Global Hearing Aids Market

Market Size in USD Billion

CAGR :

%

USD

9.79 Billion

USD

16.69 Billion

2025

2033

USD

9.79 Billion

USD

16.69 Billion

2025

2033

| 2026 –2033 | |

| USD 9.79 Billion | |

| USD 16.69 Billion | |

|

|

|

|

Hearing Aids Market Size

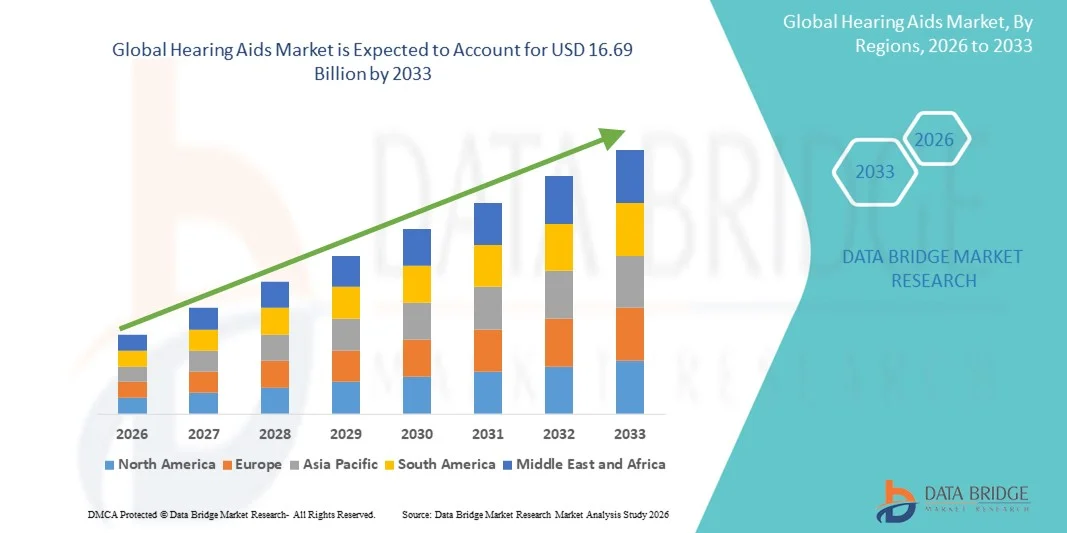

- The global hearing aids market size was valued at USD 9.79 billion in 2025 and is expected to reach USD 16.69 billion by 2033, at a CAGR of 6.90% during the forecast period

- The market growth is largely fueled by the growing adoption of advanced healthcare technologies and the increasing prevalence of hearing loss across all age groups, leading to higher demand for innovative and user-friendly hearing aids

- Furthermore, rising consumer awareness about hearing health, coupled with the availability of technologically advanced, compact, and digitally connected hearing solutions, is driving market expansion. These converging factors are accelerating the uptake of Hearing Aids solutions, thereby significantly boosting the industry's growth

Hearing Aids Market Analysis

- Hearing aids, providing advanced auditory support for individuals with hearing loss, are increasingly vital medical devices in both clinical and home settings due to their enhanced sound clarity, noise reduction capabilities, and seamless integration with digital and mobile technologies

- The escalating demand for hearing aids is primarily fueled by the growing prevalence of hearing impairment, increasing awareness of hearing health, technological advancements such as AI-based sound processing and rechargeable batteries, and a rising preference for personalized, user-friendly auditory solutions

- North America dominated the hearing aids market with the largest revenue share of 46% in 2025, driven by well-established healthcare infrastructure, high R&D expenditure, and the presence of key industry players. The U.S. experienced substantial growth in hearing aid installations across hospitals, audiology clinics, and specialized hearing centers, supported by innovations in digital, AI-powered, and rechargeable hearing devices

- Asia-Pacific is expected to be the fastest-growing region in the hearing aids market during the forecast period, owing to increasing healthcare access, rising prevalence of hearing loss, growing awareness of hearing health, and expanding disposable incomes in countries such as China, India, and Japan. Technological advancements and the affordability of modern hearing solutions are further boosting adoption across the region

- The Adults segment dominated the market with a revenue share of 78.3% in 2025, driven by age-related hearing loss, occupational noise exposure, and lifestyle-related auditory impairments

Report Scope and Hearing Aids Market Segmentation

|

Attributes |

Hearing Aids Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Sonova Holding AG (Switzerland) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Hearing Aids Market Trends

Rising Adoption of Advanced and Personalized Hearing Solutions

- A significant trend in the global hearing aids market is the increasing preference for advanced, compact, and personalized hearing solutions. Modern hearing aids are now offering features such as noise reduction, directional microphones, rechargeable batteries, and connectivity with mobile applications, enabling users to customize settings for their unique hearing needs

- For instance, in 2024, Phonak introduced the Audéo Paradise series, which provides personalized sound adjustments and enhanced speech understanding in noisy environments, reflecting growing demand for tailored hearing solutions

- Consumers increasingly seek discreet devices that integrate seamlessly into daily life, along with improvements in battery life and sound quality. This trend is also driven by technological advancements in microelectronics, allowing for smaller, more comfortable, and more efficient hearing devices

- The trend towards wireless, app-controlled, and adaptive hearing aids is redefining user expectations for hearing performance, with manufacturers focusing on both clinical efficacy and lifestyle convenience

- Overall, this shift toward highly personalized hearing solutions is shaping product development and encouraging companies to offer devices that cater to diverse hearing requirements

Hearing Aids Market Dynamics

Driver

Increasing Prevalence of Hearing Loss and Aging Population

- The growing global prevalence of hearing impairment, especially among older adults, is a key driver for the Hearing Aids market. According to WHO data, over 430 million people worldwide require rehabilitation for hearing loss, creating strong demand for hearing devices

- For instance, in 2023, Starkey launched its Livio Edge AI hearing aids designed to support users with age-related hearing loss while incorporating health monitoring features, highlighting the focus on age-specific needs

Rising awareness about hearing health, early diagnosis, and the benefits of amplification are encouraging adoption across all age groups

- For instance, in 2023, Starkey launched its Livio Edge AI hearing aids designed to support users with age-related hearing loss while incorporating health monitoring features, highlighting the focus on age-specific needs

- Government initiatives and reimbursement policies in developed countries, along with increasing affordability of hearing aids in emerging markets, are further promoting market growth

- These factors collectively contribute to a consistent expansion of the global hearing aids market

Restraint/Challenge

High Cost and Limited Awareness in Emerging Markets

- One of the key challenges facing the Hearing Aids market is the relatively high cost of advanced devices, which can limit accessibility, particularly in low- and middle-income countries. Premium features, such as rechargeable batteries, advanced digital signal processing, and wireless connectivity, significantly increase the retail price

- For instance, in 2022, top-tier hearing aids from companies like Oticon and Phonak were priced well above average consumer budgets in several emerging markets, limiting adoption

- In addition, lack of awareness regarding hearing impairment and the benefits of hearing aids in some regions further restricts market penetration

- Healthcare infrastructure limitations, shortage of trained audiologists, and social stigma associated with hearing loss can also impede growth

- Addressing these challenges through government programs, subsidized pricing, public education campaigns, and more affordable hearing solutions will be crucial for ensuring broader adoption and sustained market expansion

Hearing Aids Market Scope

The market is segmented on the basis of product, type of hearing loss, severity, technology, patient type, and distribution channel.

- By Product

On the basis of product, the Hearing Aids market is segmented into Hearing Aid Devices and Hearing Implants. The Hearing Aid Devices segment dominated the market with a revenue share of approximately 76.4% in 2025, driven by their widespread adoption among adults and pediatric patients for routine hearing loss management. Hearing aid devices offer non-invasive, adjustable solutions for varying degrees of hearing impairment, making them highly preferred over surgical interventions. Rising awareness of hearing loss, increasing disposable income, and rapid advancements in miniaturization and sound amplification technology are contributing to robust growth. The convenience of over-the-counter solutions and strong presence in retail and online channels further supports market leadership. Additionally, government initiatives promoting early diagnosis and hearing rehabilitation programs are expanding the adoption base. The integration of wireless connectivity, smartphone compatibility, and rechargeable batteries has enhanced user experience and boosted repeat purchases. Hearing aid devices are widely recommended by audiologists and ENT specialists, reinforcing clinical acceptance. Increasing global geriatric population and prevalence of age-related hearing loss also fuel demand. Manufacturers are investing in product innovation, improving battery efficiency, and offering customizable solutions to strengthen market presence. Cost-effective devices in emerging markets are further expanding reach. The ongoing focus on aesthetics and discreet designs is encouraging adoption among young adults and professionals. The market dominance of hearing aid devices reflects their versatility, accessibility, and alignment with evolving consumer preferences.

The Hearing Implants segment is projected to witness the fastest CAGR of 11.2% from 2026 to 2033, driven by growing adoption of cochlear implants and bone-anchored hearing systems for severe to profound hearing loss. Implants are increasingly recommended for patients with sensorineural hearing loss who do not respond to conventional hearing aids. Rising awareness of implant technology, enhanced surgical techniques, and supportive insurance coverage are accelerating adoption. Additionally, ongoing R&D in implantable devices for improved sound quality, long-term reliability, and integration with mobile devices further boosts market growth. Government reimbursement programs in developed countries and growing medical infrastructure in emerging markets also play a critical role. Advanced implants offering wireless connectivity and multi-channel sound processing are driving patient preference. Increasing pediatric implant programs and early intervention initiatives support segment growth. Expanding partnerships between healthcare providers and manufacturers are enhancing accessibility. The demand for hearing implants is further reinforced by rising global prevalence of congenital hearing loss. Emerging markets are witnessing gradual adoption due to improving awareness and affordability. Technological innovations improving patient comfort and speech recognition are expected to sustain high CAGR over the forecast period.

- By Type of Hearing Loss

On the basis of type of hearing loss, the market is segmented into Sensorineural Hearing Loss and Conductive Hearing Loss. The Sensorineural Hearing Loss segment dominated the market with a revenue share of 68.7% in 2025, as it represents the most common form of hearing impairment globally. This type is primarily caused by aging, noise exposure, and genetic factors, necessitating the use of advanced hearing aids and implants. Continuous advancements in digital signal processing, noise reduction, and feedback management enhance the efficacy of devices for sensorineural hearing loss. The segment benefits from strong awareness campaigns, clinical recommendations, and widespread availability of hearing solutions. Healthcare professionals consistently prioritize early diagnosis and amplification to improve quality of life. Rising geriatric population and high prevalence of chronic conditions like diabetes contribute to increased incidence. Insurance coverage and government-led hearing screening programs in developed countries further support market leadership. Innovations such as wireless streaming, rechargeable batteries, and app-enabled customization reinforce adoption. Pediatric programs for sensorineural loss also expand the patient base. The segment’s dominance is sustained by consistent clinical validation and strong patient preference. Ongoing R&D in adaptive algorithms and multi-environment sound optimization further strengthens growth.

The Conductive Hearing Loss segment is expected to register the fastest CAGR of 10.4% from 2026 to 2033, primarily due to rising awareness about treatment options such as bone conduction hearing devices and surgical interventions. Increased early detection, especially in children, drives adoption. Technological improvements enhancing device comfort, sound amplification, and aesthetic appeal are expanding reach. Awareness campaigns by audiologists and ENT specialists in schools and pediatric centers contribute to rapid growth. Growth in healthcare infrastructure in emerging regions also supports market expansion. Conductive hearing loss interventions often serve as alternatives when conventional hearing aids are insufficient. Insurance coverage for corrective procedures is boosting accessibility. Partnerships between device manufacturers and clinics are improving patient outreach. Adoption is further strengthened by global programs promoting universal hearing screening. The integration of wireless features in bone conduction devices enhances usability. Medical advancements enabling minimally invasive procedures are accelerating demand. Rising parental awareness about early childhood hearing loss drives the pediatric segment within this category.

- By Severity

On the basis of severity, the market is segmented into Mild, Moderate, Severe, and Profound hearing loss. The Moderate segment dominated the market with a revenue share of 41.5% in 2025, as most patients are diagnosed at a stage where hearing aids provide optimal improvement in daily life and communication. Moderate hearing loss accounts for a significant portion of cases across adults and children, prompting consistent demand for amplification devices. The segment benefits from insurance coverage, clinical recommendations, and accessibility of advanced hearing aid models. Rising public awareness campaigns and availability of over-the-counter devices encourage early intervention. The segment sees strong adoption due to the ability to provide immediate functional improvement and enhanced social engagement. Technological advancements such as digital signal processing and adaptive noise cancellation are key drivers. Patient comfort, battery longevity, and discreet designs further boost uptake. The moderate segment also benefits from school hearing programs, workplace health initiatives, and geriatric care programs. Manufacturers continue to innovate to provide high-quality audio experiences. Emerging markets are gradually witnessing increasing adoption due to affordability programs. The widespread recognition of moderate hearing loss as a treatable condition supports long-term growth.

The Severe segment is anticipated to witness the fastest CAGR of 12.1% from 2026 to 2033, driven by increasing adoption of cochlear implants and high-performance hearing aids. Severe hearing loss often requires advanced devices with multi-channel processing, directional microphones, and connectivity with assistive listening systems. Technological advancements improving speech clarity and noise reduction are enhancing usability. Early intervention programs and pediatric cochlear implant initiatives are accelerating adoption. Growing investments in research and development for improved amplification devices are further driving growth. Insurance reimbursement and government support for severe cases expand patient access. Public awareness campaigns emphasize the importance of timely intervention for severe hearing loss. Rising noise pollution and occupational hazards contribute to increasing incidence rates. Collaboration between hospitals, clinics, and manufacturers ensures rapid availability of advanced solutions. Integration of wireless connectivity and mobile app controls improves patient experience. Awareness among audiologists and ENT specialists promotes proper device selection.

- By Technology

On the basis of technology, the market is segmented into Conventional Hearing Aids and Digital Hearing Aids. The Digital Hearing Aids segment dominated the market with a revenue share of 63.9% in 2025, attributed to superior sound quality, noise reduction capabilities, and adaptability to different listening environments. Digital devices allow fine-tuning and integration with mobile applications for personalized settings. Their widespread acceptance by audiologists and strong consumer preference for clarity in noisy conditions contribute to dominance. Continuous innovation in miniaturization, rechargeable batteries, and advanced processing chips further drives adoption. Digital hearing aids also enable features like directional microphones, tinnitus masking, and connectivity to smartphones and televisions. Growing geriatric population and high awareness about hearing health support consistent growth. The segment’s leadership is reinforced by ongoing clinical validation and patient preference for discreet, lightweight devices. The increasing adoption of wireless accessories and tele-audiology services enhances their appeal. Global manufacturers continue to focus on improving reliability and ease of use. Enhanced battery life, comfort, and aesthetics drive repeat purchases. Emerging markets are witnessing gradual penetration of digital devices due to declining prices.

The Conventional Hearing Aids segment is expected to witness the fastest CAGR of 10.8% from 2026 to 2033, primarily in developing regions where cost-effective solutions are preferred. These devices remain popular due to simplicity, durability, and low maintenance requirements. Their accessibility in rural areas with limited healthcare infrastructure drives adoption. Awareness campaigns and entry-level hearing devices further accelerate growth. Partnerships between manufacturers and local distributors expand reach. Conventional devices are often recommended for patients with mild-to-moderate hearing loss in regions with limited audiology services. Gradual improvements in design and battery technology also enhance usability. Increasing number of government-subsidized programs for affordable devices supports expansion.

- By Patient Type

On the basis of patient type, the market is segmented into Adults and Pediatrics. The Adults segment dominated the market with a revenue share of 78.3% in 2025, driven by age-related hearing loss, occupational noise exposure, and lifestyle-related auditory impairments. Adult adoption is supported by technological advancements, awareness campaigns, and insurance reimbursement. The growing geriatric population contributes to increased sales of hearing devices and implants. The adult segment benefits from both conventional and digital hearing aids, with strong clinical guidance from audiologists. Work-from-home trends and increased social interactions also highlight the importance of hearing enhancement devices. The segment sees strong repeat purchases for device upgrades and replacement batteries. Integration with smartphones and lifestyle-oriented features further encourage adoption. Awareness initiatives by healthcare providers and NGOs strengthen market penetration. Public and private insurance coverage boosts affordability. The segment’s dominance is reinforced by clinical recommendations and growing patient acceptance.

The Pediatrics segment is expected to register the fastest CAGR of 12.5% from 2026 to 2033, driven by increasing newborn hearing screening programs, early detection of congenital hearing loss, and adoption of pediatric-specific hearing devices and implants. Advancements in cochlear implant technology, improved audiology services, and government support in developed countries are accelerating adoption. Pediatric devices are increasingly designed for comfort, safety, and ease of use. Educational initiatives and awareness campaigns by hospitals and schools promote early intervention. Growth in neonatal hearing programs in emerging economies is enhancing market penetration. Technological innovations in pediatric amplification devices, including miniaturized components and wireless connectivity, further support rapid growth. Parental awareness and advocacy for early treatment continue to drive adoption. Pediatric cochlear implants are becoming more accessible through insurance and subsidy programs. Collaborative initiatives between device manufacturers and hospitals support training and device fitting. Rising incidence of congenital hearing loss and increased attention to speech development underscore segment growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Large Retail Chains, Manufacturer-Owned Retail Chains, Public, and Others. The Large Retail Chains segment dominated the market with a revenue share of 44.1% in 2025, due to wide geographic coverage, strong brand presence, and the ability to offer a range of hearing aids and implants under one roof. Retail chains provide easy access, trial opportunities, and post-sale support, contributing to high adoption. Partnerships with manufacturers ensure availability of latest products. The segment benefits from marketing campaigns, in-store demonstrations, and after-sales service infrastructure. Urban consumers often prefer retail chains for convenience, product variety, and immediate availability. Strong online and offline integration by retail chains further strengthens market reach. High consumer trust in established brands supports repeat purchases. Retail networks facilitate bulk sales for audiology clinics and hospitals. Strategic collaborations with insurance providers improve affordability. Accessibility and awareness programs organized by retail chains reinforce market leadership. Retail chains also offer financing options and product bundles for enhanced adoption.

The Manufacturer-Owned Retail Chains segment is expected to witness the fastest CAGR of 11.3% from 2026 to 2033, driven by increasing emphasis on brand experience, personalized fitting services, and direct-to-consumer marketing. Manufacturers are opening exclusive stores to provide demonstration, adjustment, and maintenance services, improving customer satisfaction. This model ensures availability of the latest technological innovations directly to consumers. Growth is supported by urban expansion and rising disposable income. Manufacturer-owned chains are particularly effective in promoting premium hearing aids and implants. Customized fitting services and audiologist support enhance patient adherence. Direct-to-consumer approach enables better pricing control and service quality. Government programs collaborating with manufacturers further accelerate adoption. Expansion in tier-2 and tier-3 cities provides untapped growth opportunities. Consumer trust in brand-specific services encourages repeated purchases. High-quality after-sales support and warranty services increase market competitiveness.

Hearing Aids Market Regional Analysis

- North America dominated the hearing aids market with the largest revenue share of 46% in 2025

- Driven by a well-established healthcare infrastructure, high R&D expenditure, and the presence of key industry players

- The region has witnessed significant adoption of advanced hearing solutions, including digital, AI-powered, and rechargeable devices, supported by increasing awareness of hearing health and robust healthcare coverage

U.S. Hearing Aids Market Insight

The U.S. hearing aids market captured a substantial portion of the North American share in 2025, fueled by growing installations across hospitals, audiology clinics, and specialized hearing centers. Consumers increasingly prefer digital and AI-powered hearing devices that offer personalized sound optimization, rechargeable batteries, and wireless connectivity. The integration of tele-audiology services, smartphone-compatible apps, and remote hearing aid adjustments is further driving market growth, making the U.S. one of the most technologically advanced markets for hearing solutions globally.

Europe Hearing Aids Market Insight

The Europe hearing aids market is projected to grow steadily during the forecast period, driven by an increasing geriatric population, rising prevalence of hearing loss, and improved reimbursement policies for hearing devices. European consumers value high-quality and energy-efficient hearing aids, and the region continues to see growth in private clinics and public healthcare systems providing advanced hearing solutions.

U.K. Hearing Aids Market Insight

The U.K. hearing aids market is anticipated to expand at a notable CAGR due to rising awareness of hearing health, growing government support, and increasing accessibility to audiology services. The market benefits from advanced digital hearing devices and strong consumer demand for personalized solutions that improve quality of life for adults and the elderly.

Germany Hearing Aids Market Insight

The Germany hearing aids market is expected to grow consistently, fueled by a combination of increasing healthcare expenditure, advanced research and development in audiology technologies, and the country’s emphasis on sustainable and high-quality medical devices. Germany’s well-developed healthcare system and emphasis on innovation support the adoption of next-generation hearing aids across both clinical and retail channels.

Asia-Pacific Hearing Aids Market Insight

The Asia-Pacific hearing aids market is poised to grow at the fastest CAGR during the forecast period, driven by increasing healthcare access, rising prevalence of hearing loss, growing awareness of hearing health, and expanding disposable incomes in countries such as China, India, and Japan. Technological advancements, including AI-enabled hearing aids, smartphone integration, and affordability of modern hearing solutions, are further boosting adoption across the region.

Japan Hearing Aids Market Insight

The Japan hearing aids market is gaining momentum due to the country’s high-tech culture, rapidly aging population, and increasing adoption of advanced audiology devices. There is a growing focus on devices that offer convenience, enhanced sound quality, and connectivity with other digital health solutions, making Japan a key growth market for innovative hearing aids.

China Hearing Aids Market Insight

The China hearing aids market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s growing middle class, rapid urbanization, and rising awareness of hearing health. The expansion of healthcare infrastructure, government initiatives to improve access to audiology services, and availability of cost-effective modern hearing solutions are driving strong growth in the region.

Hearing Aids Market Share

The Hearing Aids industry is primarily led by well-established companies, including:

• Sonova Holding AG (Switzerland)

• Widex A/S (Denmark)

• Sivantos Pte. Ltd. (Singapore)

• GN Store Nord A/S (Denmark)

• Cochlear Limited (Australia)

• Starkey Hearing Technologies (U.S.)

• WS Audiology (Denmark)

• MicroTech Hearing (China)

• Med-El (Austria)

• Oticon (Denmark)

• Hansaton (Germany)

• Rexton (Germany)

• HearingLife (Canada)

• Unitron (Canada)

• Amplifon S.p.A. (Italy)

Latest Developments in Global Hearing Aids Market

- In May 2023, over-the-counter (OTC) hearing aids were widely reported to be “gaining a hipper reputation as lifestyle products,” especially following U.S. regulatory changes. Major consumer electronics companies such as Sony and Bose began entering the OTC hearing aid space, helping to increase accessibility and reduce stigma around hearing devices

- In In August 2024, Sonova announced the launch of the Sphere Infinio, the first hearing aid using a dedicated real-time AI chip for speech‑from‑noise separation. This innovation, which runs on Sonova’s new Infinio platform, aims to significantly improve speech clarity in noisy environments and is expected to drive strong growth in its hearing instrument business

- In March 2025, Starkey introduced a new accessory line for its Edge AI hearing aids. The announced accessories build on the LE Audio (Auracast) standard, allowing users to stream high-fidelity audio directly to their hearing devices from compatible TVs and devices

- In February 2025, GN Hearing launched the ReSound Vivia, which the company describes as its “most intelligent AI‑powered hearing aid” yet. Alongside the AI-driven processing, Vivia supports Auracast broadcasting, enabling sharing of audio streams from compatible devices.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.