Global Healthcare Smart Beds Market

Market Size in USD Million

CAGR :

%

USD

756.69 Million

USD

1,400.59 Million

2025

2033

USD

756.69 Million

USD

1,400.59 Million

2025

2033

| 2026 –2033 | |

| USD 756.69 Million | |

| USD 1,400.59 Million | |

|

|

|

|

What is the Global Healthcare Smart Beds Market Size and Growth Rate?

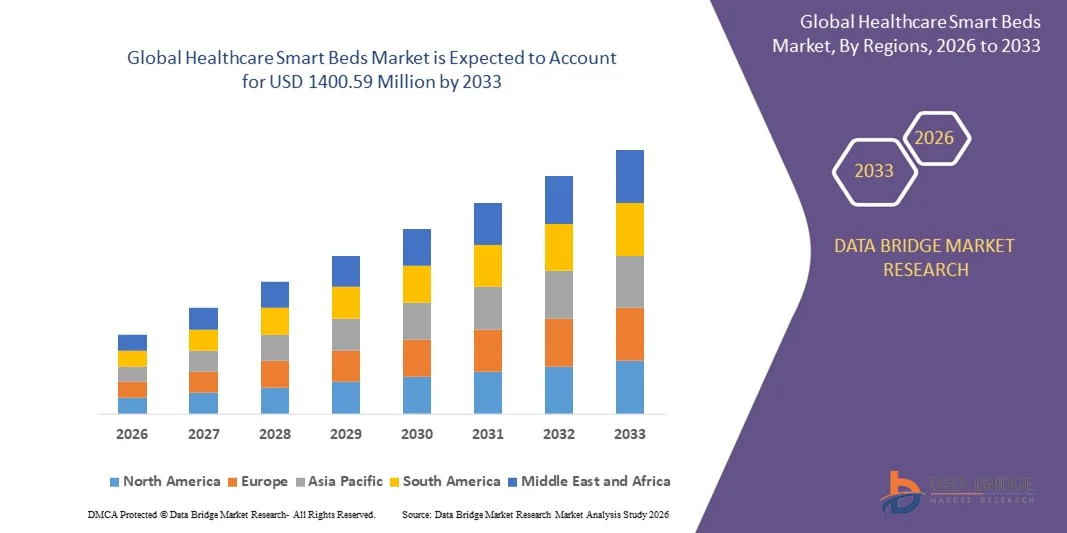

- The global healthcare smart beds market size was valued at USD 756.69 million in 2025 and is expected to reach USD 1400.59 million by 2033, at a CAGR of8.00% during the forecast period

- Major factors that are expected to boost the growth of the healthcare smart beds market in the forecast period are the increase in the per capita income in the advanced countries. Furthermore, the growth in the health care expenses is further anticipated to propel the growth of the healthcare smart beds market

What are the Major Takeaways of Healthcare Smart Beds Market?

- The change in the shift in patient preference and increase in the demand for advanced health care facilities is further estimated to cushion the growth of the healthcare smart beds market. On the other hand, a rise in the price is further projected to impede the growth of the healthcare smart beds market in the timeline period

- In addition, the developments in the technologies and unused prospects in the advancing countries will further provide potential opportunities for growth in the coming years. However, the decrease in the accessibility of smart hospital beds might further challenge the growth of the healthcare smart beds market in the near future

- North America dominated the healthcare smart beds market with a 41.6% revenue share in 2025, driven by advanced healthcare infrastructure, high adoption of digital hospital technologies, and strong investments in patient safety and care automation across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 10.8% from 2026 to 2033, driven by rapid healthcare infrastructure development, rising hospital construction, and increasing adoption of smart medical technologies across China, Japan, India, South Korea, and Southeast Asia

- The Semi-Automatic segment dominated the market with a 58.6% share in 2025, as these beds offer an optimal balance between functionality, cost efficiency, and ease of adoption

Report Scope and Healthcare Smart Beds Market Segmentation

|

Attributes |

Healthcare Smart Beds Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Healthcare Smart Beds Market?

Increasing Shift Toward Connected, Sensor-Integrated, and Data-Driven Healthcare Smart Beds

- The healthcare smart beds market is witnessing strong adoption of sensor-based, connected, and software-enabled beds designed to support real-time patient monitoring, pressure management, and workflow automation

- Manufacturers are introducing smart beds integrated with IoT connectivity, weight sensing, motion detection, and AI-enabled analytics to enhance patient safety and clinical decision-making

- Growing demand for compact, modular, and interoperable smart beds is driving adoption across hospitals, long-term care facilities, rehabilitation centers, and home healthcare settings

- For instance, companies such as Stryker, Hill-Rom (Baxter), LINET, and Getinge have launched advanced smart beds with integrated alarms, fall-prevention systems, and electronic health record (EHR) connectivity

- Increasing need for continuous patient monitoring, reduced nurse workload, and improved care quality is accelerating the shift toward digitally connected smart bed platforms

- As healthcare systems prioritize efficiency, safety, and data-driven care delivery, healthcare smart beds will remain critical for modern patient-centric hospital infrastructure

What are the Key Drivers of Healthcare Smart Beds Market?

- Rising demand for improved patient safety, fall prevention, pressure ulcer reduction, and mobility assistance in acute and long-term care environments

- For instance, during 2024–2025, leading players such as Stryker, Arjo, and Getinge expanded their smart bed portfolios with enhanced sensor accuracy, remote monitoring, and automated alerts

- Growing adoption of digital hospitals, smart ICUs, and connected healthcare infrastructure is boosting demand across the U.S., Europe, and Asia-Pacific

- Advancements in embedded sensors, wireless communication, AI-based analytics, and cloud-enabled monitoring platforms have improved bed performance and clinical outcomes

- Rising geriatric population, increasing hospitalization rates, and higher prevalence of chronic diseases are creating sustained demand for intelligent patient support systems

- Supported by increasing healthcare investments, hospital modernization programs, and focus on value-based care, the Healthcare Smart Beds market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Healthcare Smart Beds Market?

- High costs associated with advanced smart beds, including sensor integration, software platforms, and connectivity infrastructure, limit adoption among small hospitals and care facilities

- For instance, during 2024–2025, rising component costs, supply chain disruptions, and higher software development expenses increased overall smart bed pricing for several global manufacturers

- Complexity in integrating smart beds with hospital IT systems, EHR platforms, and existing workflows increases implementation challenges

- Limited awareness and technical expertise in emerging markets regarding smart bed functionality and long-term benefits slow adoption rates

- Competition from conventional hospital beds, retrofitted monitoring solutions, and nurse-based manual monitoring creates pricing pressure

- To address these challenges, companies are focusing on cost-optimized designs, scalable software platforms, interoperability standards, and clinician training to expand global adoption of healthcare smart beds

How is the Healthcare Smart Beds Market Segmented?

The market is segmented on the basis of product type, end use, and application.

- By Product Type

On the basis of product type, the healthcare smart beds market is segmented into Semi-Automatic and Fully-Automatic smart beds. The Semi-Automatic segment dominated the market with a 58.6% share in 2025, as these beds offer an optimal balance between functionality, cost efficiency, and ease of adoption. Semi-automatic smart beds typically feature electronic height adjustment, backrest and leg movement, basic patient monitoring, and safety alarms, making them widely suitable for hospitals, nursing homes, and rehabilitation centers. Their lower upfront cost, reduced maintenance requirements, and compatibility with existing hospital infrastructure support strong adoption, particularly in mid-sized hospitals and emerging markets.

The Fully-Automatic segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for advanced automation, AI-enabled patient monitoring, automatic repositioning, fall prevention systems, and EHR integration. Increasing investments in smart hospitals, critical care automation, and labor-saving technologies are accelerating adoption of fully-automatic healthcare smart beds globally.

- By End Use

On the basis of end use, the healthcare smart beds market is segmented into Acute Care Environments and Post-Acute Environments. The Acute Care Environments segment dominated the market with a 62.3% share in 2025, supported by high deployment across hospitals, intensive care units (ICUs), emergency departments, and surgical recovery wards. In acute care settings, smart beds play a critical role in continuous patient monitoring, pressure ulcer prevention, fall detection, and workflow optimization for clinical staff. The need for real-time data, rapid response, and enhanced patient safety strongly drives adoption in these environments.

The Post-Acute Environments segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by the expanding geriatric population, rising prevalence of chronic diseases, and growing shift toward long-term care, rehabilitation, and home healthcare. Increasing focus on remote monitoring, mobility assistance, and cost-effective care delivery is accelerating smart bed adoption in post-acute settings.

- By Application

On the basis of application, the healthcare smart beds market is segmented into Hospitals, Outpatient Clinics, Medical Nursing Homes, and Medical Laboratory and Research facilities. The Hospitals segment dominated the market with a 55.1% share in 2025, owing to high patient volumes, advanced care requirements, and significant investments in digital healthcare infrastructure. Hospitals extensively deploy smart beds to improve patient safety, reduce nurse workload, enhance monitoring accuracy, and support integrated clinical workflows. Features such as fall prevention, automated alerts, and EHR connectivity are particularly critical in hospital environments.

The Medical Nursing Homes segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by aging demographics, increasing long-term care demand, and growing emphasis on patient comfort and safety. Rising adoption of smart monitoring solutions and pressure injury prevention systems in elderly care facilities is further supporting segment growth.

Which Region Holds the Largest Share of the Healthcare Smart Beds Market?

- North America dominated the healthcare smart beds market with a 41.6% revenue share in 2025, driven by advanced healthcare infrastructure, high adoption of digital hospital technologies, and strong investments in patient safety and care automation across the U.S. and Canada. Widespread deployment of smart ICUs, connected medical devices, and hospital information systems continues to fuel demand for Healthcare Smart Beds across acute care hospitals, long-term care facilities, and rehabilitation centers

- Leading companies in North America are introducing sensor-integrated smart beds with real-time monitoring, fall detection, pressure injury prevention, and EHR connectivity, strengthening the region’s technological leadership. Continuous investment in value-based care, patient monitoring, and healthcare digitization supports sustained market expansion

- High healthcare spending, favorable reimbursement policies, and strong presence of major smart bed manufacturers further reinforce North America’s market dominance

U.S. Healthcare Smart Beds Market Insight

The U.S. is the largest contributor in North America, supported by rapid adoption of smart hospital infrastructure, high patient admission rates, and increasing focus on patient safety and clinical efficiency. Hospitals are actively deploying Healthcare Smart Beds to reduce falls, prevent pressure ulcers, optimize nursing workflows, and enable continuous patient monitoring. Rising prevalence of chronic diseases, growing elderly population, and strong investments in hospital modernization programs further drive demand. Presence of leading manufacturers, advanced IT integration capabilities, and widespread EHR adoption significantly accelerate market growth across acute and post-acute care environments.

Canada Healthcare Smart Beds Market Insight

Canada contributes significantly to regional growth, driven by expanding healthcare digitization initiatives, rising investments in hospital infrastructure, and growing demand for long-term care solutions. Hospitals and nursing homes increasingly deploy Healthcare Smart Beds to improve patient monitoring, mobility assistance, and staff efficiency. Government-funded healthcare programs, aging population trends, and increasing emphasis on patient-centered care strengthen smart bed adoption across public and private healthcare facilities.

Asia-Pacific Healthcare Smart Beds Market

Asia-Pacific is projected to register the fastest CAGR of 10.8% from 2026 to 2033, driven by rapid healthcare infrastructure development, rising hospital construction, and increasing adoption of smart medical technologies across China, Japan, India, South Korea, and Southeast Asia. Growing elderly populations, rising chronic disease burden, and strong government investment in healthcare modernization are accelerating demand for Healthcare Smart Beds across acute and long-term care facilities.

China Healthcare Smart Beds Market Insight

China is the largest contributor in Asia-Pacific due to extensive hospital expansion, rising healthcare expenditure, and strong government support for smart healthcare initiatives. Increasing adoption of digital wards, connected medical devices, and AI-enabled patient monitoring systems drives demand for advanced Healthcare Smart Beds. Large-scale manufacturing capacity and competitive pricing further boost domestic and export market growth.

Japan Healthcare Smart Beds Market Insight

Japan shows steady growth supported by a rapidly aging population, advanced medical infrastructure, and strong focus on patient safety and elderly care. High adoption of smart beds in hospitals, nursing homes, and rehabilitation centers is driven by demand for fall prevention, mobility assistance, and pressure injury management. Emphasis on quality healthcare and automation supports long-term market expansion.

India Healthcare Smart Beds Market Insight

India is emerging as a high-growth market, driven by expanding hospital networks, increasing healthcare investments, and rising adoption of smart medical equipment. Growth in private hospitals, medical tourism, and government healthcare programs fuels demand for Healthcare Smart Beds. Increasing awareness of patient safety and digital healthcare solutions accelerates market penetration.

South Korea Healthcare Smart Beds Market Insight

South Korea contributes significantly due to advanced healthcare systems, high technology adoption, and strong focus on smart hospitals. Increasing demand for connected patient monitoring, elderly care solutions, and automated healthcare infrastructure drives adoption of Healthcare Smart Beds. Technological innovation, digital healthcare ecosystems, and government-backed healthcare modernization initiatives support sustained market growth.

Which are the Top Companies in Healthcare Smart Beds Market?

The healthcare smart beds industry is primarily led by well-established companies, including:

- Stryker Corporation (U.S.)

- Hill-Rom Holdings, Inc. (U.S.)

- Invacare Corporation (U.S.)

- Paramount B.E.D. CO., LTD. (Japan)

- LINET spol. s r.o. (Czech Republic)

- Joerns Healthcare LLC. (U.S.)

- Joh. Stiegelmeyer & Co. GmbH (Germany)

- Arjo (Sweden)

- Völker GmbH (Germany)

- Favero Health Projects SpA (Italy)

- Koninklijke Philips N.V. (Netherlands)

- General Electric Company (U.S.)

- Medtronic (Ireland)

- Midmark Corporation (U.S.)

- Getinge AB (Sweden)

- G.F. Health Products, Inc. (U.S.)

- Besco Medical Co., Ltd. (China)

- B.A.M. Labs Inc. (U.S.)

- NVIDIA Corporation (U.S.)

- Honeywell International Inc. (U.S.)

What are the Recent Developments in Global Healthcare Smart Beds Market?

- In June 2023, Baxter International Inc. launched the Hill-Rom Progressa+ bed for the U.S. ICU market, incorporating advanced technologies to improve nurse efficiency and accelerate patient recovery, thereby enhancing clinical workflows and strengthening patient-centered critical care delivery

- In June 2023, Severance Hospital deployed an advanced smart bed management system using Wi-Fi connectivity and e-Paper displays to manage room occupancy records and patient identification, thereby improving operational efficiency and accuracy in hospital bed management

- In April 2023, Sleep Number Corporation introduced its next-generation Sleep Number® smart beds along with Lifestyle Furniture, designed to work independently or together to optimize sleep quality across different life stages, thereby reinforcing its leadership in wellness-driven sleep technology innovation

- In February 2023, Stryker launched the SmartMedic platform to enhance ICU bed functionality by enabling patient weight monitoring, turn tracking from nurse stations, and in-room X-ray capabilities, thereby improving workflow efficiency, patient safety, and critical care support

- In August 2022, LINET Group acquired Pegasus Health Group to expand its portfolio into physiotherapy, occupational therapy, and speech-language therapy services, thereby strengthening its integrated healthcare solutions offering beyond hospital beds

- In February 2021, Stryker introduced the ProCuity wireless hospital bed in the EMEA region, featuring cable-free integration with nurse call systems to reduce patient falls and improve nursing workflows, thereby expanding access to safe and technologically advanced hospital bed solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.