Global Geocomposites Market

Market Size in USD Million

CAGR :

%

USD

515.50 Million

USD

1,610.15 Million

2024

2032

USD

515.50 Million

USD

1,610.15 Million

2024

2032

| 2025 –2032 | |

| USD 515.50 Million | |

| USD 1,610.15 Million | |

|

|

|

|

Geocomposites Market Size

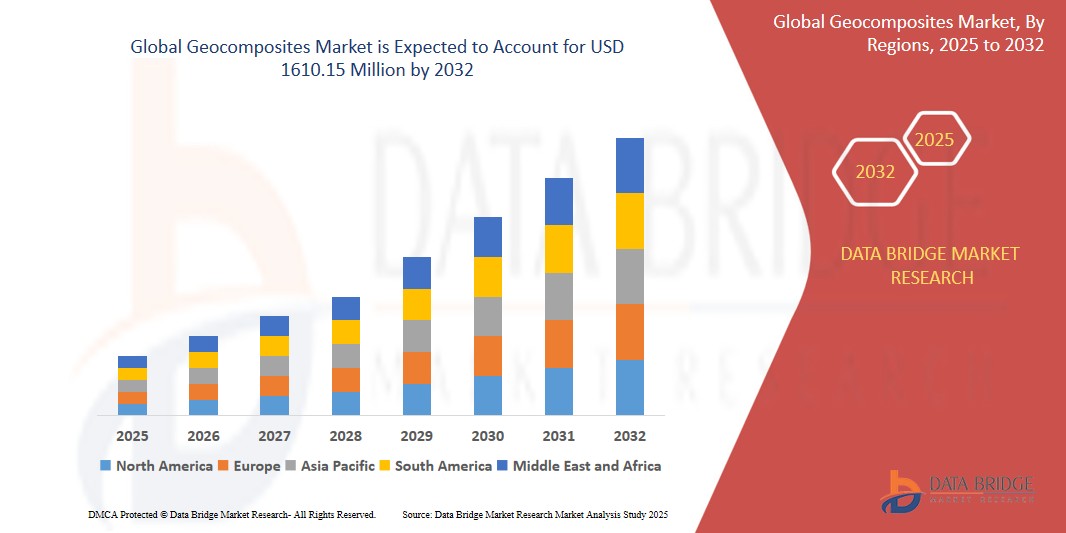

- The global geocomposites market size was valued at USD 515.50 million in 2024 and is expected to reach USD 1610.15 million by 2032, at a CAGR of 15.30% during the forecast period

- This growth is driven by increasing of the infrastructural expansion with the supportive government policies

Geocomposites Market Analysis

- Geocomposites are vital in civil engineering, used for filtration, drainage, and separation in infrastructure projects such as roads, landfills, and mining. These materials enhance sustainability and durability, offering efficient solutions for construction and environmental protection

- Market growth is driven by rising infrastructure demand, urbanization, and environmental concerns. Geocomposites are favored for their cost-effectiveness in improving soil reinforcement, water management, and erosion control, supported by global government investments in sustainable infrastructure

- Asia-Pacific is expected to dominate the global geocomposites market with a market share of 32.41%, driven by rapid urbanization, infrastructure development, and increasing demand for sustainable construction materials

- Europe is expected to be the fastest growing region in the geocomposites market, driven by increasing government regulations on environmental sustainability and infrastructure development

- The drainage segment is expected to dominate the geocomposites market with the largest market share of 45.73%, owing to its growing demand for efficient water management solutions is driven by increasing infrastructure development. With the rapid acceleration of urbanization and the expansion of road and highway networks globally, the need for advanced drainage systems in civil engineering projects has significantly risen

Report Scope and Geocomposites Market Segmentation

|

Attributes |

Geocomposites Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Geocomposites Market Trends

“Innovative Geocomposites for Sustainable Infrastructure”

- The demand for sustainable construction materials is driving innovation in geocomposites, with an emphasis on using recycled and eco-friendly materials to improve the environmental footprint of infrastructure projects

- New generations of geocomposites are being developed to include recycled plastics, biodegradable materials, and environmentally friendly adhesives, making them more attractive to industries aiming for green certifications

- Advances in manufacturing processes are enabling cost-effective production of these eco-friendly geocomposites, making them a viable option for large-scale construction projects

- For instance, in June 2024, Geofabrics Australasia introduced a new line of Geocomposites made from 100% recycled materials, aimed at reducing landfill waste and promoting sustainable road and highway construction

- This trend is expected to further drive the adoption of geocomposites in green building projects and infrastructure developments worldwide, meeting the growing demand for environmentally responsible materials

Geocomposites Market Dynamics

Driver

“Rising Demand for Erosion Control and Water Management Solutions”

- The increasing need for efficient erosion control and water management solutions is significantly driving the geocomposites market, especially in sectors such as agriculture, civil engineering, and environmental conservation

- Geocomposites provide an effective solution for erosion control, filtration, drainage, and reinforcement, particularly in riverbanks, coastal regions, and construction sites

- The growing emphasis on managing stormwater, preventing soil erosion, and enhancing water conservation in construction projects is boosting the demand for advanced geocomposite materials

- For instance, in May 2023, HUESKER introduced a new Geocomposite solution for erosion control in flood-prone regions in Europe, enhancing the protection of riverbanks and minimizing soil erosion

- This driver highlights the expanding need for geocomposites in sustainable water management, contributing to environmental preservation and efficient land use in construction projects

Opportunity

“Integration of Geocomposites with Smart Technology for Advanced Infrastructure”

- The incorporation of smart technology into geocomposites is creating new opportunities in the market, enabling real-time monitoring and enhanced performance in infrastructure applications

- Geocomposites integrated with sensors, monitoring devices, and data analytics can provide insights into soil conditions, stress levels, and material degradation, leading to more efficient maintenance and longer lifespans for infrastructure projects

- Smart geocomposites are expected to be increasingly used in roads, highways, landfills, and other critical infrastructures to monitor performance and prevent failures

- For instance, in September 2024, Tenax SPA announced a partnership with a tech firm to develop Geocomposites with embedded sensors for road reinforcement, allowing real-time monitoring of traffic load and soil stability

- This opportunity presents a new frontier for the geocomposites market, offering advanced technological solutions for smarter, more durable infrastructure projects

Restraint/Challenge

“Regulatory and Standards Challenges in Geocomposites Development”

- The lack of standardized regulations and guidelines for geocomposites is a challenge for manufacturers and industries adopting these materials, especially when used in critical infrastructure projects

- Variations in quality control, performance testing, and material certification across regions complicate the development of universal standards for geocomposites, delaying market adoption and increasing risks

- The absence of clear regulatory frameworks may also discourage investments in Geocomposite solutions, as industries face uncertainties regarding product compliance and long-term performance

- For instance, in November 2023, a Geocomposite supplier in the U.K. faced delays in product approvals due to inconsistent regulatory standards for erosion control materials in construction

- Addressing this challenge will require the development of industry-wide standards and clearer regulations to ensure the safe and reliable use of geocomposites in infrastructure applications

Geocomposites Market Scope

The market is segmented on the basis of product, function, and application.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Function |

|

|

By Application |

|

In 2025, the drainage is projected to dominate the market with a largest share in function segment

The drainage segment is expected to dominate the geocomposites market with the largest share of 45.73% in 2025 due to its growing demand for efficient water management solutions is driven by increasing infrastructure development. With the rapid acceleration of urbanization and the expansion of road and highway networks globally, the need for advanced drainage systems in civil engineering projects has significantly risen.

The road & highway is expected to account for the largest share during the forecast period in application segment

In 2025, the road & highway segment is expected to dominate the geocomposites market with the largest share of 47.11% due to surge in infrastructure development projects across the globe has led to significant investments by governments and private sectors in road expansion and maintenance initiatives aimed at strengthening landfill and mining networks. Geocomposites have emerged as a vital component in modern road construction due to their ability to enhance road durability, reduce maintenance expenses, and improve load-bearing capacity.

Geocomposites Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Geocomposites Market”

- Asia-Pacific is expected to dominate the global geocomposites market with a market share of 32.41%, driven by rapid urbanization, infrastructure development, and increasing demand for sustainable construction materials

- Countries such as China, India, and Japan are key contributors, with significant investments in projects related to water management, road infrastructure, and mining, all of which require Geocomposites

- The region benefits from a growing focus on eco-friendly and durable materials for infrastructure, further cementing its position as the leading market in the geocomposites industry

“Europe is projected to register the Highest CAGR in the Geocomposites Market”

- Europe is expected to experience the highest growth rate in the geocomposites market, driven by increasing government regulations on environmental sustainability and infrastructure development

- The region is focused on enhancing water management systems, improving roads, and reinforcing soil for civil construction, creating strong demand for geocomposites across various industries

- Countries such as Germany, France, and the U.K. are investing heavily in green construction technologies, positioning Europe as a rapidly expanding market for geocomposites

Geocomposites Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- ABG Limited (U.K.)

- Terram Geosynthetics Pvt. Ltd. (India)

- Thrace Group (Greece)

- TENAX SPA (Italy)

- Crafco, Inc. (U.S.)

- SKAPS Industries (U.S.)

- Solmax (Canada)

- CLIMAX SYNTHETICS PVT. LTD. (India)

- Tensar (U.S.)

- Officine Maccaferri Spa (Italy)

- HUESKER International (Germany)

- Leggett & Platt, Incorporated (U.S.)

- Qingdao Haisan New Energy Co., Ltd. (China)

- EDILFLOOR SPA (Italy)

- Low & Bonar (U.K.)

- American Wick Drain (U.S.)

- ALYAF (Saudi Arabia)

- Naue GmbH & Co. KG (Germany)

- Contech Engineered Solutions LLC (U.S.)

- FEICHENG LIANYI ENGINEERING PLASTICS CO LTD (China)

Latest Developments in Global Geocomposites Market

- In August 2024, Genap entered into an exclusive partnership with Watershed Geo, a leading geosynthetics manufacturer, to distribute and install ClosureTurf, a state-of-the-art synthetic closure system tailored for landfill applications. This strategic move is expected to expand Genap’s footprint in the environmental protection and waste management sector

- In June 2023, GSE Environmental launched GSE RoaDrain, a synthetic drainage layer designed specifically for roadway infrastructure, offering high compressive strength and superior hydraulic conductivity. The product strengthens GSE's position in road construction solutions with durable and efficient geosynthetics

- In April 2023, HUESKER introduced the SoilTain Protect System, a geocomposite that combines a woven filter fabric with a nonwoven cushion layer to shield geomembranes from punctures and abrasions. This innovation underscores HUESKER’s commitment to improving membrane protection in critical infrastructure projects

- In February 2022, Freudenberg Performance Materials, a Germany-based manufacturer, unveiled EnkaGrid MAX C, a new geogrid geocomposite that integrates nonwoven geotextiles with reinforcement grids to perform functions such as separation and filtration in soil systems. This development enhances Freudenberg’s product offering for sustainable soil stabilization

- In October 2021, Geofabrics Australasia completed the acquisition of Plascorp, marking the creation of one of the largest private industrial product and solution providers in Australia and New Zealand. The acquisition broadens Geofabrics’ manufacturing capabilities and strengthens its market position across the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Geocomposites Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Geocomposites Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Geocomposites Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.