Global Frozen Poultry And Meat Market

Market Size in USD Billion

CAGR :

%

USD

86.00 Billion

USD

127.07 Billion

2024

2032

USD

86.00 Billion

USD

127.07 Billion

2024

2032

| 2025 –2032 | |

| USD 86.00 Billion | |

| USD 127.07 Billion | |

|

|

|

|

Frozen Poultry and Meat Market Size

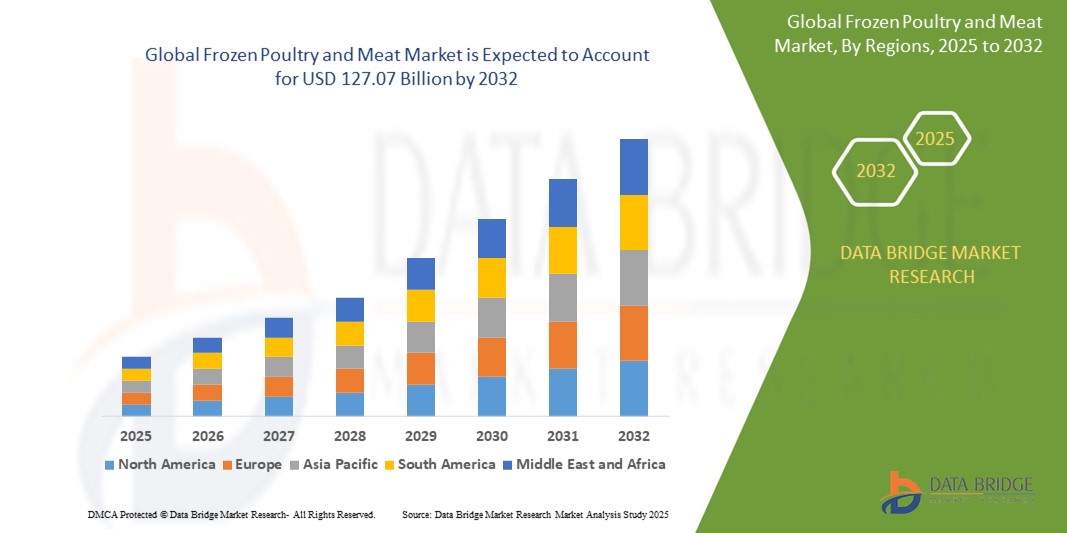

- The global frozen poultry and meat market size was valued at USD 86.00 billion in 2024 and is expected to reach USD 127.07 billion by 2032, at a CAGR of 5.00% during the forecast period

- The market growth is primarily driven by increasing consumer demand for convenient, long-shelf-life protein sources, advancements in cold chain logistics, and growing preference for ready-to-cook and pre-prepared food product

- Rising urbanization, busy lifestyles, and the expansion of retail channels such as supermarkets and e-commerce platforms are further accelerating the adoption of frozen poultry and meat products globally

Frozen Poultry and Meat Market Analysis

- Frozen poultry and meat products are essential components of the global food industry, offering convenience, extended shelf life, and consistent quality for both household and commercial use

- The demand for frozen poultry and meat is fueled by growing consumer awareness of food safety, the need for time-saving meal solutions, and increasing penetration of refrigeration infrastructure in emerging markets

- North America dominated the frozen poultry and meat market with the largest revenue share of 42.5% in 2024, driven by high consumption of processed foods, advanced cold chain infrastructure, and strong presence of key industry players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rapid urbanization, rising disposable incomes, and increasing demand for convenient protein-rich foods in countries such as China and India

- The frozen poultry segment dominated the largest market revenue share of 52.3% in 2024, driven by its affordability, versatility, and high consumer preference for lean protein sources, such as chicken, across both retail and food service sectors

Report Scope and Frozen Poultry and Meat Market Segmentation

|

Attributes |

Frozen Poultry and Meat Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Frozen Poultry and Meat Market Trends

“Increasing Adoption of Advanced Freezing Technologies and Cold Chain Innovations”

- The global frozen poultry and meat market is experiencing a significant trend toward the integration of advanced freezing technologies, such as Individual Quick Freezing (IQF) and blast freezing, to enhance product quality and shelf life

- These technologies enable rapid freezing, preserving the nutritional value, texture, and flavor of poultry and meat products, making them more appealing to consumers

- Cold chain logistics advancements, including temperature-controlled storage and transportation, are improving the efficiency of distribution networks, ensuring product freshness across global markets

- For instance, companies are investing in smart cold storage solutions that monitor temperature in real time to prevent spoilage and reduce food waste

- This trend is increasing the appeal of frozen poultry and meat products for both retail and food service sectors, as it supports consistent quality and longer shelf life

- Innovations in packaging, such as vacuum-sealed and eco-friendly materials, are further enhancing product preservation and aligning with consumer demand for sustainable options

Frozen Poultry and Meat Market Dynamics

Driver

“Rising Demand for Convenient and Long-Shelf-Life Food Products”

- Growing consumer preference for convenient, ready-to-cook, and ready-to-eat poultry and meat products is a major driver for the global frozen poultry and meat market

- Frozen poultry and meat products offer extended shelf life, reducing food waste and enabling consumers to store products for longer periods without compromising quality

- The rise in busy lifestyles, urbanization, and dual-income households, particularly in regions such as North America and Asia-Pacific, is fueling demand for quick meal solutions, such as pre-marinated or pre-cooked frozen meat and poultry

- Government regulations promoting food safety and the adoption of cold chain infrastructure in emerging markets are further supporting market growth

- The expansion of modern retail formats, such as supermarkets and hypermarkets, and the growth of e-commerce platforms are making frozen poultry and meat more accessible to a broader consumer bas

- The increasing popularity of high-protein diets, such as keto and paleo, is driving demand for frozen poultry and meat as versatile and nutritious protein sources.

Restraint/Challenge

“High Operational Costs and Supply Chain Challenges”

- The high costs associated with establishing and maintaining advanced cold chain infrastructure, including freezing equipment and refrigerated transportation, pose a significant barrier to market growth, particularly in developing regions

- Energy-intensive freezing processes and the need for continuous temperature monitoring increase operational costs, which may result in higher prices for consumers

- Supply chain disruptions, such as those caused by trade restrictions, climate change, or inadequate cold storage facilities in emerging markets, can limit market reach and affect product availability

- In addition, concerns about the environmental impact of energy-intensive freezing processes and non-recyclable packaging materials are prompting scrutiny from environmentally conscious consumers.

- Regulatory variations across countries regarding food safety standards and labeling requirements create challenges for manufacturers operating in multiple regions

- These factors can hinder market expansion, particularly in cost-sensitive markets or regions with limited infrastructure

Frozen Poultry and Meat market Scope

The market is segmented on the basis of product type, distribution channel, and end-user.

- By Product Type

On the basis of product type, the global frozen poultry and meat market is segmented into frozen meat and frozen poultry. The frozen poultry segment dominated the largest market revenue share of 52.3% in 2024, driven by its affordability, versatility, and high consumer preference for lean protein sources, such as chicken, across both retail and food service sectors. Poultry’s widespread use in quick-service restaurants and home cooking, coupled with its perceived health benefits, supports its dominance.

The frozen meat segment is expected to witness the fastest growth rate of 5.8% from 2025 to 2032, fueled by increasing demand for beef and pork in processed and ready-to-cook forms. Rising consumer interest in high-protein diets and the convenience of frozen meat products, such as pre-marinated cuts and sausages, are key drivers of growth in this segment.

- By Distribution Channel

On the basis of distribution channel, the global frozen poultry and meat market is segmented into supermarkets and hypermarkets, traditional grocery stores, and convenience stores. The supermarkets and hypermarkets segment dominated the market with a revenue share of 62.7% in 2024, owing to their extensive product variety, competitive pricing, and large freezer capacities that cater to consumer preferences for one-stop shopping. These retail formats ensure easy access to a wide range of frozen poultry and meat products, driving their market leadership.

The convenience stores segment is anticipated to experience the fastest growth rate of 6.2% from 2025 to 2032. The increasing number of convenience stores in urban and semi-urban areas, coupled with their accessibility for quick purchases, is driving demand for frozen poultry and meat products. The rise in on-the-go consumption and the expansion of convenience store chains in emerging markets further support this growth.

- By End-User

On the basis of end-user, the global frozen poultry and meat market is segmented into retail customers, food service, and business customers. The food service segment held the largest market revenue share of 48.6% in 2024, driven by the widespread adoption of frozen poultry and meat in restaurants, fast-food chains, and catering services. The need for consistent quality, reduced preparation time, and extended shelf life makes frozen products a preferred choice for food service providers.

The retail customers segment is expected to witness the fastest growth rate of 6.5% from 2025 to 2032. Growing consumer preference for convenient, ready-to-cook, and ready-to-eat frozen poultry and meat products, particularly among urban households and working professionals, is fueling this growth. The rise in e-commerce and online grocery platforms further enhances accessibility, supporting the segment’s rapid expansion.

Frozen Poultry and Meat Market Regional Analysis

- North America dominated the frozen poultry and meat market with the largest revenue share of 42.5% in 2024, driven by high consumption of processed foods, advanced cold chain infrastructure, and strong presence of key industry players

- Consumers prioritize frozen poultry and meat for their convenience, extended shelf life, and ability to meet diverse culinary needs, particularly in regions with busy lifestyles and varying dietary preferences

- Growth is supported by advancements in freezing and packaging technologies, such as vacuum-sealing and blast freezing, alongside increasing adoption in retail, food service, and business segments

U.S. Frozen Poultry and Meat Market Insight

The U.S. frozen poultry and meat market captured the largest revenue share of 82.5% in 2024 within North America, fueled by strong demand from retail and food service sectors, as well as growing consumer preference for convenient meal solutions. The trend toward ready-to-cook and pre-seasoned products, coupled with stringent food safety regulations, boosts market expansion. The integration of frozen products in both household and commercial kitchens supports a robust market ecosystem.

Europe Frozen Poultry and Meat Market Insight

The European frozen poultry and meat market is expected to witness significant growth, supported by increasing demand for convenient and high-quality protein sources. Consumers seek products that offer ease of preparation while maintaining nutritional value. Growth is prominent in both retail and food service sectors, with countries such as Germany and France showing strong uptake due to rising health consciousness and urbanized lifestyles.

U.K. Frozen Poultry and Meat Market Insight

The U.K. market for frozen poultry and meat is expected to experience rapid growth, driven by demand for convenient meal options in urban and suburban areas. Increased interest in high-quality, pre-prepared products and growing awareness of food safety standards encourage adoption. Evolving regulations on food storage and safety further influence consumer choices, balancing quality with compliance.

Germany Frozen Poultry and Meat Market Insight

Germany is expected to witness rapid growth in the frozen poultry and meat market, attributed to its advanced food processing industry and strong consumer focus on convenience and sustainability. German consumers prefer products that reduce food waste and offer consistent quality. The integration of frozen poultry and meat in premium retail brands and food service outlets supports sustained market growth.

Asia-Pacific Frozen Poultry and Meat Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding food processing industries and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of convenience, nutritional benefits, and food safety is boosting demand. Government initiatives promoting cold chain infrastructure and food security further encourage the adoption of frozen poultry and meat products.

Japan Frozen Poultry and Meat Market Insight

Japan’s frozen poultry and meat market is expected to experience rapid growth due to strong consumer preference for high-quality, convenient protein sources that align with busy lifestyles. The presence of major food processing companies and the integration of frozen products in retail and food service sectors accelerate market penetration. Rising interest in ready-to-cook meals also contributes to growth.

China Frozen Poultry and Meat Market Insight

China holds the largest share of the Asia-Pacific frozen poultry and meat market, propelled by rapid urbanization, rising meat consumption, and increasing demand for convenient food solutions. The country’s growing middle class and focus on food security support the adoption of frozen products. Strong domestic production capabilities and competitive pricing enhance market accessibility.

Frozen Poultry and Meat Market Share

The frozen poultry and meat industry is primarily led by well-established companies, including:

- JBS S.A. (U.S)

- The Kraft Heinz Company (U.S)

- BRF (Brazil)

- Astral Foods (South Africa)

- Hormel Foods Corporation (U.S)

- 2 Sisters Food Group (UK)

- Waitrose & Partners (UK)

- Wm. Morrison Supermarkets Limited (U.K)

- Samworth Brothers (U.K)

- General Mills Inc (U.S)

- Conagra Brands, Inc (U.S)

- Nestlé SA (U.S)

- Unilever (UK)

- Kellogg Co (U.S)

- McCain Foods Ltd. (U.S)

- Associated British Foods plc (U.K)

- Ajinomoto Foods (Japan)

- LantmännenUnibake (Germany)

What are the Recent Developments in Global Frozen Poultry and Meat Market?

- In July 2024, Coleman All Natural Meats unveiled a new line of ground pork sausage featuring five flavorful varieties: mild sweet Italian, hot Italian, chorizo, mild breakfast, and hot breakfast. Crafted from Heritage Duroc pork, known for its rich marbling and tenderness, these sausages are designed to meet growing consumer demand for convenient, versatile, and high-quality meal options. Each one-pound package highlights Coleman’s commitment to no antibiotics ever, no added hormones, and humane farming practices. The products ship frozen with “Slack and Sell” merchandising flexibility, making them ideal for breakfast, lunch, or dinner recipes

- In July 2024, Beyond Meat debuted its innovative Beyond Sun Sausage™ exclusively at Sprouts Farmers Market locations across the U.S. These plant-based sausages come in three bold flavors—Cajun, Pesto, and Pineapple Jalapeño—and are crafted from wholesome ingredients such as yellow peas, brown rice, red lentils, faba beans, spinach, and bell peppers. Each link delivers 12g of clean protein, just 1g of saturated fat, and 0mg of cholesterol. The product is certified by the American Heart Association’s Heart-Check program and the American Diabetes Association’s Better Choices for Life program, making it a nutritious and flavorful choice

- In June 2024, Tyson Brand introduced two new frozen offerings—Restaurant Style Crispy Wings and Honey Chicken Bites—designed to deliver bold flavor, high protein, and easy preparation for busy households. The Honey Chicken Bites feature tender, all-white meat chicken coated in honey-infused breading, offering 14g of protein per serving and ready in under 25 minutes. The Restaurant Style Crispy Wings are fully cooked, dry-rubbed, and available in flavors such as Rotisserie (Original), Garlic Parmesan, and Caribbean Style, with 15g of protein per serving. Both products are ideal for oven or air fryer prep, bringing restaurant-quality taste to home kitchens

- In December 2024, Ralph's Packing Company recalled about 3,132 pounds of ready-to-eat pork and beef bologna products due to misbranding and an undeclared allergen—specifically milk, which was not listed on the product labels. The affected items include vacuum-sealed chubs of Ralph’s CIRCLE R BRAND GARLIC BOLOGNA and GARLIC BOLOGNA with Jalapenos, produced since September 2022 and distributed in Oklahoma. Some were sold at deli counters without proper labeling. No illnesses were reported, but consumers with milk allergies are urged to avoid these products and return or discard them

- In December 2024, Impero Foods & Meats, Inc. recalled about 7,485 pounds of raw pork sausage products after it was discovered they were produced without federal inspection, violating USDA regulations. The affected items—Old World Italian Sausage labeled as “rope” or “link”—were manufactured between October 3 and December 19, 2024, and distributed to restaurants and retailers in Delaware, Maryland, and Pennsylvania. Some may have been sold at deli counters without proper labeling. While no illnesses were reported, consumers are urged to discard or return the products and contact a healthcare provider if concerned

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Frozen Poultry And Meat Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Frozen Poultry And Meat Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Frozen Poultry And Meat Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.