Global Grocery Market

Market Size in USD Billion

CAGR :

%

USD

13.29 Billion

USD

20.40 Billion

2024

2032

USD

13.29 Billion

USD

20.40 Billion

2024

2032

| 2025 –2032 | |

| USD 13.29 Billion | |

| USD 20.40 Billion | |

|

|

|

|

Grocery Market Size

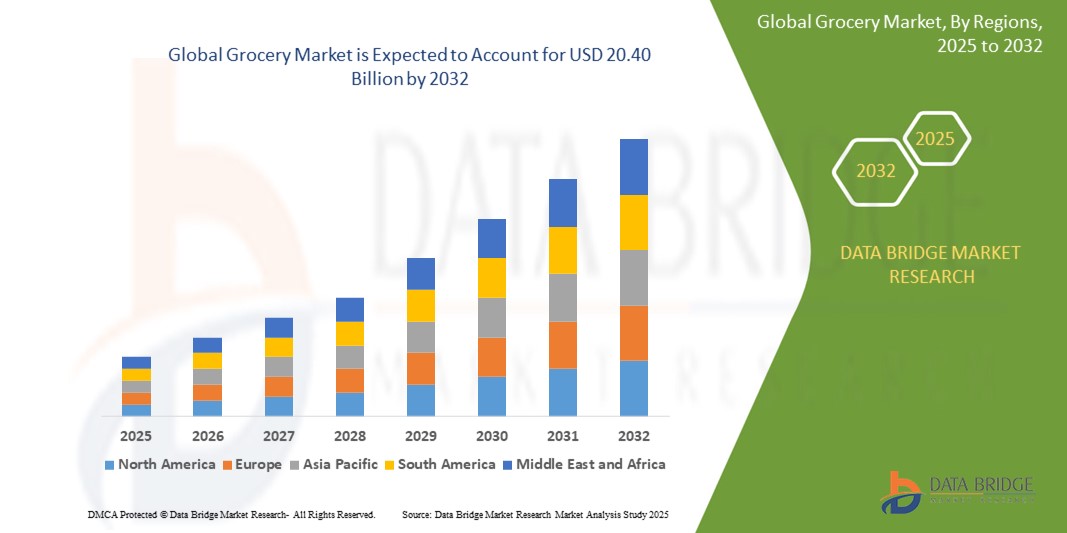

- The global grocery market size was valued at USD 13.29 billion in 2024 and is expected to reach USD 20.40 billion by 2032, at a CAGR of 5.50%during the forecast period

- The market growth is largely fueled by rising consumer preference for packaged, ready-to-eat, and convenience foods, alongside the rapid expansion of organized retail and e-commerce platforms, especially in emerging economies. Shifting lifestyles, increasing urbanization, and time-constrained routines are accelerating the demand for easily accessible grocery solutions across both developed and developing regions

- Furthermore, the growing emphasis on health and wellness, clean-label products, and sustainable packaging is reshaping product assortments and influencing purchasing decisions. These evolving consumer expectations, coupled with technological advancements in supply chain, cold storage, and last-mile delivery, are driving innovation and efficiency across the grocery value chain, thereby significantly boosting the industry's growth

Grocery Market Analysis

- The grocery market encompasses the retail sale of food, beverages, household products, and personal care items across various formats including supermarkets, convenience stores, and online platforms. It plays a fundamental role in daily consumption, with demand influenced by demographic shifts, consumer preferences, and evolving retail models

- The market’s upward trajectory is primarily driven by increasing demand for health-focused, organic, and functional food products, alongside rapid digitalization in retail. The proliferation of mobile grocery apps, real-time inventory systems, and AI-based personalization is transforming how consumers shop, while sustainability goals are prompting retailers to adopt eco-friendly practices across packaging and sourcing

- Asia-Pacific dominated the grocery market with a share of 37.1% in 2024, due to rapid urbanization, expanding middle-class population, and rising disposable incomes across the region

- North America is expected to be the fastest growing region in the grocery market during the forecast period due to strong demand for organic, functional, and convenience-driven grocery products

- Packaged food segment dominated the market with a market share of 39% in 2024, due to rising urbanization, growing demand for convenience, and increasing reliance on ready-to-eat meals and long-shelf-life products. Consumers increasingly prefer packaged foods for their hygiene, safety, and labeling transparency, especially in metropolitan areas with busy lifestyles. The market for packaged foods is further supported by strong retail penetration and innovations in food preservation, portion control, and packaging technology

Report Scope and Grocery Market Segmentation

|

Attributes |

Grocery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Grocery Market Trends

“Increasing Focus on Sustainability and Health & Wellness”

- The grocery market is rapidly evolving as consumers increasingly prioritize sustainability and health, pushing retailers and brands to adopt eco-friendly practices and expand assortments of health-focused products

- For instance, major grocery chains such as Whole Foods Market (Amazon), Kroger, Walmart, Albertsons, and retailer-branded organic lines such as Trader Joe’s and Aldi are investing in sustainable packaging, local sourcing, and expanding organic, plant-based, and functional food categories to meet shifting consumer demands

- Innovations include reducing plastic packaging, increasing recyclable and compostable materials, and promoting farm-to-table and transparent supply chains to appeal to eco-conscious shoppers

- Growing consumer interest in health and wellness drives product demand for fresh, organic, gluten-free, lactose-free, and allergen-friendly foods—reflecting rising public awareness about nutrition and lifestyle-related diseases

- Digital transformation facilitates enhanced transparency, with QR codes and apps providing detailed product origin, nutrition, and sustainability information to shoppers

- Retailers are incorporating AI and data analytics to optimize inventory, reduce food waste, and personalize product recommendations aligned with health and sustainability preferences

Grocery Market Dynamics

Driver

“Rising Incidence of Lactose Intolerance”

- Increasing recognition and diagnosis of lactose intolerance in diverse populations is driving demand for dairy alternatives and lactose-free grocery products, reshaping product portfolios and consumer preferences

- For instance, companies such as Danone (Alpro), Chobani, Silk (Danone), Oatly, and Blue Diamond Growers lead in developing plant-based milk alternatives, lactose-free yogurts, and dairy-free snacks tailored to lactose-intolerant consumers across North America and Asia Pacific

- Rising consumption of these specialty dairy alternatives is supported by educational campaigns and health-focused marketing addressing digestive health and dietary inclusivity

- The growth of veganism, flexitarian diets, and increasing availability of lactose-free options in grocery aisles encourage consumers to switch or supplement traditional dairy products with alternatives

- Expansion of lactose-free product lines across beverages, cheese, dessert, and infant nutrition categories indicates broadening market acceptance and innovation incentives

Restraint/Challenge

“Intense Competition among Grocery Retailers”

- The grocery retail market is highly competitive, with traditional grocers, discounters, online platforms, and specialty retailers battling aggressively on price, product assortment, and convenience

- For instance, leading retailers such as Walmart, Amazon Grocery, Costco, Aldi, and Kroger compete fiercely to capture market share through pricing strategies, private label growth, omnichannel service offerings, and loyalty programs

- The rise of online grocery and delivery models adds pressure on brick-and-mortar stores to innovate and improve customer experience, raising operational complexities and margins pressure

- Small independent grocers and regional chains face challenges maintaining competitive pricing and assortment variety given large-scale operations and technology investments by industry giants

- Fluctuating input costs, supply chain disruptions, and changing consumer preferences require continuous adaptation, increasing the risk and cost of competition among retailers

Grocery Market Scope

The market is segmented on the basis of product type and distribution channel.

- By Product Type

On the basis of product type, the grocery market is segmented into packaged food, unpackaged food, drinks, tobacco, household products, and others. The packaged food segment dominated the largest market revenue share of 39% in 2024, owing to rising urbanization, growing demand for convenience, and increasing reliance on ready-to-eat meals and long-shelf-life products. Consumers increasingly prefer packaged foods for their hygiene, safety, and labeling transparency, especially in metropolitan areas with busy lifestyles. The market for packaged foods is further supported by strong retail penetration and innovations in food preservation, portion control, and packaging technology.

The drinks segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increasing consumer shift toward functional beverages, health drinks, and bottled water. The growing health-conscious population, rising disposable incomes, and expansion of premium and organic beverage offerings are accelerating demand in this segment. Moreover, the proliferation of single-serve and on-the-go drink formats is resonating with young, mobile consumers who seek convenience without compromising health or quality.

- By Distribution Channel

On the basis of distribution channel, the grocery market is segmented into supermarkets and hypermarkets, convenience stores, online stores, and others. The supermarkets and hypermarkets segment held the largest market revenue share in 2024, benefiting from their wide product assortment, promotional pricing, and one-stop shopping convenience. Consumers continue to prefer these formats for their accessibility, trust in product quality, and the ability to physically evaluate goods before purchase. These stores also frequently incorporate loyalty programs and bulk discounts, enhancing foot traffic and repeat purchases.

The online stores segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by the increasing penetration of e-commerce platforms, improved digital infrastructure, and changing consumer shopping behavior favoring home delivery. Mobile-first ordering, subscription models, and the rise of quick commerce (10–30 minute delivery) are reshaping how groceries are bought, especially in urban areas. The convenience of doorstep delivery, wide product availability, and the use of AI-driven recommendations are making online platforms the preferred channel for a growing segment of consumers.

Grocery Market Regional Analysis

- Asia-Pacific dominated the grocery market with the largest revenue share of 37.1% in 2024, driven by rapid urbanization, expanding middle-class population, and rising disposable incomes across the region

- The increasing demand for convenience food, evolving dietary habits, and growing adoption of digital retail platforms are major contributors to grocery market expansion in the region

- Moreover, supportive government initiatives promoting food security and retail infrastructure, along with significant investment in cold chain logistics and e-commerce penetration, are accelerating grocery consumption across both urban and rural areas

India Grocery Market Insight

India is emerging as one of the fastest-growing grocery markets in Asia-Pacific, driven by rising urban migration, a young consumer base, and increased awareness of packaged food products. The expansion of organized retail and the proliferation of online grocery apps such as BigBasket, JioMart, and Blinkit are transforming purchasing patterns. Tier-2 and tier-3 cities are witnessing increased penetration of branded and hygienically packaged grocery items, while government-backed initiatives in food processing, agricultural reforms, and digital infrastructure are enhancing overall supply chain efficiency and accessibility.

China Grocery Market Insight

China held the largest share of the grocery market in Asia-Pacific in 2024, supported by its extensive urban population, digitally advanced retail systems, and a robust demand for both domestic and imported grocery items. Consumers are increasingly opting for high-quality, organic, and functional foods, prompting retailers to innovate and diversify offerings. The integration of AI, mobile payments, and omnichannel delivery models by players such as Alibaba and JD.com has made grocery shopping more seamless. In addition, strong investment in cold storage and logistics ensures consistent availability and freshness of goods across the nation.

Europe Grocery Market Insight

Europe’s grocery market is expected to grow steadily over the forecast period, supported by high consumer awareness of food safety, sustainability, and health-related concerns. Countries across Western and Northern Europe have well-established retail infrastructures and a strong preference for organic, natural, and plant-based grocery products. The demand for local, eco-friendly, and ethically sourced goods continues to rise. Supermarkets are expanding private-label offerings focused on clean-label ingredients and sustainable packaging, while digital grocery platforms are gaining traction among younger consumers. Efficient logistics, high-quality standards, and regulatory support for sustainability are reinforcing long-term market stability.

U.K. Grocery Market Insight

The U.K. grocery market is evolving as consumers shift toward healthier, sustainable, and ready-to-cook grocery options. The increasing popularity of organic, gluten-free, and vegan items, coupled with a growing preference for recyclable and minimal packaging, is influencing product innovation. Retailers are embracing online and hybrid shopping models such as click-and-collect and same-day delivery. Government initiatives aimed at reducing food waste and plastic use are further encouraging adoption of sustainable practices in the grocery retail sector.

Germany Grocery Market Insight

Germany’s grocery market is expanding steadily, underpinned by strong environmental consciousness and a high demand for clean-label, organic, and plant-based grocery products. Discount chains such as Lidl and Aldi are reshaping their assortments to include eco-friendly and sustainably sourced items. Advanced logistics and digital retail adoption are enhancing convenience and access for consumers. Germany’s leadership in recycling and sustainability also influences grocery packaging choices, encouraging widespread adoption of biodegradable and recyclable materials.

North America Grocery Market Insight

North America is projected to witness the fastest CAGR in the grocery market from 2025 to 2032. The region’s growth is fueled by strong demand for organic, functional, and convenience-driven grocery products. Shifting consumer lifestyles, health awareness, and the desire for clean-label, minimally processed food are shaping product choices across both urban and suburban areas. The rapid growth of e-commerce and delivery-based grocery models—led by players such as Amazon Fresh, Instacart, and Walmart—has transformed the way groceries are bought. Investment in AI-powered personalization, real-time inventory systems, and sustainability initiatives are enhancing user experience and loyalty in a competitive retail landscape.

U.S. Grocery Market Insight

The U.S. captured the largest share of the North America grocery market in 2024, driven by strong consumer demand for packaged foods, beverages, and premium household products. Growing interest in organic, allergen-free, and culturally diverse grocery offerings is influencing retail assortment strategies. Consumers increasingly value convenience and customization, prompting retailers to expand subscription-based services and personalized product recommendations. The growth of clean-label trends and sustainability commitments is further supporting innovations in eco-conscious packaging and ethical sourcing across the grocery supply chain.

Grocery Market Share

The grocery industry is primarily led by well-established companies, including:

- Nestlé (Switzerland)

- Procter & Gamble (U.S.)

- Unilever (U.K.)

- The Coca-Cola Company (U.S.)

- PepsiCo (U.S.)

- Mondelez International (U.S.)

- Kellogg's (U.S.)

- General Mills (U.S.)

- Mars, Incorporated (U.S.)

- The Kraft Heinz Company (U.S.)

- Danone (France)

Latest Developments in Global Grocery Market

- In October 2023, Unilever invested USD 21.10 million to expand its Poznan facility in Poland, significantly increasing its production capacity for instant noodles. This move highlights the company’s strategic response to the growing consumer demand for convenience foods in Europe. By scaling up operations in a cost-effective manufacturing hub, Unilever aims to strengthen its market position in the ready-to-eat and quick-meal segment, while meeting the rising expectations for affordability and accessibility among time-constrained consumers

- In September 2023, Nestlé announced its commitment to increase sales of its nutritious food and beverage portfolio by 50% by 2030, with a strong emphasis on Health Star Rating-certified products. This strategic initiative underscores the company’s shift toward health-centric innovation and responsible nutrition. Nestlé’s focus on balanced diets, ethical marketing, and clean-label offerings is expected to drive long-term brand loyalty and align with the global trend toward wellness-driven food choices, especially among health-conscious consumers and regulatory stakeholders

- In September 2023, Kroger Co. and Albertsons Companies Inc. entered into a binding agreement with C&S Wholesale Grocers, LLC for the divestiture of selected stores, distribution centers, and private-label assets. This transaction is a crucial step in satisfying regulatory requirements related to their proposed merger, originally announced in October 2022. The sale facilitates market consolidation while maintaining competitive balance in regional grocery markets, potentially reshaping retail dynamics and improving operational efficiency for both merging entities

- In September 2023, C&S Wholesale Grocers, LLC formally agreed to acquire 413 retail stores, eight distribution centers, and two corporate offices from Kroger and Albertsons. This acquisition expands C&S’s footprint in the U.S. grocery supply and distribution landscape and also enhances its vertical capabilities in retail operations. The move positions C&S to play a more direct role in shaping consumer access, private-label strategy, and regional grocery availability—ultimately reinforcing its presence in a consolidating market environment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Grocery Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Grocery Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Grocery Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.