Global Food Spray Drying Equipment Market

Market Size in USD Billion

CAGR :

%

USD

16.48 Billion

USD

25.30 Billion

2025

2033

USD

16.48 Billion

USD

25.30 Billion

2025

2033

| 2026 –2033 | |

| USD 16.48 Billion | |

| USD 25.30 Billion | |

|

|

|

|

Food Spray Drying Equipment Market Size

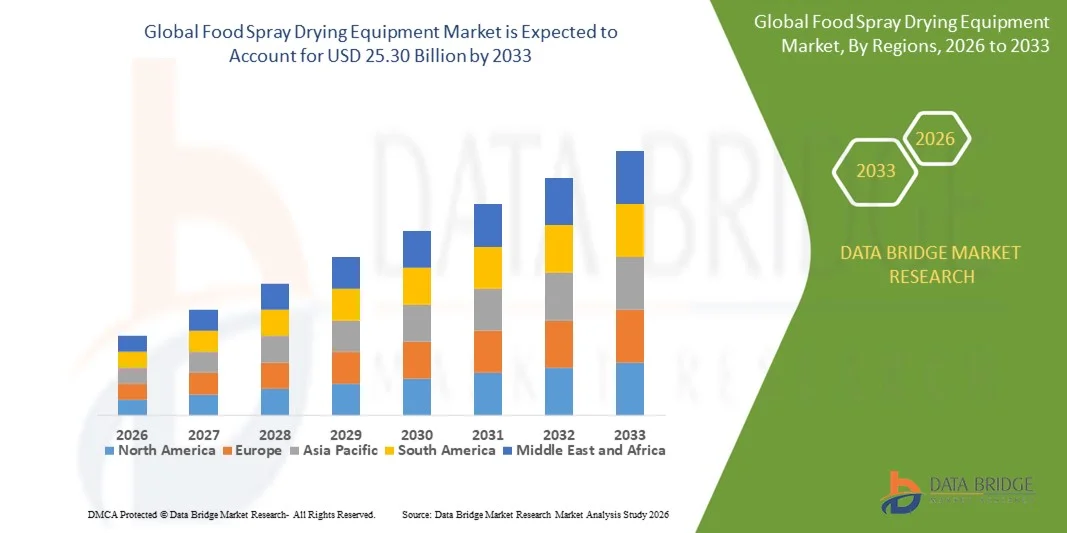

- The global food spray drying equipment market size was valued at USD 16.48 billion in 2025 and is expected to reach USD 25.30 billion by 2033, at a CAGR of 5.50% during the forecast period

- The market growth is largely fuelled by increasing demand for powdered and shelf-stable food products, expanding dairy and beverage industries, and rising adoption of advanced processing technologies

- Growing consumer preference for convenient, long-shelf-life products and nutritional supplements is further driving the market

Food Spray Drying Equipment Market Analysis

- The market is witnessing increasing adoption of spray drying equipment across dairy, beverage, bakery, and nutritional supplement applications

- Rising investments in food processing infrastructure, especially in emerging economies, are fueling market expansion and encouraging equipment manufacturers to innovate and offer customized solutions

- North America dominated the food spray drying equipment market with the largest revenue share of 38.75% in 2025, driven by the rising demand for processed and powdered food products, as well as the adoption of advanced drying technologies across the food and beverage industry

- Asia-Pacific region is expected to witness the highest growth rate in the global food spray drying equipment market, driven by urbanization, rising disposable incomes, growing processed food consumption, and government initiatives promoting food processing technologies

- The rotary atomizer segment held the largest market revenue share in 2025, driven by its ability to produce uniform particle size, high throughput, and suitability for dairy and beverage applications. These systems are widely preferred for large-scale production due to consistent quality and operational reliability. Manufacturers are also investing in energy-efficient rotary atomizers to reduce operational costs and environmental impact. The growing demand for functional powders and specialty ingredients is further encouraging innovation in rotary atomizer technology

Report Scope and Food Spray Drying Equipment Market Segmentation

|

Attributes |

Food Spray Drying Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Food Spray Drying Equipment Market Trends

Rising Demand for Powdered and Shelf-Stable Food Products

- The growing focus on convenience, long shelf-life, and nutritional preservation is significantly shaping the food spray drying equipment market, as manufacturers increasingly adopt advanced drying technologies to produce powdered dairy, beverages, and nutritional supplements. Spray drying equipment helps retain product quality, improve solubility, and extend shelf life, encouraging adoption across dairy, beverage, bakery, and nutraceutical industries

- Increasing demand for functional, fortified, and ready-to-use powdered food products has accelerated the adoption of spray drying equipment. Food and beverage manufacturers are actively seeking energy-efficient and automated systems that reduce processing time while ensuring consistent product quality, prompting collaborations between equipment suppliers and food producers to enhance operational efficiency and output

- Technological advancements in spray drying equipment, including automation, energy recovery, and process control systems, are influencing purchasing decisions. Manufacturers are emphasizing high-performance, scalable, and eco-friendly equipment to differentiate in a competitive market, while also complying with stringent food safety and quality standards

- For instance, in 2024, GEA Group in Germany and SPX FLOW in the U.S. expanded their product offerings by introducing next-generation spray drying equipment capable of producing high-quality powdered dairy and plant-based beverages. These launches were aimed at meeting growing demand for shelf-stable and functional products across retail, foodservice, and nutraceutical applications

- While adoption of spray drying equipment is rising, sustained market expansion depends on continuous innovation, cost-effective solutions, and integration with other food processing systems. Manufacturers are also focusing on improving energy efficiency, reducing operational costs, and developing equipment that balances performance, reliability, and sustainability

Food Spray Drying Equipment Market Dynamics

Driver

Growing Demand for Powdered and Shelf-Stable Food Products

- Rising consumer preference for convenience, ready-to-use, and shelf-stable food products is a major driver for the food spray drying equipment market. Manufacturers are increasingly investing in automated and high-efficiency spray drying systems to meet growing demand for dairy powders, powdered beverages, and nutraceutical products

- Expanding applications in dairy, bakery, beverages, and nutritional supplements are influencing market growth. Spray drying equipment helps retain functional properties, improve solubility, and maintain consistent quality, enabling manufacturers to meet evolving consumer expectations for high-quality, shelf-stable products

- Food manufacturers are actively adopting next-generation spray drying systems through product innovation, equipment upgrades, and automation integration. These efforts are supported by increasing demand for energy-efficient, eco-friendly, and scalable solutions, encouraging partnerships between equipment suppliers and food producers to improve operational efficiency

- For instance, in 2023, SPX FLOW in the U.S. and GEA Group in Germany reported increased deployment of advanced spray drying equipment across dairy and plant-based beverage applications. This expansion followed higher demand for powdered functional products and enhanced product consistency, while highlighting energy efficiency and automation features to strengthen manufacturer productivity and market positioning

- Although rising demand supports growth, wider adoption depends on high capital investment, skilled workforce availability, and maintenance capabilities. Investment in energy-efficient technologies, equipment standardization, and service support will be critical for meeting global demand and maintaining competitive advantage

Restraint/Challenge

High Capital Cost and Operational Complexity

- The relatively high cost of advanced spray drying equipment remains a key challenge, limiting adoption among small and medium-sized manufacturers. High capital expenditure, complex installation requirements, and ongoing maintenance costs contribute to slower uptake in price-sensitive markets

- Operational complexity and technical skill requirements restrict adoption across certain regions. Limited expertise in process optimization, equipment handling, and troubleshooting may result in suboptimal performance and reduced efficiency, especially for smaller manufacturers

- Energy consumption and operational costs associated with large-scale spray drying operations impact overall cost-effectiveness. Companies must invest in energy recovery systems, automation, and skilled personnel to maintain productivity and ensure consistent product quality

- For instance, in 2024, smaller dairy and beverage manufacturers in Southeast Asia reported slower adoption of advanced spray drying equipment due to high upfront costs, operational complexity, and limited access to technical support. These factors also prompted some manufacturers to continue using conventional drying methods, affecting market penetration

- Overcoming these challenges will require cost-optimized solutions, simplified operation systems, and technical training programs for manufacturers. Collaboration with equipment suppliers, service providers, and industry associations can help unlock long-term growth potential of the global food spray drying equipment market. Furthermore, developing energy-efficient, scalable, and user-friendly systems will be essential for broader adoption

Food Spray Drying Equipment Market Scope

The food spray drying equipment market is segmented on the basis of type, cycle, drying stage, flow, and applications.

- By Type

On the basis of type, the food spray drying equipment market is segmented into rotary atomizer, nozzle atomizer, fluidized, and centrifugal. The rotary atomizer segment held the largest market revenue share in 2025, driven by its ability to produce uniform particle size, high throughput, and suitability for dairy and beverage applications. These systems are widely preferred for large-scale production due to consistent quality and operational reliability. Manufacturers are also investing in energy-efficient rotary atomizers to reduce operational costs and environmental impact. The growing demand for functional powders and specialty ingredients is further encouraging innovation in rotary atomizer technology.

The nozzle atomizer segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its simplicity, low maintenance, and ability to handle heat-sensitive products. Nozzle atomizers are particularly suitable for plant-based powders, protein concentrates, and nutraceutical products. The segment is also benefiting from rising demand for smaller-scale, flexible, and customizable production lines. Increasing adoption in emerging markets with expanding plant-based food industries is boosting growth prospects.

- By Cycle

On the basis of cycle, the market is segmented into open cycle and closed cycle. The open cycle segment dominated the market in 2025 due to its cost-effectiveness and ease of integration with existing processing lines. It remains widely used in conventional dairy, beverage, and bakery powder production. Manufacturers value the simplicity and lower upfront costs associated with open cycle systems.

The closed cycle segment is expected to grow at the fastest rate from 2026 to 2033, driven by the rising demand for hygienic, contamination-free production and energy-efficient operations. Closed cycle systems are ideal for high-value products like infant formula, plant-based powders, and sensitive nutraceutical ingredients. The adoption is further supported by stringent regulatory requirements for product safety and traceability. Continuous innovations in automation and energy recovery are also enhancing the appeal of closed cycle spray drying equipment.

- By Drying Stage

On the basis of drying stage, the market is segmented into multistage, two-stage, and single-stage. The single-stage segment held the largest share in 2025 owing to its simplicity, lower operational cost, and versatility across food applications. Single-stage systems are used extensively for milk powders, fruit powders, and carbohydrate products. Manufacturers favor this stage for standard production due to reliable performance and ease of operation.

The multistage segment is projected to witness the fastest growth from 2026 to 2033, driven by its ability to enhance powder quality, reduce energy consumption, and process heat-sensitive products effectively. Multistage drying is increasingly adopted for specialty functional powders, plant-based beverages, and high-value nutraceuticals. Advances in process control and automation are helping manufacturers optimize energy efficiency and yield. The trend toward premium, fortified, and plant-based powders is accelerating multistage adoption globally.

- By Flow

On the basis of flow, the market is segmented into co-current flow spray dryers, counter-current flow spray dryers, and mixed flow spray dryers. The co-current flow segment held the largest market share in 2025 due to rapid drying, high product quality, and widespread use in dairy and beverage powders. Co-current systems are favored for products requiring high solubility and uniform particle size. Manufacturers are increasingly adopting energy-efficient and automated co-current dryers to enhance productivity.

The counter-current flow segment is expected to register the fastest growth rate from 2026 to 2033, driven by its superior energy efficiency, suitability for high-quality powders, and ability to process heat-sensitive ingredients. Adoption is growing in specialty powders, functional beverages, and plant-based proteins. Manufacturers are focusing on integrating process automation and real-time monitoring to improve product consistency. Counter-current systems are also increasingly used in emerging markets for functional and fortified food production.

- By Applications

On the basis of applications, the market is segmented into milk products, plant products, fish and meat proteins, fruit and vegetable products, carbohydrate products, and others. The milk products segment dominated the market in 2025 due to growing demand for milk powders, infant formula, and dairy-based nutritional products. The expansion of dairy-based beverages and functional powders is driving market adoption.

The plant products segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising global consumption of plant-based beverages, protein powders, and functional food ingredients. The trend toward vegan and clean-label products is encouraging manufacturers to adopt spray drying for plant-derived powders. Growth is also supported by increasing government initiatives promoting nutrition, food innovation, and sustainable production methods. Emerging markets with expanding plant-based industries are key contributors to the rapid adoption of spray drying equipment.

Food Spray Drying Equipment Market Regional Analysis

- North America dominated the food spray drying equipment market with the largest revenue share of 38.75% in 2025, driven by the rising demand for processed and powdered food products, as well as the adoption of advanced drying technologies across the food and beverage industry

- Manufacturers in the region are increasingly investing in high-efficiency spray drying systems to improve product quality, shelf life, and energy efficiency

- This widespread adoption is further supported by technological advancements, high disposable incomes, and the presence of major food processing companies, establishing North America as a leading market for food spray drying equipment.

U.S. Food Spray Drying Equipment Market Insight

The U.S. food spray drying equipment market captured the largest revenue share in 2025 within North America, fueled by the growing demand for milk powders, plant-based proteins, and nutraceutical products. The adoption of automated, energy-efficient spray dryers is increasing to meet production requirements and maintain product consistency. Moreover, the expansion of the food and beverage manufacturing sector, along with rising consumer demand for powdered and ready-to-use food ingredients, is significantly contributing to the market's growth.

Europe Food Spray Drying Equipment Market Insight

The Europe food spray drying equipment market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by the increasing focus on high-value nutritional products and functional food ingredients. Strict quality and safety regulations, coupled with growing investments in modern food processing technologies, are fostering the adoption of advanced spray drying equipment. European manufacturers are also emphasizing sustainability, energy efficiency, and minimal product loss in their operations.

U.K. Food Spray Drying Equipment Market Insight

The U.K. food spray drying equipment market is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising production of powdered dairy, plant-based, and nutraceutical products. In addition, consumer demand for fortified and functional food products is encouraging food manufacturers to invest in innovative drying technologies. The country’s robust food processing sector and strong R&D capabilities are expected to further stimulate market expansion.

Germany Food Spray Drying Equipment Market Insight

The Germany food spray drying equipment market is expected to witness the fastest growth rate from 2026 to 2033, fueled by the increasing demand for high-quality powdered products in the dairy, plant-based, and bakery segments. Germany’s emphasis on technological innovation, energy-efficient processes, and sustainable production supports the adoption of advanced spray drying equipment. Manufacturers are also focusing on enhancing product consistency, reducing operational costs, and complying with stringent food safety standards.

Asia-Pacific Food Spray Drying Equipment Market Insight

The Asia-Pacific food spray drying equipment market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and increasing demand for processed and convenience foods in countries such as China, India, and Japan. The region's growing food and beverage manufacturing industry, supported by government initiatives for modernizing food processing infrastructure, is driving the adoption of high-capacity, energy-efficient spray drying systems. Furthermore, Asia-Pacific is emerging as a key manufacturing hub for spray drying equipment, increasing accessibility and affordability.

Japan Food Spray Drying Equipment Market Insight

The Japan food spray drying equipment market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s technologically advanced food processing industry, rising demand for powdered dairy and plant-based proteins, and focus on functional food products. Japanese manufacturers are adopting automated, high-efficiency spray drying systems to enhance productivity, reduce energy consumption, and maintain consistent product quality. In addition, innovations in multistage and co-current drying technologies are further fueling growth.

China Food Spray Drying Equipment Market Insight

The China food spray drying equipment market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the country’s expanding food processing sector, increasing consumption of powdered and functional foods, and high demand for dairy and plant-based protein powders. The push towards modernizing food manufacturing facilities, coupled with government support for advanced processing technologies, is significantly propelling the adoption of spray drying equipment. Strong domestic manufacturing capabilities also contribute to competitive pricing and wider market penetration.

Food Spray Drying Equipment Market Share

- LEWA GmbH (Germany)

- acmefil (India)

- BÜCHI Labortechnik AG (Switzerland)

- GEA Group Aktiengesellschaft (Germany)

- Dedert Corporation (U.S.)

- European Spraydry Technologies (U.K.)

- Changzhou Lemar Drying Engineering Co Ltd. (China)

- AVM Systech Pvt. Ltd. (India)

- Advanced Drying System (U.S.)

- Labplant UK (U.K.)

- Dion Engineering (U.K.)

- OKAWARA MFG. CO., LTD. (Japan)

- Saka Engineering Systems Private Limited (India)

- Swenson Technology Inc (U.S.)

- Shandong Shungeng Drying Equipment Co., Ltd. (China)

- Hemraj Engineering (India) LLP (India)

- G. Larsson Starch Technology AB (Sweden)

- SiccaDania (Denmark)

Latest Developments in Global Food Spray Drying Equipment Market

- In September 2024, SPX Flow (U.S.) formed a strategic partnership with a leading food processing company to co-develop advanced spray drying solutions for dairy products. This collaboration is designed to expand SPX Flow’s product portfolio, foster innovation, and accelerate the creation of specialized equipment tailored to industry-specific needs. The partnership strengthens the company’s presence in the dairy sector and promotes the development of high-performance, application-specific solutions

- In August 2024, GEA Group (Germany) launched a new line of energy-efficient spray dryers aimed at reducing operational costs for food manufacturers. This development supports sustainability initiatives and positions the company as a leader in eco-friendly food processing technology. The new dryers are expected to influence industry standards for energy consumption and attract environmentally conscious clients, potentially reshaping market expectations and driving adoption of greener solutions

- In July 2024, Bühler Group (Switzerland) unveiled a digital platform for optimizing spray drying equipment performance through real-time data analytics. By integrating AI and IoT technologies, the platform enables manufacturers to monitor and improve production processes, enhancing operational efficiency and product quality. This initiative positions Bühler as a leader in digital transformation within the spray drying sector and sets new benchmarks for process optimization

- In August 2022, SPX Flow (U.S.) announced a collaboration with Flottweg to design, supply, install, and commission end-to-end plant-based process solutions for the nutrition, health, food, and beverage industries. This development aims to streamline production, improve process efficiency, and meet growing demand for plant-based products, strengthening SPX Flow’s market position in the plant-based sector

- In June 2022, BÜCHI Labortechnik (Switzerland) launched the Mini Spray Dryer S-300, an automated system regulating spray gas, drying gas, and pump speed while monitoring outlet and product temperatures. The equipment ensures the safe processing of heat-sensitive samples, enhancing product quality and consistency. The launch reinforces BÜCHI’s reputation for innovative, precision spray drying solutions and expands its offerings in laboratory-scale food and pharmaceutical applications

- In June 2022, Dedert Corporation (U.S.) commissioned a Spray Drying and Evaporation plant for EverGrain’s plant-based protein production. The system improves solubility and functionality of specialty proteins, supporting scalable production of high-quality plant-based ingredients. This deployment strengthens Dedert’s position in the protein processing market and promotes adoption of advanced drying technologies

- In March 2021, Tetra Pak (Sweden) and Rockwell Automation (U.S.) announced a strategic partnership to deliver Cheese and Powder Solutions using integrated data and technology. The collaboration aims to reduce production variability, improve quality consistency, and support sustainable, cost-effective manufacturing. This initiative enhances both companies’ capabilities in food processing automation and addresses the growing demand for reliable, high-quality dairy and powdered products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Food Spray Drying Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Food Spray Drying Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Food Spray Drying Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.