Global Food Savory Ingredients Market

Market Size in USD Billion

CAGR :

%

USD

1.96 Billion

USD

3.06 Billion

2025

2033

USD

1.96 Billion

USD

3.06 Billion

2025

2033

| 2026 –2033 | |

| USD 1.96 Billion | |

| USD 3.06 Billion | |

|

|

|

|

Food Savory Ingredients Market Size

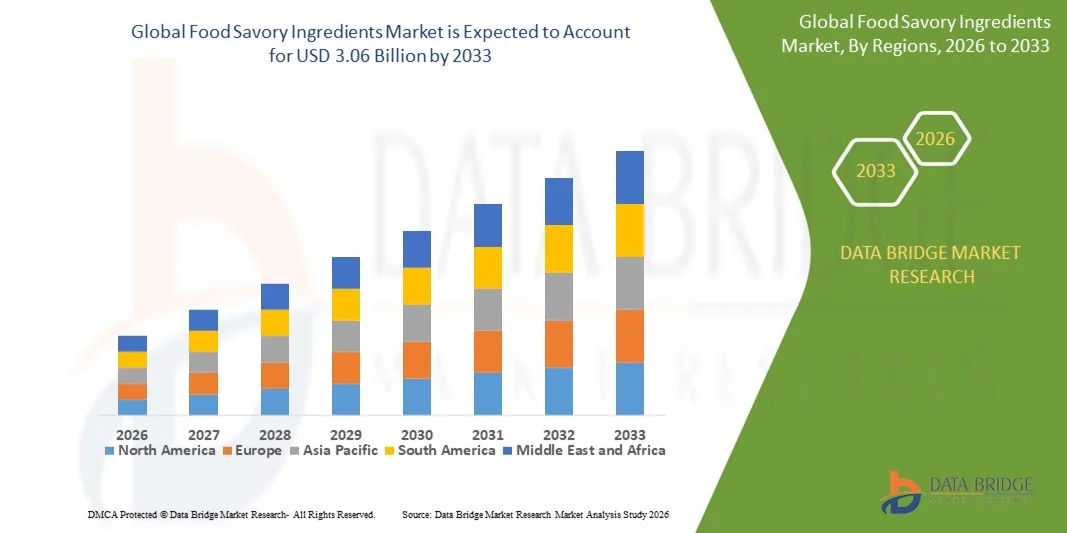

- The global food savory ingredients market size was valued at USD 1.96 billion in 2025 and is expected to reach USD 3.06 billion by 2033, at a CAGR of 5.70% during the forecast period

- The market growth is largely fuelled by rising demand for processed and convenience foods across urban populations

- Increasing consumer preference for enhanced taste, umami flavors, and flavor-rich food products is supporting market expansion

Food Savory Ingredients Market Analysis

- The market is witnessing steady growth due to the widespread use of savory ingredients in snacks, ready-to-eat meals, soups, sauces, and seasonings

- Product innovation, clean-label formulations, and expanding applications in foodservice and packaged food industries are shaping overall market dynamics

- North America dominated the food savory ingredients market with the largest revenue share of 38.75% in 2025, driven by increasing demand for processed and convenience foods, along with a growing preference for natural and clean-label flavor enhancers

- Asia-Pacific region is expected to witness the highest growth rate in the global food savory ingredients market, driven by rapid population growth, expanding food processing industry, increasing consumer preference for flavorful and ready-to-eat products, and rising adoption of modern food technologies

- The yeast extracts segment held the largest market revenue share in 2025, driven by their strong umami profile, clean label perception, and wide usage across soups, sauces, snacks, and ready meals. Yeast extracts are widely preferred by manufacturers due to their natural origin and ability to enhance flavor while supporting reduced sodium formulations

Report Scope and Food Savory Ingredients Market Segmentation

|

Attributes |

Food Savory Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Food Savory Ingredients Market Trends

Rising Demand For Flavor Enhancement And Convenience Foods

- The increasing consumption of processed, ready-to-eat, and convenience foods is significantly shaping the food savory ingredients market, as consumers seek products with enhanced taste, aroma, and mouthfeel. Savory ingredients such as yeast extracts, hydrolyzed vegetable proteins, and flavor enhancers are widely used to improve overall sensory appeal, supporting their growing adoption across snacks, soups, sauces, and ready meals. This trend is encouraging manufacturers to develop innovative savory solutions tailored to diverse culinary preferences

- Growing urbanization, busy lifestyles, and rising disposable incomes are accelerating demand for savory ingredients in packaged and foodservice products. Consumers increasingly prefer foods that deliver rich umami and savory profiles without extensive preparation time, driving the use of savory ingredients in instant foods, frozen meals, and quick-service restaurant offerings. This shift is strengthening demand across both retail and foodservice channels

- Clean-label and natural flavor trends are influencing purchasing behavior, with manufacturers focusing on transparent ingredient lists and reduced reliance on artificial additives. This is driving innovation in naturally derived savory ingredients, including plant-based and fermented solutions, helping brands differentiate products and align with evolving consumer expectations

- For instance, in 2024, food manufacturers in the U.S. and Europe expanded the use of yeast extracts and natural savory ingredients in snack foods and ready meals to meet rising consumer demand for clean-label flavor solutions. These products were launched across supermarkets, convenience stores, and online platforms, enhancing brand visibility and repeat purchases

- While demand for savory ingredients continues to grow, sustained market expansion depends on balancing flavor performance, cost efficiency, and regulatory compliance. Manufacturers are investing in R&D, process optimization, and sustainable sourcing to deliver high-quality savory solutions at competitive prices

Food Savory Ingredients Market Dynamics

Driver

Growing Consumption Of Processed And Convenience Foods

- The rising global consumption of processed and convenience foods is a key driver for the food savory ingredients market. Manufacturers increasingly rely on savory ingredients to enhance taste, consistency, and overall palatability of packaged foods, supporting strong demand across multiple food categories

- Expanding applications in snacks, soups, sauces, ready meals, and meat alternatives are contributing to market growth. Savory ingredients play a crucial role in delivering umami flavors and improving flavor depth, enabling food producers to meet consumer expectations for flavorful and satisfying products

- Food manufacturers are actively promoting savory ingredient-based formulations through product innovation and menu diversification. These efforts are supported by increasing consumer demand for flavorful, convenient, and affordable food options, encouraging collaborations between ingredient suppliers and food brands

- For instance, in 2023, major food companies in the U.S. and Europe increased the use of savory ingredients in ready-to-eat meals and snack products to address growing demand for taste-enhanced convenience foods. These initiatives helped improve product differentiation and strengthen market presence

- Despite strong demand drivers, continued growth relies on maintaining consistent flavor quality, managing raw material costs, and adapting to evolving regulatory and consumer requirements

Restraint/Challenge

Regulatory Constraints And Clean-Label Reformulation Challenges

- Stringent food safety regulations and labeling requirements present a key challenge for the food savory ingredients market, particularly for products containing flavor enhancers or additives. Compliance with varying regional regulations can increase formulation complexity and development costs for manufacturers

- Growing consumer scrutiny of ingredient lists is pressuring manufacturers to reformulate products with fewer artificial components. Transitioning to clean-label savory solutions can be technically challenging and may impact flavor intensity or cost structures, slowing adoption in certain applications

- Supply chain volatility and raw material price fluctuations also affect market growth, as savory ingredients often rely on agricultural or fermentation-based inputs. Disruptions in sourcing can impact pricing and availability, posing challenges for consistent production

- For instance, in 2024, food manufacturers in Asia and Europe reported reformulation delays due to regulatory changes and difficulties in sourcing clean-label savory ingredients at scale. These challenges affected product launches and limited short-term market expansion

- Addressing these restraints will require investment in advanced flavor technologies, regulatory expertise, and sustainable sourcing strategies. Strengthening supplier partnerships and focusing on innovation will be essential to unlock long-term growth in the global food savory ingredients market

Food Savory Ingredients Market Scope

The market is segmented on the basis of type, origin, form, and production technique.

- By Type

On the basis of type, the food savory ingredients market is segmented into yeast extracts, hydrolyzed vegetable protein, hydrolyzed animal protein, monosodium glutamate, nucleotides, and other. The yeast extracts segment held the largest market revenue share in 2025, driven by their strong umami profile, clean label perception, and wide usage across soups, sauces, snacks, and ready meals. Yeast extracts are widely preferred by manufacturers due to their natural origin and ability to enhance flavor while supporting reduced sodium formulations.

The nucleotides segment is expected to witness the fastest growth rate from 2026 to 2033, driven by their synergistic effect with other savory ingredients and their ability to intensify umami taste even at low inclusion levels. Nucleotides are increasingly adopted in processed foods, meat alternatives, and convenience products for improving flavor depth and overall palatability, making them a key growth segment within the global food savory ingredients market.

- By Origin

On the basis of origin, the market is segmented into natural and synthetic. The natural segment accounted for the largest market revenue share in 2025, driven by growing consumer preference for clean label and minimally processed ingredients. Food manufacturers are increasingly shifting toward natural savory ingredients to meet regulatory requirements and evolving consumer expectations.

The synthetic segment is expected to witness steady growth during the forecast period, supported by its cost effectiveness, consistent quality, and functional stability in large scale food production. Synthetic savory ingredients remain widely used in mass produced and price sensitive food products.

- By Form

On the basis of form, the food savory ingredients market is segmented into liquid, powder, and other. The powder segment dominated the market in 2025 due to its longer shelf life, ease of handling, and compatibility with a wide range of food applications. Powdered savory ingredients are extensively used in seasoning blends, instant foods, and dry mixes.

The liquid segment is expected to register the fastest growth rate from 2026 to 2033, driven by increasing demand in sauces, soups, gravies, and ready to eat meals. Liquid forms offer better solubility and uniform flavor distribution, making them attractive for foodservice and industrial applications.

- By Production Technique

On the basis of production technique, the market is segmented into heat treatment, acid treatment, and maillard reaction. The heat treatment segment held the largest revenue share in 2025, driven by its widespread use in producing consistent and scalable savory ingredients. This method is preferred for its efficiency and compatibility with various raw materials.

The maillard reaction segment is expected to witness the fastest growth rate during the forecast period, supported by its ability to generate rich, roasted, and complex flavor profiles. Growing demand for authentic taste experiences and premium savory products is driving increased adoption of maillard reaction based savory ingredients.

Food Savory Ingredients Market Regional Analysis

- North America dominated the food savory ingredients market with the largest revenue share of 38.75% in 2025, driven by increasing demand for processed and convenience foods, along with a growing preference for natural and clean-label flavor enhancers

- Consumers in the region are increasingly seeking high-quality savory ingredients that enhance taste, aroma, and nutritional value in food products

- This widespread adoption is supported by strong distribution networks, rising disposable incomes, and the growing trend of ready-to-eat and packaged foods, positioning savory ingredients as essential components for food manufacturers

U.S. Food Savory Ingredients Market Insight

The U.S. food savory ingredients market captured the largest revenue share in 2025 within North America, fueled by rising demand for natural flavor enhancers in bakery, dairy, and snack products. Manufacturers are increasingly focusing on incorporating yeast extracts, hydrolyzed proteins, and nucleotides to improve taste and nutritional profile. The growth is further supported by consumer interest in clean-label and plant-based alternatives, alongside innovations in processing techniques that enhance functional and sensory attributes of savory ingredients.

Europe Food Savory Ingredients Market Insight

The Europe food savory ingredients market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by increasing adoption of clean-label and natural flavoring solutions. Rising health consciousness, along with stringent food safety and labeling regulations, is encouraging manufacturers to incorporate natural savory ingredients. The growth is also supported by demand from the processed food, ready-to-eat meals, and plant-based product segments, with European consumers seeking authentic taste experiences.

U.K. Food Savory Ingredients Market Insight

The U.K. food savory ingredients market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing consumer preference for natural and minimally processed foods. In addition, the trend toward plant-based diets and rising awareness of healthy eating habits is fueling demand for high-quality savory ingredients. Manufacturers are investing in R&D to develop innovative flavor solutions that cater to these preferences, while e-commerce and retail channels are expanding accessibility.

Germany Food Savory Ingredients Market Insight

The Germany food savory ingredients market is expected to witness significant growth from 2026 to 2033, fueled by high demand for processed and convenience foods with enhanced taste and nutritional value. Germany’s strong food manufacturing sector, combined with consumer preference for natural, non-GMO, and clean-label ingredients, promotes the adoption of savory ingredients. Product innovation, such as yeast extracts and hydrolyzed proteins, and integration into bakery, dairy, and meat products are key growth drivers.

Asia-Pacific Food Savory Ingredients Market Insight

The Asia-Pacific food savory ingredients market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising urbanization, disposable incomes, and evolving food consumption patterns in countries such as China, India, and Japan. The region’s growing processed food and packaged meal industry, along with increasing awareness of natural and functional ingredients, is encouraging the adoption of savory ingredients. In addition, the expanding manufacturing base and local production capabilities are making high-quality ingredients more accessible to regional consumers.

Japan Food Savory Ingredients Market Insight

The Japan food savory ingredients market is expected to witness significant growth from 2026 to 2033, due to the country’s strong culinary culture, high demand for convenience foods, and focus on flavor and quality. Consumers are increasingly seeking products with authentic taste profiles and functional benefits, leading manufacturers to invest in yeast extracts, nucleotides, and hydrolyzed proteins. The integration of these ingredients into processed, ready-to-eat, and plant-based foods further supports market growth.

China Food Savory Ingredients Market Insight

The China food savory ingredients market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, increasing disposable incomes, and growing consumption of processed and convenience foods. The demand for natural, clean-label, and plant-based flavor enhancers is rising across bakery, meat, dairy, and snack applications. Strong domestic production capabilities, along with innovation in ingredient formulations, are key factors driving the growth of the food savory ingredients market in China.

Food Savory Ingredients Market Share

The Food Savory Ingredients industry is primarily led by well-established companies, including:

- Ajinomoto Health & Nutrition North America, Inc. (U.S.)

- DSM (Netherlands)

- Kerry Inc. (Ireland)

- Tate & Lyle (U.K.)

- Givaudan (Switzerland)

- Lesaffre (France)

- Sensient Technologies Corporation (U.S.)

- AngelYeast Co., Ltd. (China)

- Synergy Flavors (U.S.)

- MANE (France)

- Nikken Foods USA (U.S.)

- Ingredion Incorporated (U.S.)

- MaeilFoods (South Korea)

- Lallemand Inc (Canada)

- Synthite Industries Ltd (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Food Savory Ingredients Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Food Savory Ingredients Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Food Savory Ingredients Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.