Global Halogen Biocides Market

Market Size in USD Billion

CAGR :

%

USD

2.60 Billion

USD

3.70 Billion

2025

2033

USD

2.60 Billion

USD

3.70 Billion

2025

2033

| 2026 –2033 | |

| USD 2.60 Billion | |

| USD 3.70 Billion | |

|

|

|

|

Halogen Biocides Market Size

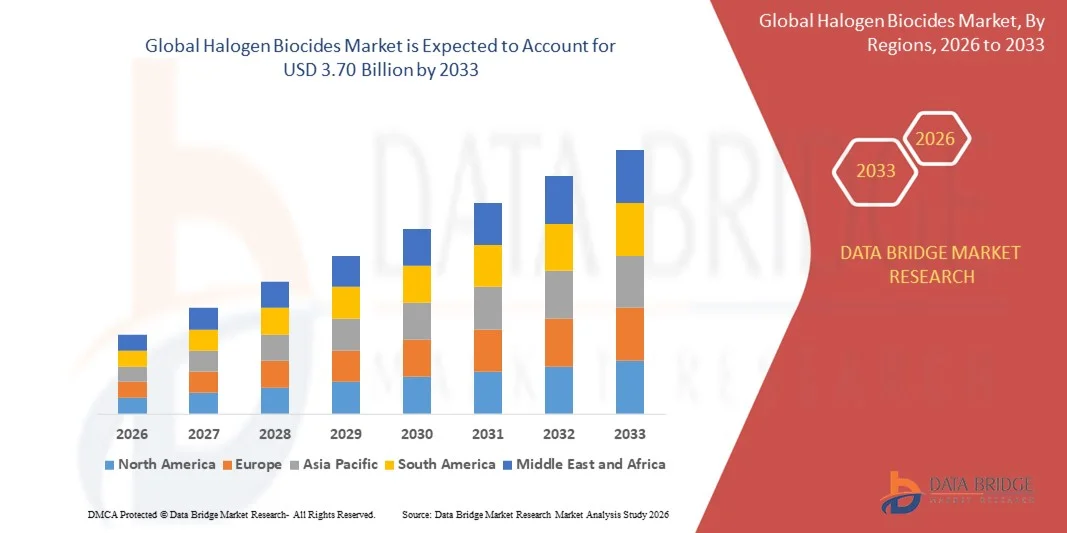

- The global halogen biocides market size was valued at USD 2.60 billion in 2025 and is expected to reach USD 3.70 billion by 2033, at a CAGR of 4.50% during the forecast period

- The market growth is largely fueled by increasing demand for safe and efficient water treatment solutions across municipal and industrial sectors, driving widespread adoption of halogen biocides for microbial control and system maintenance

- Furthermore, stringent regulatory standards for water quality and environmental compliance are encouraging the use of advanced halogen-based disinfection technologies. These converging factors are accelerating the uptake of halogen biocides, thereby significantly boosting market growth

Halogen Biocides Market Analysis

- Halogen biocides, including chlorine, chlorine dioxide, bromine, and chloramine, are increasingly essential for preventing microbial contamination, biofilm formation, and operational inefficiencies in water systems across wastewater treatment, cooling towers, and boiler water applications

- The escalating demand for halogen biocides is primarily fueled by rapid industrialization, urbanization, and expanding municipal water treatment infrastructure. Growing concerns over waterborne diseases and the need for reliable microbial control are further enhancing market adoption

- Asia-Pacific dominated the halogen biocides market with a share of around 35% in 2025, due to rapid industrialization, increasing municipal water treatment infrastructure, and a strong presence of chemical manufacturing hubs

- North America is expected to be the fastest growing region in the halogen biocides market during the forecast period due to increasing demand for safe drinking water, industrial water treatment, and strict environmental regulations

- Chlorine segment dominated the market with a market share of 46.1% in 2025, due to its strong oxidizing properties, high efficacy against a wide range of microorganisms, and established use in water disinfection applications. Chlorine biocides are widely preferred due to their cost-effectiveness, ease of handling, and compatibility with both municipal and industrial water systems. The segment also benefits from widespread availability, extensive regulatory approval, and proven long-term performance in controlling microbial growth

Report Scope and Halogen Biocides Market Segmentation

|

Attributes |

Halogen Biocides Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Halogen Biocides Market Trends

Growing Use of Halogen Biocides in Water Treatment

- A significant trend in the halogen biocides market is the increasing adoption of these chemicals for municipal and industrial water treatment applications, driven by the rising need for effective microbial control and safe water management. Halogen biocides are being increasingly utilized to prevent biofilm formation, inhibit pathogen growth, and ensure system efficiency across wastewater treatment plants, cooling towers, and boiler water systems

- For instance, Nouryon supplies chlorine and chlorine dioxide-based biocides that are extensively used in municipal water treatment facilities worldwide. These products help maintain water quality standards and reduce microbial contamination, ensuring safe supply to communities

- The adoption of halogen biocides is growing in industrial cooling and process water systems where consistent disinfection is critical for operational reliability. Companies such as Solenis provide bromine and chloramine solutions for cooling tower water management, helping industries prevent biofouling while complying with environmental regulations

- Halogen biocides are also increasingly integrated into boiler water treatment programs to reduce scaling and corrosion while controlling microbial proliferation. This trend is positioning halogen-based solutions as essential tools for both municipal authorities and industrial operators seeking efficient water treatment strategies

- Growing concerns about waterborne diseases and regulatory pressures on water safety are accelerating the incorporation of halogen biocides in advanced water treatment protocols. The market is witnessing strong demand for high-purity, low-residue formulations that minimize environmental impact while delivering reliable antimicrobial performance

- The trend is further reinforced by innovation in formulation technologies that allow safer, more targeted, and environmentally compliant biocides. For instance, LANXESS has developed chlorine dioxide solutions for agricultural and industrial applications, highlighting the shift toward specialized, application-driven biocide products

Halogen Biocides Market Dynamics

Driver

Rising Demand for Effective Microbial Control

- The increasing need for reliable microbial control in municipal and industrial water systems is driving the adoption of halogen biocides. These chemicals provide rapid disinfection, long-lasting residual protection, and prevent biofilm formation, which is critical for maintaining operational efficiency and regulatory compliance

- For instance, Dow Inc. supplies chlorine and bromine-based biocides for industrial water treatment systems, supporting thermal efficiency in cooling towers and process water applications while ensuring microbial control

- Expansion of industrial and municipal infrastructure, particularly in emerging economies, is further fueling demand for halogen biocides. Organizations such as SUEZ are deploying chlorine dioxide and other halogen solutions in wastewater treatment to meet growing population needs and strict water quality regulations

- The rising awareness of waterborne diseases and hygiene standards in both developed and developing regions continues to reinforce this driver. Halogen biocides are increasingly preferred for their proven efficacy, ease of application, and compatibility with diverse water treatment systems

- The need for low-maintenance, cost-effective, and environmentally compliant disinfection solutions is also boosting the uptake of halogen biocides. Companies such as BASF SE are focusing on producing high-purity, safe halogen formulations to meet both operational and regulatory expectations across global markets

Restraint/Challenge

Regulatory and Environmental Compliance

- The halogen biocides market faces challenges due to strict regulations and environmental concerns related to their usage. High chlorine or bromine concentrations, potential formation of harmful byproducts, and disposal issues require companies to adopt stringent safety and compliance measures, increasing operational complexity

- For instance, regulatory bodies in the U.S. and Europe impose limits on residual halogen concentrations in treated water, compelling manufacturers such as Lonza and Clariant to innovate safer formulations that meet legal standards while maintaining efficacy

- Environmental monitoring requirements and compliance with international water safety guidelines add to operational costs and procedural complexities. Companies must invest in R&D to develop low-residue, eco-friendly biocides that minimize environmental impact while ensuring effective microbial control

- The market also encounters challenges in balancing high-performance disinfection with sustainable practices, particularly in industries such as agriculture and industrial cooling. This tension can slow adoption rates in regions with stringent environmental legislation

- In addition, handling, storage, and transportation of halogen biocides require specialized infrastructure and safety measures. These factors contribute to operational risk and increase cost structures for manufacturers and end users alike, creating barriers for market expansion

Halogen Biocides Market Scope

The market is segmented on the basis of product, application, and end use.

- By Product

On the basis of product, the Halogen Biocides market is segmented into chlorine, chloramine, bromine, chlorine dioxide, and iodine. The chlorine segment dominated the market with the largest revenue share of 46.1% in 2025, driven by its strong oxidizing properties, high efficacy against a wide range of microorganisms, and established use in water disinfection applications. Chlorine biocides are widely preferred due to their cost-effectiveness, ease of handling, and compatibility with both municipal and industrial water systems. The segment also benefits from widespread availability, extensive regulatory approval, and proven long-term performance in controlling microbial growth.

The chlorine dioxide segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by increasing demand for safer, non-toxic, and residue-free disinfection solutions. For instance, companies such as Ecolab are leveraging chlorine dioxide for advanced water treatment in industrial cooling systems, highlighting its effectiveness in biofilm control and odor management. Chlorine dioxide’s selective oxidizing mechanism, low corrosiveness, and reduced formation of harmful byproducts are driving its adoption in both industrial and municipal applications. Growing awareness of environmental and health safety regulations further supports the rapid expansion of this segment.

- By Application

On the basis of application, the Halogen Biocides market is segmented into wastewater treatment, cooling towers, and boiler water. The wastewater treatment segment dominated the market with the largest revenue share in 2025, driven by the need for stringent microbial control and compliance with environmental discharge standards. Halogen biocides in wastewater systems help reduce pathogen loads, prevent biofilm formation, and maintain system efficiency, making them a critical component in municipal and industrial wastewater management. The segment benefits from increasing urbanization, growing industrial effluents, and the rising adoption of automated water treatment solutions.

The cooling towers segment is projected to witness the fastest growth from 2026 to 2033, fueled by the rising demand for industrial and commercial cooling infrastructure. For instance, companies such as SUEZ are implementing halogen-based biocides in cooling tower water to prevent legionella proliferation and improve thermal efficiency. Cooling towers require continuous microbial management due to stagnant water conditions, and halogen biocides offer rapid action and residual protection. Increasing regulatory focus on water safety and operational efficiency supports the adoption of advanced halogen biocides in this segment.

- By End Use

On the basis of end use, the Halogen Biocides market is segmented into municipal and industrial. The municipal segment dominated the market with the largest revenue share in 2025, driven by the growing demand for safe drinking water, strict government regulations, and the need to control microbial contamination in public water supply systems. Municipal water utilities rely on halogen biocides to maintain water quality standards, prevent outbreaks of waterborne diseases, and meet environmental compliance. The segment also benefits from large-scale infrastructure projects and continuous investment in modern water treatment facilities.

The industrial segment is expected to witness the fastest growth from 2026 to 2033, fueled by expanding industrial activities and the increasing use of process water in manufacturing, power generation, and chemical industries. For instance, companies such as BASF are supplying halogen biocides for industrial applications to control biofouling and scaling in process water systems. Industrial end users prioritize biocides that provide efficient microbial control, minimize corrosion, and reduce operational downtime. Growing awareness of water treatment efficiency and sustainability further accelerates the adoption of halogen biocides in industrial sectors.

Halogen Biocides Market Regional Analysis

- Asia-Pacific dominated the halogen biocides market with the largest revenue share of around 35% in 2025, driven by rapid industrialization, increasing municipal water treatment infrastructure, and a strong presence of chemical manufacturing hubs

- The region’s cost-effective production capabilities, rising investments in water treatment technologies, and expanding industrial applications are accelerating market growth

- Availability of skilled labor, favorable government regulations, and increasing adoption of advanced biocides in both municipal and industrial sectors are contributing to strong market demand

China Halogen Biocides Market Insight

China held the largest share in the Asia-Pacific Halogen Biocides market in 2025, owing to its extensive chemical manufacturing base and active investments in water treatment infrastructure. The country’s government initiatives to enhance clean water access, combined with growing industrial effluents and focus on environmental compliance, are major growth drivers. Demand is further supported by expansion in industrial sectors and consistent adoption of chlorine and chlorine dioxide for large-scale disinfection applications.

India Halogen Biocides Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by increasing municipal water projects, rapid industrial expansion, and rising awareness of water safety standards. For instance, companies such as Tata Chemicals are supplying halogen-based biocides for industrial cooling and wastewater treatment systems, strengthening market growth. Government initiatives promoting clean water, coupled with expanding manufacturing and chemical processing activities, are further accelerating demand for halogen biocides.

Europe Halogen Biocides Market Insight

The Europe Halogen Biocides market is expanding steadily, supported by stringent water safety regulations, rising industrial compliance standards, and growing focus on sustainable treatment solutions. The region emphasizes high-quality biocides with minimal byproduct formation for municipal and industrial water systems. Increasing adoption of chlorine dioxide and bromine in advanced water treatment processes is further enhancing market growth, particularly in sectors requiring precise microbial control.

Germany Halogen Biocides Market Insight

Germany’s Halogen Biocides market is driven by its well-established chemical industry, advanced wastewater treatment infrastructure, and strong emphasis on environmental regulations. The country has extensive R&D capabilities and partnerships between chemical manufacturers and research institutes, fostering innovation in halogen biocide formulations. Demand is particularly strong in municipal water systems and industrial cooling towers, where effective microbial control and regulatory compliance are critical.

U.K. Halogen Biocides Market Insight

The U.K. market is supported by a mature water treatment sector, increasing focus on sustainable industrial processes, and stringent compliance with environmental standards. Rising investments in advanced biocide solutions for both municipal and industrial applications, coupled with R&D initiatives in chemical manufacturing, are driving adoption. The country’s focus on innovation and regulatory adherence ensures consistent demand for high-purity halogen biocides.

North America Halogen Biocides Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for safe drinking water, industrial water treatment, and strict environmental regulations. Expanding municipal and industrial water infrastructure, adoption of advanced treatment technologies, and growing focus on biofilm and pathogen control are boosting market growth. In addition, reshoring of chemical manufacturing and rising collaborations between water treatment solution providers and industries support market expansion.

U.S. Halogen Biocides Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its advanced municipal water systems, strong industrial base, and significant investment in chemical and water treatment infrastructure. The country’s focus on regulatory compliance, sustainable treatment solutions, and high-performance halogen biocides encourages adoption in both industrial and municipal sectors. Presence of major players and a robust distribution network further consolidates the U.S.'s leading position in the region.

Halogen Biocides Market Share

The halogen biocides industry is primarily led by well-established companies, including:

- Nouryon (Netherlands)

- Solenis (U.S.)

- Lonza (Switzerland)

- Clariant (Switzerland)

- Lubrizol Corporation (U.S.)

- Aditya Birla Chemicals India (India)

- BASF SE (Germany)

- Cortec Corporation (U.S.)

- Dow (U.S.)

- Akzo Nobel N.V. (Netherlands)

- SUEZ (France)

- Albemarle Corporation (U.S.)

- DuPont (U.S.)

- Kemira (Finland)

- LANXESS (Germany)

- Baker Hughes (U.S.)

- Valtris Specialty Chemicals (U.S.)

- Merck KGaA (Germany)

- Buckman (U.S.)

- Dalian Xingyuan Chemistry Co., Ltd (China)

Latest Developments in Global Halogen Biocides Market

- In October 2025, Dow Inc. launched a comprehensive sustainability initiative focused on reducing the carbon footprint of its halogen biocide production. This move reflects the growing importance of environmentally responsible manufacturing in the chemical industry. By adopting greener production practices, Dow Inc. (U.S.) is likely to strengthen its market position, meet increasingly stringent regulatory standards, and appeal to environmentally conscious industrial and municipal customers. The initiative may also encourage competitors to follow suit, further accelerating the shift toward sustainable halogen biocide solutions across the market

- In September 2025, Solvay S.A. entered into a strategic partnership with a leading technology firm to develop AI-driven solutions for halogen biocide formulation. This collaboration underscores a broader digitalization trend within the chemical sector, enabling faster, more precise product development. By integrating AI technologies, Solvay S.A. (Belgium) can enhance the efficacy of its biocides, reduce environmental impact, and respond more quickly to evolving market demands and regulatory requirements. This positions the company to capture new opportunities in both municipal and industrial water treatment applications

- In August 2025, Lanxess AG announced the launch of a new line of halogen biocides tailored for the agricultural sector. By focusing on crop protection applications, Lanxess AG (Germany) is strategically diversifying its product portfolio and responding to rising demand from farmers and agribusinesses. This initiative is expected to expand the company’s market share in agriculture-focused water and microbial management solutions, while aligning its offerings with sustainable and efficient crop protection trends in the region

- In July 2025, Nouryon (Netherlands) introduced advanced chlorine dioxide-based biocides designed specifically for industrial cooling tower applications. This launch addresses the need for highly effective microbial control in industrial water systems while minimizing corrosion and byproduct formation. By providing solutions that combine efficiency with environmental compliance, Nouryon is expected to enhance its competitive position and drive adoption among industrial end users, particularly in energy, manufacturing, and chemical sectors

- In June 2025, BASF SE expanded its halogen biocide production capabilities with a new state-of-the-art manufacturing facility in Germany. The expansion is aimed at meeting the growing global demand for high-purity chlorine and bromine-based biocides in municipal and industrial water treatment. By increasing production capacity and strengthening supply chain reliability, BASF SE (Germany) is likely to reinforce its market leadership and cater to emerging markets seeking consistent and high-quality biocide solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Halogen Biocides Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Halogen Biocides Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Halogen Biocides Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.