Global Food And Beverages Nutraceutical Ingredients Market

Market Size in USD Billion

CAGR :

%

USD

94.57 Billion

USD

162.48 Billion

2025

2033

USD

94.57 Billion

USD

162.48 Billion

2025

2033

| 2026 –2033 | |

| USD 94.57 Billion | |

| USD 162.48 Billion | |

|

|

|

|

Food and Beverages Nutraceutical Ingredients Market Size

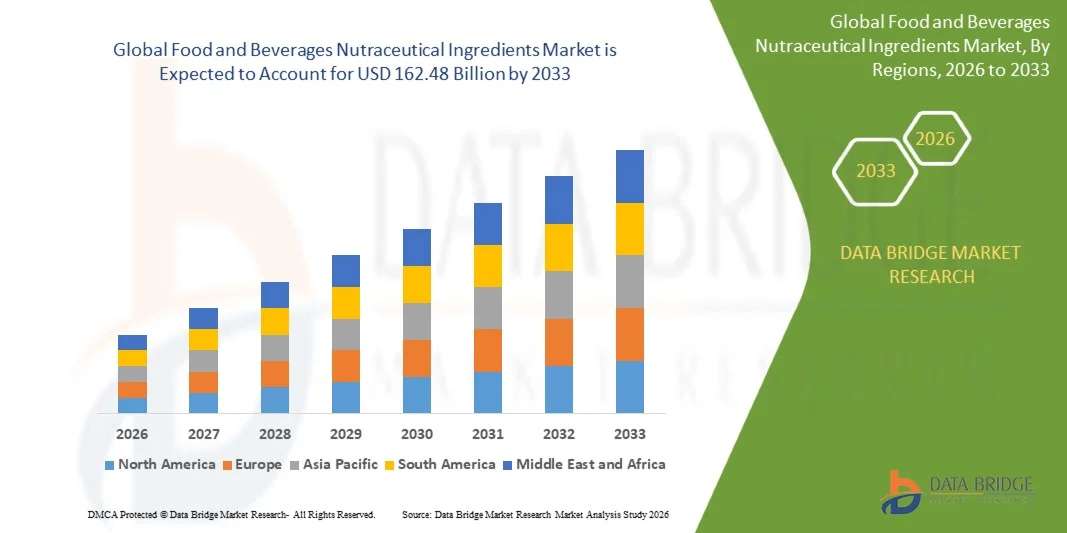

- The global food and beverages nutraceutical ingredients market size was valued at USD 94.57 billion in 2025 and is expected to reach USD 162.48 billion by 2033, at a CAGR of 7.00% during the forecast period

- The market growth is largely fueled by increasing consumer awareness of health and wellness, rising demand for functional foods and beverages, and expanding applications of nutraceutical ingredients in dietary supplements. These factors are driving manufacturers to innovate and incorporate bioactive compounds, vitamins, proteins, and plant extracts into a wide range of products, accelerating market expansion

- Furthermore, growing focus on preventive healthcare, rising disposable incomes, and changing dietary habits are boosting consumption of fortified and functional products. These converging trends are establishing nutraceutical ingredients as essential components in the food and beverage industry, thereby significantly enhancing market growth

Food and Beverages Nutraceutical Ingredients Market Analysis

- Food and beverages nutraceutical ingredients include vitamins, minerals, proteins, omega‑3 fatty acids, prebiotics, plant extracts, and specialty fibers that are incorporated into functional foods, beverages, and dietary supplements to improve health outcomes. Their application spans immunity, digestive health, cardiovascular support, and mental wellness, providing versatility across product lines

- The escalating demand for nutraceutical ingredients is primarily fueled by increasing health-consciousness, expansion of retail and e-commerce channels, and technological advancements in ingredient formulation. Consumers increasingly prefer natural, plant-based, and clinically validated ingredients, prompting manufacturers to adopt innovative solutions for enhanced efficacy and bioavailability

- Asia-Pacific dominated the food and beverages nutraceutical ingredients market with a share of around 40% in 2025, due to increasing health-conscious populations, rising demand for functional foods and beverages, and a strong presence of nutraceutical ingredient manufacturers

- North America is expected to be the fastest growing region in the food and beverages nutraceutical ingredients market during the forecast period due to robust demand for functional foods, dietary supplements, and specialty nutraceutical ingredients

- Powder segment dominated the market with a market share of 62.8% in 2025, due to its longer shelf life, ease of storage, and convenience in formulation into various food and beverage products. Powdered nutraceuticals are widely preferred by manufacturers for fortifying functional foods, nutritional bars, and powdered drink mixes due to their stability and consistency in nutrient content. The market also sees strong demand for powder forms due to their adaptability in blending multiple active ingredients without compromising taste or texture

Report Scope and Food and Beverages Nutraceutical Ingredients Market Segmentation

|

Attributes |

Food and Beverages Nutraceutical Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Food and Beverages Nutraceutical Ingredients Market Trends

Rising Demand for Functional Foods and Fortified Beverages

- A notable trend in the food and beverages nutraceutical ingredients market is the growing consumer preference for functional foods and fortified beverages that offer added health benefits beyond basic nutrition, driven by increasing awareness of preventive healthcare and wellness. This trend is influencing manufacturers to develop products enriched with vitamins, minerals, probiotics, and plant-based bioactive compounds to cater to health-conscious consumers

- For instance, Nestlé Health Science and Danone have introduced fortified beverages and functional dairy products that target digestive health, immunity, and overall wellness. Such offerings are creating new consumption occasions and encouraging continuous innovation in nutraceutical formulations

- Plant-based protein and botanical extracts are gaining popularity in functional foods as they provide natural sources of nutrients while addressing dietary restrictions and lifestyle preferences. This adoption is positioning nutraceutical ingredients as integral components in product development strategies that emphasize clean label and health-focused benefits

- The demand for ready-to-drink functional beverages is accelerating as busy lifestyles encourage convenient consumption formats that combine hydration with nutritional supplementation. Companies are leveraging ingredients such as omega-3 fatty acids, antioxidants, and fiber to enhance the health appeal of beverages

- Growth in e-commerce and online grocery platforms is supporting the trend by improving accessibility to nutraceutical-enhanced foods and beverages, enabling consumers to explore a wider range of health-focused options from global brands

- Consumer awareness campaigns and educational initiatives by organizations such as the International Food Information Council are promoting understanding of functional ingredients and their health benefits. This trend is fostering stronger consumer trust and encouraging long-term adoption of nutraceutical-enriched food and beverage products

Food and Beverages Nutraceutical Ingredients Market Dynamics

Driver

Growing Consumer Focus on Preventive Healthcare and Wellness

- The increasing global emphasis on preventive healthcare and wellness is driving demand for nutraceutical ingredients that support immunity, heart health, and digestive well-being. Consumers are actively seeking products that enhance overall health and reduce lifestyle-related health risks

- For instance, Abbott Laboratories has developed nutritional beverages fortified with vitamins and minerals targeting immunity and bone health. These products cater to proactive health management and influence purchase decisions

- Rising prevalence of chronic diseases and health awareness programs are encouraging individuals to incorporate functional foods into daily diets to maintain optimal health. This is motivating manufacturers to innovate and provide value-added ingredients that meet targeted health needs

- Healthcare practitioners and dieticians are recommending nutraceutical-based products as complementary solutions to support wellness routines. Their endorsement is increasing consumer confidence and broadening market penetration

- The expanding aging population is seeking foods and beverages that prevent age-related health issues, which is bolstering the inclusion of nutraceutical ingredients in mainstream products. This sustained focus on preventive care continues to drive market expansion

Restraint/Challenge

Regulatory Complexities and Varying Global Standards

- The nutraceutical ingredients market faces challenges due to complex regulatory frameworks and varying standards across countries, which affect product formulation, labeling, and approval processes. Compliance with multiple guidelines increases time-to-market and operational costs for manufacturers

- For instance, DSM Nutritional Products navigates stringent FDA and EFSA regulations to ensure its nutraceutical formulations meet safety and efficacy standards. Such compliance requirements limit flexibility in product development and pose barriers for smaller companies

- Divergence in permissible health claims and ingredient approvals across regions complicates global product launches, requiring extensive documentation and validation. Companies must adapt formulations to satisfy local regulatory authorities while maintaining product consistency

- Monitoring and adapting to frequent regulatory updates demands dedicated resources and expertise, increasing operational overhead for manufacturers. This challenge can delay product introduction and affect competitiveness

- Market growth is further restrained by the need for scientific substantiation of health benefits, as regulators increasingly demand clinical evidence supporting product claims. These constraints collectively challenge manufacturers to balance innovation with compliance while sustaining market growth

Food and Beverages Nutraceutical Ingredients Market Scope

The market is segmented on the basis of type and form.

- By Type

On the basis of type, the Food and Beverages Nutraceutical Ingredients market is segmented into Prebiotics, Amino Acids and Proteins, Omega-3 Fatty Acids, Vitamins, Minerals, Carotenoids, Plant Extracts and Phytochemicals, and Specialty Carbohydrates and Fibers. The Vitamins segment dominated the largest market revenue share in 2025, driven by its essential role in supporting immunity, metabolic functions, and overall health. Consumers often prioritize vitamin-based nutraceuticals due to their easy incorporation into daily diets and widespread awareness of their health benefits. The market also sees strong demand for vitamin ingredients due to their versatility in functional foods, beverages, and dietary supplements, as well as the availability of diverse formulations enhancing bioavailability and efficacy.

The Omega-3 Fatty Acids segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing awareness of heart health, cognitive benefits, and anti-inflammatory properties. Omega-3 fatty acids are highly valued in functional beverages and fortified foods, with consumers seeking convenient and natural sources of these essential nutrients. For instance, companies such as DSM Nutrition leverage microencapsulation technology to improve the stability and taste of Omega-3 ingredients, making them more appealing in commercial applications. Rising demand in preventive healthcare and aging populations further contributes to their accelerating adoption in both global and regional markets.

- By Form

On the basis of form, the Food and Beverages Nutraceutical Ingredients market is segmented into Liquid and Powder. The Powder form segment dominated the largest market revenue share of 62.8% in 2025, driven by its longer shelf life, ease of storage, and convenience in formulation into various food and beverage products. Powdered nutraceuticals are widely preferred by manufacturers for fortifying functional foods, nutritional bars, and powdered drink mixes due to their stability and consistency in nutrient content. The market also sees strong demand for powder forms due to their adaptability in blending multiple active ingredients without compromising taste or texture.

The Liquid form segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising consumer preference for ready-to-consume nutraceutical beverages and liquid dietary supplements. Liquid forms offer superior bioavailability and faster absorption, making them attractive for health-conscious consumers seeking quick and effective supplementation. For instance, companies such as Amway incorporate liquid nutraceutical formulations into health drinks and energy supplements, enhancing consumer convenience and compliance. The increasing penetration of functional beverages and fortified drinks in emerging markets further drives the rapid growth of the liquid segment.

Food and Beverages Nutraceutical Ingredients Market Regional Analysis

- Asia-Pacific dominated the food and beverages nutraceutical ingredients market with the largest revenue share of around 40% in 2025, driven by increasing health-conscious populations, rising demand for functional foods and beverages, and a strong presence of nutraceutical ingredient manufacturers

- The region’s cost-effective production landscape, growing investments in food technology, and expanding exports of fortified foods and dietary supplements are accelerating market growth

- Availability of skilled workforce, supportive government initiatives promoting health and wellness products, and rapid urbanization across developing economies are contributing to increased consumption of nutraceutical ingredients in both food and beverage sectors

China Food and Beverages Nutraceutical Ingredients Market Insight

China held the largest share in the Asia-Pacific nutraceutical ingredients market in 2025, owing to its position as a global leader in functional food production and dietary supplement manufacturing. The country benefits from a robust industrial base, favorable policies supporting health and nutrition sectors, and strong export capabilities for nutraceutical ingredients. Demand is further supported by increasing consumer awareness of preventive healthcare and investments in research and development of bioactive compounds.

India Food and Beverages Nutraceutical Ingredients Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by a rapidly expanding functional foods and dietary supplements market, increasing health awareness, and rising investment in nutraceutical manufacturing infrastructure. Government initiatives promoting health and nutrition, along with the growing middle-class population and increasing disposable income, are strengthening the demand for nutraceutical ingredients. In addition, rising exports of fortified foods and beverages and expanding research in plant-based and specialty ingredients are contributing to strong market expansion.

Europe Food and Beverages Nutraceutical Ingredients Market Insight

The Europe nutraceutical ingredients market is expanding steadily, supported by stringent food safety regulations, high consumer demand for fortified and functional foods, and growing investment in natural and specialty ingredients. The region emphasizes quality, traceability, and sustainable sourcing, particularly in plant extracts, vitamins, and proteins. Increasing use of nutraceutical ingredients in preventive healthcare, wellness products, and personalized nutrition solutions is further enhancing market growth.

Germany Food and Beverages Nutraceutical Ingredients Market Insight

Germany’s nutraceutical ingredients market is driven by its strong food technology sector, emphasis on high-quality and innovative functional foods, and export-oriented production model. The country has well-established research networks and collaborations between academic institutions and food manufacturers, fostering continuous innovation in vitamins, proteins, and bioactive compounds. Demand is particularly strong for use in fortified beverages, dietary supplements, and specialty functional foods.

U.K. Food and Beverages Nutraceutical Ingredients Market Insight

The U.K. market is supported by a mature health and wellness industry, growing efforts to develop locally sourced nutraceutical ingredients, and increasing consumer focus on preventive healthcare. With rising investments in research, product innovation, and collaborations between food companies and academic institutions, the U.K. continues to play a key role in the functional food and dietary supplement sector.

North America Food and Beverages Nutraceutical Ingredients Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by robust demand for functional foods, dietary supplements, and specialty nutraceutical ingredients. Strong focus on preventive healthcare, advancements in nutraceutical research, and growing consumer preference for natural and fortified products are boosting demand. In addition, increasing collaborations between food and pharmaceutical companies and rising awareness of personalized nutrition are supporting market expansion.

U.S. Food and Beverages Nutraceutical Ingredients Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by a highly developed dietary supplement and functional foods industry, strong R&D infrastructure, and significant investment in nutraceutical manufacturing. The country’s focus on innovation, regulatory compliance, and consumer education is encouraging the adoption of vitamins, proteins, and specialty ingredients in functional foods and beverages. Presence of key players and a mature distribution network further solidify the U.S.'s leading position in the region.

Food and Beverages Nutraceutical Ingredients Market Share

The food and beverages nutraceutical ingredients industry is primarily led by well-established companies, including:

- Ajinomoto Co., Inc. (Japan)

- Cargill, Incorporated (U.S.)

- ADM — Archer Daniels Midland Company (U.S.)

- BASF SE (Germany)

- Associated British Foods plc (U.K.)

- Ingredion Incorporated (U.S.)

- DSM — Koninklijke DSM N.V. (Netherlands)

- Arla Foods amba (Denmark)

- Tate & Lyle PLC (U.K.)

- DuPont de Nemours, Inc. (U.S.)

- Kerry Group plc (Ireland)

- Balchem Corporation (U.S.)

- Prinova Group (U.S.)

- Roquette Frères (France)

- Kyowa Hakko Bio Co., Ltd. (Japan)

Latest Developments in Global Food and Beverages Nutraceutical Ingredients Market

- In December 2025, Greenvit’s acquisition of a majority stake in Synkol significantly strengthened its position in the nutraceutical ingredients market by broadening its portfolio into type II collagen, a high-value ingredient widely used in joint, bone, and mobility health products. This strategic move enhances Greenvit’s global R&D and technological capabilities, enabling the company to expand into new markets with advanced ingredient platforms. The acquisition also allows Greenvit to leverage Synkol’s established supply chain and manufacturing expertise, increasing its competitiveness and market reach in both functional foods and dietary supplements

- In November 2025, Precious Petals unveiled high-purity saffron actives, including Crocin, Picrocrocin, and Safranal, at FI Global 2025, marking a significant innovation in standardized botanical extracts. This launch supports formulators in developing functional foods, beverages, and nutraceutical products with consistent, high-performance natural ingredients, meeting growing consumer demand for premium and natural wellness solutions. By providing ingredients with verified bioactive content, Precious Petals enhances product efficacy, safety, and quality, which is expected to drive adoption in both domestic and international nutraceutical markets

- In May 2025, OmniActive Health Technologies launched its botanical ingredients Zenroot and Sleeproot in European markets, offering standardized ashwagandha and valerian-based solutions targeting stress relief, mood enhancement, and sleep support. This development strengthens OmniActive’s presence in the fast-growing mental wellness segment of the nutraceutical market. The launch addresses increasing consumer demand for clinically validated, natural solutions for mental and emotional well-being, allowing formulators to integrate high-quality bioactive compounds into functional foods, beverages, and dietary supplements

- In February 2025, Brenntag Specialties showcased a range of advanced pharmaceutical and nutraceutical ingredient innovations at Vitafoods India, including formulations designed for joint care, immunity, and holistic health support. This strategic presentation highlights Brenntag’s role in accelerating the adoption of cutting-edge functional ingredients across South Asia’s growing health and wellness markets. By offering a portfolio of high-purity, ready-to-use ingredients, Brenntag strengthens its partnerships with manufacturers and formulators, driving faster product development and adoption in nutraceutical applications

- In August 2025, Prinova’s acquisition of Brazilian ingredient distributor Aplinova expanded its supply capabilities across food, beverage, and nutraceutical ingredients, significantly reinforcing its portfolio in functional ingredient solutions. The acquisition improves Prinova’s distribution reach in Latin America, a region experiencing rapid growth in health-focused food and beverage products. By integrating Aplinova’s local expertise and customer base, Prinova can better address the rising demand for fortified foods, dietary supplements, and specialty nutraceutical ingredients, accelerating market penetration and supporting long-term growth strategies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Food And Beverages Nutraceutical Ingredients Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Food And Beverages Nutraceutical Ingredients Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Food And Beverages Nutraceutical Ingredients Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.