Global Fundus Cameras Market

Market Size in USD Million

CAGR :

%

USD

591.83 Million

USD

951.86 Million

2025

2033

USD

591.83 Million

USD

951.86 Million

2025

2033

| 2026 –2033 | |

| USD 591.83 Million | |

| USD 951.86 Million | |

|

|

|

|

Fundus Cameras Market Size

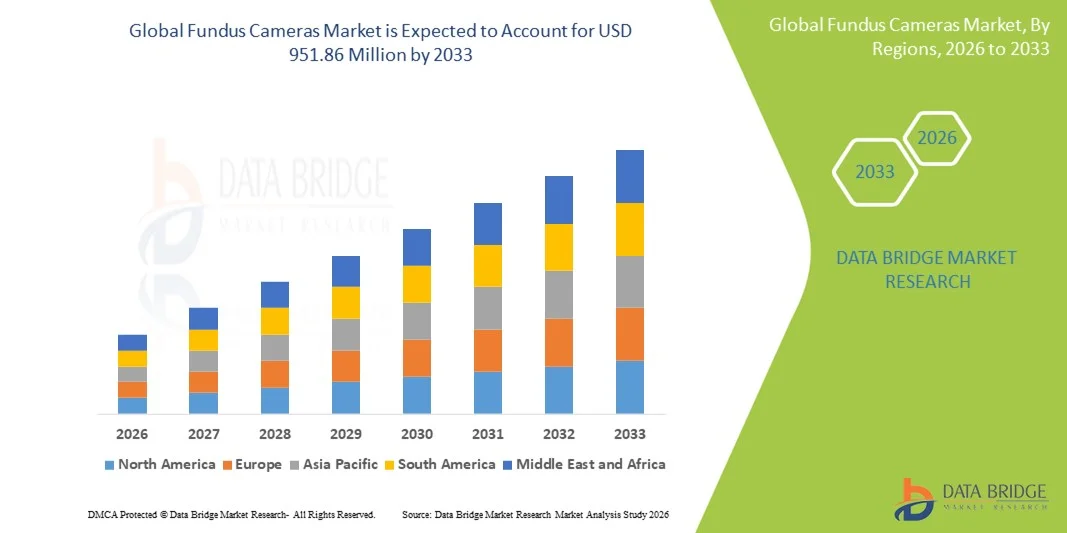

- The global fundus cameras market size was valued at USD 591.83 million in 2025 and is expected to reach USD 951.86 million by 2033, at a CAGR of 6.12% during the forecast period

- The market growth is primarily driven by the rising prevalence of eye disorders such as diabetic retinopathy, glaucoma, and macular degeneration, coupled with increasing awareness about early diagnosis and preventive eye care

- In addition, advancements in imaging technology, including the integration of AI and high-resolution imaging in fundus cameras, are enhancing diagnostic accuracy and workflow efficiency. These factors are collectively fueling the adoption of fundus cameras in ophthalmology clinics, hospitals, and diagnostic centers, thereby propelling the market’s expansion

Fundus Cameras Market Analysis

- Fundus cameras, providing high-resolution imaging of the retina, optic disc, and macula, are becoming essential tools in modern ophthalmology for the diagnosis, monitoring, and management of various eye diseases such as diabetic retinopathy, glaucoma, and age-related macular degeneration. Their adoption is driven by improved diagnostic accuracy, ease of use, and integration with teleophthalmology and AI-assisted imaging systems

- The growing prevalence of eye disorders, rising geriatric population, and increasing awareness about preventive eye care are the primary factors fueling the demand for fundus cameras across clinics, hospitals, and diagnostic centers globally

- North America dominated the fundus cameras market with the largest revenue share of 38.9% in 2025, supported by high healthcare spending, advanced medical infrastructure, and early adoption of AI-integrated imaging technologies, with the U.S. witnessing significant growth in fundus camera installations for routine eye screening and teleophthalmology initiatives

- Asia-Pacific is expected to be the fastest-growing region in the fundus cameras market during the forecast period, driven by a large population base, rising prevalence of diabetes and related retinal disorders, and increased investment in healthcare infrastructure

- Non-mydriatic fundus cameras dominated the market with a share of 45.7% in 2025, attributed to their convenience for patients, faster imaging process, and suitability for mass screening programs without the need for pupil dilation

Report Scope and Fundus Cameras Market Segmentation

|

Attributes |

Fundus Cameras Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Fundus Cameras Market Trends

Advancements in AI-Enabled Imaging and Teleophthalmology Integration

- A major trend in the global fundus cameras market is the integration of artificial intelligence (AI) for automated image analysis, disease detection, and patient monitoring, significantly improving diagnostic accuracy and efficiency

- For instance, Topcon’s AI-enabled fundus cameras can automatically detect diabetic retinopathy and glaucoma, providing instant diagnostic support to ophthalmologists and facilitating remote screening programs

- AI integration allows fundus cameras to analyze retinal images in real-time, highlight abnormalities, and suggest possible diagnoses, reducing the dependency on manual interpretation and improving workflow in busy clinics

- The rise of teleophthalmology is further complementing AI capabilities, enabling remote eye screening and consultation services, especially in rural or underserved regions where access to specialists is limited

- This trend is encouraging manufacturers such as Nidek and Optomed to develop smart fundus cameras with cloud connectivity, AI-assisted image analysis, and remote reporting features to meet growing clinical demands

- Portable and hand-held fundus cameras are gaining popularity, enabling community-based eye screenings and outreach programs, particularly in regions with limited access to specialized ophthalmology centers

- The adoption of AI-integrated and teleophthalmology-compatible fundus cameras is rapidly increasing across hospitals, eye clinics, and screening programs, driven by the need for faster, accurate, and scalable retinal imaging solutions

Fundus Cameras Market Dynamics

Driver

Rising Prevalence of Eye Disorders and Preventive Eye Care Awareness

- The increasing incidence of diabetic retinopathy, glaucoma, and age-related macular degeneration, along with growing awareness about preventive eye care, is a key driver for the fundus cameras market

- For instance, in March 2025, Zeiss launched initiatives to expand diabetic retinopathy screening programs using their AI-assisted fundus cameras, aiming to improve early detection rates in high-risk populations

- As the global geriatric population grows and chronic conditions such as diabetes rise, healthcare providers are increasingly adopting fundus cameras for routine retinal examinations and early diagnosis

- Fundus cameras enable non-invasive, high-resolution retinal imaging that supports effective disease management, patient monitoring, and timely treatment interventions

- Rising government and private healthcare initiatives for eye disease screening are also boosting demand for fundus cameras in hospitals, clinics, and mobile screening units

- Increased funding for telemedicine and digital health initiatives is supporting the deployment of fundus cameras in remote and underserved areas

- Collaboration between camera manufacturers and AI software providers is accelerating product innovation and expanding clinical applications in ophthalmology

- The convenience, accuracy, and preventive care benefits of fundus cameras continue to encourage ophthalmologists and healthcare organizations to invest in advanced imaging technologies

Restraint/Challenge

High Equipment Costs and Need for Skilled Operation

- The relatively high cost of advanced fundus cameras and associated AI software can limit adoption in small clinics and budget-constrained healthcare settings, posing a barrier to market growth

- For instance, portable AI-enabled fundus cameras from Optomed, while effective, remain a significant investment for small ophthalmology practices in developing regions

- Effective operation of fundus cameras requires trained technicians or ophthalmologists, which can be a challenge in regions with limited healthcare workforce or training resources

- Maintenance, calibration, and software updates are necessary to ensure accurate imaging and diagnosis, adding to operational costs and complexity for healthcare facilities

- While prices are gradually decreasing and portable models are being introduced, the initial capital expenditure remains a deterrent for widespread adoption in lower-income regions

- Overcoming these challenges through cost reduction, training programs, and user-friendly portable solutions is essential for sustaining market growth and expanding access to retinal imaging services globally

- Limited awareness and adoption of advanced fundus imaging in small clinics and rural healthcare centers restrict market penetration in certain regions

- Regulatory approvals and compliance requirements for AI-enabled diagnostic devices can delay product launches and increase time-to-market for new fundus camera models

Fundus Cameras Market Scope

The market is segmented on the basis of product, end use, and distribution channel.

- By Product

On the basis of product, the global fundus cameras market is segmented into mydriatic fundus cameras, nonmydriatic fundus cameras, hybrid fundus cameras, and ROP fundus cameras. The nonmydriatic fundus cameras segment dominated the market with the largest revenue share of 45.7% in 2025, primarily due to their ability to capture high-quality retinal images without pupil dilation, improving patient comfort and compliance. These systems are widely used in routine eye examinations, mass screening programs, and primary care settings where speed and efficiency are critical. Nonmydriatic cameras reduce examination time and allow higher patient throughput, making them ideal for hospitals and diagnostic centers. Their growing integration with AI-based image analysis and teleophthalmology platforms further supports early detection of retinal diseases. In addition, increasing awareness of preventive eye care and diabetic retinopathy screening programs has strengthened demand for these devices. The availability of portable and user-friendly nonmydriatic models also contributes to their dominant market position.

The hybrid fundus cameras segment is expected to witness the fastest growth from 2026 to 2033, driven by their dual capability to perform both mydriatic and nonmydriatic imaging. These systems provide greater clinical flexibility, enabling ophthalmologists to conduct routine screenings as well as detailed diagnostic evaluations using a single device. Hybrid fundus cameras are increasingly adopted by multi-specialty hospitals and advanced eye clinics aiming to optimize workflow efficiency. Their compatibility with AI-assisted diagnostics, cloud storage, and EMR systems enhances their value proposition. The ability to serve diverse patient groups, including those requiring detailed retinal assessment, supports rapid adoption. Continuous technological advancements and higher investments in comprehensive imaging solutions are further accelerating growth in this segment.

- By End Use

On the basis of end use, the fundus cameras market is segmented into hospitals, ophthalmology clinics, and ophthalmic & optometrist offices. The hospitals segment dominated the market in 2025 due to high patient volumes and the availability of advanced diagnostic infrastructure. Hospitals increasingly use fundus cameras for routine eye screenings, preoperative evaluations, and chronic disease management, particularly for diabetic patients. Integration with hospital IT systems and teleophthalmology networks allows efficient data sharing and remote consultations. Hospitals also benefit from higher budgets that enable investment in advanced AI-enabled and high-resolution imaging systems. The presence of trained ophthalmologists and technicians further supports effective utilization of fundus cameras. Growing government-supported screening programs conducted through hospitals also contribute to segment dominance.

The ophthalmology clinics segment is anticipated to grow at the fastest rate during the forecast period, fueled by the rapid expansion of private eye care centers and specialty clinics. These clinics increasingly adopt compact and portable fundus cameras to enhance diagnostic accuracy and patient experience. Rising patient preference for specialized outpatient eye care is boosting demand in this segment. Ophthalmology clinics benefit from faster turnaround times and improved workflow efficiency enabled by modern fundus imaging systems. The availability of AI-based diagnostic support allows clinics to manage higher patient loads with consistent accuracy. Increased investment in advanced retinal imaging technologies further supports strong growth in this segment.

- By Distribution Channel

On the basis of distribution channel, the fundus cameras market is segmented into online and offline channels. The offline channel dominated the market in 2025, supported by traditional procurement through authorized distributors, medical equipment suppliers, and direct sales representatives. Healthcare providers often prefer offline channels for high-value equipment due to the availability of product demonstrations and hands-on training. Offline sales also offer installation support, maintenance services, and after-sales technical assistance, which are critical for fundus camera systems. Hospitals and large clinics rely on established vendor relationships to ensure reliability and service continuity. Customized procurement agreements and long-term service contracts further strengthen offline channel dominance. Regulatory compliance and quality assurance are also more easily managed through offline purchases.

The online channel is expected to witness the fastest growth from 2026 to 2033, driven by increasing digitalization of healthcare procurement processes. Online platforms allow easy comparison of product specifications, pricing, and technological features across multiple vendors. Manufacturers are increasingly offering direct-to-customer sales through official websites, improving accessibility and transparency. The availability of virtual demonstrations, remote training, and digital support services is enhancing buyer confidence in online purchases. Smaller clinics and optometry offices are particularly adopting online channels for cost-effective procurement. Growing acceptance of e-commerce in medical device purchasing is accelerating growth in this segment.

Fundus Cameras Market Regional Analysis

- North America dominated the fundus cameras market with the largest revenue share of 38.9% in 2025, supported by high healthcare spending, advanced medical infrastructure, and early adoption of AI-integrated imaging technologies, with the U.S. witnessing significant growth in fundus camera installations for routine eye screening and teleophthalmology initiatives

- Healthcare providers in the region place significant emphasis on early disease detection, preventive eye care, and the use of AI-enabled imaging systems, supporting widespread deployment of fundus cameras across hospitals and ophthalmology clinics

- This strong adoption is further supported by high healthcare spending, favorable reimbursement policies, and the presence of leading medical device manufacturers, establishing fundus cameras as essential tools for routine screening and advanced retinal diagnostics in both clinical and institutional settings

U.S. Fundus Cameras Market Insight

The U.S. fundus cameras market captured the largest revenue share within North America in 2025, driven by the high prevalence of diabetic retinopathy, glaucoma, and age-related macular degeneration. Healthcare providers increasingly prioritize early diagnosis and preventive eye care, supporting strong adoption of advanced retinal imaging systems. The widespread use of AI-enabled diagnostics, teleophthalmology platforms, and EMR-integrated imaging solutions is further propelling market growth. Moreover, favorable reimbursement policies and the presence of leading ophthalmic device manufacturers significantly contribute to continued market expansion.

Europe Fundus Cameras Market Insight

The Europe fundus cameras market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising awareness of preventive eye screening and strong regulatory emphasis on early disease detection. Increasing aging populations across European countries are elevating demand for routine retinal examinations. The adoption of digital healthcare technologies and telemedicine initiatives is fostering the use of fundus cameras in both hospital and outpatient settings. Growth is evident across public healthcare systems and private ophthalmology clinics, supported by investments in modern diagnostic infrastructure.

U.K. Fundus Cameras Market Insight

The U.K. fundus cameras market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising burden of diabetes-related eye diseases and national screening programs. Increased focus on early diagnosis within the National Health Service (NHS) is encouraging the deployment of fundus cameras across hospitals and community clinics. The adoption of teleophthalmology solutions and AI-assisted imaging tools is enhancing screening efficiency. In addition, strong healthcare digitization and investments in diagnostic modernization continue to stimulate market growth.

Germany Fundus Cameras Market Insight

The Germany fundus cameras market is expected to expand at a considerable CAGR during the forecast period, supported by advanced healthcare infrastructure and strong emphasis on precision diagnostics. Increasing awareness of retinal diseases and preventive ophthalmic care is driving demand for high-resolution fundus imaging systems. Germany’s focus on innovation, medical technology adoption, and data-driven healthcare supports the integration of AI-enabled fundus cameras. The preference for reliable, high-quality, and regulation-compliant medical devices aligns well with market growth in both hospitals and specialized eye clinics.

Asia-Pacific Fundus Cameras Market Insight

The Asia-Pacific fundus cameras market is poised to grow at the fastest CAGR during the forecast period, driven by a large patient population, rising prevalence of diabetes, and expanding access to eye care services. Rapid urbanization, improving healthcare infrastructure, and increasing investments in medical imaging technologies are fueling market adoption across China, Japan, and India. Government-led screening programs and telemedicine initiatives are accelerating the deployment of fundus cameras in underserved regions. In addition, the availability of cost-effective and portable devices is expanding market reach across emerging economies.

Japan Fundus Cameras Market Insight

The Japan fundus cameras market is gaining momentum due to the country’s aging population and strong focus on preventive healthcare. High awareness of eye health and routine retinal screening practices support steady adoption of fundus cameras. Japanese healthcare providers emphasize accuracy, automation, and integration with digital health systems, encouraging the uptake of AI-enabled imaging solutions. The growing number of hospitals and clinics offering advanced ophthalmic diagnostics further contributes to market growth.

India Fundus Cameras Market Insight

The India fundus cameras market accounted for the largest revenue share in Asia Pacific in 2025, driven by the rising prevalence of diabetes and increasing awareness of diabetic retinopathy screening. Rapid expansion of healthcare infrastructure, coupled with government initiatives focused on preventive eye care, is supporting strong market growth. India’s growing adoption of teleophthalmology and mobile screening units is boosting demand for portable and nonmydriatic fundus cameras. The availability of cost-effective devices and a large patient base positions India as a key growth market within the region.

Fundus Cameras Market Share

The Fundus Cameras industry is primarily led by well-established companies, including:

- Topcon Corporation (Japan)

- Carl Zeiss Meditec AG (Germany)

- Canon Inc. (Japan)

- NIDEK Co., Ltd. (Japan)

- Optomed Oyj (Finland)

- Remidio Inc. (U.S.)

- Epipole Ltd. (U.K.)

- Kowa Company, Ltd. (Japan)

- Optovue, Inc. (U.S.)

- CenterVue S.p.A. (Italy)

- Heidelberg Engineering GmbH (Germany)

- Forus Health Pvt Ltd (India)

- Volk Optical Inc. (U.S.)

- Optos PLC (U.K.)

- Alcon Inc. (Switzerland)

- Eyenuk, Inc. (U.S.)

- Phoenix Technology Group, Inc. (U.S.)

- Medimaging Integrated Solution Inc. (Taiwan)

- Visunex Medical Systems, Inc. (U.S.)

- IDx Technologies, Inc. (U.S.)

What are the Recent Developments in Global Fundus Cameras Market?

- In July 2025, Optomed USA launched the Optomed Lumo®, a next-generation handheld fundus camera designed to expand high-quality retinal imaging into primary care, community clinics, and remote settings, featuring wireless DICOM integration and intuitive workflows for flexible use across healthcare environments

- In August 2024, Visionix USA unveiled the VX 610 automated non-mydriatic fundus camera, which combines auto alignment, autofocus, and auto capture with cross-polarized light technology for high-clarity retinal imaging without pupil dilation, enhancing workflow efficiency in clinical settings

- In May 2024, Optomed USA, Inc. introduced the Optomed Aurora AEYE, the first FDA-cleared handheld AI fundus camera capable of instant detection of more than mild diabetic retinopathy, providing quick, on-site retinal screening before specialist referral

- In October 2022, Topcon introduced the NW500 Non-Mydriatic Retinal Camera, a fully automatic non-mydriatic retinal imaging system offering reliable, sharp imaging performance to support comprehensive retinal diagnostics in ophthalmic practices

- In April 2021, Samsung launched the Eyesuch as fundus camera developed under its Galaxy Upcycling program, which transforms older Samsung smartphones into medical retinal imaging devices using AI for diagnostic support broadening access to low-cost fundus imaging

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.