Global Floriculture Market

Market Size in USD Billion

CAGR :

%

USD

5.50 Billion

USD

10.65 Billion

2025

2033

USD

5.50 Billion

USD

10.65 Billion

2025

2033

| 2026 –2033 | |

| USD 5.50 Billion | |

| USD 10.65 Billion | |

|

|

|

|

Floriculture Market Size

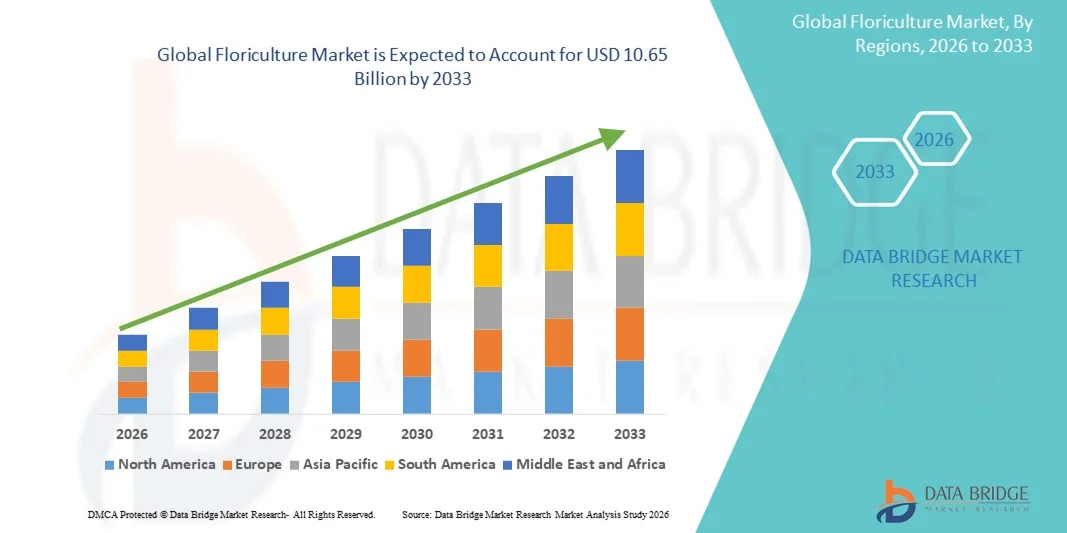

- The global floriculture market size was valued at USD 5.50 billion in 2025 and is expected to reach USD 10.65 billion by 2033, at a CAGR of 8.60% during the forecast period

- The market growth is largely fueled by the growing adoption of ornamental plants, cut flowers, and potted plants in homes, offices, and commercial spaces, combined with advancements in greenhouse technology and horticultural practices that improve yield, quality, and variety

- Furthermore, rising consumer demand for aesthetically appealing, sustainable, and eco-friendly floral products is establishing floriculture as a key segment in lifestyle, gifting, and landscaping industries. These converging factors are accelerating the consumption of flowers and plants, thereby significantly boosting the industry’s growth

Floriculture Market Analysis

- Floriculture, encompassing the cultivation and trade of ornamental flowers, bedding plants, potted plants, and other decorative plants, is increasingly vital in residential, commercial, and retail applications due to its aesthetic appeal, gifting value, and environmental benefits

- The escalating demand for floriculture products is primarily fueled by urbanization, rising disposable incomes, growth of the floral gifting culture, and increasing interest in home décor, indoor gardening, and corporate landscaping solutions

- Asia-Pacific dominated the floriculture market with a share of over 40% in 2025, due to increasing adoption of ornamental plants, rising disposable incomes, and strong presence of commercial floriculture production hubs

- North America is expected to be the fastest growing region in the floriculture market during the forecast period due to rising demand for ornamental and potted plants in residential, commercial, and gifting applications

- Rose segment dominated the market with a market share of 49.2% in 2025, due to its unmatched global popularity and high usage across gifting, décor, celebrations, and ceremonial functions. Roses benefit from vast cultivation clusters in key producing countries ensuring year-round supply. Their wide color range and suitability for diverse arrangements maintain sustained retail and event demand. Advanced greenhouse techniques improve output quality and longevity, supporting premium pricing. Seasonal peaks such as Valentine’s Day and festive occasions further strengthen market share. Expanding e-commerce gifting platforms also help accelerate rose sales

Report Scope and Floriculture Market Segmentation

|

Attributes |

Floriculture Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Floriculture Market Trends

Rising Adoption of Indoor and Decorative Plants

- A significant trend in the floriculture market is the increasing adoption of indoor, potted, and decorative plants across residential, commercial, and hospitality spaces, driven by rising interest in home décor, wellness, and lifestyle enhancement. This trend is positioning floriculture as a key segment in urban living and premium gifting markets, elevating its importance across both domestic and international trade channels

- For instance, companies such as Beekenkamp Group and Dümmen Orange are introducing innovative plant varieties and ornamental solutions that cater to interior décor and sustainable gardening preferences. These offerings enhance the aesthetic appeal of living and working spaces while strengthening brand presence and market visibility

- The demand for decorative plants is rising rapidly in urban housing and office environments as consumers increasingly seek indoor greenery for stress reduction, air purification, and visual enhancement. This is positioning floriculture as a critical component of lifestyle-oriented interior solutions

- The hospitality sector is integrating ornamental flowers and potted plants into hotels, restaurants, and event venues, where applications such as décor, ambiance creation, and thematic styling require high-quality, long-lasting plants. This adoption is accelerating innovation in plant cultivation, delivery, and maintenance services

- Retailers and e-commerce platforms are expanding their range of decorative plants and bouquets, providing convenient access to consumers and enabling personalized floral gifting solutions. This trend is supporting broader market penetration and higher frequency of purchases

- The market is witnessing strong growth in premium and sustainable floral offerings where advanced greenhouse cultivation, disease-resistant varieties, and eco-friendly packaging contribute to enhanced product quality and consumer appeal. This rising incorporation of innovative practices is reinforcing the transition toward a more sustainable, aesthetically focused, and lifestyle-driven floriculture market

Floriculture Market Dynamics

Driver

Growing Consumer Demand for Sustainable and Eco-Friendly Floral Products

- The growing awareness of environmental sustainability, plant health benefits, and eco-friendly gardening practices is driving the demand for ornamental flowers, potted plants, and cut flowers cultivated with minimal chemical inputs. Consumers increasingly prefer products that align with green lifestyles, promoting the adoption of sustainable floriculture solutions

- For instance, Syngenta Flowers and Dümmen Orange are introducing disease-resistant, pollinator-friendly, and low-maintenance plant varieties that minimize chemical usage and environmental impact. These innovations enable commercial growers and home gardeners to adopt sustainable practices while maintaining aesthetic appeal and crop quality

- Rising interest in biodegradable packaging, reduced water consumption, and energy-efficient greenhouse cultivation is further enhancing market growth. Consumers are increasingly willing to pay premium prices for flowers and plants that adhere to sustainability principles, creating opportunities for eco-conscious producers

- Urban gardening and indoor plant trends are increasing demand for sustainable ornamental plants that improve air quality and wellness in homes and offices. This is fostering the expansion of both B2C and B2B floriculture markets

- Growing demand for environmentally responsible corporate gifting, landscaping, and event décor is also driving adoption of eco-friendly floral products. Companies and event planners increasingly prioritize flowers and plants with low environmental footprints, reinforcing market expansion

Restraint/Challenge

Vulnerability to Climate Change and Seasonal Variations

- The floriculture market faces challenges due to its high sensitivity to climatic conditions, temperature fluctuations, and seasonal variations, which can impact plant quality, yield, and availability. Extreme weather events, water scarcity, and shifting growing seasons increase operational risks for producers

- For instance, floriculture companies such as Afriflora and Karen Roses experience production and supply chain disruptions due to unpredictable rainfall, heatwaves, and cold snaps. These factors lead to reduced output, increased costs, and inconsistent product availability, constraining market growth

- Dependence on natural light, temperature control, and water availability makes outdoor and greenhouse cultivation vulnerable to environmental stress, requiring significant investment in climate-resilient infrastructure and risk management strategies

- Seasonal demand fluctuations, such as spikes during festivals, weddings, and holidays, create additional pressure on production planning and inventory management. Failure to match supply with peak demand periods can result in lost revenue or waste

- The market continues to face constraints related to balancing high-quality flower production with environmental uncertainties. These challenges collectively highlight the need for innovative cultivation techniques, controlled-environment farming, and climate-adaptive practices to sustain growth

Floriculture Market Scope

The market is segmented on the basis of product type, application, price range, flower type, and sales channel.

- By Product Type

On the basis of product type, the floriculture market is segmented into cut flowers, bedding plants, potted plants, and others. The cut flowers segment dominated the market in 2025 with the largest revenue share, driven by strong demand across gifting, décor, weddings, religious use, and commercial arrangements. Their high consumption frequency and seasonal spikes during festivals ensure consistent market flow for global suppliers. Cut flowers benefit from well-established cold-chain systems that preserve quality during long-distance exports, supporting higher sales and reduced wastage. The segment is further strengthened by the popularity of roses, lilies, tulips, and orchids across retail and event industries. Expanding online flower delivery platforms also enhance the reach of cut flower offerings across both urban and semi-urban markets.

The potted plants segment is anticipated to witness the fastest growth rate from 2026 to 2033 due to increasing demand for long-lasting indoor greenery among residential and commercial users. Rising consumer preference for air-purifying and low-maintenance plant species supports strong adoption across homes, cafés, offices, and hospitality spaces. Growing awareness of mood-enhancing and wellness-related benefits significantly contributes to segment expansion. Social media trends promoting indoor gardening and aesthetic décor further accelerate consumption of decorative and premium potted plants. Broader species availability across specialty nurseries and online plant stores strengthens the growth outlook. Urban gardening movements and rising participation in plant-care hobbies also enhance segment momentum.

- By Application

On the basis of application, the floriculture market is segmented into personal use, gift, conference and activities, and others. The personal use segment dominated the market in 2025, supported by rising consumer interest in home décor, indoor gardening, aromatherapy, and everyday floral purchases. Increasing urbanization and a growing focus on wellness-driven lifestyles stimulate the adoption of flowers and plants for indoor ambience enhancement. The segment benefits from wide product availability across supermarkets, garden centers, and online channels. Frequent household use during festivals and daily décor boosts recurring purchase cycles. Visual trends on social media promoting aesthetic interiors further strengthen demand. Rising household incomes continue to drive consistent spending on floral products.

The conference and activities segment is expected to record the fastest growth from 2026 to 2033 due to expanding corporate event culture, business exhibitions, cultural festivals, and destination gatherings. Flowers play a crucial role in stage décor, entrance themes, table arrangements, and brand-oriented setups. Increasing government-hosted conferences, large-scale product launches, and award ceremonies create substantial opportunities for floral suppliers. Premium events increasingly prefer thematic floral installations to enhance ambience and guest experience. Hotels, convention centers, and event planners continue to allocate larger budgets for floral decoration. Growing investments in luxury weddings and international conferences further accelerate segment expansion.

- By Price Range

On the basis of price range, the floriculture market is segmented into premium price, medium, and low price. The medium-price segment dominated the market in 2025 due to its strong affordability appeal and balanced value for both households and businesses. Consumers commonly prefer medium-priced floral arrangements for routine gifting, celebrations, and decorative use. Retail chains promote mid-range flowers through seasonal deals, combos, and attractive packaging that increase consumer uptake. The segment benefits from consistent supply of widely grown varieties that maintain stable pricing throughout the year. Hotels, offices, and event planners frequently choose medium-priced options to manage décor budgets without compromising on visual appeal. High product availability across multiple retail formats also ensures strong segment performance.

The premium-price segment is expected to witness the fastest growth from 2026 to 2033, driven by rising demand for exotic and luxury floral varieties. High-end customers increasingly opt for imported orchids, hydrangeas, long-stem roses, and curated designer bouquets. Boutique florists and online premium gifting brands fuel demand with customization-driven offerings. Luxury weddings, celebrity events, and corporate galas increasingly rely on premium arrangements for thematic ambiance. International trade expansion of rare and high-value flower species supports global premium consumption. Growing interest in upscale gifting and personalized floral experiences enhances segment momentum.

- By Flower Type

On the basis of flower type, the market is categorized into rose, chrysanthemum, tulip, lily, gerbera, carnations, texas bluebell, freesia, hydrangea, and others. The rose segment dominated the market with the largest share of 49.2% in 2025 due to its unmatched global popularity and high usage across gifting, décor, celebrations, and ceremonial functions. Roses benefit from vast cultivation clusters in key producing countries ensuring year-round supply. Their wide color range and suitability for diverse arrangements maintain sustained retail and event demand. Advanced greenhouse techniques improve output quality and longevity, supporting premium pricing. Seasonal peaks such as Valentine’s Day and festive occasions further strengthen market share. Expanding e-commerce gifting platforms also help accelerate rose sales.

The hydrangea segment is expected to grow the fastest from 2026 to 2033 due to rising demand from luxury décor, premium events, and high-end weddings. Hydrangeas are widely preferred for voluminous arrangements, pastel themes, and ornamental installations across upscale venues. Their increasing availability through greenhouse cultivation improves durability and shelf life, supporting broader market adoption. Event planners and boutique florists use hydrangeas for thematic, large-scale décor setups that appeal to modern aesthetics. Rising social media trends that highlight hydrangea-based décor significantly enhance consumer interest. Growing consumption in hospitality and luxury retail décor further drives segment expansion.

- By Sales Channel

On the basis of sales channel, the market is segmented into direct sales, specialty stores, franchises, florists and kiosks, supermarkets/hypermarkets, independent small stores, online retailers, and other channels. Supermarkets and hypermarkets dominated the market in 2025 due to high consumer footfall and strong visibility of ready-to-buy floral products. These outlets invest in temperature-controlled floral sections to maintain freshness and reduce wastage. Seasonal showcases and promotional campaigns encourage impulse purchases among shoppers. Their extensive distribution networks ensure consistent replenishment of popular floral varieties. The convenience of purchasing flowers along with household goods supports strong segment adoption. Urban expansion and retail chain penetration further reinforce leadership.

Online retailers are projected to grow the fastest from 2026 to 2033 as consumers increasingly prefer doorstep delivery, wide selection, and customization options. E-commerce platforms provide advanced features such as curated bouquets, express delivery, and real-time order tracking that enhance customer experience. Growth in cold-logistics infrastructure ensures freshness during transit, boosting consumer confidence. Subscription-based floral services and curated gift boxes attract premium buyers seeking convenience. Social media promotions and influencer-driven floral trends significantly increase online conversions. Cross-border online floral sales also expand access to premium and exotic varieties.

Floriculture Market Regional Analysis

- Asia-Pacific dominated the floriculture market with the largest revenue share of over 40% in 2025, driven by increasing adoption of ornamental plants, rising disposable incomes, and strong presence of commercial floriculture production hubs

- The region’s cost-effective cultivation practices, growing e-commerce penetration for floral products, and expansion of greenhouse infrastructure are accelerating market expansion

- The availability of skilled horticultural labor, favorable government policies supporting floriculture, and rapid urbanization across developing economies are contributing to increased consumption of flowers and plants in both domestic and export markets

China Floriculture Market Insight

China held the largest share in the Asia-Pacific floriculture market in 2025, owing to its expansive commercial flower farms, established distribution networks, and strong export capabilities. The country’s investments in greenhouse technology, advanced floriculture techniques, and high-yield flower varieties are major growth drivers. Demand is also bolstered by increasing domestic consumption for gifting, home décor, and corporate events, supporting steady market growth.

India Floriculture Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rising urban middle-class populations, increasing floral gifting culture, and expanding greenhouse and nursery infrastructure. Government initiatives promoting horticulture and floriculture entrepreneurship, along with growth in export-oriented flower cultivation, are strengthening demand. In addition, rising participation in indoor gardening and decorative plant adoption is contributing to robust market expansion.

Europe Floriculture Market Insight

The Europe floriculture market is expanding steadily, supported by high demand for premium flowers, strict quality and sustainability standards, and growing investments in greenhouse and controlled-environment cultivation. The region emphasizes environmentally friendly practices, organic flower production, and high-quality ornamental plants, particularly for gifting and corporate events. Increasing adoption of floriculture innovations in landscaping and luxury décor is further enhancing market growth.

Germany Floriculture Market Insight

Germany’s floriculture market is driven by its strong floral retail network, focus on sustainable and high-quality ornamental plants, and growing domestic demand for premium flowers. The country’s horticultural R&D, combined with collaborations between growers and distributors, fosters continuous innovation in flower varieties and cultivation techniques. Demand is particularly strong for roses, tulips, and potted plants used in corporate, personal, and gifting applications.

U.K. Floriculture Market Insight

The U.K. market is supported by a mature floriculture and garden décor industry, increasing interest in indoor plants, and growing investments in greenhouse cultivation. Efforts to localize flower supply chains and a focus on sustainable horticulture further enhance market expansion. Rising consumer awareness of plant-based wellness and aesthetic trends is driving demand for premium and decorative flowers and potted plants.

North America Floriculture Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for ornamental and potted plants in residential, commercial, and gifting applications. Growth in e-commerce floral delivery platforms, increased focus on home décor, and expanding adoption of sustainable indoor plants are boosting demand. In addition, rising interest in premium flowers, urban gardening, and corporate landscaping is supporting market expansion.

U.S. Floriculture Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its expansive floriculture industry, well-established retail and e-commerce networks, and strong consumer interest in ornamental and decorative plants. The country’s focus on high-quality flower varieties, greenhouse cultivation, and premium floral arrangements is encouraging adoption in residential, gifting, and corporate applications. Presence of key growers, florists, and online retailers further solidify the U.S.'s leading position in the region.

Floriculture Market Share

The floriculture industry is primarily led by well-established companies, including:

- Multiflora (Netherlands)

- Karen Roses (Kenya)

- Harvest Flowers UK Ltd (U.K.)

- Queens Group (Netherlands)

- Ball Horticultural Company (U.S.)

- Afriflora (Kenya)

- Oserian (Kenya)

- Selecta Klemm (Germany)

- Tulips.com (Netherlands)

- Soc. Agr. Arcangeli Giovanni e Figlio S.A.S. di Giovanni Arcangeli e C. (Italy)

- Floralife (U.S.)

- ERNST BENARY SAMENZUCHT GMBH (Germany)

- Danziger (Israel)

- Sakata Seed America (U.S.)

- Beekenkamp Group (Netherlands)

- Dümmen Orange (Netherlands)

- Flamingo (Netherlands)

- Kurt Weiss Greenhouses, Inc. (U.S.)

- The Marginpar BV (Netherlands)

- Selecta Klemm (Germany)

Latest Developments in Global Floriculture Market

- In 2024, Syngenta Flowers launched Cora XDR Vinca, a disease-resistant ornamental flower variety, offering a sustainable solution to combat the soil-borne pathogen Phytophthora nicotianae. This innovation addresses the challenge of root diseases that commonly affect vinca crops, significantly reducing crop losses and minimizing the need for chemical fungicides. By promoting environmentally friendly farming practices, the introduction of Cora XDR Vinca supports the growing demand for sustainable floriculture solutions and enhances the efficiency and profitability of ornamental flower production

- In 2024, Dümmen Orange established a breeding and testing system for pollinator-friendly plants in collaboration with the Naturalis Biodiversity Center. The initiative evaluates nectar volume, sugar content, flower number, and color to measure pollinator attractiveness, promoting biodiversity and ecosystem health. Receiving the Plantum Sustainability Award 2024 highlights the company’s commitment to sustainable horticulture practices. This development strengthens the market trend toward environmentally conscious plant breeding, catering to both commercial growers and eco-conscious consumers seeking pollinator-supportive ornamental plants

- In 2024, Beekenkamp Group commenced construction of a new 4-hectare greenhouse in Maasdijk, Netherlands, employing advanced technology to optimize product quality, improve climate control, and reduce labor requirements. The facility is designed for the production of starting plants for various field-grown vegetables, reflecting the company’s focus on innovation and eco-friendly cultivation methods. This investment enhances operational efficiency, increases production reliability, and positions Beekenkamp as a leader in sustainable floriculture, meeting rising market demand for high-quality plant starts

- In 2023, Marginpar partnered with VBW (Royal Association of Florist Retailers) to provide florists with exclusive cut flowers and drive sales through events and competitions. This collaboration fosters stronger engagement between suppliers and florists, promotes premium floral varieties, and encourages creativity in flower arrangements. By supporting florists with specialized products and marketing initiatives, the partnership strengthens the retail segment, boosts market visibility, and enhances the overall quality and diversity of cut flowers available to consumers

- In September 2023, Crayola LLC collaborated with Mrs Bloom's License Corp. to launch Crayola Flowers, a pioneering platform allowing consumers to purchase floral bouquets while contributing a portion of proceeds to participating nonprofit organizations. This initiative merges retail innovation with social responsibility, appealing to a broader consumer base and enhancing brand engagement. By integrating charitable contributions into floral sales, the partnership supports market growth in the retail floral segment and encourages socially conscious consumer behavior, thereby expanding the reach and impact of the floriculture market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.