Global Gel Imaging Documentation Market

Market Size in USD Million

CAGR :

%

USD

374.00 Million

USD

474.14 Million

2025

2033

USD

374.00 Million

USD

474.14 Million

2025

2033

| 2026 –2033 | |

| USD 374.00 Million | |

| USD 474.14 Million | |

|

|

|

|

Gel Imaging Documentation Market Size

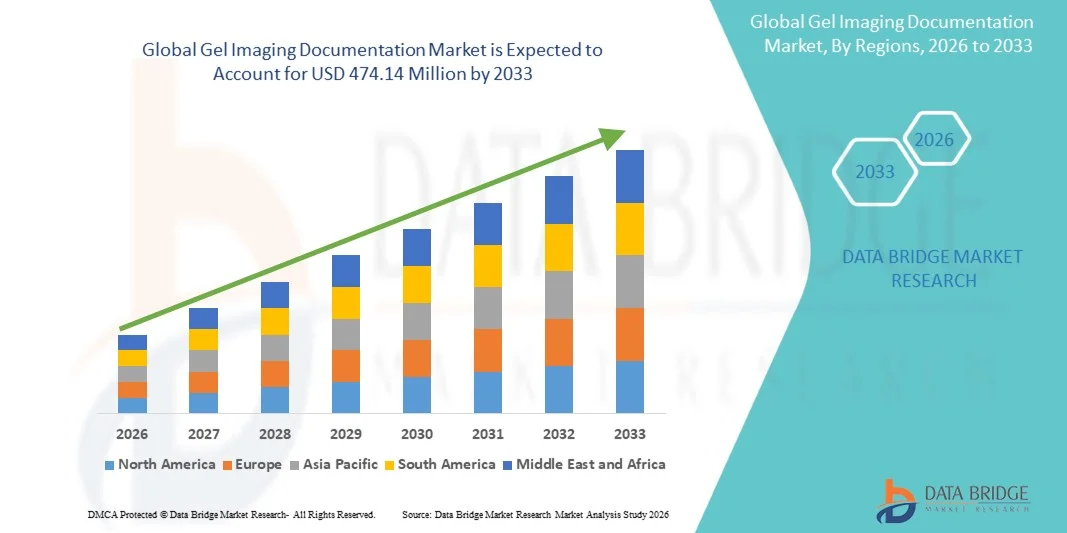

- The global gel imaging documentation market size was valued at USD 374.00 Million in 2025 and is expected to reach USD 474.14 Million by 2033, at a CAGR of 3.01% during the forecast period

- The market growth is largely driven by increasing adoption of advanced laboratory technologies, rising investments in life sciences research, and continuous technological advancements in imaging hardware and software, leading to greater digitization and efficiency in academic, clinical, and industrial laboratories

- Furthermore, growing demand for accurate, high-resolution, and user-friendly imaging systems for DNA, RNA, and protein analysis is accelerating the uptake of Gel Imaging Documentation solutions, thereby significantly boosting the overall growth of the Gel Imaging Documentation Market

Gel Imaging Documentation Market Analysis

- Gel Imaging Documentation systems, which enable precise visualization, documentation, and analysis of DNA, RNA, and protein gels, are essential tools in modern molecular biology, biotechnology, and clinical research laboratories due to their accuracy, reproducibility, and integration with advanced imaging software

- The increasing demand for gel imaging documentation systems is primarily driven by the growing volume of genomics and proteomics research, rising adoption of automated and digital laboratory workflows, and the need for reliable data capture and analysis in life sciences and diagnostic applications

- North America dominated the gel imaging documentation market with the largest revenue share of 38.4% in 2025, supported by strong research funding, a well-established biotechnology and pharmaceutical industry, and widespread adoption of advanced laboratory instruments, with the U.S. accounting for a significant share due to continuous investments in academic and clinical research infrastructure

- Asia-Pacific is expected to be the fastest-growing region in the gel imaging documentation market during the forecast period, driven by expanding biotechnology sectors, increasing government support for life sciences research, and rapid growth of academic and diagnostic laboratories across countries such as China, India, and South Korea

- The Nucleic Acid Quantification segment dominated the market with a revenue share of nearly 52.1% in 2025, supported by extensive use in genomics, molecular diagnostics, and genetic research

Report Scope and Gel Imaging Documentation Market Segmentation

|

Attributes |

Gel Imaging Documentation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Gel Imaging Documentation Market Trends

“Advancements in Digital Imaging and Automation Technologies”

- A significant and accelerating trend in the global gel imaging documentation market is the growing adoption of advanced digital imaging systems integrated with automation, high-resolution sensors, and enhanced data analysis software to improve accuracy and efficiency in molecular biology workflows

- For instance, in 2024, several leading life science instrument manufacturers introduced next-generation gel documentation systems featuring automated exposure control and high-sensitivity CMOS cameras to support more precise DNA, RNA, and protein analysis in research laboratories

- Technological advancements are enabling improved image clarity, faster processing times, and reduced manual intervention, which enhances reproducibility and minimizes user-related variability during gel analysis procedures

- The integration of gel imaging systems with laboratory information management systems (LIMS) and cloud-based data storage platforms is facilitating streamlined data management, easier collaboration, and long-term storage of experimental results

- This trend toward more automated, user-friendly, and digitally connected gel documentation solutions is reshaping laboratory workflows across academic, clinical, and pharmaceutical research settings

- As a result, manufacturers are increasingly focusing on developing compact, versatile, and software-driven gel imaging systems to meet the evolving needs of modern laboratories worldwide

Gel Imaging Documentation Market Dynamics

Driver

“Rising Demand from Molecular Biology and Life Science Research”

- The growing emphasis on molecular biology research, genomics, proteomics, and biotechnology applications is a key driver fueling demand for gel imaging documentation systems across global research and clinical laboratories

- For instance, in 2025, increased funding for genomic research programs in North America and Europe led to higher procurement of advanced gel documentation systems by academic institutions and pharmaceutical research centers

- Gel imaging systems play a critical role in routine laboratory applications such as nucleic acid electrophoresis, protein separation, and western blot analysis, making them indispensable tools in life science research

- Furthermore, the expansion of pharmaceutical and biotechnology industries, coupled with rising drug discovery and development activities, is increasing the need for reliable and high-throughput gel imaging solutions

- The growing number of diagnostic laboratories and contract research organizations (CROs), particularly in emerging markets, is also contributing to sustained demand for efficient and easy-to-use gel imaging documentation systems

Restraint/Challenge

“High Equipment Costs and Technical Complexity”

- The relatively high initial cost of advanced gel imaging documentation systems remains a major restraint, particularly for small laboratories, academic institutions, and research facilities in developing regions

- For instance, in 2024, several academic laboratories in Southeast Asia reported delays in upgrading gel documentation equipment due to budget constraints associated with high-resolution imaging systems and proprietary software licenses

- The technical complexity of operating and maintaining sophisticated imaging systems can require specialized training, which may limit adoption among laboratories with limited skilled personnel

- Regular maintenance, calibration requirements, and the need for compatible consumables can further increase the total cost of ownership over time

- In addition, variability in laboratory infrastructure, including limited access to stable power supply or digital data management systems in certain regions, can restrict widespread adoption

- Overcoming these challenges through cost-effective product offerings, simplified system designs, training programs, and expanded technical support will be essential for sustained growth of the global Gel Imaging Documentation market

Gel Imaging Documentation Market Scope

The market is segmented on the basis of product, detection technique, application, and end user.

• By Product

On the basis of product, the Gel Imaging Documentation market is segmented into Instruments, Digital Gel Documentation Instruments, Film Gel Documentation Instruments, Software, and Accessories. The Digital Gel Documentation Instruments segment dominated the largest market revenue share of approximately 44.6% in 2025, driven by the growing shift from conventional film-based systems to advanced digital imaging platforms. These systems provide superior image clarity, higher sensitivity, and faster processing times, which significantly enhance laboratory productivity. Pharmaceutical and biotechnology companies widely adopt digital systems due to their compatibility with regulatory documentation standards. Increasing automation in molecular biology workflows further strengthens demand. Integration with image analysis software improves accuracy and reproducibility of results. Academic and diagnostic laboratories prefer digital systems for their ease of data storage and sharing. Continuous technological upgrades, including CCD and CMOS sensors, support sustained adoption. As a result, digital gel documentation instruments continue to dominate the product segment globally.

The Software segment is expected to witness the fastest growth, registering a CAGR of around 11.9% from 2026 to 2033, driven by rising demand for advanced image analysis and quantitative data interpretation. Software solutions enable precise band detection, molecular weight estimation, and automated reporting, reducing human error. Growing adoption of AI-powered image processing tools is accelerating software uptake. Cloud-based platforms allow seamless data management and remote accessibility. Increasing integration with laboratory information management systems (LIMS) further fuels growth. Research institutions increasingly invest in standalone software upgrades to enhance analytical efficiency. These factors position software as the fastest-growing product segment.

• By Detection Technique

On the basis of detection technique, the Gel Imaging Documentation market is segmented into Ultraviolet, Chemiluminescence, and Fluorescence. The Ultraviolet detection segment accounted for the largest market revenue share of about 41.3% in 2025, owing to its widespread application in nucleic acid visualization. UV detection is commonly used for DNA and RNA gels due to its cost-effectiveness and ease of operation. Most academic and diagnostic laboratories rely on UV-based systems for routine molecular biology applications. High compatibility with common stains such as ethidium bromide supports extensive usage. Improvements in UV shielding and safety features have enhanced adoption. The availability of compact and integrated UV systems further strengthens dominance. Strong demand from emerging economies also contributes to its leading position.

The Chemiluminescence segment is projected to grow at the fastest CAGR of approximately 12.6% from 2026 to 2033, driven by increasing demand for high-sensitivity protein detection. This technique is widely used in Western blotting and proteomics research due to its ability to detect low-abundance proteins. Pharmaceutical and biotechnology companies increasingly adopt chemiluminescence systems for advanced R&D. Growing biologics and biosimilar development pipelines further accelerate growth. Compatibility with digital imaging platforms enhances workflow efficiency. These advantages make chemiluminescence the fastest-growing detection technique.

• By Application

On the basis of application, the Gel Imaging Documentation market is segmented into Protein Quantification and Nucleic Acid Quantification. The Nucleic Acid Quantification segment dominated the market with a revenue share of nearly 52.1% in 2025, supported by extensive use in genomics, molecular diagnostics, and genetic research. Rising prevalence of infectious and genetic diseases has increased reliance on DNA and RNA analysis. Nucleic acid quantification is essential in PCR validation, sequencing, and cloning workflows. Academic research expansion and government funding for genomics projects further support dominance. Diagnostic laboratories also use these systems for routine testing. High-volume usage and standardized protocols strengthen this segment’s leadership.

The Protein Quantification segment is expected to grow at the fastest CAGR of around 10.8% from 2026 to 2033, driven by increasing focus on proteomics and biomarker discovery. Pharmaceutical companies rely heavily on protein analysis for drug development and quality control. Growth in monoclonal antibody and biologics research further fuels demand. Advanced staining and detection techniques improve quantification accuracy. Rising clinical research activity also supports faster adoption. These factors position protein quantification as the fastest-growing application segment.

• By End User

On the basis of end user, the Gel Imaging Documentation market is segmented into Pharmaceutical & Biotechnology Companies, Academic Institutes & Research Centers, and Diagnostic Laboratories.

The Academic Institutes & Research Centers segment held the largest market revenue share of approximately 46.8% in 2025, driven by extensive usage in teaching, basic research, and experimental studies. Universities and research institutes routinely use gel documentation systems for molecular biology and biochemistry experiments. Continuous funding from governments and private organizations supports equipment procurement. High student and researcher volumes lead to frequent system utilization. Adoption of upgraded digital platforms enhances research accuracy. Collaboration with biotechnology firms also boosts usage levels. These factors collectively support segment dominance.

The Pharmaceutical & Biotechnology Companies segment is anticipated to witness the fastest growth, registering a CAGR of nearly 12.2% from 2026 to 2033, driven by increasing drug discovery and biologics development activities. These companies require precise gel imaging for protein and nucleic acid analysis in R&D and quality control. Rising investments in life sciences innovation further accelerate adoption. Regulatory compliance needs drive demand for reliable documentation systems. Expansion of contract research organizations also supports growth. As a result, this segment is expected to grow at the fastest pace.

Gel Imaging Documentation Market Regional Analysis

- North America dominated the gel imaging documentation market with the largest revenue share of approximately 38.4% in 2025, supported by strong research funding, a well-established biotechnology and pharmaceutical industry, and widespread adoption of advanced laboratory instruments. The region benefits from a high concentration of academic institutions, clinical research organizations, and diagnostic laboratories that extensively utilize gel imaging systems for molecular biology and proteomics research

- Research laboratories in the region highly value the accuracy, sensitivity, and digital documentation capabilities offered by modern gel imaging documentation systems, enabling efficient analysis and reproducibility of experimental results

- This widespread adoption is further supported by continuous investments in life sciences research, rapid technological advancements in imaging systems, and increasing demand for automated and high-throughput laboratory solutions, establishing gel imaging documentation systems as essential tools in research and clinical settings

U.S. Gel Imaging Documentation Market Insight

The U.S. gel imaging documentation market captured the largest revenue share within North America in 2025, driven by continuous investments in academic, clinical, and pharmaceutical research infrastructure. The presence of leading biotechnology companies, government-funded research programs, and advanced diagnostic laboratories is accelerating the adoption of gel imaging documentation systems. Additionally, the growing focus on genomics, proteomics, and molecular diagnostics, along with increasing use of digital imaging and analysis software, is significantly contributing to market growth.

Europe Gel Imaging Documentation Market Insight

The Europe gel imaging documentation market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strong academic research activity, increasing biotechnology investments, and growing demand for advanced laboratory imaging systems. Countries across the region are witnessing rising adoption of gel documentation systems in pharmaceutical research, clinical diagnostics, and academic laboratories. Supportive government funding for life sciences research and technological advancements in imaging platforms are further fostering market growth.

U.K. Gel Imaging Documentation Market Insight

The U.K. gel imaging documentation market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by robust research activities in molecular biology and life sciences. The presence of leading universities, research institutes, and biopharmaceutical companies is boosting demand for gel imaging documentation systems. Additionally, increasing government support for biomedical research and the growing emphasis on precision diagnostics are expected to further stimulate market growth.

Germany Gel Imaging Documentation Market Insight

The Germany gel imaging documentation market is expected to expand at a considerable CAGR during the forecast period, fueled by a strong pharmaceutical and biotechnology sector and a well-developed research infrastructure. German laboratories are increasingly adopting advanced gel imaging documentation systems to support drug discovery, clinical research, and academic studies. The country’s focus on innovation, automation, and high-quality laboratory standards is further driving market expansion.

Asia-Pacific Gel Imaging Documentation Market Insight

The Asia-Pacific gel imaging documentation market is expected to be the fastest-growing region during the forecast period, driven by expanding biotechnology sectors, increasing government support for life sciences research, and rapid growth of academic and diagnostic laboratories across countries such as China, India, and South Korea. Rising healthcare expenditure, improving research infrastructure, and increasing adoption of advanced laboratory instruments are accelerating market growth across the region.

Japan Gel Imaging Documentation Market Insight

The Japan gel imaging documentation market is gaining momentum due to strong research capabilities, advanced laboratory infrastructure, and increasing focus on molecular and genetic research. Japanese academic institutions and pharmaceutical companies are actively adopting gel imaging documentation systems to enhance research efficiency and accuracy. Continuous technological innovation and demand for compact, high-performance imaging solutions are further supporting market growth.

China Gel Imaging Documentation Market Insight

The China gel imaging documentation market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid expansion of biotechnology and pharmaceutical research, increasing number of academic and diagnostic laboratories, and strong government investments in life sciences. The growing focus on genomics, proteomics, and clinical diagnostics, along with the availability of cost-effective gel imaging systems from domestic manufacturers, is propelling market growth in China.

Gel Imaging Documentation Market Share

The Gel Imaging Documentation industry is primarily led by well-established companies, including:

- Bio-Rad Laboratories (U.S.)

- Thermo Fisher Scientific (U.S.)

- GE Healthcare (U.S.)

- Azure Biosystems (U.S.)

- Analytik Jena (Germany)

- Syngene (U.K.)

- Cleaver Scientific (U.K.)

- Major Science (Taiwan)

- Vilber Lourmat (France)

- Herolab (Germany)

- Hoefer (U.S.)

- LABREPCO (U.S.)

- Thomas Scientific (U.S.)

- Enduro™ GDS (U.S.)

Latest Developments in Global Gel Imaging Documentation Market

- In October 2023, Azure Biosystems (U.S.) launched AI-integrated gel imaging software designed to automate analysis and improve data reproducibility, significantly reducing manual intervention in high-throughput molecular biology workflows. This software enhancement reflects broader industry trends toward integrating artificial intelligence into gel documentation systems to boost efficiency and analytical accuracy in research and diagnostic laboratories

- In January 2024, Bio-Rad Laboratories (U.S.) expanded its gel imaging documentation portfolio with a new gel imaging system tailored for enhanced protein quantification and advanced software compatibility, addressing rising demand from proteomics and pharmaceutical research sectors. The system targets improved quantitative accuracy across diverse staining chemistries, reinforcing Bio-Rad’s leadership in high-performance imaging instruments

- In April 2024, Thermo Fisher Scientific (U.S.) introduced a compact gel documentation system featuring enhanced fluorescence detection and cloud connectivity, enabling remote data access and collaborative workflow support for academic and pharmaceutical customers. This launch underscores the growing importance of connectivity and remote operation in lab instrumentation

- In June 2024, GE Healthcare (U.S.) unveiled an eco-friendly LED-based gel documentation platform that reduces energy consumption by over 35% while delivering faster protein band detection, marking a significant advancement in sustainable laboratory technology. This development aligns with industry priorities on energy efficiency and performance

- In June 2024, LI-COR Biosciences (U.S.) launched the Odyssey M Imaging System with multi-channel fluorescence detection, enabling simultaneous imaging of multiple protein targets and expanding capabilities for complex proteomic analysis. This product launch supports deeper insights in protein research and high-resolution imaging needs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.