Global Grease Market

Market Size in USD Billion

CAGR :

%

USD

5.45 Billion

USD

6.78 Billion

2021

2029

USD

5.45 Billion

USD

6.78 Billion

2021

2029

| 2022 –2029 | |

| USD 5.45 Billion | |

| USD 6.78 Billion | |

|

|

|

|

Market Analysis and Size

Rise in the automotive industry, overall the world is generating a positive outlook for the market. Grease is extensively used to lubricate suspension, chassis, ball joints, tie-rod ends, control arm-shafts and U-joints. In line with this, the growing demand for high-performance vehicles is favoring the market growth. Furthermore, grease prevents numerous auto parts, such as connectors, switches, wheel bearings and gears from wear and tear due to its stability and temperature tolerance properties. Moreover, the cleaner operations and extensive adoption of high-performance grease in wind power plants to eliminate residue positively impact market growth. Apart from this, the implementation of many government initiatives boost the market by using bio-based grease and the growing product demand in the manufacturing sector are expected to drive the market toward growth.

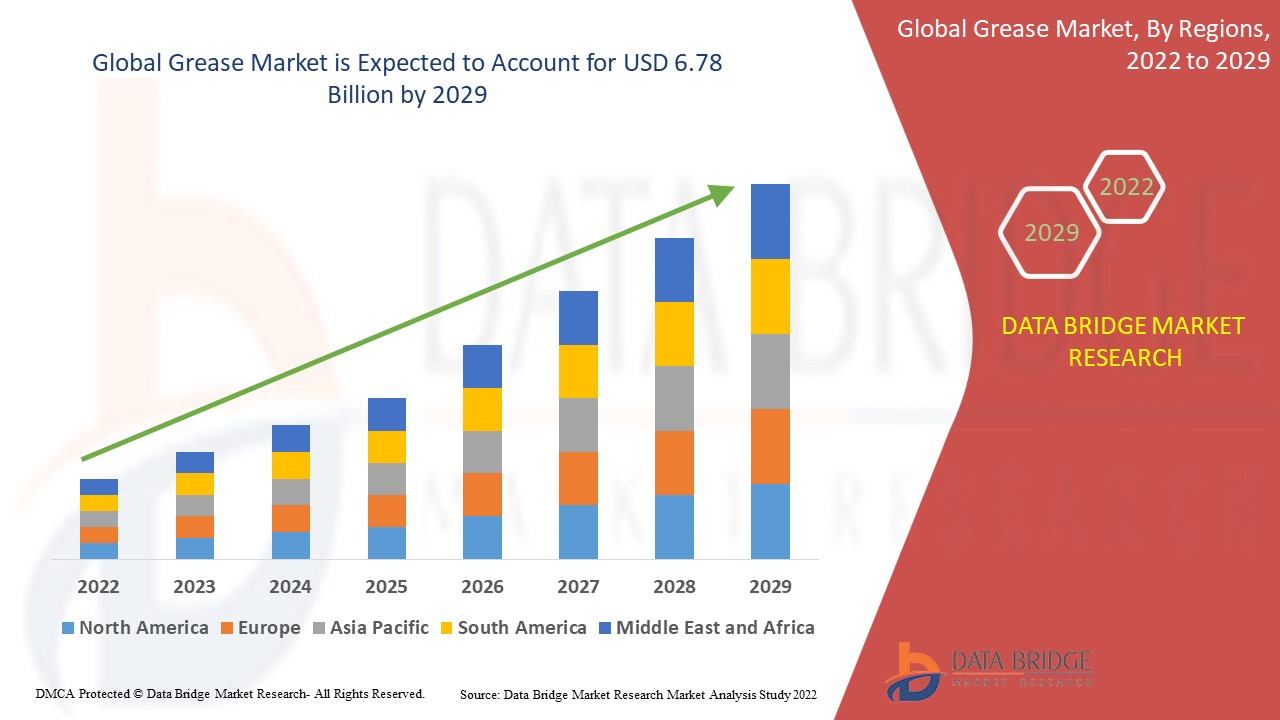

Data Bridge Market Research analyses that the grease market was valued at USD 5.45 billion in 2021 and is expected to reach USD 6.78 billion by 2029, registering a CAGR of 2.77% during the forecast period of 2022 to 2029. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, patent analysis and technological advancements.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Base Oil (Mineral, Synthetic, Bio-Based), Thickener Type (Metallic Soap, Non-Soap, Inorganic), End-Use Industry (Automotive, Construction, General Manufacturing, Metal, Mining, Food and Beverage, Power) |

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia and New Zealand, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, United Arab Emirate, Saudi Arabia, Egypt, Israel, South Africa, Rest of Middle East and Africa |

|

Market Players Covered |

Shell PLC. (UK), Chevron Corporation (US), Idemitsu Kosan Co., Ltd. (Japan), China Petrochemical corporation (China), BP p.l.c. (UK), TotalEnergies (France), and ExxonMobil Corporation (US), JX Nippon Oil & Gas Exploration Corporation (Japan), Chemtool Incorporated (US), Petroliam Nasional Berhad (Patrons) (Malaysia), FUCHS (Germany), Lubrita Europe B.V (Europe), Dow (US), Citgo Petroleum Corporation (US), Balmer Lawrie & Co. Ltd (India), Penrite Oil (Australia), Harrison Manufacturing Company (Australia) Axel Americas LLC (US), Calumet Branded Products llc (US), Hexol. Com (Canada), Indian Oil Corporation Ltd. (India), Phillips 66 company (US) |

|

Market Opportunities |

|

Market Definition

Grease is a semi-solid lubricant which is used for protecting vessels, vehicles machines, and their constituents from tear, wear and corrosion. It has lubricating fluids performance-enhancing additives, and thickeners. It is produce by using reduced fat of waste inedible lard, animal parts, and synthetic oil, or can be petroleum-derived containing a thickening agent. Grease acts as a sealant to decrease leakage of water and protects from impurities. It helps to maintain stop-start performance flexibility, protect bearing surfaces, and reduce friction. It provides enhanced rust-proofing performance, high thermal stability and wear resistance, and high viscosity index and corrosion protection. As a result, grease finds widespread application across several industries, such as power generation, automotive, chemical manufacturing, metallurgy, food and beverage.

Grease Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Rise in automation in various industries

Construction, manufacturing, and mining are some of the businesses that use several heavy-load equipment required for regular lubrication. Due to rising competition and increasing challenges in manual operations, the use of highly efficient technology is dynamic for the growth of all these industries. The growing cost of safety requirements and workforce is also expanding the demand for process automation. Hence, most companies are automating their operating systems, which is expected to drive the consumption of grease.

- Lower crude oil prices to benefit grease suppliers

The distinction significantly influences in the crude oil market affect the grease market. The volatile costs affect the margins of manufacturing industries. The majority of grease products are based on mineral oil, which is obtained from the crude oil. Thus, the costs of grease depend on the prices of crude oil which has positively affect the growth of the grease market.

- Increase the demand in automotive sector

Substantial growth in the automotive industry overall the globe is generating a positive outlook for the grease market. Grease is extensively used to suspension, chassis, lubricate ball joints, tie-rod ends, and control arm-shafts and U-joints. Therefore, the growing demand for high-performance vehicles is favoring the growth of grease market.

Opportunities

- Rise in product innovations

Moreover, many product innovations, such as the development of environment-friendly and bio-based grease manufactured using non-toxic and renewable materials with low sulfur levels, are providing a considerable boost to market growth.

- Adoption of high performance grease

The extensive adoption of high-performance grease in wind power plants to ensure cleaner operations and eliminate residue positively impacts market growth which will act as market drivers and further boost beneficial opportunities for the market's growth rate.

Restraints/ Challenges

The growth of the grease market is restrained by many regulatory rules issued by different governing authorities. Environmental Protection Agency (EPA) imposes rules to ensure that industries treated pollutants in their wastes to protect wastewater treatment plants. All these guidelines apply pressure on grease producers and forced them to invest in eco-friendly products. Furthermore, the factors such as equipment, exchange charges, fluctuation in development of self-lubricating and unfavorable accessibility of raw materials are projected to restrain the growth of the market during the forecast period.

This grease market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the grease market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Grease Market

In 2019, a coronavirus epidemic occurred, resulting in a global pandemic of COVID-19. Companies that used to play a big role have shifted their operations away from the source. The epidemic of COVID-19 has caused momentous social and economic disruption. The pandemic has had an influence on the value chain and supply chain of several industries. The grease market is not an exception. The impact of the COVID-19 pandemic will be analysed based on the overall industry, including both the supply side and demand side outlooks. The lockdown and travel bans imposed in most of the major cities have reduced the production of oil in the country. However, Most of the businesses have now reopened, which is expected to create demand for grease.

Recent Development

- In March 2021, Castrol declared that they will launch of Castrol ON (a Castrol e-fluid range that includes e-coolants, e-gear oils, and e-greases) to its product portfolio. This range is specially considered for electric vehicles.

- In February 2020, a UAE-based lubricants manufacturer, GP Global announced its plans in western India to invest USD 14 million in building a greenfield lubricant blending plant which will produce lubricants, grease, and white oil.

- In March 2020, Royal Dutch Shell PLC, doubled its production capacity in the lubricant plant in Java. This is to capture a bigger part of the domestic market

Global Grease Market Scope

The grease market is segmented on the basis of base oil, thickener type and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Base Oil

- Mineral

- Synthetic

- Bio-Based

Thickener Type

- Metallic Soap

- Non-Soap

- Inorganic

End-User

- Automotive

- Construction

- General Manufacturing

- Metal

- Mining

- Food and Beverage

- Power

Grease Market Regional Analysis/Insights

The grease market is analysed and market size insights and trends are provided by country, base oil, thickener type and end-user as referenced above.

The countries covered in the grease market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia and New Zealand, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, United Arab Emirate, Saudi Arabia, Egypt, Israel, South Africa, Rest of Middle East and Africa.

Asia-Pacific dominates the grease market in terms of market share and revenue and will continue to flourish its dominance during the forecast period. This is due to the rising demand for grease in this region. The Asia-Pacific region dominates the grease market, with China leading the way in terms of huge production and consumption of grease. Due to the ease of huge production and consumption grease, China leads the Asia-Pacific market.

During the projected period, North America is expected to be the fastest developing region due to the rising demand of grease in automotive sector in this region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Grease Market Share Analysis

The grease market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to grease market.

Some of the major players operating in the grease market are:

- Shell PLC. (UK)

- Chevron Corporation (US)

- Idemitsu Kosan Co., Ltd. (Japan)

- China Petrochemical Corporation (China)

- BP p.l.c. (UK)

- TotalEnergies (France)

- ExxonMobil Corporation (US)

- JX Nippon Oil & Gas Exploration Corporation (Japan)

- Chemtool Incorporated (US)

- Petroliam Nasional Berhad (Patrons) (Malaysia)

- FUCHS (Germany)

- Lubrita Europe B.V (Europe)

- Dow (US)

- Citgo Petroleum Corporation (US)

- Balmer Lawrie & Co. Ltd (India)

- Penrite Oil (Australia)

- Harrison Manufacturing Company (Australia)

- Axel Americas LLC (US)

- Calumet Branded Products llc (US)

- Hexol. Com (Canada)

- Indian Oil Corporation Ltd. (India)

- Phillips 66 Company (US)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL GREASE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL GREASE MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 SECONDARY SOURCES

2.15 GLOBAL GREASE MARKET: RESEARCH SNAPSHOT

2.16 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

5.8.1 PRODUCT CODES

5.8.2 CERTIFIED STANDARDS

5.8.3 SAFETY STANDARDS

5.8.3.1. MATERIAL HANDLING & STORAGE

5.8.3.2. TRANSPORT & PRECAUTIONS

5.8.3.3. HARAD IDENTIFICATION

6 PRICING ANALYSIS

7 SUPPLY CHAIN ANALYSIS

7.1 OVERVIEW

7.2 LOGISTIC COST SCENARIO

7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

8 CLIMATE CHANGE SCENARIO

8.1 ENVIRONMENTAL CONCERNS

8.2 INDUSTRY RESPONSE

8.3 GOVERNMENT’S ROLE

8.4 ANALYST RECOMMENDATIONS

9 GLOBAL GREASE MARKET, BY BASE OIL, 2022-2031 (USD MILLION) (KILO TONS)

(VALUE, VOLUME AND ASP FOR EACH SEGMENT WILL BE PROVIDED)

9.1 OVERVIEW

9.2 MINERAL OIL

9.3 SYNTHETIC OIL

9.4 BIO-BASED OIL

10 GLOBAL GREASE MARKET, BY THICKENER TYPE, 2022-2031 (USD MILLION)

10.1 OVERVIEW

10.2 METALLIC SOAP THICKENERS

10.3 NON-SOAP THICKENERS

10.4 INORGANIC THICKENERS

10.5 ALUMINUM THICKENERS

10.6 BENTANE THICKENERS

10.7 CALCIUM THICKENERS

10.8 LITHIUM THICKENERS

10.9 POLYUREA THICKENERS

10.1 SODIUM THICKENERS

10.11 NATURAL THICKENERS

10.12 OTHER THICKENERS

11 GLOBAL GREASE MARKET, BY END-USER, 2022-2031 (USD MILLION)

11.1 OVERVIEW

11.2 AUTOMOTIVE

11.3 POWER GENERATION

11.4 CONSTRUCTION & OFF HIGHWAYS

11.5 GENERAL MANUFACTURING

11.6 AGRICULTURE

11.7 ENERGY

11.8 FOOD PROCESSING

11.9 METAL

11.1 MINING

11.11 OTHERS

12 GLOBAL GREASE MARKET, BY SALES CHANNEL, 2022-2031 (USD MILLION)

12.1 OVERVIEW

12.2 OEM

12.3 AFTERMARKET

13 GLOBAL GREASE MARKET, BY REGION, 2022-2031 (USD MILLION) (KILO TONS)

13.1 GLOBAL GREASE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.2 NORTH AMERICA

13.2.1 U.S.

13.2.2 CANADA

13.2.3 MEXICO

13.3 EUROPE

13.3.1 GERMANY

13.3.2 U.K.

13.3.3 ITALY

13.3.4 FRANCE

13.3.5 SPAIN

13.3.6 RUSSIA

13.3.7 SWITZERLAND

13.3.8 TURKEY

13.3.9 BELGIUM

13.3.10 NETHERLANDS

13.3.11 NORWAY

13.3.12 SWEDEN

13.3.13 FINLAND

13.3.14 DENMARK

13.3.15 POLAND

13.3.16 REST OF EUROPE

13.4 ASIA-PACIFIC

13.4.1 JAPAN

13.4.2 CHINA

13.4.3 SOUTH KOREA

13.4.4 INDIA

13.4.5 SINGAPORE

13.4.6 THAILAND

13.4.7 INDONESIA

13.4.8 MALAYSIA

13.4.9 PHILIPPINES

13.4.10 AUSTRALIA

13.4.11 NEW ZEALAND

13.4.12 VIETNAM

13.4.13 TAIWAN

13.4.14 REST OF ASIA-PACIFIC

13.5 SOUTH AMERICA

13.5.1 BRAZIL

13.5.2 ARGENTINA

13.5.3 REST OF SOUTH AMERICA

13.6 MIDDLE EAST AND AFRICA

13.6.1 SOUTH AFRICA

13.6.2 EGYPT

13.6.3 SAUDI ARABIA

13.6.4 UNITED ARAB EMIRATES

13.6.5 ISRAEL

13.6.6 OMAN

13.6.7 BAHRAIN

13.6.8 QATAR

13.6.9 KUWAIT

13.6.10 REST OF MIDDLE EAST AND AFRICA

14 GLOBAL GREASE MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.5 MERGERS AND ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

14.7 EXPANSIONS

14.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

16 GLOBAL GREASE MARKET - COMPANY PROFILES

16.1 SHELL PLC

16.1.1 COMPANY SNAPSHOT

16.1.2 PRODUCT PORTFOLIO

16.1.3 REVENUE ANALYSIS

16.1.4 RECENT DEVELOPEMENTS

16.2 TOTAL ENERGIES

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 REVENUE ANALYSIS

16.2.4 RECENT DEVELOPEMENTS

16.3 CHEVRON CORPORATION

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 REVENUE ANALYSIS

16.3.4 RECENT DEVELOPEMENTS

16.4 EXXONMOBIL CORPORATION

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 REVENUE ANALYSIS

16.4.4 RECENT DEVELOPEMENTS

16.5 BP PLC

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 REVENUE ANALYSIS

16.5.4 RECENT DEVELOPEMENTS

16.6 IDEMITSU KOSAN CO., LTD.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 REVENUE ANALYSIS

16.6.4 RECENT DEVELOPEMENTS

16.7 SINOPEC

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 REVENUE ANALYSIS

16.7.4 RECENT DEVELOPEMENTS

16.8 FUCHS PETROLUB SE

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 REVENUE ANALYSIS

16.8.4 RECENT DEVELOPEMENTS

16.9 VALVOLINE

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 REVENUE ANALYSIS

16.9.4 RECENT DEVELOPEMENTS

16.1 ENEOS GROUP

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 REVENUE ANALYSIS

16.10.4 RECENT DEVELOPEMENTS

16.11 PETRONAS

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 REVENUE ANALYSIS

16.11.4 RECENT DEVELOPEMENTS

16.12 MOSIL LUBRICANTS

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 REVENUE ANALYSIS

16.12.4 RECENT DEVELOPEMENTS

16.13 GAZPROMNEFT - LUBRICANTS LTD. (GAZPROM NEFT PJSC)

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 REVENUE ANALYSIS

16.13.4 RECENT DEVELOPEMENTS

16.14 KLÜBER LUBRICATION (FREUDENBERG CHEMICAL SPECIALITIES SE & CO. KG)

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 REVENUE ANALYSIS

16.14.4 RECENT DEVELOPEMENTS

16.15 LUKEOIL

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 REVENUE ANALYSIS

16.15.4 RECENT DEVELOPEMENTS

16.16 PETROMIN CORPORATION (AL DABBAGH GROUP HOLDING COMPANY LIMITED)

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 REVENUE ANALYSIS

16.16.4 RECENT DEVELOPEMENTS

16.17 JX NIPPON OIL & ENERGY CORPORATION

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 REVENUE ANALYSIS

16.17.4 RECENT DEVELOPEMENTS

16.18 AXEL AMERICAS LLC

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 REVENUE ANALYSIS

16.18.4 RECENT DEVELOPEMENTS

16.19 BALMER LAWRIE & CO. LTD.

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 REVENUE ANALYSIS

16.19.4 RECENT DEVELOPEMENTS

16.2 BEL-RAY COMPANY, LLC

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 REVENUE ANALYSIS

16.20.4 RECENT DEVELOPEMENTS

16.21 CHEMTOOL INCORPORATED

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 REVENUE ANALYSIS

16.21.4 RECENT DEVELOPEMENTS

16.22 CITGO PETROLEUM CORPORATION

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 REVENUE ANALYSIS

16.22.4 RECENT DEVELOPEMENTS

16.23 HARRISON MANUFACTURING CO. PTY LTD.

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 REVENUE ANALYSIS

16.23.4 RECENT DEVELOPEMENTS

16.24 HEXOL INTERNATIONAL LTD.

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 REVENUE ANALYSIS

16.24.4 RECENT DEVELOPEMENTS

16.25 INDIAN OIL CORPORATION LTD.

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 REVENUE ANALYSIS

16.25.4 RECENT DEVELOPEMENTS

16.26 MARATHON PETROLEUM CORPORATION

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 REVENUE ANALYSIS

16.26.4 RECENT DEVELOPEMENTS

16.27 PENRITE OIL COMPANY

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 REVENUE ANALYSIS

16.27.4 RECENT DEVELOPEMENTS

16.28 QUAKERHOUGHTON

16.28.1 COMPANY SNAPSHOT

16.28.2 PRODUCT PORTFOLIO

16.28.3 REVENUE ANALYSIS

16.28.4 RECENT DEVELOPEMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

17 RELATED REPORTS

18 QUESTIONNAIRE

19 CONCLUSION

20 ABOUT DATA BRIDGE MARKET RESEARCH

Global Grease Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Grease Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Grease Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.