Global Fruit Sorting Machinery Market

Market Size in USD Million

CAGR :

%

USD

354.17 Million

USD

523.27 Million

2025

2033

USD

354.17 Million

USD

523.27 Million

2025

2033

| 2026 –2033 | |

| USD 354.17 Million | |

| USD 523.27 Million | |

|

|

|

|

Fruit Sorting Machinery Market Size

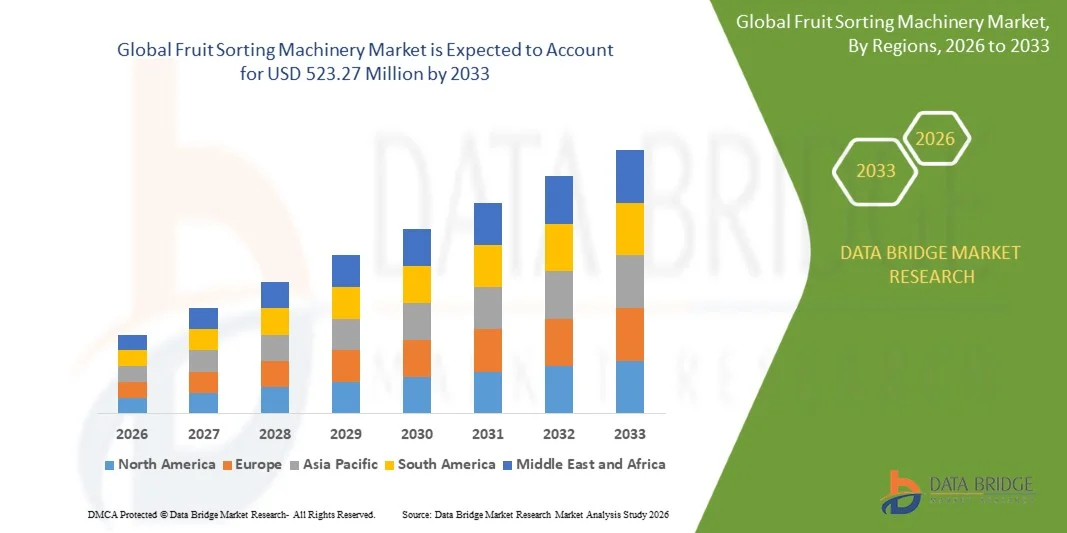

- The global fruit sorting machinery market size was valued at USD 354.17 million in 2025 and is expected to reach USD 523.27 million by 2033, at a CAGR of 5.00% during the forecast period

- The market growth is largely fuelled by the increasing demand for automation in the agriculture and food processing sectors, rising need for high-quality and uniform fruit products, and advancements in sorting technologies such as optical, laser, and weight-based systems

- Adoption of automated fruit sorting machinery is driven by the need to reduce labor costs, improve efficiency, and minimize post-harvest losses

Fruit Sorting Machinery Market Analysis

- Technological innovations in sorting machinery, including AI-enabled and vision-based systems, are enhancing accuracy, throughput, and reliability, making these solutions attractive for large-scale and small-scale operations

- Growing consumer preference for fresh, uniform, and defect-free fruits, along with stringent quality standards set by exporters and retailers, is driving the adoption of advanced sorting machinery across the globe

- North America dominated the fruit sorting machinery market with the largest revenue share of 38.75% in 2025, driven by the presence of large-scale fruit processing industries, advanced agricultural practices, and increasing demand for high-quality sorted fruits

- Asia-Pacific region is expected to witness the highest growth rate in the global fruit sorting machinery market, driven by rapid urbanization, rising disposable incomes, government initiatives supporting modern agriculture, and increasing adoption of mechanized sorting systems in countries such as China, Japan, and India

- The fresh fruit segment held the largest market revenue share in 2025, driven by the high demand for quality inspection and grading in the fresh fruit supply chain. Fresh fruit sorting machinery ensures accurate size, color, and defect detection, which is essential for meeting stringent quality standards in retail and export markets

Report Scope and Fruit Sorting Machinery Market Segmentation

|

Attributes |

Fruit Sorting Machinery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fruit Sorting Machinery Market Trends

“Rising Demand for Automation and Precision in Fruit Processing”

• The increasing focus on automation and high-quality fruit processing is significantly shaping the fruit sorting machinery market, as producers increasingly prefer equipment that ensures uniformity, reduces waste, and improves operational efficiency. Advanced sorting machinery is gaining traction due to its ability to accurately grade fruits by size, color, weight, and defects, strengthening adoption across fresh produce, packaged, and processed fruit sectors

• Growing awareness around food safety, quality standards, and supply chain efficiency has accelerated the demand for fruit sorting machinery in packing houses, food processing plants, and export facilities. Producers and exporters are actively seeking solutions that minimize human error, enhance throughput, and maintain product integrity, prompting machinery manufacturers to innovate and expand their technology offerings

• Automation and precision trends are influencing purchasing decisions, with manufacturers emphasizing multi-parameter sorting, integration with packing lines, and energy-efficient operations. These factors are helping companies differentiate offerings in a competitive market and build customer trust, while also driving adoption of AI-enabled and vision-based sorting systems

• For instance, in 2024, TOMRA in Norway and Compac in New Zealand expanded their product portfolios by introducing AI and camera-based fruit sorting machines capable of handling higher volumes with improved accuracy. These launches were aimed at meeting rising consumer demand for defect-free and uniform fruits, while also supporting exporters and processors in maintaining quality compliance across international markets

• While demand for fruit sorting machinery is growing, sustained market expansion depends on continuous R&D, cost-effective production, and developing equipment suitable for diverse fruit types and processing environments. Manufacturers are also focusing on improving scalability, maintenance efficiency, and user-friendly interfaces to encourage broader adoption

Fruit Sorting Machinery Market Dynamics

Driver

“Growing Demand for Automated and Efficient Fruit Sorting”

• Rising demand for high-quality, uniform, and safe fruit products is a major driver for the fruit sorting machinery market. Producers are increasingly replacing manual sorting with automated systems to meet quality standards, enhance efficiency, and comply with regulatory requirements. This trend is also encouraging development of multi-parameter and AI-enabled sorting solutions

• Expanding applications in fresh produce packing, processed fruit production, and export operations are influencing market growth. Automated sorting machinery helps reduce labor costs, minimize post-harvest losses, and improve operational efficiency while maintaining product quality, enabling manufacturers to meet evolving market expectations

• Food processors, exporters, and large-scale farms are actively promoting automated sorting machinery through product demonstrations, trade shows, and customized solutions. These efforts are supported by the growing consumer preference for uniform and defect-free fruits, and they also encourage partnerships between machinery manufacturers and processors to enhance processing efficiency and traceability

• For instance, in 2023, TOMRA in Norway and Aweta in the Netherlands reported increased deployment of optical and AI-based fruit sorting machinery in Europe and North America. This expansion followed rising demand for high-throughput, precise sorting equipment that reduces waste and ensures consistent quality, strengthening customer trust and operational efficiency

• Although rising automation and quality trends support growth, wider adoption depends on cost optimization, equipment versatility, and technical support availability. Investment in advanced vision systems, AI integration, and scalable machinery designs will be critical for meeting global demand and maintaining competitive advantage

Restraint/Challenge

“High Cost and Technical Complexity Compared to Conventional Sorting Methods”

• The relatively higher cost of automated fruit sorting machinery compared to manual or semi-automatic methods remains a key challenge, limiting adoption among small-scale producers. High equipment prices, complex setup, and maintenance requirements contribute to elevated investment costs

• Limited awareness of technological benefits and training requirements restricts adoption in developing markets where traditional sorting methods are still predominant. Insufficient knowledge about operational efficiency and ROI can slow innovation uptake in emerging economies

• Supply chain, installation, and maintenance challenges also impact market growth, as sorting machinery requires specialized installation, calibration, and periodic servicing. Logistical complexities and technical support requirements increase operational costs, particularly for high-capacity optical or AI-enabled machines

• For instance, in 2024, distributors in Southeast Asia reported slower uptake of advanced sorting machinery by small and mid-sized farms due to high costs, limited training, and concerns over maintenance and downtime. These factors prompted some buyers to delay purchases or continue using conventional sorting methods

• Overcoming these challenges will require cost-effective production, simplified user interfaces, expanded after-sales service networks, and focused educational initiatives for producers. Collaboration with industry associations, technology providers, and training centers can help unlock the long-term growth potential of the global fruit sorting machinery market, while developing scalable and versatile solutions will be essential for widespread adoption

Fruit Sorting Machinery Market Scope

The market is segmented on the basis of fruit type, fruit, feeding system, and application

• By Fruit Type

On the basis of fruit type, the fruit sorting machinery market is segmented into fresh fruit, frozen fruit, and whole and processed fruit. The fresh fruit segment held the largest market revenue share in 2025, driven by the high demand for quality inspection and grading in the fresh fruit supply chain. Fresh fruit sorting machinery ensures accurate size, color, and defect detection, which is essential for meeting stringent quality standards in retail and export markets.

The frozen fruit segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing consumption of frozen fruits in smoothies, desserts, and ready-to-eat products. Frozen fruit sorting machinery offers reliable handling and precise quality control, ensuring that frozen produce maintains its nutritional value and appearance throughout processing.

• By Fruit

On the basis of fruit, the market is segmented into blueberries, cherries, peaches, pears, and others. The blueberry segment accounted for the largest market share in 2025, supported by the growing popularity of berries for their health benefits and high export potential. Blueberry sorting machinery provides efficient grading, sizing, and defect removal, which enhances product consistency and marketability.

The cherry segment is projected to register the fastest growth during 2026–2033, fueled by rising consumer preference for premium fresh fruits and increasing automated fruit processing in orchards. Cherry sorting machines help reduce manual labor and improve sorting speed and accuracy, making them attractive for large-scale fruit producers.

• By Feeding System

On the basis of feeding system, the market is divided into manual feeding and automatic feeding. The automatic feeding segment dominated the market in 2025 due to its ability to enhance processing efficiency, reduce labor costs, and ensure continuous operation in large fruit processing facilities. Automatic feeding systems are increasingly integrated with advanced sensors and conveyor systems to handle fruits delicately while maintaining high throughput.

The manual feeding segment is expected to witness steady growth from 2026 to 2033, as small and medium-scale farms and local processing units continue to rely on labor-intensive operations for certain fruit varieties or niche markets. Manual feeding allows operators to handle delicate fruits with care and make on-the-spot quality assessments.

• By Application

On the basis of application, the market is categorized into fruit planting base, fruit processing plant, fruit processing company, and others. The fruit processing plant segment held the largest market share in 2025, driven by the growing demand for processed fruit products such as juices, purees, and dried fruits. Sorting machinery in processing plants ensures uniformity and quality of raw materials, which is crucial for downstream operations.

The fruit planting base segment is expected to witness the fastest growth during 2026–2033, owing to the increasing adoption of mechanized sorting solutions at orchards and plantations to improve post-harvest efficiency and reduce losses. On-site sorting at planting bases enables faster grading and better preparation for storage, transportation, or processing.

Fruit Sorting Machinery Market Regional Analysis

• North America dominated the fruit sorting machinery market with the largest revenue share of 38.75% in 2025, driven by the presence of large-scale fruit processing industries, advanced agricultural practices, and increasing demand for high-quality sorted fruits

• The region benefits from technological adoption in automated sorting systems, rising investment in food processing infrastructure, and strict quality control standards in both domestic and export markets

• Widespread adoption is further supported by high labor costs encouraging automation, the presence of leading equipment manufacturers, and a growing emphasis on efficiency and post-harvest loss reduction

U.S. Fruit Sorting Machinery Market Insight

The U.S. fruit sorting machinery market captured the largest revenue share in 2025 within North America, fueled by the expanding fruit processing industry and the growing demand for premium fresh and processed fruits. High demand for automation in grading, sizing, and defect detection is propelling market growth. In addition, the adoption of advanced technologies such as optical sorters, color detection systems, and conveyor-based automation enhances operational efficiency and reduces post-harvest losses, supporting continued market expansion.

Europe Fruit Sorting Machinery Market Insight

The Europe fruit sorting machinery market is expected to witness the fastest growth rate from 2026 to 2033, driven by stringent food safety and quality standards, coupled with increasing automation in fruit processing plants. Rising consumer demand for high-quality, uniform fruits, along with strong investments in modern agricultural practices, supports the adoption of sorting machinery. Countries such as Germany, Italy, and the Netherlands are integrating advanced optical and AI-based sorting systems, boosting efficiency and minimizing waste.

U.K. Fruit Sorting Machinery Market Insight

The U.K. fruit sorting machinery market is expected to witness significant growth from 2026 to 2033, driven by increasing mechanization in fruit farms and processing facilities. The focus on reducing manual labor costs and improving quality consistency in both fresh and processed fruits is a key driver. In addition, rising imports of fresh fruits and government initiatives supporting modernized agricultural practices are expected to propel the adoption of advanced sorting machinery.

Germany Fruit Sorting Machinery Market Insight

The Germany fruit sorting machinery market is expected to witness rapid growth from 2026 to 2033, fueled by advanced agricultural technologies and strong emphasis on quality control in fruit processing. Adoption of automated feeding systems, optical sorters, and AI-assisted defect detection is increasing across fruit processing plants and packing facilities. The integration of environmentally friendly and energy-efficient machinery aligns with local sustainability regulations, further supporting market expansion.

Asia-Pacific Fruit Sorting Machinery Market Insight

The Asia-Pacific fruit sorting machinery market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing fruit production, rising demand for processed and packaged fruits, and growing adoption of mechanized sorting in countries such as China, Japan, and India. Government initiatives promoting modern agriculture and digital farming solutions, along with investment in cold chain infrastructure, are accelerating the deployment of advanced sorting machinery.

Japan Fruit Sorting Machinery Market Insight

The Japan fruit sorting machinery market is expected to witness strong growth from 2026 to 2033, driven by the country’s technologically advanced agricultural sector and focus on high-quality fruit production. The demand for precision sorting systems, including color, size, and defect detection machinery, is increasing in response to consumer preference for premium fruits. Aging farm populations are also encouraging the adoption of automated machinery to reduce manual labor and improve productivity.

China Fruit Sorting Machinery Market Insight

The China fruit sorting machinery market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s rapid urbanization, expanding fruit production, and increasing adoption of mechanized processing solutions. The growth of modern fruit processing plants, demand for export-quality fruits, and government support for smart agriculture are key factors driving market expansion. Domestic manufacturers are introducing cost-effective and technologically advanced sorting systems, further accelerating market penetration.

Fruit Sorting Machinery Market Share

The Fruit Sorting Machinery industry is primarily led by well-established companies, including:

- China Renowned Supplier of Food Processing Machinery (China)

- Bühler AG (Switzerland)

- CFT S.p.A. (Italy)

- Crux Agribotics (U.K.)

- Duravant (U.S.)

- Elifab Solution S.L. (Spain)

- Ellips B.V. (Netherlands)

- Sesotec GmbH (Germany)

- TOMRA (Norway)

- Unitec S.p.A. (Italy)

- FUTURA SRL (Italy)

- GREEFA (Netherlands)

- Gridbots Technologies Private Limited (India)

- GEA Group Aktiengesellschaft (Germany)

- Krones AG (Germany)

- JBT (U.S.)

- Haith Tickhill Group of Companies (U.K.)

- REEMOON TECHNOLOGIES HOLDINGS CO.,LTD. (China)

- Navatta Group Food Processing srl (Italy)

- Pigo S.r.l. (Italy)

Latest Developments in Global Fruit Sorting Machinery Market

- In August 2025, Tomra Systems ASA (Norway) launched its latest sorting machine featuring artificial intelligence to improve sorting accuracy. This development strengthens Tomra’s position as a leader in AI adoption within the fruit sorting sector. The advanced technology is expected to enhance operational efficiency for producers, improve sorting precision, and potentially increase Tomra’s market share and customer loyalty

- In September 2025, Maf Roda Agrobotic (Spain) entered a strategic partnership with a major agricultural cooperative to expand its distribution network. This collaboration enables the company to deepen its presence in the Spanish market, leverage existing cooperative relationships, and enhance credibility among local producers. The move is likely to boost regional market penetration and strengthen Maf Roda’s competitive advantage

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.