Global Green Cement Market

Market Size in USD Billion

CAGR :

%

USD

41.11 Billion

USD

68.81 Billion

2025

2033

USD

41.11 Billion

USD

68.81 Billion

2025

2033

| 2026 –2033 | |

| USD 41.11 Billion | |

| USD 68.81 Billion | |

|

|

|

|

Green Cement Market Size

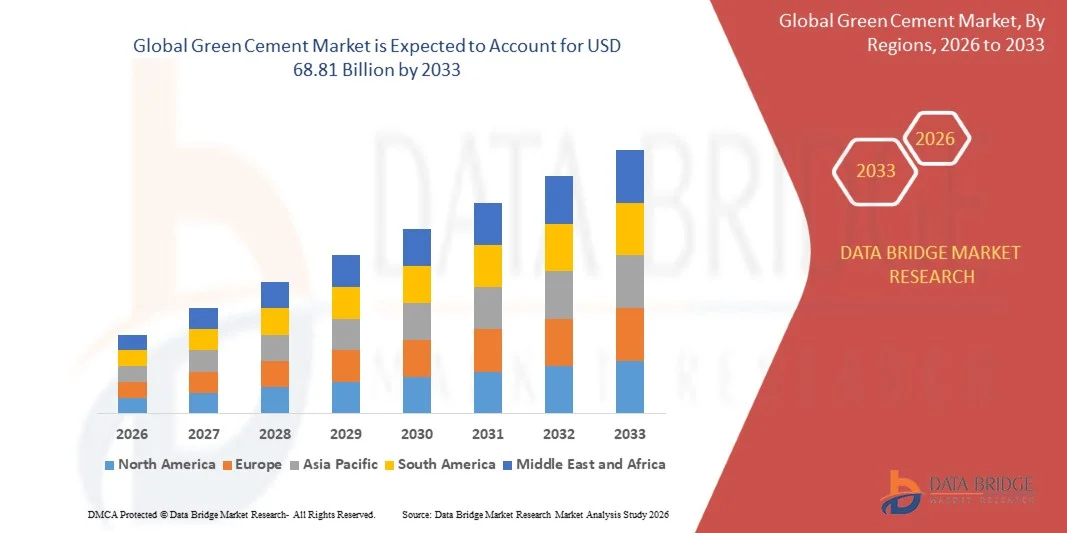

- The global green cement market size was valued at USD 41.11 billion in 2025 and is expected to reach USD 68.81 billion by 2033, at a CAGR of 6.65% during the forecast period

- The market growth is largely fueled by the increasing adoption of sustainable construction practices and government initiatives promoting low-carbon building materials, leading to higher demand for green cement in residential, commercial, and infrastructure projects

- Furthermore, rising awareness among developers, builders, and homeowners about the environmental benefits of fly-ash, slag-based, and recycled aggregate cements is establishing green cement as the preferred choice for eco-friendly construction. These factors are accelerating adoption and significantly boosting the market’s growth

Green Cement Market Analysis

- Green cement, offering reduced carbon footprint and sustainable alternatives to traditional cement, is becoming an essential material in modern construction projects across residential, commercial, and industrial sectors due to its environmental benefits and compliance with green building certifications

- The escalating demand for green cement is primarily fueled by stringent environmental regulations, rising global focus on carbon emission reduction, and the growing emphasis on sustainable and energy-efficient construction practices

- North America dominated the green cement market with a share of 37.67% in 2025, due to increasing adoption of sustainable construction practices and growing government incentives for eco-friendly building materials

- Asia-Pacific is expected to be the fastest growing region in the green cement market during the forecast period due to rapid urbanization, large-scale infrastructure development, and growing environmental awareness in countries such as China, India, and Japan

- Fly-ash based segment dominated the market with a market share of 43% in 2025, due to its proven environmental benefits and widespread availability as a by-product from thermal power plants. Construction companies often prioritize fly-ash based green cement for its high durability, enhanced workability, and cost-effectiveness compared to conventional cement. The segment also benefits from government incentives promoting industrial by-product utilization and sustainable construction practices. Furthermore, fly-ash based cement integrates well with existing concrete mixes and modern construction technologies, reinforcing its market dominance

Report Scope and Green Cement Market Segmentation

|

Attributes |

Green Cement Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Green Cement Market Trends

“Rising Adoption of Low-Carbon and Sustainable Construction Materials”

- A significant trend in the green cement market is the growing adoption of low-carbon and sustainable construction materials, driven by increasing environmental awareness, regulatory pressures to reduce carbon emissions, and the global push toward energy-efficient building practices. The trend is shaping construction activities across residential, commercial, and infrastructure sectors, as builders and developers prioritize environmentally responsible alternatives to conventional cement

- For instance, Holcim’s ECOPlanet green cement, launched across Europe and North America, delivers at least 30% lower carbon footprint while maintaining high performance, encouraging adoption in new construction and renovation projects. This initiative demonstrates how major cement producers are integrating sustainability into their offerings to meet market demand

- The shift toward low-carbon materials is particularly evident in large-scale infrastructure and smart city projects, where fly-ash, slag-based, and recycled aggregate cements are increasingly used to comply with environmental standards. This trend is promoting circular economy principles by utilizing industrial by-products and reducing reliance on traditional clinker-based cement

- Government and private sector construction projects are progressively incorporating green cement in green building certifications and LEED-compliant structures. This adoption is reinforcing the role of sustainable cement in achieving long-term carbon reduction targets

- The trend is also accelerating research and development in innovative formulations, enabling manufacturers to improve performance characteristics, reduce energy consumption, and enhance durability while minimizing environmental impact

- Overall, the rising preference for eco-friendly building materials is strengthening the green cement market, positioning it as a key driver for sustainable construction practices globally

Green Cement Market Dynamics

Driver

“Growing Government Initiatives and Incentives for Eco-Friendly Building Practices”

- The green cement market is being driven by government regulations, incentives, and programs aimed at promoting the use of low-carbon construction materials. Policies targeting CO2 emission reduction, energy efficiency, and sustainable infrastructure development are creating substantial opportunities for green cement adoption

- For instance, JSW Cement’s USD 390 million investment in integrated green cement facilities in Madhya Pradesh and Uttar Pradesh aligns with India’s national policies promoting sustainable construction and energy-efficient manufacturing. Such initiatives demonstrate how regulatory support stimulates both capacity expansion and market uptake

- Internationally, initiatives such as the European Union’s Green Deal and building code reforms in countries such as Germany and Japan are encouraging developers to select environmentally friendly cement alternatives. This regulatory environment reinforces the growing reliance on green cement for both new constructions and renovation projects

- The increasing funding and subsidies for low-carbon building materials are motivating manufacturers to scale up production, invest in R&D, and improve technology adoption. This support is strengthening the supply chain for eco-friendly cement products

- The growing emphasis on green certification for residential, commercial, and industrial buildings is also promoting the use of sustainable cement solutions. Developers are prioritizing materials that help meet sustainability goals and corporate social responsibility targets, further propelling market growth

Restraint/Challenge

“High Production Costs and Limited Availability of Green Raw Materials”

- The green cement market faces challenges due to the higher production costs and restricted availability of raw materials required for low-carbon cement formulations, such as fly-ash, slag, and recycled aggregates. These factors limit widespread adoption and increase the price of green cement compared with conventional cement

- For instance, Calera Corporation and Solidia Technologies face operational constraints as sourcing sufficient quantities of industrial by-products such as fly-ash and slag depends on consistent availability from power plants and steel manufacturing facilities. Supply limitations can delay production and restrict scaling efforts

- The production of green cement also involves specialized technologies, additional energy input for low-carbon processing, and stringent quality control measures to ensure performance parity with traditional cement. These requirements further elevate costs and operational complexity

- Limited raw material supply chains in emerging markets, coupled with high logistics costs for transporting eco-friendly materials, reduce accessibility and market penetration, particularly in regions with nascent green infrastructure adoption

- These challenges collectively necessitate investment in innovative material sourcing, process optimization, and strategic partnerships to balance cost, supply, and environmental objectives, which can be a barrier for smaller manufacturers entering the market

Green Cement Market Scope

The market is segmented on the basis of product and application.

• By Product

On the basis of product, the green cement market is segmented into fly-ash based, slag based, recycled aggregates, and others. The fly-ash based segment dominated the market with the largest market revenue share of 43% in 2025, driven by its proven environmental benefits and widespread availability as a by-product from thermal power plants. Construction companies often prioritize fly-ash based green cement for its high durability, enhanced workability, and cost-effectiveness compared to conventional cement. The segment also benefits from government incentives promoting industrial by-product utilization and sustainable construction practices. Furthermore, fly-ash based cement integrates well with existing concrete mixes and modern construction technologies, reinforcing its market dominance.

The recycled aggregates segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising construction and demolition waste recycling initiatives and urban infrastructure development. For instance, companies such as HeidelbergCement are investing in recycled aggregate-based green cement solutions for sustainable urban projects. Recycled aggregates-based cement reduces environmental impact by minimizing landfill use and conserving natural resources, making it highly appealing to eco-conscious builders. The growing focus on green building certifications and circular economy principles further accelerates adoption of this segment, especially in commercial and public construction projects.

• By Application

On the basis of application, the green cement market is segmented into residential, commercial, and others. The residential segment dominated the market with the largest market revenue share in 2025, driven by increasing awareness among homeowners regarding eco-friendly construction materials and energy-efficient building solutions. Residential developers often prefer green cement for its ability to enhance indoor air quality and reduce the carbon footprint of housing projects. The segment is also supported by government programs encouraging sustainable housing and affordable green homes, leading to steady adoption. In addition, residential green cement benefits from compatibility with modern construction techniques and materials, making it a preferred choice for both urban and suburban housing projects.

The commercial segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by rapid urbanization, expansion of office complexes, and green building initiatives in institutional and corporate construction. For instance, LafargeHolcim has introduced commercial-grade green cement products for large-scale infrastructure projects with sustainability goals. Commercial buildings increasingly adopt green cement to meet green building certifications and corporate sustainability targets, which enhances market penetration. The segment also benefits from innovative applications in high-rise buildings, hotels, and shopping complexes, where durability, energy efficiency, and environmental impact are key decision factors.

Green Cement Market Regional Analysis

- North America dominated the green cement market with the largest revenue share of 37.67% in 2025, driven by increasing adoption of sustainable construction practices and growing government incentives for eco-friendly building materials

- Consumers in the region are prioritizing the use of low-carbon, fly-ash based cement and other green alternatives for residential and commercial projects

- This widespread adoption is further supported by stringent environmental regulations, rising awareness of carbon footprint reduction, and the growing trend of green building certifications, establishing green cement as a preferred solution for sustainable construction projects

U.S. Green Cement Market Insight

The U.S. green cement market captured the largest revenue share in 2025 within North America, fueled by extensive adoption in residential, commercial, and infrastructure projects. Builders and developers are increasingly choosing fly-ash and slag-based cements to meet sustainability targets and comply with environmental norms. The growing emphasis on LEED-certified buildings, coupled with demand for energy-efficient and durable construction materials, further drives market growth. Moreover, government initiatives promoting low-carbon construction and industrial by-product utilization significantly contribute to the expansion of the green cement sector.

Europe Green Cement Market Insight

The Europe green cement market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strict carbon emission regulations and increasing demand for eco-friendly infrastructure. Urbanization and the push for energy-efficient buildings are fostering adoption of green cement in both residential and commercial projects. European consumers and developers are also motivated by environmental sustainability goals and government-backed incentives, which promote the use of fly-ash and recycled aggregate-based cement.

U.K. Green Cement Market Insight

The U.K. green cement market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising awareness of sustainable construction and stringent building codes. Concerns over carbon emissions and sustainability targets are encouraging both developers and homeowners to select green cement solutions. The U.K.’s focus on energy-efficient and eco-friendly buildings, combined with support for green infrastructure projects, is expected to continue to stimulate market growth.

Germany Green Cement Market Insight

The Germany green cement market is expected to expand at a considerable CAGR during the forecast period, fueled by strong regulatory frameworks promoting low-carbon construction and the adoption of sustainable materials. Germany’s emphasis on environmental sustainability, innovation, and industrial efficiency encourages the use of fly-ash and slag-based cement across residential and commercial projects. Integration of green cement in modern construction techniques is becoming increasingly prevalent, aligning with local environmental and technological standards.

Asia-Pacific Green Cement Market Insight

The Asia-Pacific green cement market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid urbanization, large-scale infrastructure development, and growing environmental awareness in countries such as China, India, and Japan. The region’s push towards sustainable cities, combined with government initiatives promoting low-carbon construction, is fueling demand for green cement.

Japan Green Cement Market Insight

The Japan green cement market is gaining momentum due to increasing government support for sustainable construction and the demand for durable, low-carbon materials. Japanese developers are adopting green cement in residential, commercial, and public infrastructure projects to achieve environmental certifications. The integration of green cement with modern construction practices is also supporting market growth.

China Green Cement Market Insight

The China green cement market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, rising construction activities, and increasing government regulations for eco-friendly building materials. China is investing heavily in sustainable infrastructure and green buildings, promoting the use of fly-ash and slag-based cement. Affordable availability, strong domestic production capabilities, and awareness of environmental benefits are key factors driving market growth in China.

Green Cement Market Share

The green cement industry is primarily led by well-established companies, including:

- HEIDELBERGCEMENT AG (Germany)

- LafargeHolcim Ltd. (Switzerland)

- TAIHEIYO CEMENT CORPORATION (Japan)

- Taiwan Cement Corporation (Taiwan)

- EcoChem (U.S.)

- ACC Limited (India)

- UltraTech Cement Ltd. (India)

- Calera Corporation (U.S.)

- Ceratech, Inc. (U.S.)

- Solidia Technologies (U.S.)

- Anhui Conch Cement Company Limited (China)

- CEMEX Colombia SA (Colombia)

- BASF SE (Germany)

- Pidilite Industries Ltd. (India)

- MAPEI S.p.A. (Italy)

- CHRYSO GROUP (France)

- Kiran Global Chem Limited (India)

- Dow (U.S.)

Latest Developments in Global Green Cement Market

- In November 2023, Heidelberg Cement launched a low-carbon cement brand aimed at significantly reducing greenhouse gas emissions during the cement manufacturing and mixing process. This development strengthens Heidelberg Cement’s position in the green cement market by providing environmentally responsible solutions, attracting sustainability-focused construction projects, and reinforcing the company’s leadership in low-carbon construction materials

- In January 2023, ACC Limited introduced ‘ACC ECOMaxX,’ a range of green concrete solutions developed using Unique Green Ready Mix Technology. This innovation allows for maximizing environmental benefits by reducing CO2 emissions by up to 100%, positioning ACC as a key player in the green cement and concrete market and encouraging adoption among eco-conscious developers and large-scale infrastructure projects

- In October 2022, JSW Cement announced plans to invest USD 390 million in an integrated green cement production facility in Madhya Pradesh and a split grinding unit in Uttar Pradesh. The project includes a 2.5 MTPA grinding capacity, 2.5 MTPA clinker capacity, and a 15 MW waste heat recovery system. This strategic investment expands JSW Cement’s production capabilities, enhances sustainable operations, and meets rising demand for low-carbon cement in India, supporting both residential and commercial construction growth

- In July 2022, Hallett Group launched a USD 125 million green cement project across Port Adelaide, Port Augusta, Port Pirie, and Whyalla, designed to reduce CO2 emissions by 300,000 tons annually. This initiative reinforces Hallett Group’s commitment to sustainability, strengthens its regional market presence, and provides environmentally friendly options to construction companies aiming to meet stricter emission standards

- In July 2021, Holcim launched ECOPlanet, a range of green cement delivering at least 30% lower carbon footprints while maintaining equal or superior performance compared with traditional cement. Available in Romania, Germany, Switzerland, Canada, France, Spain, and Italy, and distributed across 15 countries, this product line enhances Holcim’s global market share in sustainable construction, supports green building projects, and sets a benchmark for low-carbon cement solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Green Cement Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Green Cement Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Green Cement Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.