand for lightweight interior components, under-the-hood parts, sealants, and coatings. Automakers increasingly use expandable microspheres to meet fuel-efficiency, emission reduction, and performance requirements.

The Construction segment is anticipated to grow at the fastest CAGR from 2026 to 2033, driven by rising use in lightweight concrete, insulation materials, adhesives, and coatings. Rapid urbanization, infrastructure development, and demand for energy-efficient buildings are accelerating adoption across global construction markets.

Which Region Holds the Largest Share of the Expandable Microspheres Market?

- Asia-Pacific dominated the expandable microspheres market with an estimated 41.6% revenue share in 2025, driven by strong growth in automotive manufacturing, construction activities, consumer goods production, and rapid industrial expansion across China, Japan, India, South Korea, and Southeast Asia. High demand for lightweight materials, cost-efficient fillers, and advanced polymer additives continues to fuel adoption of expandable microspheres in coatings, plastics, rubber, and adhesives across the region

- Leading manufacturers in Asia-Pacific are expanding production capacities and investing in advanced polymer technologies to meet rising demand from automotive lightweighting, infrastructure development, and consumer packaging sectors, strengthening the region’s manufacturing dominance

- Abundant raw material availability, cost-effective labor, and strong downstream demand further reinforce Asia-Pacific’s leadership in the global expandable microspheres market

China Expandable Microspheres Market Insight

China is the largest contributor in Asia-Pacific, supported by massive construction activity, strong automotive production, and a well-established polymer manufacturing ecosystem. Rising use of expandable microspheres in lightweight construction materials, synthetic leather, automotive interiors, and industrial coatings is driving sustained market growth. Government support for advanced materials and domestic manufacturing further boosts demand.

Japan Expandable Microspheres Market Insight

Japan shows steady growth, driven by precision manufacturing, high-quality standards, and strong demand from automotive, electronics, and specialty coatings industries. Focus on performance enhancement, durability, and material efficiency supports continued adoption of premium expandable microspheres.

India Expandable Microspheres Market Insight

India is emerging as a key growth market, supported by expanding construction projects, rising automotive production, and growing consumer goods manufacturing. Increasing use of lightweight fillers and blowing agents in infrastructure and industrial applications accelerates market penetration.

South Korea Expandable Microspheres Market Insight

South Korea contributes significantly due to strong demand from automotive components, high-performance plastics, and advanced industrial coatings. Innovation-driven manufacturing and export-oriented production strengthen regional adoption.

North America Expandable Microspheres Market

North America is projected to register the fastest CAGR of 11.36% from 2026 to 2033, driven by increasing focus on lightweight automotive components, sustainable construction materials, and high-performance consumer products across the U.S. and Canada. Growing demand for energy-efficient buildings, electric vehicles, and advanced polymer formulations is accelerating adoption of expandable microspheres.

U.S. Expandable Microspheres Market Insight

The U.S. leads North American growth due to strong demand from automotive lightweighting, construction insulation, and consumer goods manufacturing. Increasing emphasis on sustainability, material efficiency, and performance optimization continues to drive market expansion.

Canada Expandable Microspheres Market Insight

Canada contributes steadily, supported by rising infrastructure development, automotive component manufacturing, and growing adoption of advanced materials in coatings and construction applications. Government-led sustainability initiatives further enhance market growth.

Which are the Top Companies in Expandable Microspheres Market?

The expandable microspheres industry is primarily led by well-established companies, including:

- Nanjing Chemical Material Corp. (China)

- Maque Impex (India)

- Matsumoto Yushi-Seiyaku Co., Ltd. (Japan)

- Nouryon (Netherlands)

- KUREHA CORPORATION (Japan)

- Poraver (Germany)

- Chase Corp (U.S.)

- Microspheres-Nanospheres (U.S.)

- SEKISUI CHEMICAL CO., LTD. (Japan)

- Zhejiang Joysun New Materials Co., Ltd (China)

- 3M (U.S.)

- Akzo Nobel N.V. (Netherlands)

- Sigmund Lindner GmbH (Germany)

- Thermo Fisher Scientific (U.S.)

- The Kish Company, Inc. (U.S.)

- The Cary Company (U.S.)

- Luminex Corporation (U.S.)

- Momentive (U.S.)

- Givaudan (Switzerland)

- Trelleborg AB (publ) (Sweden)

What are the Recent Developments in Global Expandable Microspheres Market?

- In September 2025, Varian, a Siemens Healthineers company, announced that its Embozene microspheres received CE Marking for Genicular Artery Embolisation (GAE) in the treatment of knee osteoarthritis, making Embozene the first embolic agent specifically approved for this indication and enabling targeted inflammation control and pain relief for patients. This milestone significantly strengthens Varian’s position in minimally invasive embolization therapies and expands clinical treatment options

- In April 2025, Terumo Europe N.V. introduced BioPearlTM microspheres, the world’s first resorbable drug-eluting microspheres, combining established drug-eluting technology with the advantages of resorbable agents to enhance Transarterial Chemoembolization (TACE) therapies. This launch highlights Terumo’s continued focus on innovation in advanced and minimally invasive medical treatments

- In April 2025, Nouryon unveiled Expancel WB expandable microspheres at the 2024 Chinaplas exhibition in Shanghai, China, targeting white shoe sole applications within the clothing and apparel industry and addressing growing consumer demand for enhanced comfort and performance. This innovation reinforces Nouryon’s leadership in specialty additives for high-growth consumer applications

- In May 2024, during the Chinaplas exhibition, Nouryon introduced expandable microspheres specifically designed for white shoe sole applications in the apparel sector, ensuring improved performance, lightweight properties, and comfort for footwear manufacturers amid rising consumer preferences. This development underscores Nouryon’s strategic focus on consumer-driven material innovation

- In October 2023, Nouryon successfully began full-scale production at its new Expancel expandable microspheres manufacturing facility in Green Bay, Wisconsin, U.S., aimed at serving specialty additives customers across packaging, construction, mining, and automotive industries in North America. This expansion marked a critical step in strengthening regional supply capabilities and supporting long-term market growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Expandable Microspheres Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Expandable Microspheres Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Expandable Microspheres Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.