Global Glass Bottles Market

Market Size in USD Billion

CAGR :

%

USD

65.20 Billion

USD

94.15 Billion

2025

2033

USD

65.20 Billion

USD

94.15 Billion

2025

2033

| 2026 –2033 | |

| USD 65.20 Billion | |

| USD 94.15 Billion | |

|

|

|

|

Glass Bottles Market Size

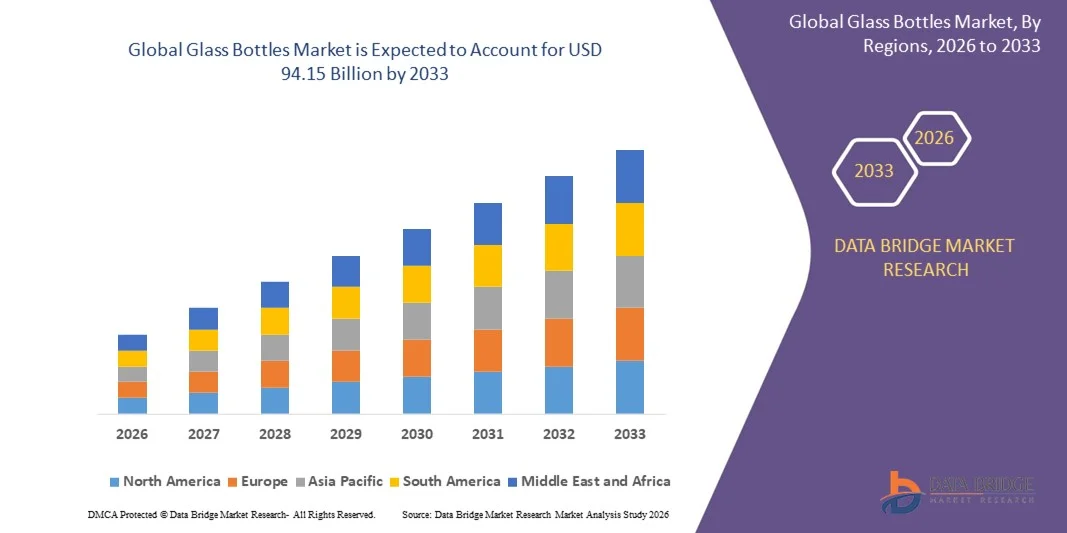

- The global glass bottles market size was valued at USD 65.2 billion in 2025 and is expected to reach USD 94.15 billion by 2033, at a CAGR of 4.7% during the forecast period

- The market growth is largely fueled by the increasing demand for sustainable, premium, and aesthetically appealing packaging solutions across the food and beverage, cosmetics, and pharmaceutical industries. Growing consumer awareness regarding recyclability and environmental impact is encouraging manufacturers to adopt glass bottles over alternative packaging materials, thereby driving market expansion

- Furthermore, the rising preference for high-quality, durable, and reusable packaging solutions is establishing glass bottles as the packaging format of choice for premium products. These converging factors, including the push for eco-friendly practices and brand differentiation through premium packaging, are accelerating the adoption of glass bottles and significantly boosting the industry’s growth

Glass Bottles Market Analysis

- Glass bottles, providing superior durability, chemical inertness, and recyclability, are increasingly vital components of modern packaging for food, beverages, cosmetics, and pharmaceuticals. Their ability to preserve product integrity, support brand image, and meet sustainability standards makes them a preferred packaging solution in both commercial and residential product segments

- The escalating demand for glass bottles is primarily fueled by the growth of premium and craft beverage markets, rising cosmetic and pharmaceutical product consumption, and increasing regulatory emphasis on recyclable and environmentally friendly packaging. In addition, innovations in bottle design, lightweighting, and material efficiency are further enhancing their adoption across diverse end-use industries

- North America dominated glass bottles market with a share of 56.21% in 2025, due to increasing demand for sustainable and premium packaging solutions across the food, beverage, and cosmetic industries

- Asia-Pacific is expected to be the fastest growing region in the glass bottles market during the forecast period due to rapid urbanization, rising disposable incomes, and growing awareness of sustainable packaging in countries such as China, Japan, and India

- Food and beverages segment dominated the market with a market share of 52.3% in 2025, due to the widespread use of glass bottles for beverages, sauces, condiments, and packaged foods. Glass is preferred due to its non-reactive nature, ability to preserve flavor, and safety for long-term storage. The segment also benefits from growing consumer awareness of sustainable packaging, as glass is fully recyclable and reusable. In addition, manufacturers favor glass bottles for premium beverage brands due to the enhanced consumer perception of quality and trust. Food and beverage companies often integrate glass packaging with advanced closure systems and labels, which increases product shelf appeal and market competitiveness

Report Scope and Glass Bottles Market Segmentation

|

Attributes |

Glass Bottles Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Glass Bottles Market Trends

Rising Demand for Sustainable and Recyclable Glass Packaging

- The increasing awareness among consumers and manufacturers about environmental sustainability is driving the demand for glass bottles, which are highly recyclable, reduce reliance on plastic, and contribute to long-term environmental conservation

- For instance, Verallia’s launch of Vista bottles made entirely from post-consumer recycled glass demonstrates a strong industry shift toward circular economy practices, achieving energy savings while providing premium packaging solutions for spirits and cosmetic products

- Manufacturers are adopting lightweighting technologies and material-efficient designs, allowing for reduced raw material consumption, lower transportation costs, and minimized carbon footprint, while maintaining product durability and aesthetic appeal

- The trend of premiumization across beverages, spirits, and luxury cosmetic products is encouraging brands to choose glass bottles for their visual appeal, perceived quality, and ability to enhance brand positioning and consumer loyalty

- Innovation in glass bottle design, such as customized shapes, colored glass, embossing, and decorative finishes, enables companies to differentiate their products and capture consumer attention in competitive retail environments

- The demand for sustainable, visually appealing, and high-quality glass packaging is growing across multiple end-use sectors, establishing glass bottles as a preferred and environmentally responsible solution while driving manufacturers to continuously innovate and upgrade production processes

Glass Bottles Market Dynamics

Driver

Growing Preference for Premium and High-Quality Packaging Solutions

- The rising consumer inclination toward high-quality, durable packaging materials that preserve product integrity and extend shelf life is significantly driving the adoption of glass bottles across industries

- For instance, Gerresheimer AG’s consistent revenue growth in pharmaceutical glass packaging demonstrates strong demand for durable, reliable, and specialized bottles in healthcare applications, supporting industry expansion and investment in innovative glass solutions

- The food and beverage sector is increasingly adopting glass bottles due to their chemical inertness, non-reactivity, and ability to maintain product taste, aroma, and freshness over extended periods, which is critical for premium, craft, and organic products

- The cosmetic and personal care industries are leveraging glass packaging to convey luxury, sustainability, and product safety, enhancing perceived product value and consumer preference for environmentally conscious brands

- The overall market growth is further propelled by regulatory emphasis on recyclable packaging, corporate sustainability initiatives, and the expanding demand for refillable, reusable, and premium glass containers in both developed and emerging markets

Restraint/Challenge

High Production Costs and Energy-Intensive Manufacturing Processes

- The production of glass bottles involves substantial energy consumption, raw material costs, and capital-intensive manufacturing infrastructure, which poses challenges for cost optimization and profitability, especially in price-sensitive regions

- For instance, O-I Glass’s investment of USD 125 million in hybrid-furnace technology highlights the industry’s efforts to reduce energy usage and carbon emissions while addressing high operational costs and improving sustainability credentials

- Smaller manufacturers often face difficulty competing with large-scale players due to the high capital requirement for advanced furnaces, automation, and energy-efficient production processes, limiting market entry and regional expansion opportunities

- While lightweighting, automation, and process optimizations are being implemented, the initial investment required for modern, energy-efficient production equipment remains a significant barrier for widespread adoption and scalability

- Overcoming these challenges through process innovations, sustainable energy utilization, cost-effective manufacturing techniques, and adoption of eco-friendly technologies will be essential to sustain market growth and meet the increasing global demand for premium and environmentally responsible glass packaging

Glass Bottles Market Scope

The market is segmented on the basis of product, filament type, and application.

- By Product

On the basis of product, the glass bottles market is segmented into standard glass quality, premium glass quality, and super premium glass quality. The standard glass quality segment dominated the market with the largest revenue share of 41.8% in 2025, driven by its cost-effectiveness and widespread usage across food and beverage applications. Manufacturers and consumers often prefer standard glass bottles for their reliability, durability, and ease of sourcing in bulk, making them a staple in packaging solutions. The segment also benefits from established production infrastructure and compatibility with automated filling and labeling systems, ensuring operational efficiency for bottlers. In addition, the standard glass quality segment meets regulatory requirements for safety and food-grade packaging, further strengthening its market position.

The super premium glass quality segment is anticipated to witness the fastest growth rate of 19.4% from 2026 to 2033, fueled by rising consumer preference for luxury and high-end packaging solutions. For instance, brands such as Moët Hennessy increasingly adopt super premium glass bottles to enhance product aesthetics and brand perception, particularly in the spirits and cosmetics sectors. This segment also benefits from innovations in design, clarity, and strength, providing differentiation and premium appeal. In addition, premium consumers are willing to pay higher prices for visually appealing, high-quality glass that enhances the unboxing and consumption experience. The growth is further supported by marketing strategies emphasizing sustainability, as many super premium bottles are designed for reuse or recycling.

- By Filament Type

On the basis of filament type, the glass bottles market is segmented into moulded and tubular. The moulded segment dominated the market with the largest revenue share of 47.5% in 2025, driven by its versatility in creating complex shapes and designs for multiple end-use industries. Moulded glass bottles are widely adopted for beverages and food packaging due to their ability to maintain product integrity and withstand handling stresses. The segment also benefits from faster production cycles, lower production costs, and scalability for high-volume orders. In addition, moulded bottles support branding through embossing and decorative finishes, which enhance consumer appeal and brand differentiation. Their compatibility with automated packaging lines further reinforces their market dominance, especially in commercial production setups.

The tubular segment is expected to witness the fastest CAGR of 18.2% from 2026 to 2033, driven by increasing adoption in premium pharmaceuticals and cosmetics applications. For instance, companies such as Gerresheimer use tubular glass bottles for luxury serums and medicinal products requiring precise filling and elegant design. Tubular bottles are valued for their uniform wall thickness, optical clarity, and superior strength, which reduces breakage and ensures product safety. The growth of this segment is also fueled by consumer demand for aesthetically refined, high-quality packaging that reinforces brand prestige. In addition, tubular bottles are gaining traction in niche markets such as artisanal beverages and high-end confectionery, supporting consistent revenue growth.

- By Application

On the basis of application, the glass bottles market is segmented into food and beverages, cosmetics, pharmaceuticals, and others. The food and beverages segment dominated the market with the largest revenue share of 52.3% in 2025, driven by the widespread use of glass bottles for beverages, sauces, condiments, and packaged foods. Glass is preferred due to its non-reactive nature, ability to preserve flavor, and safety for long-term storage. The segment also benefits from growing consumer awareness of sustainable packaging, as glass is fully recyclable and reusable. In addition, manufacturers favor glass bottles for premium beverage brands due to the enhanced consumer perception of quality and trust. Food and beverage companies often integrate glass packaging with advanced closure systems and labels, which increases product shelf appeal and market competitiveness.

The cosmetics segment is expected to witness the fastest growth rate of 20.1% from 2026 to 2033, fueled by the rising demand for high-end beauty and personal care products. For instance, companies such as L’Oréal increasingly adopt glass bottles for serums, perfumes, and skincare products to enhance the luxurious brand image and product experience. Glass bottles provide superior visual appeal, weight, and stability, which are critical for luxury cosmetic applications. The segment growth is further supported by consumer preference for sustainable, refillable, and aesthetically designed packaging solutions. In addition, innovation in bottle shapes, finishes, and colors is driving differentiation and boosting adoption across premium cosmetic brands globally.

Glass Bottles Market Regional Analysis

- North America dominated the glass bottles market with the largest revenue share of 56.21% in 2025, driven by increasing demand for sustainable and premium packaging solutions across the food, beverage, and cosmetic industries

- Consumers in the region highly value the durability, recyclability, and aesthetic appeal offered by glass bottles, which enhance product perception and support environmentally conscious purchasing decisions

- This widespread adoption is further supported by strong regulatory frameworks promoting recyclable packaging, high consumer awareness of eco-friendly products, and the growing trend of premiumization in beverages and personal care items

U.S. Glass Bottles Market Insight

The U.S. glass bottles market captured the largest revenue share in 2025 within North America, fueled by growing consumption of packaged beverages, luxury spirits, and cosmetic products packaged in glass containers. Consumers increasingly prioritize premium, eco-friendly packaging that preserves product quality and supports brand image. The surge in demand for craft beverages, organic foods, and high-end cosmetics further propels the glass bottles market. In addition, widespread adoption of reusable and refillable glass bottles by brands is enhancing sustainability initiatives. Government regulations encouraging recyclable packaging, combined with corporate strategies for environmentally conscious operations, are significantly contributing to market growth.

Europe Glass Bottles Market Insight

The Europe glass bottles market is projected to expand at a substantial CAGR during the forecast period, driven by strict environmental regulations and growing adoption of sustainable packaging practices. Consumers are increasingly drawn to glass bottles for their recyclability, premium appearance, and safety for food and beverage storage. The rise in demand for alcoholic beverages, gourmet foods, and luxury cosmetics fosters the growth of glass packaging. Europe is also witnessing innovations in bottle design, closure systems, and lightweight glass, enhancing appeal across multiple applications. Strong adoption across residential and commercial packaging, coupled with premiumization trends, is accelerating market growth throughout the region.

U.K. Glass Bottles Market Insight

The U.K. glass bottles market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising awareness of sustainable and premium packaging solutions. Consumers prefer glass for beverages, spirits, and high-end cosmetic products due to its perceived quality and safety. Growing concerns over plastic packaging and government incentives for recyclable containers are encouraging the adoption of glass bottles. The U.K.’s well-developed retail and e-commerce infrastructure supports distribution and marketing of glass-packaged products. Luxury and craft brands increasingly leverage glass packaging to enhance product presentation, further stimulating market growth.

Germany Glass Bottles Market Insight

The Germany glass bottles market is expected to expand at a considerable CAGR during the forecast period, fueled by high consumer awareness of environmental sustainability and premium packaging. The country’s strong food and beverage sector, particularly in beer, spirits, and juices, drives demand for durable and visually appealing glass bottles. Germany’s emphasis on recycling, eco-friendly materials, and technological advancements in glass production promotes adoption. Glass bottles are increasingly integrated into modern packaging lines for both food and cosmetics, improving operational efficiency and product differentiation. Consumer preference for safe, reusable, and elegant packaging aligns with the market’s growth trajectory.

Asia-Pacific Glass Bottles Market Insight

The Asia-Pacific glass bottles market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and growing awareness of sustainable packaging in countries such as China, Japan, and India. Increasing demand for packaged beverages, cosmetics, and pharmaceutical products is supporting adoption. Government initiatives promoting environmentally friendly packaging and the rise of premium and craft product segments are boosting market expansion. APAC’s emergence as a manufacturing hub for glass bottles enhances affordability, accessibility, and technological advancements in bottle design. Growing middle-class populations with evolving consumer preferences for premium, safe, and recyclable packaging further propel market growth.

Japan Glass Bottles Market Insight

The Japan glass bottles market is gaining momentum due to the country’s high standards for quality, aesthetics, and sustainability in packaging. Consumers prefer glass for beverages, luxury cosmetics, and pharmaceutical products because of its premium appearance, durability, and safety. The trend of gift packaging and artisanal products encourages decorative and high-quality glass bottles. Integration with advanced bottling and labeling technologies supports operational efficiency and product differentiation. Japan’s aging population also drives demand for easy-to-use, safe, and reusable glass bottles in both residential and commercial sectors, fueling consistent market growth.

China Glass Bottles Market Insight

The China glass bottles market accounted for the largest revenue share in Asia-Pacific in 2025, driven by the country’s booming food and beverage sector, rising disposable incomes, and expanding middle-class population. Glass bottles are increasingly used for alcoholic beverages, health drinks, and cosmetics due to their premium appeal and safety. The push for sustainable and recyclable packaging by both government and industry players is accelerating adoption. China’s domestic glass manufacturing capabilities and competitive pricing support market growth and accessibility. The rise of e-commerce, premium brands, and craft beverage segments continues to propel demand for high-quality glass bottles.

Glass Bottles Market Share

The glass bottles industry is primarily led by well-established companies, including:

- Ardagh Group S.A. (Luxembourg)

- Vidrala (Spain)

- Verallia (France)

- Wiegand-Glas Holding GmbH (Germany)

- Central Glass Co., Ltd. (Japan)

- Owens-Illinois, Inc. (U.S.)

- Consol (Italy)

- FRIGOGLASS (Greece)

- Hindusthan National Glass & Industries Limited (India)

- Vitro (Mexico)

- AGI glaspac (India)

- BA GLASS GROUP (Belgium)

- General Bottle Supply (U.S.)

- Glass Bottle Outlet (U.S.)

- Saverglass (France)

- Saint-Gobain (France)

- Vetropack (Switzerland)

- Amcor plc (Australia)

- Nihon Yamamura Glass Co., Ltd. (Japan)

- Piramal Glass Private Limited (India)

- Gerresheimer AG (Germany)

- Stoelzle Oberglas GmbH (Austria)

- Beatson Clark (U.K.)

Latest Developments in Global Glass Bottles Market

- In August 2025, Verallia launched its “Vista” bottle made entirely from post-consumer recycled (PCR) glass, achieving a 40% reduction in energy consumption compared with virgin-glass production. This innovation supports the industry’s shift toward circular economy practices, allowing brands to significantly lower their carbon footprint while maintaining premium quality standards. Targeting spirits, wine, and luxury cosmetic applications, Vista bottles enable companies to combine sustainability with aesthetics, appealing to environmentally conscious consumers. This move also strengthens Verallia’s position as a leader in sustainable glass solutions and encourages broader adoption of recycled materials across the market

- In August 2025, Vidrala introduced the 260G bottle, the world’s lightest 75 cl glass bottle, demonstrating significant material-efficiency gains without compromising on strength or premium appeal. This development reflects the growing industry focus on lightweighting to reduce transportation costs, lower carbon emissions, and enhance supply chain efficiency. The 260G bottle addresses both environmental concerns and operational efficiency for beverage producers, enabling brands to meet sustainability goals while maintaining consumer perception of quality. Its adoption is expected to influence competitors and stimulate innovation in lightweight glass packaging globally

- In June 2025, Gerresheimer AG reported EUR 898.6 million (USD 1.02 billion) in 2024 primary packaging glass revenue and projected an 8–10% organic CAGR, fueled by strong demand from the pharmaceutical sector. This highlights the resilience of glass packaging beyond food and beverages, demonstrating its critical role in pharma and healthcare for safety, durability, and product preservation. The forecasted growth also reflects increasing adoption of high-quality, specialty glass products for injectable drugs, vials, and other medical applications. Gerresheimer’s performance signals strong investor confidence in glass packaging as a growth segment in healthcare and specialty markets

- In June 2025, O-I Glass secured USD 125 million from the U.S. Department of Energy to develop hybrid-furnace technology aimed at decarbonizing production and improving energy efficiency. This strategic investment represents a significant step toward reducing greenhouse gas emissions and enhancing sustainable manufacturing practices in the glass industry. By integrating hybrid furnaces, O-I Glass can achieve lower energy consumption and improved operational efficiency, which is likely to encourage other manufacturers to adopt similar eco-friendly technologies. This development strengthens O-I’s competitive position and also aligns the glass packaging market with global sustainability goals, further driving demand for environmentally responsible products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.