Global Flight Simulator Market

Market Size in USD Billion

CAGR :

%

USD

5.92 Billion

USD

8.11 Billion

2025

2033

USD

5.92 Billion

USD

8.11 Billion

2025

2033

| 2026 –2033 | |

| USD 5.92 Billion | |

| USD 8.11 Billion | |

|

|

|

|

What is the Global Flight Simulator Market Size and Growth Rate?

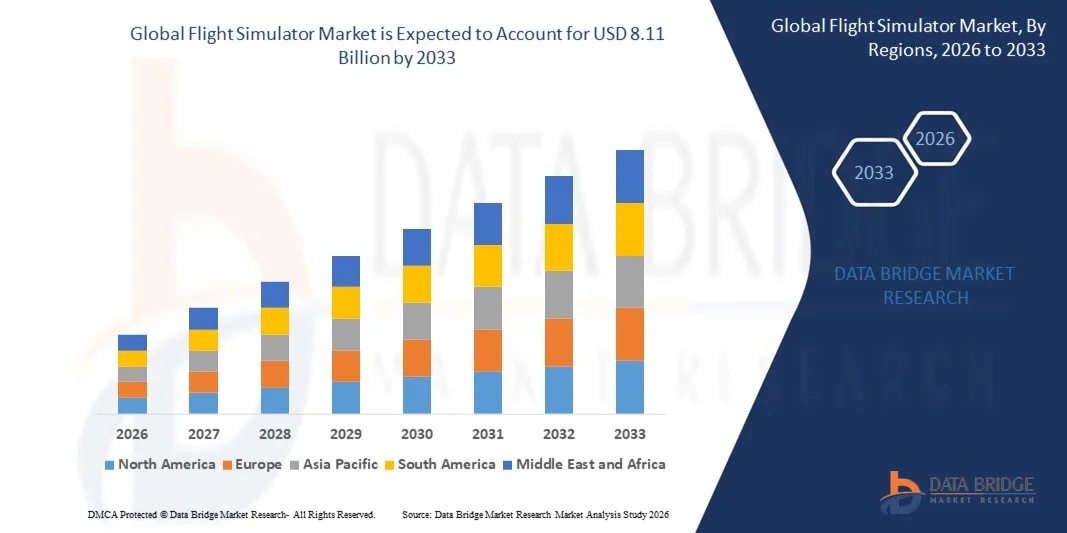

- The global flight simulator market size was valued at USD 5.92 billion in 2025 and is expected to reach USD 8.11 billion by 2033, at a CAGR of4.00% during the forecast period

- The increasing demand for pilots in the aviation industry has been directly influencing the growth of flight simulator market

- Also, the increasing acceptance of virtual pilot training to ensure aviation safety and growing need to reduce cost of pilot training is also flourishing the growth of the flight simulator market

What are the Major Takeaways of Flight Simulator Market?

- The increasing importance of aircraft safety and the growing need for substantial training as well as various benefits offered by these devices consist of mission critical training programs that make sure efficient low operational costs, aircraft operation and visual systems are also positively impacting the growth of the market

- Furthermore, the increasing demand for better and effective pilot as well as the rising cost of production of the aircrafts and the loss of human lives is also largely lifting the growth of the flight simulator market

- North America dominated the flight simulator market with a 36.47% revenue share in 2025, driven by the strong presence of major aircraft manufacturers, advanced pilot training infrastructure, and high defense and aviation training budgets across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 8.32% from 2026 to 2033, driven by rapid growth in air passenger traffic, airline fleet expansion, and increasing defense aviation investments across China, Japan, India, South Korea, and Southeast Asia

- The Full Flight Simulator (FFS) segment dominated the market with an estimated 41.6% share in 2025, driven by its high-fidelity motion systems, full aircraft replication, and regulatory approval for zero-flight-time training

Report Scope and Flight Simulator Market Segmentation

|

Attributes |

Flight Simulator Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Flight Simulator Market?

Increasing Shift Toward High-Fidelity, Compact, and PC-Based Flight Simulation Systems

- The flight simulator market is witnessing growing adoption of compact, PC-based, and modular simulators that deliver high realism while reducing infrastructure and operating costs for airlines, flight schools, and defense organizations

- Manufacturers are introducing software-driven simulators with advanced visual systems, motion cueing, real-time physics engines, and AI-enabled scenario generation to enhance training effectiveness

- Rising demand for cost-efficient, scalable, and space-optimized training solutions is accelerating deployment across civil aviation academies, military training centers, and regional airlines

- For instance, companies such as CAE, L3Harris, Thales, Boeing, and FlightSafety International are expanding their PC-based and fixed-base simulator portfolios with enhanced graphics, sensor integration, and data analytics

- Increasing focus on remote training, rapid pilot certification, and recurrent training is further driving the shift toward digitally integrated flight simulators

- As pilot shortages intensify and aircraft systems grow more complex, Flight Simulators will remain critical for safe, standardized, and efficient aviation training

What are the Key Drivers of Flight Simulator Market?

- Rising demand for pilot training and certification driven by global air traffic growth, fleet expansion, and commercial aviation recovery

- For instance, in 2024–2025, leading players such as CAE, TRU Simulation + Training, and HAVELSAN expanded simulator installations to support next-generation aircraft platforms

- Growing adoption of advanced military aircraft, UAVs, and helicopters is boosting demand for high-fidelity simulation systems across defense forces worldwide

- Technological advancements in visual rendering, motion systems, AI-based scenario modeling, and data-driven performance assessment are enhancing simulator realism and training outcomes

- Increasing regulatory emphasis on simulator-based training hours by aviation authorities reduces dependence on costly live flight training

- Supported by airline expansion, defense modernization, and aviation safety regulations, the Flight Simulator market is expected to witness sustained long-term growth

Which Factor is Challenging the Growth of the Flight Simulator Market?

- High capital investment and maintenance costs associated with full-flight simulators and advanced motion systems limit adoption among smaller training organizations

- For instance, during 2024–2025, supply chain disruptions and rising electronics costs increased manufacturing and deployment expenses for simulator OEMs

- Complexity in replicating real-world flight dynamics, weather conditions, and aircraft-specific behaviors increases development timelines and technical requirements

- Limited availability of skilled simulator instructors and technicians poses operational challenges in emerging aviation markets

- Competition from augmented reality (AR), virtual reality (VR), and mixed-reality training solutions creates pricing pressure and shifts buyer preferences

- To overcome these challenges, manufacturers are focusing on modular designs, software upgrades, cloud-enabled training platforms, and cost-optimized simulators to expand global adoption of Flight Simulators

How is the Flight Simulator Market Segmented?

The market is segmented on the basis of type, simulator type, solution, and platform.

- By Type

On the basis of type, the flight simulator market is segmented into Full Flight Simulator (FFS), Full Mission Simulator (FMS), Flight Training Devices (FTD), Fixed Base Simulator (FBS), UAV Simulators, Cockpit Procedures Trainers, and Others. The Full Flight Simulator (FFS) segment dominated the market with an estimated 41.6% share in 2025, driven by its high-fidelity motion systems, full aircraft replication, and regulatory approval for zero-flight-time training. Airlines, defense forces, and training academies extensively use FFS for type rating, recurrent training, and emergency scenario simulation.

The UAV Simulator segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising deployment of unmanned aerial systems in defense, surveillance, logistics, and disaster management. Increasing military modernization programs and growing use of drones in commercial applications are accelerating demand for UAV-specific simulation platforms.

- By Simulator Type

On the basis of simulator type, the market is segmented into Live Simulation and Virtual Simulation. The Live Simulation segment held the largest share of approximately 58.3% in 2025, as it enables real-time pilot interaction with physical cockpit controls, motion systems, and immersive visual environments. Live simulators are widely adopted by airlines and air forces for operational readiness, mission rehearsal, and safety-critical training.

The Virtual Simulation segment is projected to register the fastest CAGR during 2026–2033, driven by advancements in cloud computing, VR/AR technologies, and AI-based scenario modeling. Virtual simulators offer cost efficiency, remote accessibility, and scalable deployment, making them increasingly attractive for pilot screening, procedural training, and early-stage flight education.

- By Solution

On the basis of solution, the flight simulator market is segmented into Products and Services. The Products segment dominated the market with a 64.9% share in 2025, supported by strong demand for full-flight simulators, fixed-base simulators, and advanced training devices from airlines, defense organizations, and aviation academies. Continuous aircraft fleet expansion and regulatory mandates for simulator-based training further strengthen product demand.

The Services segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for simulator maintenance, upgrades, software updates, training-as-a-service, and lifecycle support. Outsourcing simulator operations and increasing adoption of subscription-based training models are accelerating service revenue growth globally.

- By Platform

On the basis of platform, the flight simulator market is segmented into Commercial Aircraft Simulator, Military Aircraft Simulator, and UAV Simulator. The Commercial Aircraft Simulator segment dominated the market with a 46.7% share in 2025, driven by rising global air passenger traffic, pilot shortages, and continuous induction of next-generation aircraft. Airlines increasingly rely on simulators to reduce training costs, improve safety, and comply with aviation authority requirements.

The Military Aircraft Simulator segment is expected to witness the fastest growth from 2026 to 2033, supported by increasing defense budgets, fleet modernization programs, and growing emphasis on mission readiness. Advanced combat training, multi-domain operations, and networked simulation environments are further accelerating adoption across global defense forces.

Which Region Holds the Largest Share of the Flight Simulator Market?

- North America dominated the flight simulator market with a 36.47% revenue share in 2025, driven by the strong presence of major aircraft manufacturers, advanced pilot training infrastructure, and high defense and aviation training budgets across the U.S. and Canada. Widespread adoption of full flight simulators, mission simulators, and advanced training devices by commercial airlines, military forces, and aviation academies continues to fuel regional demand

- Leading companies in North America are introducing high-fidelity motion systems, AI-enabled training modules, and immersive visual technologies, strengthening the region’s technological leadership. Continuous investments in airline fleet expansion, military modernization, and pilot training capacity support long-term market growth

- Strong regulatory frameworks, skilled aviation professionals, and a mature aerospace ecosystem further reinforce North America’s dominant market position

U.S. Flight Simulator Market Insight

The U.S. is the largest contributor in North America, supported by extensive commercial aviation activity, robust defense spending, and a strong focus on pilot safety and operational readiness. Increasing demand for recurrent pilot training, type certification, and mission rehearsal drives adoption of advanced flight simulators across airlines, air forces, and training centers. Presence of global simulator manufacturers, aviation schools, and continuous fleet modernization further accelerates market growth.

Canada Flight Simulator Market Insight

Canada contributes significantly to regional growth, driven by a strong aerospace manufacturing base, rising demand for commercial pilot training, and growing defense simulation programs. Flight simulators are increasingly utilized by airlines, helicopter operators, and military training facilities. Government-backed aviation training initiatives and a skilled workforce support steady market expansion.

Asia-Pacific Flight Simulator Market

Asia-Pacific is projected to register the fastest CAGR of 8.32% from 2026 to 2033, driven by rapid growth in air passenger traffic, airline fleet expansion, and increasing defense aviation investments across China, Japan, India, South Korea, and Southeast Asia. Rising pilot shortages and expanding aviation training infrastructure significantly boost simulator demand.

China Flight Simulator Market Insight

China is the largest contributor in Asia-Pacific, supported by aggressive airline expansion, growing domestic aircraft programs, and increasing investments in pilot training centers. Strong government support and rising demand for locally manufactured simulators further accelerate adoption.

Japan Flight Simulator Market Insight

Japan shows steady growth due to a strong focus on aviation safety, advanced training standards, and continuous modernization of commercial and defense aviation fleets. Demand for high-precision simulators supports long-term growth.

India Flight Simulator Market Insight

India is emerging as a major growth hub, driven by rapid airline expansion, increasing pilot training academies, and government initiatives to strengthen domestic aviation infrastructure. Rising demand for cost-effective simulators accelerates market penetration.

South Korea Flight Simulator Market Insight

South Korea contributes significantly due to strong military aviation programs, advanced aerospace capabilities, and increasing investment in pilot training technologies. Adoption of next-generation simulators supports sustained market growth.

Which are the Top Companies in Flight Simulator Market?

The flight simulator industry is primarily led by well-established companies, including:

- CAE Inc. (Canada)

- L3Harris Technologies, Inc. (U.S.)

- FlightSafety International (U.S.)

- Boeing (U.S.)

- Thales Group (France)

- Collins Aerospace (U.S.)

- Avion Group (Estonia)

- Indra Sistemas S.A. (Spain)

- TRU Simulation + Training Inc. (U.S.)

- Raytheon Company (U.S.)

- Elite Simulation Solutions Inc. (U.S.)

- FRASCA International, Inc. (U.S.)

- Lockheed Martin Corporation (U.S.)

- HAVELSAN Inc. (Turkey)

- Fidelity Technologies Corporation (U.S.)

- Kratos Defense & Security Solutions, Inc. (U.S.)

- Precision Flight Controls (U.S.)

- SIMCOM Aviation Training (U.S.)

- FSS India (India)

What are the Recent Developments in Global Flight Simulator Market?

- In February 2025, Microsoft Flight Simulator (MSFS 2024) announced the release of the Cessna 185F Skywagon as a free addition to its existing aircraft fleet, developed in collaboration with Carenado and originally planned as a paid “Famous Flyer” series aircraft, highlighting Microsoft’s strategy to enhance user engagement through high-quality free content

- In December 2024, EasyJet announced a partnership with Microsoft Flight Simulator 2024, enabling access to its fleet including the Airbus A319, A320, A320neo, and A321neo, although only the A320neo and A321neo are included as default aircraft, strengthening airline brand integration within consumer flight simulation platforms

- In November 2024, Simaero, a France-based flight training provider, unveiled plans to launch a flight training school in New Delhi, India, in 2025, initially featuring eight narrow-body full-flight simulators with future expansion to wide-body aircraft, reinforcing the growing demand for advanced pilot training infrastructure in emerging aviation markets

- In November 2024, Microsoft unveiled Pimax as the official VR partner for Microsoft Flight Simulator 2024, featuring the Pimax Crystal Light headset with ultra-wide field of view and high-resolution visuals, significantly enhancing immersion and realism in next-generation flight simulation experiences

- In May 2022, CAE announced the deployment of the first CAE 7000XR Series Dassault Falcon 6X full-flight simulator at its Burgess Hill training center in the U.K., supporting its role as the exclusive training provider and strengthening advanced pilot training capabilities for new aircraft entry into service

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.