Global Functional Food Ingredients Market

Market Size in USD Billion

CAGR :

%

USD

119.88 Billion

USD

201.40 Billion

2024

2032

USD

119.88 Billion

USD

201.40 Billion

2024

2032

| 2025 –2032 | |

| USD 119.88 Billion | |

| USD 201.40 Billion | |

|

|

|

|

Functional Food Ingredients Market Size

- The global functional food ingredients market size was valued at USD 119.88 billion in 2024 and is expected to reach USD 201.40 billion by 2032, at a CAGR of 6.70% during the forecast period

- The market growth is significantly driven by increasing global awareness and understanding among consumers about the crucial link between diet and health, leading to a higher demand for foods that offer health benefits beyond basic nutrition. Consumers are actively seeking out products with functional ingredients to improve their overall well-being and prevent diseases

- A rising prevalence of chronic diseases and lifestyle-related health issues worldwide is propelling the demand for functional food ingredients. Growing health consciousness and a proactive approach towards wellness, with individuals taking greater responsibility for their health through dietary choices. This includes a rising interest in preventive healthcare and the potential of functional foods to contribute to a healthier lifestyle

Functional Food Ingredients Market Analysis

- Functional food ingredients refer to bioactive compounds added to food products to impart health benefits beyond basic nutrition. These ingredients play an increasingly significant role in today's food industry due to their ability to address the rising consumer demand for healthier and more nutritious food options, manage the growing prevalence of lifestyle-related diseases, and drive innovation in food product development

- The expanding utilization of functional food ingredients is primarily driven by a greater consumer awareness of the critical role of diet in maintaining health and preventing illness, a rising demand for natural and health-enhancing food products, and ongoing advancements in food science and technology that enable the effective incorporation of these ingredients into a wide range of food and beverage applications. This shift reflects a growing preference for proactive health management through diet rather than solely relying on reactive medical treatments

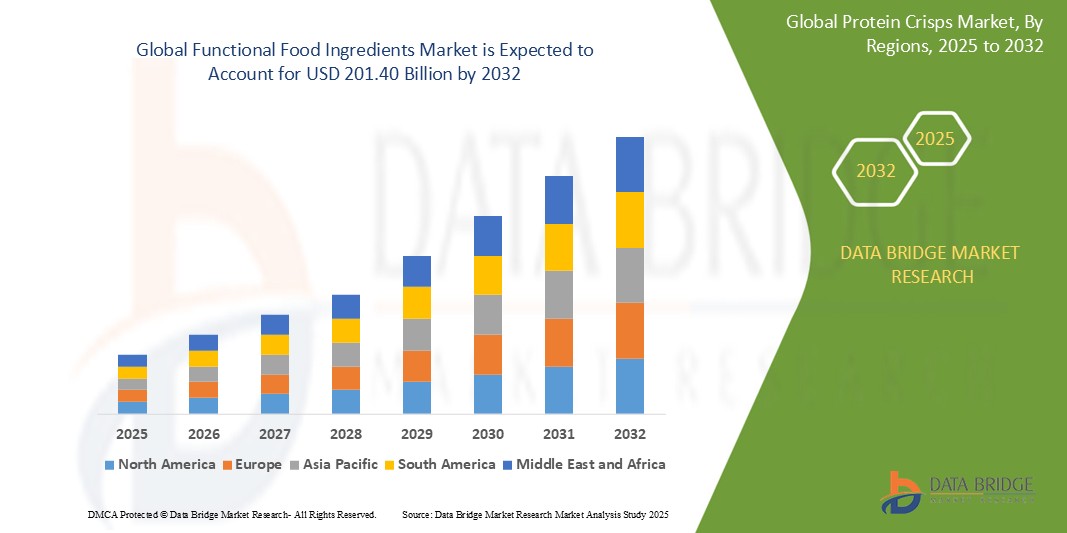

- North America is expected to dominate the functional food ingredients market with a share of 32.7% due to growing health and wellness concerns and the increasing prevalence of conditions such as obesity, digestive issues, and diabetes, which are critical factors expected to drive demand for these products

- Asia-Pacific is expected to be the fastest growing region in the functional food ingredients market with a share of during the forecast period due to rapid economic growth, increasing awareness of lifestyle-related diseases, and a growing emphasis on health and wellness in rapidly expanding economies such as China and India

- Probiotics segment is expected to dominate the market with a market share of 29.8% due to the increasing consumer awareness of their digestive health benefits and the rising prevalence of conditions such as lactose intolerance and digestive imbalances. Probiotics are also gaining popularity as a preventive healthcare solution, supported by extensive research on their efficacy

Report Scope and Functional Food Ingredients Market Segmentation

|

Attributes |

Functional Food Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Functional Food Ingredients Market Trends

“Rising Demand for Plant-Based Ingredients”

- A significant and rapidly expanding trend in the global functional food ingredients market is the increasing consumer preference and demand for plant-based ingredients across various food and beverage applications. This growing emphasis is driven by a greater awareness of the health benefits associated with plant-based diets, rising concerns about sustainability and animal welfare, and the increasing availability of innovative plant-derived ingredients

- For instance, major food and beverage companies across various sectors, such as Beyond Meat and Impossible Foods in meat alternatives, Danone with its Silk and Alpro plant-based dairy alternatives, and Nestlé with its plant-based offerings, are heavily investing in and expanding their portfolios of products featuring plant-based functional ingredients. This includes the use of pea protein, soy protein, almond flour, oat fiber, and a wide array of fruit and vegetable extracts

- This heightened focus on plant-based ingredients enables the development of food products that cater to a growing segment of consumers, including vegans, vegetarians, flexitarians, and those seeking healthier or more sustainable options. It also fosters innovation in creating products with enhanced nutritional profiles, such as higher fiber content or added plant-based proteins, compared to traditional formulations

- The growing recognition among food manufacturers of the strong consumer demand for plant-based options and the increasing availability of technologically advanced plant-based ingredients further fuels the importance of this trend as a critical component of modern functional food ingredient strategies

- Organizations are increasingly acknowledging the potential of these ingredients to tap into new market segments, improve product health credentials, and align with consumer values related to ethical and environmental considerations. This trend towards prioritizing plant-based ingredients within the functional food market is driving significant research, development, and investment in this area

- The demand for innovative and high-quality plant-based ingredients is growing rapidly as the increasing awareness of their health and sustainability benefits encourages food and beverage companies to develop and adopt proactive and versatile strategies tailored to address the evolving preferences of their consumers. This direct and intentional approach to incorporating plant-based ingredients is vital for staying competitive in the modern food market and significantly boosts the innovation and diversification within the functional food sector

Functional Food Ingredients Market Dynamics

Driver

“Increasing Trend of Vegan and Plant-Based Diets”

- The increasing global adoption of vegan and plant-based diets is a significant driver for the heightened demand for diverse and innovative functional food ingredients. This dietary shift is fueled by growing consumer awareness of the health benefits associated with reducing or eliminating animal products, increasing ethical concerns regarding animal welfare and the environmental impact of animal agriculture, and a broader interest in sustainable food choices

- For instance, leading food and beverage manufacturers, such as Unilever with its acquisition of The Vegetarian Butcher, Nestlé with its plant-based Incredible Burger and Pea Protein beverages, and Danone with its extensive range of plant-based yogurts and milks under brands such as Silk and Alpro, are actively developing and marketing products to cater to this rapidly expanding consumer segment

- As the understanding of the nutritional needs and preferences of individuals following vegan and plant-based diets expands, the functional food ingredients market offers superior solutions compared to traditional animal-based ingredients. These ingredients allow for the creation of plant-based alternatives that closely mimic the taste, texture, and nutritional profile of conventional products, thereby fostering greater consumer adoption and satisfaction

- The increasing availability of diverse and high-quality plant-based functional ingredients, coupled with the growing awareness among consumers of the health, environmental, and ethical benefits of these diets, makes it an attractive area for innovation and investment

- The demand for sophisticated and versatile plant-based functional ingredients is growing rapidly as the increasing popularity of vegan and plant-based diets encourages food and beverage companies to develop and adopt proactive and consumer-centric strategies tailored to address the specific needs and preferences of this expanding market segment. This direct and intentional approach to formulating appealing and nutritious plant-based products is vital for market success and significantly boosts the growth and diversification of the functional food ingredients industry

Restraint/Challenge

“High Production Costs”

- Elevated initial and ongoing production costs pose a considerable challenge to the widespread application and market penetration of various functional food ingredients within the functional food ingredients market. The financial investment necessary for raw material sourcing, advanced processing technologies, research and development, and quality control measures can create a significant barrier for many companies

- For instance, smaller or emerging companies, much such as established giants such as ADM or Cargill that possess extensive resources, might find the high expenses associated with acquiring specialized extraction equipment for novel ingredients or implementing stringent purity standards to be substantial and potentially restrictive to their growth

- Addressing these cost-related challenges requires the development of more efficient and sustainable production methods, exploration of alternative and cost-effective raw material sources, and technological innovations that can reduce manufacturing expenses without compromising quality or efficacy

- While the potential long-term benefits of overcoming these limitations, such as increased affordability for consumers and wider adoption by food and beverage manufacturers, are substantial, the current reality of high production costs can impede the rapid growth and universal integration of certain functional food ingredients

- Overcoming these challenges through advancements in agricultural practices, optimization of extraction and purification processes, and the establishment of economies of scale will be vital for ensuring the continued growth and broader accessibility of the functional food ingredients sector

Functional Food Ingredients Market Scope

The market is segmented on the basis of type, source, application, and health benefit.

- By Type

On the basis of type, the market is segmented into probiotics, prebiotics, proteins and amino acids, phytochemical and plant extracts, omega-3 fatty acids, carotenoids, fibres and specialty carbohydrates, and vitamins and minerals. The probiotics segment dominates the largest market revenue share of 29.8% in 2025, driven by the increasing consumer awareness of their digestive health benefits and the rising prevalence of conditions such as lactose intolerance and digestive imbalances. Probiotics are also gaining popularity as a preventive healthcare solution, supported by extensive research on their efficacy.

The vitamins and minerals segment is expected to witness the fastest CAGR from 2025 to 2032, driven by a rising consumer focus on overall health and wellness, coupled with an increasing awareness of the importance of micronutrients in maintaining immunity and preventing chronic diseases. This growth is also fueled by their versatility in applications across various food and beverage products.

- By Source

On the basis of source, the market is segmented into natural and synthetic source. The natural segment dominates the largest market revenue share in 2025, driven by the growing consumer preference for clean-label products and ingredients perceived as healthier and safer. This demand is supported by increasing health consciousness and a desire for ingredients with minimal processing.

The synthetic segment is expected to witness the fastest CAGR from 2025 to 2032, driven by advancements in manufacturing processes that allow for cost-effective and large-scale production of high-quality functional ingredients. The increasing demand for fortified foods and beverages to address specific nutritional deficiencies also contributes to the growth of this segment.

- By Application

On the basis of application, the market is segmented into food and beverages. The beverages segment dominates the largest market revenue share in 2025, driven by the increasing consumer demand for convenient and on-the-go products that offer added health benefits. Functional beverages, such as energy drinks, fortified water, and plant-based protein shakes, are becoming increasingly popular.

The food segment is expected to witness the fastest CAGR from 2025 to 2032, driven by a growing consumer interest in incorporating health-promoting ingredients into their daily diets through functional foods such as fortified dairy products, whole grains, and snacks targeting specific health concerns such as immunity and gut health.

- By Health Benefit

On the basis of health benefit, the market is segmented into gut health, heart health, bone health, immunity, nutritive health, and weight management. The heart health segment dominates the largest market revenue share in 2025, driven by an increasing geriatric population prone to cardiovascular diseases and a rising prevalence of heart issues due to unhealthy lifestyles. Government initiatives promoting heart-healthy products also contribute to this dominance.

The gut health segment is expected to witness the fastest CAGR from 2025 to 2032, driven by growing consumer awareness regarding the importance of a healthy gut microbiome for overall well-being, coupled with the development of more effective and targeted ingredients such as prebiotics and probiotics. The increasing demand for healthy food and supplements is also fueling this growth.

Functional Food Ingredients Market Regional Analysis

- North America dominates the functional food ingredients market with the largest revenue share of 32.7% in 2024, driven by growing health and wellness concerns and the increasing prevalence of conditions such as obesity, digestive issues, and diabetes, which are critical factors expected to drive demand for these products

- Organizations in this region are increasingly focusing on incorporating functional ingredients into food and beverage products to meet the rising consumer demand for health-enhancing options

- This significant market share is further supported by a high consumer awareness of the health benefits of functional foods and beverages, coupled with the presence of major food and beverage manufacturers in the region actively incorporating these ingredients

U.S. Functional Food Ingredients Market Insight

U.S. functional food ingredients market held the largest revenue share within North America in 2025, driven by escalating healthcare expenditure, a growing prevalence of chronic diseases, and a strong consumer focus on preventive healthcare through diet. Corporations are increasingly reformulating products with functional ingredients to cater to health-conscious consumers and capitalize on this growing market. The demand for natural and clean-label functional ingredients is significantly fueling the market growth in the U.S.

Europe Functional Food Ingredients Market Insight

European functional food ingredients market is expected to grow at a substantial CAGR over the forecast period, primarily driven by increasing consumer interest in health and wellness, rising prevalence of lifestyle-related diseases such as obesity and diabetes, and an aging population. A growing demand for natural and clean-label ingredients across various food and beverage applications is also encouraging market growth. The market is witnessing significant activity in the development and incorporation of ingredients with health claims.

U.K. Functional Food Ingredients Market Insight

U.K. functional food ingredients market is anticipated to expand at a noteworthy CAGR of 7.1% during the forecast period, driven by a growing recognition of the link between diet and health, along with increasing consumer spending on health-enhancing food and beverage products. Rising awareness of the benefits of ingredients such as prebiotics, probiotics, and vitamins is prompting food and beverage manufacturers to innovate and introduce new products with functional benefits. U.K.'s strong retail sector and health-conscious consumer base are further contributing to the market's growth.

Germany Functional Food Ingredients Market Insight

German functional food ingredients market is projected to expand at a considerable CAGR of 7.0% during the forecast period, fueled by a strong emphasis on health and nutrition, coupled with increasing demand for functional foods and beverages that support overall well-being. Germany's well-established food processing industry and consumer preference for high-quality, health-oriented products are key drivers for the adoption of functional ingredients. The market is seeing a rise in demand for ingredients that offer specific health benefits, such as improved digestion and immunity.

Asia-Pacific Functional Food Ingredients Market Insight

Asia-Pacific functional food ingredients market is poised to grow at the fastest CAGR in the forecast period, driven by rapid economic growth, increasing awareness of lifestyle-related diseases, and a growing emphasis on health and wellness in rapidly expanding economies such as China and India. Rising disposable incomes and a growing middle class are also enabling consumers to spend more on health-enhancing food and beverage options. As the region experiences increasing urbanization and a shift towards processed foods, the demand for functional ingredients to improve their nutritional profile is also on the rise.

Japan Functional Food Ingredients Market Insight

Japan functional food ingredients market is gaining momentum due to the country’s increasing focus on preventative healthcare and the need to address the health concerns of an aging population. The Japanese government's support for functional foods with specific health benefits (FOSHU) and the emphasis on improving overall health and reducing healthcare costs are driving the adoption of functional ingredients across various food and beverage categories. There is a growing demand for ingredients that address concerns such as digestive health, bone health, and immunity.

China Functional Food Ingredients Market Insight

China functional food ingredients market is expected to account for the largest market revenue share in Asia Pacific, attributed to the country's large population, rapid economic development, and increasing awareness of the impact of diet on health and well-being. Rising healthcare costs and a growing focus on health and wellness are encouraging consumers to seek out functional food and beverage options. The market is seeing a significant demand for ingredients that support immunity, digestive health, and overall nutrition, with both domestic and international manufacturers actively catering to this growing demand.

Functional Food Ingredients Market Share

The functional food ingredients industry is primarily led by well-established companies, including:

- BASF (Germany)

- ADM (U.S.)

- DuPont (U.S.)

- AJINOMOTO CO., INC. (Japan)

- DSM (Netherlands)

- Ingredion (U.S.)

- Arla Foods amba (Denmark)

- Kerry Group (Ireland)

- Tate & Lyle (U.K.)

- BENEO (Germany)

- Kemin Industries, Inc. (U.S.)

- Roquette Frères (France)

- Soylent (U.S.)

- A&B Ingredients (U.S.)

- Golden Grain Group Limited (Australia)

- Zimitech, Inc. (U.S.)

- Stratum Nutrition (U.S.)

- Ashland Inc. (U.S.)

- Coöperatie Koninklijke Cosun U.A. (Netherlands)

- Associated British Foods plc (U.K.)

- Amway (U.S.)

- Nestlé (Switzerland)

- DMH Ingredients (U.S.)

Latest Developments in Global Functional Food Ingredients Market

- In October 2022, Teijin Limited established the Teijin Meguro Institute Co., Ltd. to enhance its capabilities in developing and manufacturing probiotics aimed at functional food applications. This initiative is designed to advance research in probiotics, enabling the company to offer high-quality functional food ingredients. The focus on probiotics aligns with growing consumer interest in gut health, providing innovative solutions for health-conscious consumers seeking dietary enhancements

- In April 2022, At the Vitafoods Europe event in Geneva, Bioberica announced the launch of new ingredients targeting the digestive health and skin and beauty sectors. This strategic expansion aims to diversify their product portfolio and meet rising consumer demand for health-focused ingredients. Among their innovations, the company showcased Collavant n2, a native type II collagen ingredient designed for joint health, highlighting its potential in functional food applications

- In July 2021, Kerry Group, a leading Irish food company, confirmed its acquisition of Biosearch Life for USD 150 million. This strategic move enables Kerry to broaden its healthy ingredient offerings, particularly in probiotics and omega-3 fatty acids. By integrating Biosearch Life’s expertise and products, Kerry aims to enhance its competitive edge in the growing market for health-focused ingredients, catering to the increasing consumer demand for wellness solutions

- In February 2021, in a significant investment collaboration, Cargill and Manna Tree invested in Evolve BioSystems, Inc. This partnership aims to advance the commercialization of cutting-edge probiotics that address deficiencies in the infant gut microbiome. By focusing on infant health, the collaboration seeks to create specialized probiotic solutions that can enhance the development of newborns, reinforcing the importance of gut health from an early age

- In February 2020, Grupo Arcor and Ingredion Incorporated announced a joint venture to bolster their manufacturing capabilities and expand their geographic reach in Argentina, Chile, and Uruguay. This collaboration aims to enhance their offerings in the food and beverage sector, allowing both companies to leverage each other's strengths. By combining resources, they intend to innovate and provide high-quality food ingredients that meet diverse consumer needs in the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Functional Food Ingredients Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Functional Food Ingredients Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Functional Food Ingredients Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.