Global Gastroscopes Market

Market Size in USD Billion

CAGR :

%

USD

2.44 Billion

USD

4.16 Billion

2025

2033

USD

2.44 Billion

USD

4.16 Billion

2025

2033

| 2026 –2033 | |

| USD 2.44 Billion | |

| USD 4.16 Billion | |

|

|

|

|

Gastroscopes Market Size

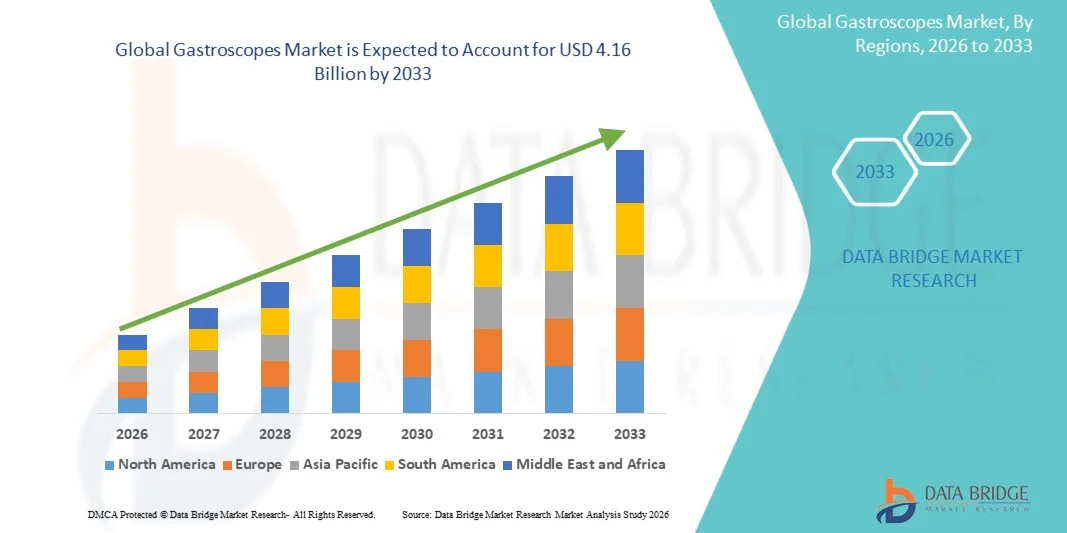

- The global gastroscopes market size was valued at USD 2.44 billion in 2025 and is expected to reach USD 4.16 billion by 2033, at a CAGR of 6.91% during the forecast period

- The market growth is largely fueled by the rising prevalence of gastrointestinal disorders, increasing demand for early and accurate diagnosis, and continuous technological advancements in endoscopic imaging, leading to wider adoption of gastroscopes across hospitals, clinics, and diagnostic centers

- Furthermore, growing emphasis on minimally invasive procedures, expanding geriatric population, improving healthcare infrastructure, and increasing awareness about preventive gastrointestinal screening are accelerating the uptake of gastroscope solutions, thereby significantly boosting the industry’s growth

Gastroscopes Market Analysis

- Gastroscopes, used for visual examination, diagnosis, and treatment of upper gastrointestinal disorders, are critical medical devices in modern gastroenterology across hospitals, diagnostic centers, and ambulatory surgical facilities due to their role in minimally invasive procedures, real-time imaging, and improved patient outcomes

- The increasing demand for gastroscopes is primarily driven by the rising prevalence of gastrointestinal diseases such as gastric ulcers, GERD, and gastric cancer, growing emphasis on early diagnosis, expanding geriatric population, and continuous advancements in endoscopic imaging technologies, including high-definition and AI-assisted visualization

- North America dominated the gastroscopes market with the largest revenue share of approximately 34.8% in 2025, supported by a well-established healthcare infrastructure, high adoption of advanced endoscopic systems, strong reimbursement frameworks, and a high volume of gastrointestinal diagnostic procedures, particularly in the U.S.

- Asia-Pacific is expected to be the fastest growing region in the gastroscopes market during the forecast period, registering a strong CAGR of around 9.9%, driven by increasing awareness of digestive health, rising healthcare expenditure, expanding hospital networks, and growing adoption of endoscopic screening programs in countries such as China and India

- The standard gastroscopes segment dominated the global gastroscopes market with a revenue share of approximately 41.6% in 2025

Report Scope and Gastroscopes Market Segmentation

|

Attributes |

Gastroscopes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Gastroscopes Market Trends

“Advancements in Endoscopic Imaging and Minimally Invasive Diagnostics”

- A significant and accelerating trend in the global gastroscopes market is the increasing adoption of advanced imaging technologies and minimally invasive diagnostic procedures to improve gastrointestinal disease detection and patient outcomes

- For instance, in 2023, Olympus Corporation introduced enhanced high-definition gastroscopes with improved narrow-band imaging (NBI) capabilities, enabling clinicians to detect early-stage gastrointestinal abnormalities with greater accuracy

- The shift toward high-resolution and ultra-slim gastroscopes is improving patient comfort during endoscopic examinations

- Growing use of flexible gastroscopes in outpatient and ambulatory care settings is supporting faster diagnosis and reduced hospital stays. Technological improvements in optical clarity, illumination, and maneuverability are enhancing procedural efficiency

- Integration of digital visualization systems with gastroscopes is allowing real-time image capture and documentation. The demand for disposable and infection-resistant components is rising to address cross-contamination concerns

- Advancements in ergonomics are reducing physician fatigue during prolonged procedures. Gastroscopes are increasingly used for both diagnostic and therapeutic interventions, expanding their clinical utility

- The rise in gastrointestinal cancer screening programs worldwide is accelerating adoption. Manufacturers are focusing on lightweight and durable materials to extend device lifespan

- Overall, this trend reflects a global shift toward precision diagnostics and patient-centric endoscopic care

Gastroscopes Market Dynamics

Driver

“Rising Prevalence of Gastrointestinal Disorders and Growing Screening Programs”

- The increasing incidence of gastrointestinal diseases such as ulcers, GERD, gastric cancer, and inflammatory bowel disease is a major driver for the global Gastroscopes market.

- For instnace, in 2022, Fujifilm Healthcare expanded its endoscopy portfolio to support large-scale gastrointestinal screening initiatives across Asia-Pacific and Europe

- Aging populations worldwide are more susceptible to digestive disorders, boosting demand for gastroscopic procedures

- Government-led cancer screening programs are increasing the volume of endoscopic examinations. Growing awareness about early diagnosis and preventive healthcare is encouraging routine gastroscopy

- The expansion of hospitals, specialty clinics, and ambulatory surgical centers is increasing equipment demand

- Rising healthcare expenditure in emerging economies supports market growth. Improved reimbursement policies for endoscopic procedures in developed regions are driving adoption

- Medical tourism for gastrointestinal treatments further fuels demand. Training programs for gastroenterologists are expanding procedural capacity

- Increasing use of gastroscopes in therapeutic applications such as biopsies and polyp removal supports growth. Collectively, these factors are significantly contributing to sustained market expansion

Restraint/Challenge

“High Equipment Costs and Stringent Regulatory Requirements”

- The high cost associated with advanced gastroscopes and related endoscopic systems presents a key challenge to market growth, particularly in low- and middle-income regions

- For instance, in 2021, several small healthcare facilities in developing countries reported delayed adoption of next-generation gastroscopes due to budget constraints and high maintenance costs

- The need for regular servicing and replacement of components increases total ownership costs. Stringent regulatory approvals and compliance requirements can delay product launches

- Limited availability of skilled professionals to operate advanced gastroscopes restricts utilization. Risk of device-associated infections necessitates strict reprocessing protocols, increasing operational complexity

- Smaller clinics may face challenges in investing in high-end visualization systems. Reimbursement variability across regions can affect purchasing decisions

- Training requirements add time and cost burdens for healthcare providers. Supply chain disruptions can impact equipment availability

- Addressing these challenges through cost-effective product development and expanded training initiatives is critical

- Overcoming financial and regulatory barriers will be essential for broader global adoption of gastroscopes

Gastroscopes Market Scope

The market is segmented on the basis of type, application, and end user.

• By Type

On the basis of type, the Gastroscopes market is segmented into standard gastroscopes, trans nasal gastroscopes, therapeutic gastroscopes, dual channel gastroscopes, and others. The standard gastroscopes segment dominated the global gastroscopes market with a revenue share of approximately 41.6% in 2025.This dominance is primarily attributed to their widespread use in routine upper gastrointestinal diagnostic procedures across hospitals and diagnostic centers. Standard gastroscopes are preferred due to their cost-effectiveness, broad availability, and compatibility with existing endoscopy systems. They are extensively used for detecting common conditions such as gastritis, ulcers, and gastrointestinal bleeding. High physician familiarity and established clinical protocols further support their adoption. The segment benefits from strong demand in both developed and emerging healthcare markets. In addition, increasing screening programs for gastrointestinal disorders are boosting procedure volumes. Continuous product refinements, including improved optics and maneuverability, are enhancing usability. The large installed base of standard gastroscopes ensures steady replacement demand. This segment continues to play a foundational role in endoscopic diagnostics globally.

The trans nasal gastroscopes segment is expected to witness the fastest growth, registering a CAGR of around 9.4% from 2026 to 2033. This growth is driven by increasing preference for minimally invasive and patient-friendly diagnostic procedures. Trans nasal gastroscopes offer improved patient comfort by eliminating the gag reflex commonly associated with oral insertion. These devices often do not require sedation, reducing procedural risks and healthcare costs. Rising outpatient endoscopy procedures and demand for faster recovery are accelerating adoption. The segment is also gaining traction in elderly and high-risk patient populations. Technological advancements such as ultra-thin designs and enhanced imaging capabilities further support growth. Expanding awareness among clinicians regarding patient satisfaction benefits is boosting uptake. Growth is particularly strong in Asia-Pacific and Europe, where minimally invasive diagnostics are increasingly emphasized.

• By Application

On the basis of application, the Gastroscopes market is segmented into gastric ulcer, chronic gastritis, normal mucosa examination, contraindications, and others. The gastric ulcer segment dominated the market with a revenue share of approximately 36.8% in 2025. This dominance is driven by the high global prevalence of gastric ulcers associated with Helicobacter pylori infections, NSAID usage, and lifestyle factors. Gastroscopes are the primary diagnostic tools for visualizing ulcerations and monitoring treatment progress. Increasing awareness of early diagnosis and complication prevention supports segment growth. Hospitals and clinics frequently perform gastroscopy for ulcer detection and follow-up. Rising incidence of stress-related gastrointestinal disorders also contributes to procedural volume. Technological advancements enabling high-resolution visualization improve diagnostic accuracy. The segment benefits from strong reimbursement support in developed markets. Growing geriatric populations further increase demand. As gastric ulcers remain a major gastrointestinal concern, this segment maintains a strong market position.

The chronic gastritis segment is projected to grow at the fastest CAGR of about 8.9% from 2026 to 2033. This growth is fueled by rising incidence of chronic inflammatory gastric conditions linked to dietary habits and infections. Increasing long-term monitoring needs for gastritis patients are driving repeat gastroscopy procedures. Advancements in imaging technologies enhance early detection and differentiation from malignant lesions. Growing emphasis on preventive healthcare is encouraging routine endoscopic evaluations. Expanding access to diagnostic endoscopy in emerging economies is accelerating growth. The segment also benefits from increasing physician awareness of disease progression risks. Integration of AI-assisted diagnostics further supports growth. Demand is particularly strong in Asia-Pacific due to high prevalence rates.

• By End User

On the basis of end user, the Gastroscopes market is segmented into hospitals and clinics, diagnostic laboratories, ambulatory surgical centres, and others. The hospitals and clinics segment dominated the global gastroscopes market with a revenue share of approximately 52.4% in 2025.

This dominance is supported by the high volume of inpatient and outpatient endoscopic procedures conducted in hospital settings. Hospitals possess advanced infrastructure, skilled gastroenterologists, and access to anesthesia support. Most complex diagnostic and therapeutic gastroscopy procedures are performed in hospitals. Strong reimbursement frameworks in developed regions further support this segment. Hospitals also serve as primary centers for emergency gastrointestinal interventions. Continuous investments in advanced endoscopy suites enhance procedural efficiency. Training and academic affiliations further strengthen adoption. The presence of large patient pools ensures consistent demand. As primary healthcare hubs, hospitals remain the largest end-user segment.

The ambulatory surgical centres (ASCs) segment is expected to witness the fastest growth, registering a CAGR of approximately 10.2% from 2026 to 2033. This growth is driven by the shift toward outpatient and same-day procedures. ASCs offer cost-effective, efficient, and patient-convenient alternatives to hospitals. Shorter wait times and faster recovery enhance patient preference for ASCs. Increasing adoption of minimally invasive gastroscopy supports this trend. Technological advancements enabling compact and portable gastroscope systems benefit ASCs. Growing payer support for outpatient procedures is accelerating growth. Expansion of ASCs in North America and Europe further drives demand. As healthcare systems focus on reducing hospital burden, ASCs are emerging as a high-growth end-user segment.

Gastroscopes Market Regional Analysis

- North America dominated the gastroscopes market with the largest revenue share of approximately 34.8% in 2025, supported by a well-established healthcare infrastructure, high adoption of advanced endoscopic systems, strong reimbursement frameworks, and a high volume of gastrointestinal diagnostic procedures

- The region benefits from early adoption of technologically advanced gastroscopes, including high-definition and minimally invasive endoscopic systems, particularly across hospitals and specialty clinics

- This dominance is further reinforced by the presence of leading medical device manufacturers, continuous product innovation, and increasing screening for gastrointestinal disorders, especially in the U.S.

U.S. Gastroscopes Market Insight

The U.S. gastroscopes market accounted for the largest revenue share within North America in 2025, driven by a high prevalence of gastrointestinal diseases, widespread availability of endoscopy centers, and strong clinical adoption of advanced diagnostic and therapeutic gastroscopes. Favorable reimbursement policies and growing emphasis on early disease detection continue to support market growth.

Europe Gastroscopes Market Insight

The Europe gastroscopes market is projected to grow at a steady CAGR during the forecast period, supported by rising incidence of digestive disorders, increasing elderly population, and strong public healthcare systems. Countries across the region are witnessing growing adoption of minimally invasive diagnostic procedures, along with continuous investments in hospital infrastructure and medical technology upgrades.

U.K. Gastroscopes Market Insight

The U.K. gastroscopes market is expected to expand at a notable CAGR, driven by increasing demand for endoscopic screening, growing awareness of gastrointestinal health, and strong support from the National Health Service (NHS). The focus on early diagnosis and preventive care is further accelerating the adoption of advanced gastroscopy procedures.

Germany Gastroscopes Market Insight

The Germany gastroscopes market is anticipated to register considerable growth during the forecast period, supported by advanced healthcare facilities, high procedural volumes, and strong emphasis on precision diagnostics. Germany’s focus on technological innovation and high-quality medical devices contributes significantly to the adoption of next-generation gastroscopes.

Asia-Pacific Gastroscopes Market Insight

The Asia-Pacific gastroscopes market is expected to be the fastest growing region, registering a strong CAGR of around 9.9% during the forecast period. Growth is driven by increasing awareness of digestive health, rising healthcare expenditure, expanding hospital networks, and growing adoption of endoscopic screening programs across emerging economies.

Japan Gastroscopes Market Insight

The Japan gastroscopes market is experiencing steady growth due to advanced medical technology adoption, a high standard of clinical care, and a rapidly aging population. The country’s strong focus on early diagnosis and routine gastrointestinal screening continues to drive demand for high-quality gastroscopy equipment.

China Gastroscopes Market Insight

The China gastroscopes market held the largest revenue share in the Asia-Pacific region in 2025, driven by expanding healthcare infrastructure, rising prevalence of gastrointestinal diseases, and increasing government investment in medical diagnostics. Growing adoption of endoscopic procedures in both urban and rural healthcare facilities is further supporting market expansion.

Gastroscopes Market Share

The Gastroscopes industry is primarily led by well-established companies, including:

- Olympus Corporation (Japan)

- Fujifilm Holdings Corporation (Japan)

- Karl Storz SE & Co. KG (Germany)

- Stryker Corporation (U.S.)

- BD (U.S.)

- Medtronic (Ireland)

- Ambu A/S (Denmark)

- Cook Medical (U.S.)

- EndoMed Systems (Germany)

- SonoScape Medical Corp. (China)

- Mindray Medical International (China)

- Machida Endoscope Co., Ltd. (Japan)

- Richard Wolf GmbH (Germany)

- Fujinon (Japan)

Latest Developments in Global Gastroscopes Market

- In November 2023, Olympus Corporation introduced its next-generation EVIS X1 endoscopy system in China, offering advanced imaging capabilities designed to improve early detection of gastrointestinal disorders and enhance procedural precision for gastroscopy diagnostics. This launch reflects Olympus’ strategic expansion in the Chinese gastroscope market, supporting broader adoption of high-definition imaging technology in complex GI procedures

- In March 2023, AIG Hospitals in Hyderabad launched a Center of Excellence (CoE) in partnership with Boston Scientific focused on advanced gastrointestinal treatment and diagnostic services, including state-of-the-art gastroscopy solutions. This collaboration aims to improve patient outcomes by providing specialized care and demonstrates how leading providers and device manufacturers are working together to expand access to gastroscope-based diagnostics in emerging markets such as India

- In January 2023, FUJIFILM India unveiled two innovative gastrointestinal procedural tools — FushKnife (diathermic slitter) and ClutchCutter (rotatable forceps) — at the 63rd Annual Conference of the Indian Society of Gastroenterology (ISGCON), designed to enhance tissue manipulation and resection during gastroscopy and related endoscopic procedures, supporting more precise therapeutic interventions

- In January 2024, Medtronic received U.S. FDA approval for its next-generation gastroscope, Hydrodrag™, featuring water-filled balloon technology that improves patient comfort during upper GI procedures and enhances maneuverability and visualization for clinicians, addressing key challenges in diagnostic gastroscopy

- In March 2024, Fujifilm Corporation and Olympus Corporation announced a strategic partnership to co-develop and commercialize next-generation endoscopic and gastroscopy technologies. This collaboration shows industry convergence toward combining expertise to drive innovation in imaging, scope performance, and procedural capabilities across gastroscope platforms

- In April 2024, Fujifilm Holdings Corporation announced a strategic partnership with a major hospital chain to expand market reach for its advanced gastroscopy systems, highlighting industry efforts to strengthen clinical adoption and improve patient outcomes through enhanced scope performance and customer support infrastructure

- In May 2024, Pentax Medical launched a new line of eco-friendly gastroscopes designed to meet sustainability goals and reduce environmental impact, responding to growing healthcare industry emphasis on sustainable medical technologies and demonstrating how product innovations are aligning with broader environmental priorities

- In June 2024, Karl Storz SE & Co. KG acquired a local distribution partner in Europe to strengthen its gastroscope distribution network, aiming to improve market penetration and customer service capabilities for its endoscopic solutions across regional healthcare systems

- In May 2025, Boston Scientific Corporation completed the acquisition of EndoChoice, expanding its portfolio of diagnostic and therapeutic gastroscope solutions, a strategic move that strengthens its position in the gastrointestinal market and enhances its ability to offer comprehensive endoscopic care options

- In July 2025, Olympus launched the EVIS X1 GI endoscopy system in North America, contributing to a significant increase in GI endoscopy sales, and Boston Scientific introduced a next-generation flexible gastroscope with enhanced imaging capabilities targeting improved diagnostic accuracy in GI procedures. In addition, Medtronic announced a strategic partnership with a U.S. AI startup to develop advanced AI-assisted endoscopic imaging platforms to support real-time diagnostic insights during gastroscopy

- In June 2025, Fujifilm Corporation unveiled an AI-powered gastroscope designed to assist in early detection of gastric cancers, marking a significant advancement in diagnostic capability by integrating machine learning into scope imaging systems to enhance lesion recognition and clinical decision support

- In May 2025, Hoya Corporation (Pentax) announced launch of a next-generation flexible esophagoscope with improved maneuverability and enhanced image quality for better patient outcomes in gastroscopy and esophageal diagnostics. This launch reflects ongoing innovation to improve device usability and diagnostic detail across upper GI endoscopy applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.