Global Glufosinate Market

Market Size in USD Billion

CAGR :

%

USD

3.34 Billion

USD

6.19 Billion

2025

2033

USD

3.34 Billion

USD

6.19 Billion

2025

2033

| 2026 –2033 | |

| USD 3.34 Billion | |

| USD 6.19 Billion | |

|

|

|

|

Glufosinate Market Size

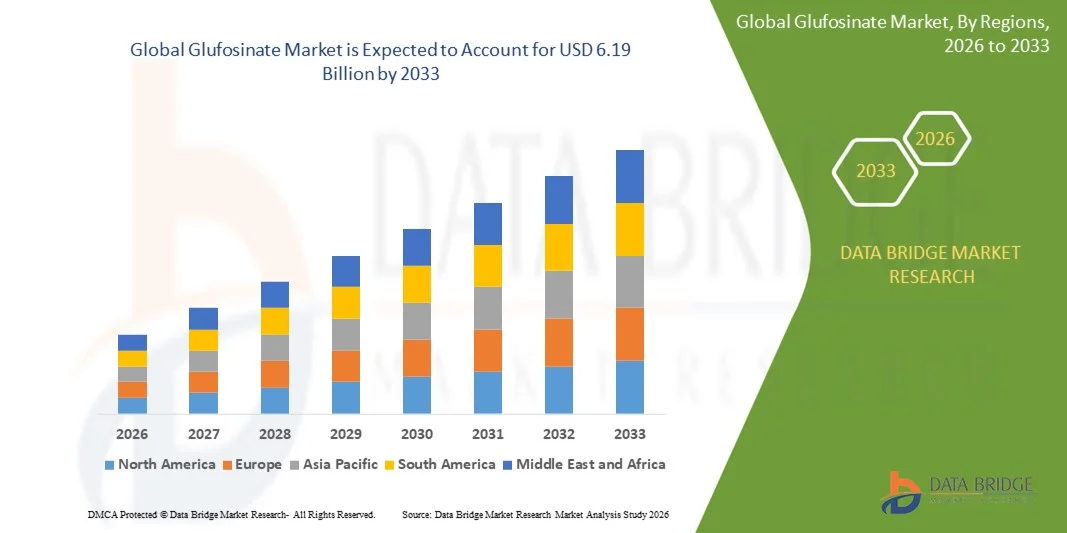

- The global glufosinate market size was valued at USD 3.34 billion in 2025 and is expected to reach USD 6.19 billion by 2033, at a CAGR of 8.0% during the forecast period

- The market growth is largely fueled by the increasing prevalence of herbicide-resistant weeds and the rising need for effective, non-selective weed control solutions across major crop systems. This trend is accelerating the adoption of glufosinate as farmers seek reliable alternatives to traditional herbicides to maintain crop productivity and operational efficiency

- Furthermore, expanding cultivation of herbicide-tolerant crops and the growing emphasis on yield optimization are reinforcing the role of glufosinate in modern agricultural practices. These converging factors are accelerating the uptake of glufosinate-based herbicides, thereby significantly supporting overall market growth

Glufosinate Market Analysis

- Glufosinate, a broad-spectrum post-emergence herbicide, plays a critical role in contemporary crop protection programs by enabling effective weed management across cereals, oilseeds, fruits, and vegetables. Its fast-acting nature and compatibility with integrated weed management strategies make it a preferred choice in both large-scale commercial farming and intensive cultivation systems

- The rising demand for glufosinate is primarily driven by increasing weed resistance to conventional herbicides, the expansion of genetically modified crop acreage, and the need for efficient labor-saving agricultural inputs. These factors collectively position glufosinate as a key component in sustaining crop yields and ensuring long-term agricultural productivity

- North America dominated the glufosinate market with a share of 33% in 2025, due to the widespread cultivation of genetically modified crops and the high adoption of advanced herbicide solutions

- Asia-Pacific is expected to be the fastest growing region in the glufosinate market during the forecast period due to expanding agricultural activities, rising food demand, and increasing adoption of modern farming inputs

- Liquid segment dominated the market with a market share of 52.5% in 2025, due to ease of handling, accurate dosing, and compatibility with conventional spraying equipment. Liquid formulations enable uniform application and rapid absorption, improving weed control efficiency across diverse crop systems. Their widespread availability and farmer familiarity further support strong adoption, particularly in large-scale commercial agriculture

Report Scope and Glufosinate Market Segmentation

|

Attributes |

Glufosinate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Glufosinate Market Trends

Rising Adoption of Glufosinate as an Alternative to Glyphosate

- A prominent trend in the glufosinate market is the increasing adoption of glufosinate-based herbicides as an effective alternative to glyphosate, driven by the rapid spread of glyphosate-resistant weed species across major agricultural regions. Farmers are increasingly integrating glufosinate into weed management programs to maintain crop productivity and reduce dependency on single-mode-of-action herbicides

- For instance, BASF has strengthened this trend through its Liberty herbicide portfolio, which is widely used in glufosinate-tolerant cropping systems to manage resistant broadleaf and grass weeds. The availability of branded, high-efficacy formulations from established agrochemical companies is reinforcing grower confidence in glufosinate solutions

- The expansion of glufosinate-tolerant crop traits is further accelerating adoption, as these systems enable flexible post-emergence weed control across diverse crop stages. Seed and trait developers are increasingly aligning crop technologies with glufosinate compatibility, supporting its broader integration into modern farming practices

- Horticultural and specialty crop growers are also adopting glufosinate due to its fast-acting weed control and suitability for orchard floors, vegetable rows, and non-crop areas. This is extending the use of glufosinate beyond row crops into high-value agricultural segments

- The trend is supported by continuous product innovation, including improved formulations that enhance absorption and reduce application variability. These developments are positioning glufosinate as a critical component of diversified weed management strategies

- Overall, the rising shift away from over-reliance on glyphosate and toward alternative herbicides is reinforcing sustained demand for glufosinate across global agricultural markets

Glufosinate Market Dynamics

Driver

Increasing Prevalence of Herbicide-Resistant Weeds

- The growing prevalence of herbicide-resistant weeds is a key driver for the glufosinate market, as resistance to widely used herbicides has become a significant challenge for farmers worldwide. Resistant species threaten crop yields and increase production costs, prompting growers to adopt alternative chemical solutions with different modes of action

- For instance, Bayer has highlighted the role of glufosinate-based weed control programs in addressing resistance issues within integrated crop management systems. The company promotes diversified herbicide usage to maintain long-term field effectiveness and reduce resistance buildup

- Weed resistance is particularly prominent in large-scale cultivation of corn, soybean, and cotton, where repeated use of similar herbicides has reduced efficacy. Glufosinate offers a reliable post-emergence option, helping farmers regain control over problematic weed populations

- Agricultural extension services and research institutions are increasingly advocating diversified weed control strategies, which include glufosinate as a core component. This guidance is influencing grower practices and reinforcing market growth

- The persistent rise of resistant weeds continues to necessitate effective chemical alternatives, firmly positioning glufosinate as a critical driver-supported solution within global crop protection markets

Restraint/Challenge

Stringent Regulatory Scrutiny on Chemical Herbicides

- The glufosinate market faces notable challenges due to stringent regulatory scrutiny on chemical herbicides, particularly concerning environmental impact and human safety. Regulatory bodies impose strict approval processes, usage limitations, and periodic reviews that affect product availability across regions

- For instance, the European Food Safety Authority plays a central role in evaluating active substances such as glufosinate, influencing registration status and application guidelines within the European Union. These regulatory evaluations can restrict usage patterns and impact regional market growth

- Compliance with evolving regulatory standards increases development and registration costs for manufacturers, limiting the speed at which new formulations can enter the market. Smaller producers may face barriers in meeting extensive data and testing requirements

- Public concern over chemical inputs in agriculture has intensified regulatory oversight, leading to tighter controls and usage monitoring. This environment creates uncertainty for farmers and suppliers regarding long-term product continuity

- Despite strong agronomic demand, regulatory pressures remain a key constraint, requiring manufacturers to balance efficacy, safety, and compliance to sustain glufosinate market presence over the long term

Glufosinate Market Scope

The market is segmented on the basis of crop type and formulation type.

- By Crop Type

On the basis of crop type, the glufosinate market is segmented into cereals & grains, oilseeds & pulses, fruits & vegetables, and others. The cereals & grains segment dominated the market with the largest revenue share of 46.5% in 2025, driven by extensive global cultivation of crops such as corn, wheat, and rice and the rising incidence of herbicide-resistant weeds. Farmers increasingly rely on glufosinate for effective post-emergence weed control, supporting stable yields and operational efficiency. Its compatibility with genetically modified crops and conservation tillage practices further strengthens adoption across large-scale cereal farming systems. High acreage under cereals, combined with growing demand for food security, continues to support the segment’s leadership position.

The fruits & vegetables segment is anticipated to witness the fastest growth rate from 2026 to 2033, supported by expanding horticultural production and rising demand for high-quality produce. Growers favor glufosinate for its broad-spectrum weed control and relatively quick action, which helps maintain crop quality and reduce labor costs. Increasing adoption of intensive farming practices and greenhouse cultivation further accelerates demand in this segment. The shift toward commercial horticulture and export-oriented fruit and vegetable production is expected to sustain strong growth momentum.

- By Formulation Type

On the basis of formulation type, the glufosinate market is segmented into aqueous suspension, liquid, suspension concentrate, and others. The liquid formulation segment accounted for the largest market revenue share of 52.5% in 2025, driven by ease of handling, accurate dosing, and compatibility with conventional spraying equipment. Liquid formulations enable uniform application and rapid absorption, improving weed control efficiency across diverse crop systems. Their widespread availability and farmer familiarity further support strong adoption, particularly in large-scale commercial agriculture.

The soluble (liquid) concentrate segment is expected to register the fastest growth from 2026 to 2033, owing to its high solubility, storage stability, and reduced residue concerns. These formulations allow precise dilution and consistent performance under varying field conditions, appealing to professional growers and contract farming operations. Growing emphasis on optimized input usage and improved spray efficiency supports rising demand for advanced concentrate formulations. Continued innovation in formulation technology is likely to reinforce growth prospects for this segment.

Glufosinate Market Regional Analysis

- North America dominated the glufosinate market with the largest revenue share of 33% in 2025, driven by the widespread cultivation of genetically modified crops and the high adoption of advanced herbicide solutions

- Farmers across the region emphasize effective weed management and yield optimization, particularly in large-scale corn, soybean, and cotton farming systems

- This strong market position is further supported by well-established agricultural infrastructure, high awareness of herbicide-resistant weeds, and the presence of major agrochemical companies, reinforcing consistent demand for glufosinate-based products

U.S. Glufosinate Market Insight

The U.S. glufosinate market captured the largest revenue share within North America in 2025, supported by extensive acreage under herbicide-tolerant crops and the growing challenge of glyphosate-resistant weeds. Farmers increasingly adopt glufosinate as a reliable post-emergence herbicide to ensure effective weed control and stable crop yields. The strong focus on precision agriculture, combined with continuous product innovation and regulatory support for approved herbicide use, continues to propel market growth in the U.S.

Europe Glufosinate Market Insight

The Europe glufosinate market is projected to expand at a steady CAGR during the forecast period, primarily driven by the need for efficient weed management amid strict agricultural and environmental regulations. European growers seek herbicides that balance efficacy with controlled application, supporting the use of glufosinate in specific crop systems. Rising emphasis on sustainable farming practices and yield stability across cereals, oilseeds, and horticultural crops further contributes to regional market growth.

U.K. Glufosinate Market Insight

The U.K. glufosinate market is anticipated to grow at a moderate CAGR over the forecast period, supported by increasing awareness of herbicide resistance and the need for diversified weed control strategies. Farmers are adopting glufosinate as part of integrated weed management programs to maintain productivity in cereal and oilseed cultivation. The focus on efficient farm inputs and compliance with evolving agricultural regulations continues to shape market demand.

Germany Glufosinate Market Insight

The Germany glufosinate market is expected to expand at a notable CAGR during the forecast period, driven by the country’s strong emphasis on modern agricultural practices and crop productivity. German farmers prioritize precise herbicide application to optimize yields while meeting regulatory standards. The adoption of advanced spraying technologies and structured farm management systems supports consistent demand for glufosinate in the country.

Asia-Pacific Glufosinate Market Insight

The Asia-Pacific glufosinate market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, fueled by expanding agricultural activities, rising food demand, and increasing adoption of modern farming inputs. Rapid population growth and shrinking arable land are encouraging farmers to use effective herbicides to enhance crop output. The growing penetration of commercial farming practices and improving access to crop protection products are key factors driving regional growth.

Japan Glufosinate Market Insight

The Japan glufosinate market is gaining traction due to the country’s focus on high-efficiency agriculture and limited availability of arable land. Japanese farmers adopt glufosinate to support intensive cultivation practices and maintain crop quality. The integration of precision farming tools and a strong preference for reliable weed control solutions continue to support steady market expansion.

China Glufosinate Market Insight

The China glufosinate market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to extensive agricultural production, rising labor costs, and rapid modernization of farming practices. Chinese farmers increasingly rely on chemical herbicides to manage weeds efficiently across large crop areas. Strong domestic manufacturing capacity, supportive government initiatives for agricultural productivity, and growing adoption of herbicide-tolerant crops are key factors propelling market growth in China.

Glufosinate Market Share

The glufosinate industry is primarily led by well-established companies, including:

- LIER Chemical Co., Ltd. (China)

- ChemicalBook (China)

- Veyong (China)

- BASF SE (Germany)

- Bayer AG (Germany)

- UPL Limited (India)

- Syngenta AG (Switzerland)

- Nufarm Limited (Australia)

- Jiangsu Seven-continent Green Chemical Co., Ltd. (China)

- Zhejiang Yongnong Chemical Co., Ltd. (China)

- Fuhua Tongda Chemical Inc. (China)

- Sumitomo Chemical Co., Ltd. (Japan)

- Albaugh LLC (U.S.)

- Limin Group Co., Ltd. (China)

- FMC Corporation (U.S.)

- Corteva Agriscience (U.S.)

- Rainbow Agro (China)

Latest Developments in Global Glufosinate Market

- In March 2025, Shandong Lubachem strengthened its competitive position in the glufosinate market with the launch of Jinxunchu (glufosinate-P K⁺ 194 g/L SL), a second-generation herbicide offering higher absorption efficiency than conventional glufosinate-P salts. This advancement enables faster weed control and improved performance across diverse applications including orchards, vegetable rows, and crop rotations. By demonstrating strong efficacy against resistant weeds, the product enhances market confidence in next-generation glufosinate formulations and supports premium product adoption in China and other Asian markets

- In October 2024, BASF expanded the high-performance segment of the glufosinate market after its Liberty ULTRA herbicide received EPA registration, pending state-level approvals. The product’s patented Glu-L Technology and refined L-glufosinate ammonium deliver up to 20% better weed control than generic alternatives, positioning BASF strongly in value-added herbicide solutions. Its superior trial performance reinforces demand for branded glufosinate products in the U.S. market, particularly among growers facing herbicide-resistant weed pressure

- In May 2024, UPL Limited enhanced its footprint in traited crop protection following U.S. regulatory approval for a supplemental label amendment for its glufosinate-based Interline herbicide. The approval allows over-the-top application on glufosinate-tolerant camelina varieties, expanding glufosinate usage into emerging oilseed crops. This development supports market growth by broadening application scope and reinforcing glufosinate’s role in next-generation crop systems

- In February 2024, AMVAC Chemical Corporation advanced product differentiation in the glufosinate market with federal registration of its Zalo herbicide, developed using ProLease technology. By combining glufosinate with quizalofop, the product offers enhanced weed control flexibility, appealing to growers seeking multi-mode action solutions. Its commercial launch strengthened competition in the U.S. market and increased adoption of combination herbicide formulations

- In May 2022, Syngenta accelerated its participation in the L-glufosinate segment by introducing Gold Kelituo (L-glufosinate 20% AS) in the Chinese market. This launch marked a strategic move to strengthen Syngenta’s competitive position through innovation-driven product offerings. The entry of a global major into the L-glufosinate space intensified competition and supported broader adoption of high-purity glufosinate formulations in China

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Glufosinate Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Glufosinate Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Glufosinate Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.